Recloser Market Size and Forecast 2025 to 2034

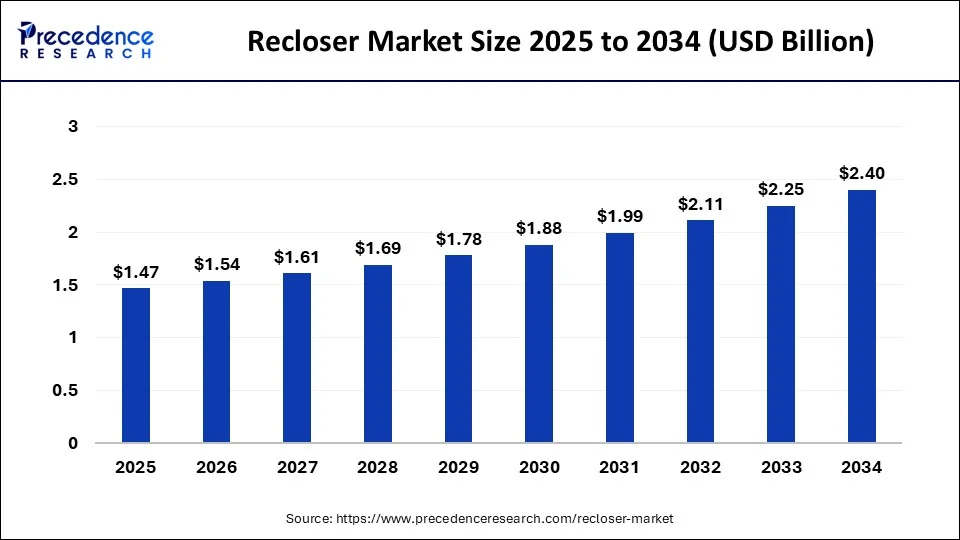

The global recloser market size was estimated at USD 1.41 billion in 2024 and is predicted to increase from USD 1.47 billion in 2025 to approximately USD 2.40 billion by 2034, expanding at a CAGR of 5.62% from 2025 to 2034.

Recloser Market Key Takeaways

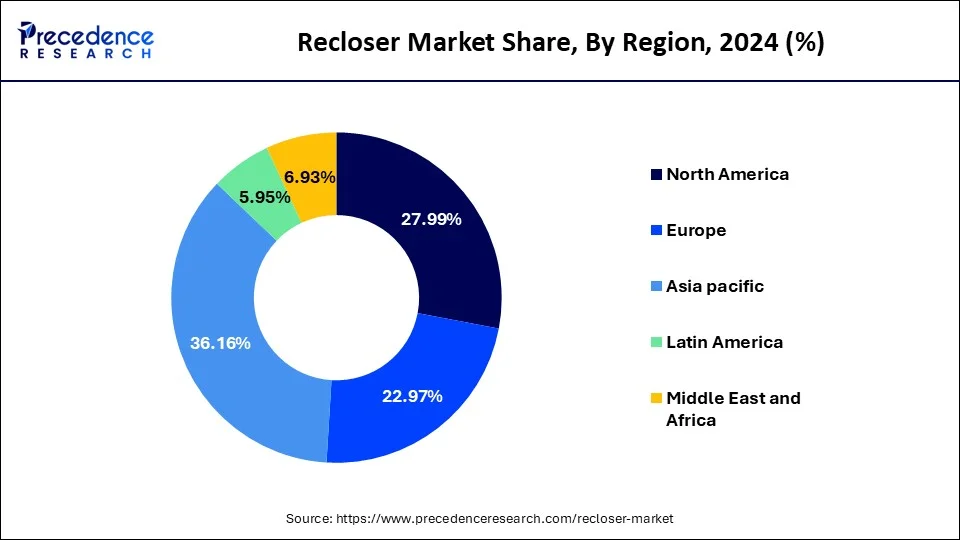

- Asia Pacific dominated the market with the largest market share of 36.16% in 2024.

- By phase, the single-phase segment captured a significant market share of 47.65% in 2024.

- By phase, the three-phase segment is expected to grow at a solid CAGR of 6.3% during the forecast period.

- By insulation medium, the epoxy segment accounted the highest market share of 41.83% in 2024.

- By insulation medium, the air segment is projected to grow at a solid CAGR of 6.4% during the forecast period.

- By control type, the electronics and semiconductor segment has held a major market share of 54.31% in 2024.

- By voltage, the medium voltage segment has contributed the biggest market share of 54.14% in 2024.

- By control type, the electronic recloser segment is projected to experience the highest growth market during the forecast period 2025 to 2034.

- By voltage rating, the up to 15 kV segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

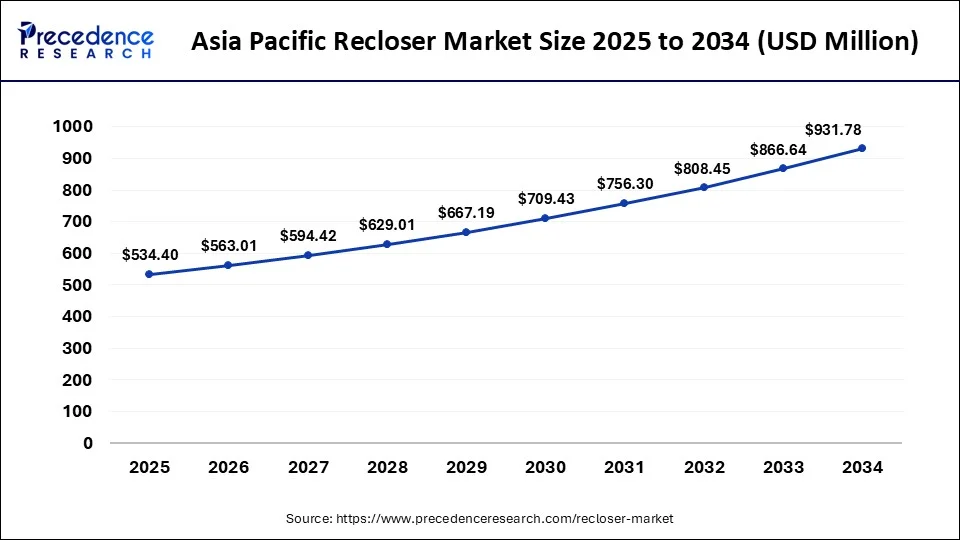

Asia Pacific Recloser Market Size and Growth 2025 to 2034

The Asia Pacifc recloser market size reached USD 508.29 million in 2024 and is predicted to be worth around USD 931.78 million by 2034, growing at a CAGR of 6.4% from 2025 to 2034.

Asia Pacific registered dominance in the recloser market by capturing the largest share in 2024. This is mainly due to the rapid industrialization, expansion of power transmission and distribution networks, and increased renewable energy generation. The region is expected to witness the fastest growth in the coming years, driven by increasing demand for reliable power and a rapid shift toward renewable energy.

Countries such as India and China play a major role in the Asia Pacific recloser market. China aims to increase its renewable energy generation capacity to reduce greenhouse emissions. China's emphasis on clean energy drives the demand for distribution infrastructure. India has also introduced policies and targets to expand its transmission and distribution network, particularly for renewable energy sources.

Europe was the second-largest shareholder in 2024 and is anticipated to witness a steady growth rate during the forecast period. The increasing demand for renewable energy to reduce emissions is a key factor supporting the regional market growth. The EU has set ambitious targets to reduce emissions by 2050. Moreover, rising investments in smart grid technologies and the increasing focus on modernizing power grids are likely to boost the market's growth. The growing demand for electricity and the expansion of distribution networks to support the transition to clean energy further boost the need for reclosers.

Market Overview

The recloser market is all about creating, distributing, and using reclosers. Reclosers are devices that help manage electrical power distribution systems by detecting and fixing faults on overhead power lines. They can stop and restart the flow of power automatically, reducing the need for manual fixing and minimizing interruptions in the power supply.

Since we rely on electricity for many things, there is a growing need for power distribution systems that work well. Reclosers play a key role in ensuring that we have uninterrupted power by quickly finding and is olating faults, which helps to reduce power outages. Another trend is the integration of smart grid technologies. This integration allows utilities (the companies that provide power) to optimize power distribution, improve maintenance practices, and make the overall system more reliable. There is also a growing focus on grid automation. This means that utilities are working to automate the operation of power grids to improve efficiency and reduce costs.

Reclosers have various applications. They are used in overhead power distribution systems, including distribution lines, feeders, and substations, to maintain power quality and protect the system from faults caused by lightning strikes, tree branches, or equipment failures. Reclosers are also deployed in renewable energy installations, such as solar farms and wind power plants. In smart grid systems, reclosers play a crucial role in enabling grid automation, real-time monitoring, and remote control. In rural and remote areas, reclosers are used to improve power reliability and reduce the time it takes to restore service after an outage. By automatically isolating faults and attempting to restore power, reclosers minimize the impact of outages and reduce the need for manual intervention, especially in areas that are difficult to access.

Growth Factors

- The rising demand for electricity due to global population growth and rising power consumption are boosting the growth of the market.

- There is a rising need for reclosers to protect electrical distribution networks from faults and ensure reliable power supply, boosting market growth.

- Governments and utilities are investing in the expansion of transmission and distribution networks to meet the growing electricity demand, supporting market growth.

- The rising investments in renewable energy sources, such as solar and wind power, drives the demand for reclosers. These renewable energy sources are more prone to faults compared to traditional fossil fuel power plants, necessitating the deployment of reclosers for fault protection and grid stability.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 1.41 Billion |

| Market Size in 2024 | USD 1.47 Billion |

| Market Size by 2034 | USD 2.40 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.62% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Phase, Control Type, Voltage, Insulation Medium, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Growing Integration of Renewable Energy

The growing integration of renewable energy sources such as solar wind their inherently variable outputs is a key driver steering demand for reclosers. As these intermittent sources feed into grids, reclosers play a critical role in maintaining grid stability by rapidly detecting faults and restoring power, assuring smoother management of load fluctuations. Simultaneously, the global push towards smart grid modernization featuring advanced automation, communications, and real time monitoring has led utilities to invest heavily in intelligent reclosers. These devices facilitate proactive fault detection, remote control, and integration with supervisory systems like SCADA, enhancing network reliability and resilience.

Another powerful growth driver is the rapid pace of urbanization and industrialization, specially in merging economies. As cities expand and industries grow, demand for uninterrupted and stable electricity surges, placing pressure on aging distribution networks. Reclosers address these challenges by swiftly isolating temporary faults and restoring power automatically minimizing downtime and protecting critical infrastructure like data centres and manufacturing facilities. Government and utility investments in grid upgrades driven by the need to serve rising electricity demand further reinforce the deployment of recloser technologies as foundational to robust to robust electrical infrastructure.

Restraints

High Upfront Cost

One of the primary constraints in the recloser market is the high upfront cost associated with purchasing and installing advanced recloser systems. Utilities specially smaller providers and those in developing regions are deterred by these substantial capital expenditures, which encompass equipment costs, infrastructure upgrades, and integration into existing grid frameworks. As noted, “the high upfront investment required for advanced recloser systems can be a significant barrier”. In North America, for instance, deploying recloser technologies involves costs ranging from USD 10,000 to US$ 30,000 per unit, not including installation and integration, which can stretch limited budgets further. These steeps costs not only limit initial adoption but may also delay modernization projects, particularly in cost sensitive markets.

Opportunity

There are several great opportunities in the recloser market. First, many countries have old power systems that need upgrading, so there's a demand for modern reclosers that can improve the reliability and efficiency of power distribution. Second, as renewable energy becomes more popular, reclosers are needed to integrate these energy sources into the power grid effectively. Third, with the rise of smart grid technologies, reclosers with advanced features are in high demand for automation and remote control of power systems. Fourth, there is a growing focus on making the power grid more resilient and ensuring high-quality power, and reclosers play a crucial role in achieving that. Fifth, emerging markets and rural areas need a reliable power supply, so providing cost-effective reclosers can help improve electricity access. Finally, technological advancements in fault detection and communication offer opportunities for innovative recloser solutions that can make power distribution more efficient and reliable.

Phase Insights

The single-phase segment held the largest share of the recloser market in 2024. Single-phase reclosers are widely applied to protect single-phase lines like taps or branches of a three-phase feeder. They are also used on three-phase circuits where the load is mostly single-phase. These reclosers can be controlled with hydraulic control by integrating into the recloser tank or electronic control by housed in a separate enclosure, depending on the design of the recloser. The increased adoption of these reclosers in single-phase electrical distribution networks, which are commonly found in smaller networks serving homes and businesses bolstered the growth of the segment.

The three-phase segment is expected to grow at the fastest rate during the forecast period. The growth of the segment can be attributed to the rising grid modernization. Three-phase reclosers are the most commonly used type of reclosers and are deployed in three-phase electrical distribution networks. These reclosers are typically employed in larger networks that supply power to cities and towns. They are widely used on three-phase circuits to enhance system reliability and grid stability.

Recloser Market Revenue, By Phase2022-2024 (USD Million)

| Phase | 2022 | 2023 | 2024 |

| Three-phase | 446.21 | 467.22 | 490.11 |

| Single-phase | 617.22 | 642.36 | 669.80 |

| Triple-Single phase | 233.94 | 239.64 | 245.88 |

Insulation Medium Insights

The epoxy segment dominated the recloser market in 2024. Epoxy offers superior insulation against electric current and also avoids short circuits. It enhances the reliability and longevity of the system. Epoxy insulation functions more safely and efficiently, improving the safety of electrical systems. It has many advantages, like corrosion resistance, leakage prevention, and heat resistance, making it indispensable in various applications.

The air segment is projected to expand at the highest CAGR in the coming years. Air resists heat transfer to some degree, making it suitable for insulation. Air insulation is relatively thin because of the lightweight properties of air. This insulation is safe for the consumer since it does not feature any hazardous chemicals or injurious products. Air insulation is a type of heat insulation that uses air as a heat insulator instead of using solid materials.

Recloser Market Revenue, By Insulation Medium 2022-2024 (USD Million)

| Insulation Medium | 2022 | 2023 | 2024 |

| Oil | 468.81 | 481.04 | 494.43 |

| Air | 294.07 | 308.09 | 323.36 |

| Epoxy | 534.49 | 560.09 | 587.99 |

Control Type Insights

The electronic recloser segment is projected to experience the fastest growth in the market from 2025 to 2034. In 2024, this segment already held a substantial share of the market, thanks to the rising adoption of advanced automation technologies in power distribution systems. Electronic recloses are equipped with intelligent control units that allow utilities to monitor, diagnose, and restore faults remotely. This capability is becoming increasingly important as utilities across the globe modernize their grids to improve reliability, reduce outage times, and meet the growing demand for electricity. The growth of the electronic recloser segment is further fuelled by the integration of smart grid and IoT based technologies, which enable predictive maintenance, data analytics, and seamless grid connectivity. Governments and utilities are heavily investing in digital substations and smart distribution networks, where electronic recloses play a critical role is assuring uninterrupted power supply and reducing operational costs. With urbanization and industrial expansion driving higher energy demand, the flexibility and real time control offered by electronic recloses will continue to make this segment the most dynamic and rapidly expanding within the recloser market.

Recloser Market Revenue, By Control Type 2022-2024 (USD Million)

| Control Type | 2022 | 2023 | 2024 |

| Electronics & Semiconductor | 693.10 | 726.75 | 763.44 |

| Hydrolic | 604.28 | 622.47 | 642.35 |

Voltage Insights

The up to 15 kV segment is anticipated to grow at the fastest rate in the recloser market during the forecast period of 2025 to 2034. This growth is largely attributed to the rising deployment of low to medium voltage reclosers in residential, commercial, and rural distribution networks, where the demand for stable and reliable electricity supply is increasing rapidly. These reclosers are particularly suited for short distant distribution lines that power homes, small businesses, and agricultural facilities, making them essential in both urban and rural electrification projects. The segment's expansion is also supported by large scale government initiatives aimed to strengthening rural electrification and minimizing power outages in developing economies across Asia Pacific, Africa, and Latin America. As many of these regions are experiencing population growth and rising electricity consumption, utilities are investing in grid modernization to ensure efficient and safer power distribution. Furthermore, the up to 15 kV reclosers are more cost effective compared to higher voltage alternatives, making them a preferred choice for widespread adoption in small scale networks. The combination of affordability, reliability, and growing deployment in smart distribution systems positions this segment as the fastest growing voltage category in the global recloser market.

Recloser Market Revenue, By Voltage, 2022-2024 (USD Million)

| Voltage | 2022 | 2023 | 2024 |

| Low Voltage | 226.62 | 231.77 | 237.43 |

| Medium Voltage | 693.63 | 725.90 | 761.06 |

| High Voltage | 377.13 | 391.55 | 407.29 |

Recloser Market Companies

- NOJA Power

- Arteche

- BRUSH Group

- S&C Electric Company

- GE

- Eaton

- G&W Electric Co.

- Tavrida Electric Global

- Schneider Electric

- Iljin Electric

- Siemens

- Hughes Power System

- Solomon Corporation

- ABB

- ENTEC Electric & Electronic

Recent Developments

- In March 2025, Hubbell introduce its new single phase recloser featuring advanced fault detection, remote ground level resetting via a yellow handle, and visible semaphore/ beacon indicators enhancing both grid reliability and line worker safety through improved operational efficiency.

(Source: Hubbell Introduces the LineDefender Advanced Lateral-Protection Recloser to Enhance Grid Reliability and Worker Safety ) - In 2025, Easton unveiled a novel solution integrated into its Form 7 recloser control that uses sensors and machine learning to identify and isolate high impedance faults achieving over 90% detection accuracy. Pilot tests with U.S. utilities supports its deployment.

(Source: Eaton Announces Breakthrough, AI-Powered Innovation to Help Utilities Strengthen Wildfire Prevention Efforts)

Segments Covered in the Report:

By Phase

- Three-phase

- Single-phase

- Triple-Single phase

By Insulation Medium

- Oil

- AirEpoxy

By Control Type

- Electronics & Semiconductor

- Hydrolic

By Voltage

- Low Voltage

- Medium Voltage

- High Voltage

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting