What is the Ship Leasing Market Size?

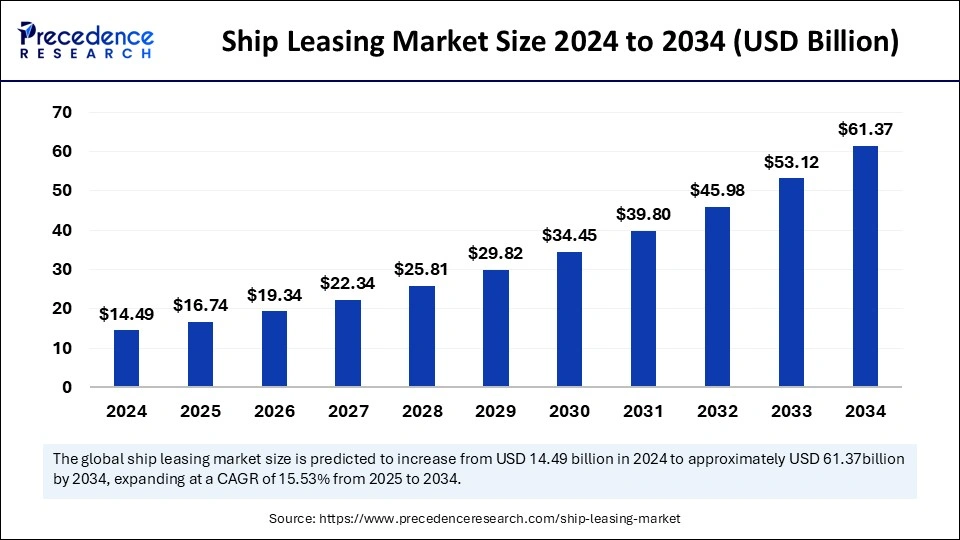

The global ship leasing market size was estimated at USD 16.74 billion in 2025 and is predicted to increase from USD 19.34 billion in 2026 to approximately USD 68.88 billion by 2035, expanding at a CAGR of 15.20% from 2026 to 2035. The global market growth is attributed to the increase in the transportation of heavy cargo and the increasing growth in international trade.

Ship Leasing Market Key Takeaways

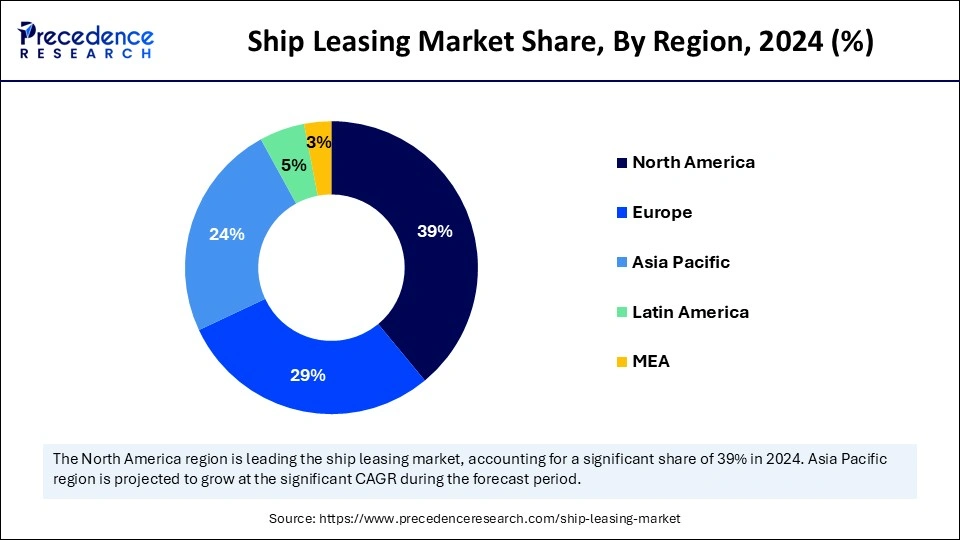

- North America dominated the global market with the largest market share of 39% in 2025.

- Asia Pacific is expected to grow at the fastest rate during the forecast period.

- By lease type, the financial lease segment contributed the highest market share in 2025.

- By lease type, the full-service lease segment is expected to grow at the fastest CAGR during the forecast period.

- By type, the bareboat charter segment captured the biggest market share in 2025.

- By application, the container ships segment generated the major market share in 2025.

- By application, the bulk carriers segment is expected to grow rapidly during the forecast period.

Market Overview

The ship leasing market plays an important role in the international transportation and trade landscape. It includes the practice of leasing ships, primarily to commodities and goods across the globe. This market is becoming an integral part of the global trade infrastructure and has experienced significant growth. Ship leasing provides a cost-effective solution for companies. The market encompasses various types of vessels, such as oil tankers, bulk carriers, and container ships.

The dynamics of the ship leasing market are driven by factors such as environmental regulations, international trade agreements, and the global economic situation and increasing robust growth. In addition, the increasing volume of trade and popular e-commerce platforms and the increasing need for sea-borne transportation services across the globe are expected to enhance market growth during the forecast period. Furthermore, according to market demands, ship leasing allows companies to adjust their fleets, which further enhances operational efficiency.

How is Artificial Intelligence (AI) Changing the Ship Leasing Market?

Artificial Intelligence is revolutionizing ship leasing operations through route optimization, autonomous navigation, and predictive maintenance. AI optimizes operational costs, maintenance schedules, and fuel efficiency and enhances forecasting accuracy. AI technologies analyze extensive datasets, such as port congestion, traffic patterns, and weather conditions, to determine the most efficient shipping routes. This process reduces operational costs and fuel consumption. In addition, shipping companies can continuously monitor the health of their vessels by integrating AI with the Internet of Things. AI plays an important role in safety. By automating the reporting and monitoring processes, AI helps ensure compliance with international regulations. Thereby, the adoption of AI technologies into ship leasing is transforming the ship leasing market, making it more innovative, responsive, and efficient.

Ship Leasing Market Growth Factors

- The increase in transportation of heavy cargo, increasing growth in international trade, and rising demand for cargo transportation through marines are expected to drive market growth.

- The increase in the number of ship leases and the rise in demand for secure and safe transportation are anticipated to drive the growth of the ship leasing market during the forecast period.

- The market for environmentally friendly boats with increased energy efficiency and reduced emissions is propelled by sustainability programs and strict environmental rules.

- The increasing need for marine transportation of commodities, which is brought on by increased international trade, economic expansion, and consumer spending, further drives the growth of the ship leasing market.

- Ship leasing provides fleet managers with the freedom to improve their vessel capacity in response to changes in organizational requirements and market demand.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 68.88 Billion |

| Market Size in 2025 | USD 16.74 Billion |

| Market Size in 2026 | USD 19.34 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 15.20% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Lease Type, Type, Application, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The increasing environmental regulations

As operators seek to address sustainability requirements without heavy investment in new eco-friendly vessels, environmental regulations are contributing to the growth of ship leasing. Ship leasing helps operators adhere to regulations such as the IMO's 2020 sulfur cap and enables them to access compliant ships without upfront costs. In addition, the pressure to manage fleets efficiently is another factor driving the growth of the ship leasing market. Shipping companies need the ability to adjust fleet capacity based on changing demand as global trade grows. Furthermore, modern vessels need ship leasing, and significant investment offers access to advanced ships.

Restraint

High cost related to regulatory compliance

Due to compliance with strict environmental rules, ship lessees and owners may increase operating costs, such as those pertaining to ballast water management and emissions requirements. In addition, the market may be hindered by the requirement to adapt old vessels and invest in new technology with these regulatory restrictions.

Opportunity

Rising technological advancements

The rising technological advancements, such as digital ship management systems and autonomous vessels, have increased the demand for ship leasing. Ship leasing enables operators to access cutting-edge ships without making significant capital investments. These innovations provide operational efficiency. In addition, emerging markets in various regions are also a major opportunity. As demand for shipping capacity increases with infrastructure development and growing trade, these regions create major opportunities. Without the financial strain of outright purchases, leasing enables companies to expand their fleets.

Segment Insights

Lease Type Insights

The financial lease segment dominated the ship leasing market in 2025. The segment growth in the market is attributed to the various benefits associated with financial leases, such as ownership options, fixed payments, easy upgrades, preserved capital, and more. Financial leasing enables businesses to access assets without a large upfront payment. It makes it easier to allocate resources and manage cash flow effectively. The ship leasing sector in the IFSC aims to realize the vision of ‘Ship Acquisition Financing and Leasing.

The full-service lease segment is expected to grow at the fastest rate during the forecast period. The segment growth in the market is driven by the increasing company shift towards all-inclusive solutions to avoid the complexities of managing vessel operations and increasing operational costs. Without the burden of day-to-day management, the demand for this type of lease grew as shipping companies focused on improving operational efficiency. It offers reduced risks and flexibility.

Type Insights

The bareboat charter segment dominated the ship leasing market in 2025. The segment growth in the market is attributed to the increasing versatility and widespread adoption across several industries. The flexibility to customize operations and autonomy of bareboat charters made it an ideal choice for sectors such as cargo transportation, offshore exploration, and shipping. In addition, by providing access to specialized and advanced vessels, bareboat charters delivered financial benefits. These charters served operators aiming to use fuel-efficient or newer ships coupled with advanced technologies such as automated systems and LNG engines. In addition, the strategic significance of bareboat charters and their extensive adoption across diverse maritime applications are further expected to drive segment growth.

Application Insights

The container ships segment dominated the ship leasing market. Container ships allow even business owners and small manufacturers to take advantage of economies of transporting their products to consumers across the globe. Various people understand the process on a detailed level, such as operating fuel consumption, fuel costs, container shortage, port congestion, supply chain, and costs. In addition, segment growth in the market is attributed to the increasing number of large vessels that carry dry cargo. Container ships use containers that are standardized in terms of container ship capacity and size, unlike general cargo ships. Standard-size containers enable each ship to carry a maximum amount of goods and maximize cargo space.

The bulk carriers segment is expected to grow rapidly during the forecast period. Bulk carriers help transport the raw materials and are workhorses of the merchant fleet. Bulk carriers provide the most environmentally friendly method of transporting large volumes of dry cargo long distances.

Regional Insights

What is the U.S. Ship Leasing Market Size?

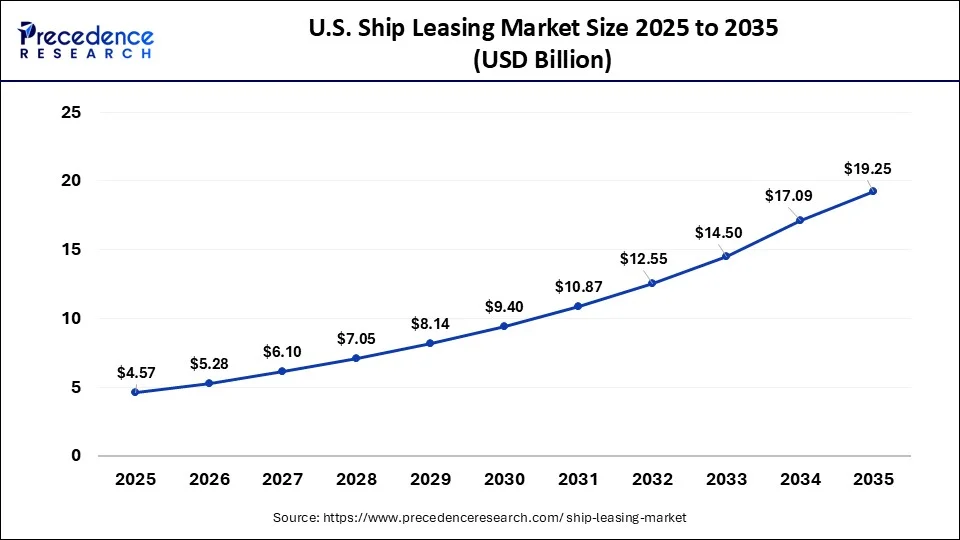

The U.S. ship leasing market size was exhibited at USD 4.57 billion in 2025 and is projected to be worth around USD 19.25 billion by 2035, growing at a CAGR of 15.47% from 2026 to 2035.

North America dominated the ship leasing market in 2025. The market growth in the region is attributed to the rising robust growth and various advantages such as a well-established shipping network, advanced infrastructure, and strategic location. In addition, the increasing need for environmentally compliant ships, the growing offshore oil and gas exploration, and the rise in maritime trade.

The U.S. dominates the North American market. The market growth in the U.S. is driven by the increasing shift towards more sustainable practices, combined with the need for operational flexibility, the growing emphasis on greener technologies, and the availability of specialized vessels, such as oil tankers.

Asia Pacific is expected to grow at the fastest rate during the forecast period. The ship leasing market growth in the region is attributed to the increasing demand for ships across various industries, increasing shipping activities, and expanding trade routes. In addition, the rising demand for infrastructure development and shipping services is further anticipated to propel the growth of the ship leasing market in the region. China, India, Japan, and South Korea are the fastest-growing countries.

Europe Maritime Asset Leasing Industry Analysis & Forecast

Europe shows a significant growth during the forecast period. The European maritime industry is under intense pressure to comply with strict International Maritime Organization (IMO) and even EU environmental regulations. Leasing offers an immediate route for operators to obtain new, dual-fuel, or eco-efficient vessels without vast upfront capital expenditure. Europe boasts some of the world's most advanced, as well as well-connected ports and even shipbuilding, ensuring a high need for vessel financing and leasing.

Investment Outlook for the Latin America Ship Leasing Market

Latin America shows a notable growth during the forecast period. It is driven by growing regional trade, rising demand for modern, eco-friendly vessels, and the demandfor capital-efficient financing such as sale-and-leaseback for fleet modernization.

Value Chain Analysis for the Ship Leasing Market

- Infrastructure Development: By creating the necessary physical, regulatory, as well as financial framework for investors to deploy, manage, and even monetize vessel assets. It shifts the industry from capital-intensive ownership to flexible "asset-light" models, allowing faster fleet modernization and expansion.

Key Players: ICBC Financial Leasing, CMB Financial Leasing, Minsheng Financial Leasing. - Warehousing and Inventory Management: It acts as the logistical backbone, ensuring that containers, vessels, and their critical components are available, maintained, along with legally compliant.

Key Players: Triton International Limited, Textainer Group, Seaspan Corporation - Last-Mile Delivery Services: It acts as the vital final, land-driven leg of the international maritime supply chain, directly impacting the need for, and operational efficiency of, vessels and also containers within the market.

Key Players: Minsheng Financial Leasing Co., Ltd., Global Ship Lease, Inc., Seaspan Corporation

Ship Leasing Market Companies

- Navios Maritime Partners: Navios Maritime Partners L.P. offers modern, environmentally friendly tonnage, like LNG dual-fuel vessels and ECO-type ships, usually contracted under long-term agreements with reputable partners, thus delivering stable cash flow.

- Atlas Corp: Atlas Corp offers creative outsourcing options to vessel ownership, combining modern, high-quality vessel leasing with industry-leading ship management services.

- TBS International: TBS International acts as an owner, operator, and manufacturer of maritime transportation, along with logistics services, rather than a financial leasing firm. Their providing for the ship leasing market focuses on the operational, chartering, and even technical management of vessels.

- Teekay Corporation: Teekay Corporation provides a comprehensive suite of services to the ship leasing and marine transportation market, thus centered on operating a modern fleet of conventional and specialized tankers.

Other Major Key Players

- Euroseas

- Zodiac Maritime

- Star Bulk Carriers

- Brokers' Circle

- Costamare

- Danaos Corporation

- Horizon Shipowners

- Seaspan Corporation

- Global Ship Lease

Recent Developments

- In February 2025, Global Ship Lease, Inc., a containership charter owner, announced that it will hold a conference call to discuss the Company's results for the fourth quarter and full year 2024.

- In February 2025, Merichem Technologies announced its SULFURTRAP Lead/Lag Vessel Skid-Mounted Systems are available for lease. SULFURTRAP has long been known as a preeminent hydrogen sulfide treatment option for gas streams through an innovative lease program provided by Merichem Technologies.

- In April 2023, Sabrina Chao and Kenneth Lam launched a ship-leasing firm. The aim behind this launch was to provide long-term sustainable and responsible capital to shipping.

Segments Covered in the Report

By Lease Type

- Financial Lease

- Full-Service Lease

By Type

- Real-Time Lease

- Periodic Tenancy

- Bareboat Charter

- Other Types

By Application

- Container Ships

- Bulk Carriers

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting