What is the Industrial Boilers Market Size?

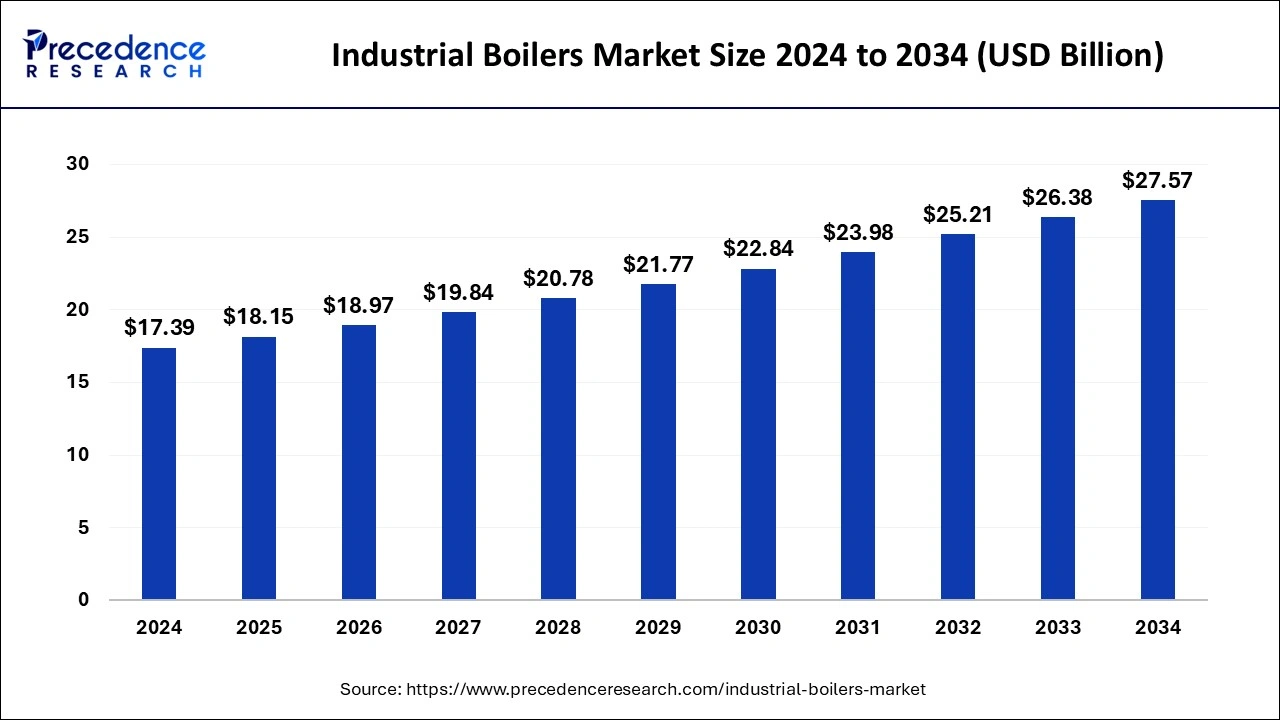

The global industrial boilers market size is calculated at USD 18.15 billion in 2025 and is predicted to increase from USD 18.97 billion in 2026 to approximately USD 28.75 billion by 2035, expanding at a CAGR of 4.71% from 2026 to 2035.

Industrial Boilers Market Key Takeaway

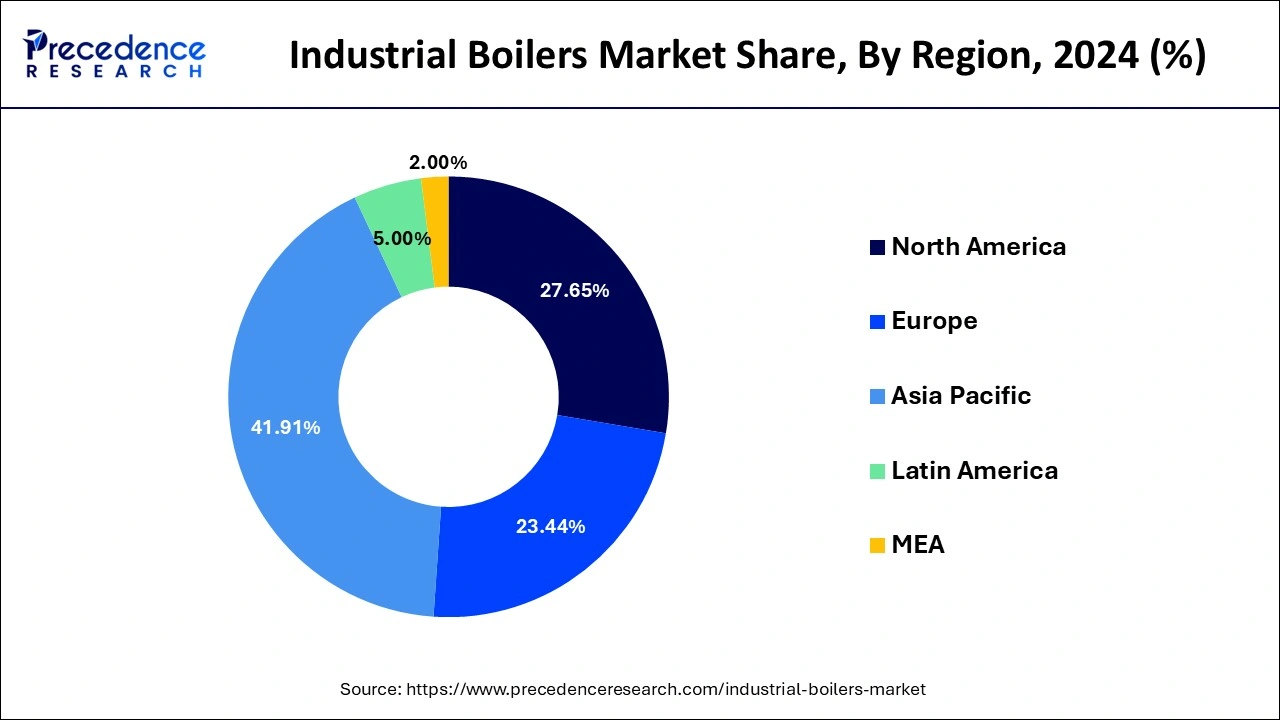

- North America dominated the global market with the largest market share of 41.91% in 2025.

- By application , the chemical and petrochemicals segment contributed the highest market share in 2025.

- By type, the water tube segment is expected to grow at a significant CAGR from 2026 to 2035.

- By fuel type, the fossil segment captured the biggest market share in 2025.

Role of Artificial Intelligence in the Industrial Boilers Market

Artificial intelligence and machine learning helps in the optimization of boilers for efficient and clean energy production. AI also helps in reducing the harmful gas emissions in the environment by requiring the least amount of construction and operating expenditures. AI-based approaches are helpful in modelling, predicting performances, and achieving control over emissions of combustion processes. AI-ML algorithms are used to process the data obtained from internet of things (IoT) devices. They can also create models and train them to allow machines to learn and take their own practical decisions for operational and engineering practices of boilers.

Industrial Boilers Market Growth Factors

The global industrial boilers market is driven by surging demand from the chemicals & petrochemical and the food & beverages industries. The rapid industrialization and the stringent government regulations pertaining to the harmful emissions are significantly driving the demand for the industrial boilers across the globe. The rising adoption of the industrial boilers across various industries such as chemical, food & beverages, and mining is expected to foster the market growth in the forthcoming years. The growing population and rising disposable income are encouraging the manufacturers to set up new manufacturing facilities in order to cater the demand for the food and beverages, textiles, and consumer goods. The rising investments in the growth of the industries across the globe are boosting the demand for the industrial boilers. The chemical industry has huge contributions in the global GDP, which highlights the importance of increasing demand for the industrial boilers in the chemicals industry. The growing demand in the chemical and petrochemical industry in the developing nations is expected to have a huge impact on the market growth in the foreseeable future.

The rising concerns regarding pollution, carbon emissions, and environment protection have forced the government to take strict actions regarding the industrial emissions. The stringent government norms pertaining to the harmful emissions to the environment are supporting the growth of the global industrial boilers market. Moreover, the rising investments in the thermal power owing to the rising demand for the efficient power supply are major factors that drive the growth of the industrial boilers market across the globe. The technological advancements and the rising focus of the manufacturers to increase the capacity of the boilers is supplementing the market growth. For instance, Bosch Industriekessel Gmbh provides water boilers that range up to 38 MW to the top food & beverage companies like Coca Cola, Nestle, and Daimler.

Major Trends of the Industrial Boilers Market

- The manufacturing sector is becoming more reliant on electric and hybrid boilers, rather than fossil fuel, due to their ability to have less downtime with fast start-ups, lower maintenance costs, and improved compatibility with renewable energy systems, especially in the food and pharmaceutical sectors.

- Boiler manufacturers now include IoT sensors, artificial intelligence diagnostic tools, and predictive maintenance systems in their industrial boilers. These tools reduce unplanned downtime, provide optimized fuel usage, and improve operational safety for continuous process manufacturers.

- The trend toward modular and compact industrial boiler designs continues to accelerate, especially in urban areas, as the modular boiler system provides a scalable capacity for future growth, faster installation times, and lower civil infrastructure costs.

- Boiler manufacturers are designing specifically for end-use applications, including chemical, pulp and paper, textile, and power generation, while improving the thermal efficiency of the products and meeting stringent emissions compliance.

Industrial Boilers Market-Trade Analysis:

- International Imports of Boilers between June 2024 and May 2025 amount to about 930 units, representing approximately 30% growth compared to last year. As of May 2021, the total number of units that have been imported from abroad was 63, an increase of 5% compared to May 2024.

- China is currently the largest exporter of boilers, comprising around 1030 shipments (49%) of all exports to the world, followed by India (438 shipments ~23%) and the US (159 shipments ~8%).

- Southeast Asia and South Asia have experienced a surge in demand for boilers due to the presence of strong developing economies within their respective regions.

- Total imports for Boiler Parts globally recorded around 2416 units between 6/20 – 5/21 with 858 importers, 623 exporters, and across 56 importing countries and 47 exporting countries, highlighting a large number of importers located throughout many various countries.

Market Outlook:

- Industry Growth overview: The industrial boilers market continues to grow at a steady pace. Global market growth is driven by an overall increase in production, a higher demand for energy, and the replacement of older, inefficient thermal systems in the power generation, chemical, and food processing industries.

- Sustainability Trends: As sustainability trends have developed globally, many sectors have begun to adopt low-emission boiler technology, the implementation of waste-heat recovery systems, and the ability to use alternative fuels. Sustainability initiatives and regulatory pressures, in conjunction with corporate carbon-reduction targets, are increasing investment in cleaner and more efficient boiler technologies.

- Global Expansion: The rapid economic growth of emerging economies, along with urban development and the construction of energy-related infrastructure, is driving significant growth in the installation of new boilers. Many multinational manufacturers are establishing new manufacturing facilities in these countries to better service regional demand and to minimize their supply-chain dependence.

- Startup Ecosystem: The market is witnessing the emergence of a strong startup ecosystem that has developed around the creation of digital boiler management systems, efficiency-upgrade retrofits, and emission-control technologies. The focus of many startups is on providing small to mid-sized industrial operators with tools to optimize costs, analyze energy usage, and automate compliance with environmental regulations.

Market Scope

| Report Coverage | Details |

| Market Size In 2025 | USD 18.15 Billion |

| Market Size In 2026 | USD 19.97 Billion |

| Market Size by 2035 | USD 28.75 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.71% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Fuel, By Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

The water tube segment dominated the global industrial boilers market in 2024. This is attributed the increased demand for the water tube boilers in the paper & pulp, chemical & petrochemical, and the food processing industries across the globe. The features like low carbon emissions along with the higher thermal efficiency are the major factor that has fostered the growth of the water tube boilers across industries. The growing investments on the adoption of large capacity boilers along with the replacement of conventional heating systems are further expected to propel the growth of this segment in the forthcoming future.

How Water Tube Segment Dominated the Industrial Boilers Market?

The water tube segment dominated the industrial boilers market in 2024. The growing various industries like food processing, paper & pulp, and chemical & petrochemical industries increase demand for water tube boilers. It consists of higher thermal efficiency and lower carbon emissions. The extensive investment in the adoption of large-capacity boilers, with the replacement of the conventional heating system, drives the overall growth of the market.

Application Insights

The chemical and petrochemicals segment garnered a market share in 2024. The huge demand for the high quality steam that has utilization in the production of chemicals such as petrochemicals, alkali, chlorine, fertilizers, and pesticides has fueled the growth of this segment in the past years. The chemical industry has huge contributions in the GDP. The huge demand for huge variety of chemicals across all the industries has boosted its growth. The rising demand for the various chemical products is boosting the demand for the industrial boilers in the chemical industry across the globe. Hence, this segment is expected to sustain its significance throughout the forecast period.

Fuel Type Insights

The fossil segment held the largest share of the market in 2024. The growing emphasis on green fuel, especially in industrial areas promotes the segment's expansion in the market. Multiple industry players are focused on the innovation of products that meet government emission standards and goals. Fossil fuels are readily available on a global scale, making them a convenient choice for industrial boiler operators operating in diverse geographic locations. This global availability ensures consistent fuel supply and reduces logistical challenges associated with sourcing alternative fuels.

Why did Fossil Segment dominate the Industrial Boilers Market?

The fossil segment dominated the industrial boilers market in 2024. The growing adoption of green fuel in industrial areas helps in the market growth. The strong government emission standards and goals increase demand for innovative fuels. It is easily available worldwide and is a convenient choice for industrial boiler operations. The growing demand for a consistent fuel supply and minimizing logistical challenges increases demand for alternative fuels, driving overall growth of the market.

Regional Insights

Asia Pacific Industrial Boilers Market Size and Growth 2026 to 2035

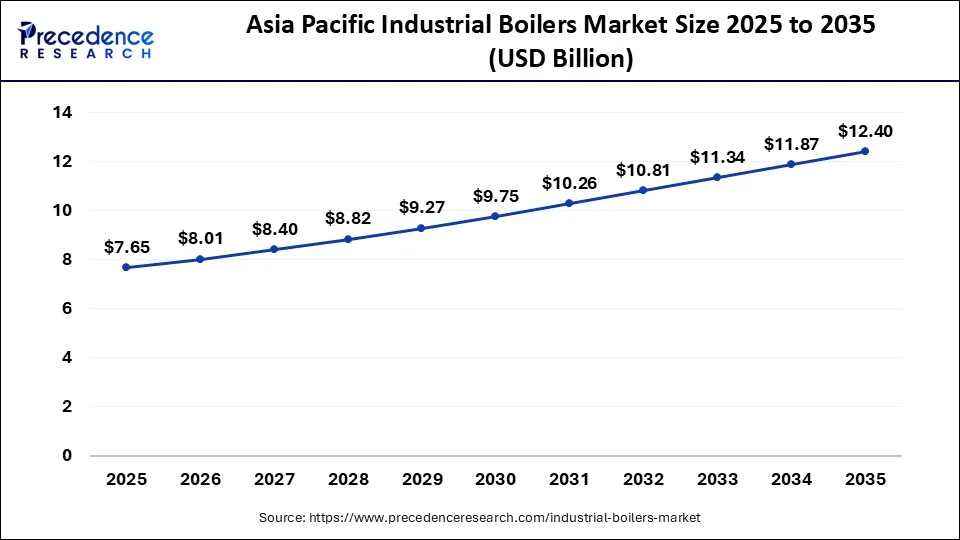

The Asia Pacific industrial boilers market reached USD 7.65 billion in 2025 and is expected to be worth around USD 12.40 billion by 2035, growing at a CAGR of 4.95% between 2026 and 2035.

Asia Pacific accounted for around 41.91% of the market share and dominated the global industrial oilers market in 2024. The rapid industrialization owing to the constant government initiatives to attract FDIs is expected to propel the growth of the industrial boilers market. The availability of cheap factors of production and the favorable government policies are attracting the top manufacturers of various industries to expand their manufacturing facilities in the Asia Pacific region. Thus, the demand for industrial boilers is expected to foresee huge growth across the Asia Pacific region especially in the countries like India and China. China and India are becoming the manufacturing hubs of the world. Moreover, the presence of a huge population is presenting lucrative growth opportunities to food & beverages, consumer goods, textiles, and various other industries. This is a crucial factor that can be held responsible for the growth of the industrial boilers market in the Asia Pacific region in the forthcoming future.

China's Industrial Boilers Market Trends

China is growing in the industrial boilers market. The rapid industrialization and rising consumption of energy increase demand for industrial boilers. The growing expansion of processing and manufacturing industries helps in the market growth. The strong government support for improving energy efficiency fuels adoption in industrial boilers. The growing adoption of renewable energy sources and cleaner fuels increases demand for industrial boilers. The strong investment in power generation capacity, such as renewable sources & thermal sources, is fueling demand for industrial boilers. The growing demand from various industries like food processing, textiles, and chemicals drives the overall growth of the market.

India Industrial Boilers Market Trends

India's strong industrial expansion, especially in areas like manufacturing, food processing, and pharmaceuticals, is greatly influencing the India Industrial Boilers Market Industry. The Indian Government has established ambitious objectives for renewable energy, encouraging industries to invest in biomass and waste heat recovery boilers, regarded as environmentally friendly options that aid in achieving sustainability aims. Moreover, the latest trends indicate a move towards intelligent and automated boiler systems. As sectors increasingly digitize, there is a rising need for IoT-equipped boilers that facilitate real-time oversight and enhancement of processes. In a tactical effort to enhance local manufacturing, India has chosen to limit foreign involvement in government contracts concerning industrial boilers or steam generators. According to the new guideline, solely Indian companies will be permitted to provide these essential components for future thermal power initiatives and industrial uses. India's industrial boilers serve as the essential core of the nation's swiftly expanding manufacturing industry.

- More than 45,000 steam boilers generate 1.26 billion tonnes of steam annually, contributing over a quarter of total industrial greenhouse gas emissions. iFOREST organized the 'National Conclave on Greening Industrial Boilers in India' in Lucknow while conducting an unprecedented comprehensive study on process boilers in India. Two documents were published during the conclave – a national document titled ‘Greening Industrial Steam: Low-carbon and Clean Air Roadmap for Process Boiler' and a state-specific document ‘Greening Industrial Process Boiler: Low carbon and clean air pathways for Uttar Pradesh'.

- In November 2024, the Japanese government planned to introduce a carbon emissions trading system applicable in April 2026 which sets targets over 300 to 400 companies involved 100,000 tons of CO2 emissions annually. This system will complete 60% of domestic greenhouse gas emissions in Japan including several industries like steel, cars, airlines, and electricity.

What Makes Europe the Most Opportunistic Region in the Market?

Europe region is estimated to be the most opportunistic segment during the forecast period. The presence of a higher number of industries and manufacturing units across Europe has fostered its growth. The increased awareness regarding carbon emissions, increased environmental consciousness, and increased focus of the industries on achieving sustainability have compelled the government to implement strict regulations regarding harmful industrial emissions. This has significantly boosted the growth of the industrial boilers market in Europe. Moreover, with the higher adoption rate of advanced and innovative technologies to attain sustainability and energy efficiency across the manufacturing units in Europe, the demand for industrial boilers has witnessed a surge in demand.

- In February 2025, the European Commission approved the €325 million scheme initiative of France to promote biomass heat production and move towards sustainable energy.

Germany Industrial Boilers Market Trends

Germany is growing in the industrial boilers market. The growing shift towards sustainable and energy-efficient industrial processes increases demand for industrial boilers. The strong government support for the adoption of clean energy technologies helps in the market growth. The growing investment in decarbonization and adoption of low-emission heating systems & heat pumps increases demand for industrial boilers. The robust industrial base in various sectors like pharmaceuticals, chemicals, & food processing, and growing demand for heat generation & energy-efficient steam drives the overall growth of the market.

What Drives the Industrial Boilers Market in North America?

The market in North America is driven by the region's strong emphasis on boosting energy efficiency and modernizing aging boiler systems. Technological advancements and the adoption of low-emission boilers are prominent trends in the regional market. The region also faces pressure to reduce its carbon footprint, which further drives the replacement and upgrading of existing equipment. North America also has a strong presence of leading boiler manufacturers that carry out continuous technological advancements. Furthermore, investments in upgrading aging infrastructure boost market growth.

What Opportunities Exist in Latin America?

Latin America offers immense opportunities in the industrial boilers market. These opportunities arise from the expansion of the food & beverage, mining, and manufacturing sectors. Countries like Brazil and Argentina are leading players in the market as they are seen actively investing in industrial modernization and energy infrastructure. There is also a growing demand for processed heat and steam, which creates new opportunities for boiler suppliers. The region's focus on industrial modernization also increases demand for efficient and reliable steam generation systems. Government incentives promoting renewable energy are encouraging the use of biomass boilers, thus propelling the market even further.

How is the Opportunistic Rise of the Middle East & Africa in the Industrial Boilers Market?

The Middle East & Africa (MEA) is experiencing an opportunistic rise in the market. This is mainly due to rising investments in the petrochemicals, energy, and desalination sectors. Countries like Saudi Arabia, the UAE, and South Africa are leading players in the region as they are expanding their industrial bases, thus boosting boiler demand. The region also has a focus on diversifying economies beyond oil, which helps in driving infrastructure and industrial development. Various government incentives and policies, such as Vision 2030, are driving infrastructure and manufacturing growth. The region is witnessing increasing investments in clean energy and modern industrial equipment, fostering innovation and boosting market potential.

Value Chain Analysis

- Raw Material Sourcing

Industrial boilers mainly require materials such as carbon steel, alloy steel, burners, heat exchangers, valves, and control electronics.

Key Players: Sandvick, Honeywell, Emerson - Manufacturing and Processing

In this stage, manufacturers design and build fire tubes, water tubes, and hybrid industrial boilers.

Key Players: Bosch, Thermax, Fulton - Distribution and After Sales

In this stage, boilers are sold directly through direct sales, EPC contractors, and industrial distributors.

Key Players: ENGIE, Larsen and Toubro, Doosan

Industrial Boilers Market Companies

- AMEC Foster Wheeler PLC

- Siemens AG

- Thermax Limited

- Harbin Electric Corporation

- Bharat Heavy Electricals Limited

- General Electric Company

- Dongfang Electric Corporation Ltd.

- Babcock & Wilcox Enterprises, Inc.

- IHI Corporation

- AC Boilers S.P.A

Recent Developments

- In August 2025, Bosch (DE) launched a comprehensive digital platform that integrates IoT capabilities into its boiler systems, enabling real-time monitoring and predictive maintenance. This initiative reflects Bosch's focus on digitalization and its potential to enhance operational efficiency for clients. By providing actionable insights through data analytics, Bosch aims to differentiate itself in a competitive market increasingly driven by technology and innovation.(Source: bing.com)

- In February 2025, Cleaver-Brooks launched “myBoilerRoom,” a digital platform that simplifies boiler room operations by offering centralized access to critical tools and information. The platform provides features such as equipment documentation, parts tracking, and user training resources in one place. The system also includes real-time monitoring and analytics to improve performance and maintenance planning. This platform aims to enhance efficiency, reduce downtime, and support smarter boiler management.

(Source: bing.com ) - In February 2024, Addison Stark, CEO of Atmos Zero reported that the company is making efforts to solve industrial decarbonization by electrifying the boiler room and building a scalable, drop-in replacement product than complicated expensive customized projects.

- In October 2024, Emma Falck, Executive Vice President of Siemens AG announced that there is 40% energy consumption by buildings worldwide and 75% of buildings face inefficient management. So, the company introduces its innovative Climatix Hub Technology at Chillventa to help customers and partners in lowering gas emissions and energy costs.

Recent Developments

- In March 2025, The Environmental Group revealed that it has entered into a binding agreement to purchase Advanced Boilers & Combustion for $5.5 million, enhancing its industrial boiler service and production capabilities. The purchase will be financed using current cash reserves and finalized by 5 April 2025, as stated in a release to the ASX.

- In February 2025, AtmosZero, a company dedicated to electrifying steam, inaugurated its initial 100,000 square-foot manufacturing facility at the Forge Campus in Loveland, Colorado. This new facility marked the initial phase of bringing Boiler 2.0 to market and the company's growth in its production capacity to accommodate over one gigawatt of steam. This facility is set to produce as many as 100 Boiler 2.0 units annually and will start commercial deliveries in 2026.

- In February 2024, Siemens AG introduced innovative and sustainable building technology, products, solutions, and systems at Mostra Convegno Expocomfort (MCE) trade show including highly efficient chillers and heat pumps with magnetic expansion valve.

- In September 2024, Thermax showcases its technologically advanced solutions or innovative technologies in clean air, clean energy, and clean water at Boiler India 2024 which is the India's largest exhibition on advanced boiler technologies held at the CIDCO Exhibition Centre, Navi Mumbai.

Segments Covered in the Report

By Type

- Fire Tube

- Water Tube

- Others

By Function

- Hot Water

- Steam

By Fuel Type

- Oil & Gas

- Biomass

- Fossil

- Non-Fossil

By Boiler Horsepower

- 10-150 BHP

- 151-300 BHP

- 301-600 BHP

By Technology

- Condensing

- Non-Condensing

By Steam Pressure

- High Pressure Boilers

- Medium Pressure Boilers

- Low Pressure Boilers

By Steam Usage

- Process Boilers

- Utility Boilers

- Marine Boilers

By Furnace Position

- Externally Fired Boilers

- Internally Fired Boilers

By Shell Axis

- Horizontal Boilers

- Vertical Boilers

By Tubes In Boilers

- Multi-Tube Boilers

- Single Boilers

By Water And Steam Circulation In Boilers

- Forced Circulation Boilers

- Natural Circulation Boilers

By Application

- Paper & Pulp

- Food & Beverages

- Chemicals & Petrochemicals

- Metals & Mining

- Others

By Geography

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting