What is the Retail Ready Packaging Market Size?

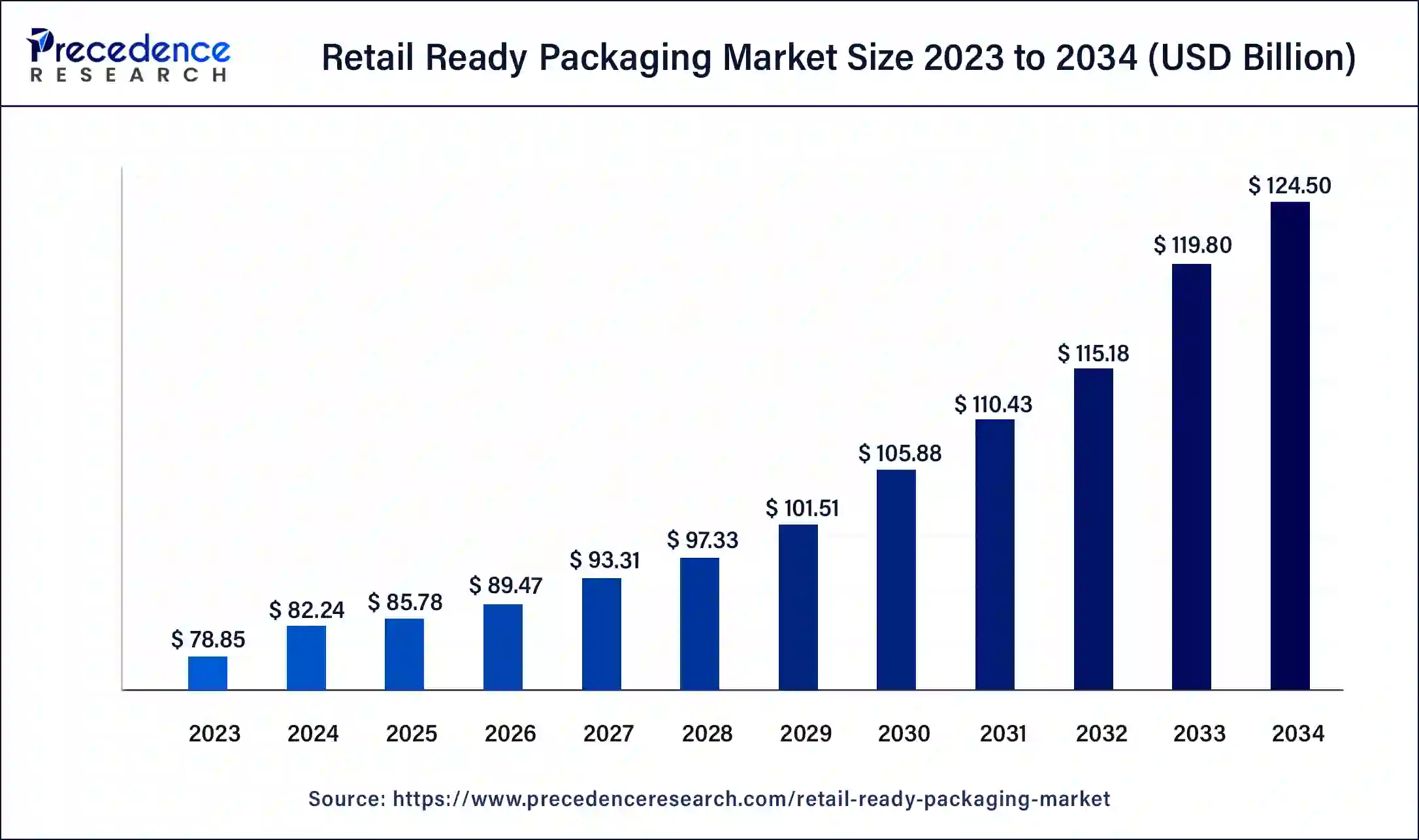

The global retail ready packaging market size accounted at USD 85.78 billion in 2025, and is expected to reach around USD 124.50 billion by 2034, expanding at a CAGR of 4.23% from 2025 to 2034.

Market Highlights

- North America contributed the largest revenue share of 37% in 2024.

- Asia-Pacific is expected to expand at the fastest CAGR during the forecast period.

- By Material, the software segment held a 31.3% revenue share in 2024.

- By Material, the paperboard segment is predicted to grow at a significant CAGR of 5.8% between 2025 and 2034.

- By Product Type, the corrugated cardboard boxes segment contributed more than 29% of revenue share in 2024.

- By Product Type, the shrink-wrapped trays segment is expected to expand at the fastest CAGR over the projected period.

- By Application, the food & beverage segment accounted for around 56.8% of revenue share in 2024.

- By Application, the personal care & cosmetics segment is anticipated to grow at the fastest CAGR over the projected period.

Market Size and Forecast

- Market Size in 2025: USD 85.78 Billion

- Market Size in 2026: USD 89.47 Billion

- Forecasted Market Size by 2034: USD 124.50 Billion

- CAGR (2025-2034): 4.23%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia-Pacific

Market Overview

The retail-ready packaging (RRP) market refers to the segment of packaging solutions designed to optimize product presentation, ease of stocking, and consumer shopping experiences within retail environments. RRP is characterized by its convenient, shelf-ready design, often including branded graphics and efficient handling features. This market addresses the growing demand from retailers for streamlined supply chain operations and enhanced shelf visibility. It encompasses various packaging types, such as corrugated boxes, plastic trays, and display cases, tailored to accommodate diverse product categories. The retail-ready packaging market plays a pivotal role in influencing consumer purchasing decisions and enhancing overall retail efficiency.

Retail Ready Packaging Market Growth Factors

- The retail-ready packaging (RRP) market is a dynamic segment of the packaging industry that focuses on creating consumer-friendly, shelf-ready packaging solutions. RRP is characterized by its convenience, eye-catching branding, and efficient handling features, making it a key component for retailers looking to streamline their supply chain and enhance in-store product presentation.

- RRP encompasses various packaging types, such as corrugated boxes, plastic trays, and display cases, tailored to meet the specific needs of diverse product categories. As environmental concerns grow, businesses are opting for eco-friendly RRP options that reduce waste and minimize the carbon footprint.

- Another significant driver is the rise of e-commerce, which has propelled the need for RRP solutions that are not only shelf-ready but also e-commerce ready. The pandemic further accelerated this trend, as consumers increasingly turned to online shopping. Additionally, the global push for brand differentiation and the need to grab consumers' attention on crowded retail shelves are driving innovation in RRP designs, favoring bold graphics and creative packaging solutions.

- For businesses operating in the RRP market, there are several opportunities for growth. The increasing emphasis on sustainability presents a chance to develop and market eco-friendly RRP options. Collaborations with retailers and manufacturers to create customized, eye-catching designs can be a lucrative avenue.

- Additionally, expanding into emerging markets where the adoption of RRP is on the rise can offer new revenue streams. Integrating technology, such as RFID tags for inventory tracking and consumer engagement, is another avenue for differentiation and added value.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 85.78 Billion |

| Market Size in 2026 | USD 89.47 Billion |

| Market Size by 2034 | USD 124.50 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.23% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Technology, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Convenience features, personalization, and branding

Convenience features in retail-ready Packaging (RRP) such as easy-open designs, resealable options, and carrying handles enhance the shopping experience, attracting consumers seeking hassle-free solutions. This surge in user-friendly RRP solutions drives market demand as retailers and brands recognize the competitive advantage of offering products that are not only visually appealing but also easy to access and use. Consequently, the RRP market experiences growth due to increased demand for convenient, consumer-centric packaging.

Moreover, personalization and branding play a pivotal role in surging market demand for retail-ready Packaging (RRP). Customized RRP solutions with eye-catching graphics and unique branding elements enhance product visibility, distinguish brands on retail shelves, and foster stronger consumer connections. This drives consumer preference and loyalty, boosting demand as companies recognize the value of RRP as a powerful tool for elevating their brand image and increasing sales in highly competitive retail environments.

Restraint

Evolving consumer preferences and sustainability challenges

Evolving consumer preferences can restrain the demand for retail-ready Packaging (RRP) by driving a shift away from excessive packaging or non-sustainable materials. Consumers seeking eco-friendly and minimalistic packaging may resist products with overcomplicated RRP, impacting market demand. Additionally, changing lifestyle trends, such as reduced single-use plastics, may lead to reduced demand for RRP solutions that do not align with these evolving preferences. Thus, RRP providers must adapt to these changing consumer expectations to maintain market relevance.

Moreover, sustainability challenges restrain the demand for the retail-ready packaging (RRP) market as consumers and retailers increasingly prioritize eco-friendly solutions. Higher costs associated with sustainable materials and production processes can limit adoption. Additionally, transitioning from conventional packaging to sustainable RRP may require significant investment and operational changes for businesses. Meeting sustainability goals while maintaining cost-efficiency poses a dilemma for many industry players, impacting the broader market demand for RRP solutions.

Opportunities

E-commerce integration and smart packaging

E-commerce integration has significantly boosted demand for the retail-ready Packaging (RRP) market by necessitating packaging solutions that are not only shelf-ready but also suitable for direct shipping to consumers. As online shopping continues to witness growth, RRP designs are evolving to meet the unique demands of e-commerce, including protective packaging, efficient handling, and visually appealing designs. This surge in demand for e-commerce-ready RRP solutions underscores the pivotal role of RRP in enhancing the online shopping experience and ensuring products arrive in pristine condition.

Smart packaging, equipped with technologies like RFID and QR codes, has revolutionized the retail-ready packaging (RRP) market. It enhances inventory management, supply chain visibility, and consumer engagement. Brands and retailers benefit from real-time data, reduced losses from shrinkage, and improved customer experiences. As a result, the integration of smart packaging solutions has surged the demand for RRP, as businesses seek modern, technology-enhanced packaging to stay competitive and meet the evolving needs of consumers and the retail industry.

Technological Advancement

Technological advancements in the retail-ready packaging market feature smart packaging, digital printing, and hybrid packaging. The digital printing allows customization according to the brand name and type of product. It creates a designed graphic and tremendous data printing on labels. Hybrid packaging creates designs for e-commerce delivery and physical retail displays. This enables brands to connect with the supply chain. The smart packaging consists of RFID tags and QR codes. It authenticates products and tracks inventory. This improves and enhances consumer interaction. The advances and sustainable materials enable achieving quality performance throughout the packaging process. The recyclable plastics and corrugated board are effective packaging materials. The compostable and biodegradable materials support the environment.

The die-cut display containers are famous in the retail-ready packaging market. It elevates product visibility and the restocking process. These technologies encourage the market to approach innovations and development. This will gain more consumer engagement and enhance the branding business.

Segments Insights

Material Insights

The software sector has held a 31.3% revenue share in 2024. The paper-based retail-ready packaging (RRP) is an eco-friendly option gaining traction. It's characterized by its recyclability and sustainability, aligning with the growing consumer demand for environmentally responsible packaging. The trend towards minimalist and clean aesthetics, using natural paper textures, is enhancing the appeal of paper based RRP. Brands are also exploring innovative paper engineering techniques to create unique, functional packaging. Overall, paper based RRP is becoming a popular choice, blending sustainability with versatile design possibilities in response to evolving consumer preferences.

The paperboard segment is anticipated to expand at a significant CAGR of 5.8% during the projected period. Paperboard, a popular material in retail-ready packaging (RRP), is a sturdy, eco-friendly choice. Trends in the RRP market highlight a growing preference for sustainable paperboard packaging due to its recyclability and biodegradability. Brands are opting for creative paperboard designs that emphasize branding and product visibility. Additionally, lightweight paperboard reduces transportation costs. As sustainability gains importance, expect paperboard to continue being a key player in RRP, offering both durability and environmental appeal to businesses and consumers alike.

Product Type Insights

Based on the product type, corrugated cardboard boxes is anticipated to hold the largest market share of 29% in2024. Corrugated cardboard boxes, a staple in the RRP market, are durable and eco-friendly packaging solutions. They provide excellent protection and are highly customizable, making them ideal for various retail products. A key trend is the incorporation of eye-catching graphics and branding to enhance shelf appeal. Additionally, as sustainability gains importance, corrugated boxes are being made from recycled materials and designed for easy recycling, aligning with the growing eco-consciousness of consumers and retailers.

On the other hand, the Shrink-wrapped trays segment is projected to grow at the fastest rate over the projected period. Shrink-wrapped trays in the retail-ready packaging (RRP) market are rigid trays that encase products and are then sealed with a shrink film, providing both protection and visibility. A notable trend is the increasing use of eco-friendly materials in shrink-wrapped trays, aligning with sustainability goals. These trays are also evolving to be more user-friendly with easy-open features. Additionally, customized branding and graphics on shrink-wrapped trays are gaining prominence to enhance product presentation and consumer engagement.

Application Insights

In2024, the Food & Beverage segment had the highest market share of 56.8% on the basis of the application. In the Food & Beverage sector, retail-ready packaging (RRP) refers to packaging solutions designed for efficient display and handling of food products in retail environments. RRP trends include a heightened focus on sustainability with eco-friendly materials and designs. Additionally, there is an emphasis on convenience features like resealable closures. Eye-catching graphics and branding elements are employed to capture consumer attention. RRP for perishable foods often includes ventilation and moisture control to extend product shelf life. This sector showcases the integration of RRP to enhance both presentation and functionality in the food retail space.

Personal Care & Cosmetics is anticipated to expand at the fastest rate over the projected period. In the Personal Care & Cosmetics segment of the retail-ready packaging (RRP) market, packaging plays a crucial role in product presentation and consumer appeal. Trends in this sector include sustainable and eco-friendly packaging options, minimalist and aesthetically pleasing designs, and packaging that emphasizes product safety and hygiene. Personalized and branded RRP solutions are also on the rise, as cosmetics brands seek to create a memorable and distinctive presence on retail shelves to capture consumer attention and loyalty.

Regional Insights

U.S. Retail Ready Packaging Market Size and Growth 2025 to 2034

The U.S. retail ready packaging market size was estimated at USD 22.34 billion in 2025 and is predicted to be worth around USD 32.98 billion by 2034, at a CAGR of 4.43% from 2025 to 2034.

North America has held the largest revenue share of 37% in 2024. In North America, the retail-ready packaging (RRP) market has seen a surge in demand for sustainable packaging solutions, driven by consumer eco-consciousness. E-commerce readiness remains a prominent trend, with RRP designs adapting to accommodate online shopping. Personalization and branding are also key, as brands focus on eye-catching graphics and unique packaging to stand out. The region's emphasis on convenience is reflected in RRP designs that prioritize easy-open features. Additionally, there is a growing interest in smart packaging technologies, such as RFID, to enhance supply chain visibility and consumer engagement.

Currently, North America is dominating the retail-ready packaging market. The numerous retail industry and increasing consumer demand lead to the significant market growth of North America. The government's initiative towards packaging waste management boosts the market of the region. The heavy demand for attractive and appealing packaging has exceeded the manufacturing rate. The large consumer foundation elevates the growth factor.

In the Asia-Pacific region, the retail-ready packaging (RRP) market is witnessing robust growth driven by rising urbanization and changing consumer preferences. Sustainability is a prominent trend, with a focus on eco-friendly RRP solutions. The e-commerce boom has fueled demand for e-commerce-ready packaging. Customization, innovative materials, and advanced printing techniques are also gaining traction, as brands seek to capture consumer attention in this dynamic market.

Moreover, In Europe, the retail-ready packaging (RRP) market is witnessing a growing emphasis on sustainability, with a focus on recyclable materials and reduced waste. E-commerce readiness is becoming crucial as online shopping continues to surge. Personalized and minimalist designs are gaining traction, enhancing brand visibility. Additionally, the integration of smart packaging technologies, such as RFID, is on the rise, enabling better inventory management. Europe's RRP market is adapting to these trends to meet consumer demands for eco-friendly, convenient, and visually appealing packaging solutions.

Retail Ready Packaging Market Companies

- International Paper Company

- Smurfit Kappa Group

- Mondi Group

- WestRock Company

- DS Smith Plc

- Amcor Plc

- Georgia-Pacific LLC

- Menasha Packaging Company, LLC

- Orora Limited

- Packaging Corporation of America

- KapStone Paper and Packaging Corporation (now part of WestRock)

- Clearwater Paper Corporation

- Sonoco Products Company

- Visy Industries

- Graphic Packaging International, LLC

Recent Developments

- In October 2024, Farmers Boy (Morrisons manufacturing) announced their intension to relaunch their best bacon product, improving its retail-ready packaging (RRP) solution to attract shoppers in store. The company claims DS Smith to be the perfect partner to initiate so. (Source: packagingstrategies.com )

- In December 2023, Linpac unveiled a new line of rigid-plastic, retail-ready packaging. The new line will improve the appearance of the product, which will achieve the main purpose of the development. (Source: plasticstoday.com )

- In 2023, Sealed Air Corp. has rebranded as SEE to reflect its customer-centric, market-driven approach as a solutions company. This change underscores their commitment to delivering innovative packaging and hygiene solutions that meet evolving customer needs.

- In 2023, Sonoco, a global packaging solutions provider, has divested its folding cartons business to Caraustar Industries, Inc. This strategic move allows Sonoco to focus on its core packaging and protective solutions while enabling Caraustar to strengthen its presence in the folding cartons market.

- In 2021,Amcor partnered with Nestlé to develop innovative, sustainable packaging solutions for Nestlé's products. This collaboration aims to reduce the environmental footprint of packaging materials, emphasizing recyclability and responsible sourcing, contributing to a more sustainable future.

- In 2021, DS Smith, a sustainable packaging solutions provider, is testing digital 3D dimensioning technology to revolutionize its logistics operations. This innovative approach aims to enhance efficiency and accuracy in packaging and transportation processes.

Segments Covered in the Report

By Material

- Plastic

- Paper

- Paperboard

- Others

By Technology

- Die Cut Display Containers

- Corrugated Cardboard Boxes

- Shrink-Wrapped Trays

- Folding Cartons

- Others

By Application

- Food & Beverage

- Pharmaceuticals

- Electronics

- Personal Care & Cosmetics

- Other

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting