What is Off-road Tires Market Size?

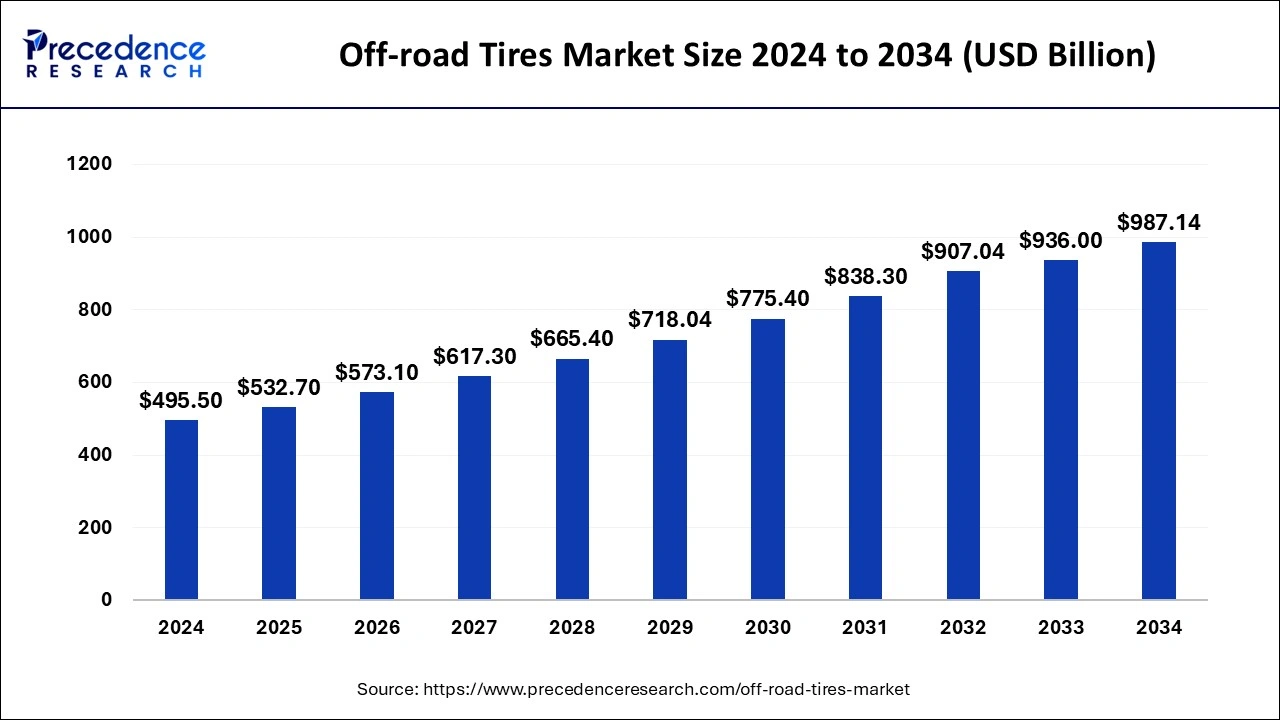

The global off-road tires market size was estimated at USD 532.7 billion in 2025 and is anticipated to reach around USD 1023.49 billion by 2035, expanding at a CAGR of 6.75% from 2026 to 2035.

Market Highlights

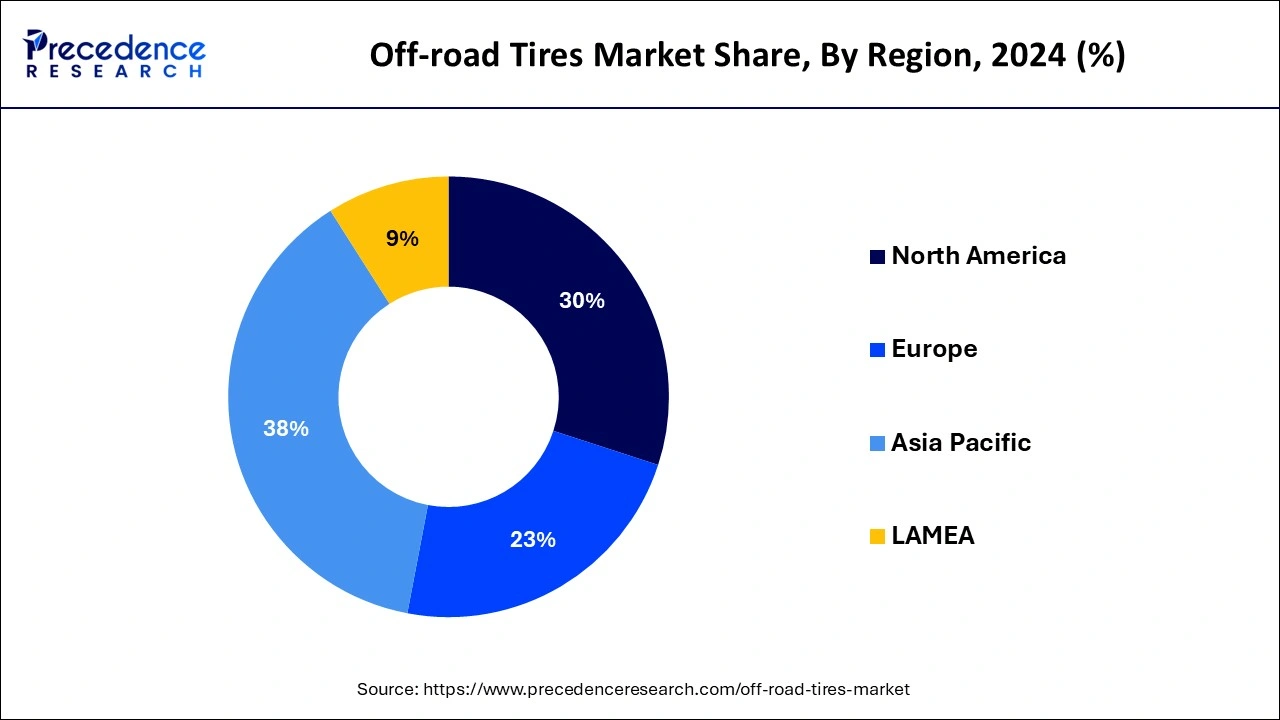

- Asia Pacific dominated the global off-road tires market with the largest market share of 38% in 2025.

- North America is projected to grow at a significant CAGR during the forecast period.

- By material, the synthetic rubber segment has held a major market share in 2025.

- By tires height, the above 45 inches segment is growing at a notable CAGR during the forecast period.

AI Impact on the Off-road Tires Industry

Artificial intelligence is transforming the off-road tires industry by enabling predictive maintenance through real-time monitoring of tire wear, pressure, and operating conditions, which helps reduce downtime and extend tire life. AI-driven data analytics are improving tire design and material selection by simulating performance under extreme terrains and loads, leading to more durable and efficient products.

In manufacturing, AI is enhancing quality control, process automation, and yield optimization, resulting in lower defect rates and improved consistency.

Off-road Tires Market Growth Factors

The off-road tires are commonly used in heavy duty vehicles for off-road applications in the agriculture, mining, and logistics industries, as well as in the housing industry. The development of the housing industry in emerging nations has increased demand for construction and material handling equipment, which is likely to drive the significant growth in the off-road tires market. The increased use of off-road vehicles such as wheel loaders, cranes, telescopic handlers, special purpose vehicles, and tractors is further driving the off-road tires market expansion.

The increased sales of off-highway vehicles and increased farm mechanization are driving the global off-road tires market growth during the forecast period. Furthermore, the global off-road tires market's growth is hampered by adverse weather conditions and low-cost tires from an unorganized sector. However, the development of environmentally friendly off-road tires is expected to present a lucrative growth opportunity for the industry.

The key market players are diversifying their portfolios in the off-road tires market, as agriculture is expected to generate the highest revenue among all industrial types. The harvester and floater tires, among others, were introduced by Michelin to help maximize harvests.

The off-road tires manufacturers are increasing production capacity for high performance radial tires with long service life and excellent year-round traction. They're ramping up research and development to include strong and flexible sidewalls as well as self-cleaning connectors for maximum pulling force. In addition, harvester tires are being developed that deliver less pressure, resulting in reduced soil compaction.

The increased in medium-sized farms around the world is driving up demand for agricultural equipment, which in turn is driving up demand for agriculture tires. The transportation activities have increased as a result of increased industrialization around the world. Intercity transportation operations, such as business to business (B2B) and business to consumer (B2C) trade, are increasing, resulting in a demand for compact and rapid transport vehicles to get around the cities efficiently. The global off-road tires market is propelled by aforementioned factors.

The growing global population and increased consumer affluence are expected to push the agriculture sector toward mechanization, boosting the off-road tires market. Increasing technological advancements in tires, such as connected tires and the TeadStat rim management system, which provides information prior to a vehicle breakdown. The off-road tires market is expected to grow as a result of this.

The costing of bias tire is heavily influenced by rawmaterial price volatility. The natural rubber and synthetic rubber prices fluctuate due to a lack of natural rubber cultivation or a surge in the price of crude oil.

Market Outlook

- Industry Growth Overview: High-performance radial off-road tires are needed for mining, construction, and mechanized agriculture.

- Sustainability Trends: Environmentally friendly materials, the use of retreads, and minimizing the size of rolling resistance favor environmental and operational efficiency.

- Major investors: Key Investors Michelin, Bridgestone, Continental, Goodyear, Yokohama Rubber, Titan International, and BKT are driving growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 532.7 Billion |

| Market Size in 2026 | USD 573.1 Billion |

| Market Size by 2035 | USD 1023.49 Billion |

| Growth Rate from 2026 to 2035 | 6.75% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Material, Tires Height, Vehicle, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Material Insights

Synthetic rubber is the most extensively utilized material in off-road manufacturing, thus it's a major source of revenue. The synthetic rubber segment accounted for huge revenue share in 2025 , and it is expected to expand at a significant rate until 2034. The widespread of butadiene rubber and styrene-butadiene rubber in mining and agricultural vehicles is a major element is the high market capturing ability. The material's high strength and abrasion resistance, as well as its low cost, are driving its adoption.

Tires Height Insights

The above 45 inches segment is growing at a notable CAGR during the forecast period. The growing demand for off-road tires and agricultural vehicles is the main driver of the market growth. Various trends, such as farming mechanization and automation, increasing adoption of heavy machinery, and growing mining activities, are expected to drive the segment penetration. This can also be seen in the steps taken by product manufacturers to meet the rising demand.

Vehicle Insights

The off-road tires market's UTV segment has a huge amount of potential and is expected to produce greater demand by 2035. UTV's functional adaptability when compared to heavier machinery like trucks and tractors is promoting their popularity for a variety of farm operations. The off-road tires market revenue will be driven by a movement in preference toward UTV vehicles because to their simplicity and mobility for completing different chores. Furthermore, the off-road tires market's growth will be aided by the increasing use of drones in adventure events and racing championships.

The market revenue, market shares, business strategies, recent developments, and growth rates of major businesses holding substantial market shares in the worldwide off-road tires market are all examined. Recent events for these firms, such as new solution, product launches, acquisitions, research activities, geographic expansions, and technological advancements, are taken into account when determining their position in the off-road tires market. All important stakeholders in the off-road tires value chain and technological ecosystem are expected to benefit the growth of the off-road tires market.

The key market players concentrate on developing new technologies that can be used to improve the off-road tires market's product portfolio. The market players are adopting various marketing strategies for the growth and development of the market during the forecast period.

Regional Insights

What is the Asia Pacific Off-road Tires Market Size?

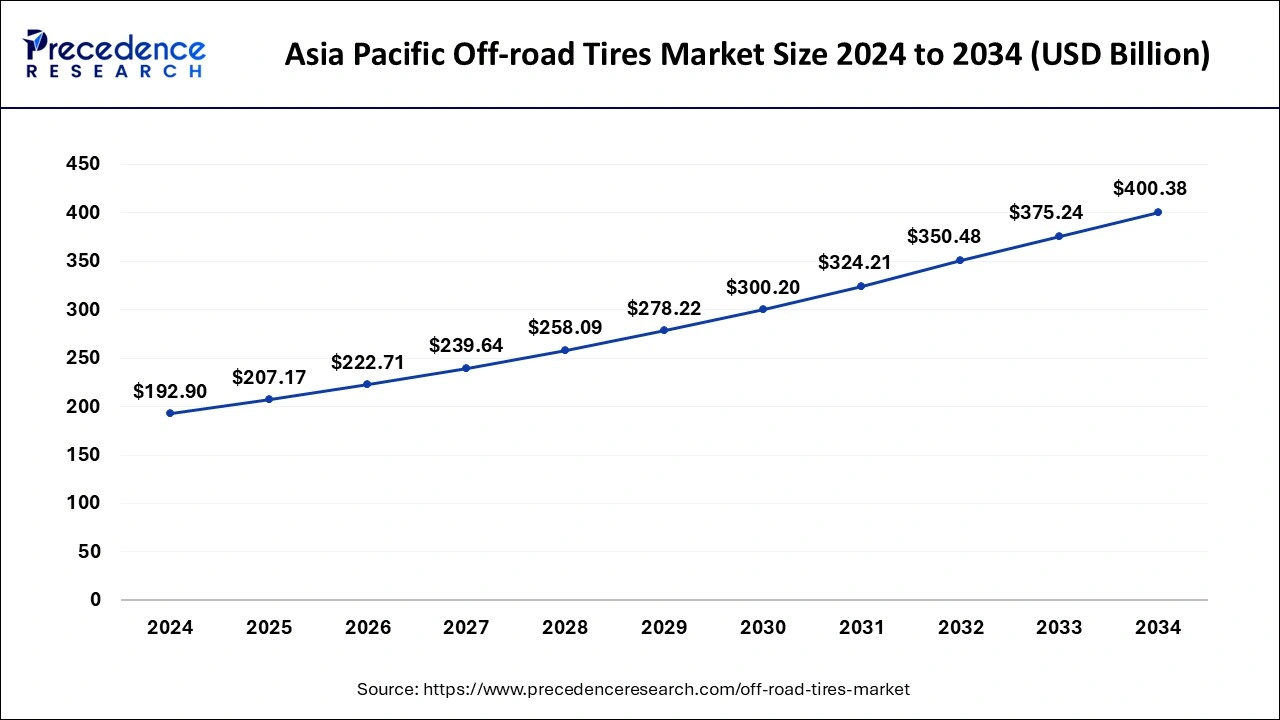

The Asia Pacific off-road tires market size was evaluated at USD 207.17 billion in 2025 and is predicted to be worth around USD 425.26 billion by 2035, rising at a CAGR of 7.46% from 2026 to 2035.

Asia Pacific dominated the global off-road tires market with the largest market share of 38% in 2025. The China and India are leading countries of the Asia-Pacific off-road tires market. China and India's economic expansion, combined with China's significant investments in road and other infrastructure development, will fuel the Asia-Pacific regional market demand. However, rising demand from developing nations and strategic measures from key market players are expected to boost the off-road tires market's growth.

Off-road Tires Industry in China and Japan Trends

- In November 2024, Yokohama Tire announced the renewal of its strategic partnership with Tread Lightly by continuing with its outstanding public support of environmental outreach programs and aiming to protect off-road trail access and public lands.

- In May 2024, the International Council on Clean Transportation (ICCT) that the recent publication report entitled “China Mobile Source Environmental Management Annual Report 2023” provided by the Ministry of Ecology and Environment (MEE) highlighted the significant emissions rising from off-road sectors and construction equipment. China is proactively supporting with policies for transitioning zero-emission construction equipment.

How Is North America Performing in the Off-road Tires Market?

North America is expected to grow at a significant rate during the forecast period. The innovation in North America is in mining, infrastructure, and advanced industrial nations. There is a high demand for heavy-duty equipment tires. Smart tire systems to track the pressure, temperature, and wear are being progressively implemented by fleet operators to enhance productivity, safety, and cost management in the lifecycle.

U.S. Off-road Tires Market Trends:

The U.S. is a nation that is highly embracing electric mining and construction equipment. Such high torque and weight of batteries heighten the need for specialized, tough tires. Customers are more attracted to the high-quality all-weather solutions that reduce downtimes and enhance reliability, as well as sustain constant operations even in challenging terrains.

What Are the Driving Factors of The Off-road Tires Market in Europe?

Europe is expected to grow at a notable rate during the forecast period. Europe is based more on sustainability and high-performance tires. Eco-friendly materials and retreading are encouraged by environmental regulations. Demand for high-load, low-rolling-resistance tires is in favor of construction growth. The manufacturers are concerned with efficiency, durability, and adherence to the standards of energy, with the quality of the products being high.

Germany Off-road Tires Market Trends:

Germany gives preference to sustainable tire materials and smart sensor incorporation. Agriculture moves to highly developed radial tires so as to enhance efficiency and lessen soil erosion. The programs of the circular economy promote long-lasting, self-healing, and retread-friendly tire designs that are in line with long-term environmental objectives.

What are the Advancements in the Off-road Tires Market in Latin America?

Latin America is expected to witness substantial growth throughout the forecast period, driven by high demand from the construction, agriculture, and mining sectors. The region also benefits from supportive government initiatives that push infrastructure development and industrial growth. Manufacturers are focusing on creating cost-effective tire solutions that are tailored to local terrain conditions. Countries like Brazil and Mexico are leading players in the region.

Brazil Off-road Tires Market Trends: The country's market growth is primarily driven by factors like increasing investments in mining and construction sectors and a growing demand for agricultural machinery. Regulatory initiatives aimed at improving infrastructure are also contributing to market expansion.

MEA's Off-road Tires Industry

The Middle East and Africa regions are expected to grow at a steady pace throughout the forecast period. This growth is fueled by large-scale mining, oil exploration, and infrastructure projects in the region, thus driving demand for premium off-road tires that are designed for extreme conditions and heavy equipment. Expansion of transportation and energy networks across nations further supports market adoption.

Saudi Arabia Off-road Tires Market Trends: The expansion of construction and mining industries, the extensive infrastructure development projects, increasing environmental consciousness, rapid technological advancements, and the growing logistics and transportation sector are some of the factors boosting the country's market landscape.

Value Chain Analysis of the Off-road Tires Market

- Raw Material Sourcing: Starting with the rubber suppliers and carbon black suppliers, to weigh the durability, consistency of quality, and economy of input prices.

Key Players: Michelin, Bridgestone, Goodyear, Birla Carbon - Component Manufacturing: Tire sub-assemblies made with mixes, calenders, and beads to be strong with a low level of waste.

Key players: BKT Tires, Titan International, Continental AG, Pirelli, Trelleborg AB - Vehicle Assembly and Integration: Curing and vulcanization are done to achieve heavy-duty performance and endurance criteria in off-road tires.

Key players: Caterpillar, Deere & Company, Komatsu, CNH Industrial, JCB - Testing and Quality Control: Intensive testing is done to prove traction, load capacity, puncture resistance, and reliability to withstand harsh environments.

Key Players: TÜV SÜD, SGS, Intertek, Smithers, HASETRI - Distribution to Dealers and OEMs: Adequate logistics will be streamlined to deliver on time to mining, construction, and agricultural equipment.

Key Players: Goodyear, Michelin, Bridgestone, BKT Tires, Yokohama Tire Corp.

Top Off-road Tires Market Companies and their Offerings

- Hengfeng Rubber: Offers low-price truck and bus tires that can work in heavy-duty and unpaved applications, with the focus on cost efficiency and local market flexibility.

- Continental AG: Provides specialized off-road tires under the brand general tire, maintains earthmoving, agriculture, and material handling with durable solutions.

- GITI Tire: Produces strong commercial and all-terrain tyres, suitable for extreme off-road use, to suit the different regional needs.

Other Off-road Tires Market Companies

- Triangle Group

- Nokian Tires

- Toyo Tire

- Michelin

- Hankook

- Yokohama

- Maxxis

Latest Announcements by Industry Leaders

- In July 2024, Mark Stewart, CEO and President of Goodyear Corporate reported that the sale of Off-the-road (OTR) business set the important benchmark by continuing the execution against the company's Forward Transformation Plan. He also reported that the company is grateful to its colleagues in driving the business and commitment with Yokohama in ensuring a smooth transition for customers and associates.

Key Developments

- In January 2026, Continental Tires launched the CrossContact A/T² all-terrain tyre in India, enhancing its presence in the 4x4 and SUV market. Unveiled at the Continental Tires Track Day 2026 in Goa, the tyre showcases its capabilities through an off-road experience. The CrossContact A/T², featuring an adaptive Black Paw compound for consistent grip and durable sidewalls for protection, marks India among the first global markets for this innovation.

- In June 2025, BKT's new five-year strategic plan targets INR 23,000 Crores in revenues by 2030, investing INR 3,500 Crores mainly from internal sources. Key focus areas include enhancing off-highway tire leadership, expanding the carbon black business, and introducing new tire categories in India.

- MICHELIN bought PT Multistrada Arah Sarana TBK, an Indonesian bias tire producer and two-wheeler tires, and has a capacity of 250,000 truck tires per year.

- In October 2024, Continental AG announced that the company plans to introduce a wide range of its innovative products for the two-wheeler industry at the EICMA motorcycle show in Milan, Italy.

- In December 2024, Nokian Tyres announced that the company set production records at its North American Factory with the expansion of its product range and volume and achieved significant growth in its regional market presence in 2024.

Segments Covered in the Report

By Material

- Synthetic Rubber

- Natural Rubber

- Fabrics & Wire

- Carbon Black

By Tire Height

- Below 31 inches

- 31-40 inches

- 41-45 inches

- Above 45 inches

By Vehicle

- 4WD

- HDT

- SUV

- UTV

- Dirt Bikes & Quad

- OTR

By Distribution Channel

- Original Equipment Manufacturer (OEM)

- Secondary/ Replacement

- Distributor/ Dealer Equipped

By Application

- Agriculture

- Construction

- Material Handling

- Mining

By Construction Type

- Solid

- Radial

- Belted Bias Tire

- Bias Tire

- Non-Pneumatic Tires

By Process

- Pre-Cure

- Mold Cure

By Industrial Equipment

- Forklifts

- Aisle Trucks

- Tow Tractors

- Container Handlers

By Agriculture Tractors

- <30 HP

- 31-70 HP

- 71-130 HP

- 131-250 HP

- >250 HP

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting