Pyrolysis Oil Market Size and Forecast 2025 to 2034

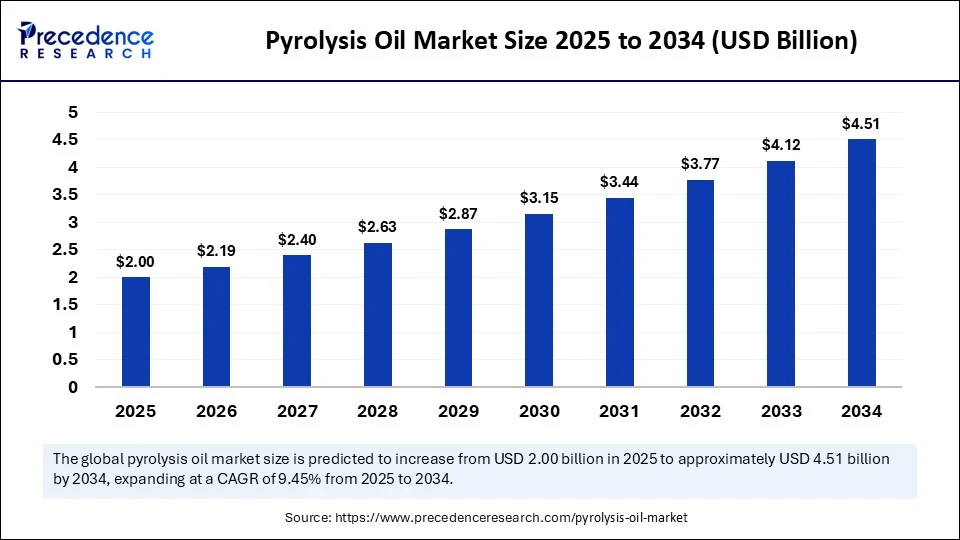

The global pyrolysis oil market size accounted for USD 1.83 billion in 2024 and is predicted to increase from USD 2.00 billion in 2025 to approximately USD 4.51 billion by 2034, expanding at a CAGR of 9.45% from 2025 to 2034. This market is growing due to rising demand for renewable fuels, waste management, and the global transition toward a circular economy.

Pyrolysis Oil Market Key Takeaways

- In terms of revenue, the global pyrolysis oil market was valued at USD 1.83 billion in 2024.

- It is projected to reach USD 4.51 billion by 2034.

- The market is expected to grow at a CAGR of 9.45% from 2025 to 2034

- Asia Pacific dominated the pyrolysis oil market with the largest share in 2024.

- North America is expected to grow at a notable CAGR during the forecast period.

- By feedstock, the plastic segment held the biggest market share in 2024.

- By feedstock, rubber is expected to grow at the fastest CAGR during the forecast period.

- By process, the flash pyrolysis segment generated the major market share in 2024.

- By process, the fast pyrolysis segment is expected to grow at the fastest CAGR in the coming years.

- By fuel, the diesel segment captured the highest market share in 2024.

- By fuel, the gasoline segment is expected to grow at the fastest CAGR in the upcoming period.

How is Artificial Intelligence Optimizing Pyrolysis Oil Production?

Artificial intelligence revolutionizes pyrolysis oil production by improving feedstock analysis, real-time temperature control, and product yield prediction. Pyrolysis oil production is being revolutionized by artificial intelligence through improved yield forecasting, temperature control, and feedstock classification. AI enables the real-time analysis process to be flexible and energy-efficient, rather than relying on manual monitoring. It reduces downtime, enhances reactor performance, and anticipates and fixes operational bottlenecks. AI-powered systems also stabilize oil output, lower emissions, and automate the sorting of plastic waste, thereby increasing the overall dependability and economic scalability of the pyrolysis process.

Market Overview

The pyrolysis oil market is experiencing strong growth, driven by increasing demand for renewable fuels, rising plastic waste, and growing environmental awareness. Companies in the transportation, chemical, and power sectors are exploring pyrolysis oil as a potential alternative to traditional fossil fuels. The market is also being driven forward by supportive regulations, the push for net-zero emissions, and advancements in pyrolysis reactor design. Government subsidies and investments in circular economy infrastructure are accelerating the international adoption of commercial pyrolysis systems.

Which New Technologies are Helping Improve Pyrolysis Oil Systems?

Technological developments are increasing the stability, consistency, and efficiency of pyrolysis oil production. The use of modular reactor designs, AI-integrated control systems, catalytic pyrolysis, and enhanced bio-oil stabilization techniques is growing in popularity. Blockchain facilitates eco-certification and traceability, while IoT-enabled monitoring and real-time analytics enhance transparency. The industry is meeting sustainability standards, cutting costs, and increasing throughput thanks to these innovations, which will eventually allow for broad adoption across all industrial sectors.

Pyrolysis Oil Market Growth Factors

- Rising adoption of pyrolysis as a waste-to-fuel solution amid increasing plastic waste.

- Growth focuses on renewable energy sources and circular economy models.

- Technological improvements in pyrolysis systems, catalysts, and automation.

- Favorable government regulations and financial incentives for clean energy

- Increasing R&D investment in waste valorization and chemical recycling

- Expansion of the industrial sector seeking sustainable fuel alternatives.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 4.51 Billion |

| Market Size in 2025 | USD 2.00 Billion |

| Market Size in 2024 | USD 1.83 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.45% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Feedstock, Process, Fuel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Pressure for Plastic Waste Recycling

Growing global plastic consumption and limited recycling capabilities have led to an urgent need for effective disposal technologies. Pyrolysis provides a scalable waste management option, converting non-recyclable plastics into usable fuel. Pyrolysis is gaining popularity due to increased public pressure and government regulations aimed at reducing landfilling and incineration. Partnerships between private waste processors and municipal authorities are also aiding the development of infrastructure. This technology is appealing to investors due to its economic benefits of converting low-value plastic into high-value pyrolysis oil. The implementation of extended producer responsibility in several nations has also provided incentives for plastic manufacturers to support these recycling practices.

- On 18 March 2025, OMV launched its ReOil plant in Austria with a 16,000 tons/year capacity for plastic to pyrolysis oil conversion.

(Source:https://www.omv.com)

Industrial Shift Toward Sustainable Feedstocks

As corporations face mounting pressure to decarbonize, pyrolysis oil is emerging as a viable substitute for fossil-derived feedstocks in the petrochemical sector. To lessen their dependency on virgin crude oil and to support ESG objectives, businesses are investing in chemical recycling. Additionally, pyrolysis oil has reduced lifecycle emissions, which qualifies it for green product certification. By enabling traceability, ISCC PLUS-certified pyrolysis oil enhances sustainability disclosures. This change is driven by both market demand and regulations, as downstream consumers' desire for eco-friendly and circular ingredients increases. The integration of pyrolysis oil into naphtha crackers and refineries, from pilot to commercial scale, is growing more widespread.

Restraint

Inconsistent Feedstock and Process Quality

One of the biggest technical challenges is dealing with contaminated or inconsistent plastic waste streams. Unwanted chemical by-products, unstable yields, and decreased oil quality can all be caused by variations in the input feed, such as multilayered or composite plastic. This increases operational complexity and costs by requiring sophisticated sorting and preprocessing systems. Additionally, non-thermoplastics and chlorinated plastics can require post-treatment or corroded equipment, which reduces process efficiency. Technology scalability is hampered by the lack of globally accepted standards for acceptable input materials, particularly in emerging markets.

High Capital Investment Requirements

Building a commercial pyrolysis facility entails significant capital expenditures, including the cost of high-temperature reactors, emission control systems, feedstock handling infrastructure, and often AI-integrated automation. Small and mid-sized businesses are discouraged from entering because of these upfront expenses. Additionally, the lengthy payback period and financiers' perception of technical risk make it difficult to secure investment. Project viability becomes even more challenging in areas with inadequate waste collection infrastructure or uneven policy support. To close this investment gap, government incentives and public-private partnerships are essential.

Opportunities

Growing Use of Pyrolysis Oil in Petrochemicals

The petrochemical sector is increasingly turning to pyrolysis oil as a sustainable, circular alternative to virgin naphtha. With mounting pressure to decarbonize supply chains, several refiners and chemical manufacturers are piloting the use of pyrolysis oil in crackers and reformers. The regulatory push toward chemical recycling, especially in Europe and North America, is reinforcing this trend. The growing availability of ISCC PLUS-certified pyrolysis oil supports traceable, low-carbon sourcing for global brands. This is opening new long-term contracting opportunities between pyrolysis providers and major chemical players.

- On 10 February 2025, Braven Environmental entered into a second offtake agreement with Chevron Phillips Chemicals for pyrolysis oil supply to support circular feedstock integration.

(Source: https://resource-recycling.com)

AI and Digitization Enhancing Commercial Viability

Artificial intelligence, real-time monitoring, and digital twin technology are reshaping how pyrolysis operations are monitored, controlled, and scaled. AI improves feedstock classification, optimizes thermal parameters, and predicts yields, making commercial production more reliable and profitable. Enhancing transparency and stakeholder trust is another benefit of integrating sustainability certification tools and blockchain. Businesses in the pyrolysis industry that provide intelligent systems are becoming more competitive as digital adoption increases in the manufacturing and energy sectors. Cleantech and Industry 4.0 are converging to drive innovation and attract investment.

Feedstock Insights

Why did the plastic segment dominate the pyrolysis oil market in 2024?

The plastic segment dominated the market with the largest share in 2024 due to its vast availability, especially non-recyclable plastics that typically end up in landfills. Businesses and governments are looking to pyrolysis as a practical way to turn plastic waste into valuable oil in response to growing international pressure to reduce plastic pollution. For polyolefins like PE and PP, which make up a significant amount of post-consumer waste, the process works particularly well. It is the most favored input for commercial-scale operations due to its capacity to recover energy from plastic and lessen reliance on landfills.

The rubber segment is expected to grow at the fastest rate in the coming years, largely driven by rising amounts of automotive rubber waste and tires that have reached the end of their useful lives. Growing environmental scrutiny, particularly in the tire industry, is driving demand for environmentally friendly disposal methods. Rubber pyrolysis is a profitable recycling process that yields premium oil, steel, and carbon black. Over the course of the forecast period, the rubber feedstock segment is expected to experience rapid capacity expansions due to increased investments in tire recycling facilities and strict global regulations regarding tire disposal.

Process Insights

What made flash pyrolysis the dominant technology in the market?

The flash pyrolysis segment dominated the market in 2024 due to its ability to produce high-quality liquid oil rapidly using extremely short residence times and high heating rates. It is widely adopted in industrial applications where consistency in oil composition is critical. Flash pyrolysis systems also offer high throughput, energy efficiency, and lower tar formation, making them suitable for continuous operation. Their adaptability to multiple feedstocks and the growing demand for process intensification are key reasons for their dominant position in large-scale facilities.

The fast pyrolysis segment is expected to expand at the fastest rate during the projection period due to its commercial viability and advantageous ratio of capital investment, energy consumption, and liquid yield. It can process a wide range of feedstocks with little preprocessing and allows for faster conversion than slow pyrolysis. Fast pyrolysis is gaining traction among mid-size operators seeking scalable decentralized fuel production due to rising investments in modular pyrolysis units and AI-based process control systems. Because of the rising demand for renewable heating fuels and chemicals, its role is growing in both developed and emerging markets.

Fuel Insights

How does the diesel segment dominate the pyrolysis oil market in 2024?

The diesel segment dominated the pyrolysis oil market with a major share in 2024 because of its high energy density, extensive industrial use, and compatibility with current boiler and engine systems. Diesel produced by pyrolysis is being used more and more as a blending agent or drop-in replacement in industries like heavy industry, shipping, and agriculture. Additionally, after processing and refinement, it satisfies regulatory requirements in numerous regions, making it a widely recognized substitute for diesel derived from fossil fuels. In the pyrolysis fuel market, diesel is the most popular end-user category due to its broad utility and comparable performance.

Gasoline is emerging as the fastest-growing fuel type due to rising interest in clean, renewable alternatives for light-duty transportation. Innovations in refining and upgradation of pyrolysis oil have made it suitable for gasoline blending, particularly in emission-sensitive markets. Regulatory mandates for bio-based fuel integration and carbon-neutral fuel initiatives are further accelerating this trend. With increased R&D investments into upgrading pyrolysis oil into lighter fractions, gasoline is anticipated to gain significant market share in the coming years.

Regional Insights

Why did Asia Pacific dominate the pyrolysis oil market in 2024?

Asia Pacific holds the dominant position in the global pyrolysis oil market. This is primarily due to rapid industrial growth and large waste generation volumes. Since the area is making significant investments in clean energy and circular economy models, pyrolysis is a desirable option for producing renewable fuels and managing waste. Favorable governmental regulations, increased public awareness, and expanding private sector involvement are all contributing to the expansion of pyrolysis infrastructure. The region's market leadership is being reinforced by the focus on enhancing waste valorization and decreasing reliance on landfills.

North America is the fastest-growing region, experiencing rapid adoption of pyrolysis technologies across key industrial sectors. Supportive environmental regulations, strong research capabilities, and corporate commitments to sustainability are encouraging the expansion of waste-to-fuel projects. The region benefits from well-developed infrastructure and financing mechanisms that enable faster commercialization. Increased demand for low-emission fuels and renewable chemicals is fueling further investment in pyrolysis capacity, positioning North America as a key growth engine over the forecast period.

Europe is expected to witness notable growth, supported by a strong emphasis on decarbonization and progressive environmental frameworks. The consistent demand for pyrolysis oil is being driven by the regional strategy centered on net-zero targets, circular materials, and chemical recycling. Both public and private stakeholders can now take part in the transition thanks to infrastructure investments and the broad use of green certifications. Europe's regulatory stability and long-term sustainability focus ensure continued market relevance even though its growth rate is modest when compared to emerging regions.

Pyrolysis Oil Market Companies

- Agilyx, Inc.

- Alterra Energy

- Plastic2Oil Inc.

- OMV Aktiengeselllschaft

- Nexus Fuels

- Plastic Advanced Recycling Corporation

- Brightmark LLC

- Klean Industries, Inc.

- BTG Biomass Technology Group

- Trident Fuels Ltd

- Pyro Oil Big Ltd.

- Setra

Latest Announcements

- On 8 May 2025, Freepoint Eco Systems announced a landmark feedstock agreement to supply pyrolysis oil to Shell Polymers in Pennsylvania. The CEO of the company stated that “This agreement reflects our commitment to scaling circular feedstock supply and partnering with industry leaders to advance sustainable polymer production.”

(Source: https://www.argusmedia.com) - On 5 May 2025, Shell Polymers announced a long-term supply agreement with Freepoint Eco Systems for pyrolysis oil, covering up to 130 million pounds per year. The CEO of company stated that “This pack enables up to scale recycled feedstock integration and supports our strategy to meet sustainability targets at our strategy to meet sustainability targets at our Monaca facility.”

(Source: https://www.scrapmonster.com)

Recent Developments

- On 18 March 2025, OMV inaugurated its expanded ReOil plant at the Schwechat refinery in Austria, capable of converting 16,000 tons/year of mixed plastic waste into pyrolysis oil.

(Source:https://www.omv.com)

- On 15 March 2025, BASF signed a long-term agreement with Braven Environmental to source ISCC PLUS‑certified pyrolysis oil from its Texas facility, supporting BASF's Chem Cycling project.

(Source:https://www.basf.com)

- On 10 February 2025, Braven Environmental announced a second offtake agreement with Chevron Phillips Chemical for the supply of circular pyrolysis oil.

(Source:https://resource-recycling.com)

- On 22 February 2025, Quantafuel continued AI-driven process enhancement at its Denmark pyrolysis facility to improve energy yield and operational stability.

Segments Covered in the Report

By Feedstock

- Plastic

- LDPE (Low Density Polyethylene)

- HDPE (High Density Polyethylene)

- Polypropylene (PP)

- Rubber

- Biomass

- Lignocellulosic

- Bagasse

- Others

By Process

- Fast Pyrolysis

- Flash Pyrolysis

By Fuel

- Diesel

- Gasoline

- Fuel Oil

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting