What is the Road Rollers Market Size?

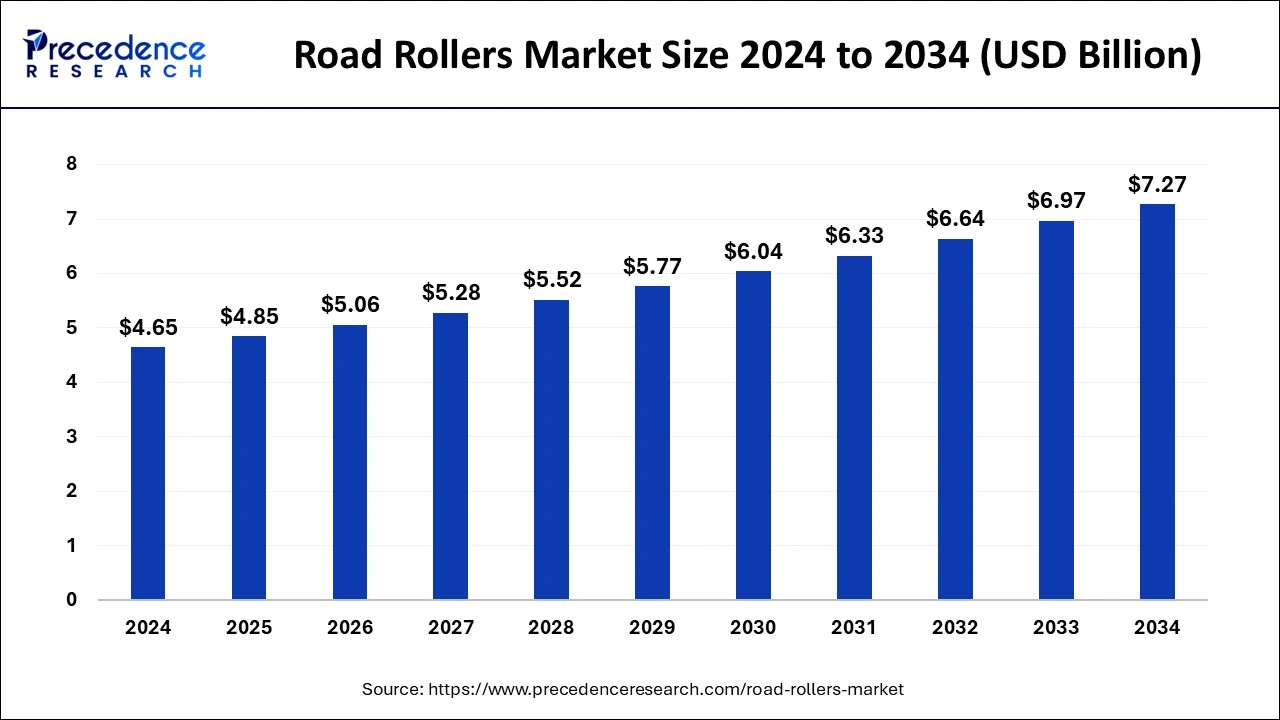

The global road rollers market size is calculated at USD 4.85 billion in 2025 and is predicted to increase from USD 5.06 billion in 2026 to approximately USD 7.59 billion by 2035, expanding at a CAGR of 4.58% from 2026 to 2035.

Road Rollers Market Key Takeaways

- The global road rollers market was valued at USD 4.85 billion in 2025.

- It is projected to reach USD 7.59billion by 2035.

- The market is expected to grow at a CAGR of 4.58% from 2026 to 2035.

- Asia Pacific dominated the road rollers market in 2025.

- North America is expected to witness the fastest rate of expansion during the forecast period of 2026-2035.

- By type, the vibratory roller segment holds the largest share of the road rollers market.

- By type, the static rollers segment is expected to grow at the fastest rate over the forecast period.

- By application, the construction segment held the largest market share of 37% in 2025.

- By application, the road maintenance segment is anticipated to expand at the fastest rate during the projection period.

What are Road Rollers?

A road compactor, also known as roller-compactor or roller is a vehicle-type machine that is used in the construction, and foundation of roads to reduce the size of concrete, soil, and gravel. It is also used in landfills and agriculture. The rolling activity completely ensures that the foundation is dense, and does not lose its hold. A compact roller comprises a compaction system, a water system, a drum, diesel engine, and protection for the driver. A roller is a large, heavy wheel that is used to compact and level terrain, soil, dirt, asphalt, or any other type of foundation or base material. Rollers come in different shapes and sizes, including single and double-drum rollers. Padfoot and vibrating rollers are also available.

The construction industry's expansion, rapid urbanization, and infrastructural development have all contributed to the market's moderate rise for road rollers. The need for road rollers has been driven by rising investments in road construction and maintenance projects throughout the world. Advancements in the road rollers market resulted in several developments, and manufacturers now utilize cutting-edge technologies to increase productivity, fuel economy, and operator safety.

The use of telematics and IoT integration for maintenance scheduling and real-time monitoring has increased. There are several varieties of road rollers, such as static, pneumatic, and vibratory rollers. Pneumatic rollers can handle a larger assortment of materials, whereas vibratory rollers are typically used to compact earth and asphalt. The particular application and project requirements will determine which roller is best.

Regional infrastructure development initiatives impact the road roller market. Large-scale building projects in emerging nations, particularly in Asia-Pacific, and government investments in transport infrastructure have been the primary drivers of industry growth. Environmental issues are drawing increased attention to sustainable and eco-friendly construction approaches. In response, a number of manufacturers have produced road rollers that use less fuel and produce less pollutants, better aligning them with these trends. Road rollers have several challenges, including volatile raw material prices, stringent environmental regulations, and economic worries that may impact infrastructure spending.

How is AI contributing to the Road Rollers Industry?

The integration of artificial intelligence (AI) algorithms in road rollers automates operations and improves efficiency and accuracy. AI algorithms monitor the performance and operation of road rollers in real time. They also analyze data and predict potential failures and maintenance, reducing operational costs and downtime. Furthermore, AI-driven control systems are making roller operations more efficient.

Autonomous navigation, intelligent compaction control, real-time safety monitoring, predictive maintenance, digital quality documentation, and optimized fleet resource management are the main functions through which artificial intelligence is making road rollers smarter. This way, the construction precision is improved, operational risks are reduced, productivity is raised, and an even greater contribution to the achievement of sustainability goals, along with consistency in the compaction performance of diverse infrastructure projects.

Road Rollers Market Growth Factors

- Road rollers are a necessary piece of machinery for building and maintaining highways, roads, and other infrastructure projects. The need for road rollers rises as more money is invested in infrastructure development by the public and commercial sectors.

- Global urbanization is a persistent trend that has boosted construction operations, including the creation of urban transportation networks and highways. The need for road rollers is a result of this.

- The population rise fuels the need for more homes, businesses, and better transportation, which in turn sparks a boom in building projects and propels the market for road rollers. The market is also greatly impacted by government programs, including infrastructure development plans, subsidies, and stimulus packages.

- Technological innovation and developments in road roller design and production can result in equipment that is more durable, ecologically friendly, and efficient. Businesses that make R&D investments to create innovative road rollers could benefit from a competitive edge.

- As environmental concerns have grown, road rollers with lower emissions and better fuel efficiency have been developed. Producers who adhere to stringent environmental rules may witness a rise in demand for their merchandise.

- Road rollers require constant maintenance and replacement because their lifespan is limited. The replacement market may be driven by aging fleets and the desire for more sophisticated features.

Market Outlook

- Industry Growth Overview: The consistent demand for the industry comes from the continued road construction activities supported by infrastructure expansion and urban development.

- Sustainability Trends: The sustainability trend among manufacturers is that they are focusing on electric, hybrid rollers, which will have a lesser impact on emitting and noise on job sites.

- Global Expansion: The global expansion is led by the Asia Pacific region and the emerging economies in general, as they continue to invest heavily in infrastructure.

- Major Investors: Caterpillar, Volvo, Wirtgen Group, and JCB are the major players that dominate the global market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.85 Billion |

| Market Size in 2026 | USD 5.06 Billion |

| Market Size by 2035 | USD 7.59 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.58% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Global connectivity

Construction is one of the many industries that have incorporated GPS and telematics into their machinery. These characteristics enable real-time data on location, usage, fuel consumption, and maintenance requirements to be sent by road rollers. Road rollers may be remotely monitored and controlled by operators and managers thanks to connectivity features. This can entail monitoring the condition of the machine, changing its settings, or even debugging problems without physically visiting the location.

Road rollers can provide significant volumes of data when they are connected. Predicting maintenance requirements, averting malfunctions, and enhancing efficiency can all be achieved with the aid of data analysis. Smooth integration with more comprehensive construction management systems is made possible via connectivity features.

Restraint

Fluctuating fuel prices

The operational expenses of road-building equipment, such as road rollers, are directly impacted by fluctuations in fuel prices. Construction projects may end up costing more overall due to higher gasoline prices, which contractors must factor into their budgets. Producers concentrate on creating and advertising vehicles with increased fuel economy in order to draw in customers who care about the environment and want to cut down on operating expenses. Fuel costs have an impact on the state of the construction sector as a whole. High fuel costs can raise the cost of construction projects, which could cause delays or alter the plans for the project.

Opportunity

Collaboration and partnerships

Businesses frequently work together to incorporate cutting-edge technologies into their road rollers. Telematics, GPS systems, automation, and other intelligent technologies that boost productivity and efficiency are examples of this. Companies pool resources for research and development through collaborations. Players speed up innovation and introduce new and improved road roller models to the market more quickly by exchanging knowledge and experience.

Establishing partnerships with regional distributors or producers might assist businesses in entering new markets, as forming alliances with regional firms can yield valuable information about local laws, and consumer inclinations. Improved cost and efficiency in the supply chain can result from partnerships.

Segment Insights

Type Insights

The vibratory roller segment dominated the market in 2024. The growing preference for vibratory roller models due to their exceptional efficiency in compacting materials is the primary factor for the rapid growth of the segment. The dynamic mechanism employed by vibratory rollers produces a vibrational motion to aid the movement of soil particles. These vibrations help the effective displacement of air packets by enriching the penetration of the roller into the materials.

The static rollers segment is projected to grow at the fastest rate during the forecast period. The growth of the segment is attributed to the increasing use of these rollers by construction companies. These rollers offer robust and long-lasting compaction results. These rollers are also used to avoid potential cracks and other damage, optimizing road safety.

This guarantees optimal density. The road surfaces' stability, longevity, and load-bearing capacity are all enhanced by this effective compaction. Because vibratory rollers can produce strong and durable compaction results, there is an increasing demand for them from governments and construction businesses that place a high priority on long-lasting infrastructure.

Application Insights

The road construction segment held the largest market share of 37% in 2024. This segment currently holds the largest market share by application. This monopoly can be primarily attributed to the growing demand for roads to interconnect larger cities as well as smaller remote settlements as the population exponentially increases. This basic equipment plays an important role in ensuring optimal compaction of soil and other asphalt laying material used during road construction, thus ensuring a durable and long-lasting structure. The rising need to enhance transportation infrastructure globally sets road construction as a primary market growth driver.

The road maintenance segment is anticipated to expand at the fastest rate in the coming years. The increasing need to improve transportation infrastructure across the globe is a major factor contributing to segmental growth. Road rollers are one of the key machines that play a crucial role in maintaining proper compaction of soil & asphalt while constructing the road.

Government policies, economic conditions, and regional infrastructure development initiatives can all have an impact on the need for road rollers. Active government projects open lucrative opportunities for key players to enhance their market presence. While the private sector mainly contributes in the form of investments to expand and maintain transportation grids, the demand for efficient construction solutions increases. Retailers may need to modify their tactics in order to meet the unique requirements of various geographic areas. In the road roller sector, adherence to safety and environmental laws is essential. Retailers might have to make sure the goods they offer adhere to rules and standards in the business.

Regional Insights

Asia Pacific holds the largest share of the road rollers market. One major factor affecting the demand for construction equipment is government efforts and investments in infrastructure projects. The region's governments have frequently put policies and initiatives into place to promote economic development, which in turn propels the road rollers market.

Technology has advanced in the road rollers market, and manufacturers have added features to increase productivity, fuel economy, and environmental sustainability. Such cutting-edge technologies may pique the curiosity of customers in the Asia Pacific. Asia Pacific's road rollers market is competitive, with both local and foreign producers involved. Local producers in nations like China and India frequently make major market contributions.

- In August 2025, the foundation stone for the expansion and reinforcement of the road from Moter to Banner via Ladugaon in the Kalahandi district of Bhubaneswar was ceremoniously laid by the Union Minister of India and Chief Minister of Odisha.

North America is expected to show the fastest growth during the forecast period. Road rollers demand is frequently correlated with infrastructure development initiatives. The need for road rollers would probably increase if development and infrastructure projects in North America saw a spike. Government programs and funding for infrastructure and transportation projects are important.

The market for road rollers is observed to grow as government spending on road development and upkeep increases. Road building is one of the many construction-related tasks that are facilitated by economic growth and stability. An expanding economy usually results in more building projects, which boosts the need for road rollers. Technological developments in road rollers, such as the creation of more ecologically friendly and fuel-efficient variants, might affect market trends.

What Are the Driving Factors of The Road Rollers Market in Europe?

Europe's market for road rollers is centered around the pillars of sustainability, regulatory compliance, and the use of low-emission construction equipment. The demand is for electric, hybrid, and compact rollers in urban infrastructure projects, which is backed by stringent environmental regulations, cutting-edge construction methods, and an ongoing flow of investment into road rejuvenation and modernization programs.

Germany Road Rollers Market Trends:

Germany's market for road rollers is mainly concerned with the application of precision compaction, advanced automation, and eco-friendly machines. The gradual acceptance of intelligent, low-emission rollers that support efficiency, safety, and compliance with stringent environmental and performance standards across the country has been made possible by road construction and urban redevelopment investments.

Road Rollers Market-Value Chain Analysis

- Raw Material Sourcing: Efficiently identifying, evaluating, and acquiring steel, engines, and hydraulic components.

Key players: Tata Steel, ArcelorMittal, JSW Steel, Nippon Steel - Component Manufacturing: converting the raw materials into finished parts and subassemblies.

Key players: Bosch, Cummins, Danfoss, ZF Friedrichshafen, Continental AG - Vehicle Assembly and Integration: assembly of components and purchased parts into complete road rollers.

Key players: Caterpillar (CAT), JCB, Wirtgen Group (HAMM), Volvo Construction Equipment - Testing and Quality Control: Materials, components, and vehicles are inspected to guarantee the quality performance standards.

Key Players: TUV SUD, SGS, Intertek - Distribution to Dealers and OEMs of Road Rollers: Warehousing, inventory management, and shipping of finished rollers to channels.

Key Players: GMMCO, Gainwell Commosales, Tractor India Private Limited

Road Rollers Market Companies

- Wirtgen: Provides Hamm compactors, tandem rollers, and pneumatic tire rollers that are capable of delivering effective soil and asphalt compaction across various infrastructure projects.

- Caterpillar: Offers equipment for compacting and asphalting of high-performance roads, incorporating the latest technologies for reliable, efficient road construction operations.

- Bomag: Produces digital roller solutions for both asphalt and single drum rollers that are increasing the productivity, precision, and operational efficiency globally.

- XCMG: Manufacuters and distributes all types of road rollers to suit the different needs of the road construction industry, such as single drum and pneumatic models.

Other Major Key Players

- Case

- Sakai Heavy Industries

- JCB

- Dynapac

- Volvo

- Shantui

- Ammann

- Sany

- Sinomach

Recent Developments

- In March 2023, Dynapac announced a plan to launch its Z.ERA range of the world's first serial produced electric rollers along with North American charging solutions.

Segments Covered in the Reports

By Type

- Vibratory Rollers

- Static Rollers

- Tandem Rollers

- Pneumatic Rollers

By Application

- Road Construction

- Road Maintenance

- Land Development

- Industrial Construction

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting