What is the Industrial Cooling Systems Market Size?

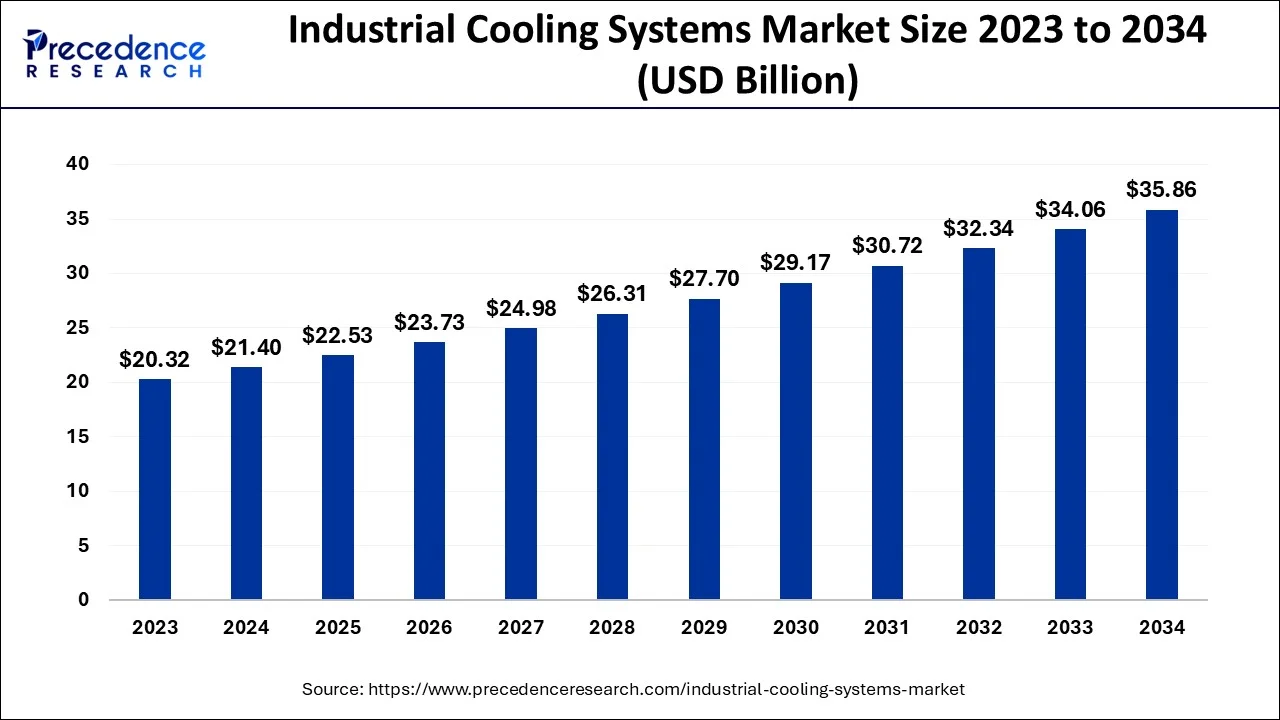

The global industrial cooling systems market size is calculated at USD 22.53 billion in 2025 and is predicted to increase from USD 23.73 billion in 2026 to approximately USD 37.61 billion by 2035, expanding at a CAGR of 5.26% from 2026 to 2035.

Industrial Cooling Systems Market Key Takeaways

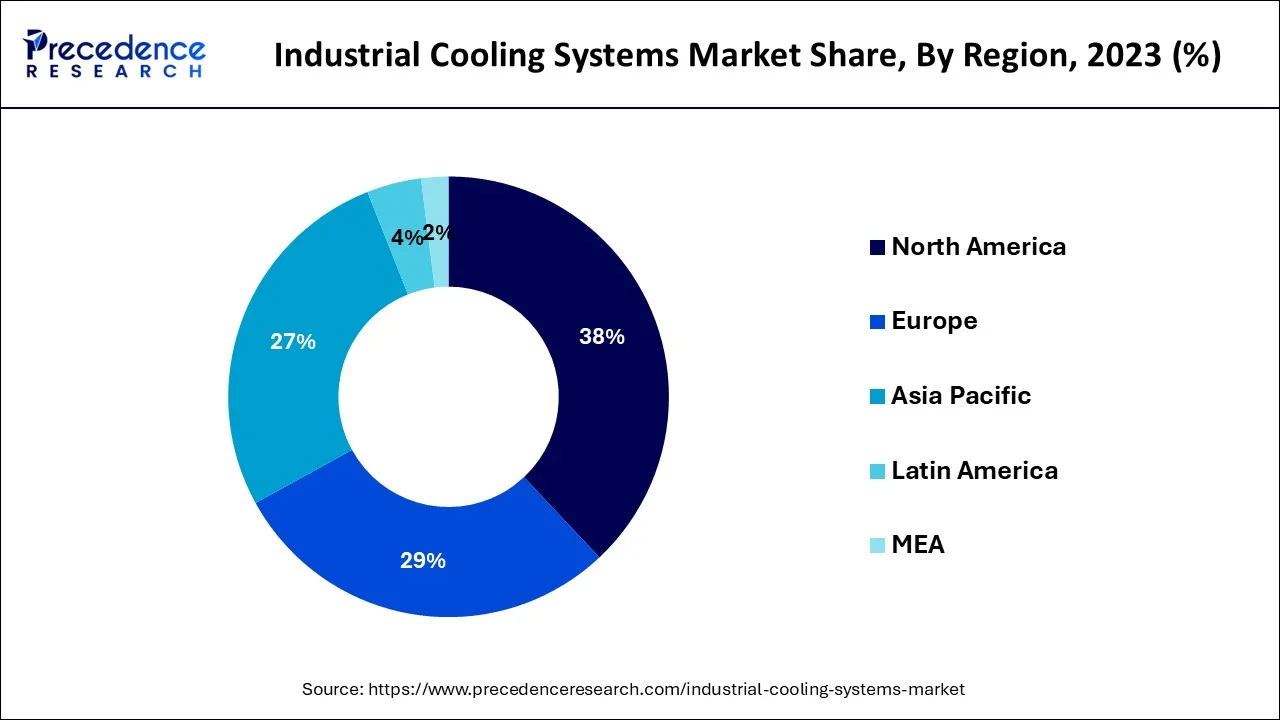

- North America dominated the industrial cooling systems market in 2025.

- By product, the evaporative cooling segment dominated the market in 2025.

- By function, the transport cooling segment led the market in 2025.

- By end user, the utility and power segment led the market in 2025.

Market Overview

Industrial locations are known for their high energy needs, both for cooling and heating purposes, which are often connected to a significant amount of fossil fuel use. Using an industrial cooling system, heat from a process or factory is rejected. Because of their great efficiency, evaporative industrial cooling systems are among the most common across all industries. Industrial cooling systems are frequently utilized in sectors like metalworking, automotive, and chemical to lessen the negative effects of excessive heat produced by various industrial equipment and components. The health of employees, the effectiveness of the equipment, and the quality of finished goods or inventory items can all be negatively impacted by excessive heat in a production process. The cooling apparatus aids in preserving the necessary temperature for various machinery, industrial procedures, and components. Industrial equipment productivity may be increased, and maintenance costs for the machinery can be decreased, by preventing overheating. The chemical business has experienced tremendous expansion during the past several years. Additionally, there has been tremendous expansion in the industrial sector, which has greatly benefited the lubricants industry and contributed to the market's overall growth. Nuclear and thermal power facilities are noticing an increase in demand for cooling equipment. The need for industrial cooling systems is anticipated to rise as energy-efficient cooling systems become more in demand and as technology advances. Over the next years, the market for industrial cooling systems is anticipated to increase as a result of these factors.

Over the course of the projection period, the market is anticipated to grow due to the widespread usage of industrial cooling systems across all key end-user sectors. Over the past ten years, the market for industrial cooling systems has shown spectacular growth, and this trend is anticipated to continue. All significant emerging nations are experiencing a surge in demand for industrial cooling systems as a result of growth in the industrial manufacturing sector. Industrial cooling system sales are being further boosted by macroeconomic factors like rising urbanization and industrial activity as well as technology advancements in the HVAC sector. It is anticipated that the rising concerns about efficient and effective process flow in industrial operations would significantly raise sales of industrial cooling systems and drive the worldwide industrial cooling system market. Additionally, the industrial sector in South and East Asia is expected to develop significantly, and there are growing worries about greenhouse gas emissions, which will likely lead to a substantial market potential for industrial cooling systems worldwide.

Additionally, the better performance qualities of industrial cooling systems, such as high energy efficiency and low power consumption, are expected to increase their popularity. Industrial cooling systems are becoming much more well-known throughout all main growing countries since they significantly contribute to the more effective operation of an industrial facility.

Over the course of the projected period, it is highly predicted that all of the key impacting factors mentioned above would propel the worldwide industrial cooling system market. The main restraints on market growth during the forecast period are the sluggish replacement rate, the difficult installation procedure for industrial cooling systems, and the dominance of traditional coolers in the current industry.

Why is AI Integral in the Industrial Cooling Systems Market?

The advancements in AI have positively impacted the heavy machinery industry. The integration of AI in industrial cooling systems helps in optimizing energy efficiency and adjusting temperature according to the requirements. AI-based industrial cooling systems find applications in several sectors, including data centers and logistics. Moreover, numerous AI companies are developing advanced platforms for predicting maintenance needs in industrial cooling systems. Therefore, AI plays an integral role in shaping the industrial cooling systems market.

- In April 2026, Themax launched an AI-enabled predictive maintenance solution. This AI-based solution is designed for predicting failures in industrial cooling systems globally.

(Source: thermalcontrolmagazine.com)

Industrial Cooling Systems Market Growth Factors

The expansion of the pharmaceutical industry, an increase in cold storage facilities in developing nations, and a rise in the use of environmentally friendly and energy-efficient refrigerants have all contributed to the growth of the industrial cooling system market globally. Strict laws governing the use of refrigerants and high energy costs for running and maintaining industrial refrigeration equipment, however, restrain market expansion. On the other hand, market participants are anticipated to benefit from new prospects brought on by the adoption of IoT-enabled refrigeration systems for equipment monitoring in the future.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 22.53 Billion |

| Market Size in 2026 | USD 23.73 Billion |

| Market Size by 2035 | USD 37.61 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.26% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered |

By Product Type,By Function,By End-User |

| Regions Covered |

North America,Europe,Asia-Pacific,Latin America,Middle East & Africa |

Market Dynamics

Key Market Drivers

- Increasing energy-efficient system adoption across several industries to support the market for industrial cooling systems - Through 2027, it is anticipated that the U.S. industrial cooling market will expand at a pace of over 9%, driven mostly by increased government norms and regulations for energy conservation. The Cooling Tower Institute (CTI) in the US and EUROVENT in Europe must certify the manufacturers' thermal performance for operational effectiveness and energy savings.

- Increasing use of cooling systems in the vehicle industry – In 2020, the Asia Pacific industrial cooling system market held a 35% revenue share, primarily due to the region's growing automotive industry in China, India, Japan, and South Korea. The COVID-19 pandemic caused a decline in the automobile sector, although it is anticipated that it would rebound by the end of FY2021. The car manufacturing industry is utilizing advanced cooling technology to provide a more productive and economical production process.

Key Market Challenges

- Water requirement and investment cost – The market for industrial cooling systems will face challenges due to the high investment costs and water consumption requirements.

- Structural stability – The global pandemic has led to an increase in limitations, which has hurt both supply and demand. The market for industrial cooling systems will also suffer from volatility in raw material costs. This would thus hinder the market growth rate for industrial cooling systems.

Key Market Opportunities

- The development of cutting-edge industrial cooling systems - The main industry players are consistently investing in the creation of cutting-edge cooling systems. For instance, Baltimore Aircoil Company (BAC) introduced the HXV hybrid cooler in March 2021. This cooler delivers both dry and evaporative cooling in an energy and water-efficient manner. The HXV is intended for use in a variety of end uses, including HVAC systems, manufacturing businesses, and data centers. The sector will develop as more businesses introduce high-performance cooling systems.

- Advancements, policies and guidelines - Additionally, during the projection period of 2022 to 2029, the market participants will benefit from improvements in industrial cooling systems, growing government policies for sustainable systems, and large expenditures in R&D activities that further improve product applications. The market for industrial cooling systems will continue to increase in the future due to stringent environmental restrictions as well as growing consumer awareness of their advantages.

- High demand across end users - With the adoption of more energy-efficient evaporative cooling systems, the market is projected to grow. Evaporative cooling systems are frequently used in production plants because of their high level of efficiency. According to predictions, the use of cooling systems will increase in the automotive, chemical, metallurgy, energy, and power industries. The market for industrial cooling systems will rise at a faster rate due to the harsh climatic conditions and the great performance of these systems worldwide. Other market development variables that are anticipated to support market expansion include the surge in interest in productive cooling systems and mechanical headways.

Segment Insights

Product Type Insights

Because of their superior economic value and efficiency than refrigerated systems, the evaporative cooling segment led the market by product type in 2025, accounting for about two-fifths of the worldwide industrial cooling system market. However, due to rising government efforts in emerging nations like India and a growth in demand for industrial air-cooling systems, the air-cooling category is anticipated to grow at the highest CAGR of 6.50% over the projection period.

Function Insights

Due to the expansion of the food processing sector and the need for stringent temperature control when transporting pharmaceutical and biopharmaceutical items, the transport cooling segment is anticipated to see the highest CAGR of 5.9% over the course of the projection period. However, the stationary cooling sector retained the lion's share in 2025, accounting for more than two-thirds of the worldwide industrial cooling system market. This is because middle-class populations' purchasing power has increased, and internet usage in emerging nations has increased as well. Due to the increasing need for such systems to manage the temperature of machines, components, and equipment on the manufacturing site, the automotive industry is anticipated to experience a large increase in demand for cooling equipment throughout the projection timeline. The automobile sector employs top-notch cooling equipment to build a productive production system and profit from the cost and efficiency-saving advantages. The car industry is being encouraged to replace the outmoded cooling systems with several inventive and technological developments as well as ongoing cooling system enhancements.

Regional Insights

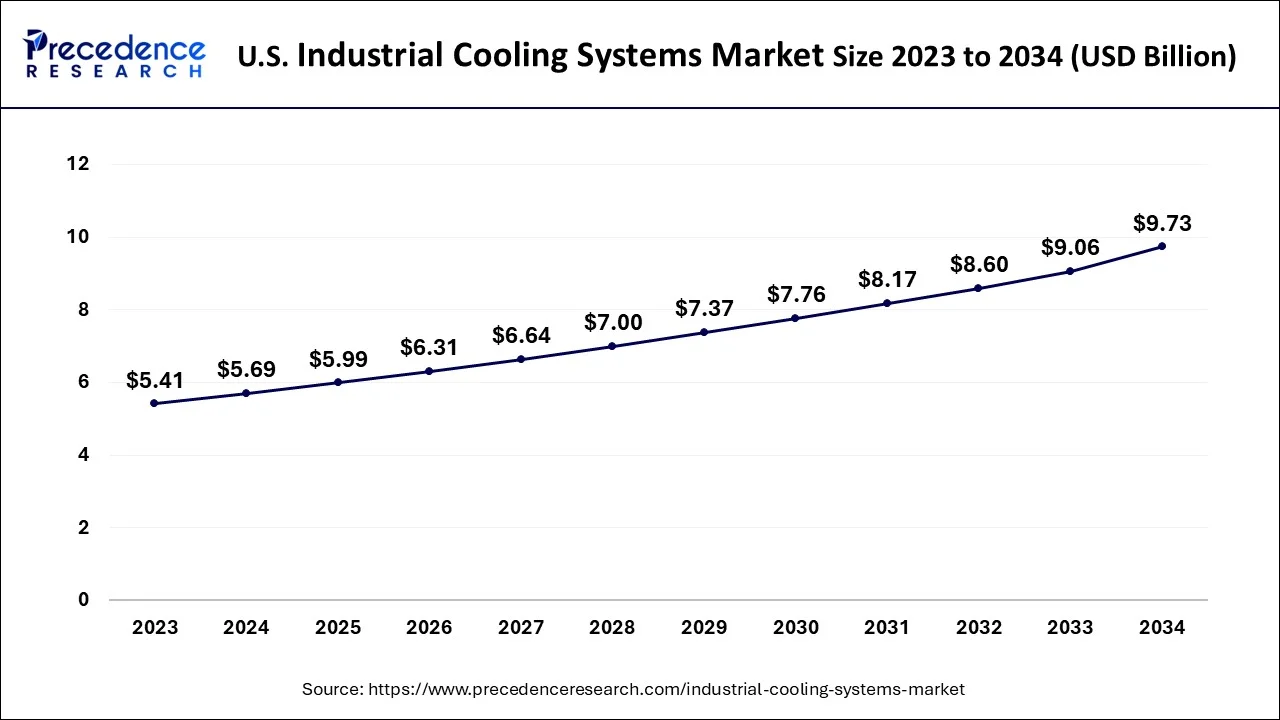

U.S. Industrial Cooling Systems Market Size and Growth 2026 to 2035

The U.S. industrial cooling systems market size is estimated at USD 5.99 billion in 2025 and is expected to be worth around USD 10.26 billion by 2035, rising at a CAGR of 5.53% from 2026 to 2035.

What Made North America the Dominant Region in the Industrial Cooling Systems Market?

North America dominated the market by capturing the largest share in 2025. This is mainly due to its strong manufacturing base, high adoption of energy-efficient technologies, and strict environmental regulations. The presence of advanced industrial infrastructure, significant investments in power generation and chemicals, and continuous technological innovation further drive market growth across the region. Moreover, stringent government regulations focusing on reducing industrial emissions contribute to the region's dominance in the market.

U.S. Industrial Cooling Systems Market Analysis

The U.S. dominates the North American market due to its large-scale industrial base, rising demand from the power generation, chemicals, and manufacturing sectors, and early adoption of energy-efficient cooling technologies. Strong investments in industrial infrastructure, strict environmental regulations, and ongoing technological advancements further support market expansion.

What Makes Asia Pacific the Fastest-Growing Region?

Asia Pacific is the fastest-growing region in the industrial cooling systems market due to rapid industrialization, expanding manufacturing sectors, and rising investments in the power generation, chemicals, and automotive industries. Rising urbanization, growing energy demand, and stricter environmental regulations are accelerating the adoption of energy-efficient and advanced industrial cooling technologies across emerging economies.

India Industrial Cooling Systems Market Analysis

India's market is growing steadily due to rapid industrialization, expanding manufacturing and power generation sectors, and rising investments in the chemicals, metals, and automotive industries. Rising urbanization, higher energy consumption, and government initiatives promoting energy efficiency and sustainable industrial practices are driving demand for advanced, cost-effective cooling systems across industrial facilities.

Europe: A Significantly Growing Area

Europe is expected to experience significant growth in the industrial cooling systems market during the forecast period due to stringent environmental regulations, a strong focus on energy efficiency, and the rapid adoption of sustainable cooling technologies. Increasing investments in industrial modernization, renewable energy, and advanced manufacturing, along with rising demand from chemical, automotive, and power generation sectors, are further supporting market expansion across the region.

UK Industrial Cooling Systems Market Analysis

The UK industrial cooling systems market is expanding due to rising demand from the manufacturing, chemical processing, food and beverage, and power generation sectors. Strict environmental regulations, a growing focus on energy efficiency, and investments in industrial modernization are driving adoption. Additionally, the shift toward sustainable cooling technologies and upgrades to aging industrial infrastructure are supporting steady market expansion across the UK.

How is the Opportunistic Rise of Latin America in the Industrial Cooling Systems Market?

Latin America is expected to expand at a considerable rate during the forecast period. The increasing demand for hybrid cooling systems from the chemical manufacturing companies across various nations, including Brazil, Argentina, Venezuela, and Peru, is driving the market. The rapid deployment of air-cooling solutions in the utility and power sector is positively contributing to the market. Moreover, the expansion of the chemicals industry, as well as partnerships among the market players and manufacturing companies for deploying advanced cooling solutions in their production centers, is expected to accelerate the growth of the market in this region.

- In January 2025, Mojave Energy Systems launched a new range of HVAC Solutions in Latin America. These HVAC solutions find applications in various sectors, including manufacturing, hospitality, and healthcare. (Source: prnewswire.com)

What Potentiates the Industrial Cooling Systems Market Within the Middle East & Africa?

The market in the Middle East & Africa is potentiated by the surging deployment of evaporative cooling systems in the oil & gas industry across several countries, including the UAE, Saudi Arabia, South Africa, and Qatar. The rapid investment by the governments for strengthening the food & beverage industry, coupled with technological advancements in the power generation sector, is playing a vital role in shaping the industrial landscape. Moreover, the presence of various market players, such as Emicool, Tabreed, and Tempcon, is expected to propel the growth of the industrial cooling systems market in this region. (Source: districtenergy.org)

Value Chain Analysis

Raw Material Sourcing: This involves sourcing materials for structures, heat exchangers, piping, and water treatment. Selection prioritizes durability, corrosion resistance, and efficient heat transfer.

- Key Players: SPX Cooling Technologies, Baltimore Aircoil Company, Alfa Laval, Daikin Industries, and GEA Group.

Testing and Certification: Industrial cooling systems are tested and certified to ensure performance, safety, and efficiency, in accordance with standards such as VDI 6022 and EPA 608.

- Key players: AHRI, CTI, UL, and ISO.

Installation and Commissioning: Installation and commissioning of industrial cooling systems follow a step-by-step quality-assurance process, ensuring that chillers, AHUs, and piping are correctly installed, tested, and calibrated for optimal performance.

- Key players: SPX Cooling Technologies, Baltimore Aircoil Company, Alfa Laval, Daikin Industries, and GEA Group.

Industrial Cooling Systems Market Top Companies

- Paharpur Cooling Towers Limited: Designs and manufactures cooling towers, air-cooled heat exchangers, and water management solutions for power, oil and gas, petrochemical, and heavy industrial applications.

- Baltimore Aircoil Company Inc.: Specializes in evaporative cooling, heat transfer, and thermal storage products, including cooling towers, evaporative condensers, and hybrid cooling solutions for industrial and commercial use.

- EVAPCO Inc.: Provides energy-efficient evaporative cooling equipment such as cooling towers, closed-circuit coolers, and hybrid systems serving power generation, industrial processing, and HVAC markets.

- Brentwood Industries, Inc.: Offers engineered plastic products, including cooling tower fill media, drift eliminators, and water management components to enhance heat transfer efficiency and reduce water consumption.

- Star Cooling Towers Pvt. Ltd.: Manufactures customized cooling towers and heat rejection systems for power plants, chemical, steel, and infrastructure industries, focusing on durability and cost-effective cooling solutions.

- ENEXIO: Develops advanced cooling and heat exchange technologies, including wet, dry, and hybrid cooling systems, primarily for power generation, mining, oil and gas, and industrial sectors.

Other Major Companies

- SPX Corporation

- Hamon Group

- Johnson Controls Inc.

- Airedale International Air Conditioning Ltd.

- American Power Conversion Corporation (APC)

- Black Box Corporation Emerson Electric Co.

- Rittal GmbH & Co. KG

- SPIG S.P.A.

- Bell Cooling Towers and Mesan Group

Recent Developments

- In January 2026, Hillphoenix launched AdvansorUltra. AdvansorUltra is an advanced cooling system that finds application in the pharma and logistics sectors.

(Source: prnewswire.com) - In November 2025, Mitsubishi Heavy Industries Thermal Systems launched the "ETI-N" series. The "ETI-N" series is a centrifugal chiller that is designed for the Japanese market.

(Source: mhi.com) - In October 2025, SP Group joined hands with Daikin Airconditioning. This joint venture is aimed at launching an industrial cooling system in Singapore.

(Source: edb.gov.sg) - Johnsons Controls announced the opening of a research and development and testing center in the US in April 2018. The firm will be able to supply the HVAC market with cutting-edge and superior goods thanks to the new facilities. Additionally, producers provide a variety of product categories across several sectors.

- The Marley BasinGard filters for cooling towers were released on September 1st, 2000 by SPX Cooling Technologies. The BasinGard filter preserves the hot water reservoir's flow inside the cooling tower by removing dirt, fibers, and pipe rust.

Segments Covered in the Report

By Product Type

- Hybrid Cooling

- Water Cooling

- Air Cooling

- Evaporative Cooling

By Function

- Transport Cooling

- Stationary Cooling

By End-User

- Utility and Power

- Chemical

- Food & Beverage

- Chemical

- Pharmaceutical

- Oil and Gas

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting