What is the QLED Displays Market Size?

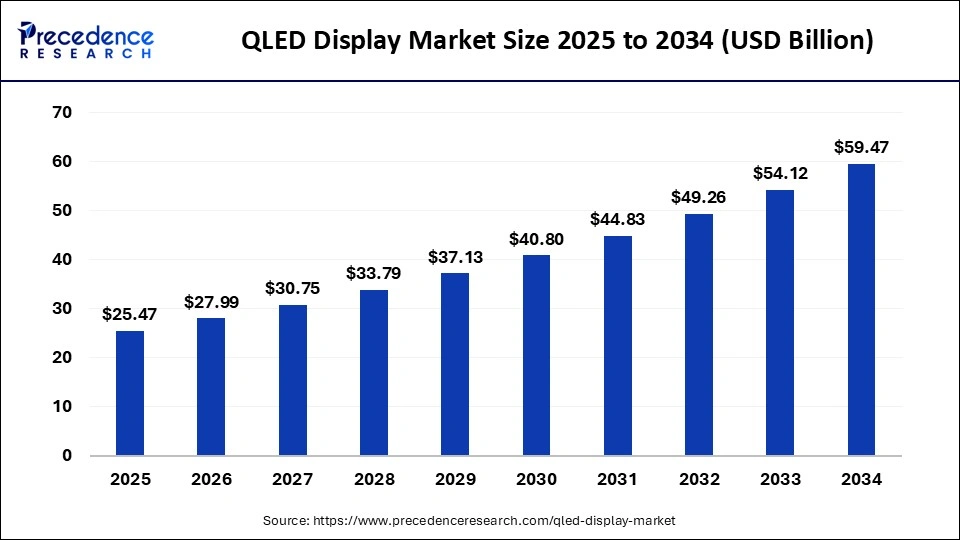

The global QLED displays market size accounted for USD 25.47 billion in 2025 and is predicted to increase from USD 27.99 billion in 2026 to approximately USD 59.47 billion by 2034, expanding at a CAGR of 9.88% from 2025 to 2034. The market growth is attributed to increasing adoption of energy-efficient, high-brightness QLED technology across gaming, commercial, and consumer electronics sectors.

Market Highlights

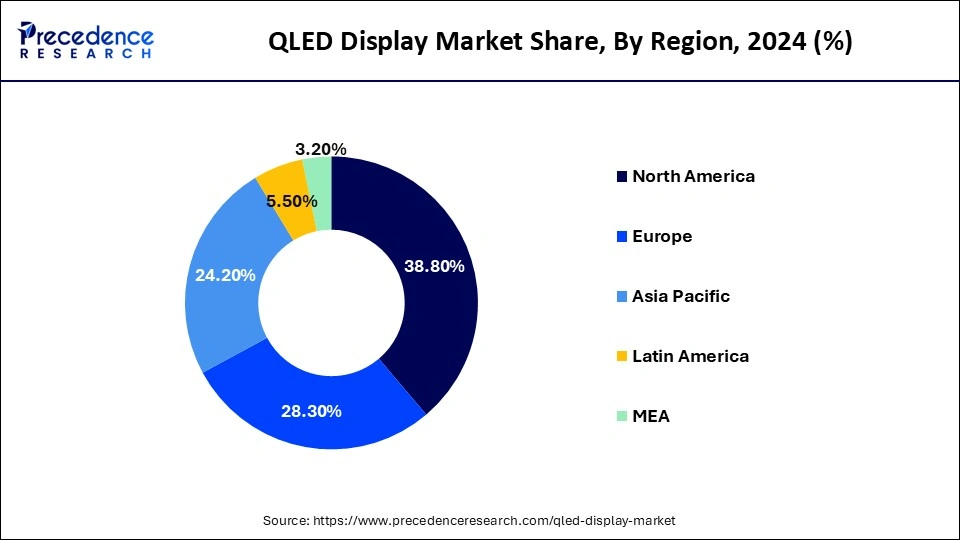

- By region, the North America segment held a dominant presence in the QLED displays market in 2024, accounting for an estimated 38.8% market share.

- By region, the Asia Pacific segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034, accounting for 17.4% of market share.

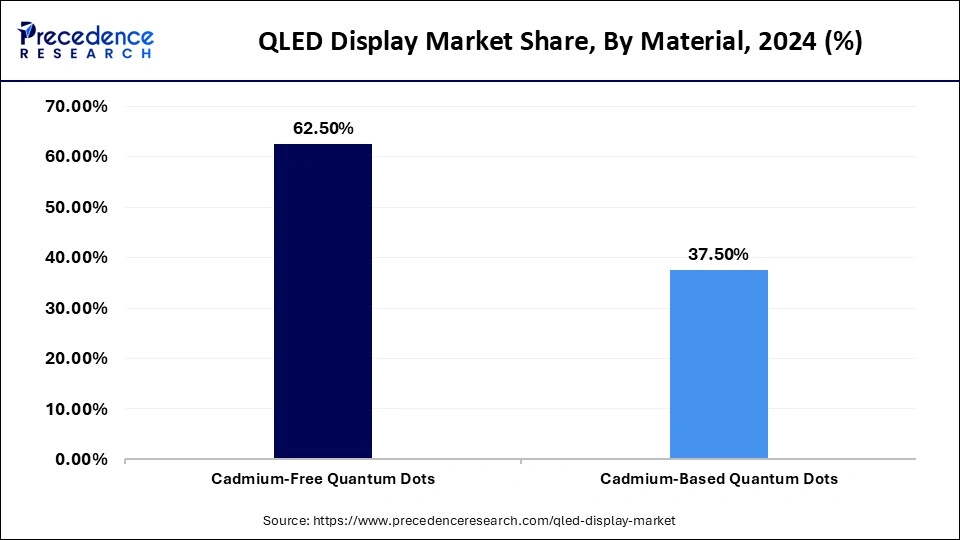

- By material, the free quantum dots segment accounted for a considerable share of the QLED displays market in 2024 that holding a market share of about 62.5%.

- By material, the cadmium-free quantum dots segment is projected to experience the highest growth rate in the market between 2025 and 2034, accounting for 16.5% market share.

- By application, the television segment led the market, accounting for an estimated 45.5% market share.

- By application, the smartphone segment is set to experience the fastest rate of market growth from 2025 to 2034, accounting for 17.2% of market share.

- By end-user, the consumer electronics manufacturers segment registered its dominance over the QLED displays market in 2024, which held a market share of about 38.3%.

- By end-user, the automotive industry segment is anticipated to grow with the highest CAGR in the market during the studied years, accounting for 16.4% market share.

Market Size and Forecast

- Market Size in 2025: USD 25.47 Billion

- Market Size in 2026: USD 27.99 Billion

- Forecasted Market Size by 2034: USD 59.47 Billion

- CAGR (2025-2034): 9.88%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

The QLED (Quantum Dot Light Emitting Diode) display technology is gaining momentum due to its incredible colour accuracy, high brightness levels, and energy efficiency. Industry leaders are investing in research and development to improve the performance and scalability of QLED displays. The Solid-State Lighting R&D Program of the U.S. Department of Energy, which focuses on developing LED materials and devices, directly impacts the efficiency of quantum dot displays. (Source:https://www.energy.gov)

The innovations lead to the adoption of QLED technology in various industries. The Information Technology and Innovation Foundation estimates that the total sales of the global display market will reach USD 182 billion in 2024, with projections indicating at least a threefold increase over the next decade. Furthermore, with these developments, the market is expected to experience steady growth and high levels of adoption in various applications.(Source:https://www2.itif.org)

Impact of Artificial Intelligence on the QLED Displays Market

Artificial intelligence (AI) is significantly transforming the QLED displays market by enhancing image rendering, color accuracy, and overall visual quality. AI-driven algorithms enable real-time optimization of brightness, contrast, and tone, providing users with more immersive viewing experiences. In manufacturing, AI technologies are utilized to detect microscopic defects and predict maintenance needs, improving production efficiency and product reliability. Leading companies such as Samsung Electronics, TCL, and Hisense are also integrating AI into research and product design to boost quantum dot performance and energy efficiency. As a result, AI continues to drive innovation and competitiveness across the QLED display industry.

QLED Displays Market Growth Factors

- Rising Adoption of AI-Enhanced Display Calibration: Integration of artificial intelligence for real-time image optimisation is driving superior visual performance and enhancing user experience in QLED displays.

- Growing Demand for Ultra-Large Format Displays: Expansion of sectors like stadiums, airports, and control centres is fuelling demand for large-scale QLED installations.

- Boosting Demand from Automotive Display Systems: Advancements in QLED technology for automotive dashboards and infotainment systems are propelling adoption in the connected vehicle sector.

Strategic Trade Partnerships & Agreements in the QLED Displays Market

- China's Export Resilience Amid Tariffs: Despite the imposition of a 20% tariff on Chinese TVs by the U.S., China's TV exports continued to grow in early 2025. This growth was driven by increased demand from emerging markets and strategic shifts in the supply chain. (Source: https://www.trendforce.com)

- US-China Trade Dynamics: In 2024, total trade between China and the United States reached $688.28 billion, marking a 3.7% year-on-year increase. China's exports to the U.S. amounted to $524.656 billion, a rise of 4.9%, indicating the resilience of trade relations despite tariff pressures. (Source: https://www.tendata.com)

- Samsung's Strategic Shift in Panel Sourcing: In 2024, Samsung and LG Electronics reshaped their LCD TV panel supply portfolios, shifting panel orders from Chinese suppliers to other sources. This move was part of a broader strategy to diversify supply chains and mitigate risks associated with geopolitical tensions. (Source: https://www.thelec.net)

- Display Equipment Spending Rebound: After a significant decline in 2023, display equipment spending is expected to rebound in 2024, growing 54% to $7.7 billion. This rebound is driven by increased investments in LCD and OLED technologies, indicating a positive outlook for the display industry. (Source: https://display.counterpointresearch.com)

- Trade Relations Between China and the U.S.In 2024, total trade between China and the United States reached $688.28 billion, marking a 3.7% year-on-year increase. China's exports to the U.S. amounted to $524.656 billion, a rise of 4.9%, reflecting the resilience of trade relations despite tariff pressures.(Source: https://www.tendata.com)

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 25.47 Billion |

| Market Size in 2026 | USD 27.99 Billion |

| Market Size by 2034 | USD 59.47 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.88% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Applications, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Global Regulatory Landscape for QLED Displays Market

| Country/Region | Regulatory Body | Key Regulations & Standards | Focus Areas | Notable Notes |

| European Union | European Commission (EC) | RoHS Directive (2011/65/EU) - REACH Regulation (EC 1907/2006) | Restriction of hazardous substances - Registration, evaluation, authorisation, and restriction of chemicals | Quantum Dot Displays must comply with RoHS, limiting the use of hazardous substances like cadmium. - REACH requires manufacturers to register chemicals used in products, ensuring safety and environmental protection. |

| United States | Environmental Protection Agency (EPA) | Toxic Substances Control Act (TSCA) - Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) | Chemical safety - Pesticide regulation | TSCA regulates the introduction of new or already existing chemicals, including those used in display technologies. - FIFRA governs the use of chemicals in products that may be used as pesticides. |

| Japan | Ministry of Economy, Trade and Industry (METI) | Chemical Substances Control Law (CSCL) - Industrial Safety and Health Law (ISHL) | Chemical substance management - Worker safety | CSCL requires the assessment and regulation of chemical substances, including those in electronic displays. - ISHL mandates safety measures for workers handling hazardous substances. |

| South Korea | Ministry of Environment (MOE) | Act on the Registration and Evaluation of Chemicals (AREC) - Act on the Safety Control of Dangerous Substances | Chemical registration and evaluation - Safety control of dangerous substances | AREC requires manufacturers to register chemicals used in products, ensuring safety and environmental protection. - The Act on the Safety Control of Dangerous Substances regulates the handling and use of hazardous materials. |

| China | Ministry of Ecology and Environment (MEE) | Environmental Protection Law - Regulation on the Control over Safety of Hazardous Chemicals | Environmental protection - Hazardous chemical safety | The Environmental Protection Law mandates the protection of the environment, including regulations on chemical substances. - The Regulation on the Control over Safety of Hazardous Chemicals governs the safety management of hazardous chemicals. |

| India | Ministry of Environment, Forest and Climate Change (MoEFCC) | Environment Protection Act - Hazardous Waste Management Rules | Environmental protection - Hazardous waste management | The Environment Protection Act provides a framework for the protection and improvement of the environment, including regulations on hazardous substances. - The Hazardous Waste Management Rules govern the handling and disposal of hazardous waste. |

Market Dynamics

Drivers

How Is the Growing Demand for High-Performance Gaming Displays Driving the QLED Displays Market?

Surging adoption of advanced gaming displays is likely to drive strong market growth. QLED displays provide a fine-grained contrast control and respond faster, making them suitable for competitive gaming and the e-sports requirements of professionals. Gaming monitors are designed by hardware manufacturers to be efficient, using QLED and adaptive sync technology to provide a smoother output.

Global Gaming Growth Trends: Expanding Player Base Through the Years

| Year | Global Gamer Population | Annual Growth in Gamers |

| 2015 | 2.03 billion | – |

| 2017 | 2.33 billion | +160 million |

| 2019 | 2.64 billion | +150 million |

| 2021 | 2.96 billion | +150 million |

| 2023 | 3.22 billion | +130 million |

| 2024 | 3.32 billion | +100 million |

(Source:https://www.affiliatebooster.com)

According to the IDC in 2024, a larger percentage of world shipments of gaming monitors with a refresh rate of more than 144Hz accounted for 20% of the overall monitor demand. This shows that gamers are increasingly favouring high-performance displays. Sony and Samsung Electronics have developed QLED displays designed specifically to be used with next-generation gaming consoles. Additionally, the increasing demand for premium visual experiences is expected to accelerate the adoption of advanced QLED technology in consumer electronics.(Source: https://my.idc.com)

Restraint

Hampered by Competition from Alternative Display Technologies

Competition from alternative display technologies is likely to hamper the growth of the QLED displays market. OLED displays, MicroLED displays, and MiniLED displays are getting close to equivalent or even better performance, at least in some aspects. These options have the advantage of already established manufacturing procedures, reduced production costs due to specific sizes, and increased consumer familiarity. Moreover, the high production and material costs are expected to restrain the growth of the QLED displays market.

Opportunity

How Are Increased R&D Investments and Material Innovations Shaping the Future of the QLED Displays Market?

High investments in research and material innovation are expected to enhance the technological potential of quantum dot-based displays. Firms invest heavily in enhancing the efficiency of lights and the lifespan of panels. The development of quantum dot materials that do not contain cadmium and other heavy metals, which are environmentally friendly.

- In 2023, Samsung Electronics announced a USD 3.2 billion investment to expand quantum dot display production capacity at its Asan facility in South Korea. Such innovations promote sustainable production and environmental compliance with international standards. Additionally, the spurring demand across commercial and digital signage applications is anticipated to create substantial expansion opportunities.(Source: https://m.economictimes.com)

Segment Insights

Material Insights

Why Are Cadmium-Free Quantum Dots Dominating the QLED Displays Market?

In 2024, the segment of cadmium-free quantum dots dominated the QLED displays market, accounting for an estimated 62.5% market share, due to the high level of industry preference for low-toxicity nanomaterials and regulatory consistency. The manufacturers favoured these formulae to achieve strict chemical limits like EU RoHS and REACH.

The European Commission's regulatory assessments and product guidance in 2024 reinforced cadmium restrictions under RoHS. Manufacturers prioritized heavy-metal-free quantum dot chemistries to secure EU market access. Furthermore, greater intensity in IP competition forms the basis of large-scale adoption of cadmium-free products.(Source: https://environment.ec.europa.eu)

The cadmium-free quantum dots segment is expected to grow at the fastest rate in the coming years, accounting for 16.5% of market share, as companies develop heavy-metal-free formulations and work on their integration onto the current panel lines. Furthermore, the high-profile product launches, such as laptops and professional monitors based on cadmium-free QD-based films, confirmed performance assertions and prompted the use of downstream channels.

Application Insights

What Makes Televisions the Leading Application Segment in the QLED Displays Market?

The television segment held the largest revenue share in the QLED displays market in 2024, due to the growing consumer preference for premium and high-contrast home entertainment systems, which accounted for about 45.5% of the market. In 2024, major producers, including Samsung Electronics, LG Display, and TCL CSOT, stepped up the manufacture of QD-enhanced and QD-MiniLED televisions.

The shift to QD-MiniLED backlighting structures enabled panels to cover more than 95% of the Rec 2020 colour gamut, strengthening consumer demand for realistic and cinematic HDR images. Moreover, integration of technological improvement, low cost, and content inclusion will continue to make television the leader in both mainstream and premium entertainment segments.(Source: https://www.tcl.com)

Smartphone segment is expected to grow at the fastest rate in the coming years, accounting for 17.2% market share, owing to the quantum-dot-on-OLED (QD-OLED) technology and nano-encapsulated film integration technology. BOE Technology Group and Visionox move swiftly to pilot manufacture of QD-OLED smartphone displays. Furthermore, the expanding AR-ready ecosystems and content-creation use cases will drive QD displays into high-end and professional-use smartphones.

End-User Insights

Why Do Consumer Electronics Manufacturers Hold the Largest Share in the QLED Displays Market?

The consumer electronics manufacturers' segment dominated the QLED displays market in 2024, accounting for an estimated 38.3% market share, due to the integration of quantum dot technology in televisions, monitors, and tablets. In 2024, the Consumer Technology Association (CTA) found that US shipments of TVs with QLED and MiniLED technologies grew by 2.8%, indicating the rapid adoption of these segments for high dynamic range and color-fidelity display technologies.

Material suppliers such as Nanosys Inc., Merck KGaA, and DuPont Electronics and Imaging increased the manufacturing of cadmium-free QD films. Additionally, the environmentally-friendly display technologies are expected to strengthen the powerful market position of consumer electronics manufacturers in the coming years.(Source: https://www.cta.tech)

The automotive industry segment is expected to grow at the fastest CAGR in the coming years, accounting for 16.4% of the market share, due to the increasing demand for high-resolution, energy-efficient, and sunlight-readable in-vehicle display systems. Furthermore, the global Telecommunication Union (ITU) and OECD measurements are anticipated to further increase the demand for displays, making QD-enhanced technologies the core aspect of automotive innovation.

Regional Insights

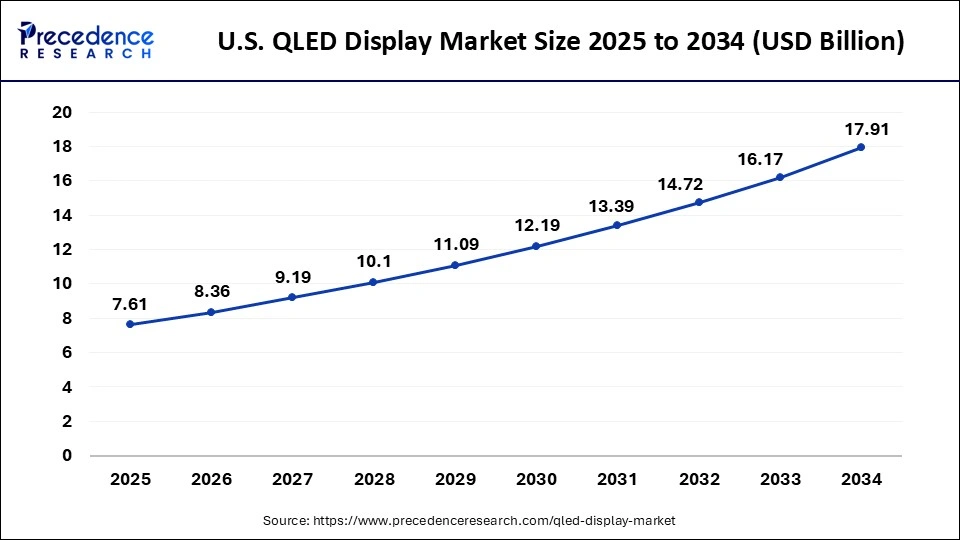

U.S. QLED Displays Market Size and Growth 2025 to 2034

The U.S. QLED displays market size is evaluated at USD 7.61 billion in 2025 and is projected to be worth around USD 17.91 billion by 2034, growing at a CAGR of 9.96% from 2025 to 2034.

Why Is North America the Dominant Region in the QLED Displays Market?

North America led the QLED displays market, capturing the largest revenue share in 2024 with an estimated 38.8% due to consumer demand for high-quality viewing experiences. Display Supply Chain Consultants (DSCC) predicts that LG Electronics and Vizio will increase the production of QLEDs in North America to emphasize the high-end large-format TVs and gaming monitors in 2024.

Streaming services and the growing popularity of immersive entertainment have further stimulated consumer demand, leading to an increase in the adoption rate of QLED products. Additionally, the commercial QLED applications to digital signage, broadcasting studios, and e-sports arenas also increased significantly in the region, thus fuelling the market.(Source: https://display.counterpointresearch.com)

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, which held a market share of about 17.4%. Owing to the increasing populations of the middle classes, increased disposable incomes, and demand for high-quality consumer electronics. The top producers, including BOE Technology Group, TCL CSOT, and Samsung Display, expanded manufacturing capabilities to supply local markets and also ship their products abroad. (Source: https://www.isdp.eu)

The use of QLED in China was boosted by government-supported programs that encouraged high-tech display production as part of the Made in China 2025 strategy. IDC stated that in 2024, shipments of QLED TVs in the Asia Pacific region grew by 22%, with China being the major player. Furthermore, the APAC increased smartphone demand and promoted the integration of QLED in mobile displays, driving the high growth rate of QLED displays in this region.(Source:https://my.idc.com)

Top Vendors in the Quantum Dot Display Market & Their Offerings

- Samsung Display Co., Ltd. (South Korea): A global leader in premium visual technologies, Samsung Display is renowned for integrating advanced quantum dot materials in QLED TVs and IT displays.

- LG Display Co., Ltd. (South Korea): LG Display leverages quantum dot technology in large-area panels and OLED/Quantum Dot synergy products.

- BOE Technology Group Co., Ltd. (China): BOE is a prominent player in the quantum dot display market, offering innovative AMQLED technology.

- TCL CSOT (China): TCL CSOT is a key player in high-resolution displays for TVs and smart appliances.

- AUO Corporation (Taiwan): AUO integrates cadmium-free quantum dots in its LCD panels, such as the 85-inch Bezel-less 8K4K ALCD TV Display.

- Nanosys, Inc. (USA): Nanosys is at the forefront of quantum dot technology innovation, specialising in cadmium-free and alloyed quantum dot formulations used across QLED TVs, monitors, and sensor devices.

- Nanoco Group plc (UK): Nanoco Group specialises in scalable, cadmium-free quantum dot production, catering to medical imaging, lighting, and advanced displays.

- Merck KGaA (Germany): Merck KGaA is a science and technology powerhouse driving high-quality quantum dot materials for display, lighting, and healthcare sectors.

- BOE Technology Group Co., Ltd. (China): BOE is a prominent player in the quantum dot display market, offering innovative AMQLED technology.

Recent Developments

- In May 2025, Samsung, India's leading consumer electronics brand, unveiled its ultra-premium 2025 lineup, including Neo QLED 8K, Neo QLED 4K, OLED, QLED TVs, and The Frame series. Central to this launch is the new Samsung Vision AI, designed to deliver a next-generation home entertainment experience with advanced AI capabilities. This innovation redefines user interaction with displays, transforming them into intelligent companions that enhance daily living. Samsung emphasised that this range reflects its ongoing commitment to pushing the boundaries of display technology. (Source: https://news.samsung.com)

- In September 2025, Kodak expanded its Matrix Series with a new line of QLED Google TVs, available in 43-, 50-, 55-, and 65-inch models. Available on Flipkart and Amazon, the new lineup features a bezel-less metallic design paired with premium QLED panels. Each model comes preloaded with popular streaming platforms, including Netflix, Prime Video, YouTube, Sony Liv, Disney+ Hotstar, and Zee5, offering consumers a versatile entertainment experience directly at their fingertips. (Source: https://indianexpress.com)

- In June 2025, HARMAN, a subsidiary of Samsung Electronics, launched a 14.53-inch Neo QLED display for the Tata Motors Harrier EV electric vehicle. This marks the first-ever automotive application of Samsung's Neo QLED technology. Licensed to HARMAN for automotive use, the display integrates advanced QLED features tailored for in-vehicle applications, delivering superior colour, brightness, and visual clarity for the next generation of automotive infotainment systems.(Source: https://www.autocarpro.in)

Segments Covered in the Report

By Material

- Cadmium-Free Quantum Dots

- Cadmium-Based Quantum Dots

By Applications

- Televisions

- Monitors

- Notebooks

- Tablets

- Smartphones

By End-User

- Consumer Electronics Manufacturers

- Automotive Industry

- Healthcare Sector

- Commercial & Industrial Applications

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East &Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting