What is the Rapid U-drills Market Size?

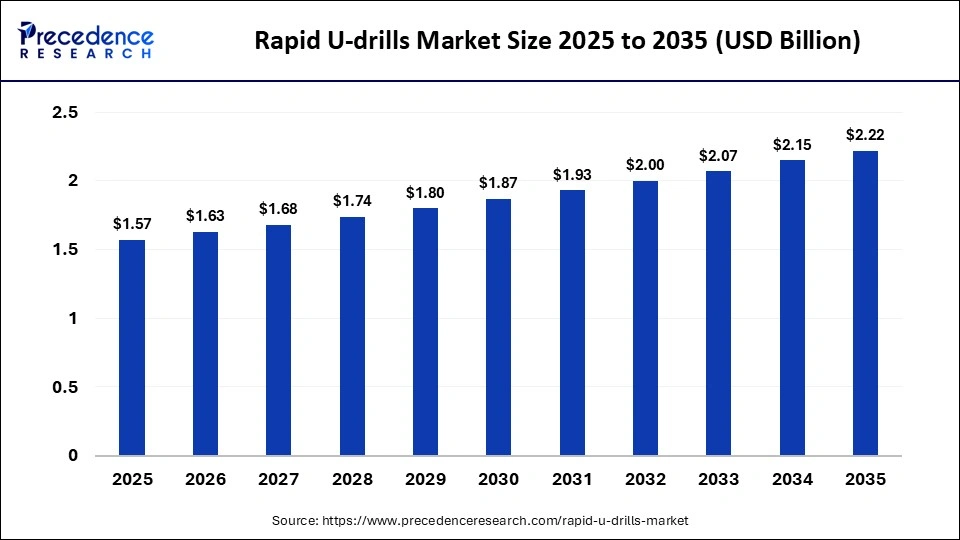

The global rapid U-drills market size was calculated at USD 1.57 billion in 2025 and is predicted to increase from USD 1.63 billion in 2026 to approximately USD 2.22 billion by 2035, expanding at a CAGR of 3.53% from 2026 to 2035. This market is growing as manufacturers adopt high-speed, precision drilling solutions for increased productivity and efficiency across aerospace, automotive, and industrial sectors.

Market Highlights

- Asia Pacific dominated the global market in 2025.

- North America is expected to grow at the fastest CAGR between 2026 and 2035.

- By drill type, the single blade segment dominated the market in 2025.

- By drill type, the combination type segment is expected to expand at the fastest CAGR between 2026 and 2035.

- By application, the metal processing segment dominated the market in 2025.

- By application, the material modification segment is expected to expand at the fastest CAGR between 2026 and 2035.

What Drives the Rapid U-drills Market?

The rising adoption of CNC machining and the demand for high-speed, cost-effective drilling in large-scale manufacturing are major factors driving the market. U-drills outperform conventional high-speed steel (HSS) bits by providing better heat resistance, higher cutting speeds, and enhanced, accurate drilling capabilities. There is a rapid expansion of the mining sector, which depends on robust drilling equipment, thereby boosting the market growth.

How is AI Influencing the Rapid U-drills Market?

Artificial Intelligence is transforming the rapid U-drills by enabling smarter, data-driven machining processes that improve precision, efficiency, and tool life. In 2025, manufacturers such as Kennametal have introduced indexable drills featuring AI-based, customized wiper geometries, which can offer up to 30% longer tool life. AI-driven systems analyze wear-and-tear patterns alongside tool performance in real time to forecast potential failures before it occurs. This proactive maintenance decreases unexpected downtime in manufacturing, enhancing overall productivity. Additionally, AI integration supports predictive maintenance, automated quality checks, and adaptive machining, making U-drills more reliable for complex metalworking and large-scale industrial applications.

What are the Key Trends Influencing the Market?

- Technological Advancements in Tool Design: U-drills are increasingly incorporating internal cooling channels, which enhance precision and remarkably extend tool life. Innovations in materials and coatings, like PVD and CVD coatings, enable better heat resistance and faster, deeper drilling.

- High-Demand End-User Industries: Rapid growth in the automotive and aerospace sectors is driving the need for versatile drilling solutions that handle complex materials efficiently.

- Industry 4.0 and Smart Drilling: The integration of IoT, AI-driven drilling, and digital-twin technology enables real-time monitoring along with optimized, adaptive drilling, enhancing efficiency.

- Sustainability and Cost-Efficiency: Manufacturers are aiming to reduce waste and enhance tool performance to meet strict regulatory and environmental standards, driving for more sustainable, durable tools.

Future Market Outlook

- Global Expansion:There is significant potential for market expansion worldwide due to increasing demand for high-speed, precision drilling in industries like aerospace, automotive, and general manufacturing, where efficiency and reduced cycle times are critical. Emerging regions offer significant opportunities as industrialization accelerates, manufacturing hubs grow, and local companies seek advanced tooling solutions to improve productivity and compete globally. Additionally, rising investments in infrastructure and automotive production in these regions are driving the adoption of high-performance drilling technologies.

- Infrastructure Development: As governments and private entities raise capital investment in transportation, energy, and even urbanization projects, the demand for high-speed, durable drilling tools, mainly indexable U-drills, rises in tandem. Moreover, aging infrastructure in developed nations necessitates rapid repair along with modernization, driving the demand for durable and efficient tooling, which can work on-site or in specialized workshops.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.57 Billion |

| Market Size in 2026 | USD 1.63 Billion |

| Market Size by 2035 | USD 2.22 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 3.53% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Drill Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Drill Type Insights

What made single blade the dominant segment in the rapid U-drills market?

The single blade segment led the market with the largest share in 2025 due to its superior efficiency in deep-hole drilling, offering excellent hole straightness, along with effective chip evacuation. The segment's leadership is also reinforced by its adaptable design, cost-effective tooling, and widespread compatibility with traditional CNC machining centers in the automotive and aerospace industries.

The combination type segment is expected to grow at the fastest CAGR throughout the forecast period. This is because combination drills enable operators to perform multiple operations, like drilling and counter-boring, simultaneously. This eliminates the demand for tool changeovers, reduces idle time, and remarkably lowers machine cycle times. They are programmed to achieve high-accuracy holes, maintain tolerances, and even enhance hole straightness in complex, deep-hole drilling scenarios. Despite higher initial investment expenses, the ability to combine operations and use long-lasting replaceable carbide inserts makes them more cost-effective over time in high-volume production, decreasing per-part machining costs.

Application Insights

Why did the metal processing segment dominate the rapid U-drills market?

The metal processing segment dominated the market in 2025. This is because industries like automotive, aerospace, and heavy machinery increasingly require precise, high-speed drilling of hard metals such as Titanium and Inconel. The integration of CNC automation and Industry 4.0 practices enhances efficiency by reducing tool changes, increasing spindle utilization, and lowering per-part machining costs, making metal processing the primary driver of demand for rapid U-drills.

The material modification segment is expected to grow at a significant CAGR in the upcoming period due to the increasing necessity of high-speed, precise drilling in aerospace, automotive, and heavy machinery, which demand superior thermal resistance, wear resistance, and even the ability to process difficult materials such as Inconel and titanium. U-drills allow multiple operations, such as drilling, boring, and finishing in a single pass, significantly decreasing tool changes and setup times.

Advanced manufacturing processes, such as hardening, alloying, and surface treatments, require precise and efficient drilling of metals to achieve the desired material properties. Rapid U-drills enable high-speed, accurate holes in tough or customized materials, supporting applications in automotive, aerospace, and industrial sectors where material performance and structural integrity are critical.

Region Insights

What made Asia Pacific the dominant region in the rapid U-drills market?

Asia Pacific dominated the rapid U-drills market in 2025. The region's dominance in the market is attributed to the increased construction and manufacturing activities, mainly in China and India, which drive the demand for efficient, high-speed drilling. Proactive government policies, like India's Make in India and China's Made in China 2025, offer incentives for adopting advanced CNC tools along with precision manufacturing. There is a rapid expansion of the energy and mining sectors, which raises the need for specialized, durable drilling technologies.

China Market Analysis

China leads the rapid U-drills market within Asia Pacific due to a strong focus on high-precision, cost-effective, and smart tooling solutions to improve productivity and decrease operational costs. There is a remarkable shift toward smart, interconnected, and automated drilling systems to enhance precision and repeatability in manufacturing. The Chinese market is undergoing rapid consolidation, with a strong focus on improving R&D capabilities and enhancing manufacturing efficiency.

What makes North America the fastest-growing region in the rapid U-drills market?

North America is expected to grow at the fastest CAGR throughout the forecast period, driven by the high adoption of advanced tooling technologies, which include specialized multi-edge inserts and biodegradable coatings, which allow up to 40% faster cutting and decreased environmental impact. Increasing investments in shale gas exploitation are driving the demand for specialized drilling equipment. The integration of automation along with smart technologies in drilling operations boosts the need for high-performance, durable tools.

U.S. Rapid U-drills Market Trends

The market in the U.S. is mainly driven by the need for automated machining solutions in various industries, which improve productivity and efficiency. Innovations in tool materials and design are improving the durability and cutting speed of U-drills, allowing faster penetration rates. Increasing manufacturing and drilling activities in the U.S. aerospace and automotive sectors are driving the need for high-performance drilling tools.

What makes Europe a significant region in the rapid U-drills market?

Europe is expected to grow at a significant rate throughout the forecast period due to the strong presence of advanced manufacturing, automotive, and aerospace industries that demand high-precision, durable drilling tools. Strict quality standards and adoption of Industry 4.0 technologies drive manufacturers to invest in efficient, high-performance U-drills. Additionally, modernization of aging infrastructure and continuous R&D in machining solutions further strengthen the region's significance in the market.

UK Rapid U-drills Market Trends

The market in the UK is driven by the rising adoption of automated machines and robotics in local manufacturing, which increases demand for U-drills that deliver consistent, high-speed performance. Additionally, U-drills' capability to perform multiple operations, such as drilling, boring, and finishing, reduces downtime and setup time, further driving their adoption.

How is the opportunistic rise of Latin America in the rapid U-drills market?

Latin America is expected to experience an opportunistic growth in the market throughout the forecast period due to increasing demand from precision-driven sectors like automotive, aerospace, and general engineering. The adoption of advanced tool technologies, including coated surfaces and modular designs, is enhancing drilling efficiency, durability, and overall productivity, making high-performance U-drills more attractive to manufacturers. Additionally, rising industrial investments and modernization initiatives across the region are creating opportunities for market leaders to expand their presence and offer premium, high-speed drilling solutions.

Brazil Rapid U-drills Market Trends

Brazil's market is primarily driven by rising industrial automation, infrastructure development, and modernization of manufacturing infrastructure. Evolving end-user requirements for efficiency, precision, and safety are accelerating the need for advanced drilling solutions. There is a rising adoption of advanced manufacturing technologies, coupled with supportive regulatory frameworks and rising investment in boosting manufacturing capacity, which are likely to contribute to the market.

What drives the rapid U-drills market in the Middle East & Africa?

The market in the Middle East & Africa (MEA) is primarily driven by the region's extensive upstream oil and gas activities, both onshore and offshore, which require durable, high-performance U-drills for drilling, maintenance, and repair operations. Additionally, the growing need to reduce cycle times in metal processing and the increasing use of hard-to-machine materials are boosting the adoption of advanced, coated U-drills that can deliver 40-60% faster operations. These factors make MEA a significant market for high-efficiency, precision drilling tools.

UAE Rapid U-drills Market Trends

The market in the UAE is growing due to the country's robust oil, gas, and energy sectors, which require high-performance drilling tools for onshore and offshore operations. Additionally, rapid industrialization, infrastructure development, and investments in manufacturing and aerospace are increasing the demand for precision, high-speed U-drills.

Who are the Major Players in the Global Rapid U-Drills Market?

The major players in the rapid U-drills market include Sandvik Group, Sumitomo Electric, Kennametal, Derek Inc, Chain Headway, Hao Zheng Machine Tools, Shang Fuh Enterprise, ECHAINTOOL Precision, Dongguan Aken Precision Machinery, Shang Tzang Wang Enterprise, Wuxi HOPE Technology, and Orient Energy Technologies.

Recent Development

- In June 2025, Kyocera Unimerco's UM RapidDrill is engineered for high-speed, process-safe machining of aluminum alloys, featuring polished flutes, a 150° point angle, internal coolant channels, and a robust design. With the new C21 DLX coating, tool life is further extended while ensuring excellent finish, roundness, and reliability. Available in standard Ø4–20 mm (5×D, 8×D, 12×D) and customizable Ø3.3–32 mm, including step drill types, it offers easy-cutting geometries for demanding environments.

- In February 2025, Element Six declared a new global collaboration for advanced tunnel development technology. The partnership combines Element Six's leading patented polycrystalline diamond cutting-edge technology with Master Drilling's fully mechanized services for the infrastructure, mining, and energy sectors to deliver a new synthetic diamond-enabled tunnelling solution.

Segments Covered in the Report

By Drill Type

- Single Blade

- Combination Type

By Application

- Material Modification

- Metal Processing

- Tools Manufacturing

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting