What is Material Handling Equipment Market Size?

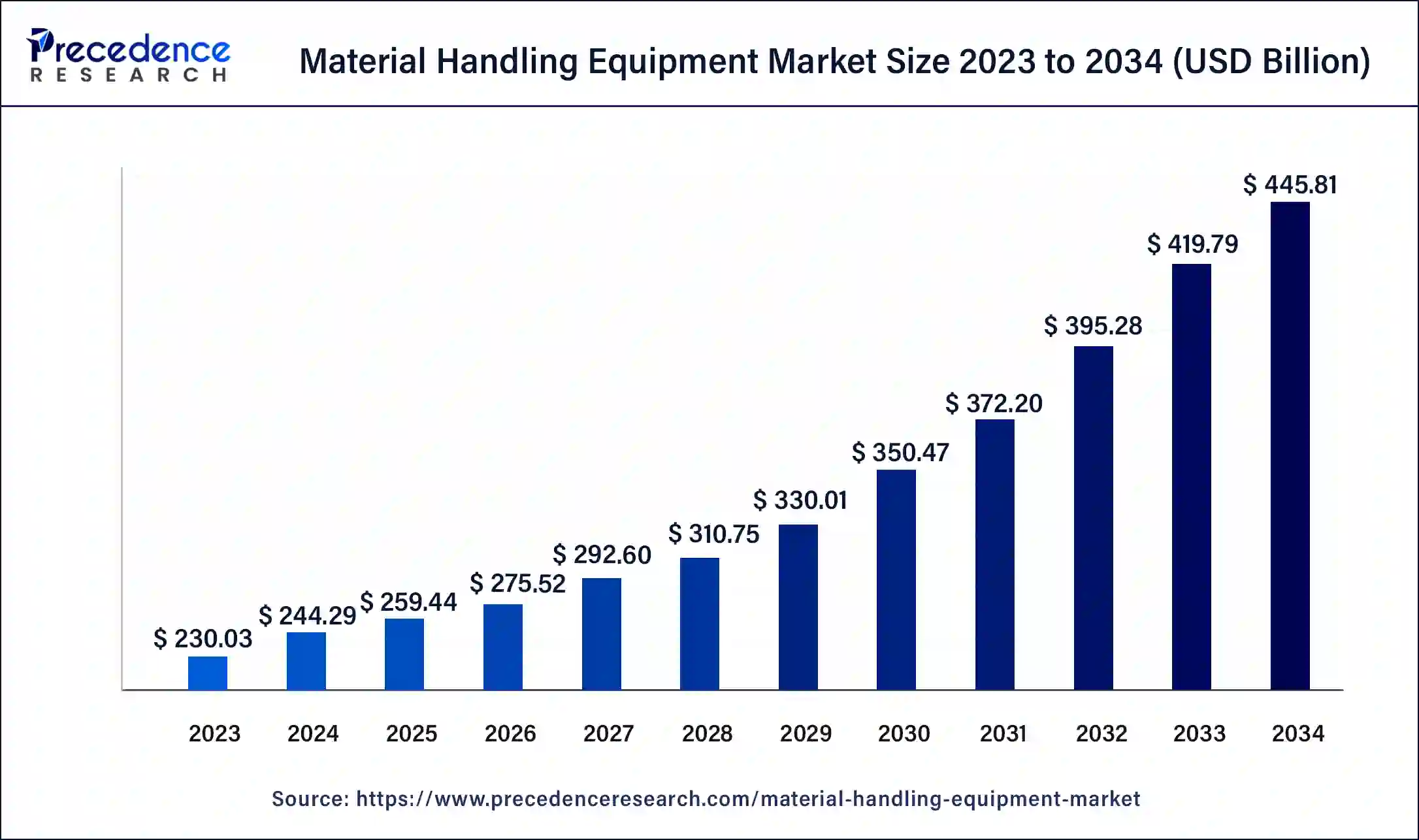

The global material handling equipment market size accounted for USD 259.44 billion in 2025, and is anticipated to hit USD 259.44 billion by 2025, and is expected to reach around USD 470.82 billion by 2035, expanding at a CAGR of 6.14% from 2026 to 2035

Market Highlights

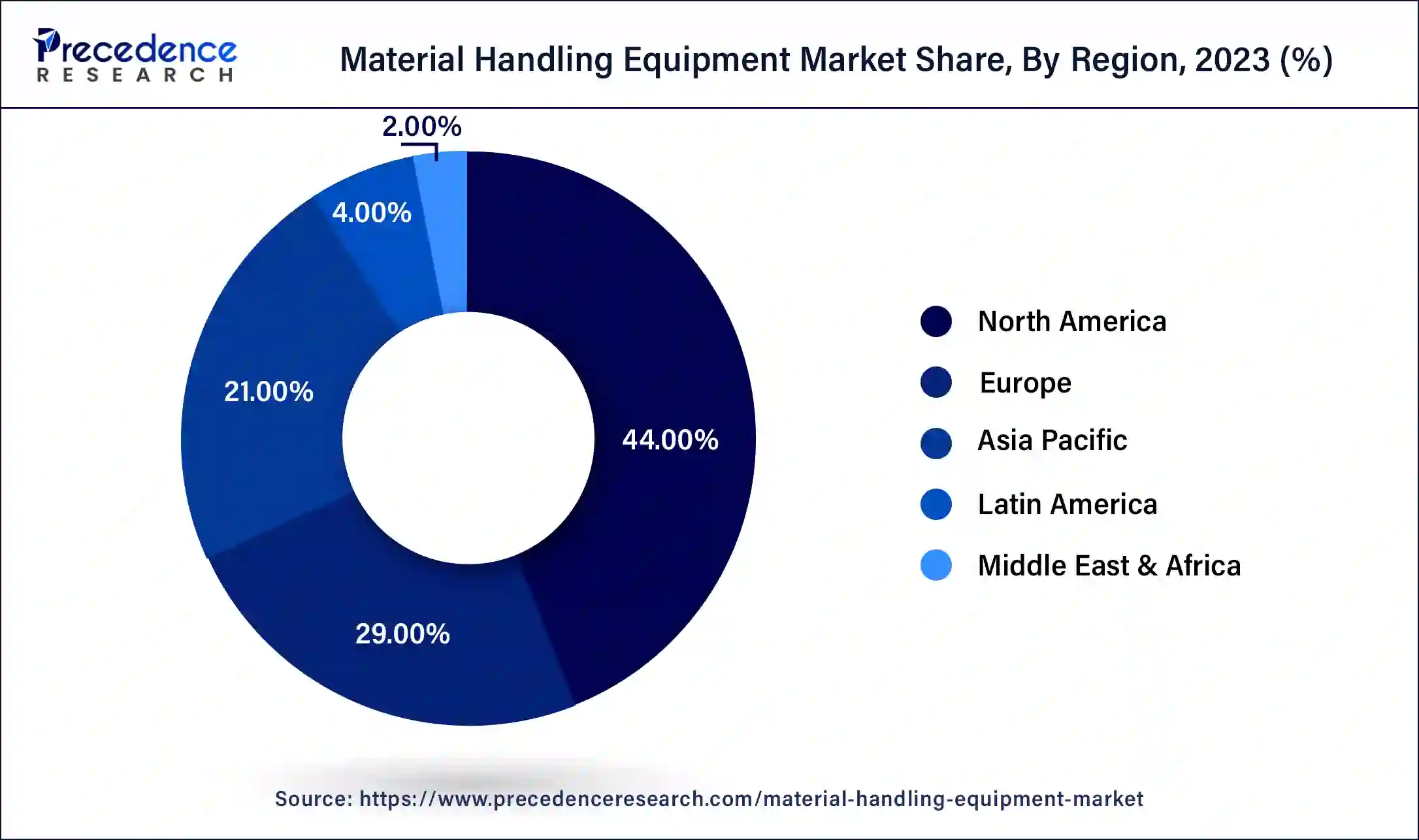

- Asia Pacific led the global market with the highest market share of 44% in 2025

- By Product, the industrial trucks product segment has held the biggest revenue share of 30.5% in 2025 .

- By Product, the mini-facelift segment is anticipated to grow at a remarkable CAGR of 8.1% during the projected period.

- By End Use, the e-commerce segment generated more than 23.4% of revenue share in 2025.

AI in the Market

Artificial intelligence is revolutionizing the market of material handling equipment with its ability to increase efficiency, automation, and sustainability. AI-driven predictive maintenance prevents wastage of time due to equipment malfunction; machine vision systems assist in picking, sorting, and order fulfillment with high levels of accuracy. On the other hand, autonomous robots and AGVs increase operational speed, reduce manual errors, and aid in making workplace environments safer. AI powers the optimization of routing and workflows and improves warehouse efficiencies with its integration capabilities into management systems and digital twins. In the context of sustainability, machine learning helps monitor energy consumption in warehouses and guides warehouses towards greener goals. Being highly scalable, flexible, and data-driven, AI operations reduce costs and enhance the competitive position, hence placing itself as the key enabler of material handling in the future.

Material Handling Equipment Market Growth Factors

The surge in investments for the development of power and battery technology will foster the market growth. Apart from that, favorable government initiatives worldwide encourage new infrastructure development, resulting in growth prospects in the material handling equipment market over the forecast period.

The developing economies such as India and China attract foreign investments promoting infrastructure and industrial development; this is expected to drive the market growth. Also, the development of public infrastructure such as rail networks, airports, seaports and power plants, and others are estimated to foster the market growth.

The development of Belt and Road Initiative (BRI) by China is anticipated to create lucrative opportunities that will fuel the growth of the materials handling equipment market. This initiative focuses on connecting a network of rail and road routes from China to Europe via the Middle East.

The material Handling Equipment Market has benefited greatly from the rapid rise of the ecommerce industry. Furthermore, in reaction to the COVID-19 epidemic, the imposition of social distance rules, lockdowns, and other measures has prompted consumers to turn to internet shopping, which has helped market growth.

The increase in labor cost and safety concerns has led many industries to choose the equipment's in order to improve work efficiency and time reduction and this factor will foster the market growth. Also, with the enhancement of technology there will be demand for automation and productivity and this will trigger the market growth. Furthermore, the increasing requirement for efficient material movement necessitates automated processes, which is expected to fuel market growth.

- Infrastructure development is an area with a major investment dimension, and various government initiatives, including railways, airports, and seaports, are encouraging strong demand for material handling equipment.

- The expansion of industrial and manufacturing activities in developing territories is contributing to the accelerated adoption of advanced handling solutions.

- With the expansion of e-commerce activities, the demand for efficient logistics and automated warehouse equipment is increasing.

- Rise in wages and health risks has pushed companies toward equipment that grants productivity and reduces risk.

- Rapid technological advances to preserve automation and efficiency are pushing industries to adopt the latest machinery for a more streamlined way of working.

Material Handling Equipment Market Trade Analysis

- Dependence on Cross-Border Logistics:The increase in global trade has led to an increase in reliance on efficient systems for moving goods in and out to increase speed and reduce the length of time goods are stored.

- Trade Flow Cost Sensitivity: The costs associated with shipping goods across borders, including fluctuating shipping costs, customs fees, and supply chain interruptions, can directly impact the cost of equipment and thus the manufacturer's decision to locate production near their customers or to use multiple sources for materials.

- Effects of Regulation on Trade: As international safety regulations and compliance requirements for manufacturing products continue to evolve, manufacturers need to adjust their equipment requirements and certifications to be in compliance with the various regions where they export products.

Market Outlook

- Industry Growth Overview:The growth of the industry continues to be driven by rapid advancement in automating industries, the establishment of warehouse space by companies investing in logistics, and the growing realization of the need to increase productivity and efficiency through the reduction of cycle times and the introduction of supply chain solutions that support the manufacturing, logistics, and retail segments.

- Sustainability Trends: Sustainability trends are driving the development of electric material-handling equipment, more energy-efficient motors, using recyclable materials, and creating ways to optimize the total lifecycle costs of manufacturing equipment to meet a company's ESG objectives, as well as continuing to meet regulatory pressures.

- Global Expansion: Global growth continues at an accelerated pace in emerging markets with the expansion of investment in logistics networks, smart factories, and high-tech warehouses, creating an unprecedented need for state-of-the-art material handling technologies.

- Startup Ecosystems: The evolution of start-ups in the material-handling equipment market continues to be propelled by the development of products based on autonomous robots, AI-based warehouse management systems, cloud-based fleet monitoring systems, and predictive maintenance systems, raising significant venture capital funding.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 259.44 Billion |

| Market Size in 2026 | USD 275.52 Billion |

| Market Size by 2035 | USD 470.82 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.14% |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, End User, and Region |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

Segment Insights

Product Insights

Based on the product, the industrial trucks product segment is expected to lead the market with largest market share of over 30.5% in 2025. These trucks are a desirable choice due to their wide area of application in an industrial setting. The transportation of heavy containers or crates in several end use markets is undertaken using industrial trucks and this attribute accelerates the market growth. As the logistics industries are shifting towards sustainable products, the demand for battery-operated trucks will be surged over the forecast period. For instance, On 8th July 2021, KION Group AG has announced that manufacture of forklift trucks would begin near the German-Polish border in order to balance equipment for all KION Industrial Trucks &Services brand firms. The goal of this initiative is to increase the level of automation and digitization at these locations.

The automated storage and retrieval system segment accounted for a remarkable revenue share of 28.4% in 2023 and is expected to grow at a CAGR of 8.1% during the forecast periodowing to the COVID-19 pandemic's implementation of social distancing standards During this time, these systems were preferred because they emphasized efficiency and corresponded with social distancing norms. Also, during the projection period, the investments in automated equipment will surge which is anticipated to create lucrative opportunities that will drive the growth of the material handling equipment market.

End Use Insights

Based on the End use, the Material Handling Equipment Market is divided into Automotive, Food & Beverages, Chemical, Semiconductor & Electronics, E-commerce, Aviation, Pharmaceutical and Others. The e-commerce sector will dominate the market with a revenue share of 23.4% in 2025 and is estimated to grow significantly during the forecast period. During the lockdown limitations, an unforeseen need for distribution and transportation of basic supplies, particularly groceries, fueled market expansion. The impact of the coronavirus will not be a short-term boost to the market; rather, it will have a long-term impact on industrial demand, offering enormous prospects for material handling equipment vendors. It is also estimated the revenue share of the ecommerce sector will cross USD 10.5 billion by 2035.

The retail sector has always offered massive profit opportunities, and this trend is expected to continue in the future. The convenience of online shopping has encouraged retailers to build micro-fulfillment centres that allow for quick product deliveries, and this attribute will boost the growth of material handling equipment market. For instance, On 28th September 2021, The Italian Calzedonia Group, a prominent player in worldwide fashion retail marketplaces, has chosen BEUMER Group, a leading global producer of automated material handling systems. to put its pouch-making technology to work Calzedonia Group has seen a rapid expansion in its Direct to Consumer (DTC) business as a result of the boom in e-commerce, and it needed to improve its dispatch operations to account for this growth while improving efficiency and customer service.

Regional Insights

What is the Asia Pacific Material Handling Equipment Market Size?

The Asia Pacific material handling equipment market size is estimated at USD 114.15 billion in 2025 and is predicted to be worth around USD 207.17 billion by 2035, at a CAGR of 6.14% from 2026 to 2035

How did Asia Pacific generate the Largest Revenue Share in the Material Handling Equipment Market in 2025?

Asia Pacific region generated over 44% of revenue share in 2025. It is because the developing economies have provided ample opportunities, subsequently helping OEMs reach broader end-user markets. Moreover, the rapid growth of the e-commerce industry in this region is anticipated to boost the market growth.

India Material Handling Equipment Market Trends

The India material handling equipment market is fueled by swift industrialization, growing manufacturing operations, government programs such as the Production-Linked Incentive scheme, increasing logistics in e-commerce, and heightened infrastructure development, all leading to greater demand for modern automation, effective warehousing solutions, and technologically enhanced handling systems in various sectors.

How is the Significant Growth of Europe in the Material Handling Equipment Market?

Europe is expected grow significantly over the forecast period. It's due to the employment of innovative products to support the region's large-scale industrial presence. Europe has a diverse range of industries, from food and beverage to electronics manufacturing, all of which offer sales opportunities. Furthermore, the e-commerce sector led by same-day delivery models has contributed remarkably towards market growth. For instance, On 14th October 2021, LogsticaCarosan, a Spanish storage and transportation company, has stated that it has rebuilt its Talavera de la Reina (Spain) facility in order to improve customer service. The company will adopt Mecalux's Easy WMS warehouse management system to streamline all of its logistical procedures. The technology will allow LogsticaCarosan to keep a close eye on its clients' entire inventory.

UK Material Handling Equipment Market Trends:

The UK material handling equipment market continues to develop driven by investments in smarter logistics, increased demand for AI-based warehouse automation, and a rise in the adoption of electric and autonomous material handling solutions. The expansion of online shopping in the UK, spearheaded by brands like ASOS, Ocado, and Tesco, is boosting the need for automated handling solutions such as AI-based inventory management, robotic sorting technologies, and AMRs. The movement towards eco-friendly warehousing and energy-saving logistics is prompting the adoption of electric forklifts, optimized conveyor belt systems, and low-energy AS/RS solutions to cut costs and enhance sustainability.

What is the Fastest Rate of Growth of North America in the Material Handling Equipment Market?

North America is expected to grow at the fastest rate in the market during the forecast period due to industrial modernization, the expansion of e-commerce, and government incentives. The other major growth drivers include green logistics, EPA guidelines, and tariff policies.

U.S. Material Handling Equipment Market Trends

The U.S. market is growing steadily as industries seek to enhance warehouse efficiency, logistics operations, and supply chain automation. Rising e-commerce activity and the demand for faster order fulfillment are driving the adoption of automated storage and retrieval systems, conveyors, and robotic material handling solutions. Technological advancements, including IoT integration, telematics, and smart warehouse systems, are improving equipment productivity, safety, and real-time monitoring.

Latin America

How does Latin America Reach Pivotal Growth in the Material Handling Equipment Market?

Latin America is expected to experience notable growth during the forecast period, driven by the booming e-commerce sector and the rising demand for material handling equipment across end-user industries like food and beverage and automotive. Latin America is advancing its economy by promoting and financing production.

MEA

What is the Considerable Growth of the Middle East and Africa in the Material Handling Equipment Market?

MEA is expected to grow at a lucrative rate in the market in the coming years, driven by automation in e-commerce and warehouse, infrastructure, mega projects, and the adoption of Industry 4.0 technologies. The construction equipment market in the Middle East and North Africa is driven by infrastructure modernization programs and the expansion of industries.

Value Chain Analysis

- Raw Material Sourcing (Metals, Electronics): Involves purchasing and administration of metals, electronic components, and other input materials required for the manufacturing of material handling equipment.

Key Players: Tata Steel, Aditya Birla Chemicals - Component Fabrication and Machining: This stage transforms raw materials into specific parts and components for the equipment by using cutting, forming, welding, and precision machining.

Key Players: Reliable Autotech, Elecon Engineering - Testing and Certification: Rigorous tests ensure and ascertain certification that components and finished equipment meet quality, safety, and performance standards.

Key Players: TÜV SÜD, DEKRA - Installation and Commissioning: At the customer's site, this involves assembling, connecting, testing, and adjusting material handling equipment to ensure its proper functioning.

Key Players: Imperial Material Handling Equipment, Seltech Engineers - Distribution and Sales: Promotion and selling of the finished material handling equipment, including storage and logistics, for timely delivery to the customer at his or her request.

Key Players: Toyota Material Handling, KION GROUP AG - Maintenance and After-Sales Service: After the sales, maintain and repair installations; troubleshoot; supply spare parts; and perform training to prevent and cure defects on the equipment provided.

Key Players: Wonder Technologies Services, Unilift Cargo Systems

Material Handling Equipment Market Companies

- BEUMER Group

- Daifuku Co., Ltd.

- Honeywell International Inc.

- Kion Group AG

- Mecalux, S.A

- Murata Machinery Ltd.

- SSI Schaefer AG

- Swisslog Holding AG

- Toyota Material Handling Group

- Vanderlande Industries B.V.

Recent Developments

- On April 7, 2025, Kalmar commenced production of electric empty container handlers and heavy forklift trucks at its Shanghai facility. The launch is enhancing sustainable cargo handling and reducing lead times in the Asia-Pacific region. (Source- https://www.kalmarglobal.com)

- In March 2025, Gather AI, an innovator in AI-based warehouse digitization, announced the introduction of Material Handling Equipment Vision, an AI-powered MHE camera system aimed at transforming real-time visibility in material handling and enhancing warehouse efficiency. MHE Vision works with Material Handling Equipment like forklifts, auto pickers, and pallet trucks.

- In March 2025, Material Handling Equipment, a Canadian industry leader in lithium solutions, unveiled its diverse lineup of electric stackers, pallet trucks, scrubbers, and lift tables. By emphasizing efficiency, performance, and reliability, the company consistently establishes the benchmark for dependability in the material handling sector.

- In May 2025, Jungheinrich and EP Equipment formed a strategic alliance to collaboratively shape the global future of material handling, adopting the slogan "Shaping the future of material handling together." This partnership aims to provide substantial advantages for clients globally by merging the capabilities of both firms to improve efficiency, productivity, and sustainability in material handling processes.

- In September 2025, Toyota Material Handling introduces new 5/35 lithium-ion batteries for forklifts in industries like cold storage, food and beverage, and manufacturing, offering high performance in hot and cold environments.(Source:https://chargedevs.com)

- In July 2025, SILA partners with Nilkama to offer Material Handling Equipment Rental Solutions, transforming logistics and warehouse operations for Indian businesses with an all-electric fleet of machinery. (Source:https://www.manufacturingtodayindia.com)

Segments Covered in the Report

By Product

- Storage and Handling Equipment

- Automated Storage and Retrieval System

- Industrial Trucks

- Bulk Material Handling Equipment

- Others

By End Use

- Automotive

- Food & Beverages

- Chemical

- Semiconductor & Electronics

- E-commerce

- Aviation

- Pharmaceutical

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting