What is the Automated Guided Vehicle Market Size?

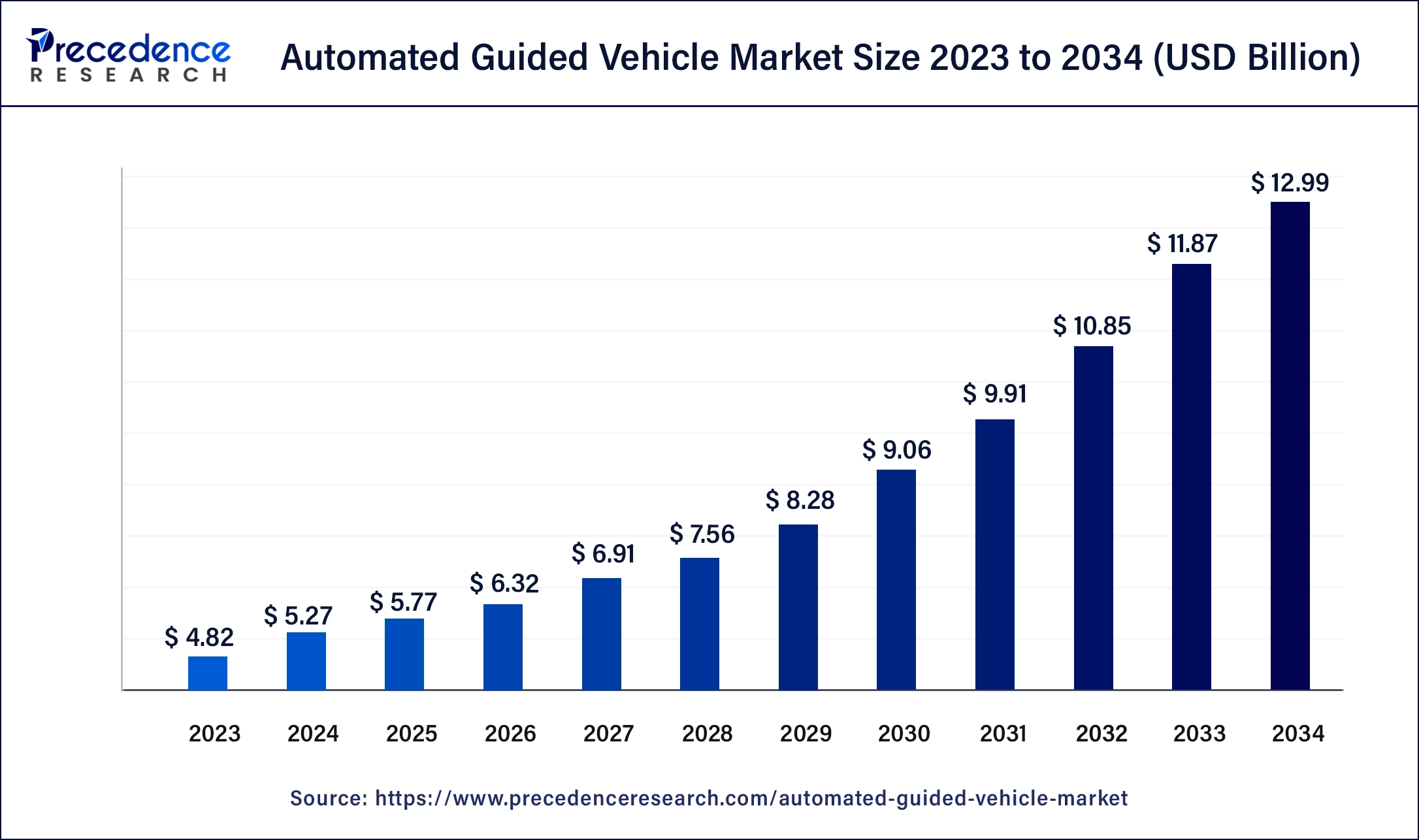

The global automated guided vehicle market size is calculated at USD 5.77 billion in 2025 and is predicted to increase from USD 6.32 billion in 2026 to approximately USD 14.04 billion by 2035, expanding at a CAGR of 9.3% from 2026 to 2035.

Market Highlights

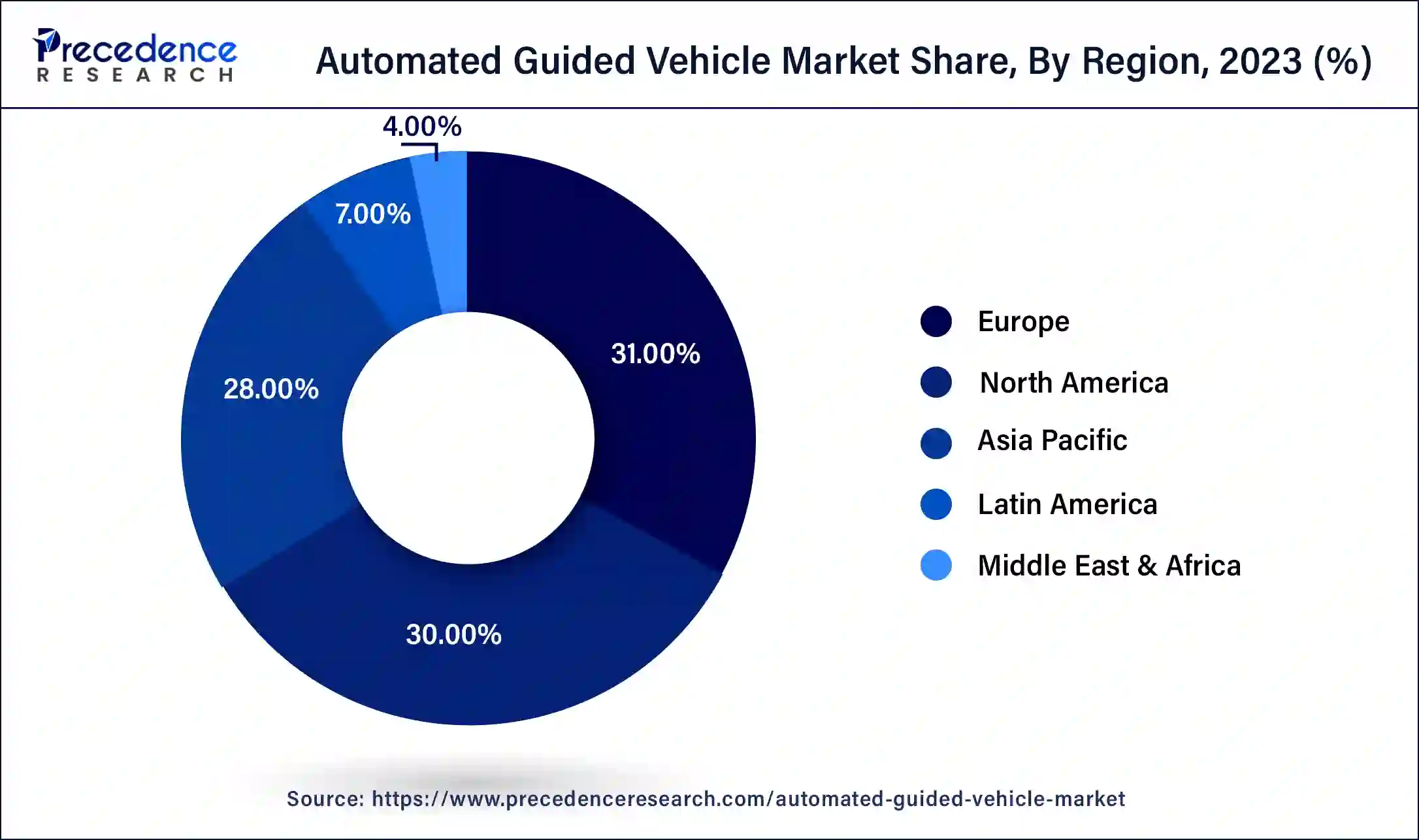

- Europe led the global market with the highest market share of 31% in 2025.

- Asia Pacific region is expanding at a CAGR of 11.2% during the forecast period 2026 to 2035.

- The natural navigation segment is expanding at a CAGR of 17.5% from 2026 to 2035.

- The wholesale and distribution sector is growing at a notable CAGR of 9.3%.

- By application, the logistics and warehousing segment accounted for a revenue share of around 41% in 2025.

- The assembly segment is expected to drive growth at a CAGR of 13.1% from 2026 to 2035.

- By component, the hardware segment dominated the market in 2025 and accounted for a revenue share of over 70%.

- The service segment is growing at a CAGR of 9.3% from 2026 to 2035.

- By battery type, the lead battery segment has captured a revenue share of around 61% in 2025.

- The lithium-ion battery segment is expanding at a CAGR of 15.9%.

Market Overview

The automated guided vehicle market is experiencing strong growth, driven by increasing demand for automation in manufacturing, warehousing, and logistics operations. Companies are adopting the automated guided vehicle approach to improve operational efficiency, reduce labor dependency, and enhance workplace safety. Rapid expansion of e-commerce and omni-channel retail has significantly increased the need for automated advancements in navigation systems, sensors, and fleet management software, which are improving the performance and flexibility.

Growth Factors

The demand for automation in material handling across various industries, the rise in popularity of online sales channel, the transition from mass production to mass customization, and enhanced workplace safety norms are some of the factors driving the automated guided vehicle market growth.

The automated guided vehicle market is growing due to an increase in demand for automation technologies in different types of industries. The market is also driven by improvements in accuracy, safety, and high productivity of automated guided vehicles. Moreover, the low labor costs help to boost the market growth of automated guided vehicle market.

However, the automated guided vehicle market's growth is hampered by high initial investment costs and a lack of flexibility. Furthermore, the integration of industry 4.0 is expected to give lucrative growth prospects for market players in the automated guided vehicle market.

The industries such as food & beverage, automotive, aerospace, manufacturing, retail, logistics, and other end-use industries are all using automated guided vehicles. The demand for industrial equipment is driven by lower labor costs and increased productivity. As industries have become more technology driven and automated, the need for automated guided vehicles is likely to rise.

The factors such as increasing automation in material handling process and increased production and efficiency of automated guided vehicles is boosting the market growth. On the other hand, risks associated with automated guided vehicles restrict the growth of automated guided vehicles market. The technological advancements are creating lucrative opportunities for the growth and development of automated guided vehicle market.

Market Outlook

- Industry Growth Overview: The AGV Industry has been experiencing consistent growth driven by an increasing number of automated solutions, labor shortages, and the growth of smart factories. Companies focus on using AGV solutions to improve their efficiency in material handling, accuracy in operations, and safety within the workplace.

- Sustainability: Businesses focused on sustainability are increasingly turning to AGVs as a powerful method of achieving their goals. In particular, there has been an increasing interest in the use of Energy-Efficient AGVs that utilize regenerative braking, optimized route algorithms, and recyclable components.

- Start-Up Ecosystem:Start-up companies have had an impact on the AGV Industry by offering service-centric solutions driven by artificial intelligence-based navigation and modular-designed AGVs, as well as cloud-based fleet management solutions. Start-ups have been able to develop needs-based solutions quickly and efficiently, providing small to medium-sized enterprises with cost-effective automation solutions that would not otherwise be available to them.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.27 Billion |

| Market Size in 2026 | USD 6.32 Billion |

| Market Size by 2035 | USD 14.04 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 9.3% |

| Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Navigation Technology, Application, Industry, End User, Component, Battery, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Segment Insights

Type Insights

Based on the type, the tow vehicles segment has garnered 41.5% revenue share in 2024. This is attributed to improved lifestyles in emerging economies, rising middle class group in developing countries, and increased urban population. As disposable income rises, more people are willing to drive their own vehicle instead of ride sharing or carpooling. All these factors drive the growth of tow vehicles segment.

The unit load carrier segment is expected to grow at a CAGR of 13.4% during the forecast period. The main advantages of unit load carrier include better protection against weather conditions and damage & faster loading and unloading of cargo products.

Navigation Technology Insights

Based on the navigation technology, the laser guidance segment has hit 35.6% revenue share in 2024. The market for laser automated guided vehicles is growing because of the features such as scalability, versatility, and accuracy. The technology also helps to improve safety of the automated guided vehicles. The laser guidance provides accurate navigation.

On the other hand, the others segment is estimated to be the most opportunistic segment during the forecast period. The wire-guided and other types of automated guided vehicles comprise the others segment of the navigation technology.

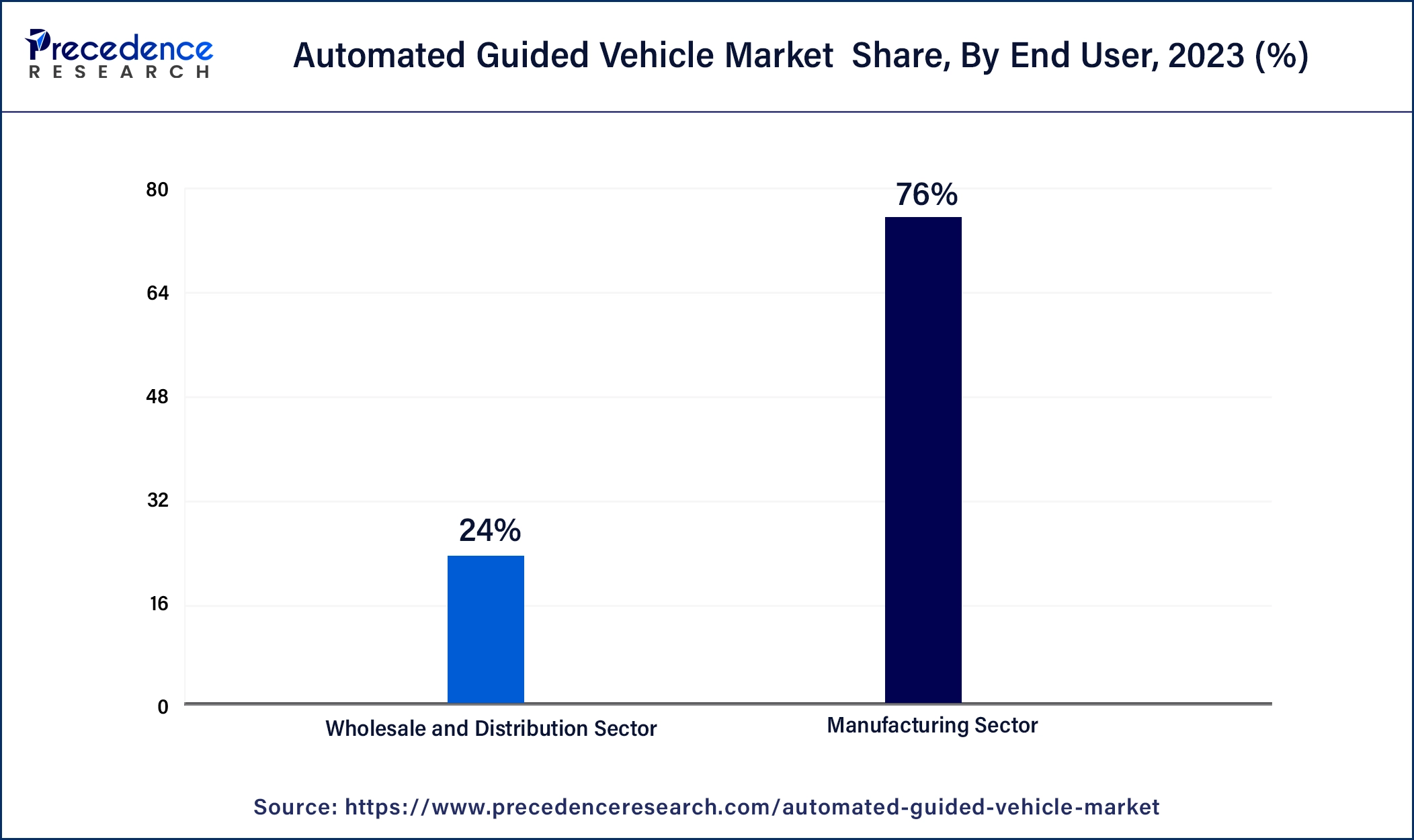

End Use Industry Insights

Based on the end use industry, the manufacturing segment has garnered 76% revenue share in 2024. The manufacturing segment includes manufacturing of automotive, chemicals, food & beverage, pharmaceuticals, and others.

The aerospace is estimated to be the most opportunistic segment during the forecast period. The complexity of components such as wings, engine pods, and nacelles, causes aerospace manufacturing facilities to be immense. The automated guided vehicles help aerospace components to transport easily without any accidents or mishaps.

Key Companies Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting different marketing strategies, such as new product launch, investments, partnerships, and mergers & acquisitions. The companies are also spending on the development of improved products. Moreover, they are also focusing on competitive pricing.

- In October 2019, the Hit Robotic Group (HRG) launched new product line of automated guided vehicles for simultaneous localization and mapping.

The various developmental strategies such as new product launches, acquisition, partnerships, joint venture, and mergers fosters market growth and offers lucrative growth opportunities to the market players.

Regional Insights

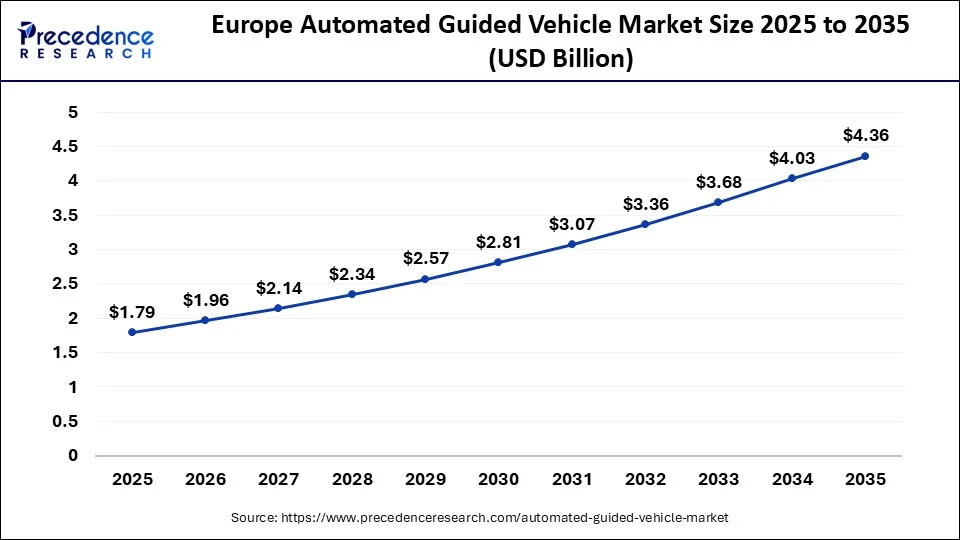

Europe Automated Guided Vehicle Market Size and Growth 2026 to 2035

The Europe automated guided vehicle market size is exhibited at USD 1.63 billion in 2025 and is projected to be worth around USD 4.36 billion by 2035, poised to grow at a CAGR of 9.31% from 2026 to 2035.

Based on the region, the Europe segment dominated the global automated guided vehicle market in 2025, in terms of revenue. The use of automated guided vehicles is increasing in Europe in various sectors to enhance the safety of workers in risky tasks. At the same time, technological advancements are also enhancing various parameters of AGVs, increasing their use. Furthermore, the regulations by the government, as well as regulatory bodies, are also enhancing their use and safety. Thus, all these factors promote the market growth.

Germany is a major contributor to the European automated guided vehicle market due to its strong industrial and manufacturing base, extensive adoption of Industry 4.0 technologies, and high demand for automation in warehouses and factories. The country's focus on advanced logistics, automotive production, and smart factory initiatives further drives the deployment of AGVs across sectors.

What Potentiates the Automated Guided Vehicle Market in North America?

The automated guided vehicle market in North America is driven by the rapid adoption of industrial automation, e-commerce growth, and the need for efficient material handling in warehouses and manufacturing facilities. Additionally, increasing investments in smart factories, advanced robotics, and supply chain optimization are further accelerating market growth in the region.

In North America, the U.S. is the most powerful economy. The manufacturing industry in this region is a major source for automated guided vehicles. Furthermore, automation allows small enterprises or local market players to compete on an equal ground with the global market players. The U.S. is regarded as one of the top most automobile and automotive manufacturer across the globe. Thus, the increase in demand for automated guided vehicle in U.S. is contributing to the region's expansion.

What Makes Asia Pacific the Most Opportunistic Region in the Market?

On the other hand, the Asia-Pacific is estimated to be the most opportunistic segment during the forecast period. The retail industry, particularly e-commerce industry is growing at a faster rate in Asia-Pacific countries. The application of automated guided vehicle in e-commerce industry is growing at a rapid pace which is contributing to the growth of the market in Asia-Pacific region.

China dominates the regional market, driven by extensive manufacturing operations, rapid adoption of smart factory technologies, and strong government support for industrial automation. Japan also contributes to the market, driven by its advanced robotics ecosystem in the automotive industry and high demand for precision material handling solutions.

What Drives the Automated Guided Vehicle Market in Latin America?

The market in Latin America is driven by the region's growing manufacturing and logistics sectors, rising demand for warehouse automation, and efforts to improve operational efficiency. Additionally, increasing investments in industrial infrastructure and the adoption of advanced technologies are boosting the deployment of AGVs across key industries.

In Brazil, the automated guided vehicle market is driven by a large industrial base, high vehicle production, and increasing adoption of warehouse automation technologies. Moreover, Chile and Colombia are also major players in the market, supported by the modernization of logistics infrastructure and the expanding retail and e-commerce sectors.

Analysis of Value Chain of the Automated Guided Vehicle Market

- Manufacturing Sensors and Integrating Components: In this phase, the components that enable AGV (automatic guided vehicle) systems are produced. This includes developing navigation sensors, lithium-ion batteries, safety scanners, control systems, and implementing embedded software throughout the production process.

Key Players: SICK AG, Omron Corporation, and Rockwell Automation. - Integration of the AGV System with Other Systems and Assembly of AGVs: Integrators play a critical role in developing and providing customized AGV systems. Integrators will integrate hardware components, navigation software programs, fleet management applications, and safety protocols to make customized AGV solutions.

Key Players: Daifuku Co., Ltd., KION Group, and Toyota Industries. - AGV Deployment, Aftermarket and Lifecycle Support: After an AGV has been deployed, it will require many services, including installation, route optimization, software upgrades, predictive maintenance, and operator training.

Key Players: JBT Corporation and Murata.

Top Companies in the Automated Guided Vehicle Market & Their Offerings

- Swisslog Holding AG: Offers a range of automated transport vehicles, including the CarryPick mobile rack system and specialized pallet AGVs for seamless warehouse integration.

- AGVE Group: Provides a diverse lineup of standard and custom-built AGVs, from small 50kg load carriers to massive vehicles capable of moving 65 tonnes.

- JBT: Specializes in heavy-duty, purpose-built AGVs for industrial environments, offering specific solutions for forked, towing, and unit load applications.

- Hyster-Yale Materials Handling, Inc.: Focuses on "robotic" lift trucks that automate their standard manual hardware, such as tow tractors and pallet trucks, using LiDAR-based navigation.

- Toyota Advanced Logistics: Operates primarily through Bastian Solutions to deliver autonomous tuggers, forklifts, and vision-guided vehicles tailored for high-speed distribution.

- KION GROUP AG: Delivers a full spectrum of automated transport through brands like Dematic and STILL, covering everything from narrow-aisle trucks to heavy pallet movers.

- Heartland Automation LLC:Specializes in versatile autonomous mobile robots and tuggers designed to replace manual delivery carts in lean manufacturing cells.

- E&K Automation GmbH: Now known as ek robotics, they engineer high-tech transport robots, including heavy-load carriers and the VARIO MOVE series for flexible pallet handling.

- Daifuku: Features the SmartCart line of flexible, magnetic-guided carts alongside heavy-duty unit load AGVs for large-scale manufacturing assembly lines.

- SSI Schaefer: Offers the WEASEL system, a compact AGV designed specifically for transporting bins, cartons, and small goods without the need for complex infrastructure.

Recent Developments

- In May 2025, the AC7 and DC7 Motor Controllers, which are powerful new generation of AC and DC motor controllers used for AGVs and AMRs, were announced and launched by Kollmorgen, who is one of the leaders in navigation and controls technology for automated guided vehicles (AGVs) and autonomous mobile robots (AMRs). These innovations offer flexibility as well as durability and enhanced performance, which are the requirements of the newest, most advanced autonomous vehicle applications.

- In May 2025, to reduce the complexities and costs associated with the infrastructure charging, a new automated overhead charging system, named Weplug, was developed by Westfalia Technologies. With the help of driver driver-inserted adapter, the 50 kW DC fast charger which utilizes gantry-based robotic arm, is connected to EVs.

- In February 2025, with the production of Automated Guided Vehicles (AGVs) at Kenitra, Morocco, the performance of the Automotive manufacturing giant Stellantis is enhancing. A total of 1,000 units per year of AGVs will be produced by the group's Kenitra factory, according to the reports of Faro de Vigo. Furthermore, the industrial autonomy and supporting local sourcing of the company's Kenitra plant will be enhanced, as per the reports of Wandaloo

(Source: https://www.automation.com)

(Source: https://www.electrive.com)

(Source: https://www.moroccoworldnews.com)

Segments Covered in the Report

By Type

-

- Unit Load Carriers

- Tow Vehicles

- Pallet Trucks

- Forklift Trucks

- Assembly Line Vehicles

By Navigation Technology

-

- Magnetic Guidance

- Laser Guidance

- Inductive Guidance

- Vision Guidance

- Natural Navigation

- Others

By Application

-

- Logistics and Warehousing

- Transportation

- Cold Storage

- Wholesale & Distribution

- Cross-docking

- Assembly

- Packaging

- Trailer Loading and Unloading

- Raw Material Handling

- Others

- Logistics and Warehousing

By Industry

-

- Food & Beverage

- Automotive

- Manufacturing

- Retail

- Logistics

- Others

By End User

-

- Manufacturing Sector

- Automotive

- Aerospace

- Electronics

- Chemical

- Pharmaceuticals

- Plastics

- Defense

- FMCG

- Tissue

- Others

- Wholesale and Distribution Sector

- E-commerce

- Retail Chains/Conveyance Stores

- Grocery Stores

- Hotels and Restaurants

- Manufacturing Sector

By Component Type

-

- Hardware

- Software

- Service

By Battery Type

-

- Lead Battery

- Lithium-ion Battery

- Nickel-based Battery

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting