Radiopharmaceuticals Market Size and Forecast 2025 to 2034

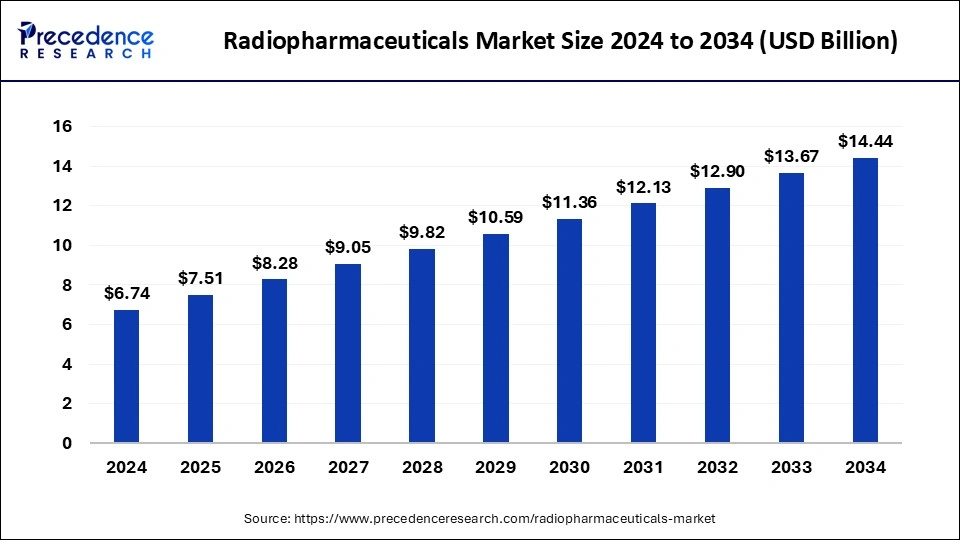

The global radiopharmaceuticals market size was calculated at USD 6.74 billion in 2024 and is predicted to increase from USD 7.51 billion in 2025 to approximately USD 14.44 billion by 2034, expanding at a CAGR of 7.53% from 2025 to 2034.

Radiopharmaceuticals Market Key Takeaways

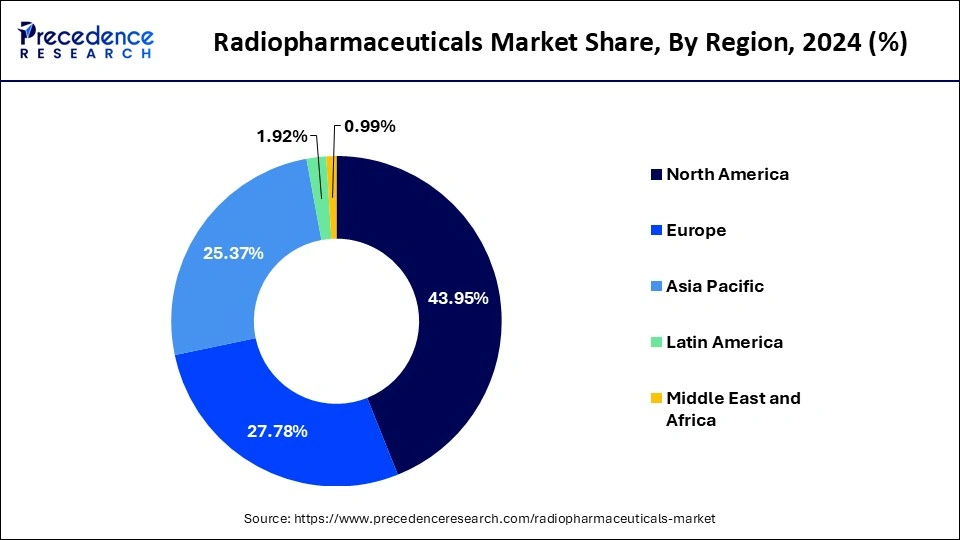

- North America led the market with the highest market share of 43.95% in 2024.

- Asia-Pacific is expected to expand at the fastest CAGR during the forecast period.

- By type, the therapeutic radiopharmaceuticals segment is expected to grow at the fastest rate in the market during the forecast period.

- By End User, the hospitals and clinics segment led the market in terms of revenue in 2024.

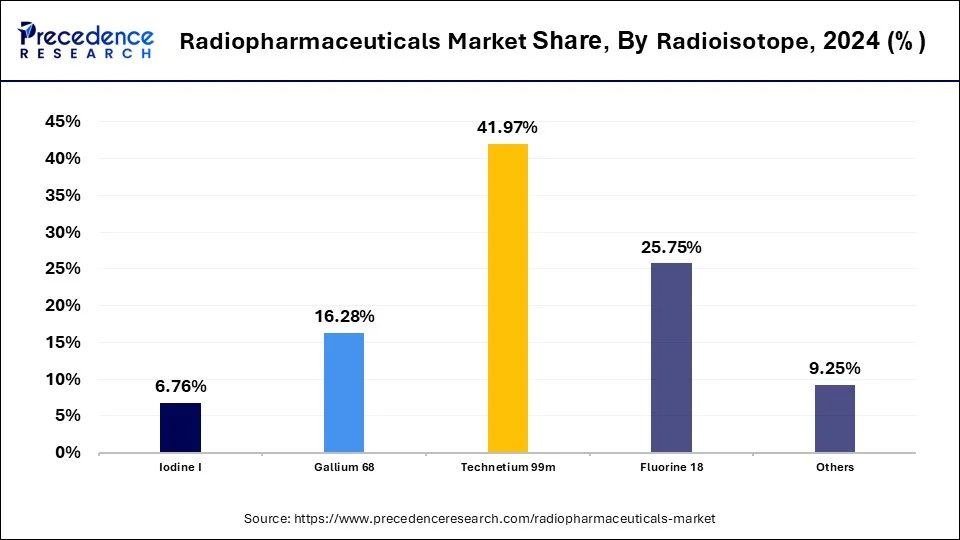

- By Source, the Technetium-99m segment captured a significant portion of the market in 2024.

- By source the Gallium-68 segment is projected to experience the highest growth rate in the market between 2025 and 2034.

What is the role of AI in the market?

AI significantly streamlines the design and development of new radiopharmaceuticals. Through in silico modelling, AI predicts the structure activity relationships of potential compounds, optimizing their efficacy and safety profiles. This approach reduces the time and cost associated with traditional experimental methods, enabling faster introduction of novel agents into clinical settings. In nuclear medicine, AI improves the precision of imaging techniques such as PET and SPECT.

Advanced algorithms assist in image reconstruction, noise reduction, and lesion detection, leading to more accurate diagnostics. Additionally, AI aids in personalized demisters by analysing imagining data to calculate optimal radiation doses for individual patients, thereby enhancing therapeutic outcomes. AI plays a crucial role in theranostics, the combines diagnostic and therapeutic approach in radiopharmaceuticals. By integrating diagnostic imaging with therapeutic strategies, AI facilitates personalized treatment plans tailored to the patient's specific condition. This integration ensures targeted therapy, minimizing side effects and improving treatment efficacy. AI assets clinicians in making informed decisions by providing decision support tools that analyse complex datasets. These tools help in identifying suitable candidates for radiopharmaceutical therapies, predicting treatment responses, and monitoring patient progress, thereby enhancing the overall quality of care.

U.S. Radiopharmaceuticals Market Size and Growth 2025 to 2034

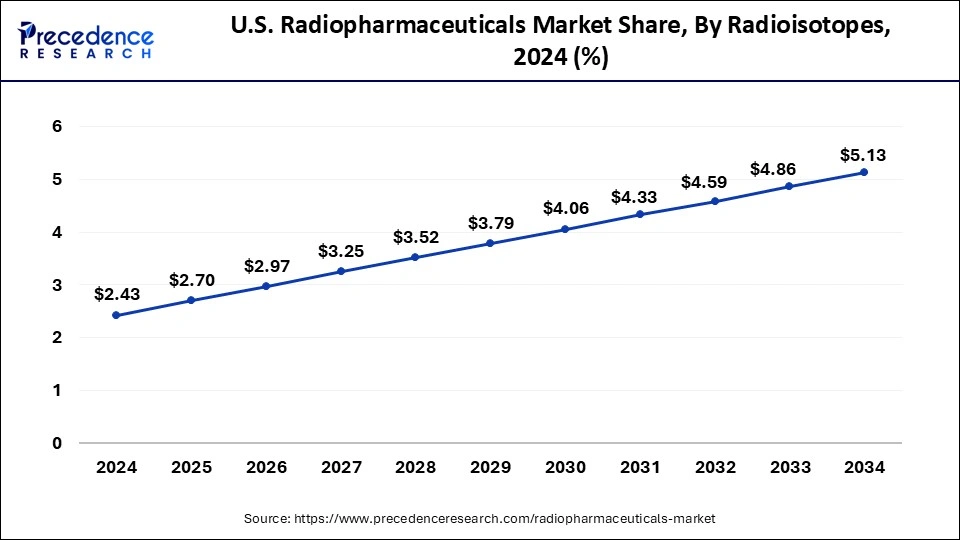

The U.S. radiopharmaceuticals market size was evaluated at USD 2.43 billion in 2024 and is projected to be worth around USD 5.13 billion by 2034, growing at a CAGR of 7.38% from 2025 to 2034.

North America has held the largest revenue share, 43.95% in 2024. North America's dominance in the radiopharmaceuticals market can be attributed to several pivotal factors. The region possesses a robust healthcare ecosystem, extensive research and development initiatives, and a high incidence of chronic ailments, fueling the demand for radiopharmaceuticals in diagnostics and treatment.

Furthermore, North America benefits from a well-established regulatory landscape, favorable reimbursement structures, and a significant presence of leading pharmaceutical and radiopharmaceutical enterprises, enhancing its market leadership. Additionally, the region's dedication to technological innovation and the embrace of cutting-edge imaging modalities solidify its preeminent position in the global radiopharmaceutical arena.

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific region has asserted its prominence in the radiopharmaceuticals market due to distinct factors. Its substantial and aging populace is encountering a surge in chronic ailments, compelling escalated employment of radiopharmaceuticals for diagnostic and therapeutic purposes. Furthermore, an upswing in healthcare infrastructure, wider accessibility to advanced medical technologies, and heightened awareness of nuclear medicine's advantages are propelling market expansion.

Additionally, the region's augmented investments in research and development, coupled with favorable shifts in regulatory landscapes, are fostering innovation and the creation of novel radiopharmaceuticals, thereby substantiating the significant market share held by Asia-Pacific.

Market Overview

The radiopharmaceuticals sector encompasses the realm of nuclear medicine pharmaceuticals. These substances contain radioactive elements, facilitating the diagnosis and treatment of a wide array of medical conditions. Radiopharmaceuticals emit radiation that can be detected through cutting-edge imaging devices like PET and SPECT scanners. This facilitates the visualization of internal physiological processes and the detection of diseases such as cancer, cardiac conditions, and neurological disorders.

The global radiopharmaceuticals market has expanded owing to breakthroughs in healthcare technology, an increasing prevalence of chronic illnesses, and a burgeoning elderly demographic. It plays a pivotal role in personalized medicine and the advancement of innovative medical therapeutics.

Radiopharmaceuticals Market Growth Factors

The radiopharmaceuticals sector, an integral component of nuclear medicine, has witnessed substantial expansion owing to its pivotal role in the diagnosis and treatment of diverse medical conditions. Radiopharmaceuticals consist of specialized drugs containing radioactive components that emit detectable radiation via sophisticated imaging instruments like PET and SPECT scanners. This technological advancement enables the visualization of internal bodily functions, aiding in the detection of ailments such as cancer, cardiovascular maladies, and neurological disorders.

The global radiopharmaceuticals market has experienced robust growth, underpinned by advancements in healthcare technology, the rising prevalence of chronic illnesses, and the burgeoning elderly population.

A primary impetus propelling the radiopharmaceuticals market is the burgeoning realm of personalized medicine. Radiopharmaceuticals play a pivotal role in customizing medical treatments for individual patients, and enhancing therapeutic outcomes. Moreover, the escalating incidence of chronic ailments like cancer and cardiovascular diseases has stimulated demand for diagnostic and therapeutic solutions offered by radiopharmaceuticals. The industry has also benefited from ongoing research and development endeavors, ushering in novel radiopharmaceuticals that augment diagnostic precision and therapeutic effectiveness.

Despite its promising trajectory, the radiopharmaceuticals sector confronts several obstacles. Regulatory complexities can impede the approval process for new radiopharmaceuticals, leading to delays in their commercial rollout. There are also concerns surrounding the secure handling and disposal of radioactive materials, which can entail substantial expenses and logistical intricacies. Additionally, the substantial initial investments required for establishing radiopharmaceutical production facilities can pose a formidable entry barrier for smaller enterprises.

The radiopharmaceuticals market offers substantial business prospects, particularly in the sphere of pioneering diagnostic and therapeutic agents. Enterprises adept at navigating the regulatory landscape and committing resources to research and development for cutting-edge radiopharmaceuticals are well-poised for success. Moreover, collaborative ventures between pharmaceutical entities, healthcare providers, and research institutions can spur joint efforts in advancing the field. With healthcare systems globally emphasizing early disease detection and personalized treatment, the radiopharmaceuticals market stands poised to leverage these opportunities.

In summation, the radiopharmaceuticals domain is a dynamic sector that has witnessed significant expansion owing to its pivotal role in healthcare. While grappling with regulatory intricacies and logistical challenges, it presents substantial business opportunities for enterprises at the vanguard of research and innovation, driven by the surging demand for personalized medicine and the escalating prevalence of chronic diseases.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.53% |

| Market Size in 2025 | USD 7.51 Billion |

| Market Size in 2024 | USD 6.74 Billion |

| Market Size by 2034 | USD 14.44 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Radioisotope, Application, Type, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Personalized medicine

Personalized medicine stands as a distinctive driving force propelling the dynamic expansion of the radiopharmaceuticals market. This groundbreaking paradigm tailors medical interventions to individual patients, leveraging their distinct genetic, molecular, and clinical profiles, thus ushering in a transformative era in healthcare. Within the realm of radiopharmaceuticals, this approach empowers the creation of exceptionally precise diagnostic and therapeutic solutions. Through the application of cutting-edge imaging techniques and the development of radiopharmaceuticals engineered to selectively bind to disease-specific biomarkers, healthcare professionals can deliver pinpoint diagnoses and meticulously monitor ailments such as cancer, cardiovascular disorders, and neurodegenerative conditions.

Furthermore, personalized medicine fuels the innovation of radiopharmaceutical-based treatments meticulously crafted to effectively combat diseases while minimizing adverse effects. The art of matching patients with radiopharmaceuticals uniquely suited to their genetic constitution and disease attributes not only elevates treatment outcomes and safety but also stimulates market growth by igniting a surge in research and development endeavors aimed at engineering novel, highly specialized radiopharmaceuticals.

Moreover, it fosters increased acceptance and utilization of radiopharmaceuticals as healthcare providers increasingly grasp their pivotal role in achieving precise diagnoses and delivering laser-focused therapeutic interventions. With the continued ascent of personalized medicine, the radiopharmaceuticals market is poised to ascend to unprecedented heights, revolutionizing the landscape of disease management and patient-centric care.

Restraints

The radiopharmaceuticals sector faces significant regulatory and reimbursement challenges that hinder its growth. Stringent regulatory requirements for the approval and manufacturing of radiopharmaceuticals can lead to lengthy development timelines and increased costs. Moreover, reimbursement policies vary widely across regions and healthcare system, with some insurers offering limited or no coverage for certain radiopharmaceutical therapies. This inconsistency can deter healthcare providers from adopting these advanced treatments, specialty when faced worth financial constraints. The combination of complex regulatory landscapes and uncertain reimbursement pathways creates a challenging environment for the widespread adoption and integration of radiopharmaceuticals into standard clinical practice.

A significant obstacle in the radiopharmaceuticals market is the inherent instability of many radioisotopes used in these treatments. These isotopes often have short half-lives, necessitating rapid production sites, quality control laboratories, and end users. Delays or disruptions at any point can render the isotopes ineffective, leading to potential treatment delays or cancellations. Additionally, the reliance on specialized infrastructure, such as cyclotrons and nuclear reactors, further complicates logistics, specially in regions lacking such facilities. This complex web of requirements makes the timely delivery of radiopharmaceuticals a persistent challenge.

Opportunities

Neurological applications

Neurological applications are etching distinctive contours in the radiopharmaceuticals market, sketching a vivid canvas of promising prospects. This metamorphosis is spurred by a myriad of forces reshaping the demand dynamics for radiopharmaceuticals. First and foremost, the surging prevalence of neurodegenerative ailments, exemplified by Alzheimer's and Parkinson's, compels a shift towards precise diagnostics, continuous surveillance, and deep-seated research. Radiopharmaceuticals, endowed with the knack for unveiling the intricacies of cerebral function and molecular-level disorders, have risen to become indispensable assets for neurologists and researchers alike.

In parallel, as the annals of neurobiology unfurl, radiopharmaceuticals are emerging as keystone elements in the realm of pharmaceutical development and clinical experimentation, sparking intricate collaborations between pharmaceutical juggernauts and radiopharmaceutical maestros. This burgeoning panorama not only fans the flames of innovation but also diversifies the utility of radiopharmaceuticals, transcending the precincts of oncology and elevating their pertinence and economic feasibility. This expansive trajectory is poised to spark heightened investments, transformative research endeavors, and fervent developmental pursuits in the radiopharmaceutical domain, promising an era rife with burgeoning opportunities and metamorphic growth.

Radioisotopes Insights

According to the Radioisotopes, the Technetium-99m sector has held a 41.94% revenue share in 2024. Technetium-99m (Tc-99m) holds a major share in the radiopharmaceutical market due to its unique properties. It's the most widely used isotope for diagnostic imaging, offering excellent imaging characteristics with a relatively short half-life, minimizing patient radiation exposure. Tc-99m is versatile, compatible with various radiopharmaceutical compounds, making it suitable for a wide range of diagnostic applications, from cardiology to oncology. Additionally, it is readily available from technetium generators, ensuring a stable supply chain. These factors, coupled with its established safety and efficacy, contribute to Tc-99m's dominant position in the radiopharmaceutical market.

The Gallium-68 sector is anticipated to expand at a significant CAGR of 8.7% during the projected period. The prominence growth of Gallium-68 (Ga-68) in the radiopharmaceuticals market is attributed to its substantial market share, driven by its adaptability and clinical significance. Ga-68 primarily finds its niche in positron emission tomography (PET) imaging, a modality that has gained increasing importance in the diagnosis, staging, and monitoring of cancer treatments. Radiopharmaceuticals labeled with Ga-68, such as Ga-68 DOTATATE for neuroendocrine tumors, offer exceptional precision and enhanced imaging quality. Furthermore, Ga-68 boasts a relatively brief half-life, facilitating the production of readily deployable radiopharmaceuticals within imaging centers. This convenience, combined with the expanding spectrum of Ga-68's applications in personalized medicine, firmly establishes its dominance in the radiopharmaceuticals market.

Radiopharmaceuticals Market Revenue, By Radioisotope 2022-2024 (USD Million)

| Radioisotope | 2022 | 2023 | 2024 |

| Iodine I | 353.9 | 405.0 | 455.7 |

| Gallium 68 | 838.3 | 967.1 | 1097.1 |

| Technetium 99m | 2179.5 | 2503.8 | 2828.6 |

| Fluorine 18 | 1341.7 | 1538.7 | 1735.3 |

| Others | 486.6 | 555.4 | 623.3 |

Application Insights

Based on the application, cancer is anticipated to hold the largest market share of 52.65% in 2024. This commanding presence results from several influential factors. Firstly, radiopharmaceuticals play a pivotal role in the multifaceted domain of cancer care, spanning diagnosis, staging, and treatment monitoring, thus elevating the precision of therapeutic interventions. Secondly, their indispensability extends to therapeutic modalities like radioimmunotherapy and targeted alpha-particle therapy, contributing significantly to the arsenal of effective cancer treatments. Furthermore, the relentless global burden of cancer, coupled with progressive strides in radiopharmaceutical technology, has considerably broadened their scope and application. The synergy of diagnostic and therapeutic utility, coupled with the escalating incidence of cancer, establishes the cancer segment as a formidable driver of market dominance.

On the other hand, the cardiology sector is projected to grow at the fastest rate over the projected period. The ascendancy of the cardiology domain within the radiopharmaceuticals market can be attributed to its pivotal and central role in unraveling the mysteries of cardiovascular diseases, which endure as a leading global cause of mortality. Radiopharmaceuticals, particularly those harnessed in single photon emission computed tomography (SPECT) and positron emission tomography (PET) imaging, bestow the gift of precision in deciphering cardiac dynamics, blood circulation, and tissue vitality, thereby empowering early ailment detection and vigilant treatment tracking.

As the prevalence of cardiovascular afflictions continues its unwavering ascent, the demand for these state-of-the-art diagnostic instruments steadfastly rises. Furthermore, concurrent endeavors in research and development, laser-focused on augmenting the effectiveness of cardiac radiopharmaceuticals, combined with the shifting demographic landscape characterized by aging, serve as cornerstones reinforcing the ascendancy and prominence of the cardiology segment within the radiopharmaceuticals market.

Radiopharmaceuticals Market Revenue, By Application2022-2024 (USD Million)

| Application | 2022 | 2023 | 2024 |

| Cancer | 2,738.1 | 3,143.0 | 3,547.8 |

| Cardiology | 1,491.9 | 1,715.1 | 1,939.0 |

| Others | 970.1 | 1,111.8 | 1,253.1 |

Type Insights

Based on the type, the therapeutics sector is anticipated to hold the largest market share of 59.58% in 2024. The dominance growth of the therapeutics segment in the radiopharmaceuticals market is attributed to its central role in the treatment landscape for a range of medical conditions, notably cancer. Radiopharmaceuticals, including targeted radionuclide therapies, offer highly precise and efficacious treatment modalities, reducing collateral damage to healthy tissues.

As the global incidence of cancer and chronic ailments continues to surge, the demand for therapeutic radiopharmaceuticals escalates. Furthermore, ongoing research and developmental endeavors are broadening the therapeutic spectrum of radiopharmaceuticals, reinforcing their prominence growth in contemporary healthcare and solidifying their commanding presence within the market.

On the other hand, the diagnostic sector is projected to grow at the fastest rate over the projected period. The diagnostic segment holds a significant share in the radiopharmaceuticals market primarily because of its critical role in disease detection and management. Radiopharmaceuticals, such as PET and SPECT tracers, provide precise and non-invasive imaging of various medical conditions, including cancer, cardiovascular diseases, and neurological disorders. They enable early diagnosis, accurate staging, and treatment planning, driving their widespread use. Additionally, the increasing prevalence of chronic diseases and the growing adoption of nuclear medicine techniques contribute to the sustained demand for radiopharmaceuticals in diagnostics, making it a major revenue-generating segment in the market.

The therapeutic radiopharmaceuticals segment is set to witness the fastest growth over the coming years. This surge is primarily driven by the rising adoption of targeted radionuclide therapies in oncology, as they offer a precise method of delivering radiation directly to cancer cells while minimizing damage to surrounding healthy tissues. Growing approval of novel radiogand therapies and the expanding pipeline of radioisotope based drugs for various cancers are also propelling demand. Increasing investments in precision medicine and favourable regulatory support are further expected to accelerate the adoption of therapeutic radiopharmaceuticals in clinical settings.

Radiopharmaceuticals Market Revenue, By Type, 2022-2024 (USD Million)

| Type | 2022 | 2023 | 2024 |

| Diagnostic | 2098.3 | 2413.1 | 2728.9 |

| Therapeutic | 3101.7 | 3556.9 | 4011.1 |

End User Insights

The hospitals and clinics sector has generated a revenue share of 54.14% in 2024. Hospitals and clinics hold a significant share in the radiopharmaceuticals market primarily due to their role as central hubs for patient care and medical imaging services. These healthcare facilities extensively utilize radiopharmaceuticals for diagnostic procedures like PET and SPECT scans, enabling accurate disease detection and treatment planning.

Moreover, hospitals and clinics often have the specialized equipment and expertise required for radiopharmaceutical administration and patient monitoring. As a result, they are key consumers, driving demand and revenue in the radiopharmaceuticals market, making them major stakeholders in this sector.

The medical imaging centers sector is anticipated to grow at a CAGR of 8.1% over the predicted period. Medical imaging centers hold a substantial share in the radiopharmaceutical market primarily because they are critical consumers of radiopharmaceutical products for diagnostic purposes. These centers, equipped with advanced imaging technologies like PET and SPECT, heavily rely on radiopharmaceuticals to conduct precise scans for disease detection and treatment monitoring.

The increasing incidence of conditions like cancer, cardiac diseases, and neurological disorders drives the demand for these diagnostic services. Additionally, medical imaging centers play a central role in the expansion of theranostic approaches, where radiopharmaceuticals are used for both diagnosis and therapy, further solidifying their significance in the market.

Although hospitals and clinics currently dominate the market, specialized diagnostic centres and nuclear medicine facilities are expected to emerge as the fastest growing segment. These centres are increasingly equipped with advanced imaging modalities and radiopharmaceutical handling units, which allows them to cater to the rising demand for early disease detection and personalize treatment approaches. As the preference shifts toward more accessible and specialized care outside of large hospital systems, diagnostic and nuclear medicine centres are anticipated to play a greater role in expanding patient access to radiopharmaceutical procedures.

Radiopharmaceuticals Market Revenue, By End User, 2022-2024 (USD Million)

| End User | 2022 | 2023 | 2024 |

| Hospitals and clinics | 2812.4 | 3232.4 | 3653.3 |

| Medical Imaging centers | 1357.4 | 1557.1 | 1756.6 |

| Others | 1030.3 | 1180.5 | 1330.1 |

Source Insights

Technetium-99m has maintained its dominance in the radiopharmaceuticals market due to its widespread use in diagnostic imaging procedures. As the most commonly utilized radioisotope in nuclear medicine, it plats a crucial role in single phantom emission computed tomography (SPECT) scans for detecting cardiovascular diseases, bine disorders, and certain cancers. Its short half-life and favourable imaging characterises make it an ideal choice for routine diagnostic applications, assuring high patient throughput and efficient utilization in hospitals and diagnostics centres. Additionally, the acceptance further reinforces its leading position in the market.

In contrast, Gallium-68 is emerging as the fastest growing source segment is the radiopharmaceuticals landscape. Its increasing adoption is closely tied to the rise of positron emission tomography (PET) imaging and the demand for more precise and targeted diagnostic tools. Gallium-68 is particularly valued for its effectiveness in imaging neuroendocrine tumours and prostate cancer, offering superior sensitivity and specificity compared to traditional isotopes. The availability of gallium-68 generators, which allow on site production, is also fuelling its growth by improving accessibility for healthcare providers. As the field of personalized medicine advances, gallium-68 is expected to see rapid integration into clinical practice, positioning it as a key driver of innovation in molecular imaging.

Radiopharmaceuticals Market Companies

- Bayer AG

- Iso-Tex Diagnostics, Inc

- Jubilant Pharmova Limited

- Novartis AG

- General Electric Company

- Lantheus Holdings, Inc.

- Eli Lilly and Company

- Siemens AG

- Curium Pharma

- Cardinal Health Inc.

Recent Developments

- In February 2025, Eli Lilly announced a strategic collaboration with Australian start up AdvanCell to develop targeted radiopharmaceutical therapies for hard to treat cancers. This partnership leverages AdvanCell's expertise in lead-212 isotope production and Lilly's oncology pipeline to create novel treatments aimed at improving patient outcomes in precision oncology.

(Source: 2025 starts strong for Eli Lilly with major M&A and partnerships) - In January 2025, Novartis completed the acquisition of Mariana Oncology, a U.S. based radiopharmaceutical company, for $1 billion. This acquisition strengthens Novartis' position in the rapidly growing field of radiopharmaceuticals, particularly in precision cancer treatments, and expands is capabilities in developing and manufacturing targeted therapies using radioactive isotopes.

(Source: 2025 M&A Deal Trends in Life Sciences | Clarkston Consulting)

Segments Covered in the Report

By Radioisotope

- Iodine I

- Gallium 68

- Technetium 99m

- Fluorine 18

- Others

By Application

- Cancer

- Cardiology

- Others

By Type

- Diagnostic

- Therapeutic

By End User

- Hospitals and clinics

- Medical Imaging centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting