What is the Semi-trailer Market Size?

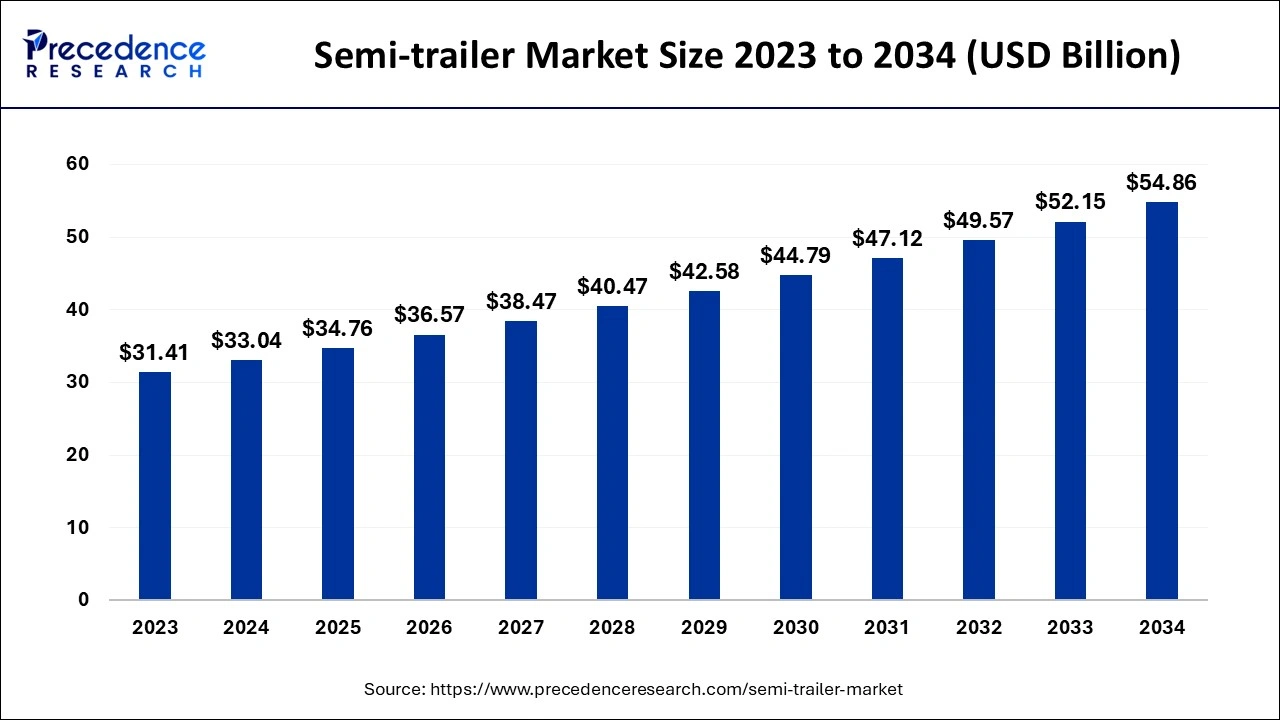

The global semi-trailer market size is accounted for USD 34.76 billion in 2025 and is predicted to increase from USD 36.57 billion in 2026 to approximately USD 57.48 billion by 2035, growing at a CAGR of 5.16% from 2026 to 2035.

Semi-trailer Market Key Takeaways

- By type, the dry vans segment hit 37% revenue share in 2025 and growing at a CAGR of 4.3% from 2026 to 2035.

- The flat bed trailer segment is growing at a CAGR of 6.5% from 2026 to 2035.

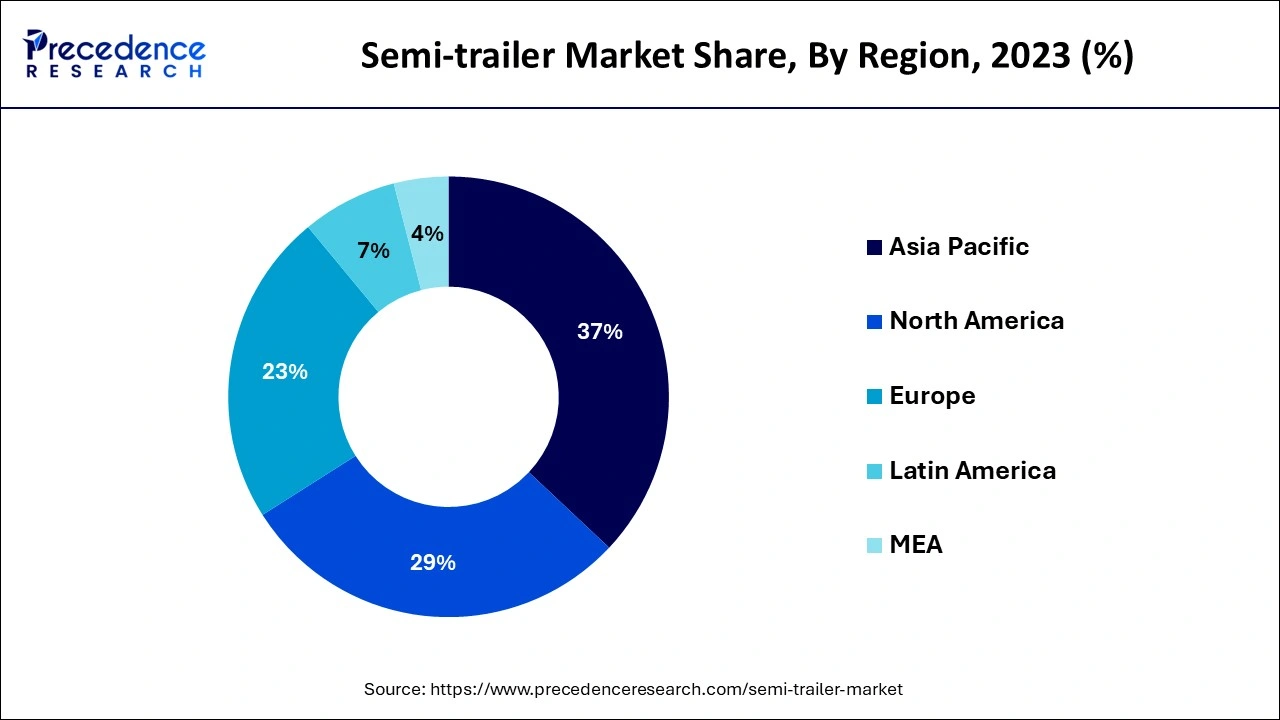

- Asia Pacific region accounted revenue share of around 37% in 2025.

Strategic Overview of the Global Semi-trailer Industry

The semi-trailer involves the four trending keys such as logistics, digitalization, electrification drivers, autonomous trucks. Increased development and technologies with increased embedded systems in the semi-trailers have increase the market rate. Road ways to be the widely used method for transportation of goods from one end to another. Increased manufacturing developments with wide production and transport of goods with increased transportation and rapid urbanization have helped to boost the market to grow at a larger extent.

Semi-trailer is the combination of truck and a semi-trailer. Big proportion of semi-trailer is supported or connected to the truck semi-trailer having the wheels semi-trailer and truck are detachable from one another. Semi-trailers can be relocated. Semi-trailers are mostly utilized in transportation of goods than full trailers. Improved modern semi-trailers mostly utilized in the domestic's transportation and international transportation. Tractor unit connected to the trailers which helps to pull the trailer available in many size, shapes, and lengths. Common trailer included such as dry vans, refrigerated trailers, flat bed trailers, side-lifts, tankers are trailers available with improved functions such as temperature management. Increased development and technologies to improve the methods of transportation and cost-effective method of transportation.

Impact of covid -19 on the market has witnessed the wide difference in the growth of the market with declined market rate due to decreased demands from the market and shortage of supply of the needs to the market. Shut down of the nation due to rules and regulations imposed by the government social distancing, lack down and many more ceased the transportation and closed the doors of the industries which stopped the manufacturing and production of semi-trailers and market growth of the semi-trailers slow down, But due to increased transportation from the pharmaceutical industries to supply of medical devices and medicines with required needs from the health care sector with increased transportation for supplying needs in larger quantities extended the market at a greater extent.

Artificial Intelligence: The Next Growth Catalyst in Semi-trailer

AI is fundamentally reshaping the semi-trailer industry by integrating advanced technologies to enhance safety, operational efficiency, and sustainability. Predictive maintenance systems, powered by AI algorithms analyzing sensor data from IoT devices, can forecast potential equipment failures, significantly reducing unscheduled downtime and maintenance costs by up to 40%.

Furthermore, AI-driven route optimization and load balancing solutions minimize fuel consumption and empty miles, addressing growing regulatory and sustainability pressures. The technology also underpins the development of advanced driver-assistance systems (ADAS) and autonomous trucking features, which improve road safety by monitoring driver behavior and preventing accidents.

Semi-trailer Market Growth Factors

Increased developed technologies with rising manufacturing and producing new innovations in semi-trailer for ease of transportation and increase in transportation method are major factors growing the market of semi-trailer with increased demand from the market.

Increased opportunities for the utilization of semi-trailers in coming years and increased the market size during the forecast period.

Furthermore, increased utilization in cold chain supply with integrating the system with adjusting the temperature effectively supply of the pharmaceuticals, beverages, dairy products, fish, fresh flowers, vegetables and many more. Increasing disposable income have improved to buy more fresh foods, organic and quality products and increased demand for packaged food. Enhancing thecold chainindustry with increased transportation across the various regions and emerging developed countries with increased economy. Fast moving consumer goods is the highest major factor for increasing the revenue share to increase the semi-trailer market rate.

Products having a short expiry includes such as dairy products, meat, fish, fruits, vegetables and many more have the high demand from the customers. Products with more bulk are transported through truck to different place within short period and sold with low prices. Fast moving consumer goods (FMCG) are major role players for increasing the market rate with increased digitalization, populations, brand consciousness are the growing the market rate.

Increased government support for developing the nation with increasing awareness about semi-trailer market and increased investment for improving the transportation method and meet the consumer needs. The key market players involved in introducing the semi-trailers with developed technology and transportation method have increased the market rate with improved research and development.

Market Outlook

- Market Growth Overview: The semi-trailer market is expected to grow significantly between 2025 and 2034, driven by the e-commerce and logistics boom, expansion of cold-chain logistics, and innovation in trailer manufacturing, including the integration of telematics, IoT sensors, and advanced aerodynamics is enhancing fleet efficiency and safety and is a key driver for upgrades.

- Sustainability Trends: Sustainability trends involve lightweighting for fuel efficiency, electrification of components, and smart and connected systems.

- Major Investors: Major investors in the market include Wabash National Corporation, Schmitz Cargobull AG, Great Dance LLC / Hyundai Translead, and Continental AG.

- Startup Economy: The startup economy is focused on disrupting traditional manufacturing with smart technology and sustainable solutions, rather than building conventional full trailers from scratch.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 34.76Billion |

| Market Size in 2026 | USD 36.57 Billion |

| Market Size by 2035 | USD 57.48Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.16% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Length, Tonnage, Axles, End-Use and Geography |

Market Dynamics

Key Market Drivers

- Increased urbanization - Increased population with rising demands from the market with improved urbanization and developing of the nation with increased transportation of goods by the semi-trailers with more bulk goods drives the market of semi- trailer market to a larger extent. Increased government attention to develop for semi-trailers for transportation purpose which is cost effective, less emission of carbon than the trailer truck and one of the majorly used mode of transportation by the roadways and increased investment by the automotive sector for manufacturing and producing semi-trailers which helps to boot the market to a higher peak. In covid-19 pandemic situation with increased demands from the health care centre for the transportation of the necessities required in the hospitals with heavy medical devices and other pharmaceutical products expanded the market of semi-trailers and increased developments of semi-trailers in the automobile industry.

- Fast Moving Consumer Goods (FMCG) - Fast moving generation is the highest sector with increased revenue share in the semi-trailer market. Products with short life are sold fast with the low rates include refrigerated products such as dairy products, fish, meat, baked products, fruits, vegetables with increased demands from the market and customers. Products in large quantities are delivered fast, sold it out fast with low rates.

Key Market Challenges

Road transportation, Consumption of fuel is more in the semi-trailer empty vehicle than semi - trailer filled with the goods with increased emission of carbondioxide gas. Newly developed technology with innovative developments semi-trailers with cost effectiveness, interchanging body, weight reduced of the semi-trailers. Newly developed innovation needs to emit less carbon foot print. Certain rules and regulations imposed for the semi-trailers with the typical roads and new developed innovative designs with increased challenges to rise the semi-trailer market rate. Reducing the weight of the semi-trailers with high quality strong material can be the challenging task in the fleet operators and OEMS with decreased cost and less emission of the carbondioxide.

Key Market Opportunities

- Newly developed technologies - In the last few years the automotive sector have highest increased revenue share with increased newly developed technologies and innovation in the semi-trailer market. Enhanced research and development in semi - trailer market with increased launching of the vehicles meant for transportation.

- Key market players - The key market players involves in introducing the new developments in the semi - trailers and increased production and manufacturing of electric vehicle for the transport means. Increased investment by the market players in the automotive sector for developing new enhanced semi-trailers with continuous research and efforts of the market players led to increase production of the vehicles.

- Government support - Increased government support for developing of semi -trailers and creating awareness regarding utilization of the semi-trailer for transporting goods from one end to another and increased investment for producing the semi-trailers across the regions due to low emission of carbon and cost effective.

Segment Insights

Type Insights

Type segment involves flatbed trailer, dry vans, refrigerated trailers, low boy trailers, tankers and others. Dry vans hold the highest position in semi-trailer with increased market rate in semi-trailer utilized in full truck load and less than truck load.

Flatbed trailers to be second highest position with increased market size and used in transporting heavy transportation of cargo, machinery equipment's, construction heavy materials. Moreover, refrigerated trailers to be in high demand due to increased products and pharmaceutical products that need to be stored at suitable cold chain temperature with enhanced market size.

Tonnage Insights

Tonnage segment divided in to 25T, 25 - 50T, 51 - 100T and above 100T. Below 25T tonnage semi-trailers used in transportation of goods such as dry vans, tankers refrigerated trailers high in demand due to reduced cost of transport. Below 25T is expecting to grow the market with increased transportation of goods with legally permit limits continue to grow with increased rate during the forecast period. The 25 - 50T segment is largely used in flat bed semi-trailers and low boy trailers.

End User Insights

End user segment includes in logistics, health care, oil and gas, automotive, chemical, Fast Moving Consumer Goods (FMCG), heavy industry. Increase wide applications of semi-trailer market in the developed regions in various sectors with improved goods transportation through semi-trailers and the daily consumer needs have boost the market of semi - trailer to a greater extent. FMCG is major role player in the semi - trailer for transporting the refrigerated goods which are sold faster with low rates due to short shelf life of the product thus increased transportation through semi-trailers.

Regional Insights

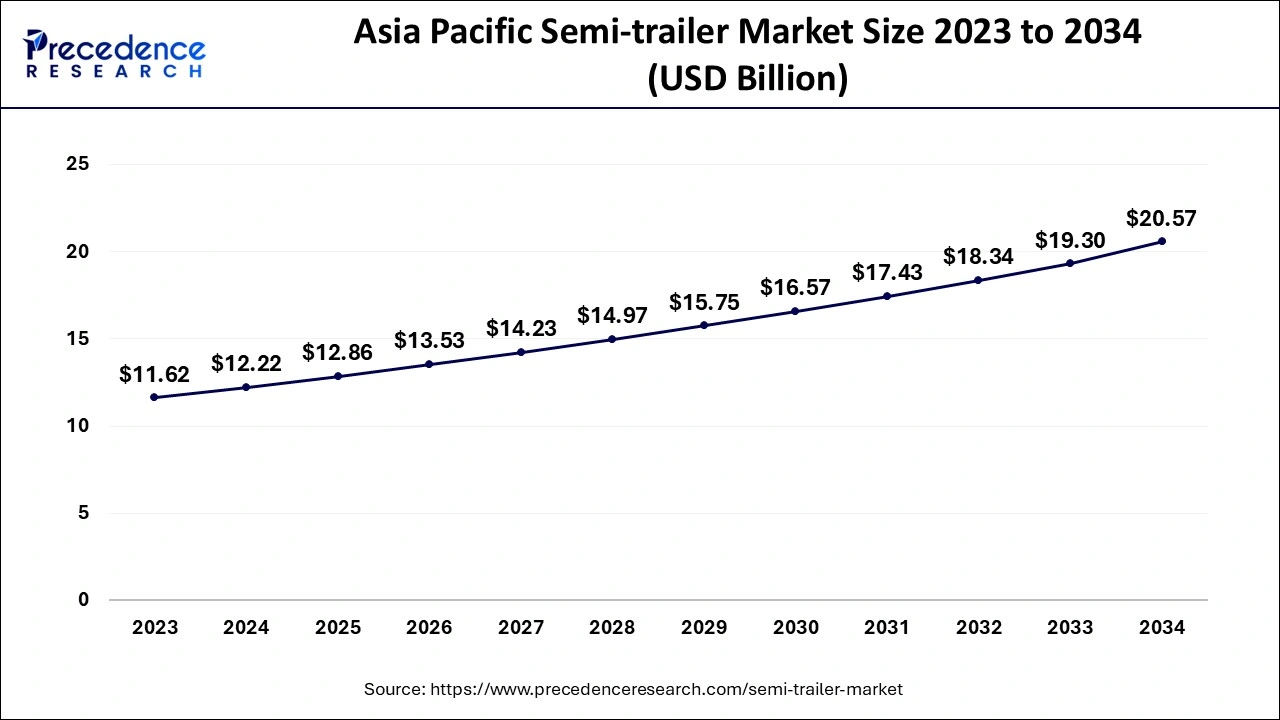

What is the Asia Pacific Semi-trailer Market Size?

The Asia Pacific semi-trailer market size is evaluated at USD 12.86 billion in 2025 and is predicted to be worth around USD 21.63 billion by 2035, rising at a CAGR of 5.34% from 2026 to 2035.

North America to be largest region to increase the market size with rising fleet operations in the regions includes countries such as Mexico, Canada, US. Market players in involves in this region with increased focus for developing new technologies in the semi-trailer market.

U.S. Semi-trailer Market Trends

The U.S. market is driven by the e-commerce boom, which has increased demand for efficient and versatile dry van and refrigerated trailers. A significant trend is the rapid adoption of "smart trailer" technologies, including IoT and telematics, for enhanced safety and predictive maintenance. The industry is also pivoting toward sustainability, focusing on lightweight materials and early electrification of components like reefer units and axles to meet stringent EPA regulations.

Asia Pacific also to be the emerging region with increased market size with increased production and manufacturing and developing infrastructures and high investment for rising developments in semi-trailers with embedded systems with increased market size of semi - trailer. Other regions included are Europe, Latin America, Middle East and Africa with enhanced semi-trailer market growth.

China Semi-trailer Market Trends

China dominates the global market, focusing heavily on high-volume production for both domestic use and a significant export market. The market is defined by a rapid and state-backed transition towards electrification, particularly through innovative battery-swapping infrastructure to support new energy trucks. A parallel trend involves the integration of smart technologies, AI, and telematics to enhance operational efficiency and safety.

How did Europe experience notable growth in the Semi-trailer Market?

Europe's market growth is fueled by the region's heavy reliance on road freight and stringent EU regulations promoting sustainability and COâ‚‚ reduction. Key innovations center on the development of "smart trailers" integrated with telematics and IoT for enhanced efficiency and predictive maintenance. The market is increasingly adopting lightweight materials and the electrification of components like refrigeration units and axles.

Germany Semi-trailer Market Trends

Germany's market is focused on highly customized, premium solutions driven by stringent EU decarbonization regulations and Industry 4.0 initiatives. The rapid adoption of "smart trailer" technologies, lightweight materials, and the electrification of components like e-axles.

Value Chain Analysis of the Semi-trailer Market

- Raw Material Sourcing & Component Manufacturing:

This foundational stage involves procuring bulk materials like steel, aluminum, composites, and specialized components such as axles, braking systems, and refrigeration units.

Key Players: Arconic Corporation (aluminum), U.S. Steel (steel), Bridgestone Americas, Inc. and Michelin (tires), and JOST World. - Design and Engineering:

In this crucial stage, manufacturers design the structure, aerodynamics, and specifications of the semi-trailers to meet diverse cargo needs, regulatory requirements, and performance objectives (e.g., lightweighting, fuel efficiency).

Key Players: Schmitz Cargobull AG, Great Dane, and Wabash National. - Manufacturing and Assembly:

This stage involves the fabrication and assembly of the semi-trailers in high-volume production facilities or specialized custom shops.

Key Players: Schmitz Cargobull AG, Wabash National Corporation, Great Dane LLC, and Krone Commercial Vehicle Group. - Distribution and Sales:

Finished trailers are distributed through a network of dealerships, leasing companies, and direct sales channels to fleet operators and individual owner-operators.

Key Players: Ryder System, Inc. and Penske Truck Leasing Co., L.P. - End-User Operations, Maintenance, and Aftermarket Services:

The final stage involves the daily operation of the trailers by logistics providers and fleet operators, along with ongoing maintenance, repair, and replacement of parts (aftermarket).

Key Players: DHL Group, FedEx, and JOST World

Semi-trailer Market Companies

- Utility Trailer Manufacturing Company: As one of North America's largest manufacturers of refrigerated vans, Utility Trailer contributes significantly to semi-trailer by innovating in the cold chain logistics sector and providing durable, energy-efficient trailers for food and pharmaceutical transport.

- Wabash National Corporation: Wabash is a leading diversified industrial manufacturer, contributing through the production of a wide range of semi-trailers, including dry vans and platform trailers, while pioneering smart trailer technologies and lightweight composite materials.

- Schmitz Cargobull AG: This German company is Europe's market leader in semi-trailers, known for its high-quality, innovative transport solutions, smart telematics systems, and emphasis on sustainable, efficient cold chain logistics.

- Kogel Trailer GmbH & Co.KG: Kogel contributes by offering a wide variety of robust and customized semi-trailers for the logistics industry, focusing heavily on engineering efficiency, reliability, and lightweight construction methods within the European market.

- Krone Commercial Vehicle Group: A major European manufacturer, Krone contributes through high production volume and innovative, modular trailer designs that emphasize operational efficiency and adaptability to diverse regional transport requirements.

- Great Dane Trailers: Great Dane is a key player in North America, providing a broad range of dry van, refrigerated, and platform trailers, and is noted for its strong focus on safety, durability, and a robust aftermarket parts network.

- Fahrzeugwerk Bernard Krone: (Note: This is part of the Krone Commercial Vehicle Group). The company contributes significantly to the European market by manufacturing high-quality, customized semi-trailers and specialized agricultural transport solutions.

- Fontaine Commercial Trailer, Inc.: Fontaine specializes in a variety of platform and heavy-haul trailers, contributing by engineering highly durable and versatile solutions for complex and demanding transportation needs in North America.

- Lamberet SAS: A French leader in the refrigerated transport sector, Lamberet contributes significantly to the cold chain market in Europe by providing innovative and high-performance temperature-controlled semi-trailers and bodywork.

- China International Marine Containers (Group) Ltd (CIMC): As a global giant in logistics equipment, CIMC dominates the market through massive production volume of various semi-trailer types, serving both the vast Chinese domestic market and extensive international export operations.

- Hyundai Translead: The company is a major producer of dry vans, refrigerated vans, and flatbed trailers in North America, contributing through large-scale, efficient manufacturing processes and integration into the broader Hyundai logistics network.

- Polar Tank Trailer, LLC: Polar specializes in the manufacturing of high-quality stainless steel and aluminum tank trailers, contributing niche, high-value solutions for the safe and efficient transport of liquid and dry bulk commodities.

Recent Developments

- In the year 2021 June, Fruehauf introduced the launch of a new services teamed up with Telematics Leader Novacom.

- In the year 2020 September, Auroras introduced services of distribution, operating knowledge aftermarket, Aurora parts, Great Dane, cutting edge digital platforms many more. With the agreements for developing the innovative ideas and solutions for transportations of the products with increased developments in the mobility.

Segments Covered in the Report

By Type

- Tankers

- Refrigerated

- Dry Van

- Lowboy

- Flatbed

- Others

By Length

- Up to 45 feet

- Above 45 feet

By Tonnage

- Below 25T

- 25T - 50T

- 51T - 100T

- Above 100T

By Axles

- Below 3 axles

- 3 - 4 axles

- 4 axles

By End-Use

- Logistics

- Healthcare

- Oil & gas

- Automotive

- Chemical

- FMCG

- Heavy Industry

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content