What is the Stereotactic Surgery Devices Market Size?

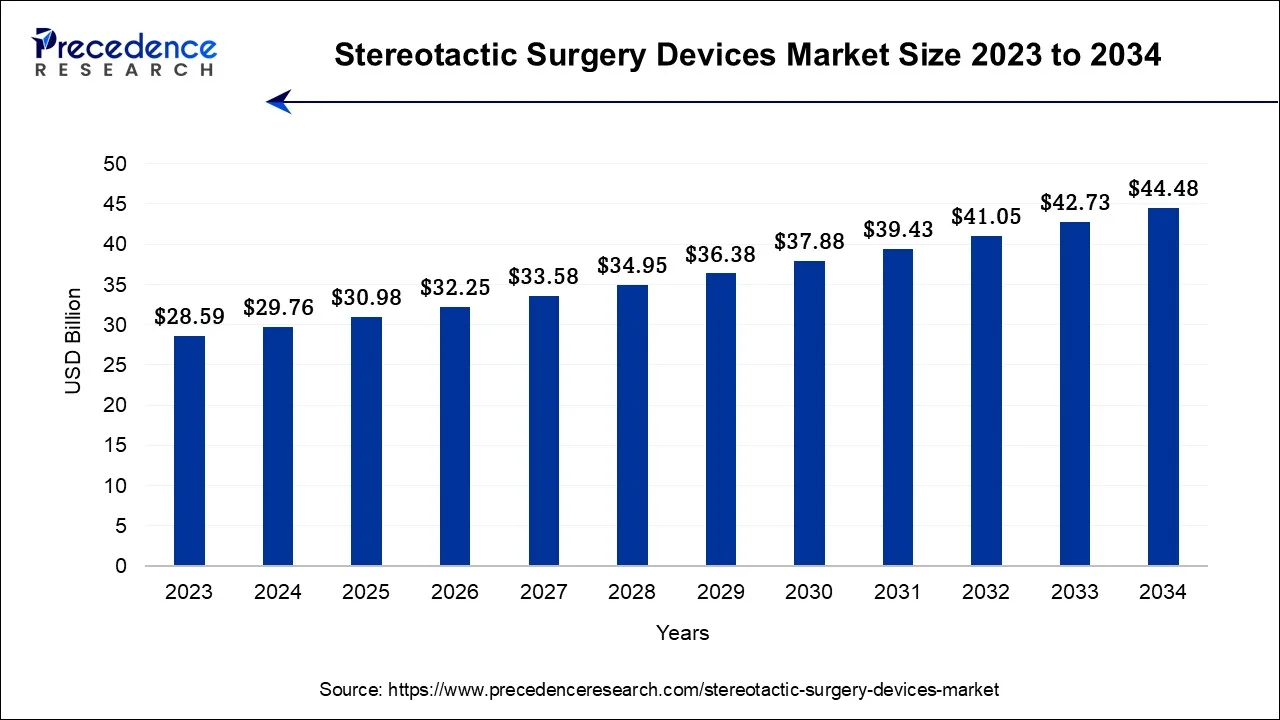

The global stereotactic surgery devices market size is calculated at USD 30.98 billion in 2025 and is predicted to increase from USD 32.25 billion in 2026 to approximately USD 46.18 billion by 2035, expanding at a CAGR of 4.07% from 2026 to 2035.

Stereotactic Surgery Devices Market Key Takeaways

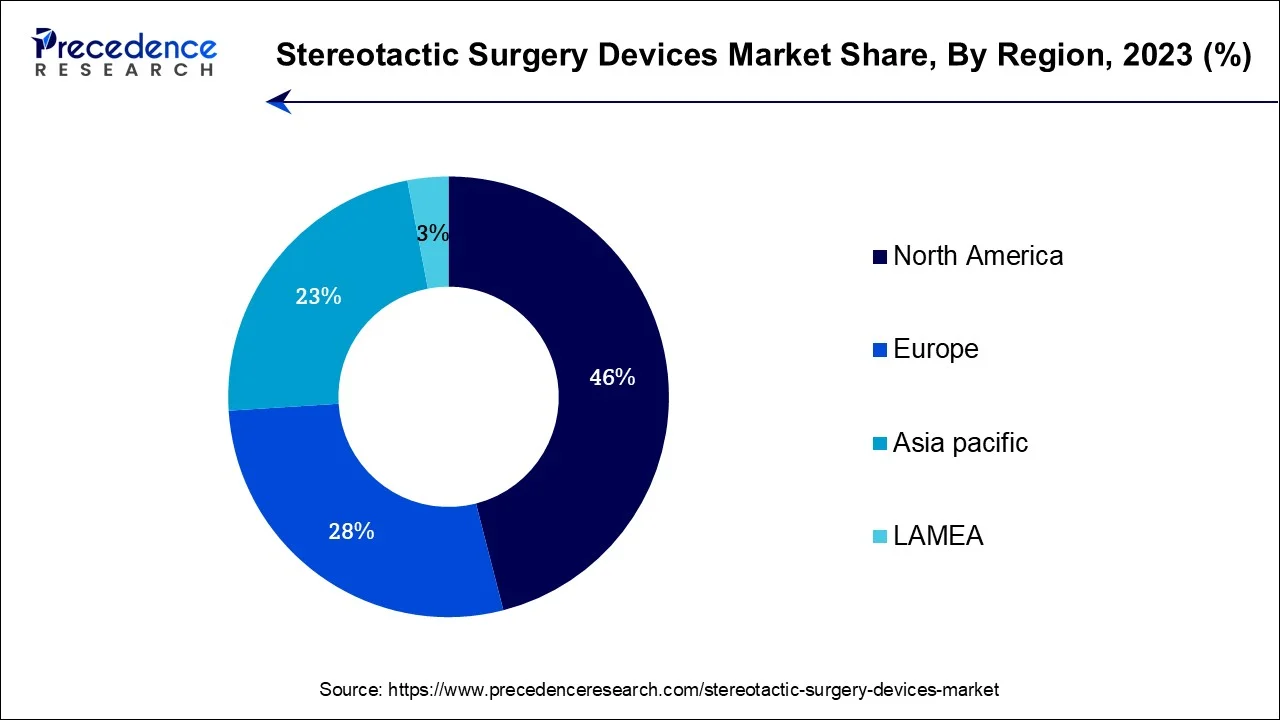

- North America contributed the largest market share of 46% in 2025.

- Asia-Pacific region is expected to expand at the fastest CAGR during the forecast period.

- By Product, the PBRT segment led the global market with the largest market share of 86.1% in 2025.

- By Product, the cyberKnife segment is anticipated to grow at a notable CAGR of 6.8% between 2025 and 2035.

- By Application, the breast segment accounted the largest market share of 28.5% in 2025.

- By Application, the lung segment is expected to grow at the fastest rate over the projected period.

What are Stereotactic Surgery Devices?

- The stereotactic surgery devices market encompasses medical tools and equipment used in precision-based surgical procedures, allowing for highly accurate and minimally invasive interventions in the brain and other areas of the body.

- This market is characterized by constant technological advancements, such as robotic assistance and image-guided systems, aimed at enhancing surgical precision and patient outcomes. It serves a niche but growing demand for treatments of neurological disorders, tumors, and functional disorders, driven by the increasing adoption of minimally invasive surgical techniques and a rising aging population.

How is AI contributing to the Stereotactic Surgery Devices Industry?

The use of artificial intelligence to its full potential in sterotactic surgical procedures has led to image analysis, automated segmentation, personalized planning, real-time navigation, motion management, robotic precision, prediction of outcomes, postoperative monitoring, and immersive surgical training, which altogether have increased procedural safety, accuracy, efficiency, and consistency while supporting clinicians during the complex procedure.

Stereotactic Surgery Devices Market Growth Factors

- The stereotactic surgery devices market is witnessing notable growth due to a convergence of factors. The market encompasses specialized medical equipment utilized in precision-based surgical procedures, particularly in neurological interventions.

- A significant growth driver for this industry is the rising prevalence of neurological disorders and brain tumors, fueled in part by an aging population. Additionally, the increasing preference for minimally invasive surgical techniques is boosting demand for stereotactic surgery devices, as they offer greater precision and reduced patient trauma.

- Innovations in technology, such as robotic-assisted systems and advanced imaging, are transforming the landscape of stereotactic surgery. These advancements enable surgeons to perform complex procedures with unprecedented accuracy, enhancing patient outcomes and reducing recovery times.

- Moreover, the expanding applications of stereotactic surgery devices beyond neurological conditions, such as in the treatment of certain cancers and functional disorders, are opening up new avenues for growth.

- Nonetheless, the industry faces challenges, with a significant obstacle being the substantial costs linked to procuring and upkeeping stereotactic surgery equipment, which can restrict its availability in certain healthcare settings. Additionally, regulatory approval processes and the need for specialized training for healthcare professionals can slow down market expansion. Ensuring affordability and addressing these barriers are vital for sustained growth.

Market Outlook

- Industry Growth Overview: Market growth is sped up due to the increase in neurological disorders and cancers, and the preference for efficient, less invasive procedures.

- Sustainability Trends: The sustainability drive is focusing on the use of equipment that can be reused, operating rooms that are energy efficient, and the adoption of surgical technologies that are friendly to the environment in the healthcare sector.

- Global Expansion:Global expansion is still going on, with North America being the main market for adoption, while Asia Pacific is progressing thanks to infrastructure development and health care investments.

- Major Investors: Market growth will be supported by investors like Medtronic, Elekta AB, Varian Medical Systems, Siemens Healthineers, and Accuray Incorporated.

Market Scope

| Report Coverage | Details |

| Market Size by 2025 | USD 30.98Billion |

| Market Size by 2026 | USD 32.25 Billion |

| Market Size in 2035 | USD 46.18Billion |

| Growth Rate from 2025 to 2035 | CAGR of 4.07% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising prevalence of neurological disorders and minimally invasive surgery trend

The escalating prevalence of neurological disorders is a pivotal factor driving the demand for stereotactic surgery devices. As neurological conditions like Parkinson's disease, brain tumors, and epilepsy become more widespread, the need for precise and minimally invasive treatment options grows. Stereotactic surgery devices offer a tailored approach for addressing these disorders, enabling surgeons to target affected areas with exceptional precision. This rising demand is propelling market growth, as healthcare providers and patients increasingly recognize the effectiveness of stereotactic surgery in improving outcomes and quality of life for individuals grappling with neurological disorders.

Moreover, the minimally invasive surgery trend is significantly surging the demand for stereotactic surgery devices industry. Patients and healthcare providers increasingly favor minimally invasive techniques for their reduced post-operative complications, faster recovery times, and improved patient outcomes. Stereotactic surgery devices play a pivotal role in this trend, enabling precise and minimally invasive interventions in conditions like brain tumors and neurological disorders. As the demand for less invasive procedures continues to rise, the market for stereotactic surgery devices is expanding, with a growing number of healthcare facilities incorporating these advanced technologies into their surgical practices to meet patient preferences and improve clinical outcomes.

Restraints

High cost, complexity and training

The high cost associated with stereotactic surgery devices presents a significant restraint on market demand. These devices require substantial capital investment not only for their purchase but also for ongoing maintenance and operational expenses. This financial burden can deter healthcare facilities, particularly those with limited budgets, from adopting these advanced technologies. Additionally, it can limit patient access to these precise and minimally invasive surgical options. To mitigate this restraint, manufacturers and healthcare institutions must explore cost-effective solutions and financing options to make stereotactic surgery devices more accessible and affordable, ultimately stimulating market demand.

Moreover, Complexity and training requirements present significant constraints on the market demand for stereotactic surgery devices. These highly specialized devices necessitate skilled healthcare professionals trained in their operation. The scarcity of trained personnel can limit the adoption of stereotactic surgery techniques, especially in underserved areas. The time and resources required for comprehensive training can also deter medical institutions from investing in these technologies. This constraint underscores the importance of developing effective training programs and expanding the pool of qualified professionals to unlock the full potential of stereotactic surgery devices and make them more accessible to patients worldwide.

Opportunities

Technological advancements and telemedicine integration

Technological advancements play a pivotal role in surging the market demand for stereotactic surgery devices. These innovations continually enhance the precision, safety, and efficacy of procedures, making them more attractive to both healthcare providers and patients. Advanced imaging technologies enable better visualization, while robotic-assisted systems offer greater surgical dexterity. Real-time monitoring and data analytics further improve surgical outcomes. As these technologies evolve, they instill confidence in healthcare professionals, boost patient satisfaction, and drive the adoption of stereotactic surgery devices. Consequently, the market experiences increased demand as the industry stays at the forefront of cutting-edge medical innovations.

Moreover, Telemedicine integration can significantly boost the market demand for stereotactic surgery devices by expanding their reach and accessibility. By incorporating these devices into telemedicine platforms, healthcare providers can offer remote consultations, guidance, and even surgical procedures. This integration enhances access to specialized care, especially in underserved or remote areas, driving demand for stereotactic surgery devices. It not only facilitates real-time communication between surgeons and patients but also enables collaboration among medical professionals, ultimately increasing the utilization of these devices for precise and minimally invasive procedures, further fueling market growth.

Segment Insights

Product Insights

The PBRT segment has held 86.1% revenue share in 2025. PBRT (Proton Beam Radiation Therapy) is a specialized technology used in the stereotactic surgery devices market. It employs proton beams to precisely target and irradiate cancerous tumors, minimizing damage to surrounding healthy tissues. This technology has gained prominence due to its ability to deliver highly focused radiation, reducing side effects and improving treatment outcomes.

In recent trends, PBRT (Proton Beam Radiation Therapy) has witnessed growing adoption within the field of stereotactic surgery, specifically for addressing intricate and deeply located tumors in the brain and other areas of the body. The increased demand for PBRT is attributed to its exceptional precision and reduced toxicity when compared to conventional radiation therapy methods. This development signifies a significant advancement in the realm of stereotactic surgery, promising improved treatment outcomes and minimize side effects for patients.

The cyberKnife segment is anticipated to expand at a significantly CAGR of 6.8% during the projected period. CyberKnife is a cutting-edge stereotactic surgery device used for non-invasive, precise, and targeted radiation therapy. It combines robotics and advanced imaging to deliver high doses of radiation to specific targets within the body, minimizing damage to surrounding healthy tissue. In the stereotactic surgery devices market, the CyberKnife system represents a growing trend towards advanced, image-guided, and minimally invasive treatments.

Its increasing adoption is driven by its ability to treat various conditions, including cancerous and non-cancerous tumors, with pinpoint accuracy, reduced treatment duration, and fewer side effects, making it a key player in the evolving landscape of stereotactic surgery.

Application Insights

The breast segment is anticipated to hold the largest market share of 28.5% in 2023. In the field of breast surgery, stereotactic surgery devices market are utilized for minimally invasive procedures like breast biopsies and wire-localization procedures. These devices enable precise targeting of breast lesions, ensuring accurate tissue sampling and guiding surgical interventions. Trends in this sector include an increasing emphasis on early breast cancer detection, prompting the demand for stereotactic surgery devices in breast screening programs.

Additionally, advancements in imaging and navigation technologies have enhanced the accuracy of breast procedures, reduced patient discomfort and improving diagnostic outcomes. The integration of artificial intelligence and 3D imaging further augments the capabilities of these devices, positioning them as essential tools in modern breast surgery and diagnosis.

The lung segment is projected to grow at the fastest rate over the projected period. Lung stereotactic surgery involves the precise, image-guided treatment of lung tumors, often using minimally invasive techniques. This approach allows for highly targeted radiation therapy or surgical interventions, minimizing damage to surrounding healthy tissue. In recent trends, the stereotactic surgery devices market has seen a notable increase in lung applications.

The rising incidence of lung cancer, coupled with advancements in imaging and robotics, has fueled demand. Stereotactic surgery devices for lung applications enable quicker recovery, reduced side effects, and improved outcomes, making them an increasingly preferred choice for both patients and healthcare providers. This trend is expected to continue as early lung cancer detection and minimally invasive treatment options gain prominence in the healthcare landscape.

Regional Insights

U.S. Stereotactic Surgery Devices Market Size and Growth 2026 to 2035

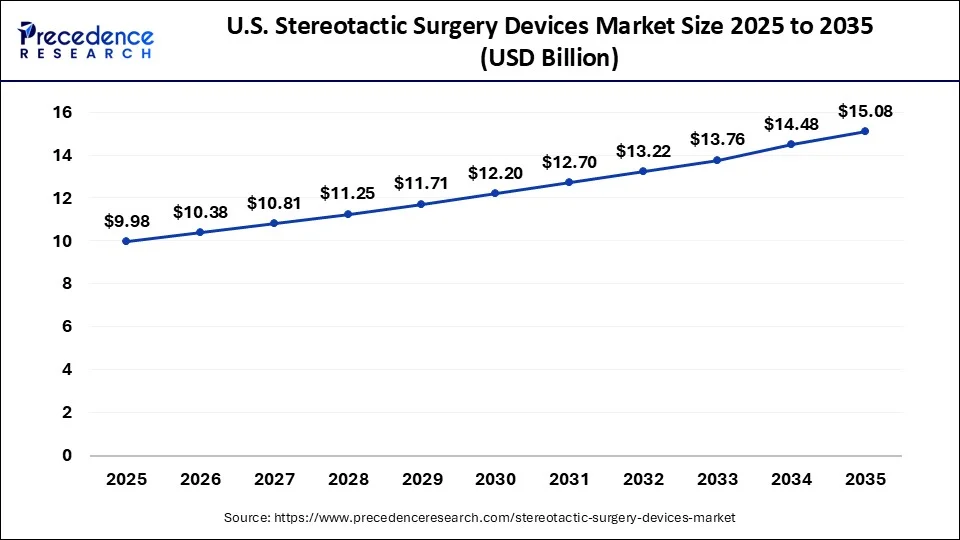

The U.S.stereotactic surgery devices market size accounted for USD 9.58 billion in 2025 and is estimated to reach around USD 14.48 billion by 2035, growing at a CAGR of 4.22% from 2026 to 2035.

North America has held the largest revenue share 46% in 2025. In North America, the stereotactic surgery devices market has witnessed several notable trends. The region has seen a growing adoption of advanced stereotactic surgery technologies, driven by a robust healthcare infrastructure and high healthcare spending. There's an increasing emphasis on minimally invasive procedures, with surgeons utilizing stereotactic devices for precision and reduced patient trauma. Telemedicine integration has also gained prominence, especially in remote areas, expanding access to these devices.

Additionally, ongoing research and development activities, as well as collaborations between medical institutions and manufacturers, continue to drive innovation in the North American market, ensuring its position at the forefront of stereotactic surgery device adoption.

Asia-Pacific is estimated to observe the fastest expansion In the Asia-Pacific region, the stereotactic surgery devices market is experiencing notable trends. With a rapidly aging population and increasing prevalence of neurological disorders, there is a growing demand for precise and minimally invasive treatment options, driving the adoption of stereotactic surgery devices. Technological advancements and improving healthcare infrastructure in countries like China and India are further propelling market growth. Additionally, collaborations between regional healthcare providers and global medical device manufacturers are fostering innovation and expanding the availability of these devices. The Asia-Pacific region is poised to become a significant player in the global market, offering both challenges and opportunities for industry stakeholders.

What Are the Driving Factors of The Stereotactic Surgery Devices Market in Europe?

The European market for stereotactic surgery is at its peak, and the advanced healthcare infrastructure, strong technology acceptance, and good patient demand are the main reasons for it. However, the region is going to focus more on innovation and precision medicine, as well as the adoption of minimally invasive neurosurgery and oncology through the creation of specialized clinical centers that will be established throughout the region.

Germany Stereotactic Surgery Devices Market Trends:

Germany is at the forefront of investing in state-of-the-art surgical devices and having a strong hospital infrastructure. The demand for robotic systems that provide excellent precision diagnostics and innovative tools that help enhance clinical outcomes through accurate interventions has not dwindled at all and is being felt throughout the country in all types of medical facilities.

Stereotactic Surgery Devices Market-Value Chain Analysis

- R&D: To a great extent, research and development concentrate on the creation of new devices, the improvement of technologies, and the recognition of the yet unmet clinical needs in neurology.

Key players: Brainlab, Elekta, Varian Medical Systems, Accuray - Clinical Trials and Regulatory Approvals: Safety and efficacy of the device are tested in clinical trials, which also help to get the regulatory approval worldwide through the structured testing pathways.

Key players: Medtronic, Elekta, Accuray, Varian Medical Systems - Formulation and Final Dosage Preparation: The manufacturing and assembly processes are carried out in such a way that the integration of the components is precise, quality is controlled, and the devices are ready for the market.

Key players: Varian Medical Systems, Elekta, Brainlab, Accuray - Packaging and Serialization: Packaging and serialization allow having sterile protection, traceability, compliance, and counterfeit prevention throughout the distribution processes and networks.

Key Players: Stereotaxis, Elekta, Accuray, Varian Medical Systems - Distribution to Hospitals, Pharmacies of Stereotactic Surgery Devices: Distribution not only sends the specialized equipment to hospitals but also includes installation, training, maintenance, and technical support services that are of an ongoing nature.

Key Players: Cardinal Health, Owens & Minor, Medtronic, Stereotaxis, Elekta

Stereotactic Surgery Devices Market Companies

- Medtronic plc: Medtronic has a wide array of medical devices, including radiosurgery systems that support precise and less invasive treatments of the neurological and oncology areas and are used all over the world.

- Elekta AB: Elekta is one of the leaders in radiation therapy technologies and is also the manufacturer of the advanced radiosurgical systems, which are used in the most delicate procedures for brain and cancer treatments.

- Varian Medical Systems, Inc.: Varian Medical Systems not only provides integrated cancer treatment devices but also software that allows for the use of radiotherapy, radiosurgery, and proton therapy solutions worldwide.

Other Major Key Players

- Medtronic plc

- Elekta AB

- Varian Medical Systems, Inc.

- Brainlab AG

- Accuray Incorporated

- Renishaw plc

- Micromar Indústria e Comércio Ltda.

- Alliance Oncology

- Möller Medical GmbH

- Leica Microsystems (Danaher Corporation)

- Nexstim Plc

- FHC, Inc.

- Isomedix, Inc. (Sterigenics)

- Inomed Medizintechnik GmbH

- Monteris Medical Inc.

Recent Developments

- In October 2025, Allan Zingeler, Raju Viswanathan, PhD, and Michael Mahoney received the first Thomas J. Fogarty Prize for their FARAPULSE™ PFA Platform, awarded on October 24 at a gala in San Francisco, recognizing impactful medical technology innovators.

(Source: businesswire.com ) - In June 2024, Apollo Cancer Centres launched the India Sub-Continent's first robotic and stereotactic therapy education centre in collaboration with Accuray. The centre offers advanced training in radiosurgery at its Chennai and Bangalore locations for healthcare professionals.

(Source: bwhealthcareworld.com ) - In 2022,Elekta's new radiosurgery system, Elekta Esprit, has been granted the CE mark, marking its compliance with European regulatory standards and allowing its distribution for advanced radiosurgery applications.

- In 2021, Philips and Elekta have strengthened their strategic partnership to advance precise and individualized oncology care, building upon their successful cooperation in magnetic resonance (MR)-guided adaptive radiation therapy, a fast-evolving field in cancer treatment.

Segments Covered in the Report

By Product

- Gamma Knife

- LINAC

- PBRT

- CyberKnife

By Application

- Liver

- Breast

- Prostate

- Lung

- Colon

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting