What is the Conveying Equipment Market Size?

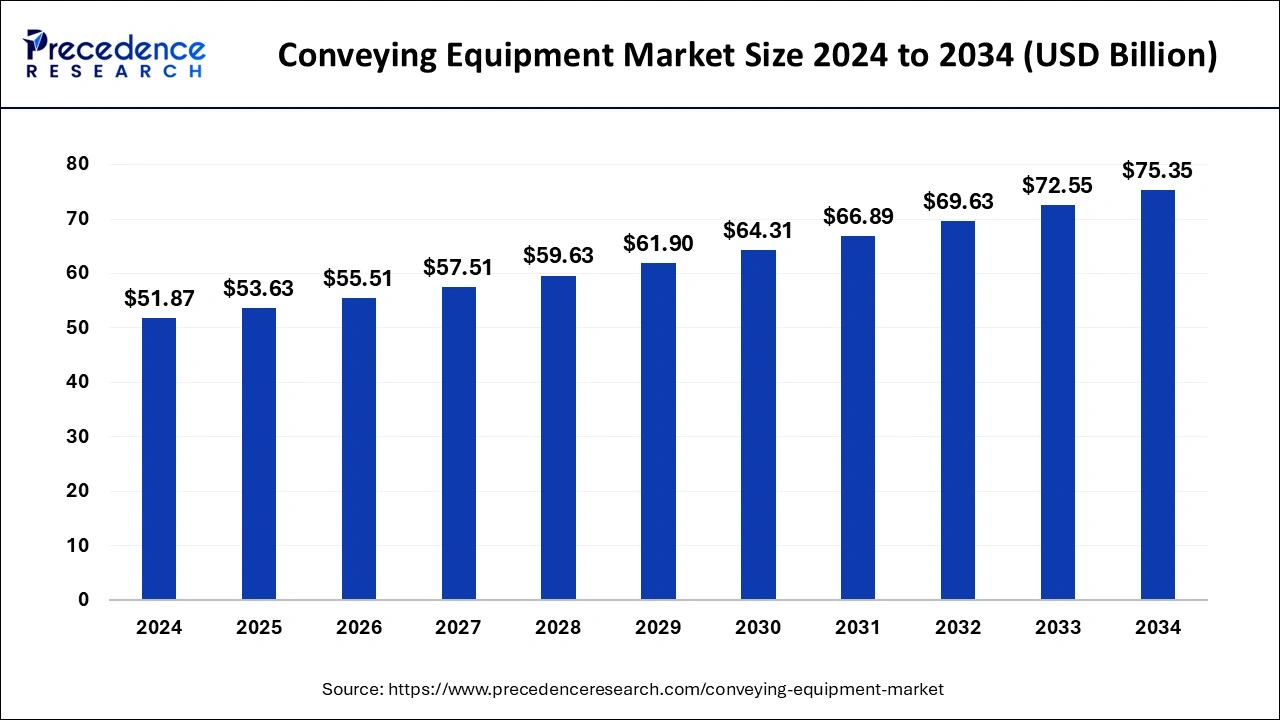

The global conveying equipmentmarket size is calculated at USD 53.63 billion in 2025 and is predicted to increase from USD 55.51 billion in 2026 to approximately USD 75.35 billion by 2034, expanding at a CAGR of 3.80% from 2025 to 2034.

Conveying Equipment Market Key Takeaways

- The global conveying equipment market was valued at USD 51.87 billion in 2024.

- It is projected to reach USD 75.35 billion by 2034.

- The conveying equipment market is expected to grow at a CAGR of 3.80% from 2025 to 2034.

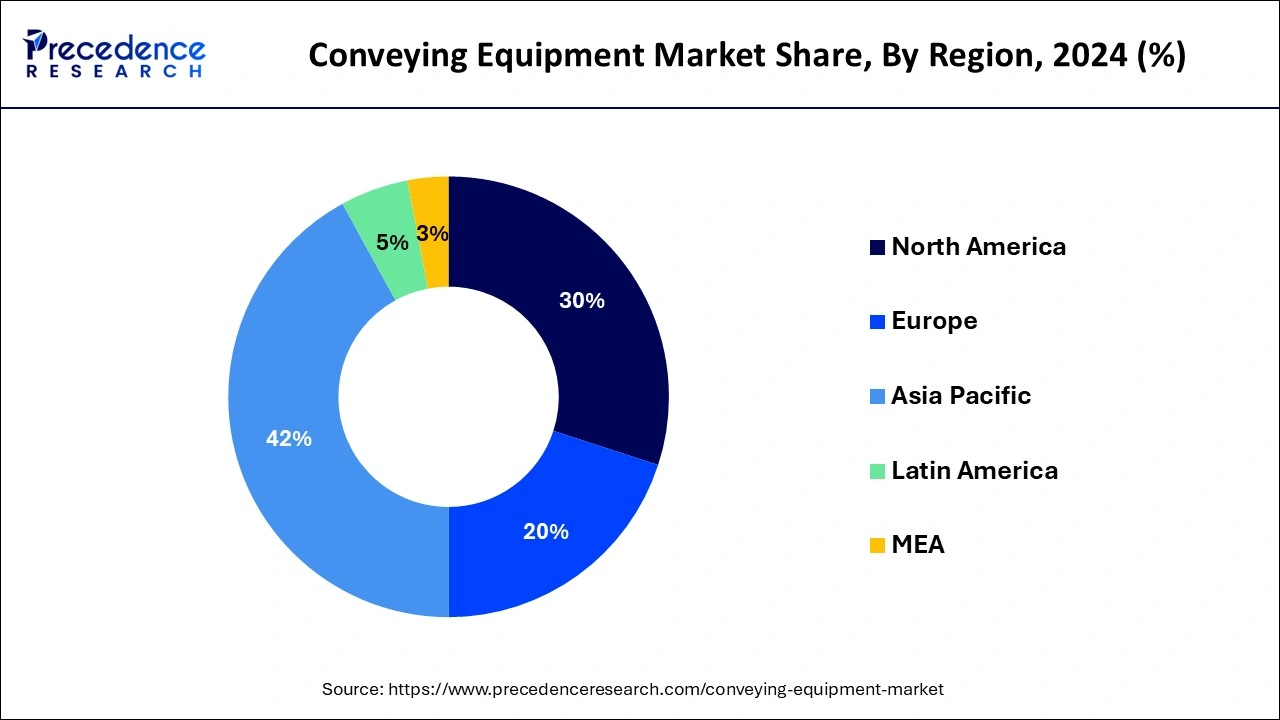

- Asia-Pacific contributed more than 42% of market share in 2024.

- North America is estimated to expand the fastest CAGR between 2025 and 2034.

- By type, the belt segment has held the largest market share of 25% in 2024.

- By type, the roller segment is anticipated to grow at a remarkable CAGR of 5.12% between 2025 and 2034.

- By product, the unit handling segment generated over 47% of the market share in 2024.

- By product, the bulk handling equipment segment is expected to expand at the fastest CAGR over the projected period.

- By application, the warehouse and distribution segment generated over 24% of the market share in 2024.

- By application, the automotive segment is expected to expand at the fastest CAGR over the projected period.

How AI is Changing the Conveying Equipment Market?

Artificial Intelligence: The Next Growth Catalyst in Conveying Equipment

AI is significantly impacting the conveying equipment market by transforming traditional systems into intelligent, autonomous material handling solutions. Through machine learning and data analytics, AI optimizes workflow, dynamically plans routes, and prioritizes loads in real-time to maximize throughput and operational efficiency. A crucial application is AI-driven predictive maintenance, which uses sensor data to foresee equipment failures before they occur, minimizing costly downtime and extending asset lifespan.

Market Outlook

- Market Growth Overview: The Conveying Equipment market is expected to grow significantly between 2025 and 2034, driven by the booming e-commerce, rising demand for automation, and integration of AI, IoT, sensors, and robotics is transforming conveyor systems into intelligent, data-driven solutions.

- Sustainability Trends: Sustainability trends involve energy efficiency as a core principle, modular and reusable designs, and integration with smart systems for optimization.

- Major Investors: Major investors in the market include Siemens AG, Honeywell International Inc., the Kion Group (owner of Dematic), Toyota Industries Corporation (owner of Vanderlande), and Daifuku Co., Ltd.

- Startup Economy: The startup economy in AI and robotic integration, software and SaaS platforms, and specialized automation.

Conveying Equipment Market Growth Factors

- The exponential growth of e-commerce is a key driver for the conveying equipment market. With the surge in online shopping, there is an increased need for efficient material handling systems in warehouses and distribution centers to cope with higher order volumes.

- The ongoing industrialization and infrastructure development in emerging economies contribute to the demand for conveying equipment. As industries expand and modernize, there is a growing requirement for conveyor systems to streamline material flow and enhance operational efficiency.

- Companies worldwide are emphasizing supply chain optimization to reduce costs and enhance productivity. Conveying equipment plays a vital role in achieving these goals by facilitating the seamless movement of goods, leading to increased adoption across industries.

- Continuous advancements in conveying technology, including automation, IoT integration, and advanced sensors, are propelling market growth. These innovations enhance the efficiency, reliability, and adaptability of conveying systems, appealing to industries seeking to stay competitive.

- The expansion of manufacturing activities across diverse sectors, including automotive, food and beverage, and pharmaceuticals, fuels the demand for conveying equipment. As production scales up, there is a corresponding need for conveyors to handle materials at various stages of the manufacturing process.

- Heightened awareness of workplace safety is driving the adoption of conveying equipment. Automated systems reduce the reliance on manual labor for material handling, minimizing the risk of accidents. This emphasis on worker safety is influencing companies to invest in conveyor solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 53.63 Billion |

| Market Size by 2026 | USD 55.51 Billion |

| Market Size by 2034 | USD 75.35 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Product, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Global manufacturing growth

- According to the World Bank, global manufacturing output witnessed a notable increase of 6.2% in 2021.

Global manufacturing growth significantly propels the demand for the conveying equipment market as industries expand and modernize their production processes. The surge in manufacturing activities across diverse sectors, including automotive, electronics, and consumer goods, necessitates efficient material handling solutions. Conveying equipment, such as conveyor belts, rollers, and automated systems, becomes integral to seamlessly transporting raw materials and finished products within manufacturing facilities. With heightened production levels worldwide, industries seek to optimize operational workflows and reduce manual labor.

The adoption of Conveying Equipment enhances productivity, minimizes downtime, and contributes to overall cost-efficiency. As global manufacturing experiences an upswing, the conveying equipment market witnesses increased demand, driven by the essential role these systems play in streamlining supply chains, ensuring timely production, and meeting the dynamic needs of a growing industrial landscape.

Restraint

Space constraints

Space constraints present a notable restraint on the market demand for conveying equipment, particularly in industries where available floor space is limited. Manufacturing and warehouse facilities often grapple with spatial challenges, hindering the installation and expansion of conveyor systems. The need to optimize operational layouts and accommodate other essential machinery can limit the feasibility of integrating conveying equipment seamlessly. Businesses operating in confined spaces may find it challenging to deploy conveyor belts or automated systems without disrupting existing workflows or sacrificing valuable floor area.

Furthermore, the space limitations pose obstacles to scalability, restricting the capacity for businesses to expand their conveying infrastructure as production volumes increase. The demand for conveying equipment is thus influenced by the adaptability of systems to spatial constraints, with compact and flexible designs becoming increasingly crucial for industries seeking efficient material handling solutions within confined working environments. Overcoming these challenges requires innovative solutions that maximize the utility of available space while maintaining the integrity and efficiency of conveying processes.

Opportunity

Customization for diverse industries

The trend towards customization in conveying equipment is creating significant opportunities in the market by addressing the unique needs of diverse industries. Different sectors, such as pharmaceuticals, food and beverage, and automotive, have distinct requirements when it comes to material handling. Conveying equipment manufacturers can seize this opportunity by developing tailored solutions that cater to industry-specific challenges.

For example, the pharmaceutical industry may demand conveyor systems with stringent hygiene features, while the automotive sector may require heavy-duty conveyors for transporting large components. Customization allows companies to offer specialized solutions that enhance operational efficiency and meet compliance standards within specific industries.

Furthermore, the ability to adapt conveying systems to the varying spatial constraints and workflows of different industries positions manufacturers as valuable partners. Tailored conveyor solutions not only improve overall productivity but also contribute to cost-effectiveness by addressing the specific demands of each sector. As industries continue to seek optimized and efficient material handling processes, the trend towards customization presents a strategic avenue for conveying equipment providers to differentiate themselves and foster long-term partnerships across diverse markets.

Segment Insights

Type Insights

The belt segment generated over 25% of the market share in 2024. In the conveying equipment market, the belt segment refers to conveyors that utilize a continuous loop of material, typically made of rubber or fabric, to transport goods. Belt conveyors are versatile and widely used across various industries for their ability to handle a diverse range of materials. The trend in the belt segment involves the integration of advanced technologies, such as sensors and automation, to enhance efficiency and enable real-time monitoring. This results in increased demand for smart belt conveyors, offering improved control and adaptability in material handling processes.

The roller segment is anticipated to expand at a significant CAGR of 5.12% during the projected period. The roller segment in the conveying equipment market refers to systems that utilize rollers to facilitate the movement of goods along a designated path. These rollers, typically mounted on frames, allow for smooth and controlled material transport. A notable trend in this segment is the increasing adoption of precision-engineered rollers for enhanced durability and efficiency. Industries are opting for advanced roller conveyors to reduce friction, improve load-bearing capacities, and ensure reliable performance, contributing to the overall growth and evolution of the conveying equipment market.

Product Insights

According to the product, the unit handling has held 47% market share in 2024. The unit handling segment in the conveying equipment market involves the transportation of individual items or loads, such as boxes, totes, or cartons. This segment is characterized by solutions like conveyor belts, rollers, and automated systems designed for precise and controlled handling of discrete units. A notable trend in unit handling is the increasing integration of advanced technologies like RFID tracking and automation to enhance accuracy and efficiency in sorting, distribution, and order fulfillment processes, meeting the growing demand for precision and speed in logistics and e-commerce operations.

The bulk handling equipment segment is anticipated to expand fastest over the projected period. The bulk handling equipment segment in the conveying equipment market encompasses machinery designed for the efficient transportation of large quantities of materials, such as grains, minerals, and aggregates. Key trends in this segment include the growing demand for robust and high-capacity conveyor systems to handle bulk materials in industries like mining, agriculture, and construction. Advancements in technology, such as improved conveyor belt materials and enhanced automation for precise material handling, are shaping the evolution of bulk handling equipment in response to industry requirements for increased efficiency and reduced operational costs.

Application Insights

The warehouse and distribution segment has hold a 24% market share in 2024. In the conveying equipment market. The exponential growth of e-commerce and the evolving landscape of supply chain dynamics have thrust warehouse and distribution into the limelight. As consumer expectations for faster deliveries and seamless logistics rise, the need for efficient conveying solutions becomes paramount, positioning this segment as a linchpin in meeting industry demands.

The automotive segment is anticipated to expand fastest over the projected period. In the conveying equipment market, the automotive segment involves the use of conveyor systems to streamline material handling within automotive manufacturing facilities. These systems efficiently transport components, parts, and assemblies along production lines, contributing to increased automation and productivity. A notable trend in the automotive sector is the integration of advanced conveying technologies, such as automated guided vehicles (AGVs) and robotic systems, to enhance precision, speed, and flexibility in assembly processes, reflecting the industry's continuous pursuit of efficiency and innovation.

Regional Insights

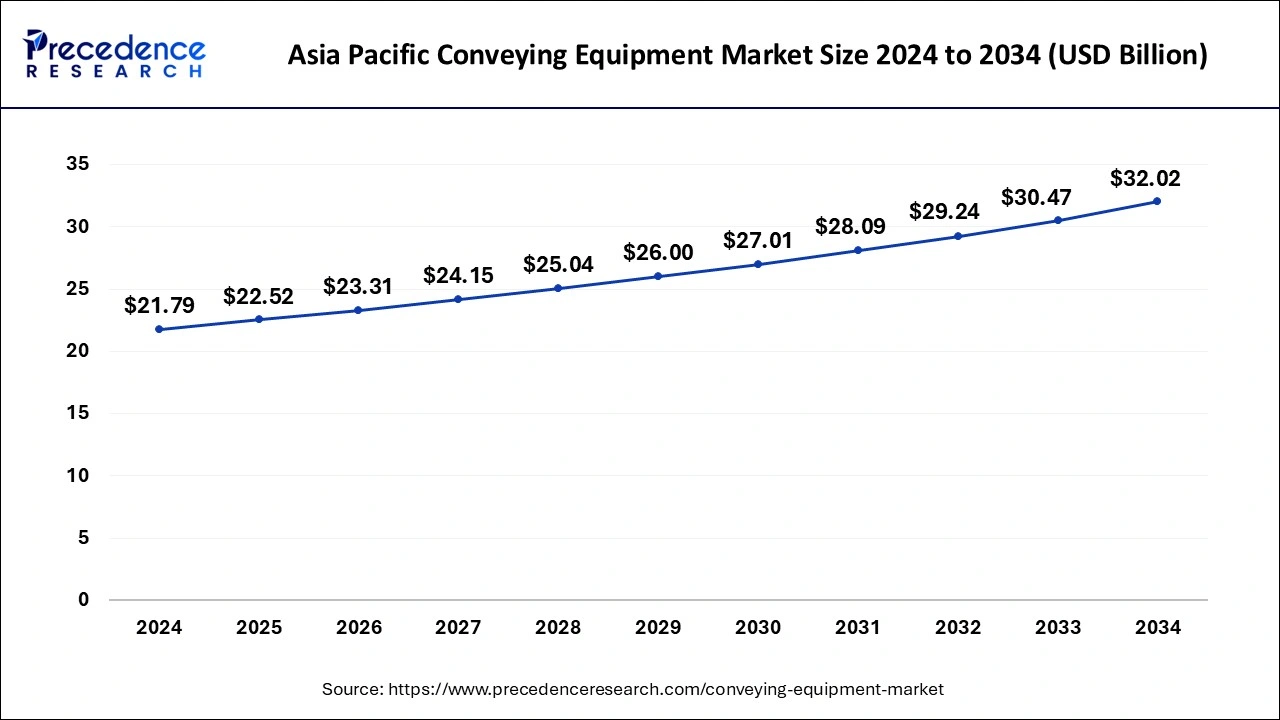

Asia PacificConveying Equipment Market Size and Growth 2025 to 2034

The Asia Pacific conveying equipment market size is evaluated at USD 22.52 billion in 2025 and is projected to be worth around USD 32.02 billion by 2034, growing at a CAGR of 3.92% from 2025 to 2034.

Asia-Pacific holds a 42% share in the conveying equipment market due to robust industrialization, burgeoning manufacturing activities, and the rapid expansion of e-commerce. Countries like China and India witness substantial demand for conveying systems across diverse industries, including automotive, electronics, and logistics. The region's economic growth, infrastructure development, and the adoption of advanced technologies contribute to the dominance of Asia-Pacific in the global conveying equipment market, attracting significant investments and fueling market expansion.

China Conveying Equipment Market Trends

China's rapid e-commerce growth and smart logistics, focused on industrial automation and smart manufacturing, and integration of AI, IoT, and other advanced technologies, is transforming conveyors into an intelligent system capable of optimizing routing, managing inventory, and predicting maintenance needs. Hybrid bulk and unit load systems an emphasis on energy efficiency and sustainability.

North America is poised for swift growth in the conveying equipment market due to a robust manufacturing sector, increased adoption of automation, and a surge in e-commerce activities. The region's emphasis on technological advancements, coupled with the need for efficient material handling in industries such as automotive and logistics, is driving market expansion. Additionally, the focus on sustainability and compliance with stringent safety standards further fuels the demand for advanced conveying solutions, positioning North America as a key growth hub for the industry.

U.S. Conveying Equipment Trends

The U.S. Conveying Equipment market is driven by the boom in e-commerce and the push for automation to address labor shortages. The integration of AI, robotics, and IoT enables smarter, more efficient, and data-driven material handling operations. There is a strong demand for modular and flexible systems that can adapt to varying production requirements and a wide array of product sizes.

Meanwhile, Europe is experiencing notable growth in the conveying equipment market due to several factors. The region's robust industrial sector, driven by automotive, pharmaceuticals, and logistics, is investing in advanced material handling solutions to enhance efficiency. Additionally, stringent regulations promoting workplace safety and sustainability are encouraging the adoption of modern conveying systems. The rise of e-commerce and the need for streamlined supply chain processes further contribute to the increased demand for conveying equipment in Europe, positioning the region as a significant market for innovative and efficient material handling solutions.

Germany Conveying Equipment Trends

Germany's conveying equipment market is technologically advanced and heavily automated, driven by the "Industrie 4.0" initiative and a strong, high-quality manufacturing base. The automotive sector is a primary consumer, demanding precision and efficiency in its production lines, while the booming e-commerce segment drives the need for sophisticated warehouse logistics.

Strategic Overview of the Global Conveying Equipment Industry

Conveying equipment is a diverse set of specialized machinery designed to efficiently move materials within industrial settings. This equipment includes conveyor belts, rollers, screw conveyors, pneumatic systems, and bucket elevators, all aimed at automating the smooth transfer of goods or raw materials. In sectors like manufacturing, mining, agriculture, and logistics, conveying equipment is widely embraced for its ability to minimize manual labor, enhance safety, and optimize operational processes. Businesses enjoy increased efficiency, reduced risk of material damage, and improved overall organization thanks to these systems. Essentially, conveying equipment stands as a crucial element in modern industries, fostering heightened productivity and a more streamlined approach to handling materials.

Value Chain Analysis

Conveying Equipment Market Value Chain Analysis

- Raw Material Sourcing & Component Manufacturing

This foundational stage involves sourcing essential raw materials like steel, aluminum, polymers for belts, and electronic components for controls and sensors.

Key Players: (Component Suppliers/Tech Providers): Siemens AG, ABB Ltd., Rockwell Automation (for motors, drives, and control systems). - Design, Engineering & Production

In this crucial stage, raw materials and components are assembled into finished conveying equipment, requiring sophisticated design, engineering, and manufacturing expertise.

Key Players: Siemens AG, Honeywell International Inc., Daifuku Co., Ltd., Schaefer Systems International, Dematic (Kion Group), Toyota Industries Corporation (Vanderlande). - Distribution & Sales

Products are distributed through a mix of direct sales teams for large, complex projects, and networks of distributors and system integrators for standardized equipment and components. - Installation & Integration

This stage involves the physical installation of the equipment at the client's facility and integrating it with existing operations and software systems (e.g., Warehouse Management Systems or WMS).

Key Players (System Integrators/Installation Services): Dematic (Kion Group), Vanderlande (Toyota Industries Corporation), Beumer Group, Siemens AG (through their digital industry services).

Conveying Equipment Market Companies

- Daifuku Co., Ltd. is a global leader in material handling systems and a major contributor to the conveying equipment market. They provide comprehensive, automated solutions that integrate various conveying technologies, from airport baggage handling to automotive production lines.

- Siemens AG is a significant technology provider in the conveying equipment market, supplying crucial electrical components, automation software, motors, and drives. Their "Digital Enterprise" solutions integrate advanced analytics and IoT capabilities, enabling smart, efficient, and interconnected conveyor systems.

- Honeywell Intelligrated contributes by offering a comprehensive portfolio of material handling solutions, including conveyors, sortation systems, and software. They focus heavily on enabling the e-commerce boom with automated solutions that enhance productivity and streamline order fulfillment processes.

- TGW Logistics Group specializes in the design, production, and installation of complex logistics centers, utilizing their own range of high-performance conveying equipment. They are major players in the warehouse automation segment, helping clients in retail and e-commerce meet rapid delivery demands.

- BEUMER Group provides highly specialized conveying equipment for bulk materials, a key segment of the market for mining, cement, and power industries. They also offer innovative, high-speed sorting and distribution systems for the parcel and post sector.

- Vanderlande Industries (part of Toyota Industries Corporation) is a leading global supplier of value-added logistics automation at airports and for parcel distribution. They provide innovative conveying and sorting systems that are essential for efficient baggage handling and warehouse operations.

- Murata Machinery, Ltd. is a key player, particularly known for its automated guided vehicles (AGVs), which complement its conveying systems. The company integrates its equipment with robotics and intelligent software to create highly automated warehouse and manufacturing solutions.

- Fives Group contributes to the conveying equipment market with a focus on high-performance sorting and conveying solutions for the intralogistics and automotive industries. They leverage their engineering expertise to provide bespoke, high-throughput systems for complex industrial applications.

- Dematic (part of the Kion Group) is a significant global provider of intelligent supply chain and material handling solutions, including a wide array of conveying equipment. Their systems integrate software with hardware, focusing on automation and meeting the demands of e-commerce fulfillment.

- Swisslog Holding AG specializes in logistics automation, robotic and smart warehouse solutions, which heavily utilize advanced conveying and transportation systems. They provide integrated systems to help businesses optimize their supply chain and manage complex logistics processes.

- Interroll Group is a key supplier of core components for material flow handling systems, including rollers, motors, and drives for conveyors. Their components are used by various other manufacturers, making them a foundational player in the value chain.

- Viastore Systems GmbH offers integrated automated material handling systems and IT solutions, with conveying equipment as a core part of its offering. They focus on warehouse automation and software integration to optimize logistics and manufacturing processes.

- KNAPP AG provides intelligent automation solutions and software for intralogistics and manufacturing, using its own range of conveying equipment to create highly efficient systems. They are particularly strong in the healthcare, fashion, and retail sectors, providing solutions for efficient order picking and distribution.

- Hytrol Conveyor Company, Inc. is a major U.S.-based manufacturer of conveying equipment, known for a wide variety of standard and customized conveyor solutions. They leverage a strong network of system integrators to deliver robust and reliable material handling solutions across various industries.

- Jervis B. Webb Company (now part of Daifuku North America) has a legacy contribution to the market, known for its innovative overhead and floor conveyor systems. They have supplied durable solutions to industries like automotive, contributing to the development of early automated production lines.

Recent Developments

- In July 2023, Jungheinrich AG announced plans to construct a new logistics warehouse in Freilassing for Hawle Armaturen GmbH by October 2024. The project includes a comprehensive conveyor system, order picking workstations, five stacker cranes with SPS, and silo steel rack constructions with roof and wall cladding.

- In June 2023, TGW Logistics Group revealed its intention to build a high-performance e-commerce system for SKECHERS USA, Inc., near Shanghai. The automated system, set to be operational in the summer of 2025, features a 13-kilometer network of energy-efficient KingDrive conveyors connecting various components and linking them to the current fulfillment center.

- In April 2023, TGW Logistics Group introduced FullPick, an innovative system enabling food service professionals and retailers to respond rapidly to challenges. FullPick facilitates completely automated mixed pallet picking, loading both pallets and roll cages in a store-friendly manner.

Segments Covered in the Report

By Type

- Belt

- Roller

- Pallet

- Overhead

- Chain Conveyors

- Others

By Product

- Unit Handling

- Bulk Handling

- Parts & Attachments

By Application

- Food & Beverage

- Warehouse & Distribution

- Automotive

- Airport

- Mining

- Electronics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting