What is the Defense Electronics Market Size?

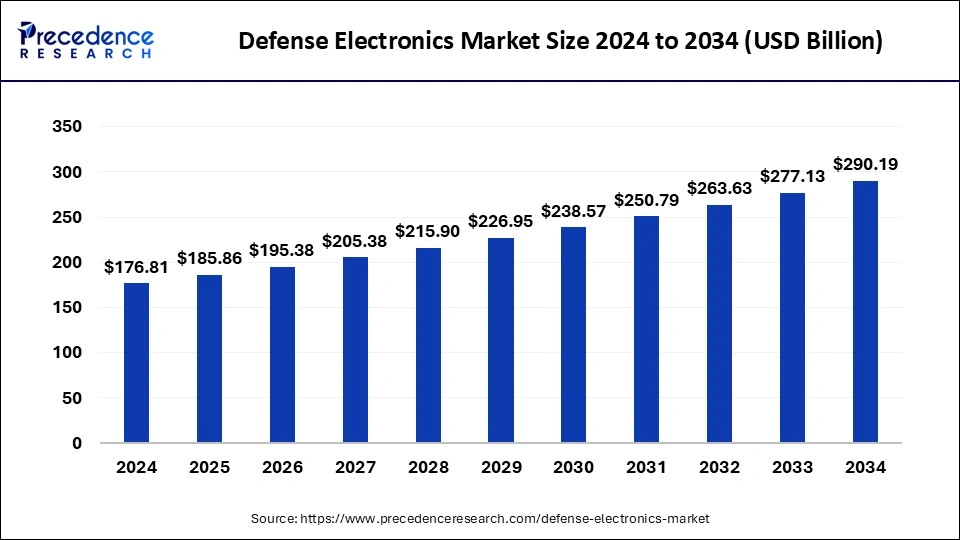

The global defense electronics market size accounted for USD 185.86 billion in 2025 and is predicted to increase from USD 195.38 billion in 2026 to approximately USD 303.54 billion by 2035, expanding at a CAGR of 5.03% from 2026 to 2035. The defense electronics market is driven by the growing need in military operations for Internet of Things (IoT) and artificial intelligence (AI) gadgets.

Defense Electronics Market Key Takeaways

- The global defense electronics market was valued at USD 185.86billion in 2025.

- It is projected to reach USD 303.54billion by 2035.

- The market is expected to grow at a CAGR of 5.03% from 2026 to 2035.

- Asia-Pacific dominated the defense electronics market in 2025.

- North America shows a significant growth in the defense electronics market during the forecast period.

- By platform, the airborne segment dominated the market in 2025.

- By platform, the space segment is observed to be the fastest-growing in the defense electronics market during the forecast period.

- By vertical, the optronics segment dominated the defense electronics market in 2025.

- By vertical, the communication and display segment is observed to be the fastest growing in the market during the forecast period.

Market Overview

Defense electronics are electronic systems and components intended for technological superiority in national defense. Cybersecurity breaches, low-profit margins, and supply chain concerns are just a few of the growing issues facing the defense sector. Production and technological grounds for defense are essentially defense capabilities in and of themselves. To preserve and fortify them, comprehensive actions are required.

The defense electronics market provides products and services for vehicle communications and data systems, surveillance systems, weapon systems, fire control systems, maritime tactical systems, soldier systems, and electronic warfare systems.

Artificial Intelligence: The Next Growth Catalyst in Defense Electronics

AI is fundamentally transforming the defense electronics industry by enabling smarter, faster, and more autonomous systems. AI is now deeply embedded in key hardware components, such as advanced radar systems, electrooptical sensors, and electronic warfare suites, allowing for real-time data processing and threat identification. It is a critical enabler of sensor fusion, which combines inputs from multiple sources to provide superior battlefield situational awareness.

Key Factors Influencing Future Market Trends

Advances in Technology

Systems such as 5G and satellite are helping the military share and access data in real time and carry out remote activities. These improvements mean that armed forces can complete more important missions, have a full and clear understanding of their environment, and operate without fear of cyberattack.

Artificial Intelligence Integration

In defense, AI is helping to automate decisions, analyze possible threats, and respond right away to any security problems. On defense missions, AI-powered systems process large amounts of data to guide the decisions of military personnel. This has resulted in AI being used and deployed more frequently in radar, surveillance, and military operations all around the world.

Making Progress in Modernization

Many countries are changing their older systems by introducing autonomous vehicles, UAVs, and electronics for warfare. The modernization, electronic equipment in defense, such as processors, sensors, and communication systems, is always in demand and brings about higher profits for defense electronics companies.

Defense Electronics Market Trends

- The National Defense Authorization Act for Fiscal 2023, which provides the Defense Department with $816.7 billion, was signed into law by President Joe Biden. Members of the military and civilian departments will receive pay increases of 4.6 percent under the act. To combat the impacts of inflation and expedite the execution of the National Defense Strategy, it provides $45 billion more than was initially proposed.

- China's yearly defense budget growth will be in the single digits for the eighth consecutive year, with a 7.2 percent increase in 2023.

- Regarding military spending, India ranked fourth globally in 2023, having invested $83.6 billion to update its weaponry and battle systems. The Stockholm International Peace Research Institute reports that the top three spenders were the United States, China, and Russia, in that order. India increased their military spending by 4.2 percent in 2023 over 2022. India is investing in its modernization efforts in tanks, artillery guns, fighter jets, helicopters, warships, rockets, missiles, unmanned aerial vehicles, and other combat systems.

- According to the research, Russia plans to spend over US$140 billion on military expenditures in 2024, which would be 29% higher in real terms than in 2023 and account for 35% of all government spending and 7.1 percent of GDP.

Defense Electronics Market Growth Factors

- Governments are investing more in their defense capabilities due to recurrent conflicts and rising geopolitical tensions, which in turn is increasing demand for sophisticated electronic systems.

- The increasing reliance of the military on information and communication technology exposes it to cyberattacks; thus, defense electronics must invest in strong cybersecurity solutions. This drives the growth of the defense electronics market.

- Incorporating artificial intelligence drives the need for complex electronics, the Internet of Things (IoT), and other cutting-edge technology into military equipment.

- Precision weaponry, electronic communication, and surveillance play a major role in modern warfare. This means that new and improved defense electronics are needed all the time.

- There is a constant need for new systems, as aging defensive electronics need to be upgraded or replaced with more contemporary models as they become obsolete.

Market Outlook

- Market Growth Overview: The defense electronics market is expected to grow significantly between 2025 and 2034, driven by the integration of advanced technology, increasing investment in electronic warfare systems, retrofitting legacy systems, and growing electronic warfare.

- Sustainability Trends: Sustainability trends involve electrification and hybrid power systems, energy-efficient components and materials, and circular economy and sustainable manufacturing.

- Major Investors: Major investors in the market include Lockheed Martin, RTX Corporation (formerly Raytheon Technologies), BAE Systems, Northrop Grumman, and Thales Group.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 303.54Billion |

| Market Size in 2025 | USD 185.86 Billion |

| Market Size in 2026 | USD 195.38 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.03% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Platform, Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing defense expenditure

Due to increased defense resources, governments can purchase state-of-the-art radar systems, communication networks, electronic warfare systems, and surveillance equipment. The modernization of military forces and the improvement of their operational capabilities depend heavily on these technologies. As cybersecurity threats increase, defense electronics become essential for protecting military networks and information systems. The development of cyber defense systems, encryption technologies, and secure communication channels is funded by governments, which propels the expansion of the defense electronics industry. This drives the growth of the defense electronics market.

Restraint

Growing cyberattacks on defense related data

Resolving cyberattacks requires large financial resources for improving cybersecurity, restoring systems, and mitigating harm. The cost of cyber insurance is rising along with cyber threats, raising the overall operating costs for defense businesses. Frequent cyberattacks have the potential to damage defense firms' reputations with government agencies, resulting in strained relations and fewer contracts. Stock values may fall, and investment may diminish because of investors losing faith in military electronics businesses. This limits the growth of the defense electronics market.

Opportunity

Increasing demand for defense electronics in border security

Global territorial conflicts and rising geopolitical tensions are the main causes behind the demand for stronger border security. Governments make significant investments in defense electronics to protect their borders from attackers. The security of borders has been completely transformed by advancements in surveillance technologies, including radar, satellite systems, and drones. Improved monitoring and threat identification are made possible by high-resolution cameras, thermal imaging, and night vision capabilities. This opens an opportunity for the growth of the defense electronics market.

Segment Insights

Platform Insights

The airborne segment dominated the defense electronics market in 2025. Airborne platforms equipped with cutting-edge electronics make mission-critical functions, including target acquisition, surveillance, reconnaissance, and precision strikes, possible. These capabilities are critical to modern defensive plans for both conventional and asymmetric combat scenarios. Airborne electronics are strategically essential for military, national security, and geopolitical stability. Deterrence and preserving military balance in diverse global locations depend heavily on the capacity to sustain air superiority and carry out efficient airborne operations.

The space segment is observed to be the fastest growing in the defense electronics market during the forecast period. The use of military and government satellites for navigation, communication, surveillance, and reconnaissance has increased significantly. Sophisticated electronics are needed for high-resolution imagery, real-time situational awareness, and secure data transfer on these satellites. Globally, governments depend more and more on assets located in space to improve their defense capacities. This covers space-based missile defense systems, satellite-based information gathering, and satellite constellations for international communication networks. Advanced electronics specifically designed for space settings are required for each application.

Vertical Insights

The optronics segment dominated the defense electronics market in 2025. Advanced sensor technologies including electro-optical (EO) and infrared (IR) systems are used in optics. These sensors offer vital functions like thermal imaging, night vision, and target acquisition for military operations involving surveillance, reconnaissance, and targeting. Optronics improve situational awareness by giving real-time visual information even in dimly lit areas or inclement weather. For military operations where visibility may be impaired, this skill is essential.

The communication and display segment is observed to be the fastest growing in the defense electronics market during the forecast period. Communication technology, such as satellite communication, secure communication systems, and cutting-edge encryption methods, have improved significantly. These developments push the need for sophisticated communication devices, which are essential to contemporary defense operations. Defense electronics are in greater need of secure communication solutions due to the increasing cybersecurity threats. The need for secure networks and encryption technologies to maintain data integrity and secrecy motivates investments in communication systems.

Regional Insights

Asia-Pacific dominated the defense electronics market in 2025. Over half of the world's population resides in Asia. Over the past ten years, Asia has contributed 43% of startup investment, 51% of R&D spending, and 52% of the global growth in tech company revenues. Asia has made remarkable advancements in human development, literacy, and innovation during the past ten years, as well as economic progress, thanks to the expansion of its infrastructure and technological capacities. Asia has embraced the digital revolution in several sectors, including banking, manufacturing, e-commerce, transportation, retail, and finance.

Asian businesses are putting a high priority on and investigating cutting edge technologies, such as big data, robots, digital ledger technologies, artificial intelligence, machine learning, and cryptography. These technologies have the power to completely transform society and the global economy. The epidemic showed how quickly technology is developing.

China Defense Electronics Market Trends

China's aggressive integration of AI-driven signal processing and military-civil fusion is accelerating the development of autonomous unmanned systems and secure C4ISR networks. The sector is undergoing a hardware revolution through the mass adoption of gallium nitride (GaN), enabling the miniaturization of high-performance components for advanced electronic warfare and counter-stealth radar.

North America shows a significant growth in the defense electronics market during the forecast period. Improving military capabilities is becoming increasingly important due to changing geopolitical dynamics and new threats. This involves expenditures on advanced electronic systems to guarantee better communications on the battlefield, command and control, and situational awareness. Defense contractors, IT companies, and academic institutions can form strategic alliances to further speed up innovation and create state-of-the-art defense electronics solutions. These partnerships frequently provide cutting-edge goods that are suited to certain defense requirements.

- In January 2024, the Defence Equipment Sales Authority (DESA) of the Ministry of Defence (MOD) and the Royal Mint collaborated to offer a creative and long-lasting solution for the disposal of electronic military equipment. Electronic garbage is one of the waste streams that is expanding the fastest; it is believed that approximately 7% of the world's gold is contained in it. The Canadian business Excir developed a proprietary technique that the Royal Mint uses to recover valuable metals from circuit boards at room temperature.

U.S. Defense Electronics Market Trends

The U.S.'s rapid convergence of AI-driven autonomous systems and the transition toward a modular open systems approach (MOSA), which facilitates the swift integration of cutting-edge technology. Strategic investments are prioritizing the modernization of legacy platforms with AESA radars and advanced electronic warfare suites to counter sophisticated signal threats.

How did Europe experience notable growth in the Defense Electronics market?

Europe's military electronics market is undergoing a structural shift toward sovereign technology and software-first innovation, fueled by new defense startups and initiatives like the European Chips Act. Regional collaboration is prioritizing indigenous semiconductor production and advanced ISR systems to eliminate external dependencies while integrating AI-driven platforms and UAVs.

Germany Defense Electronics Market Trends

Germany's massive budgetary pivot toward digitalization and C4ISR upgrades, prioritizing secure 5G networking and AI-integrated weapon systems. The emergence of Munich as a "defense-tech" hub has accelerated the deployment of software-defined radars and autonomous UAVs, bridging the gap between traditional hardware and agile, dual-use innovation.

Value Chain Analysis of the Defense Electronics Market

- R&D, Design, and Engineering (Upstream)

This initial stage focuses on conceptualizing and designing advanced electronic components, software, and systems, heavily relying on AI, IoT, and simulation tools to meet evolving combat needs.

Key Players: Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies (RTX), BAE Systems plc, Defence Research, and Safran S.A. - Component Sourcing and Raw Materials

This stage involves acquiring critical raw materials, such as gallium nitride (GaN), silicon, and advanced composites, and specialized components like microprocessors, sensors, and semiconductors.

Key Players: Teledyne Technologies Incorporated, Mitsubishi Electric Corporation, Ultra Electronics Holdings plc, and Midhani. - Subsystem and Component Manufacturing

This stage involves the fabrication and assembly of specific modules such as PCB assemblies, RF/microwave modules, antennas, sensors, and optronics payloads.

Key Players: Astra Microwave Products Limited, Data Patterns Ltd., Centum Electronics, Paras Defence & Space Technologies, Cobham Limited, and Curtiss-Wright Corporation.

Defense Electronics Market Companies

- Raytheon Technologies Corporation: Raytheon is a major developer and manufacturer of advanced sensors, radar systems (including AESAs), and guidance systems for missiles and defense electronics.

- Curtis Wright Corporation: Curtiss-Wright provides ruggedized, open-architecture (COTS) embedded computing solutions, including single-board computers, data storage, and digital signal processors for harsh military environments.

- Boeing: Boeing contributes to the defense electronics market by developing, manufacturing, and integrating advanced avionics, mission systems, and electronic warfare capabilities into platforms such as the P-8 Poseidon and F/A-18 Super Hornet.

- Aselsan A.S.: Aselsan is a leading multi-product electronics company that produces advanced defense electronics, including AESA radar systems (MURAD), electro-optical reconnaissance systems (ASELFLIR-500), and electronic warfare suites.

- Lockhead Martin Corporation: Lockheed Martin delivers advanced electronic systems, including targeting (SNIPER pod), surveillance (radar), and combat management systems, particularly for the F-35 Lightning II and various missile systems.

Other Major Key Players

- Thales Group

- L3 Harris Technologies

- Teledyne Defense Electronics

- BAE Systems

- North Grumman Corporation

Recent Developments

- In October 2024, the Safran Group announced plans to establish its first Defence Electronics site outside of France in India, and made this announcement during a strategic dialogue between India's National Security Advisor Ajit Doval and the head of the French MoD.

- In April 2024, Raytheon, a business unit of RTX, received a USD 344 million contract for the production of two missile variants called SM-2 Block IIICU and SM-6 Block IU. Several components will be common across the missiles, including the guidance section, the target detection device, the flight termination system, and the electronics unit, allowing a common line of production.

- In May 2024, DARPA issued a USD 12 million contract to BAE Systems' FAST Labs for support of the THREADS program for the investigation of thermal management issues related to defence electronics. The program seeks to overcome temperature boundaries on power-amplifying functions in monolithic microwave integrated circuits (MMICs) that use gallium nitride (GaN) devices.

- In June 2024, Honeywell declared that it had completed a $1.9 billion all-cash acquisition of CAES Systems Holdings, a defense electronics manufacturer. The acquisition would broaden Honeywell's portfolio to include work on the SPY-6 naval radar, drone, and counter-drone technologies. It will also strengthen Honeywell's present scope of work on platforms such as the F-35, AMRAAM air-to-air missile, EA-18 Growler, and GMLERS guided missiles.

Segments Covered in the Report

By Platform

- Airborne

- Space

- Land

- Marine

By Vertical

- Optronics

- Communication and Display

- C4ISR

- Electronic Warfare

- Radar

- Navigation

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting