What is the Industrial Valves Market Size?

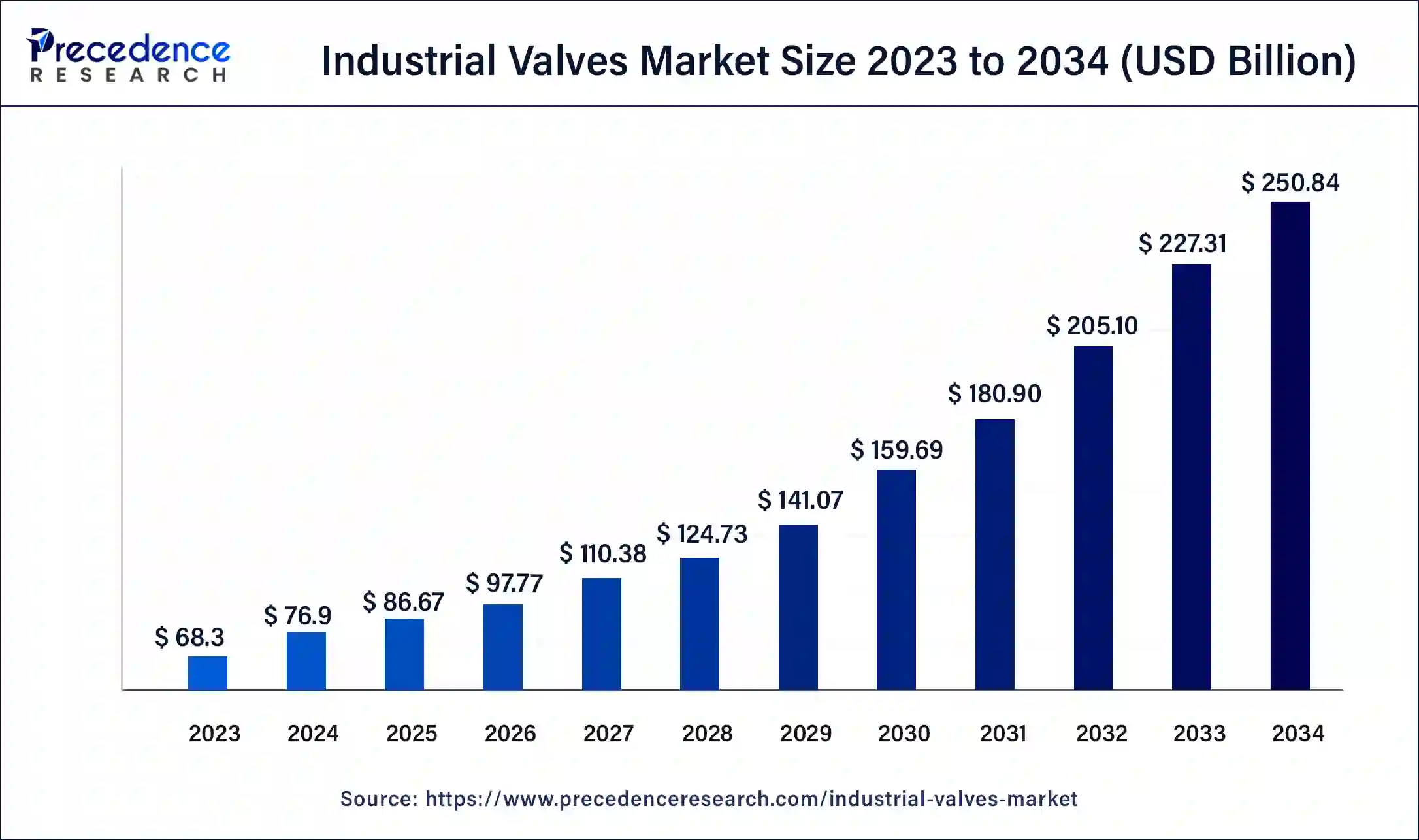

The global industrial valves market size is calculated at USD 86.67 billion in 2025 and is predicted to increase from USD 97.77 billion in 2026 to approximately USD 273.49 billion by 2035, expanding at a CAGR of 12.18% from 2026 to 2035. The market is driven by the expansion and modernization of infrastructure across major sectors like oil & gas, power generation, and water & wastewater treatment.

Market Highlights

- Asia Pacific led the market with the biggest market share of 36% in 2025.

- By Material Type, the steel industrial valves segment registered the maximum market share in 2025.

- By Application, the oil & gas segment has held a major market share in 2025.

- By Application, the water & wastewater segment is anticipated to grow at a solidCAGR of 6% during the forecast period.

AI in the Market

Artificial intelligence has been creating new vice industries for predictive maintenance, downtime minimization, and asset-life maximization. AI-empowered smart valves handle the liquids and gases for flow, temperature, and pressure conditions; thus, they make real-time adjustments for efficiency and safety. Self-tuning algorithms mean manual recalibration is done away with so that optimization can occur automatically. AI-based systems do quality control through vision systems that detect defects and maintain the desired quality level. They help in deciding the choice of valve and optimizing the design according to operational simulations. Finally, AI is used for forecasting inventory as well as planning for spares and thus keeps supply chains moving efficiently. Chatbots help provide service and provide smoother communication. The AI system provides some support to sustainability by including energy-efficient treatment in valve operations.

Industrial Valves Market Growth Factors

- Automation in control valves drives up market growth due to higher reliability, more efficiency, and lower energy consumption.

- The increasing trend of expansion of the oil & gas sector demands valves for upstream, midstream, and downstream processes, marking constant consumption.

- The need to monitor pipelines and optimize processes serves as an impetus to the growing demand for automated valve systems.

- Power, chemicals, pharmaceuticals, and water treatment are some of the other industries where the product finds application, strengthening market opportunities.

- Advances in valve materials and integration with digital monitoring systems enhance performance and adaptability.

Major Trends Influencing Growth in the Industrial Valves Market

- Smart Valve Technologies: The introduction of smart valves has enabled companies to not only monitor and control their flow rates automatically but has also allowed for predictive maintenance and enhanced safety measures within these systems.

- Eco-Friendly Valve Solutions: As governments continue to impose stricter regulations regarding environmental emissions, many companies are seeking to install valves with minimal leakage, such as those developed for chemical processing, oil & gas, and power generation industries, and this trend is expected to continue.

- Customized Design of Valves: End-users are now requesting specific valve designs that will perform in extreme pressure, temperature, or corrosive conditions, leading to much more innovative design and material development.

- Refurbished Valves: As opposed to replacing existing valve systems, companies are retrofitting their systems to improve performance and extend the life of their equipment. this supports the continued growth of aftermarket opportunities.

Statistical Analysis of Trade in the Industrial Valves Market

- Continued Growth of the Market: Continued investments in infrastructure upgrades, coupled with industrial automation on a worldwide basis, will continue to fuel this market.

- Stable International Demand: The current year has seen over 260,000 international exports, indicating that there is still stable demand in this marketplace.

- Top Exporter Countries: Both India and China are the top exporter countries due to their relatively low cost of manufacturing.

- Top Importer Countries: The United States, United Arab Emirates, and Germany remain as major importer nations of industrial valves, driven primarily by industrial or energy-related projects.

Industrial Valves Market Outlook

- Industry Growth Overview: The market is experiencing steady growth, driven by infrastructure growth, rapid industrialization, and the need for automated/smart valves. The increasing demand for automation, energy efficiency, and process control across industries like oil and gas, chemicals, and water treatment also drives the market.

- Global Expansion:The market is expanding worldwide, driven by infrastructure development, industrial automation, and rising demand for energy-efficient systems across sectors such as oil & gas, water treatment, and chemicals. Emerging regions, particularly in Asia-Pacific, Latin America, and the Middle East & Africa, present significant opportunities due to rapid industrialization, urbanization, and infrastructure investment, creating demand for advanced valve technologies in these high-growth markets.

- Major Investors: Major investors include industry giants such as Emerson Electric, IMI Plc, KSB, Flowserve, Crane Co., KITZ Corp, and The Weir Group, along with regional leaders like L&T Valves (India), AVK Group, and Schlumberger (SLB).

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 86.67 Billion |

| Market Size in 2026 | USD 97.77 Billion |

| Market Size by 2035 | USD 273.49 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 12.18% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Valve Type, Material Type, Application Type and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Material Type Insights

Steel industrial valves garnered the maximum revenue share in the global industrial valve market in 2024. Presently, increasing demand for high-quality valves in pharmaceuticals, chemicals, food & beverages, and metals & mining industries to reduce the threat of contamination fuels the demand for steel valves and a similar trend of steel materials in industrial valve expected to be observed during the analysis period.

Stainless steel is tougher than other valve materials that include brass, ductile iron, cast iron, and copper pertaining to temperature tolerance and pressure rating. Thus, the demand of stainless steel valve is likely to witness high demand in water & wastewater treatment plants owing to their longer-lasting nature. In addition, they can withstand harsh chemicals, temperatures, and pressures coupled with hard water conditions due to its corrosion resistance quality.

Application Insights

Oil & gas sector accounted for the largest market value share in the year 2024 pertaining to increasing demand of energy along with flourishing growth of transportation sector. Further, rising drilling activities in the gulf countries also primarily boosts the growth of the segment. In addition, rising demand for longer pipelines, deeper wells, and lower production costs coupled with the technological enhancement in production, processing, and transportation have positively influenced the industrial valves market growth. Increasing pipeline installation and rising need for controlling & monitoring them from a centralized location propel the demand for smart valves in the oil & gas industry.

However, water & wastewater application encountered the fastest growth close to 6% over the forecast period. Increasing need for waste water treatment plants and need for isolating the equipment & pumps predicted to trigger the demand of industrial valves in the segment.

Regional Insights

What is the Asia Pacific Industrial Valves Market Size?

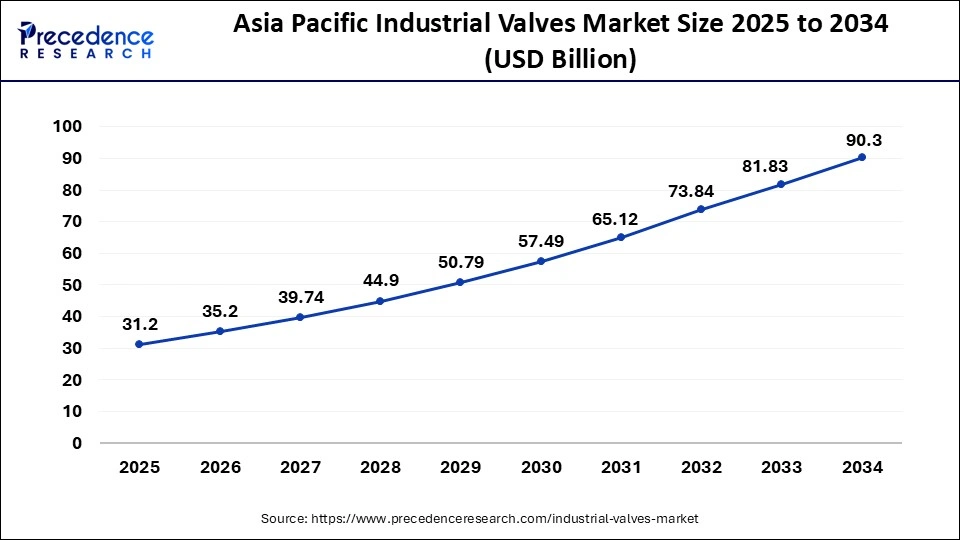

The Asia Pacific industrial valves market size is exhibited at USD 31.20 billion in 2025 and is projected to be worth around USD 98.45 billion by 2035, growing at a CAGR of 12.18% from 2026 to 2035.

In 2024, Asia Pacific dominated the global industrial valves market owing to booming consumption of chemicals coupled with escalating construction activities. Furthermore, the region witnesses the capacity expansions of petroleum refining plants along with the construction of new nuclear power stations that again fuel the demand for industrial valves in the region.

China Industrial Valves Market Analysis

China's industrial valves market is growing quickly, driven by the expansion of the energy sector, large infrastructure investments, and increased automation and digitalization to improve efficiency. Major trends fueling this growth include a rising demand for advanced smart valves with IoT and sensors and a move toward greener technologies due to strict environmental rules, especially in areas like water treatment and power generation.

What Makes North America the Fastest-Growing Region in the Market?

On the other side, North America exhibits the fastest growth over the analysis period owing to the replacement of inefficient and old valves with more efficient industrial valves for gas transportation. Further, increasing production of shale gas and oil sands offers huge growth potential for the market across this region. The region witnesses a revolution in the oil & gas sector with rising investment in the sector to transform the old pipelines into smarter along with the deployment of new pipelines.

U.S. Industrial Valves Market Analysis

The market in the U.S. is driven by the rising need for smart valves from the oil & gas, water treatment, renewable energy, and chemical sectors. There is a strong focus on infrastructure modernization. The country is home to major players such as Emerson Electric, Flowserve, and Cameron, which are developing and offering a wide range of innovative products and strong distribution networks across the U.S., contributing to the market.

What Potentiates the Market within Europe?

The industrial valves market in Europe is driven by stringent regulatory standards on energy efficiency, emissions, and environmental sustainability, which in turn drive the adoption of advanced, eco-friendly valve solutions. Additionally, significant investments in industrial automation, infrastructure modernization, and the expansion of key sectors like oil & gas, power generation, and water treatment further boost demand. Europe's focus on renewable energy projects and digital transformation across industries also creates substantial opportunities for smart, IoT-enabled valves, enhancing operational efficiency and reducing maintenance costs.

Latin America: Latin America is experiencing steady growth based on the continued development of oil and gas projects, mining operations, and water infrastructure. The largest consumers of industrial valves in Latin America are Brazil and Mexico, as government and private sector investments to improve pipelines and modernise industrial facilities have supported great growth despite current fluctuations in the economies.

Middle East & Africa (MEA): The MEA market for industrial valves is driven by large oil and gas projects, the construction of desalination plants, and industrial expansion in that region. Countries such as Saudi Arabia and the UAE continue to invest large amounts of money into energy and water infrastructure, which supports the ongoing demand for high-tech industrial valves.

Value Chain Analysis

- Raw Material Sourcing (Metals, Electronics): Selecting and procuring several materials, such as steel, alloys, and electronic components, is essential to ensure the quality and performance of a valve.

Key Players:Emerson, Flowserve, Schlumberger (SLB), IMI PLC, - Component Manufacturing and Machining: In this next stage, individual valve parts (bodies, stems, discs) are manufactured by casting, precision machining, and other methods.

Key Players: Emerson, Flowserve, IMI, KSB, and Velan - Testing and Certification: Here, the valves are subjected to all kinds of severe tests and inspections so that they measure up to performance requirements, safety requirements, and standards set by the industries at large.

Key Players: HQTS and Inspection 4 Industry - Maintenance and After-Sales Services: This phase entails providing support, repairs, and maintenance so that the valves installed can perform safely and efficiently.

Key Players: Emerson Electric, Flowserve, IMI, KSB, and Crane - Product Lifecycle Management: This gives the overall management of a product from conception down to end-of-life so that there is free data flow and integration of the various stages that constitute design, manufacture, and maintenance.

Key Players: Siemens, PTC, Aras, and Autodesk

Industrial Valves Market Companies

- Avcon Controls Private Limited: It offers a wide range of industrial valves, including control valves, ball valves, and automated valve solutions, primarily serving sectors like oil & gas, power, and water treatment.

- AVK Holding A/S: It specializes in manufacturing valves, hydrants, and valve accessories for water supply, wastewater treatment, and industrial applications, with a focus on sustainable, high-quality solutions.

- Crane Co.: It provides a comprehensive portfolio of industrial valves, including ball, butterfly, check, and pressure relief valves, serving industries such as energy, aerospace, and chemical processing.

Other Major Key Players

- Metso Corporation

- Schlumberger Limited

- Flowserve Corporation

- Emerson Electric Co.

- IMI plc

- Forbes Marshall

- The Weir Group plc.

Recent Developments

- In September 2025, Ohio Valve Company opens Valve World Headquarters in Houston, aiming to be a global hub for innovation, operational excellence, and industry leadership in valve manufacturing.(Source: www.phcppros)

- In January 2025, InflowControl introduced the Gas Autonomous Inflow Control Valve (Gas AICV), the world's first autonomous flow control valve specifically designed for gas reservoirs.(Source: worldoil.com)

Segments Covered in the Report

By Valve

- Butterfly Valves

- Ball Valves

- Globe Valves

- Gate Valves

- Check Valves

- Plug Valves

- Diaphragm Valves

By Material

- Cast Iron

- Alloy-Based

- Steel

- Others

By Application

- Water & Wastewater

- Oil & Power

- Food & Beverages

- Chemical

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting