Fluid Handling Systems Market Size and Forecast 2025 to 2034

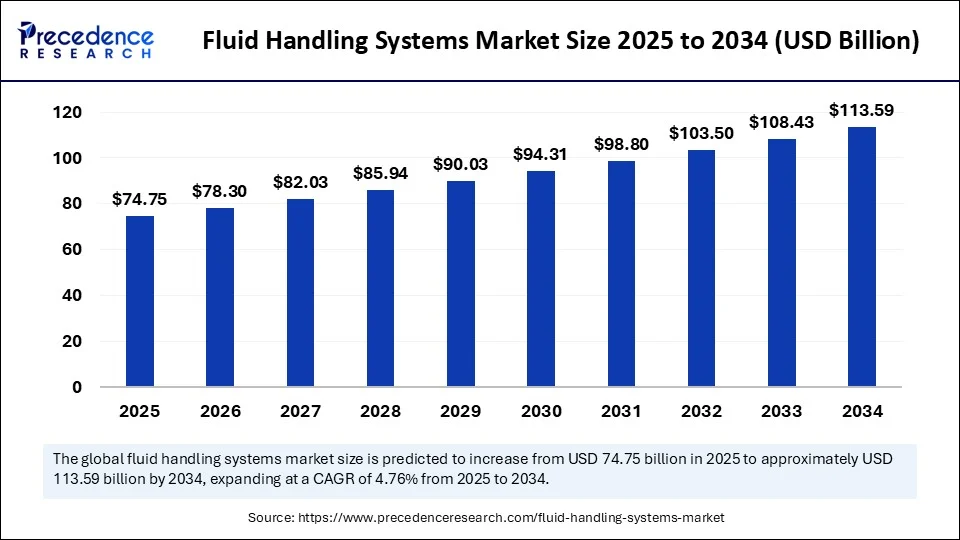

The global fluid handling systems market size accounted for USD 71.35 billion in 2024 and is predicted to increase from USD 74.75 billion in 2025 to approximately USD 113.59 billion by 2034, expanding at a CAGR of 4.76% from 2025 to 2034. The market is growing due to increasing demand for efficient and automated fluid transfer solutions across industries such as pharmaceuticals, oil and gas, and water treatment.

Fluid Handling Systems MarketKey Takeaways

- In terms of revenue, the global fluid handling systems market was valued at USD 71.35 billion in 2024.

- It is projected to reach USD 113.59 billion by 2034.

- The market is expected to grow at a CAGR of 4.76% from 2025 to 2034

- Asia Pacific dominated the fluid handling systems market with the largest share in 2024.

- North America is expected to grow at a notable rate in the coming years.

- By component, the pumps segment held the largest share of the market in 2024.

- By component, the filters & purification systems segment is observed to grow at the fastest rate during the forecast period.

- By industry, the oil & gas segment dominated the market in 2024.

- By industry, the pharmaceutical segment is expected to grow at the fastest rate in the fluid handling systems market.

- By material, the metallic segment dominated the market with a major share in 2024.

- By material, the nonmetallic segment is expected to grow at the fastest CAGR in the upcoming period.

- By end-user, the process industries segment held the largest share of the market in 2024.

- By end-user, the discrete industries segment is observed to grow at the fastest rate during the forecast period.

How is AI transforming the fluid handling systems market?

Real-time monitoring, predictive maintenance, and process optimization are made possible by artificial intelligence, which is transforming the fluid handling systems marke. Businesses can minimize unscheduled downtime, prevent equipment failure, and identify anomalies with AI-powered analytics and smart sensors. Algorithms for machine learning facilitate the optimization of temperature control, pressure levels, and fluid flow rates, thereby increasing overall system efficiency. Furthermore, integrating AI improves automation, minimizes manual intervention, and guarantees adherence to environmental and safety standards. This change is making fluid handling operations in industries such as water treatment, food and beverage, pharmaceuticals, and oil and gas smarter, more responsive, and more cost-effective.

Market Overview

The fluid handling systems market includes solutions (pumps, valves, filters, instruments, control systems, etc.) designed to transport, control, and manage the flow of fluids such as water, chemicals, oil, gas, and slurries across industries like oil & gas, water & wastewater, chemicals, pharmaceuticals, food & beverage, power generation, and automotive. It is a foundational part of industrial infrastructure, essential for process efficiency, safety, and environmental compliance.

What is driving the demand for fluid handling systems in today's industrial landscape?

The increasing demand for accurate, automated, and efficient fluid transfer processes across various industries, including food and beverages, oil and gas, pharmaceuticals, and water treatment, is driving the need for fluid handling systems. Businesses are investing in advanced fluid handling technologies to enhance operational efficiency, comply with regulations, and minimize environmental impact as global industrial operations become increasingly complex and sustainability-focused. Furthermore, the incorporation of intelligent technologies, such as automation and the Internet of Things, is converting conventional systems into responsive, intelligent solutions, driving market expansion.

Fluid Handling Systems MarketGrowth Factors

- Rising Industrial Automation: The increasing adoption of automation in manufacturing and processing industries is driving demand for advanced and efficient fluid handling systems.

- Stringent Environmental Regulations: Governments and regulatory bodies are enforcing strict guidelines on wastewater management and chemical handling, which is pushing industries to invest in safer and more efficient systems.

- Expanding Oil and Gas and Chemical Sectors: Continuous growth in oil and gas exploration and chemical manufacturing has increased the need for reliable fluid transfer and storage systems.

- Surge in Pharmaceutical and Food Processing Industries: These industries require precise and hygienic fluid handling, driving the adoption of high-performance systems with clean-in-place (CIP) and sterilize-in-place (SIP) capabilities.

- Growing Focus on Water and Wastewater Treatment: The increasing demand for clean water and efficient sewage management, particularly in developing economies, is driving investments in fluid handling infrastructure.

- Technological Advancements: Integration of IoT and smart sensors for real-time monitoring and predictive maintenance enhances the efficiency and reliability of fluid handling systems.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 113.59 Billion |

| Market Size in 2025 | USD 74.75 Billion |

| Market Size in 2024 | USD 71.35 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.76% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Industry, Material, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Industrial Growth

The need for dependable and effective fluid transfer systems is driven by the rapid growth of sectors such as chemicals, food and beverage, pharmaceuticals, and oil and gas. To produce or transport fluids, these industries require accurate and reliable fluid management. The demand for systems that can manage large volumes with minimal error is growing in tandem with industrial infrastructure. Further driving up demand for technologically sophisticated fluid handling equipment is the increasing complexity of industrial processes.

Increase Focus on Wastewater Management

Rising environmental concerns and stringent government regulations on wastewater treatment are pushing industries to adopt advanced fluid handling solutions. Governments across regions are imposing stricter discharge norms, compelling industries to upgrade or install modern fluid control systems. These systems are critical for separating, treating, and transporting industrial effluents. Increasing awareness about water conservation is also encouraging investments in efficient water reuse and recycling infrastructure.

Restraint

High Initial Investment Cost

Advanced fluid handling systems, particularly those integrated with smart technologies and automation, require substantial upfront capital investment. This high cost can be a barrier for small and medium enterprises (SMEs), particularly in emerging markets. The expenses related to installations, customization, and staff training further increase the financial burden. As a result, many businesses may delay adoption or opt for lower-cost, less efficient alternatives.

Complexity in System Integration

Integrating fluid handling systems with existing production or control infrastructure can be technically challenging. Implementation delays and expenses are frequently caused by outdated equipment, mismatched system compatibility, and a shortage of qualified staff. Additionally, standardization is challenging due to industry-specific customization requirements, which restrict scalability. This complexity may hamper the quick adoption of new technologies.

Opportunities

Rising Demand for Smart and Automated Systems

Advanced fluid handling systems with AI, IoT, and automation capabilities are becoming increasingly accessible due to the growing movement toward Industry 4.0 and smart manufacturing. These systems help businesses cut expenses and boost productivity by providing remote control and real-time monitoring, as well as predictive analytics. Smart fluid handling solutions are expected to become increasingly in demand as industries strive to digitize their operations. By investing in R&D or automation-driven systems, businesses can capitalize on a rapidly growing market.

Sustainability and Eco-Friendly Solutions

Energy-efficient and environmentally friendly fluid handling systems are becoming increasingly popular across various industries. Growing consumer awareness of the environmental effects and regulatory pressure are the main drivers of this change. There are advantages for businesses that provide minimal waste systems, recyclable materials, and low-energy pumps. In a market centered on sustainable development, innovation in green technologies will be a crucial differentiator.

Component Insights

Why did the pumps segment dominate the fluid handling systems market in 2024?

The pump segment dominated the market with the largest share in 2024. This is primarily due to the growing demand for centrifugal pumps in various industries, driven by their diverse applications, high efficiency, and ability to handle large volumes of fluid at consistent pressure. These pumps are widely used across various sectors, including oil & gas, chemicals, water treatment, and food processing, due to their simple design, low maintenance requirements, and high energy efficiency. Their dominance is also attributed to advancements in pump automation and smart monitoring technologies, which improve operational reliability and reduce downtime in critical industrial operations.

The filters & purification systems segment is expected to grow at the fastest rate in the upcoming period, driven by growing regulatory demands for fluid purity and environmental compliance. Manufacturers are being encouraged to invest in sophisticated filtration technologies by the growing demand for clean water in industries, as well as stricter emissions and discharge regulations. Concerns about contamination in the food and pharmaceutical industries are growing, which is helping to boost growth by encouraging more fluid-handling operations to use high-performance membrane and cartridge filters.

Industry Insights

How does the oil & gas segment dominate the fluid handling systems market in 2024?

The oil & gas segment dominated the market with a major revenue share in 2024, owing to its high demand for robust and high-pressure fluid transfer systems. From drilling operations to refining processes, this sector relies heavily on efficient pumping, filtration, and storage technologies to manage aggressive and hazardous fluids. With ongoing exploration and production activities and the need for safe, leak-proof operations, the oil & gas segment remains the largest revenue contributor to the market.

The pharmaceutical segment is expected to grow at the highest CAGR over the projection period. This is mainly due to stringent regulations regarding the safety and hygiene of pharmaceutical products. To comply with health regulations and preserve product quality, there is a high need for sterile, contamination-free fluid handling solutions. The increasing demand for functional foods and medical supplies worldwide is driving investments in automated dispensing, clean-in-place (CIP), and hygienic fluid systems that ensure precise and repeatable operations.

MaterialInsights

What made metallic the dominant segment in the fluid handling systems market in 2024?

The metallic segment dominated the market while holding the largest revenue share in 2024. This is mainly due to the excellent strength, durability, and ability of metallic materials to withstand high-pressure and high-temperature environments. Metallic materials, such as stainless steel, cast iron, and other alloys, are widely used in heavy-duty applications across the oil & gas, chemical processing, and power generation industries. Their resistance to mechanical stress and compatibility with aggressive fluids make them ideal for long-term industrial use, reinforcing their stronghold in the market.

The non-metallic segment is expected to expand at the fastest rate in the coming years, driven by increased adoption due to its corrosion resistance, lighter weight, and lower maintenance requirements. These materials are especially preferred in applications where chemical compatibility and energy efficiency are critical. The growing emphasis on sustainability and cost optimization is also encouraging industries to replace heavy metallic systems with durable and eco-friendly non-metallic alternatives.

End-userInsights

Why did the process industries segment dominate the fluid handling systems market in 2024?

The process industries segment dominated the fluid handling systems market in 2024, as they require continuous, large-scale, and precise fluid flow for their operations. Industries such as chemicals, energy, food processing, and water treatment rely heavily on fluid handling technologies for mixing, transferring, and treating various liquids and gases. These sectors require highly integrated, automated systems to enhance productivity and safety, thereby further supporting the dominance of the process industries.

The discrete industries segment is likely to grow at the fastest CAGR in the market over the forecast period. Discrete industries, such as manufacturing, electronics, and automotive, heavily utilize fluid handling systems to manage hydraulic, actuation, cooling, and lubrication. Fluid system needs are growing as a result of automation, precision manufacturing, and the production of electric vehicles, particularly for systems that are lightweight, small, and programmable.

Regional Insights

What made Asia Pacific the dominant region in the fluid handling systems market?

Asia Pacific dominated the fluid handling systems market with the largest revenue share in 2024 and is expected to sustain its position in the market in the coming years, driven by the expansion of the manufacturing and energy sectors, growing infrastructure, and rapid industrialization. There is a constant need for dependable fluid management solutions due to the strong presence of industries such as food processing, water treatment, and chemicals. The region is witnessing a widespread adoption of advanced fluid-handling technologies, driven by government initiatives that support waste management, access to clean water, and industrial automation. Moreover, the rising investments in infrastructure development and increasing industrial output are likely to boost the demand for fluid-handling solutions.

North America is expected to grow at a notable rate during the forecast period, driven by strong technological innovation, increasing investment to expand oil & gas infrastructure, and rising demand for sustainable and automated fluid systems. The region's focus on modernizing outdated fluid systems, along with stricter environmental regulations, is pushing companies to upgrade to smart, energy-efficient solutions. The growth of the biotech, pharma, and advanced manufacturing sectors further fuels demand for precision fluid handling technologies.

Fluid Handling Systems Market Companies

- Alfa Laval AB

- Anest Iwata Corporation

- Colfax Corporation

- Crane Co.

- Dover Corporation

- EBARA International Corporation

- Flowserve Corporation

- Graco Inc.

- Grundfos

- IFH Group

- Ingersoll Rand

- ITT Inc.

- Kadant Inc.

- KSB SE & Co.

- Metso

- Pentair Ltd.

- PSG – Dover Corporation

- SPX Flow, Inc.

- Sulzer Ltd.

- Xylem Inc.

Recent Developments

- In May 2025, SAMOA Industrial announced the launch of its new product division: Applied Industrial Fluid Solutions. This new division is created to deliver specialized solutions for fluid application in industries such as industrial painting, protective coatings, and high-viscosity fluid handling.

(Source: https://www.samoaindustrial.com) - In April 2024, Cole-Parmer launched a new range of industry-leading fluid handling solutions. These solutions comprise of tubing, fittings, parts, and accessories to suit a diverse array of research and production needs. They are well-suited for pharmaceutical, clinical, automotive, water treatment and food & beverage applications.

(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Component / Type

- Pumps (Centrifugal, Positive Displacement)

- Valves (Control, Check, Rotary)

- Filters & Purification Systems

- Measuring Instruments & Control Systems

By Industry / Application

- Oil & Gas

- Water & Wastewater

- Chemical

- Food & Beverage

- Power Generation

- Pharmaceuticals

- Automotive

- Building & Construction

- Metals & Mining

By Material

- Metallic

- Non-metallic (e.g., plastic, composite)

By End-User

- Process Industries

- Discrete Industries

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting