What is the Sexually Transmitted Diseases (STD) Diagnostics Market Size?

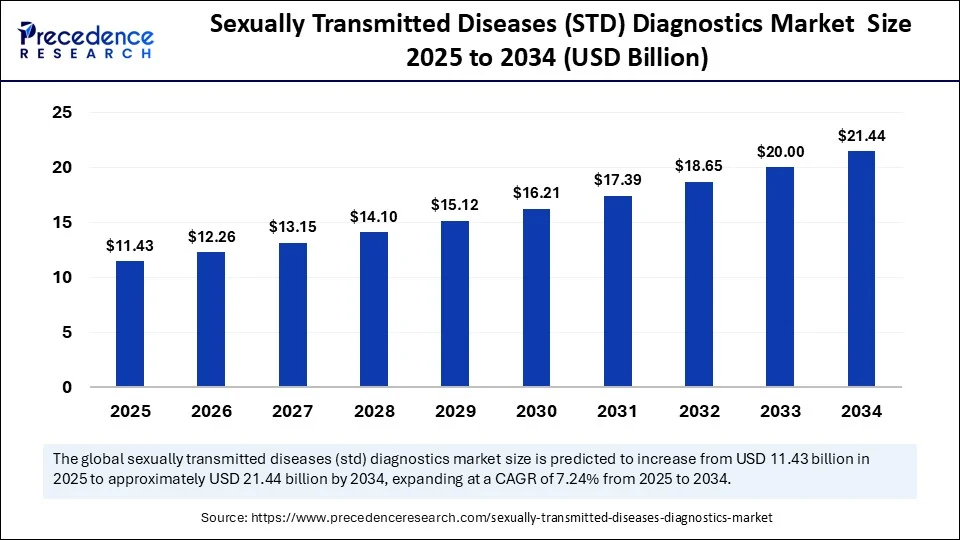

The global sexually transmitted diseases (STD) diagnostics market size is accounted at USD 11.43 billion in 2025 and predicted to increase from USD 12.26 billion in 2026 to approximately USD 21.44 billion by 2034, expanding at a CAGR of 7.24% from 2025 to 2034. The sexually transmitted disease (STD) diagnostics market is driven by increased infection rates, growing awareness of public health, and rising screening programs initiated by governments. Advances in technology, as well as increased demand for rapid and accurate diagnostic tests, continue to drive the growth of the market.

Sexually Transmitted Diseases (STD) Diagnostics MarketKey Takeaways

- In terms of revenue, the global sexually transmitted diseases (STD) diagnostics market was valued at USD 10.66 billion in 2024.

- It is projected to reach USD 21.44 billion by 2034.

- The market is expected to grow at a CAGR of 7.24% from 2025 to 2034.

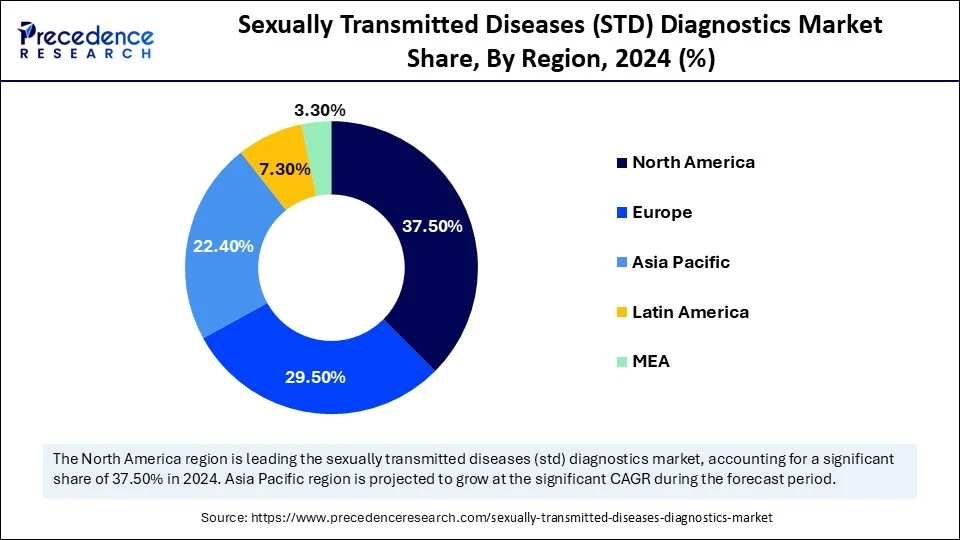

- North America dominated the sexually transmitted diseases (STD) diagnostics market with the largest market share 37.5% in 2024.

- Asia Pacific is estimated to expand at the fastest CAGR in the market between 2025 and 2034.

- By disease type/pathogen, the chlamydia trachomatis segment captured the biggest market share of 29.5% in 2024.

- By type of disease type/pathogen, the human immunodeficiency virus (HIV) segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By diagnostic technology/type, the laboratory-based tests segment contributed the highest market share of 53.50% in 2024.

- By diagnostic technology/type, the rapid point-of-care (POC) tests segment is expected to expand at a notable CAGR over the projected period.

- By sample type, the blood samples segment generated the major market share of 44.50% in 2024.

- By sample type, the urine samples segment is expected to expand at a notable CAGR over the projected period.

- By location of testing, the laboratory testing (hospitals/diagnostic labs) segment captured the highest market share of 63.50% in 2024.

- By location of testing, the home-based testing/self-testing kits segment is expected to expand at a notable CAGR over the projected period.

- By end user, the hospitals and clinics segment accounted for significant market share of 44.50% in 2024.

- By end user, the home users/individuals segment is expected to expand at a notable CAGR over the projected period.

Artificial Intelligence: The Next Growth Catalyst in Sexually Transmitted Diseases (STD) Diagnostics

Artificial Intelligence is transforming the realm of sexually transmitted disease (STD) diagnostics by providing solutions that are faster, more accurate, and more accessible. With growing concerns about increasing global rates of STDs, AI-informed and inspired solutions are facilitating earlier detection, which leads to better patient outcomes through greater accessibility and accuracy to diagnosis and treatment. Recent advances include mobile applications powered by AI, such as HeHealth, which can support image-based algorithms to accurately identify the presence of various STD symptoms.

AI-assisted mobile applications can be particularly useful in rural locations with limited access to laboratory testing or in underserved communities where access to even primary care is limited. In addition to improved screening, AI will drive advancements in molecular testing by accurately identifying pathogen-specific markers, thereby reducing some of the human error inherent in test interpretation. Some research institutions around the globe are developing deep-learning models using large datasets to support predictive modeling for disease progression and treatment responses. This technology simultaneously helps reduce stigma in diagnosis while supporting at-home testing that is discreet, increasing the likelihood of more people receiving timely diagnosis and care.

Strategic Overview of the Global Sexually Transmitted Diseases (STD) Diagnostics Industry

The sexually transmitted diseases (STD) diagnostics market refers to the global healthcare sector focused on the detection and identification of infections transmitted primarily through sexual contact. These diagnostics aim to accurately detect pathogens such as bacteria, viruses, and parasites responsible for STDs like HIV, syphilis, gonorrhea, chlamydia, HPV, and herpes simplex virus (HSV), among others. The market includes a range of diagnostic modalities, sample types, and settings (clinical laboratories, point-of-care, and home testing kits), with an emphasis on early detection, disease monitoring, and surveillance for public health management.The market is growing due to increasing public health awareness, enhanced access to screening programs, and digital innovations, including nucleic acid amplification tests and multiplex polymerase chain reaction tests. Moreover, the rise of at-home or self-testing kits is increasing access and reducing stigma.

Sexually Transmitted Diseases (STD) Diagnostics MarketGrowth Factors

- Growing Prevalence of STDs Worldwide: The rising incidence of STDs, above all among adolescents and high-risk populations, is creating a greater need for early and precise diagnostic testing in both developed countries and developing countries.

- New Diagnostic Techniques: New options, such as rapid point-of-care testing and multiplex PCR, are providing greater opportunities for timely, accurate, and affordable STD diagnosis, which also improves clinical diagnosis and patient management.

- Government Screening Programs: Many government-funded programs are moving towards promoting public health and offering funding for routine STD screening programs, particularly for HIV and HPV, allowing for increased test volumes and marketplace reach.

- Increasing Adoption of At-Home Test Kits: With the rise in self-testing products for privacy and convenience, testing is becoming more accessible to individuals, especially those from populations who are unwilling to visit clinics due to stigma or confidentiality concerns.

Market Outlook

- Market Growth Overview: The Sexually Transmitted Diseases (STD) Diagnostics market is expected to grow significantly between 2025 and 2034, driven by the rising incidence of STDs, innovation in diagnostic technologies, and a shift towards decentralized testing.

- Sustainability Trends: Sustainability trends involve waste reduction and recycling programs, improving assay efficiency and multiplex testing, and green supply chain management.

- Major Investors: Major investors in the market include Abbott Laboratories, F. Hoffmann-La Roche AG, Danaher Corporation (via Cepheid), Hologic, Inc., and Thermo Fisher Scientific Inc.

- Startup Economy: The startup economy is focused on at-home and self-testing, point-of-care testing and AI and digital health integration.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 21.44 Billion |

| Market Size in 2025 | USD 11.43 Billion |

| Market Size in 2026 | USD 12.26 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.24% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Disease Type/Pathogen, Diagnostic Technology/Type, Sample Type, Location of Testing, End User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increase in Asymptomatic Infections Driving Diagnostic Demand

As highlighted by the World Health Organization (WHO), over 1 million treatable sexually transmitted infections (STIs) in the world are acquired every day; most of them are asymptomatic. The swift spread of infections like chlamydia, gonorrhea, syphilis, or trichomoniasis is prompting advanced diagnostic solutions that can detect symptoms early. The effect of being asymptomatic is that diagnosis and treatment are delayed, which can consequently contribute to further complications such as infertility, ectopic pregnancy, or higher rates of HIV transmission.

To improve the current situation, health authorities are advocating for alternative improvements to diagnostics, particularly for asymptomatic individuals. The WHO and CDC empowered the field by promoting rapid point-of-care (POC) diagnostics, such as dual HIV/syphilis tests and nucleic acid amplification tests (NAATs), which can be used in low-resource contexts. Public health programs in many countries have already started incorporating these tests into health check-ups and public screening campaigns. Given the increased interest in early, available, and regular diagnostics for asymptomatic individuals, the STD diagnostics market is expected to grow significantly.

Restraint

Regulatory Hurdles and High Cost

One of the biggest challenges for the sexually transmitted diseases (STD) diagnostics market is the stringent regulatory requirements and approval process for diagnostic tests, which can slow down market entry and innovation. Another major restraint is the disruption in the supply chain for testing supplies, particularly nucleic acid amplification tests (NAATs), the gold standard for diagnosing infections such as chlamydia and gonorrhea (CDC). At the start of the COVID-19 pandemic, during the testing supply shortages, the U.S. Centers for Disease Control and Prevention (CDC) reported critical shortages of NAAT kits and reagents, compelling healthcare providers to ration tests and prioritize tests by risk (CDC report).

Delays in identifying and treating STIs because of limited testing opportunities subsequently led to prolonged transmission. According to WHO, in low- and middle-income countries, many tooling and molecular diagnostics remain unavailable and unaffordable, so the continued adoption of new outbreak-based tests for patients with STIs is limited. The gaps in testing not only limit continuity of care but also affect the adequacy of public health surveillance and efforts to control outbreaks. Moreover, the high cost of advanced diagnostic tests hinders the growth of the market.

Opportunity

How Can Molecular Surveillance Evolve as a Key Opportunity for STD Diagnostics?

A significant opportunity within the sexually transmitted diseases (STD) diagnostics market lies in the incorporation of molecular surveillance and bioinformatics into the normal public health infrastructure. The Centers for Disease Control and Prevention (CDC) has been leveraging Advanced Molecular Detection (AMD) methods, including whole-genome sequencing (WGS) and software tools such as MicrobeTrace, to track STIs, such as gonorrhea and syphilis, at a genomic level. These tools enable quicker and more accurate detection of infection clusters, drug-resistant strains, and transmission patterns, among other benefits, compared to traditional tracking methods.

Incorporating data into public health methods enables health departments to target interventions, enhance outbreak response, and inform public health messaging. Furthermore, the CDC's mention of scaling these AMD capabilities—getting them onto a cloud-based platform and allowing for data sharing across jurisdictions—may enable the global use of these strategies and especially lend assistance to underserved areas. With growing concern about antimicrobial resistance, molecular diagnostics can not only facilitate the early detection of infections but also enable the monitoring of developments in resistance. This type of innovation can represent the future of STD diagnostics as part of predictive, precision public health.

Disease Type/Pathogen Insights

Why is the Chlamydia Trachomatis Segment Leading the Charge?

The Chlamydia trachomatis segment dominated the sexually transmitted diseases (STD) diagnostics market with the largest share of 29.5% in 2024 because of its highest prevalence globally and protocols for necessary testing in many countries. Chlamydia (often asymptomatic) is typically targeted for screening and is especially endorsed with routine stress for younger, sexually active individuals. Detection is also fairly simple, and appropriate tools are widely available for consistent diagnostic testing, primarily nucleic acid testing, which has been widely adopted in healthcare, regardless of the type of organization. Governments have established regulations to follow, such as those mandated by the CDC and WHO, which have led to protocols. Therefore, testing for chlamydia is part of the standard process during STI panels in both private and public healthcare establishments.

The human immunodeficiency virus (HIV) segment is expected to grow at the fastest rate during the projection period, driven by greater global awareness, campaigns for early diagnosis, and widespread access to self-testing kits. The WHO's "Know Your Status" Global campaign initiatives, along with UNAIDS strategies to end AIDS as a public threat by 2030, have encouraged greater regularity and accessibility for HIV testing. Self-testing kits and mobile outreach programs, in addition to requirements for pre-marriage screening in high-burden regions, are helping expand HIV diagnostic opportunities, particularly in sub-Saharan Africa, Southeast Asia, and Latin America.

Diagnostic Technology/Type Insights

What Made Laboratory-Based Tests the Dominant Segment in the Sexually Transmitted Diseases (STD) Diagnostics Market in 2024?

The laboratory-based tests segment dominated the market, accounting for 53.50% share in 2024, as these tests provide the reliability and accuracy required for detecting many pathogens. Many laboratory-based testing methods, including PCR, ELISA, and NAAT, are utilized in hospitals and various types of diagnostic laboratories to detect diverse pathogens. Laboratory tests are highly accurate, in part because they can identify low pathogen loads and are, therefore, standard for confirmatory diagnosis. At this stage, governments and healthcare systems continue to favor laboratory tests due to their regulatory approval, the wealth of data they can generate, and the fact that laboratory results create formal records in healthcare systems, especially in developed markets.

Rapid point-of-care (POC) tests are expected to grow at the fastest rate in the upcoming period. Rapid POC tests offer well-understood benefits, including fast results and ease of use, and do not require electricity or an expert to operate. The latest innovations in lateral flow and immunochromatographic assays are making self-testing easier and drive acceptance, and providing more credibility that broad populations can adopt self-testing as suitable, inclusive with youth, rural populations, and marginalized populations.

Sample Insights

Why Did the Blood Samples Segment Dominate the Market in 2024?

The blood sample segment dominated the sexually transmitted diseases (STD) diagnostics market, holding 44.50% share in 2024. This is mainly due to their key role in the diagnosis of infections such as HIV, syphilis, and hepatitis. Blood samples exhibit a high degree of accuracy in antibody or antigen assessment because they contain antibodies and antigens in the bloodstream. Due to the superior accuracy of blood samples, they are preferred for confirming diagnostic testing results. Healthcare professionals prefer blood samples over other sample types because they are the most reliable source of identifying infections and are suitable for multiple tests.

The urine samples segment is expected to grow at the fastest rate in the upcoming period. The biggest contributor to urine samples popularity is that they are non-invasive, which is preferable for patients, especially adolescents and women. The use of urine-based nucleic acid amplification tests (NAATs), especially those integrated with home collection kits, is the least invasive and best expands access to diagnostics away from clinical visits. The U.S. CDC and similar organizations have endorsed urine testing in screening protocols or at least populations at high risk for infection.

Location of Testing Insights

How Does the Laboratory Testing (Hospitals/Diagnostic Labs) Segment Dominate the Sexually Transmitted Diseases (STD) Diagnostics Market in 2024?

Laboratory testing in hospitals/diagnostic labs continues to be the dominant segment, holding a share of 63.50% in 2024, due to its better accuracy, ability to test for multiple pathogens, integration into healthcare services and systems, and efficient sample handling and record-keeping. These location types become the primary choice for usual screening, confirmatory and treatment monitoring. Institutional testing also provides components of public health reporting and epidemiology regarding infections, both of which are critical for disease containment, public health practice, and future national health policies.

The testing at home/self-testing kits is the fastest-growing segment. The growth of the segment is driven by concerns around privacy, convenience, and the development of more accurate technology with home diagnostics. Over-the-counter testing kits for HIV, chlamydia, and syphilis are gaining approval for use across the globe. The development of programs to encourage discrete, at-home sexual health management—such as sampling kits safety net programs from the UK NHS or FDA-approved at-home HIV self-tests in the US—are allowing more people to access regular testing without going to a clinic, especially those who were previously apprehensive.

End User Insights

Why Hospitals and Clinics are the Dominant End-Users?

The hospital and clinics segment dominated the sexually transmitted diseases (STD) diagnostics market with 44.50% share because they are serving symptomatic patients and those caretakers wish to offer routine screenings at the site of care in one visit, combined with medical consultation and treatment services. In many situations, hospitals offer local, easy access for diagnostic screening and treatment of STDs. Hospitals' advanced infrastructure, availability of trained professionals, and their affiliation with insurance providers enable them to remain the most popular option for both preventive and diagnostic care. Public health campaigns frequently partner with hospitals for mass screening initiatives.

The home user/individual segment is the fastest-growing segment in the market, thanks to consumer-driven healthcare developments and discreet self-testing options. Individuals can access an expanding range of home testing kits (FDA-approved and CE-marked) to support awareness of sexual health and are empowered to take testing into their own hands with tele-consultations, digital health platforms, and e-pharmacies among others, for those who are embracing disruption, or for younger people in shifting demographics who are looking for privacy about their sexual health testing.

Regional Insights

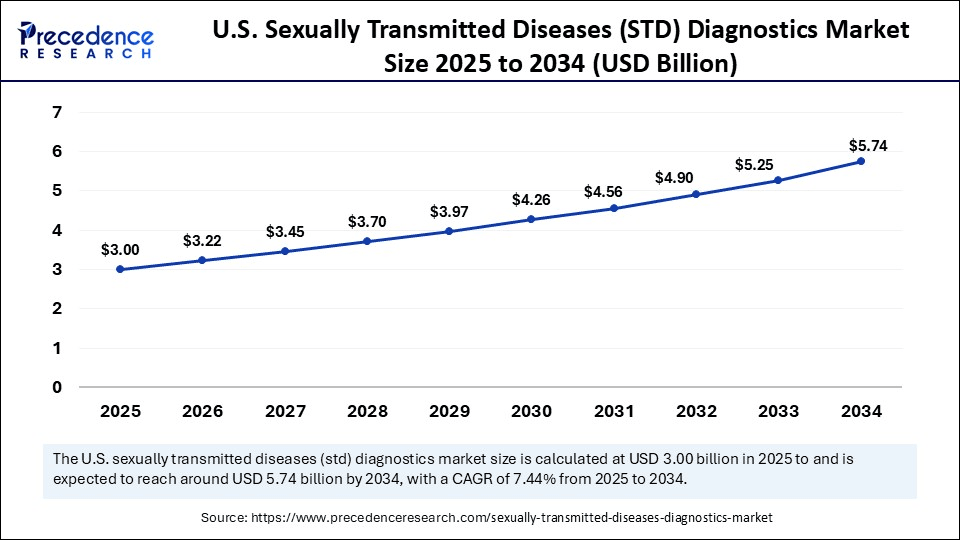

U.S. Sexually Transmitted Diseases (STD) Diagnostics Market Size and Growth 2025 to 2034

The U.S. sexually transmitted diseases (STD) diagnostics market size is exhibited at USD 3.00 billion in 2025 and is projected to be worth around USD 5.74 billion by 2034, growing at a CAGR of 7.44% from 2025 to 2034.

What Made North America the Dominant Region in the Sexually Transmitted Diseases (STD) Diagnostics Market in 2024?

North America dominated the market by holding 37.50% market share in 2024. This is due to high awareness, numerous state and local testing programs, and substantial government support. The CDC routinely figures out funding options to support local health departments to increase access to testing through access to treatment. The U.S. renewed its National Strategic Plan for STIs in 2023 with an emphasis on equitable access to diagnostics, particularly for under-resourced communities, to include rural communities. Another factor in increased access is the introduction of self-testing options, such as mail-in test kits and self-administered rapid tests approved by the FDA, which improves early detection and treatment.

The U.S. is a major player in the market within North America due to the high incidence of infections, which puts significant pressure on healthcare systems to provide quick and accurate diagnostics. Federal agencies like the NIH have moved towards supporting the development of point-of-care technologies in recent years, including artificial aberrations for detecting syphilis and gonorrhea. In addition, the FDA has recently approved the sale of home tests for sexual health disorders, such as chlamydia and HIV, for young individuals, increasing access to testing options. In 2024, the U.S. Postal Service, along with some state health departments, gave away thousands of home STD test kits free of charge in some high-burden states.

In January 2024, QIAGEN announced the U.S. Food and Drug Administration (FDA) clearance for the NeuMoDx CT/NG Assay 2.0, growing its test menu for its integrated PCR-based clinical molecular testing systems NeuMoDx 96 and 288 in the U.S. This assay is designed for direct detection of asymptomatic and symptomatic bacterial infections involving Chlamydia trachomatis (CT) and/or Neisseria gonorrhoeae (NG).

(Source:https://www.mlo-online.com)

U.S. Sexually Transmitted Diseases (STD) Diagnostics Market Trends

The U.S. sexually transmitted diseases (STDs) diagnostics market is expanding significantly due to rising infection rates and increased public health initiatives. Shift towards rapid, point-of-care, and convenient home-based testing kits for enhanced patient privacy and faster treatment initiation. Technological advancements, particularly in highly sensitive molecular diagnostics and multiplex assays, are improving testing accuracy and efficiency.

Why Europe is the Second-Largest Market?

Europe is the second-largest market. The growth of the market within Europe is driven by the rising diagnostic rates of STDs, particularly with the increase of infections in a number of Western countries. The EU governments are now announcing initiatives with NGO assistance, hence more comprehensive programmes for risk-free testing there are emerging now. The European Centre for Disease Prevention and Control (ECDC) has continued to revise regional surveillance information and has also provided support to primary care in bringing rapid tests into practice. Public health funded STI screening is being extensively supported by schools, universities and community centre outreach. SOME EU countries have launched online testing portals. There has been an improvement in privacy and outreach, as people can now order their test kits discreetly and receive their final results electronically.

Germany is leading the charge with its well-developed laboratory infrastructure and preventive, as well as risk-based, screening models. The Federal Centre for Health Education (BZgA) regularly conducts nationwide campaigns, such as "LIEBESLEBEN," to educate the public about STIs and promote routine testing. The German clinics have both public and private PCR and rapid diagnostic testing. Some insurers have established reimbursement for self-test kits. Germany is also supporting diagnostic-related research and continually advancing opportunities for diagnostic protocols to be updated and incorporated into the healthcare system to counter the increasing threats of STIs.

Germany Sexually Transmitted Diseases (STD) Diagnostics Market Trends

Germany's sexually transmitted diseases (STD) diagnostics market is growing consumer demand for convenient self-testing kits for privacy. A robust healthcare system and high public awareness, driven by government campaigns.

- In December 2024, OraSure Technologies acquired Sherlock Biosciences to accelerate the development of a novel CRISPR-based at-home test for chlamydia and gonorrhea (CT/NG), which is expected to provide results in less than 30 minutes. (https://orasure.gcs-web.com)

What Factors Contribute to Sexually Transmitted Diseases (STD) Diagnostics Market Within Asia Pacific?

Asia Pacific is the fastest-growing region in the market, driven by rising infection rates, growing awareness, and government-supported initiatives for screening. Governments in parts of the Asia Pacific, such as India, China, and Thailand, have phased in diagnostic services through public hospitals, mobile clinics, and subsidized test kits. For example, the National AIDS Control Organisation (NACO) in India has rolled out HIV and syphilis testing in thousands of primary healthcare centers, including reaffirming community-led interventions to vulnerable populations.

The rollout of services in China is significantly improving through the use of advanced technology and national reform. Several urban hospitals have begun adopting Artificial Intelligence-powered diagnostic aids introduced by health authorities to expedite the processing of results. The province has also mobilized further expansion of rural testing using mobile vans and partnerships with NGOs to mitigate outreach to high-risk groups such as adolescents and migrant workers. With strong government support, rapid technology adoption, and significant infrastructure, China is leading the charge.

China Sexually Transmitted Diseases (STD) Diagnostics Market Trends

China's rising incidence of infections and proactive government public health initiatives. Rapid expansion of convenient self-testing kits and home-based sample collection to overcome social stigma and improve accessibility. Strong government support and technological innovation are positioning China's growth

Value Chain Analysis of Sexually Transmitted Diseases (STD) Diagnostics Market

- Research & Development (R&D) and Design

This initial stage focuses on the discovery and design of novel diagnostic methodologies, including advanced molecular technologies like Nucleic Acid Amplification Tests (NAATs), and immunodiagnostic platforms like ELISA.

Key Players: Abbott Laboratories, F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., Visby Medical. - Raw Material Sourcing & Component Manufacturing

This stage involves procuring biological and chemical raw materials, such as antibodies, antigens, and DNA/RNA probes, and manufacturing critical components like reagents, test strips, and integrated circuits. - Assembly, Integration & Testing (AIT)

This stage includes the manufacturing of analyzers, the assembly of diagnostic kits and cartridges, and the integration of hardware and software for laboratory and POC devices.

Key Players: Becton, Dickinson and Company (BD), Danaher Corporation (Cepheid), Hologic, Inc. - Distribution & Sales

This stage focuses on bringing diagnostic products to market through various channels, including hospitals, diagnostic laboratories, and direct-to-consumer platforms for home testing kits.

Key Players: Abbott Laboratories

Top Companies in the Sexually Transmitted Diseases (STD) Diagnostics Market & Their Offerings

- Abbott Laboratories: Abbott is a major global player offering a broad portfolio of in vitro diagnostics for STDs, including highly sensitive molecular tests and rapid point-of-care (POC) assays. Its contributions focus on providing accessible and efficient testing solutions for both laboratory and decentralized settings.

- F. Hoffmann-La Roche AG: Roche is a leader in developing advanced molecular diagnostics for STDs, providing high-volume, automated testing platforms for clinical laboratories. The company focuses on improving workflow efficiency and accuracy in the detection of a wide range of sexually transmitted infections.

- Becton, Dickinson and Company (BD): BD contributes significantly to the STD market with integrated systems for sample collection and advanced molecular testing platforms like the BD MAX system. It focuses on streamlined laboratory workflows and highly sensitive assays for detecting common STIs.

- Hologic, Inc.: Hologic is a dominant provider of high-throughput molecular diagnostics for STDs, particularly chlamydia and gonorrhea, using its Panther system. The company focuses on automation and high precision for large-scale screening efforts.

- Thermo Fisher Scientific Inc.: Thermo Fisher provides a comprehensive range of products for STD diagnostics, including instruments, reagents, and kits used in clinical research and testing laboratories.

- bioMerieux SA: bioMérieux specializes in infectious disease diagnostics, offering a range of automated solutions for STD testing in clinical settings. The company focuses on rapid results and high diagnostic performance for effective patient management.

- Siemens Healthineers: Siemens Healthineers provides a broad range of diagnostic solutions for STDs, integrated within its extensive portfolio of clinical laboratory instruments. Its focus is on operational efficiency and reliable testing for a wide range of infections.

- Bio-Rad Laboratories, Inc.: Bio-Rad contributes to the STD market with various diagnostic products, including immunoassay and molecular tests for diseases like HIV and hepatitis. The company focuses on robust and reliable testing solutions for blood screening and clinical diagnostics.

- Qiagen N.V.: Qiagen is a leading provider of sample and assay technologies, offering integrated solutions for molecular testing of STDs on its QIAstat-Dx platform. It focuses on rapid, high-quality results from a single sample for multiple targets.

- Cepheid (a Danaher company): Cepheid is known for its rapid, point-of-care (POC) testing capabilities using the GeneXpert system, offering quick and accurate results for STDs like CT/NG in clinic settings. Its contributions focus on decentralized testing that enables same-visit diagnosis and treatment.

- OraSure Technologies, Inc.: OraSure specializes in rapid diagnostics and specimen collection devices, notably for HIV testing, with a focus on non-invasive oral fluid collection methods. The company is a key player in the growing self-testing and home-care segments.

- Trinity Biotech: Trinity Biotech develops, manufactures, and distributes medical diagnostic products, including a range of tests for infectious diseases such as HIV and syphilis. It offers solutions for various testing environments, from laboratories to rapid POC settings.

- Chembio Diagnostics, Inc.: Chembio specializes in point-of-care diagnostics, particularly for infectious diseases like HIV and syphilis, using its patented Dual Path Platform (DPP) technology. It focuses on simple-to-use, rapid, and accurate testing solutions.

- GenMark Diagnostics (now part of Roche): GenMark, acquired by Roche, specialized in multiplex molecular diagnostics, providing rapid testing for various infectious diseases including STDs. Its ePlex system offered syndromic panel testing for simultaneous detection of multiple pathogens.

- QuidelOrtho Corporation: QuidelOrtho is a major player offering a broad range of diagnostic solutions, including rapid immunoassays and molecular tests for STDs. The company focuses on delivering innovative diagnostic technologies for both clinical and POC use.

- Fujirebio (H.U. Group Holdings): Fujirebio is a leading international diagnostics company providing high-quality assay kits and automated instruments for clinical testing, including tests for STDs like HIV. It contributes with reliable and specialized diagnostic solutions in infectious disease testing.

- MedMira Inc.: MedMira develops rapid flow-through diagnostic technologies, offering quick and convenient tests for HIV and hepatitis. The company focuses on developing easy-to-use, rapid screening tools for diverse settings.

- Sekisui Diagnostics: Sekisui provides a variety of diagnostic products to clinical laboratories and point-of-care testing sites globally. Its contributions include assays and instruments used in the detection of infectious diseases, including some STDs.

- Nanjing Vazyme Medical Technology Co., Ltd.: This Chinese company focuses on R&D and manufacturing of diagnostic products and life science reagents, including PCR-based test kits for STDs. It contributes to the market by providing innovative and cost-effective domestic diagnostic solutions.

- Atlas Genetics (now part of Binx Health): Atlas Genetics (now Binx Health) focused on developing rapid, near-patient molecular testing platforms for STIs

Sexually Transmitted Diseases (STD) Diagnostics Market Companies

- Abbott Laboratories

- F. Hoffmann-La Roche AG

- Becton, Dickinson and Company (BD)

- Hologic, Inc.

- Thermo Fisher Scientific Inc.

- bioMérieux SA

- Siemens Healthineers

- Bio-Rad Laboratories, Inc.

- Qiagen N.V.

- Cepheid (a Danaher company)

- OraSure Technologies, Inc.

- Trinity Biotech

- Chembio Diagnostics, Inc.

- GenMark Diagnostics

- QuidelOrtho Corporation

- Fujirebio (H.U. Group Holdings)

- MedMira Inc.

- Sekisui Diagnostics

- Nanjing Vazyme Medical Technology Co., Ltd.

- Atlas Genetics (now part of Binx Health)

Recent Developments

- In January 2025, Roche announced that the U.S. Food and Drug Administration (FDA) has granted 510(k) clearance and for its cobas liat sexually transmitted infection (STI) multiplex assay panels. These panels, including tests for chlamydia and gonorrhea (CT/NG) and chlamydia, gonorrhea and Mycoplasma genitalium (CT/NG/MG), enable clinicians to diagnose and differentiate between multiple STIs with a single sample.

(Source: https://www.roche.com)

- In February 2025, Abbott received 510(k) clearance from the U.S. Food and Drug Administration for its self-collected molecular test for sexually transmitted infections. The Simpli-COLLECT STI Test is intended for self-collection of urogenital specimens in home settings and testing in a clinical laboratory for detection of nucleic acids from Chlamydia trachomatis (CT) and Neisseria gonorrhoeae (GC).

(Source: https://en.caclp.com)

Segments Covered in the Report

By Disease Type/Pathogen

- Chlamydia trachomatis

- Neisseria gonorrhoeae (Gonorrhea)

- Human Immunodeficiency Virus (HIV)

- Human Papillomavirus (HPV)

- Herpes Simplex Virus (HSV-1 & HSV-2)

- Syphilis (Treponema pallidum)

- Trichomoniasis

- Hepatitis B & C

- Mycoplasma genitalium

- Others

By Diagnostic Technology/Type

- Laboratory-Based Tests

- PCR (Polymerase Chain Reaction)

- ELISA (Enzyme-Linked Immunosorbent Assay)

- NAAT (Nucleic Acid Amplification Test)

- Cell Culture

- Rapid Point-of-Care (POC) Tests

- Lateral Flow Assays

- Immunochromatographic Tests

- Other Technologies

- Western Blot

- Direct Fluorescent Antibody (DFA)

- Flow Cytometry

By Sample Type

- Blood Samples

- Urine Samples

- Swab Samples (Oral, Vaginal, Urethral)

- Cervical/Vaginal Lavage

- Semen/Prostatic Fluid

By Location of Testing

- Laboratory Testing (Hospitals/Diagnostic Labs)

- Clinics & Public Health Centers

- Home-Based Testing / Self-testing Kits

By End User

- Hospitals & Clinics

- Diagnostic Laboratories

- Home Users / Individuals

- Government & Public Health Agencies

- NGOs and STI Programs

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting