Heart Valve Devices Market Size and Forecast 2025 to 2034

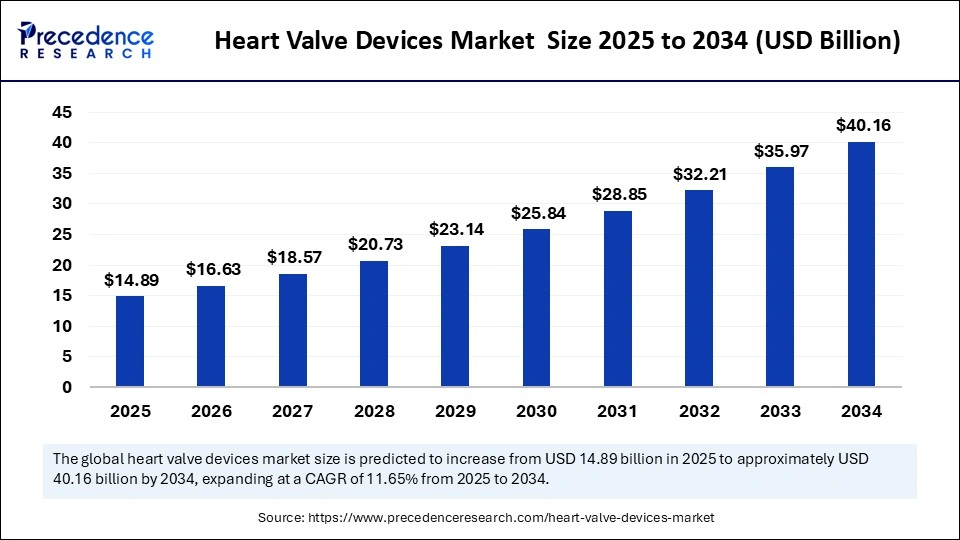

The global heart valve devicesmarket size is calculated at USD 14.89 billion in 2025 and is predicted to increase from USD 16.63 billion in 2026 to approximately USD 40.16 billion by 2034, expanding at a CAGR of 11.65% from 2025 to 2034.The growth of the market is driven by an increase in heart valve disease rates, growing elderly population, and high demand for minimally invasive procedures, providing safer, faster, and more effective treatments.

Heart Valve Devices MarketKey Takeaways

- The global heart valve devices market was valued at USD 13.34 billion in 2024.

- It is projected to reach USD 40.16 billion by 2034.

- The market is expected to grow at a CAGR of 11.65% from 2025 to 2034.

- North America led the heart valve devices market dominated the global market in 2024.

- Asia Pacific is expected to expand the fastest CAGR in the market between 2025 and 2034.

- By type of heart valve, the aortic valve segment held the largest market share in 2024.

- By type of heart valve, the mitral valve segment is anticipated to grow at a significant CAGR between 2025 and 2034.

- By material, the biological valve segment captured the biggest market share in 2024.

- By material, the mechanical valve segment is expected to expand at the fastest CAGR over the projected period.

- By age group, the adults segment accounted for the major market share in 2024.

- By age group, the geriatric patients segment is expected to expand at a notable CAGR over the projected period.

- By end-user, the hospitals segment contributed the the highest market share in 2024.

- By end-user, the ambulatory surgical centers segment is expected to grow at the highest CAGR over the forecast period.

Market Overview

Heart valve devices are used to either repair or replace heart valves to restore proper blood flow through the heart. Different types of heart valve devices include mechanical valves, biological/tissue valves, transcatheter valves, and others. Valves are predominantly used for treating diseases such as valvular stenosis and valvular regurgitation. The heart valve devices market is expanding due to the increasing incidence of cardiovascular disease, the increasing aging population, and an increase in the development of new technologies related to minimally invasive procedures.

The shift toward transcatheter techniques from open-heart surgery also increased the demand for heart valves. Market growth is also aided by increased awareness of heart valve diseases, favorable reimbursement policies, and greater access to diagnosis. With manufacturers entering the market and focusing on implementing new and biocompatible solutions (including more durable devices that fit specific patient constructs), the market continues to develop over the next few years.

Impact of AI on the Heart Valve Devices Market

Artificial intelligence is set to revolutionize the heart valve devices market by enhancing the development of new devices, improving diagnostics, and enabling personalized treatment plans. New startups and existing MedTech firms are utilizing AI in the device design and planning phase, broadening the opportunity for 3D-printed heart valves that are tailor-made for specific patients and improving pre-surgical mapping. Additionally, AI is being used for robotic-assisted techniques to rationalize and reduce the risk during a complex valve replacement procedure and recover better. Companies like Edwards Lifesciences and Abbott Laboratories are incorporating AI into their newest valve systems to assist clinicians improve surgical planning. AI accelerates the development of new heart valve devices by optimizing design and predicting their performance and durability.

Heart Valve Devices MarketGrowth Factors

- Increasing Prevalence of Vascular Heart Diseases: As more people develop progressive diseases (especially aortic stenosis and mitral regurgitation) that require valve repair or replacement, the heart valve devices market will continue to grow tremendously.

- Growing Elderly Population: The growth of the geriatric population causes the incidence of degenerative heart valve disease to rise, making this a key driver of market growth. Older people are likely to be the biggest users of valve intervention.

- Development of Transcatheter Procedures: Minimally invasive transcatheter aortic valve replacement (TAVR) and repair (TEER) procedures have become attractive for patients because the surgical risk is much lower with these procedures, and the recovery time is short. The safety and shortened recovery time of these transcatheter procedures are attractive features that are boosting market demand.

- Advanced Diagnostic and Screening Modalities: Technological advances in echocardiography, cardiac imaging, and AI-assisted diagnostics enhance detection and treatment earlier on, leading to the management of patients before they are symptomatic. Therefore, additional patients will continue to receive interventions for valvular disease, increasing heart valve device demand.

- Reimbursement and Regulatory Approval: Well-defined and supportive insurance coverage (particularly in developed counties) and timely and expedited regulatory approvals for novel valve products should stimulate expanded clinical applications for the products, increasing device sales and the heart valve devices market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 40.16 Billion |

| Market Size in 2025 | USD 14.89 Billion |

| Market Size in 2026 | USD 16.63 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.65% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type of Heart Valve, Material, Age Group, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Aging Population

The heart valve devices market is primarily driven by the rapid growth in the aging population, which is at high risk for degenerative heart valve diseases like aortic stenosis and mitral regurgitation. As of 2024, the global population aged 60 years and older was over 1.6 billion - a growth from 1.5 billion in 2023, according to UN estimates. Additionally, according to the WHO, the number of people aged 80 years or older is expected to triple between 2020 and 2050 to reach 426 million.

The American Heart Association reports about 12.4% of people aged 75 and older are affected by aortic stenosis in the U.S. Furthermore, a study published in the European Heart Journal (2024) identified more than 25% of surveyed people age 60+ screened by echocardiography demonstrated undiagnosed heart valve disease. This demographic shift in the overall population sustains interest in treatment alternatives such as “Transcatheter Aortic Valve Replacement” (TAVR). With the growing acceptance of minimally invasive therapies, along with ever-increasing life expectancy, healthcare systems are witnessing increased utilization of valve replacement therapies. Currently, valve therapy volumes are increasing, especially among intermediate- and low-risk older adults.

Restraint

High Costs and Regulatory Frameworks Slow Innovation and Market Access

The high cost of heart valve devices is a major factor restraining the growth of the market. The high cost of these devices limits access and deters potential buyers from undergoing surgical procedures. Stringent and lengthy regulatory approval processes for medical devices negatively impact the heart valve devices market and slow down innovation. The implementation of the Medical Device Regulation (MDR) by the European Union in 2023 increased the clinical evidence requirements and timelines to approval. The Food and Drug Administration (FDA) also added to the regulatory burden for heart valve products in the U.S. For Class III devices, including heart valves, the average premarket approval (PMA) requires 180 days to complete in 2023. Typically, fast approvals require significant investments in R&D and other processes, deterring new entrants from entering the market.

Opportunity

Heightened Disease Awareness is Leading to Early Diagnosis and Treatment

Heightened disease awareness surrounding valvular heart disease is creating lucrative growth opportunities for the heart valve device market. Access to diagnostics such as echocardiography is improving; with better identification, they're diagnosed earlier in their disease processes, offering patients the best chance for intervention through valve repair or valve replacement, swaying their treatment options. The U.S. Centers for Disease Control and Prevention (CDC) reported a rise in valve procedures from 25,000 in 2023 to roughly 27,500 in 2024. This increase is reflective of not only clinical advancements but also the ongoing education of patients on heart disease, increased screening frequency, and increased referrals by cardiologists.

The rising development of novel devices further creates immense opportunities in the market. In April 2024, Abbott announced that the U.S. Food and Drug Administration (FDA) has approved the company's first-of-its-kind TriClip transcatheter edge-to-edge repair (TEER) system that's specifically designed for the treatment of tricuspid regurgitation (TR), or a leaky tricuspid valve.(Source: https://www.prnewswire.com)

Segment Insights

Type of Heart Valve Insights

Why did the Aortic Valve Segment Dominate the Market in 2024?

The aortic valve segment dominated the heart valve devices market with the largest share in 2024 because of the high prevalence of aortic stenosis, particularly among elderly populations. Because of technological advancements in transcatheter aortic valve implantation (TAVI) in non-surgical treatment options, there has been an increase in the global uptake of TAVI procedures. In terms of aortic valve size, the 20–23 mm and 23–26 mm sizes dominate the aortic valve segment as these sizes accommodate a broad range of patients. Innovations in terms of hemodynamic performance further bolstered segmental growth.

The mitral valve segment is anticipated to grow at a significant CAGR in the coming years. The growth of the segment can be attributed to the increasing prevalence of mitral regurgitation and degenerative valve diseases. The development of minimally invasive mitral valve repair procedures and robotic-assisted surgeries are contributing to segmental expansion. Many of the valve sizes in the mitral segment, such as 26 to 28 mm and 29 to 31 mm, have been broadly applied to many of the anatomical needs of patient populations. The rising number of clinical trials and approvals for new mitral devices are likely to drive the growth of the segment.

Material Insights

What Made Biological Valves the Dominant Segment in the Market?

The biological valve segment dominated the market with a major share in 2024. Biological or bioprosthetic valves, which are made from either bovine or porcine tissue, are the preferred choice of surgeons or patients alike because they require less anticoagulation therapy. They are more commonly used in older patients and those with higher bleeding risk. Transcatheter Aortic Valve Implantation (TAVI) plays a significant role in the success of valve replacement procedures due to its short recovery time and improved patient outcomes. In recent years, bioprosthetic valves have become an increasingly favored option.

The mechanical valve segment is expected to expand at the fastest rate over the projected period. Mechanical valves are used for a lifetime and will last significantly longer than bioprosthetic valves, making them the preferred choice for any patient under age 50. There is growing awareness and acceptance of anticoagulation therapy; combined with improvements in biocompatibility and valve design features. Research into next-generation mechanical valves, which limit thromboembolic risk, further support segmental growth.

Age Group Insights

Why did the Adults Segment Dominate the Heart Valve Devices Market in 2024?

The adults segment dominated the market with the largest share in 2024 because valvular heart diseases are widespread among people aged 40-60, often needing intervention for valves affected by aortic stenosis or mitral regurgitation. With both surgical and minimally invasive treatment options available, treatment options for an adult patient population are better served with the recent advancements in the durability and performance of valve prostheses. Increasing lifestyle diseases and increased detection contribute to the segment's dominance.

The geriatric patients segment is expected to expand at a notable CAGR over the projected period, as life expectancy around the world increases. Geriatric people are more prone to calcific valve degeneration and stenosis, which can only be corrected with a valve replacement. The availability of less invasive solutions such as TAVI has changed the landscape for high-risk elderly patients. The availability of cardiac care in emerging economies is also expanding and improving the treatment rates for the geriatric population. Increasing demand for newer generations of heart valve devices and personalized treatment plans among geriatric people support segmental growth.

End-User Insights

How Does the Hospitals Segment Dominate the Market?

The hospitals segment dominated the heart valve devices market in 2024 because they have the integrated infrastructure to perform complex surgical procedures and provide accompanying care, attracting more patients. Most cardiac interventions, especially open-heart procedures, happen in hospitals that have specific cardiac units. The increased patient volumes, availability of skilled staff, and reimbursement policies for hospitals sustain segment's dominance. Rising government initiatives to improve and modernize hospital facilities further bolster the segmental growth.

The ambulatory surgical centers segment is expected to grow at the highest CAGR over the forecast period. The rising patient preference for outpatient surgeries drives the growth of the segment. As healthcare systems continue to evolve toward cost-effective and efficient care service delivery, the patient pool is likely to increase in ASCs. With shorter recovery periods and reduced hospital care costs, ASCs promote effective treatment modalities for selected patients, especially with relatively less invasive procedures such as catheter-based repairs of valves gaining acceptance.

Regional Insights

What Made North America the Dominant Region in the Heart Valve Devices Market?

North America is a global leader in the heart valve devices market, capturing the largest share in 2024. This is because of its sophisticated healthcare system, the presence of a large number of medical device manufacturing companies, and the increased burden of cardiovascular disease. There is a high demand and acceptance of minimally invasive surgical technologies, including TAVR and TMVR. Increased awareness of structural heart diseases and reimbursement policies for surgical procedures further contributed to the region's dominance.

The U.S. is a major player in the market within North America. This is mainly due to the increasing prevalence of heart valve diseases. In the U.S., every year, more than 5 million people are diagnosed with heart valve disease, which contributes to more than 25,000 deaths. The severity of the problem is prompting a massive push for next-generation therapies for heart valve interventions.

(Source: https://www.cdc.gov)

United States Heart Valve Devices Market Trend

The United States displays significant market demand for cardiac valve disease therapies due to a high prevalence of cardiovascular disease, an aging population, and wide acceptance of advanced minimally invasive techniques. An extensive healthcare system, robust reimbursement paths, and incessant advancement of trans catheter valve technologies foster incremental market growth. Higher awareness by patients and high diagnosis rates reinforce ongoing market growth.

European Heart Valve Devices Market Trends

Europe is expected to grow at a significant rate. This is due to its robust healthcare infrastructure and the rising demand for minimally invasive cardiac procedures. An increase in the number of transcatheter aortic valve replacement (TAVR) and mitral valve interventions solidify the region's position in the market. Supportive reimbursement policies make these devices affordable. Regional regulatory pathways relating to heart valves are becoming more aligned in the EU, enabling much clearer and less cumbersome regulatory pathways for product approvals. Germany is a major player in the market, with its strong focus on advancing cardiac care facilities and high patient volume.

- In May 2024, Edwards Lifesciences launched its SAPIEN 3 Ultra RESILIA valve in Europe, and patients will reportedly have better outcomes and durability than previously offered valves.(Source:https://citoday.com)

Germany Heart Valve Devices Market Trend

Germany is a leading European cardiac valve disease market, supported by a well-established cardiology ecosystem, high awareness of structural heart disease, and high use of advanced interventional procedures. Strong clinical experience, high early diagnosis, and innovation of trans catheter valve technologies enhance the pathway to therapy. An extensive aging population, continuous opportunities for upgrades, and infrastructure for cardiac care make for consistent growth in this market.

Asia Pacific Heart Valve Devices Market Trends

Asia Pacific is expected to grow at the fastest CAGR in the coming years. This is mainly due to the growing geriatric population and the increasing prevalence of cardiovascular diseases. Improved diagnostics capabilities and rising acceptance of minimally invasive procedures are driving the growth of the market. Governments of countries like India and China are providing funding for medical device manufacturers to boost domestic production, creating immense opportunities in the market. India is now becoming the center of attention with the launch of the Myval transcatheter aortic valve by Meril Life Sciences in November 2024, which is the first device of its kind to be fully developed and manufactured in India.

The growing awareness of early diagnosis of heart valve related disease increased the overall diagnostic and treatment rates. Partnerships between local hospitals and global MedTech players are supporting regional market growth. In addition, rising government initiatives to improve healthcare infrastructure and modernize existing facilities contribute to market growth.

- In April 2025, Peijia Medical, a Chinese company, collaborates with dsm-firmenich to create groundbreaking, innovative medical device products. The signing of the strategic innovation partnership agreement between the two parties will further focus on the research and development of polymer heart valve materials, which is expected to initiate an epoch-making transformation in the field of high-end medical device materials worldwide.

(Source: https://www.prnewswire.com)

China Heart Valve Devices Market Trend

China's heart valve disease market is expanding at a rapid pace due to an increase in cardiovascular disease incidents, an increase in access to cardiac treatment, and rapidly increasing acceptance of minimally invasive valve replacement systems. Government prioritization of building tertiary hospitals, cardiac care centers, and increasing early screening supports an increase in therapies for cardiac patients. Increasing healthcare spending and growing elderly population further support market demand.

Middle East & Africa Region Analysis

How is the Middle East & Africa Heart Valve Disease Market Expanding?

Heart valve disease in the Middle East & Africa marketed is moving forward slowly, as hospitals improve cardiac care infrastructure and adopt new valve repair and replacement treatment technologies. Increased prevalence of rheumatic heart disease, improvement of access for healthcare systems and increasing investments in specialty cardiology centers will drive market growth. However, non-uniform reimbursement systems and limited availability of specialists continue to hinder uptake more broadly across the region.

UAE Heart Valve Devices Market Trend

The UAE has tiered tertiary cardiology services, formalized training initiatives, and collaborative global partnerships for advanced valve care and research capability. Recent case series from emerging centres in the UAE have reported good TAVR outcomes and adequate perioperative pathways; albeit, the volume of procedures remains in the early stages. At the national level, data is limited and access to advanced valve care is restricted outside of the major emirates, due to infrastructure and the associated cost.

Heart Valve Devices Market Companies

Key Players in Heart Valve Disease Market and Their Offerings

|

Company |

Heart Valve Disease Offering |

|

Medtronic plc |

CoreValve/Evolut TAVR; Avalus, Mosaic, Hancock surgical valves; Harmony pulmonary valve. |

|

Boston Scientific Corporation |

ACURATE Aortic Valve System for TAVR procedures. |

|

Abbott |

MitraClip, TriClip, Navitor TAVI, Tendyne TMVR, Masters mechanical valves. |

|

Edwards Lifesciences Corporation |

SAPIEN 3 TAVR; SAPIEN M3 TMVR; EVOQUE tricuspid replacement. |

|

Foldax Inc. |

TRIA Mitral Valve made from LifePolymer polymer technology. |

|

Novostia SA |

TRIFLO Heart Valve under PILATUS clinical study. |

|

Meril Life Sciences Pvt. Ltd. |

MyVal Transcatheter Aortic Heart Valve for aortic stenosis. |

|

Corcym UK Limited |

Perceval sutureless valve; MEMO 4D mitral ring; HAART annuloplasty devices. |

|

JenaValve Technology, Inc. |

JenaValve transcatheter aortic valve |

|

Micro Interventional Devices, Inc. |

MIA (Minimally Invasive Annuloplasty) System, PolyCor anchors |

|

Auto Tissue Berlin GmbH |

Tissue‑engineered concepts; |

|

Anteris Technologies Ltd |

R&D in regenerative valves; |

|

Thubrikar Aortic Valve, Inc. |

Stentless porcine aortic valve research focus. |

|

MicroPort Scientific Corporation |

itaFlow Aortic Valve System and the second-generation VitaFlow Liberty, VitaFlow Liberty is motorized retrievable TAVI system |

|

Biosensors International Group, Ltd. |

develops and manufactures the ALLEGRA Transcatheter Heart Valve (THV) |

Recen Developments

- In January 2025, Global medical device maker Abbott has introduced the Navitor Vision in India, a state-of-the-art valve technology for treating symptomatic severe aortic stenosis in patients who face high or extreme risk from conventional surgery. The Navitor Vision represents the latest advancement in Abbott's transcatheter aortic valve implantation/replacement (TAVI/TAVR) system.

(Source:https://health.economictimes.indiatimes.com)

- In June 2024, Medtronic plc, a global leader in healthcare technology, announced the launch of its latest innovation in cardiac surgery, the Avalus Ultra valve. This next-generation surgical aortic tissue valve is designed to facilitate ease of use at implant and lifetime patient management. (Source:https://www.dicardiology.com)

- In September 2024, Pi-Cardia receives FDA clearance for ShortCut and the first in-human U.S. implantation of TriCares' Topaz tricuspid valve, North America is committed to providing first-in-class therapies.

(Source:https://www.businesswire.com)

Segments Covered in the Report

By Type of Heart Valve

- Aortic Valve

- < 20 mms

- 20–23 mm

- 23–26 mm

- >26 mm

- Mitral Valve

- < 26 mm

- 26–28 mm

- 29–31 mm

- >31 mm

- Tricuspid Valve

- Pulmonary Valve

By Material

- Biological Valve

- TAVI

- Surgical

- Others

- Mechanical Valve

By Age Group

- Pediatric Patients

- Adults

- Geriatric Patients

By End-User

- Hospitals

- Home Care

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting