What is U.S. Digital Therapeutics Market Size?

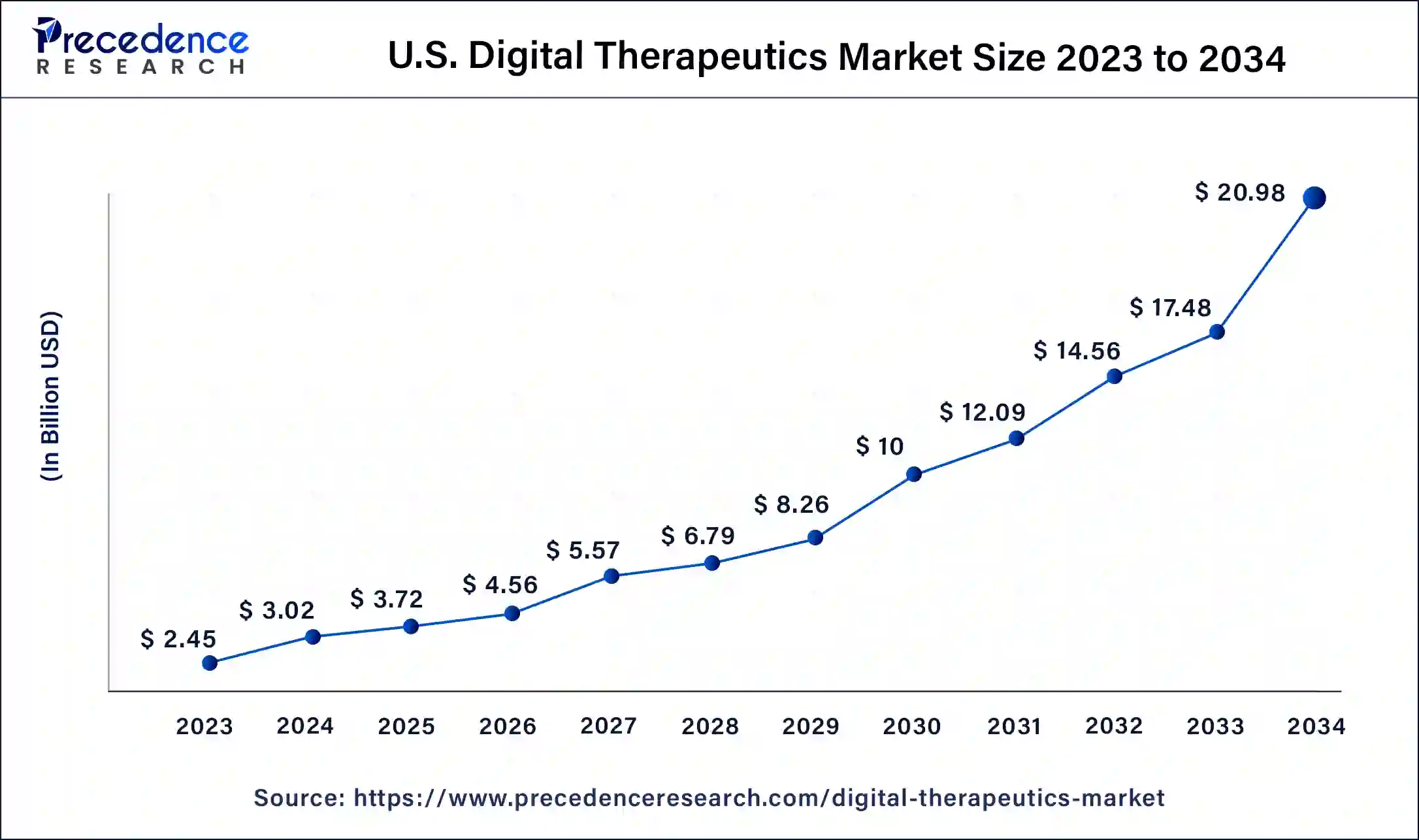

The U.S. digital therapeutics market size is valued at USD 3.72 billion in 2025 and is expected to increase from USD 4.56 billion in 2026 to approximately USD 24.09 billion by 2035, growing at a CAGR of 20.54% from Size, Share and Trends 2026 to 2035

Market Highlights

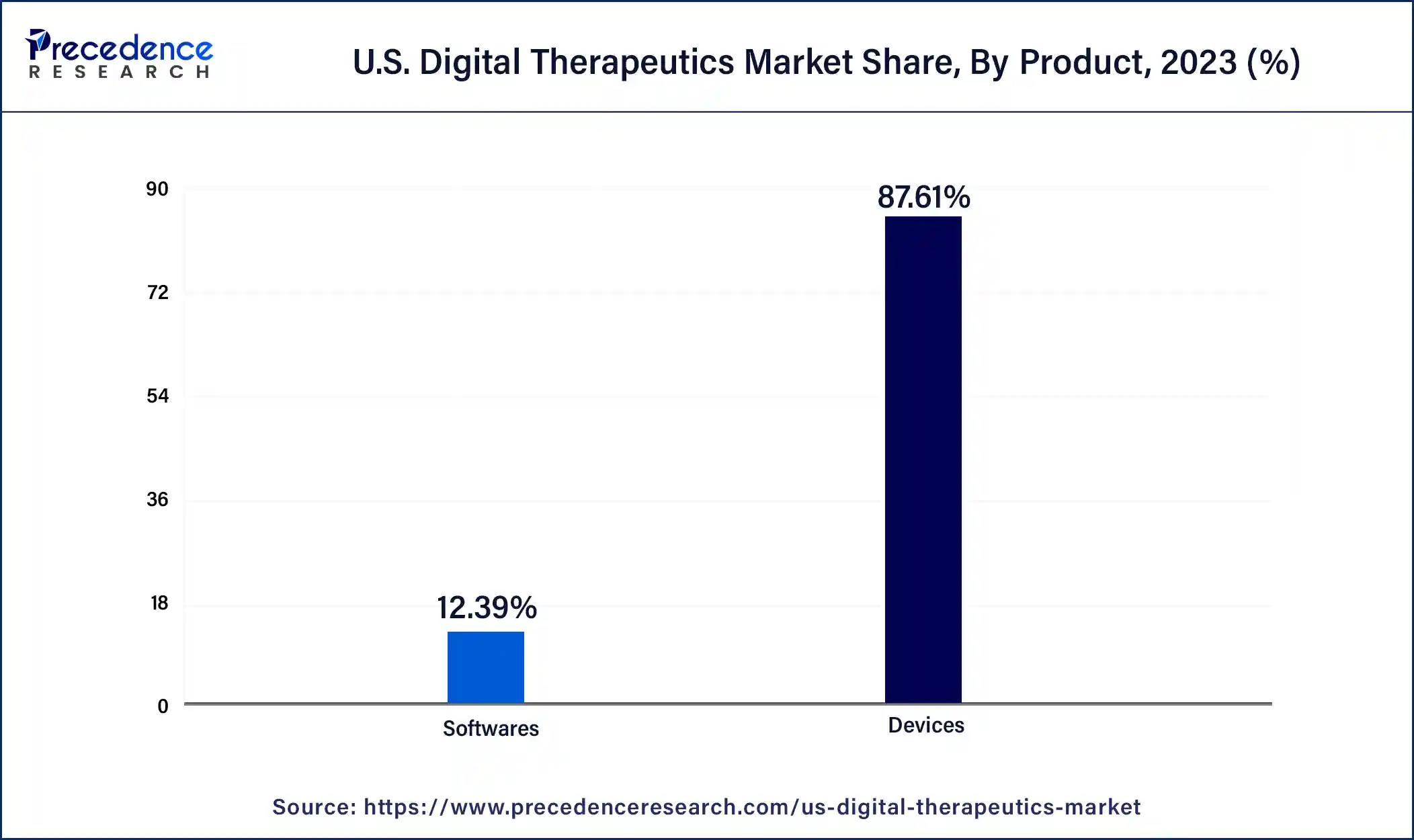

- By product, the devices segment is projected to hold the largest market share of 87.31% in 2025.

- By application, the diabetes segment holds the biggest market share of 26.39% in 2025.

- By sales channel, the business-to-business (B2B) segment registered a maximum market share of 64.51% in 2025.

Market Overview

The U.S. digital therapeutics market is poised to change the healthcare landscape, becoming an important segment within the digital health ecosystem. The market is driven mainly by an increasing need for evidence-based, software-driven therapeutic solutions. As chronic diseases (e.g., diabetes, hypertension, obesity, and mental health-related disorders) continue to increase exponentially across the nation, the importance of DTx will be an increasingly important tool for prevention, management, and treatment are helping patients. These are improving health outcomes for patients while also reducing costs for the healthcare system and alleviating pressures on clinical systems.

The modern patient is now expecting therapies that are convenient, personalized, and non-invasive, while providers and payers see the value related to insight driven data, and scalability, for these too will be modern systems of care. The U.S. digital therapeutics market is experiencing significant momentum in disease areas that may include, but are not limited to, diabetes management, behavioral health, substance use disorders and cardiovascular. Mental health solutions have been pioneered and most recently popularized this exponential intake, with the market shifting towards and meeting a growing demand for software anticipated by pharma (with a few seeing digital solutions working alongside traditional formulations).

Role of AI in U.S. Digital Therapeutics Market

Smart digital thereputics powered by artificial intelligence (AI) are transforming the U.S. digital therapeutics market and patient care by delivering smarter and more personalized health solutions. AI-enabled digital therapeutics (DTx) platforms are intercepting and using data from multiple real world and clinical scenarios and are leveraging advances in machine learning algorithms and natural language processing to be personalized interventions for chronic diseases like diabetes, mental health disorders, obesity, and cardiovascular conditions.

These AI-powered tools interact with patients and adapt based on real-time data to better connect by proactively nudging for medication adherence, personal behavioral nudging, or therapy adjustments, all while delivering clinically validated outcomes. In addition to improving the experience quieting the uneasiness of care, AI-based platforms help with remote patient monitoring and take in sensor and wearable data for real-time patient data and predictive indication for early disease and actual and likely risk behavior for predictive adjustment.

From a system approach, healthcare providers can use DTx solutions for recommendations based in algorithms that include predictive analytics and treatment optimization as a data-driven decision-support tool. Payers and employers also have access and an opportunity to implement within their organization scalable and outcome-based digital health solutions that help reduce costs. AI is the driving force that has made digital therapeutics a more common expectation in U.S. health markets, despite how limited and unregulated the DTx market may be in light of DTx limitations we have yet to define, and limited research and outcomes support. AI is providing value by making them potential reality in personal, proactive, and empathic health, care, treatment and prevention delivery systems in the USA.

U.S. Digital Therapeutics Market Trends

- Advances in Managed Care Pharmacy: These advances are made in diagnostics and therapeutics, and opportunities impact appropriate medication use. Moreover, advancements in pharmacogenomic testing improve clinical care.

- Emerging Treatment Options: The improvements in therapeutics and diagnostics are important for population health through the appropriate use of medications and treatments. Targeted therapies and other engineered biologic products are gaining traction due to notable growth in patient care and precision medicine.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.72 Billion |

| Market Size in 2026 | USD 4.56 Billion |

| Market Size by 2035 | USD 24.09 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 20.54% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Application, By Product, and By Sales Channel |

Market Dynamics

Drivers

New FDA Approvals

The U.S. digital therapeutics market is experiencing a perfect storm of factors influencing healthcare's future. Regulatory momentum is building with FDA approvals and new reimbursement models providing opportunities for providers, making the case for their confidence in the market.

New models add to the movement, as fiscally conservative payers and employers are focused on the lower long-term healthcare spending, and potential results improvement. Finally, as Artificial Intelligence, behavioral science, and remote delivery makes digital therapeutics faster and more effective and scalable, the US digital therapeutics ecosystem is positioned as a critical component of modern, preventive healthcare.

Restraint

Data Security Concerns

The U.S. digital therapeutics market currently faces several major restraints that could hinder its rapid growth. Data privacy and tyconcerns remain factors that could prevent effective development and adoption of digital therapeutics. These concerns shape some rules under the HIPAA regulations, Furthermore, it is important that patients trust the delivery of a digital therapeutic during treatment. The U.S. reimbursement and coverage landscape for provider adoption remains fragmented, especially with new solutions in digital health.

Moreover, providing proof of long-term clinical efficacy and cost-effectiveness is highly challenging; both of which often do not have statistically rigorous, large-scale randomized controlled trials. regarding patient engagement in digital therapeutics can lead to weariness (app fatigue), a majority of patients who drop-off due to limited digital literacy, and many other related obstacles that will limit the effectiveness of therapy. Even though there are major interoperability challenges within complex electronic health record systems, especially in getting providers to use technology, these challenges create a lack of incentive to creating a widespread adoption at mass scale.

Opportunity

The U.S. digital therapeutics market provides significant potential for growth because of the growing demand for scalable, personalized health care. The opportunities for growth extend to chronic disease management, such as diabetes, cardiovascular disease, obesity, and mental wellness. Employers and payers are also diverting their DTx investment strategies to murkey long-term costs and returns on investment (ROI) for preventative care. Integration with telehealth, wearable sensors, and AI-driven predictive analytics provide opportunities for real-time data insights and early interventions.

Increasing regulatory momentum, ranging from FDA clearances to new reimbursement pathways, is also enabling digital therapeutics market adoption and investment. Additionally, increased access to DTx monitoring can repair chronic healthcare inequities in underrepresented rural and older populations. Expanded behavioral science research and successful client gamification strategies, are evolving in a way that suggests DTx will continue to innovate and improve patient engagement and retention.

Segment Insights

Application Insights

Based on application, the U.S. digital therapeutics market is segmented into Diabetes, Obesity, Central Nervous System (CNS), cardiovascular disease (CVD), Gastrointestinal Disorder (GID), Respiratory diseases, Smoking Cessation, and Others. The diabetes segment holds the largest market share during the forecast period owing to the high prevalence of diabetes. Additionally, the demand for cost-efficient healthcare options and high prevalence rates for diabetes are observed in the U.S. thus it further boosts the demand for digital therapeutics among diabetes patients in the country.

Moreover, the obesity segment is estimated to account for the highest growth during the forecast period. This is due to the increasing number of overweight populations which leads to an increase in the number of chronic diseases from obesity. Furthermore, improved accessibility of digital therapeutics software applications that assist patients in maintaining a healthy diet, tracking health data, and daily physical activity boosts growth in the US digital therapeutics market. Moreover, the DTx software application offers frequent online guidance from certified doctors, which is projected to contribute to the future reduction of obesity prevalence.

U.S Digital Therapeutics Market Revenue, By Application, 2022-2024 (USD Million)

| Application | 2022 | 2023 | 2024 |

| Obesity | 345.06 | 433.48 | 542.84 |

| Diabetes | 530 | 652.38 | 800.64 |

| CNS Disorders | 240.47 | 298.21 | 368.72 |

| Gastrointestinal Disorders | 223.22 | 277.34 | 343.56 |

| CVD Disease | 267.10 | 328.58 | 402.99 |

| Smoking Cessation | 89.86 | 110.09 | 134.47 |

| Respiratory Diseases | 162.22 | 201.90 | 250.53 |

| Others | 122.98 | 148.68 | 179.12 |

Product Insights

The devices segment held 87.61% share of the market in 2025, owing to the increasing adoption of advanced healthcare technologies. Increasing focus on remote healthcare to enhance patient outcomes bolstered the market. Physicians in the US have recognized the importance of digital health devices in managing various conditions. Moreover, the increasing adoption of wearable devices significantly contributed to the segmental growth.

- According to wearable device statistics, about one in three adults in the US uses a wearable device, and more than 80% of users are willing to share their health data with doctors.

Sales Channel Insights

The business-to-business segment led the market in 2025, accounting for 64.65% market share. B2B sales channels offer customized digital health solutions to businesses, catering to the specific needs of organizations and promoting employee health. Moreover, the rising collaborations between companies providing digital health solutions and healthcare providers and pharmaceutical companies to facilitate easy integration of digital health solutions in existing healthcare facilities contributed to the segment expansion.

Country-level Insights

U.S. Digital Therapeutics Market Analysis

The U.S. industry for digital therapeutics is witnessing massive growth due to increased adoption of digital technologies in workplace wellness programs to reduce healthcare costs and improve productivity, and strategic partnerships between biopharmaceutical companies. The new federal initiatives proclaimed that the government must make efforts towards legislative and administrative efforts. These efforts will expand the accessibility of digital health tools and harness the potential of digital health innovation for Medicare beneficiaries.

U.S. Digital Therapeutics Market Companies

- Omada Health Inc.: Core product portfolio across diabetes prevention, weight management, diabetes management, hypertension, musculoskeletal conditions, and cardiovascular health conditions.

- 2Morrow Inc.: DiMe Seal, best behavioral health software, and core product offerings across sleep management, weight management, stress and mental wellbeing, and chronic pain management.

- Teladoc Health, Inc.: Livongo Chronic Care Management, AI-powered virtual sitter, Prism care delivery platform, VirtualCheckup, etc.

- Pear Therapeutics (U.S), Inc.:reSET & reSET-O, Somryst, migraine assets, Pear platform and patents, PearConnect.

- Fitbit Health Solutions:Fitbit care platform, DTx integration & trials, Fitbit premium, AI, predictive analytics, advanced sensors, Fitbit Charge 6, and glucose tracking.

Recent Developments

- In January 2024, Sean Duffy, the CEO and co-founder of Omada Health, announced a partnership with the health condition programs of Amazon Health Services and proclaimed that Omada Health would utilize Amazon's wide reach to meet consumer needs. It positions the company as a virtual-first care provider, aiming to reach more people and have an impact on the rising incidence of chronic disease.

- In June 2024, Andy Molnar, CEO of the Digital Therapeutics Alliance, announced that it would begin to accredit digital therapeutics products to establish the industry's confidence. The company will also establish criteria to evaluate the efficacy of digital therapeutic products.

Segments Covered in the Report

By Application

- Obesity

- Diabetes

- CNS Disorders

- Gastrointestinal Disorders

- CVD Disease

- Smoking Cessation

- Respiratory Diseases

- Others

By Product

- Software

- Device

By End Use

- Patients

- Providers

- Payers

- Employers

- Others

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting