What is Revenue Cycle Management Market Size?

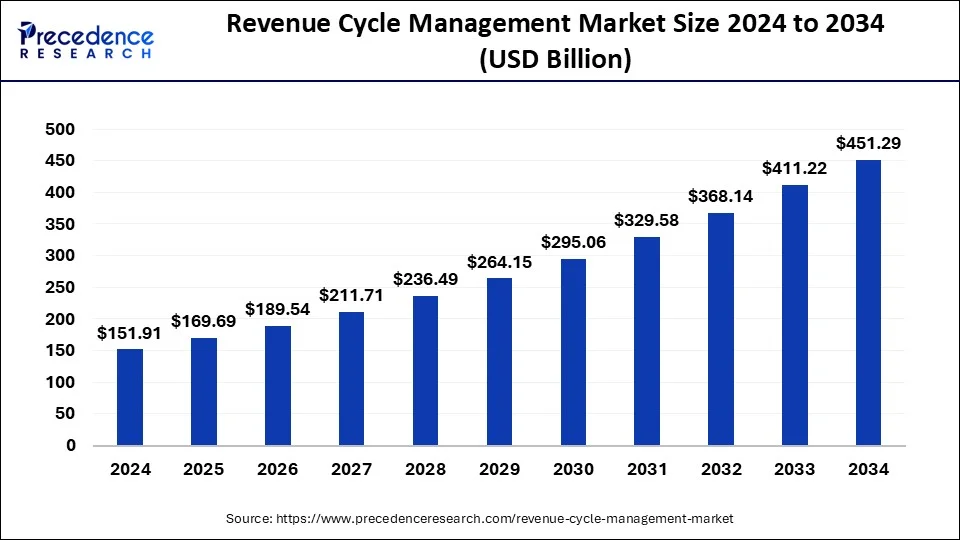

The global revenue cycle management market size reached USD 169.69 billion in 2025, estimated at USD 169.69 billion in 2026, and is anticipated to reach around USD 451.29 billion by 2034, expanding at a CAGR of 11.50% from 2025 to 2034. The demand for managing unstructured healthcare data has increased, driving the revenue cycle management market. The growing focus on patient-centric services is increasing the demand for revenue cycle management solutions.

Market Highlights

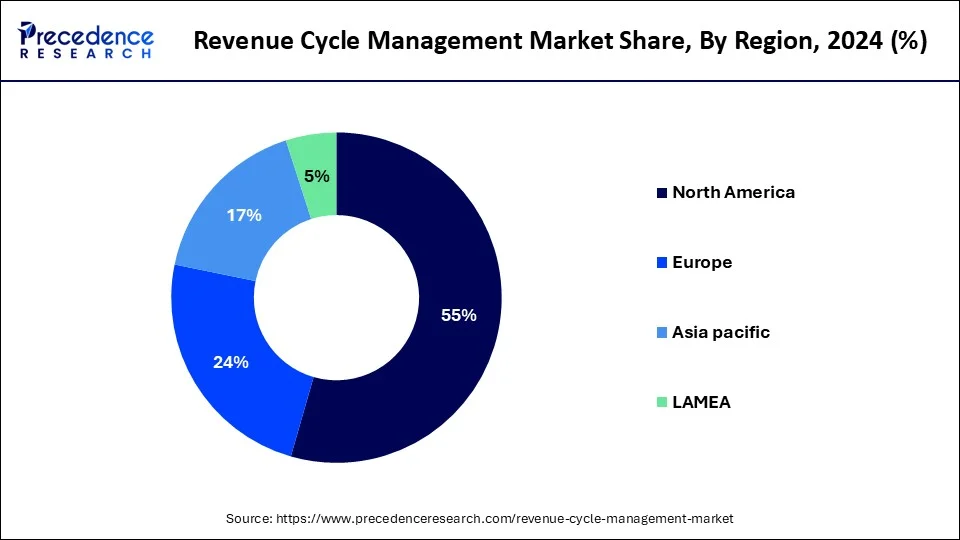

- North America dominated the global market with the largest market share of 55% in 2025.

- Asia Pacific is expected to grow rapidly during the forecast period.

- By product, the services segment led the market in 2025.

- By product, the Software segment is anticipated to expand rapidly in the coming years.

- By type, the integrated segment contributed the highest market share in 2025 and is expected to grow rapidly during the forecast period.

- By delivery mode, the web-based segment captured the biggest market share in 2025.

- By delivery mode, the cloud-deployed segment is expected to grow the fastest throughout the forecast period.

- By end-use, the physician back-office segment generated the major market share in 2025.

- By end-use, the hospital's segment is anticipated to be the fastest-growing in the coming years.

Market Size and Forecast

- Market Size in 2025: USD 169.69 Billion

- Market Size in 2026: USD 2.04 Billion

- Forecasted Market Size by 2034: USD 8.86 Billion

- CAGR (2025-2034): 11.50%

- Largest Market in 2025: North America

- Fastest Growing Market: Asia Pacific

Market Overview

The revenue cycle management market has witnessed transformative growth, driven by the growing patient volume, the need to manage unstructured healthcare data, and government support for the adoption of revenue cycle management solutions. Revenue cycle management is the backbone of the healthcare sector and operates at the well-designed core of a healthcare association ranging from a small practice to a huge hospital. However, IT infrastructural limitations in developing countries, coupled with a shortage of skilled information technology professionals, may adversely impact the global revenue cycle management in the forecast period.

Growing approaches for patient-centric services and regulatory requirements for data management are continuously fueling the need for revenue cycle management solutions. Additionally, government initiatives in the adoption of cutting-edge technologies like claims, electric health records, denial management, medical coding, and cloud-based solutions are leveraging support in the adoption of revenue cycle management solutions. The expanding utilization of telemedicine is a rising need for this solution. The market is projected to witness rapid expansion in hospital and laboratory areas.

Impact of AI Integration on Revenue Cycle Management Solutions

AI with revenue cycle management solutions is the transformative approach in healthcare organization management. EI improves the efficiency of data entry, billing, and the claim process and reduces the risk of errors. artificial intelligence (AI) algorithms analyze data and identify patterns, and that improves the accuracy. AI provides detection of potential opportunities to improve revenue capture and enhance patient experiences. Healthcare organizations are rapidly integrating AI with revenue cycle management solutions to improve patient-centric care, comply with regulatory complaints, and reduce denial. The data-driven decision provided by the algorithm optimizes the revenue cycle process and improves overall productivity. AI algorithms automatically reference both payer and custom rules so the errors won't occur.

- For instance, in January 2025, IntelligentDX, a leading healthcare technology company in India, launched its revolutionary AI-based deep learning software designed to optimize Electronic Health Records (EHR) and Electronic Medical Records (EMR) systems. This solution streamlines operations, enhances revenue cycle management (RCM), and significantly reduces insurance claim rejections and denials.

Revenue Cycle Management Market Growth Factors

- Growing demand for cloud-based revenue cycle management solutions paired with the loss of revenue due to billing mistakes has emerged as a major driving factor for the growth of the revenue cycle management (RCM) market in the near future.

- Growing demand for advanced healthcare systems is estimated to support the growth of the global revenue cycle management market in years to come.

- Favorable regulatory compliance, increasing need for process improvements in healthcare sectors.

- Rising spending on healthcare is the major factor estimated to drive the global revenue cycle management market in years to come.

- Growing patient pool and regulatory requirements are driving the adoption of revenue cycle management solutions to help healthcare organizations.

Market Scope

| Report Coverage | Details |

| Market Size by 2025 | USD 169.69Billion |

| Market Size in 2026 | USD 189.54 Billion |

| Market Size in 2034 | USD 451.29 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.50% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Deployment, Type, Offering, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Emphasis on Value-Based Care

Value-based care introduces complexities in revenue cycles as the management of financial risk, drives demand for revenue cycle management solutions. Value-based care prefers health management which requires revenue cycle management solutions to analyze patient data, identify trends, and optimize the revenue cycle process. Revenue cycle management solutions provide quick accurate reimbursements. Healthcare organizations are adopting revenue cycle management to improve patient outcomes and cost-effectiveness. As healthcare driving a surge for advanced revenue cycle management solutions for patient data management, monitoring outcomes, and delivering cost-effectiveness, the market is expanding rapidly.

Restraint

High Cost

The high initial cost of purchasing and implementing a revenue cycle management system in small and medium-sized healthcare organizations is the major hamper to the adoption of these solutions. High cost associated with the implementation and maintenance of a revenue share management system, including hardware, software, and training, and restraining the adoption of solutions. Maintenance of the service is significant in investments, challenging modern medium-sized organizations. However, the adoption of cloud-based solutions can reduce initial costs and ninja expensive hardware and software upgrades in the solution.

Opportunity

Expanding healthcare expenditure

Growing patient value and spending on health services I'm driving near for efficient and accurate revenue cycle management solutions. The rising healthcare expenditure increasing complexity in the revenue cycle process, driving need for the solutions. Increasing healthcare expenditures enables healthcare providers twin hand care services, which drives the need for revenue cycle management solutions. Healthcare providers are focusing on financial performance and operational efficiency. Additionally increasing healthcare costs has caused a burden for healthcare providers to optimize financial sustainability, increasing adoption of revenue cycle management solutions to optimize the revenue cycle.

Product Insights

The services segment dominated the market in 2025 due to increased demand for expertise in managing complex revenue cycle processes. The increased adoption of revenue cycle management solutions drives the need for services to help implementation and integration in healthcare organizations. Services allow healthcare organizations to enhance value care. Healthcare providers seeking expertise and advanced technologies to leverage with revenue cycle management facilities.

The software segment is the second-largest segment leading the market, driven by increased adoption of advanced software to streamline revenue cycle processes. The software enables the management of large datasets and procedures. The software integrates with various revenue cycle management functions like claims, management, billing, coding, and collections.

Type Insights

The integrated segment accounted for the largest market share in 2025 and is projected to continue growing at a faster rate. The surge toward value-based care is driving the need for integrated systems to manage complex payment models. An integrated system streamlines revenue cycle procedures and improves financial performance. Healthcare providers are increasing demand for integrated revenue cycle management solutions to improve efficiency and productivity. The need to comply with regulatory compliance and requirements makes integrated systems more popular in healthcare.

Delivery Mode Insights

The web-based segment generated the largest market share, driven by increased adoption due to their easier implementation and affordability. Web-based solutions provide flexibility and cost-effectiveness. the rising adoption of cloud-based solutions and the need to improve operation efficiency driving adoption of web-based revenue cycle management solutions. This solution enables robust security features to comply with regulatory requirements and compliance.

The cloud-deployed segment is the second-largest segment leading the market due to its advantages of flexibility, cost-effectiveness, and scalability. Cloud deployments help to reduce upfront costs associated with hardware and software. Cloud-deployed revenue cycle management solutions provide remote accessibility, making them popular in healthcare organizations. This solution offers automated upgrading and maintenance tasks, which reduces the burden on the in-house IT team.

End-use Insights

The physician back-office segment has witnessed the largest growth. physician back offices have increased adoption of revenue cycle management solutions operating cost, and reimbursement compliance. Healthcare organization has increasing adoption of revenue cycle management solutions to streamline financial operations and improve revenue generation. The physical back-office segment is growing due to the increasing need for efficient management and the complexity of revenue cycle procedures.

The hospital segment is expected to witness rapid growth in the forecast period, as the need for the management of high volumes of patient data, billing, and insurance claims has increased. Hospitals have large patient volumes, which drives the need to manage large datasets efficiently and accurately. The complex revenue cycle process of hospitals makes it necessary for the integration of an efficient revenue cycle management system. Additionally, regulatory requirements to manage patient data and ensure compliance increased the popularity of revenue cycle management solutions in hospitals.

Regional Insights

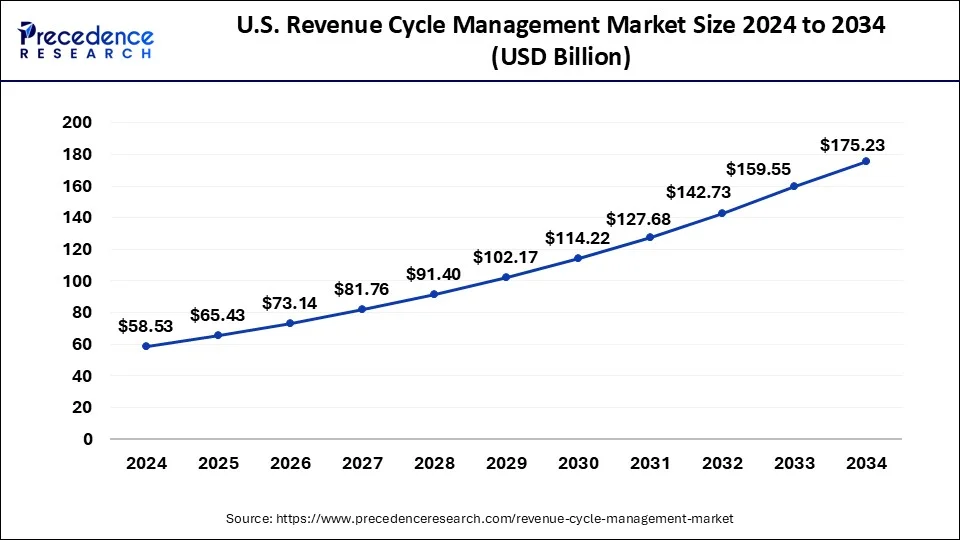

U.S. Revenue Cycle Management Market Size and Growth 2025 to 2034

The U.S. revenue cycle management market size was valued at USD 65.43 billion in 2025 and is expected to be worth around USD 175.23 billion by 2034, at a CAGR of 11.59% from 2025 to 2034.

Well-established healthcare: To Boost RCM areas in North America

North America dominates the global revenue cycle management market noting factors like the existence of key vendors, expanding healthcare expenditure, and having options for healthcare IT solutions. Well-established healthcare infrastructure and digitalization focus on increasing the adoption of revenue cycle management in the region. North America has witnessed a rapid reduction of revenue cycle management solutions in hospitals for the management of their revenue cycle efficiently.

Strong Regulatory Requirements Fueling the U.S. Market

United States leader in the regional market, driven by well-established healthcare infrastructure and the existence of strict regulatory requirements. Regulations like HIPAA have encouraged the adoption of revenue cycle management solutions to help healthcare organizations comply with regulatory requirements. Healthcare has shifted toward Computer-Assisted Coding (CAC) to Autonomous Coding due to advancements in AI and machine learning. United States expected to leverage cutting-edge approaches in solutions due to rising adoption of third-party managed Revenue Cycle Management (RCM) solutions in countries healthcare.

- In March 2025, IKS Health, a global leader in care enablement solutions named the 2025 Black Book Research leader in the newly established category of AI-driven Revenue Cycle Management (RCM). The recognition demonstrated IKS Health's expertise in harnessing AI's rapid advancements to develop and enhance its powerful RCM workflow solutions for more than 700 U.S. healthcare organizations.

Digital Health Ecosystem to Expand Asian Market

Asia Pacific accounted for fastest fastest-growing region in revenue cycle management due to expanding healthcare infrastructure and the adoption of digital health technologies. The market growth is driven by the rising adoption of electronic health records, telemedicine, and cloud-based solutions. Growing medical tourism, driving demand for efficient revenue cycle management solutions. Additionally, government initiatives for promoting the adoption of revenue cycle management solutions are transforming market growth.

Countries like China, Japan, India, and Australia leading the regional market with advancing healthcare expenditure and adoption of healthcare IT solutions. Japanese government encouraging adoption of revenue cycle management solution. Rapid digitalization and infrastructure advancements in China fueling market growth. Large patient pools and government initiatives are transforming the Indian market. the Ayushman Bharat Digital Mission initiatives improving India's digital health environments.

Revenue Cycle Management Market Companies

- Cerner Corporation

- McKesson Corporation

- Quest Diagnostics Incorporated

- Allscripts Healthcare Solutions

- Athenahealth

- CareCloud

- Emdeon

- The SSI Group Inc

- GE Healthcare

- Eclinicalworks

- Meditech

- Epic Systems

- Conifer Health Solutions

- Gebbs Healthcare Solutions

- Constellation Software

- Experian PLC

- NextGen Healthcare Information System LLC

Recent Developments

- In February 2025, IKS Health, a global leader in care enablement solutions, launched Scribble Now, the latest addition to the IKS Health Scribble Suite, at ViVE 2025.

- In March 2025, R1 partnered with Palantir Technologies for the launch of R37, an advanced AI lab dedicated to revolutionizing healthcare financial performance.

- In June 2024, Waystar Holding Corp. announced the launching of its initial public offering of 45 million shares of its common stock, targeting a valuation of up to $3.83 billion.

Segment Covered in the Report

By Product

- Software

- Services

By Type

- Integrated

- Standalone

By Delivery Mode

- Web-based

- Cloud-based

- On-premise

By End-use

- Physician Back Offices

- Hospitals

- Diagnostic Laboratories

- Other

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content