Protective Face Masks Market Size and Forecast 2025 to 2034

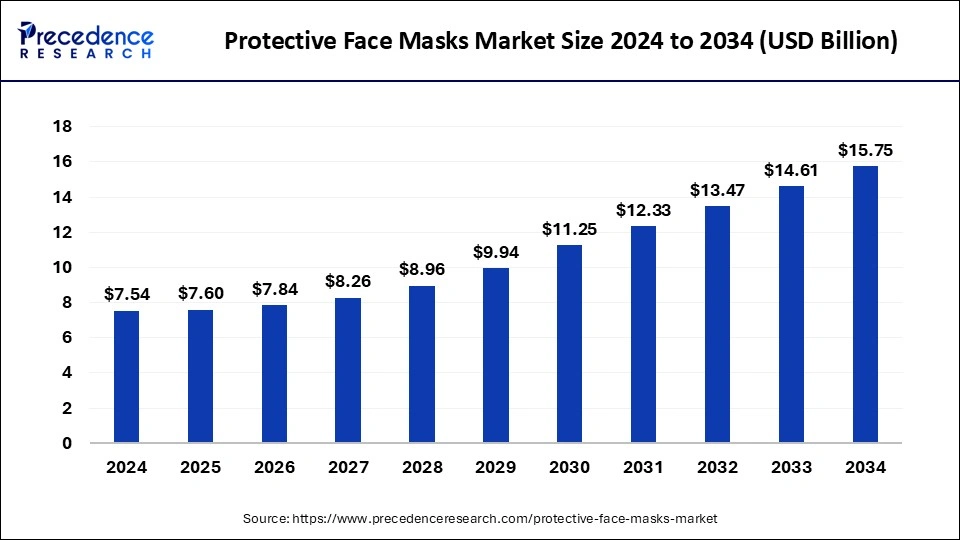

The global protective face masks market size accounted at USD 7.54 billion in 2024 and is predicted to increase from USD 7.60 billion in 2025 to approximately USD 15.75 billion by 2034, expanding at a CAGR of 8.44% from 2025 to 2034. The need for protective masks in airports, aircraft, and other transportation hubs is expected to persist as international travel picks up. This drives the growth of the protective face masks market.

Protective Face Masks Market Key Takeaways

- The global protective face masks market was valued at USD 7.54 billion in 2024.

- It is projected to reach USD 15.75 billion by 2034.

- The protective face masks market is expected to grow at a CAGR of 8.44% from 2025 to 2034.

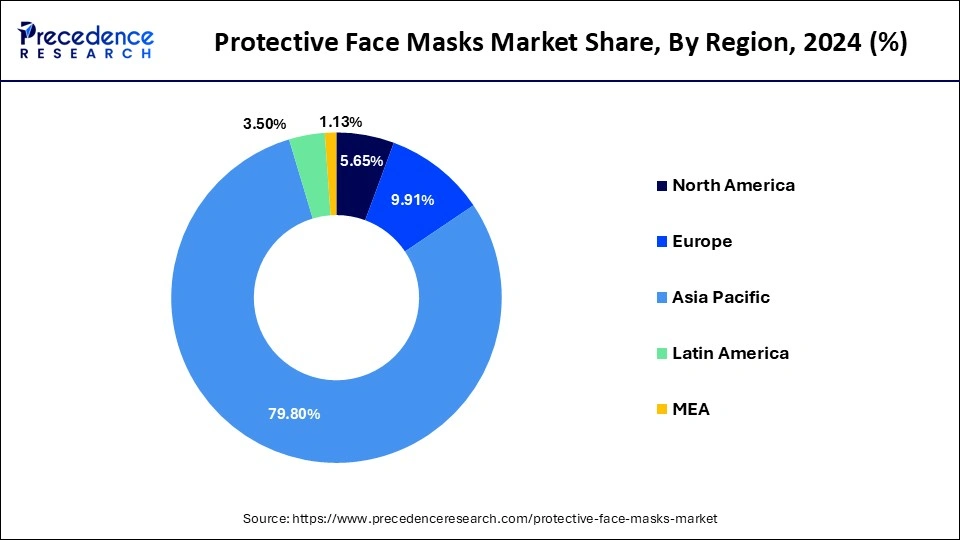

- Asia Pacific held the largest market share of 79.80% in 2024.

- Latin America is expected to grow rapidly during the forecast period.

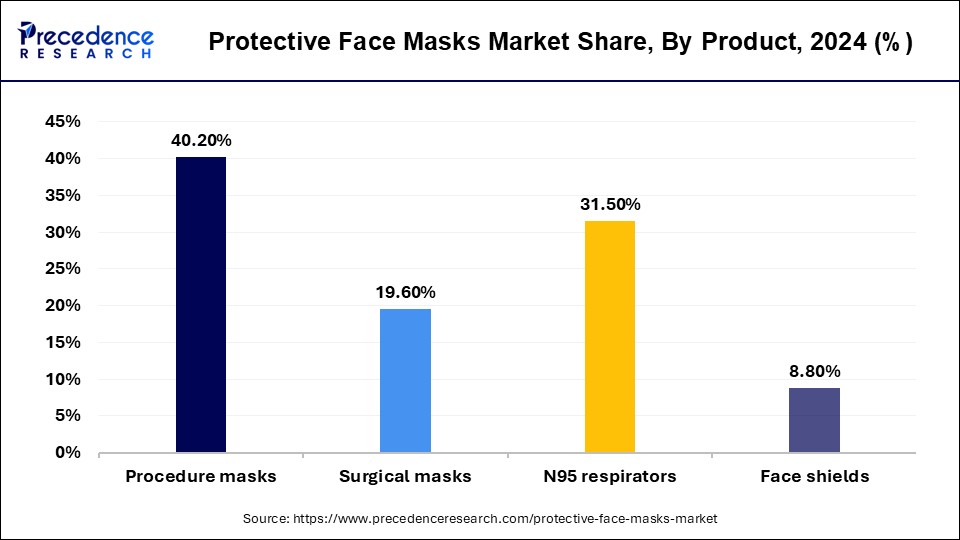

- By type, the procedure masks segment held the largest share of the market in 2024 and is expected to continue this dominance over the forecast period.

- By end use, the hospitals & clinics segment held the largest share of the market in 2024.

Asia Pacific Protective Face Masks Market Size and Growth 2025 to 2034

The Asia Pacific protective face masks market size was exhibited at USD 6.02 billion in 2024 and is projected to be worth around USD 13.00 billion by 2034, growing at a CAGR of 8.80%.

Asia Pacific led the market with the largest share in 2024. When the COVID-19 pandemic struck, the region's government enacted laws requiring face masks and urged people to wear them to stop the virus's spread. This resulted in a sharp increase in the demand for protective face masks. Asia Pacific is a significant center for producing protective face masks, ranking China among the world's top producers. Many manufacturers increased output during the pandemic's peak to fulfill the skyrocketing demand nationally and worldwide. Policies governing protective face masks differ throughout Asia Pacific nations. Governments, however, have implemented policies to guarantee the caliber and security of masks made and distributed inside their borders.

Latin America is seen to grow at the fastest rate during the forecast period. The market for protective face masks saw a significant expansion due to the spike in demand during the pandemic. To fulfill this demand, some firms increased their output. However, the market dynamics might have changed as vaccination rates rose and the pandemic changed. Distribution routes for protective face masks include pharmacies, internet merchants, pharmacies, and medical supply stores. This distribution environment has changed to reflect shifting customer tastes and market dynamics.

China Protective Face Masks Market Trends:

The market for protective face masks in China is witnessing substantial growth fueled by heightened awareness of health and safety, especially due to the COVID-19 pandemic. The focus on public health has increased the need for top-notch respiratory protection, particularly for FFP2 masks because of their efficiency in filtering airborne particles.

Government programs promoting the manufacturing and distribution of personal protective equipment have additionally propelled this expansion.

Pollution levels in China, particularly in key cities like Beijing and Shanghai, frequently surpass safe limits, resulting in numerous respiratory issues. This has led to a growing need for protective masks capable of filtering harmful particulate matter (PM) and various pollutants in the air. Respiratory ailments like asthma, bronchitis, and various chronic diseases are increasing, intensifying the demand for efficient defense against airborne particles.

North America Protective Face Masks Market Trends:

The protective face masks market in North America is essential for ensuring public health and safety, especially in both clinical and non-clinical settings. Surgical masks serve as a shield to safeguard healthcare workers, patients, and the general population from infectious agents including bacteria, viruses, and airborne particulates. The COVID-19 pandemic highlighted the essential importance of these products by significantly boosting demand in hospitals, clinics, and community environments. In addition to pandemic response, surgical masks play a role in infection control during surgeries, routine medical tasks, and the care of immunocompromised patients.

Europe Protective Face Masks Market Trends:

The increasing number of OPD sessions and surgeries across Europe is expected to enhance product demand. The surge in facemask demand across Europe is fueled by the rapid proliferation of the coronavirus on the continent. Strict government regulations regarding the use of protective masks in Europe due to the ongoing pandemic are expected to boost the market.

Owing to rigorous social distancing measures implemented by governments, the e-commerce distribution channel is expected to boost the market. The ongoing pandemic has generated an unprecedented need for face masks within the healthcare sector. These masks are used to protect against hazards that could be detrimental to the skin. To satisfy market demand, producers are concentrating on boosting facemask output in various areas, such as Europe.

The German market for protective face masks is being propelled by a mix of regulatory requirements, increasing consumer desire for safer healthcare settings, and expanding sustainability efforts. Government initiatives that encourage public health and hygiene are driving higher demand in hospitals, clinics, and among the general populace. Regulatory agencies like the European Medicines Agency are maintaining stricter standards, which boost the market's growth potential.

Market Overview

The COVID-19 epidemic has created an unprecedented global demand for masks, the main driver of the protective face mask industry. Corporations, governments, medical facilities, and private citizens have all bought masks to stop the infection from spreading. There are many different kinds of products in the protective face masks market, including fabric masks, N95 respirators, surgical masks, and more. Due to their superior filtration efficiency, N95 respirators have attracted much attention and are now the go-to choice for healthcare professionals and high-risk environments.

Guidelines and regulations have been issued by regulatory authorities such as the FDA in the United States and other similar organizations globally to guarantee the safety and effectiveness of masks. It has been essential for manufacturers and distributors to abide by these laws. Despite the stringent regulatory framework, there is an increase in demand for masks. This has often caused problems in the production process, shortages of raw materials, and disruptions in the supply chain. The general public's acceptability and uptake of mask wear impact dynamics of the protective face masks market.

Public health initiatives, governmental regulations, and cultural aspects have significantly impacted how consumers use masks. Demand spikes have occurred in various locations at different phases of the pandemic, resulting in a global protective face masks market. This circumstance sparked creativity and initiatives to boost production capacity around the world. The dynamics of international trade and supply chains impact mask distribution globally.

Protective Face Masks Market Growth Factors

- The COVID-19 pandemic has been the main driver of the expansion of the protective face masks market. Face masks were in high demand due to the virus's global spread since they were now considered necessary personal protective equipment (PPE) for stopping the virus's propagation. The epidemic has increased public awareness of good personal hygiene habits, including the value of donning face masks in public places.

- Even though COVID-19 occurrences fluctuate, there is a persistent need for protective face masks due to this heightened awareness. Health organizations and governments have globally released directives and policies endorsing or mandating face masks in various contexts.

- Technological developments have resulted in the creation of face mask designs that are more comfortable and effective.

- Innovations that increase user experience and compliance with wearing masks for extended periods, like improved breathability, adjustable straps, and antimicrobial fabrics, have helped drive the growth of the protective face masks market.

- The need for protective face masks to shield against air pollutants has increased in areas with high pollution levels.

- The protective face masks market has grown to encompass those looking for respiratory protection in contaminated workplaces and the healthcare industry.

- Customers can now easily acquire various face mask goods thanks to the growth of e-commerce platforms. In times when physical retail was restricted, or lockdowns occurred, online methods were essential for contacting customers and boosting sales.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.44% |

| Market Size in 2025 | USD 7.60 Billion |

| Market Size by 2034 | USD 15.75 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type and End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Occupational safety

The materials used to make protective face masks should be safe for extended skin and respiratory system contact. This includes ensuring the materials are hypoallergenic, non-toxic, and devoid of dangerous chemicals or other elements that can endanger the wearer's health. Using protective face masks effectively requires a proper fit. In addition to not offering enough protection, ill-fitting masks can irritate or annoy the wearer, which may reduce adherence to safety precautions.

Overly tight masks can obstruct airflow, causing discomfort or breathing problems for the person wearing them. On the other hand, masks lacking appropriate filtering capacity might not provide enough protection against airborne threats found in the workplace. The protective face masks market caters to these minute requirements, appealing to a wider consumer base.

Restraint

Disruption of social interactions

Face masks can be a communication barrier because they mute voices and cover facial emotions, which makes it more difficult for people to understand one another, especially in loud settings or for those who are hard of hearing. This disturbance might result from misunderstandings, annoyance, and a decline in the caliber of social interactions. The use of masks creates an obstacle that could reduce people's natural relationships with one another.

People may be less likely to strike up a conversation or participate in social activities because they believe it is challenging to communicate and because wearing a mask for an extended time can be uncomfortable. A sense of social distancing may bring on this unease, the incapacity to communicate through facial expressions, or worries about one's appearance when donning a mask. This significantly challenges the growth of the protective face masks market.

Opportunity

Innovation and product development

Businesses are investing in creating masks with improved filtration capabilities to offer superior defense against airborne particles, such as pollution and viruses. This involves the application of sophisticated synthetic textiles, electrospun polymers, and nanofibers—materials that provide greater filtration effectiveness without sacrificing breathability. This is made possible by new technologies and innovations in the protective face masks market.

Face masks are becoming a daily need, and as a result, there is an increasing need for protective and fashionable masks. In response to this demand, businesses provide various stylish and personalized designs with multiple colors, patterns, and embellishments. Manufacturers are utilizing innovative design approaches and ergonomic principles to achieve a snug yet comfortable fit for a wide range of face shapes and sizes. Breathable fabrics, nasal wires, and adjustable straps may be used.

Product Insights

The procedure masks segment held a dominating share of the protective face masks market in 2024 and is expected to continue this dominance over the forecast period. Procedure masks are a kind of protective face mask frequently used in medical settings, especially during operations, medical procedures, and other activities where there is a chance of exposure to infectious agents or bodily fluids. These masks keep potentially dangerous particles, liquids, and microbes from spreading away from the wearer and other people. Procedure masks hold a substantial market share in the protective face masks industry because they are widely used in various healthcare settings, such as clinics, hospitals, dentistry offices, and laboratories. The materials used to make procedure masks are usually multilayered, such as non-woven cloth, which offers fluid resistance and filtration.

Procedure masks have different filtering efficiencies based on how they are made and designed. Nonetheless, they create a barrier against droplets and big particles, even though they might not offer as much protection as respirators like N95 masks. A barrier against bodily fluids and blood frequently seen in hospital environments is built into many procedure masks. During medical treatments, this fluid resistance aids in preventing exposure and contamination. Since healthcare personnel often have to wear procedure masks throughout their shifts, they are typically made to be comfortable to wear for extended periods. To facilitate simple breathing without sacrificing protection, they ought to be breathable.

End-use Insights

The hospitals & clinics segment held the largest share of the protective face masks market in 2024. Due to their large patient volumes and the requirement to shield patients and healthcare personnel from airborne diseases, hospitals are the primary locations where protective face masks are used. They frequently wear various masks, such as N95 respirators, surgical masks, and other respiratory protection gear. Protective face masks are also used at medical clinics, such as general practitioner offices, specialty clinics, and outpatient facilities, to stop the transmission of illnesses among staff members and patients. Masks may be used in these institutions for several purposes, including minor surgeries, diagnostic procedures, and patient examinations. Protective face masks are frequently used in nursing homes, assisted living institutions, and other long-term care facilities to safeguard individuals who could be especially susceptible to illnesses.

Dental offices use protective face masks to shield staff members and patients from infectious organisms, especially during aerosol-generating procedures. These facilities undertake outpatient surgeries and procedures to maintain a clean atmosphere and stop the transmission of infections during medical operations. They also generally utilize protective face masks. During emergency medical responses and transports, emergency medical service personnel (EMS), such as ambulance services and paramedics, use protective face masks to keep themselves and their patients safe. Public health clinics may provide protective face masks to the local population to stop the spread of infectious diseases during disease outbreaks or public health emergencies.

Research Institutions segment is observed to grow at the fastest rate during the forecast period. This expansion is fueled by rising worries regarding workplace safety and the necessity to shield employees from different dangers. Regulations and increased awareness of safety measures in sectors such as manufacturing. Research institutions are a major consumer of protective masks, especially respirators. Rigorous workplace safety guidelines and increasing awareness of employee safety are fueling the need for protective face masks in industrial environments.

Recent Developments

- In December 2024, Seattle-based startup Singletto prepared with an innovative defense: pathogen-eliminating face masks that have recently received approval from the U.S. Food and Drug Administration. The masks feature a formulation that contains methylene blue, a compound recognized for its effectiveness in eliminating viruses, bacteria, and fungi. Methylene blue is considered quite safe for humans since it is utilized in treating several health issues.

- In February 2025, the PM2.5 dust levels in Thailand have surpassed global standards and greatly affect public health, prompting Chulalongkorn University's Faculty of Medicine and Chulalongkorn Hospital, Thai Red Cross Society, to create the “POR-DEE” face mask. Created to lower the likelihood of PM2.5 dust exposure, the mask was developed in partnership with CP Social Impact Company.

- In May 2025, U.S. Medical Glove Company proudly revealed the complete launch of its face mask production facility, a significant advancement in bringing the nation's health and safety supply chain back to the United States. The advanced facility includes six high-speed lines specifically for producing 3-ply disposable face masks, reinforcing USMGC's dedication to supplying essential medical products made in the USA.

Protective Face Masks Market Companies

- 3M

- Honeywell International, Inc.

- COFRA S.r.l.

- Uvex Group

- MSA

- DuPont

- Kimberly-Clark Worldwide, Inc.

- Cardinal Health

Segment Covered in the Report

By Product

- Procedure Masks

- Surgical Masks

- N95 Respirators

- Face Shields

By End-use

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Long-Term Care Centers

- Research Institutions

- Individuals

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting