What is the Active Protection Systems Market Size?

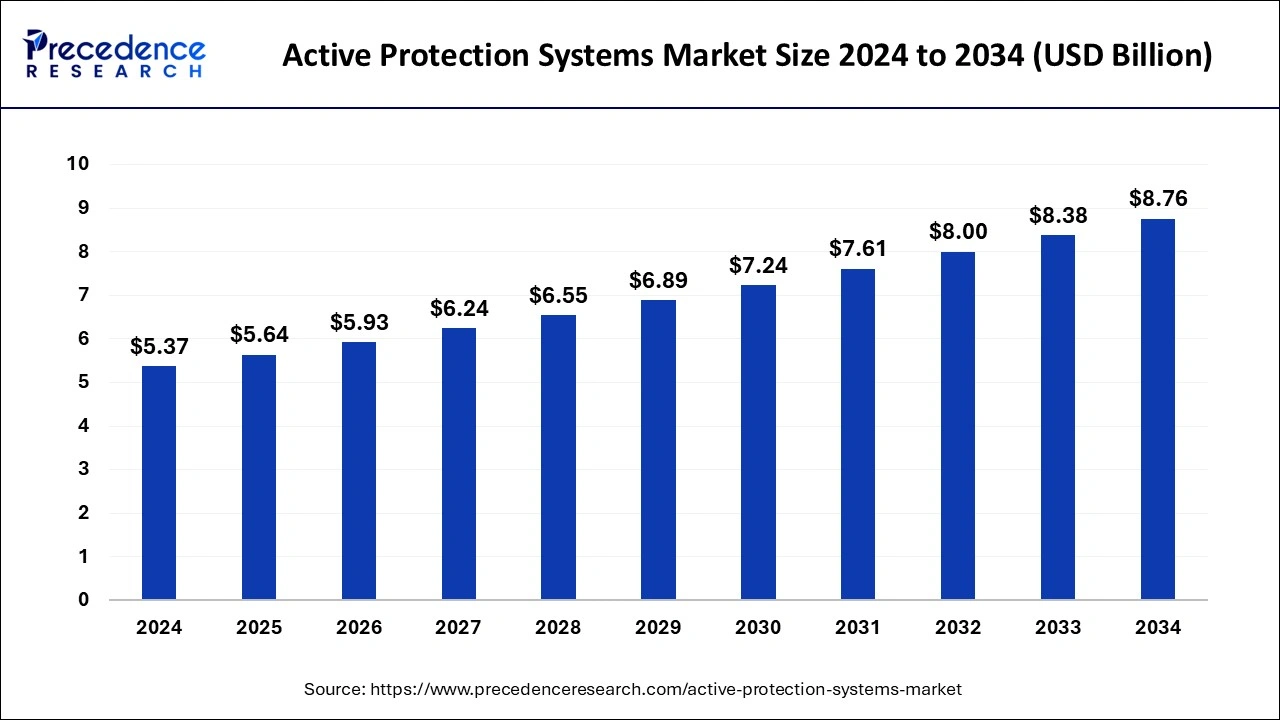

The global active protection systems market size is calculated at USD 5.64 billion in 2025 and is predicted to increase from USD 5.93 billion in 2026 to approximately USD 9.14 billion by 2035, expanding at a CAGR of 4.95% from 2026 to 2035.

Active Protection Systems Market Key Takeaways

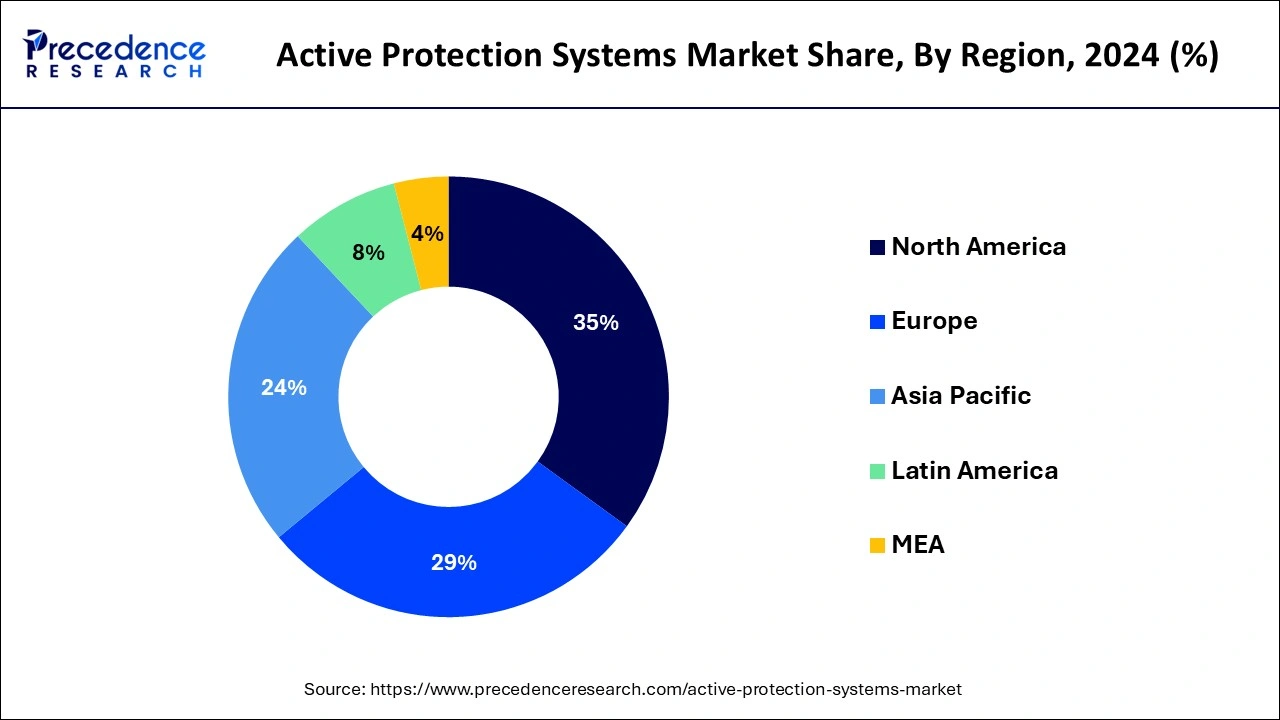

- North America dominated the global active protection systems market with the largest market share of 35% in 2025.

- Europe is expected to grow at a significant CAGR during the forecast period.

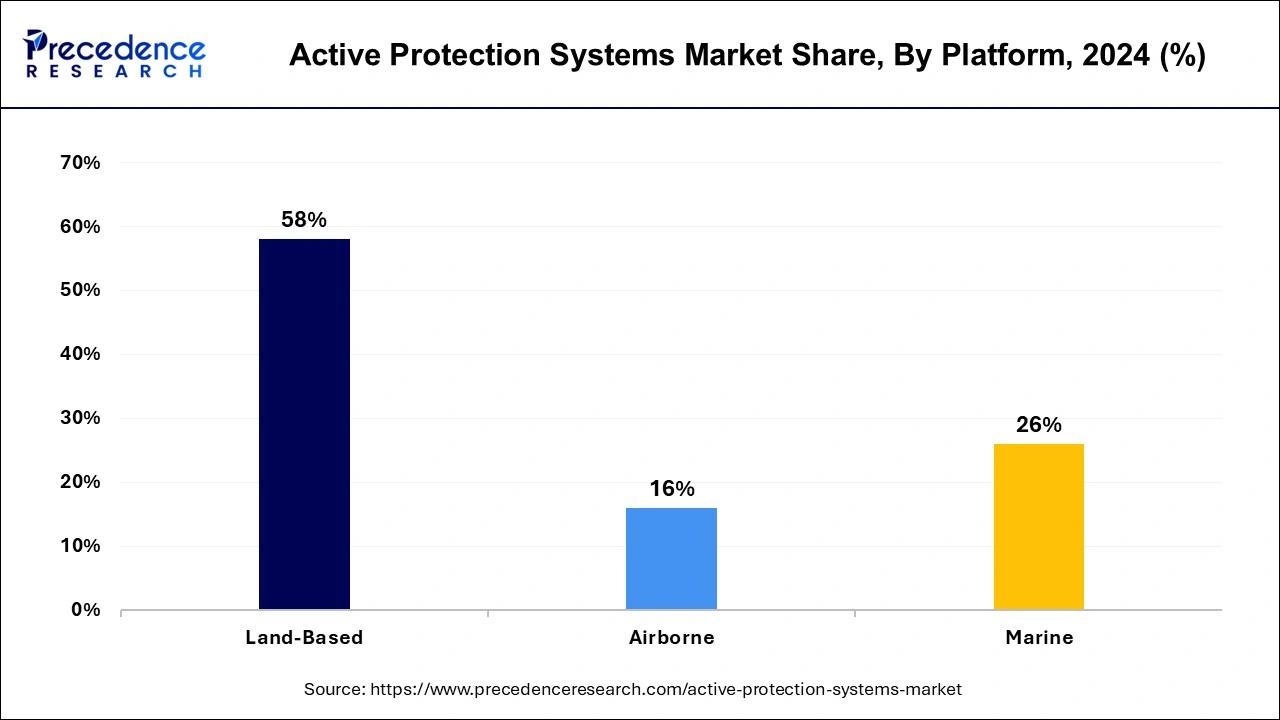

- By platform, the land-based segment contributed the highest market share of 58% in 2025.

- By type , the soft-kill system segment is projected to grow at a notable CAGR during the forecast period.

What are Active Protection Systems?

The increased demand for land-based defense systems and ballistic missile defense systems is one of the main factors driving the global active protection systems market. Anti-tank missiles and rocket-propelled grenades are two threats that active protection systems can intercept and fire down. Additionally, they do it quite accurately, minimizing collateral harm. Additionally, active protection systems can offer defense against these dangers in a variety of mission applications, including stationary locations, ships, and combat vehicles, among others.

Active protection systems are becoming more popular as a result of their numerous distinctive perceived benefits. The U.S. and South Korean governments' joint initiatives to develop land-based air and missile defense in South Korea are macroeconomic drivers supporting the market for active protection systems. The expansion of the missile defense system by China and India is also expected to spur the demand for active protection systems.

Impact of AI on the Active Protection Systems Market

The Active Protection System landscape is beginning to change as a result of automation and artificial intelligence (AI) technologies, which provide improved features, including autonomous decision-making, real-time threat detection, and effective system integration. By preventing human mistakes and facilitating data-driven insights, the incorporation of AI into APS increases operational efficacy and efficiency in thwarting threats. The total efficacy of defensive measures is also greatly increased by automation, which enables quick reactions to incoming dangers. As defense industries progressively use more intelligent and dependable systems, these technological developments are anticipated to further propel market expansion for APS.

Active Protection Systems Market Growth Factors

Increasing Focus on Creating Advanced Combat Systems

Many nations have developed and deployed their autonomous weapon systems during the past ten years in order to improve their militaries and support their troops in a number of international conflicts. The new variants of APS feature advanced optronic that render them exceptionally suitable for urban warfare and thus reduce the casualties during a war. The increasing induction of armored vehicles equipped with RWS and CIWS systems for protection against incoming projectiles is driving the demand for such systems.

- Improvement in Military: Many nations have developed and deployed their autonomous weapon systems during the past ten years in order to improve their militaries and support their troops in a number of international conflicts.

- Technological Advancements: The constant development of new sensor technologies, weapon firing systems, and other support systems aims to improve the precision and performance capabilities of the current APS generation. The emphasis on enhancing weapon system autonomy has led to the development of unmanned weapon technologies like RWS and CIWS that can successfully neutralize a target without the assistance of a person.

Market Outlook

- Industry Growth Overview: The expansion of the market was caused by the modernization of the military, the need for vehicles to be more survivable, and the changing security challenges around the world.

- Sustainability Trends: The emphasis is on lightweight modular architectures, with software upgrading to prolong the operational life, and material efficiency as the main consideration.

- Global Expansion: Increasing demand in North America, Europe, and the Asia Pacific regions, which is a result of the heightened geopolitical situation, is seen as a trend.

- Major Investors: The companies that are leading the market are Raytheon, Rheinmetall, Saab, Leonardo, and BAE Systems.

- Startup Ecosystem: The sector is still controlled by big defense companies, while small innovators are working on specialized subsystem technologies only.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.64 Billion |

| Market Size in 2026 | USD 5.93 Billion |

| Market Size by 2035 | USD 9.14Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.35% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type and By Platform |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Market Drivers

Spending More on Defense Mechanisms Will Accelerate the Development of the Active Protection Systems Market

Before the target is reached, these protective systems are employed to identify and neutralize threat projectiles. The market for active protection systems will see new opportunities arise as a result of the rising demand for the building of a secure network against cyberattacks.

During the projection period of 2023–2032, the market for active protection systems may experience significant development potential due to the rising demand for land-based defense systems and ballistic missile defense systems. The rate of technological development in the defense industry has greatly grown over time.

The market for active protection systems may rise as a result of continued research and development efforts, considerable government and non-government organization investment, and favorable economic conditions. The active protection systems market is experiencing additional expansion due to the astounding rise in military spending among both developing and developed countries. During the period 2023–2032, the market for active protection systems will experience a promising expansion due to the modernization of existing fleets of naval and ground platforms.

Restraint

High cost associated with installation & maintenance

One of the main things impeding the market's expansion is the high expense of setting up and maintaining an active protection system. Because of the intricate installation and integration with current military assets, this active defense system is made up of very costly equipment. Upgrading the APS to increase the protection capability of the main battle tanks, light-protected vehicles, and amphibious armored vehicles will cost a lot of money.

Market Opportunities

Revolutionary Parametric Countermeasure Kit (MCK) and Missile Countermeasure Device innovation (MCD)

A cutting-edge countermeasure kit developed by Giat Industries SA (France) is primarily used in armored fighting vehicles. The system includes an electro-optical IR jammer, a laser warning system, and a missile launch detection system. The use of a jammer prevents a missile strike. The missile Countermeasure Device (MCD) is used on the battlefield to identify and alert the user of an impending attack.

The MCD system emits infrared radiation (IR) signals that break up missile tracking loops. The MCD has an advanced M6 countermeasure system that releases flares and smoke to deter the adversary from the MCD. There is a good chance that several military forces around the world will use countermeasure kits and missile countermeasure devices more frequently.

Market Challenges

The central challenges facing the industry for active protection systems are the simulation of weapons and the systems they contain.

The process of integrating US standard weapons into these systems is challenging and requires significant modernization. For instance, the US F-15/F-16 fighter jets are used by nations including Saudi Arabia, Japan, and Israel. They should have no trouble adhering to US munitions standards since these aircraft only need minor modifications. However, given that they have different fighter aircraft in their inventories, nations like China, India, France, Germany, and Angola will need significant modifications and upgrades in order to set up western smart weapon systems. It is challenging to integrate and implement updated munition control units, precision strike packages, and related training and simulation of weapons and their integrated systems in a cost-effective manner. These elements are anticipated to pose a challenge to the integration of an active protection system.

Segment Insights

Type Insights

The active protection system market is divided into three categories based on Type Insights: soft kill systems and hard kill systems. There are various kinds of soft kill systems, including an electro-optic jammer, radar decoy, infrared decoy, and others. The soft kill system uses decoys, jammers, munitions, signature reduction strategies, and signature reduction techniques to deflect an enemy's approaching missile.

The soft-kill system segment is projected to grow at a notable CAGR during the forecast period.The hard-kill systems include rocket/missile, gun, and reactive armor-based weaponry that physically counterattacks an approaching danger in order to destroy/alter its payload/warhead in such a way that the intended effect on the target is substantially hindered. This growth is attributable to the US military forces' increased use of laser warning receiver systems.

Platform Insights

The market for active protection systems is divided into land-based, airborne, and maritime segments. Land-based vehicles include infantry fighting vehicles (IFVs), light-protected vehicles (LPVs), amphibious armored vehicles (AAVs), mine-resistant ambush-protected (MRAPs), main battle tanks (MBTs), armored personnel carriers (APCs), and others. The land-based segment contributed the highest market share of 58% in 2024.

The US government's dominance is due to the higher funding from private corporations for the acquisition of combat vehicles and defense equipment. In order to purchase an APS and its parts for the Abrams main combat tanks, the US Army and Leonardo DRS signed a contract in November 2019.

Regional Insights

U.S. Active Protection Systems Market Size and Growth 2026 to 2035

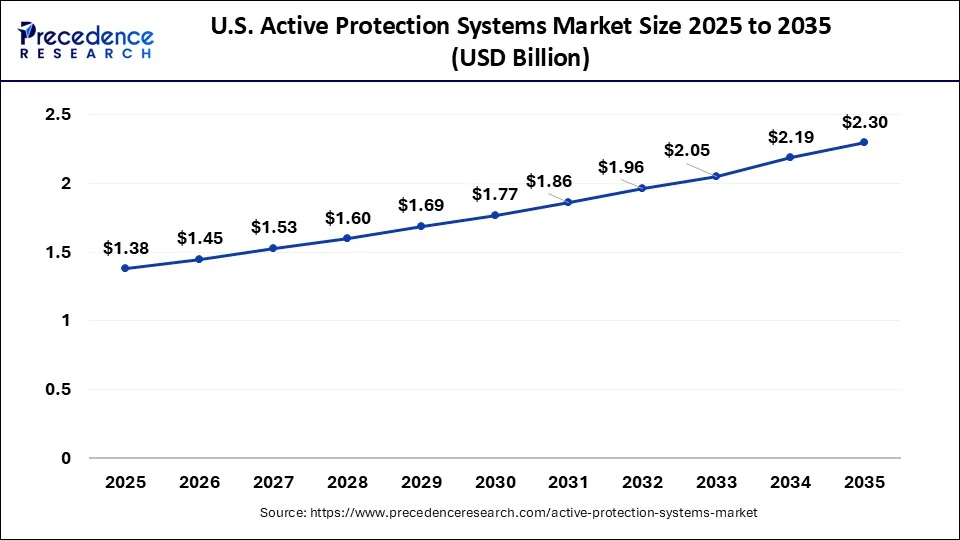

The U.S. active protection systems market size was evaluated at USD 1.38 billion in 2025 and is predicted to be worth around USD 2.30 billion by 2035, rising at a CAGR of 5.24% from 2026 to 2035.

North America dominated the global active protection systems market with the largest market share of 35% in 2025.

In North America, the United States and Canada are APS's two biggest users. They are actively concentrating on improving the capabilities of their fleet of current vehicles. The US's FY 2020 defense budget places an emphasis on day-to-day operations for existing conflicts, crisis response, and alliance participation while prioritizing military system modernization to compete with China and Russia on the international stage.

North America

A subset of cutting-edge technologies that might be important to American national security are known as critical and emerging technologies (CETs). The Department of Defense appropriations bill for fiscal year 2024 allocated $824.3 billion, which was $26.8 billion more than the 2023 budget. The measure allocated $148.3 billion for fiscal year 2024, which is $3.4 billion more than the budget request for that year and $8.6 billion more than the amount approved for fiscal year 2023. In order for forces to have the tools and systems necessary to meet the challenges of the future, the law supported the research community and made investments in fundamental and applied scientific research, development, testing, and evaluation of new technologies and equipment.

According to the 2020 defense budget's provisions, defense contractors are expected to continue producing APS while investing heavily in research and development for new systems. In order to formally incorporate APS into its Next-Generation Ground Vehicle (NGCV) program, the US Army. The US Army granted Leonardo DRS an add-on contract worth USD 79.6 million in March 2019 to help integrate Rafael's TROPHY active protection systems into the fleet of Abrams tanks. The North American section of the market will be the focus during the forecast period, and a number of procurement and upgrade programs are predicted to be launched in the following period.

Europe is expected to grow at a significant CAGR during the forecast period.

The armed forces of the European Union's increased demand for this system are anticipated to fuel market expansion. Launched by BAE Systems in October 2019, the RAVEN Countermeasure system is a combat vehicle system. Within the RAVEN APS product family, which also includes an integrated vehicle protection system, the RAVEN Countermeasure system functions as a shield of defense. An LCM system with cutting-edge capabilities is the RAVEN Countermeasure system. A guided missile threat can be neutralized using the RAVEN Countermeasure system, for instance.

Europe

In 2025, the European Defense Agency (EDA) projects that the 27 nations would spend €284 billion on defense. The European Union established the European Peace Facility (EPF) with the purpose of funding equipment for the participating nations. Compared to the previous Military Planning Law, the French military will get a substantial boost in spending. The budget for 2025 is €50 billion (compared to €45.4 billion in 2023) and €69 billion in 2030, which must be used to meet the pledge to allocate 2% of GDP to the military.

How Is Asia-Pacific Performing in The Active Protection Systems Industry?

The Asia-Pacific region is a very active market that is mainly supported by the rise in military budgets, keeping the peace between different nations, and the promotion of local defense production. The demand for hard kill and soft kill systems in the area is increasing the supply chains as well as the adoption of the region as a key site for the cooperation of new technologies with the existing ones.

India Active Protection Systems Market Trends:

India is pouring a substantial amount of money into upgrading its combat systems and acquiring the latest protection technologies. Active protection systems are gaining more and more by partnerships that are making the aircraft more survivable and the ground vehicles better. Moreover, the local manufacturing initiatives are paving the way for long-term local capacity building and procurement opportunities.

The need for active protection systems has increased as a result of the expanding economies of countries like China and India.

Owing to the region's deployment of naval and land platforms, as well as the region's increased innovation of current fleets, Asia-Pacific is predicted to have the highest rise in the world's active protection systems. Active protection systems are frequently used in the military in emerging economies like China and India. For instance, the Indian Defense Acquisition Council opted to implement Active Protection measures for 3000 Indian tanks and other armored vehicles on February 26, 2021. These programs help the market grow even more.

Furthermore, China has created the GL5 Active Protection System by NORINCO, which can neutralize any non-kinetic-energy weapons before they even come in contact with vehicles. It was created for main battle tanks and infantry combat vehicles. Thus, advancements and research in active protection systems are further boosting the region's economic growth.

Active Protection Systems Market Companies

- SAAB AB: Creates and provides advanced radar and sensor solutions that are used in ground and naval active protection applications and are integrated into defense platforms.

- Raytheon Company: Supplies highly advanced and sophisticated radar technologies and also participates in the development of active protection by providing state-of-the-art interception and detection systems.

- Airbus Group: Delivers integrated aerospace and defense solutions that come with active protection technologies built into the overall military system portfolios.

Other Major Key Players

- Konstruktorskoye Byuro Mashynostroyeniya

- Rafael Advanced Defense Systems Ltd.

- Rheinmetall AG

- Safran Electronics & Defense

- Aselsan A.S.

- Artis, LLC

- Israel Military Industries

Recent Developments

- In October 2025, the Soviet Union had a lesser-known program aimed at creating a system to counter incoming ballistic missile warheads, intended to protect ICBM silos. This concept contrasts with more familiar hard-kill active protection systems designed for defending against fast-moving threats like anti-tank missiles. (Source: https://www.twz.com )

- In September 2025, Swedish startups Nordic Air Defence and Volvo Defense partner to develop VIPRO, a compact counter-unmanned aircraft system pod for vehicle protection. Showcased at DSEI, VIPRO will integrate advanced technologies for drone interception, with a product launch anticipated in 2026. (Source: https://www.edrmagazine.eu )

- In November 2024, modern active protection systems will be added to Turkey's fleet of armored vehicles. After successfully completing its experimental phases, ASELSAN's AKKOR active protection system will be deployed with the Altay main battle tanks beginning in 2025.

- In October 2024, the Ministry of Defence (MoD) of the United Kingdom reported that the Team Pellonia collaboration, which consists of Leonardo UK, Thales UK, and the Defence Science and Technology Laboratory, has successfully completed 100% of live-fire experiments with a revolutionary laser-based airborne self-protection system.

- In January 2024, the UK Ministry of Defence (MoD) stated on October 20, 2024, that the Team Pellonia collaboration, which consists of Leonardo UK, Thales UK, and the Defence Science and Technology Laboratory, has successfully completed 100% of the live-fire experiments using a novel laser-based aerial self-protection system.

Segments Covered in the Report

By Type

- Hard-Kill Systems

- Soft-Kill Systems

By Platform

- Land-Based

- Airborne

- Marine

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting