U.S. Healthcare ERP Market Size and Forecast 2024 to 2033

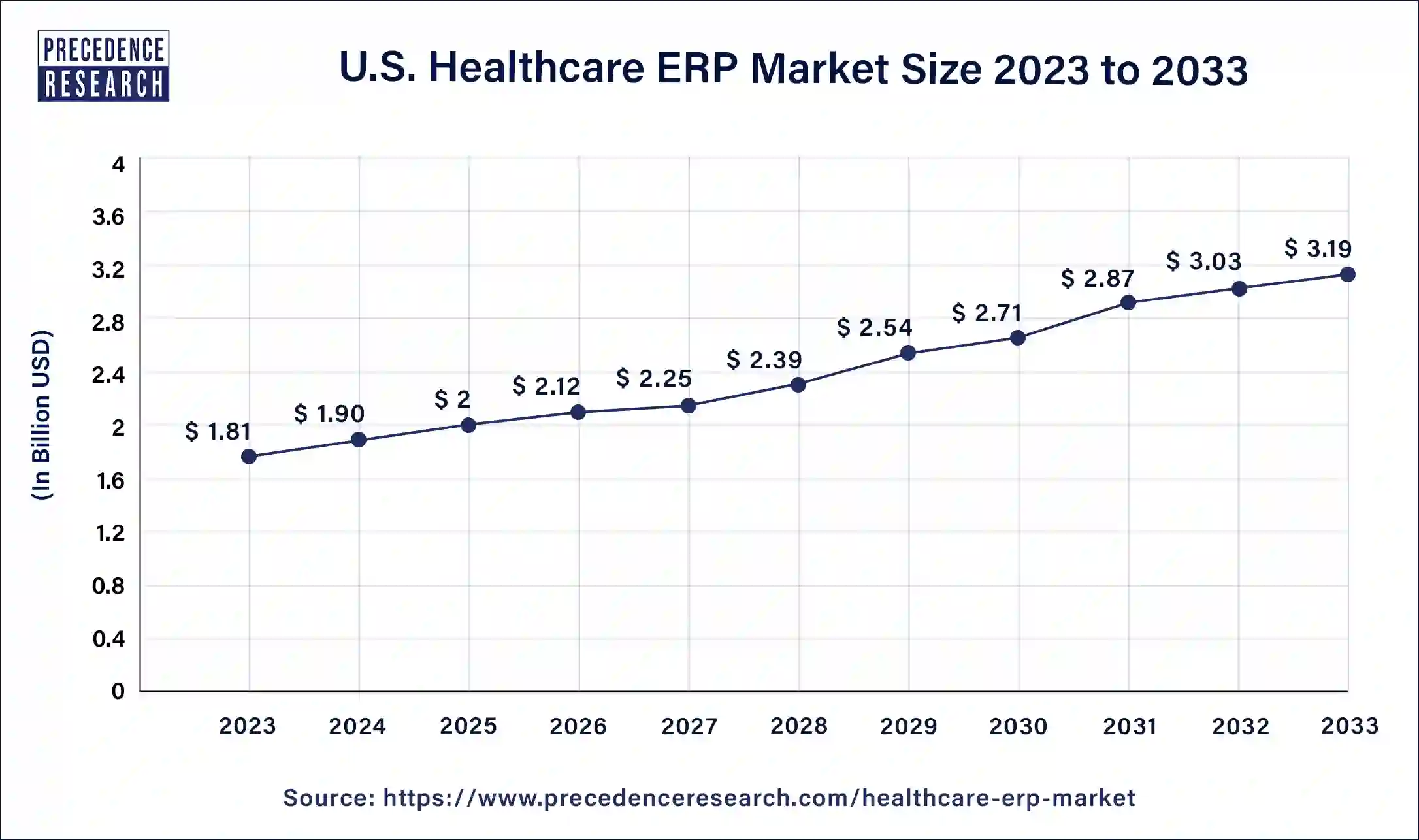

The U.S.healthcare ERP market size reached USD 1.81 billion in 2023 and is anticipated to hit around USD 3.19 million by 2033, poised to grow at a CAGR of 5.84% from 2024 to 2033.

Key Takeaways

- By function, the finance & billing segment held the largest share of 34% in 2023.

- By function, the inventory management segment is expected to grow at the fastest rate during the forecast period of 2024-2033.

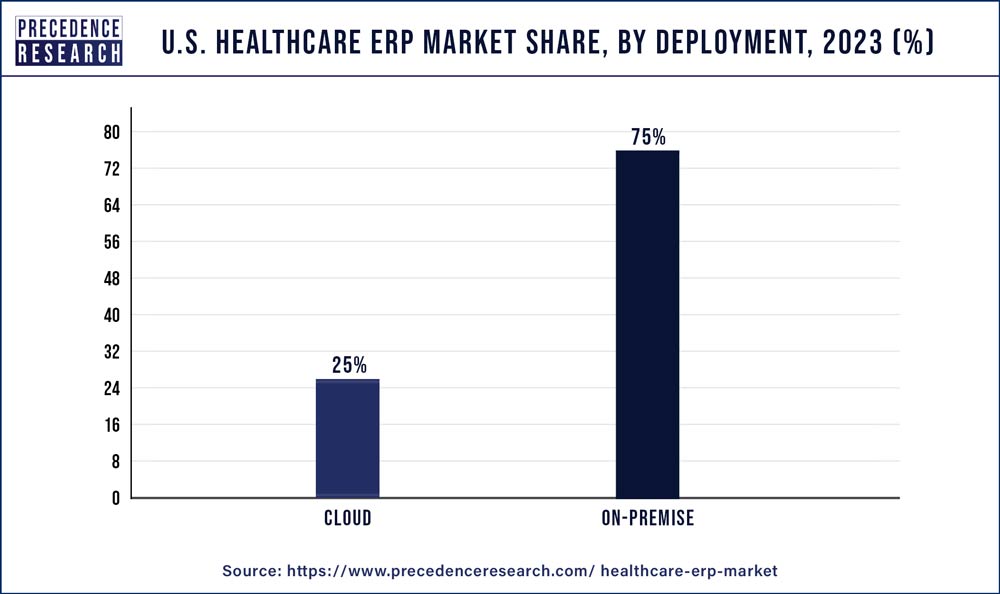

- By deployment, the on-premise segment held the largest share of 75% in 2023.

- The cloud segment is observed to witness the fastest expansion at a CAGR of 9.4% during the forecast period.

- By end user, the hospitals segment held the largest share of the U.S. healthcare ERP market and the segment is observed to sustain the dominance throughout the forecast period.

U.S. Healthcare ERP Market Overview

The U.S. healthcare ERP market refers to the integrated management of various business processes within healthcare organizations using a comprehensive software solution. ERP systems in healthcare are designed to streamline and optimize the management of resources, information, and functions across different departments and functions within a healthcare institution. Implementing a healthcare ERP system can lead to improved efficiency, reduced operational costs, enhanced patient care, and better overall management of healthcare facilities. It helps healthcare organizations adapt to the complexities of the industry by providing a centralized platform for managing diverse processes and data.

Growth Factors

- The U.S. healthcare ERP market is anticipated to grow significantly due to the rising use of electronic health records in the existing healthcare framework.

- The growing demand for affordable healthcare solutions, along with rising government initiatives encouraging the use of healthcare IT, offer businesses lucrative opportunities.

- Healthcare professionals prefer to manage patient care remotely to minimize in-person encounters; this can be mainly attributed to the COVID-19 epidemic. The use of digital healthcare technology, particularly ERP systems, is being widely accepted that promotes the growth of the U.S. healthcare ERP market.

- Advancements in technology, including cloud computing and data analytics, contribute to the growth of healthcare ERP. Cloud-based ERP solutions offer scalability, accessibility, and cost-effectiveness, making them attractive to healthcare organizations.

U.S. Healthcare ERP Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.84% |

| U.S. Market Size in 2023 | USD 1.81 Billion |

| U.S. Market Size by 2033 | USD 3.19 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Function, By Deployment, and By End User |

U.S. Healthcare ERP Market Dynamics

Driver

Increasing awareness of the benefits of healthcare ERP

The need for ERP systems to reduce operating expenses and enhance functional outcomes is increasing due to the growth in the installation rate of these systems among small and medium-sized organizations. Standardized patient data makes it easier to acquire healthcare information from a distance and improves patient acquisition and management strategies. Cloud-based ERP systems are becoming increasingly popular among healthcare institutions and businesses due to their many benefits, which include cheap ownership costs, less need for in-house technical skills, agile and adaptable infrastructure capacity, low capital requirements, and frequent upgrades. Thereby, the rising awareness is observed to act as a driver for the U.S. healthcare ERP market.

Restraint

High cost and complex integration

Healthcare organizations may need to make large financial commitments to implement ERP systems. Healthcare businesses, especially smaller ones with limited resources, may find it difficult to afford the expenses of software licenses, customization, training, and infrastructure improvements. Furthermore, healthcare ERP systems frequently require integration with medical equipment, other specialist software, and legacy systems that are still in place. It may take a while and be difficult to achieve seamless integration, which might cause problems for day-to-day operations. Thus., the high cost and complex integration might be major restraining factors for the U.S. healthcare ERP market development during the forecast period.

Opportunity

Rising collaboration

The rising number of collaborations among the market players is expected to offer a lucrative opportunity for U.S. healthcare ERP market development during the forecast period. Collaborations, mergers, acquisitions, and other forms of joint ventures between market players allow companies to capitalize on each other's strengths while overcoming their limitations in terms of technologies, infrastructure, outreach, funds, etc.

In April 2023, Microsoft Corp. and Epic announced that they are extending their long-standing strategic partnership to create and incorporate generative AI into healthcare by using Epic's cutting-edge electronic health record (EHR) software with the size and capability of Azure OpenAI Service1. The long-standing relationship is strengthened by the cooperation, which makes it possible for bU.S.inesses to run Epic environments on the Microsoft Azure cloud platform.

Collaborative efforts can enhance interoperability between different healthcare systems and facilitate seamless data sharing. This is crucial for healthcare ERP systems that need to integrate with various hospital departments, laboratories, and external partners. Collaboration among healthcare providers, including hospitals, clinics, and other healthcare entities, allows for a more comprehensive view of patient information. Integrated ERP systems can provide a holistic approach to patient care, leading to improved treatment outcomes.

Function Insights

The finance & billing segment held the largest share of 34% in 2023. To streamline operations and reduce barriers between front-end revenue cycle management activities and back-end activities, such as claims processing, healthcare firms are quickly implementing ERP systems.

Companies are using these systems to manage risk, multi-currency management, reporting, tax management, fixed asset management, profit tracking, ledger management, and elimination of financial data silos. Complete financial transparency, well-informed planning and budgeting, increased productivity, smooth integration of financial ERP modules into company systems, and real-time financial monitoring are just a few of the benefits that ERP systems provide.

The inventory management segment is expected to grow at the fastest rate over the forecast period. Healthcare ERP systems assist in streamlining the procurement of medical supplies, pharmaceuticals, and other inventory items. Organizations can optimize their supply chain, reduce manual errors, and ensure timely access to critical resources by automating procurement processes.

Additionally, these systems provide real-time visibility into inventory levels, helping healthcare organizations monitor stock levels accurately. This visibility is essential for preventing stockouts, minimizing excess inventory, and ensuring that necessary supplies are available when needed.

Deployment Insights

The on-premise segment held the largest share of 75% in 2023 and is expected to sustain during the forecast period. The segment's dominance can be attributed to a host of advantages, including simple customization, security and privacy, minimal maintenance, low reliance on vendors, ease of access from remote places, and reduced expenses. Software deployment on-premises, also referred to as "shrink-wrap," involves installing systems and solutions on computers that are accessible to organizations. These solutions use less electricity and need less installation because they can be accessed from a distance, even if they are installed on servers and PCs on-site.

The cloud segment is observed to expand at a CAGR of 9.4% in the U.S. healthcare ERP market during the forecast period of 2024-2033. Cloud-based ERP solutions offer a cost-effective alternative to traditional on-premises systems. Healthcare organizations can avoid significant upfront infrastructure costs, reduce maintenance expenses, and benefit from a pay-as-you-go model. Cloud-based healthcare ERP solutions provide real-time data accessibility, allowing healthcare professionals to access critical information securely from anywhere. This facilitates collaboration among healthcare teams, leading to improved patient care.

End-user Insights

The U.S. healthcare ERP market is bifurcated into hospitals, clinics, nursing homes and others. The hospitals segment held the dominating share of the market, and the segment is expected to sustain the position throughout the forecast period. Hospitals' healthcare ERP systems frequently include strong EHR integration features. This link facilitates information exchange between healthcare providers, guarantees easy access to patient records, and raises the standard of patient care overall.

Hospital ERP systems also help with scheduling, admittance, discharge, and patient information management. With the help of this feature, administrative work is streamlined, paperwork is decreased, and hospital operations are run more efficiently. Moreover, revenue cycle management and billing modules are commonly included in these healthcare systems. By managing insurance claims, billing procedures, and financial transactions, these modules assist hospitals in making sure that payments are made accurately and on time.

Recent Developments

- In April 2023, an industry cloud provider, Infor, announced that it had been chosen as an Amazon HealthLake Partner by Amazon Web Services (AWS). This demonstrates Infor's resolve to fortify its partnership with AWS and its commitment to offering sector-specific solutions driven by dependable, scalable, and secure cloud services.

- In April 2023, Workday, Inc., a leading provider of bU.S.iness cloud solutions for finance and HR, reported sU.S.tained growth in the healthcare sector after adding many new healthcare firms to its expanding worldwide client base.

- In September 2023, Microsoft and Mercy, a healthcare institution, partnered for an extended period. Through this partnership, Microsoft will U.S.e artificial intelligence (AI) and other digital technologies to enhance patient care and free up more time for doctors, nurses, and advanced practice clinicians. Mercy intends to U.S.e Microsoft Azure OpenAI Service to improve treatment.

U.S. Healthcare ERP Market Companies

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- McKesson Corporation

- Infor, Inc. (Koch IndU.S.tries)

- Epicor Software Corporation

- Veradigm LLC

- Azalea Health

- Premier, Inc

- Rootstock Software

Segments Covered in the Report

By Function

- Supply Chain & Logistics

- Finance & Billing

- Inventory Management

- Patient Relationship Management

- Others

By Deployment

- On-Premise

- Cloud

By End User

- Hospitals

- Clinics

- Nursing Homes

- Others

Get a Sample

Get a Sample

Table Of Content

Table Of Content