What is the Digital Out-Of-Home Advertising Market Size?

The global digital out-of-home advertising market is witnessing rapid growth as brands leverage digital displays and smart signage to engage consumers in public spaces.The market growth is driven by growing urbanization, increasing adoption of programmatic advertising, and the rising demand for dynamic, real-time, and data-driven audience targeting solutions.

Digital Out-Of-Home Advertising Market Key Takeaways

- By region, North America dominated the market with about 37% share in 2024.

- By region, Asia Pacific is expected to expand at around 11.8% CAGR during the forecasted years.

- By format type, the digital billboards segment led the market while holding a 42% share in 2024.

- By format type, the video advertising segment is expected to expand at about 13% CAGR over the forecast period.

- By location, the outdoor segment captured a 68% revenue share in 2024.

- By location, the indoor segment is expected to grow at a 12% CAGR over the forecast period.

- By end-user industry, the retail segment led the market while holding a 30% share in 2024.

- By end-user industry, the healthcare segment is expected to grow at 10.6% CAGR over the forecast period.

- By technology, the LED displays segment held the market while holding a 63% share in 2024.

- By technology, the projection systems segment is expected to expand at about 11.4% CAGR over the forecast period.

Strategic Overview of the Global Digital Out-Of-Home Advertising Industry

The digital out-of-home advertising market is being propelled by rapid advancements in digital technologies. Innovations such as programmatic advertising platforms, real-time data analytics, and geotargeting enable advertisers to dynamically plan and adjust campaigns based on factors like time of day, audience demographics, and even weather conditions. This level of flexibility enhances campaign effectiveness and facilitates more personalized consumer engagement, making DOOH an increasingly preferred platform for both global brands and local businesses.

Market growth is further driven by several catalysts, including rising urbanization, increased penetration of digital display screens, and the widespread adoption of data-driven marketing strategies. The growing number of urban commuters and consumers has amplified the need for high-visibility, impactful advertising solutions—positioning DOOH as a critical medium for reaching mass audiences. Moreover, emerging technologies such as artificial intelligence (AI), the Internet of Things (IoT), and mobile connectivity are enhancing the precision, interactivity, and measurability of campaigns. As brands move toward more integrated omnichannel strategies, DOOH plays a key role in bridging the gap between physical and digital touchpoints, enriching offline consumer engagement.

Artificial Intelligence: The Next Growth Catalyst in Digital Out-Of-Home Advertising

The introduction of AI and its potential to develop smarter, more data-driven, and highly adaptive campaigns are transforming the digital out-of-home advertising market. AI supports digital screens in detecting prevailing audience demographics, traffic, and environmental information, such as weather, events, or time of day, through machine learning, computer vision, and predictive analytics. Such intelligence can dynamically update the content and ensure that advertisements are suitable and attractive to the respective target groups of people. AI facilitates interactions by understanding gestures, facial expressions, and mobile device gestures, creating personalized and engaging consumer experiences. It also includes analytics dashboards to provide advertisers with valuable insights into engagement measurements, campaign performance, and audience behavior.

Digital Out-Of-Home Advertising Market Outlook

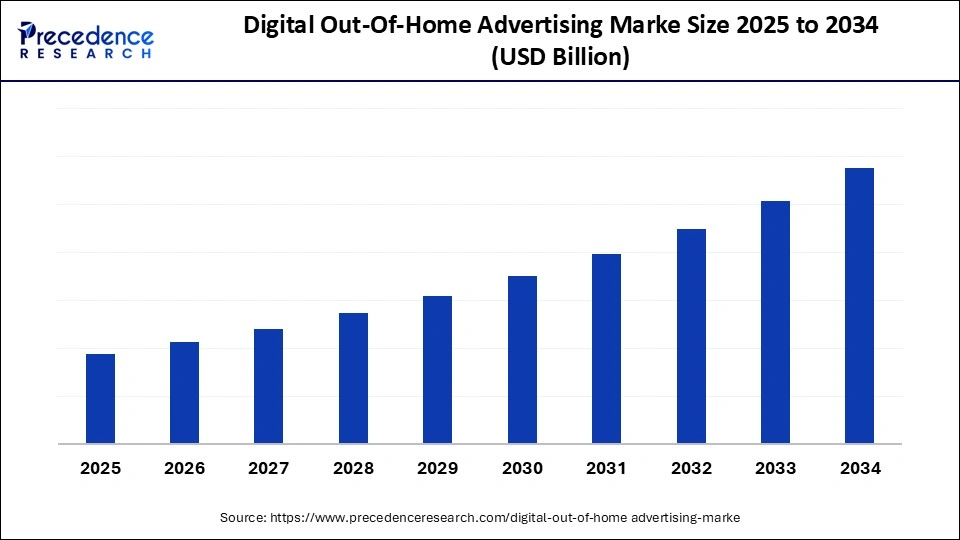

- Market Growth Overview: The DOOH advertising market is set for robust growth between 2025 and 2034, driven by rapid urbanization, the development of smart cities, and advancements in digital screens, AI, and programmatic technologies. The rising demand for dynamic, interactive, and data-driven advertising in retail, transit, and commercial environments is accelerating adoption and delivering measurable ROI for advertisers globally.

- Global Expansion: The adoption of DOOH is increasing globally, with significant momentum in North America, Europe, Asia Pacific, and emerging economies. Investments in urban infrastructure, such as transit systems, airports, and shopping centers, are opening new advertising avenues. The international rollout of DOOH networks is also being driven by cross-border campaigns and multinational brand strategies.

- Major Investors: Key areas attracting investment include DOOH networks, programmatic platforms, and digital signage technologies. Notable deals include T-Mobile's $600 million acquisition of Vistar Media and increased funding in interactive screen networks by private equity firms. Venture capital and strategic corporate investments are fueling innovation and scalability across high-traffic, data-driven DOOH solutions.

- Startup Ecosystem: The DOOH startup landscape is vibrant, focusing on AI-driven targeting, real-time analytics, and interactive display technologies. Emerging companies are developing location-based, real-time content delivery systems that offer niche, scalable solutions. A surge in venture funding and strategic partnerships is enabling these startups to innovate quickly and compete with established global players.

What Factors are Fueling the Growth of the Digital Out-Of-Home Advertising Market?

- Urbanization and a High Traffic Area: The increase in population in the urban areas, as well as the influx of more people in the shopping malls, airports, and transit areas, will result in the need to install high-visibility digital screens that will enable the brands to target large numbers of people with successful and effective advertising campaigns.

- Adoption Programmatic Advertising: The integration of programmatic platforms enables the automatic buying and selling of DOOH inventory in real-time, allowing for more specific targeting, greater campaign flexibility, and bidding. This efficiency fosters greater confidence in advertisers and drives market growth.

- Technological Developments: Technology, including LED displays, AI, the Internet of Things, and mobile connectivity, makes it more interactive, measurable, and content delivering. These technologies make DOOH a more attractive channel to advertisers, as it can be updated in real-time, utilize individual messages, and be immersive.

- Omnichannel Integration: DOOH refers to an association between online and offline advertising as brands strive to create seamless customer experiences. Connection to mobile campaigns and social media reinforces interaction and encourages brand presence across all channels continuously.

Market Outlook

- Market Growth Overview: The Digital Out-Of-Home Advertising market is expected to grow significantly between 2025 and 2034, driven by the growing adoption of programmatic ad buying, which streamlines ad placements and enables data-driven, hyper-targeted campaigns.

- Sustainability Trends: Sustainability trends involve eco-friendly materials and waste reduction, circular economy and recycling programs, and energy-efficient technology.

- Major Investors: Major investors in the market include BlackRock, Inc., The Vanguard Group, Inc., Cohen & Steers, Inc., Providence Equity Partners L.L.C., and JCDecuax SE.

- Startup Economy: The startup economy is focused on hyperlocal and contextual targeting, creative content and interactive experiences, and new advertising networks and media types.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Format Type, Location, End-User Industry, Technology, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

High Media Flexibility with Integrated Screens

Integrated and connected screens are also a crucial factor driving the digital out-of-home advertising market, as they offer high media flexibility. The conventional form of out-of-home advertising had major drawbacks, including the time-consuming delivery of content, physical setups, and labor-intensive operations required to update their campaigns. DOOH removes these restrictions through digitally linked screens, where creative content can be shared across different locations in real-time by advertisers with the touch of a few buttons clicks. Its flexibility also improves cost efficiency, as media can be reused, repositioned, or customized to meet specific audience needs. This fast flexibility, along with developed analytics, makes DOOH a better choice over the traditional fixed outdoor advertising, which has generated powerful uptake by brands interested in advertising solutions that are dynamic, responsive, and measurable.

Restraint

High Costs for Installation and Maintenance

One of the major limitations to the development of the DOOH advertising market is the high cost of installing and maintaining the digital display system. Although customers typically consider the original price of the digital screens, many overlook the fact that they must cover the operational costs to ensure the desired performance in the long run. DOOH screens, especially large-format or interactive screens, are expected to be serviced, updated with software, or even repaired by a professional should the screen experience downtime or a loss of reliability. The advent of new technology, such as drone-assisted maintenance, is beginning to make checks and the partial repair process easier by automating the process and reducing human error. Such innovative resolutions require a significant investment in equipment, education, and the integration of technologies that are otherwise expensive for smaller advertisers or network operators.

Opportunity

Improvement of the Public Transit System

Enhancement and expansion of the public transit systems are a major growth prospect of the digital out-of-home advertising market. Infrastructure investments such as transit systems, metro systems, buses, airports, and railway stations offer strategically busy places where digital advertising screens can be installed. Furthermore, these investments are sustainable in terms of ensuring mobility is environmentally friendly and easing the overcrowding in urban areas, which indirectly leads to longer dwell times in transit areas and greater exposure to adverts. These factors, including increasing mobility networks, the integration of technologies, and government assistance, make public transit systems one of the primary channels for further DOOH coverage and involvement, generating increased revenues for advertisers and media operators.

Segment Insights

Format Type Insights

Why Did Digital Billboards Segment Lead the Market in 2024?

The digital billboards segment led the digital out-of-home advertising market while holding about 42% share in 2024. This is due to the widespread use of digital billboards in high-traffic areas, which maximizes audience access and engagement. Advanced technology that allows billboards to become highly attractive and deliver dynamic content has made billboards highly attractive and effective. They are scalable to give real-time updates, location-based messages, and can be combined with data-driven advertising solutions and improve the accuracy of targeting and campaign effectiveness.

With the increasing urbanization and growing mobility of the audience, digital billboards attract attention better than stationary ones, which convey brand messages with a high level of visibility. Additionally, with billboards, there is a possibility of having several advertisements in a row, making them cost-effective and ensuring they will not lose audience.

The video advertising segment is expected to grow at a 13% CAGR in the upcoming period. Video enables the creation of dynamic, engaging, and memorable content that can effectively capture attention in urban and high-traffic areas. It offers cost efficiency, as multiple campaigns can run simultaneously on a single screen, maximizing ROI for advertisers. The continued rise in urbanization, infrastructure development, and expansion of transit and retail hubs is further driving the adoption of video-based DOOH campaigns. Additionally, video advertising offers higher precision and effectiveness than traditional outdoor formats by leveraging real-time tracking, audience targeting, and data analytics.

Location Insights

How Does the Outdoor Segment Hold the Largest Market Share in 2024?

The outdoor segment held approximately 68% share of the digital out-of-home advertising market in 2024. Formats such as digital billboards, transit screens, and street furniture offer maximum exposure, capturing the attention of commuters, pedestrians, and motorists. The impact of outdoor campaigns has been significantly enhanced through technologies like LED displays, projection mapping, and interactive panels, making them more visually compelling and engaging. While outdoor setups are typically more expensive than indoor alternatives, they offer broader reach and higher audience engagement. As urbanization accelerates and city infrastructure expands, the prominence of outdoor DOOH continues to grow, offering massive reach, dynamic messaging, and interactivity that reinforce its dominant market position.

The indoor segment is expected to grow at a 12% CAGR during the projection period due to the growing deployment of digital billboards in shopping malls, airports, theaters, office complexes, and other in-store locations. More complex data analytics is being applied to track metrics, such as engagement rates, dwell time, and conversion, ensuring that advertisers maximize the effectiveness of their campaigns. The development of business complexes, retail centers, entertainment centers, and other venues is another reason behind the rising popularity of indoor DOOH installation, where the quality of graphics is enhanced and the lighting conditions are controlled to make the viewer feel more engaged.

End-User Industry Insights

What Made Retail the Dominant Segment in the Market in 2024?

The retail segment dominated the digital out-of-home advertising market while holding a 30% share in 2024. This is due to its extensive use of dynamic displays to motivate consumer activity and drive sales. DOOH displays in high-traffic areas, such as shopping centers, storefronts, or transportation facilities, enable retailers to reach a substantial number of people with promotional messages, targeted messages, and announcements about new products. The interactive solutions and real-time content updates enable retailers to provide more personalized experiences, thereby increasing customer engagement and foot traffic within physical stores. Moreover, the insights derived from data enable ad creators to adjust campaigns based on demographics, shopping patterns, and peak hours, thereby enhancing the efficiency of marketing campaigns. The potential for high engagement, flexibility, and measurable impact has solidified the leading role of the retail segment in the market.

The healthcare segment is expected to grow at a 10.6% CAGR during the forecast period, as more investments are being made in healthcare services marketing, patient education, and awareness creation. Adoption is also being encouraged by the trend of paying more attention to public health, vaccinations, and chronic disease management programs. DOOH enables healthcare advertisers to measure engagement, track responses, and dynamically adjust content to optimize campaign effectiveness. As healthcare providers seek new ways to communicate with their patients and the broader population, the use of digital advertising solutions is gaining increasing importance.

Technology Insights

Why Did the LED Displays Segment Lead the Market in 2024?

The LED displays segment led the digital out-of-home advertising market, holding a 63% share in 2024, as LED screens are widely used in outdoor billboards, transit hubs, stadiums, and urban centers due to their ability to reach large, mobile audiences. Advancements in high-definition, energy-efficient, and weather-resistant LED technology have further increased their appeal, offering vibrant visuals with strong durability. Their capability to support real-time updates and interactive content allows advertisers to run multiple campaigns on a single screen, maximizing engagement. With superior reliability, scalability, and audience reach, LED displays continue to be the preferred format among advertisers and DOOH operators.

The projection systems segment is expected to grow at a 11.4% CAGR over the forecast period. This technology enables advertisers to transform ordinary urban spaces, such as building facades, interactive walls, and public installations, into immersive visual experiences. Dynamic, motion-based, and customized projection content enhances brand storytelling and delivers memorable engagements, especially in entertainment, retail, and tourism sectors. The rise of 3D projection mapping, advanced software tools, and AR integration is expanding creative possibilities, enabling highly differentiated and attention-grabbing campaigns in dense urban environments.

Region Insights

Why Did North America Lead the Global Digital Out-Of-Home Advertising Market?

North America led the global market with the highest market share of 37% in 2024. Thi is because of the region's advanced infrastructure, comprising developed transportation networks, airports, highways, and business hubs, provides prime locations for high-impact advertising. Technological advancements such as high-definition LED displays, programmatic platforms, and projection systems enable real-time, dynamic, and targeted content delivery. Key industries, including retail, automotive, entertainment, and consumer electronics, have been heavily investing in DOOH campaigns to target large, mobile audiences. The increasing use of audience analytics and data-driven strategies enhances campaign performance, delivering measurable ROI and reinforcing DOOH's value proposition for brands.

U.S. Digital Out-Of-Home Advertising Market Trends

The U.S. remains the largest and most profitable market for DOOH advertising in North America. Factors such as a highly urbanized population, elevated consumer mobility, and strong economic activity make locations like airports, shopping malls, retail corridors, and transit hubs ideal for digital campaigns. Leading DOOH providers are innovating through interactive installations, precise geotargeting, and programmatic ad buying to deliver personalized, real-time content. Furthermore, strong public-private collaborations in smart city development and infrastructure modernization are accelerating the deployment of advanced DOOH networks across urban centers.

Why is Asia Pacific Considered the Fastest-Growing Market for Digital Out-Of-Home Advertising?

Asia Pacific is projected to grow at a CAGR of 11.8% over the forecast period, driven by rapid urbanization, rising disposable incomes, and accelerating digitalization across emerging economies, including China, India, and Southeast Asia. Large-scale investments in public infrastructure and smart city initiatives are creating strategic opportunities for DOOH deployment across transit hubs, commercial centers, and high-footfall urban locations. The region's high population density ensures a wide audience reach, while increasing smartphone penetration and mobile connectivity enable seamless integration between DOOH campaigns and mobile or digital platforms.

China Digital Out-Of-Home Advertising Market Trends

China remains a key growth engine within the region, driven by aggressive urban development, the implementation of smart cities, and substantial investments in digital infrastructure. Cities like Beijing, Shanghai, and Shenzhen are leading in the adoption of digital billboards, interactive displays, and transit-based DOOH networks. Government initiatives supporting smart mobility, public transport modernization, and digital infrastructure expansion are further accelerating the rollout of DOOH solutions. Additionally, rising consumer spending in sectors like retail, entertainment, and lifestyle products is driving strong demand for dynamic and high-visibility digital advertising formats.

India Digital Out-Of-Home Advertising Market Trends

India is emerging as a key player in the market due to rapid urbanization, rising disposable incomes, and widespread smartphone penetration, which together drive higher consumer engagement with digital media. Additionally, significant government investments in smart city projects and public infrastructure provide prime locations for DOOH installations, while a young, tech-savvy population boosts demand for interactive and data-driven advertising solutions. The evolving regulatory environment and increasing adoption of programmatic advertising platforms further enhance India's attractiveness as a growing hub in the global DOOH landscape.

- For instance, India has proposed the removal of the 6% equalisation levy on online advertisements, effective from April 1, 2025. This move aims to ease trade tensions with the U.S. and reduce the tax burden on digital advertisers, potentially boosting investments in digital advertising platforms.(Source: https://www.thehindu.com)

Top Companies in the Digital Out-Of-Home Advertising Market & Their Offerings

Tier I: Major Market Leaders

These companies are dominant players in the DOOH advertising space, with extensive global networks, significant revenue contributions, and advanced technological capabilities.

- JCDecaux: Operates over 350,000 digital units across more than 80 countries, leading in urban billboards and transit displays.

- Clear Channel Outdoor Holdings: Manages over 450,000 displays, including 130,000 digital screens, with a strong presence in high-traffic regions.

- Lamar Advertising Company: Operates a vast network of digital billboards, particularly in the United States, with a significant presence in both urban and rural areas.

- OUTFRONT Media: Focuses on high-traffic locations in North America, offering a range of digital advertising solutions.

- Stroer SE & Co. KGaA: A leading German company with a strong presence in digital out-of-home advertising across Europe.

Cumulative Market Share for Tier I: ~63.2%

Tier II: Significant / Mid-Size Players

These companies have a notable presence in the DOOH market, with expanding networks and increasing revenue contributions.

- Broadsign International: Provides a leading programmatic advertising platform for digital signage networks, facilitating real-time content delivery.

- Daktronics: Specializes in manufacturing digital billboards and displays, with a growing footprint in the DOOH sector.

- Prismview LLC (NEC Display Solutions): Offers high-quality digital display solutions, catering to various outdoor advertising needs.

- oOh!media Limited: An Australian company with a strong presence in digital out-of-home advertising across the Asia-Pacific region.

- Mvix: Provides digital signage solutions with a focus on content management and display technology.

- Christie Digital Systems USA: Known for its advanced projection technology used in large-scale outdoor advertising displays.

Tier III: Emerging / Early-Stage Players

These companies are in the growth phase, with innovative solutions and expanding market reach.

- Ayuda Media Systems: Develops software solutions for managing digital out-of-home advertising networks.

- Deepsky Corporation: Specializes in digital signage and advertising technology, focusing on interactive displays.

- Aoto Electronics: Manufactures LED displays used in various outdoor advertising applications.

- Signagelive Limited: Offers cloud-based digital signage solutions for content management and distribution.

- Net Display Systems: Provides digital signage software solutions for content creation and management.

- ONELAN Limited: Delivers digital signage solutions with a focus on content scheduling and playback.

Value Chain Analysis of the Digital Out-Of-Home Advertising Market

- Hardware Manufacturing & Infrastructure

This stage involves the production and installation of the physical digital screens, displays, and supporting infrastructure like power supplies and connectivity solutions.

Key Players: Daktronics, Prismview LLC, NEC Display Solutions Ltd - Software & Technology Platforms

This segment focuses on the software that manages and delivers content to the screens, including Content Management Systems (CMS), ad serving platforms, and programmatic advertising technology.

Key Players: Broadsign, Vistar Media, Hivestack, VIOOH (a JCDecuax company), and Spectrio. - Content Creation & Management

Advertisers and their agencies develop the actual advertisements and media that will be displayed on the screens. This stage requires creative services to produce engaging, dynamic, and contextually relevant content optimized for digital out-of-home formats.

Key Players: Dentsu, Publicis - Media Network Operation & Sales (Media Owners/Publishers)

Media owners operate the networks of digital screens in various locations (e.g., airports, malls, roadside, public transport) and sell the advertising space (inventory) to advertisers or agencies.

Key Players: JCDecuax SE, Clear Channel Outdoor Holdings Inc., Lamar Advertising Company, OUTFRONT Media Inc., and Ströer SE & Co. KGaA. - Advertising Agencies & Media Buying

Advertising agencies plan, buy, and manage campaigns on behalf of their clients, often using Demand-Side Platforms (DSPs) to buy ad space programmatically.

Key Players: The Trade Desk and Google Ad Manager. - Audience Measurement & Analytics

This final stage involves measuring the effectiveness of the campaigns using data analytics, AI-powered audience measurement tools, and third-party verification services.

Key Players: Veridooh (verification and measurement), Vistar Media, Hivestack, and various data management platforms (DMPs) and analytics providers.

Recent Developments

- In November 2024, Haleon, the consumer health company behind brands like Sensodyne and Centrum, has chosen Vistar as its global partner for programmatic out-of-home (OOH) advertising. In collaboration with Publicis, Vistar will power Haleon's OOH campaigns through its demand-side platform across key markets.(Source: https://www.digitalsignagetoday.com)

- In October 2024, DLM Media Solutions partnered with a fast-growing digital out-of-home network in the U.S., CETV Now. According to the agreement, DLM Media will become the exclusive national service fulfillment partner and master dealer of CETV Now and become a key partner of the company to expand rapidly and capitalize on the increasing demand for digital advertising.(Source: https://www.prweb.com)

- In September 2024, Godrej Appliances launched an OOH campaign to promote its new AI-powered washing machine, aiming to raise awareness among urban consumers. The campaign targets high-traffic areas in Bangalore and Chennai to maximize visibility and reach in key metro markets.

(Source: https://www.media4growth.com)

Segments Covered in the Report

By Format Type

- Digital Billboards

- Video Advertising

- Ambient Advertising

- Others

By Location

- Outdoor

- Indoor

By End-User Industry

- Retail

- Transportation

- Education

- Healthcare

- Banking & Finance

- Others

By Technology

- LED Displays

- Projection Systems

- Interactive Kiosks

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting