U.S. Revenue Cycle Management Market Size and Forecast 2025 to 2034

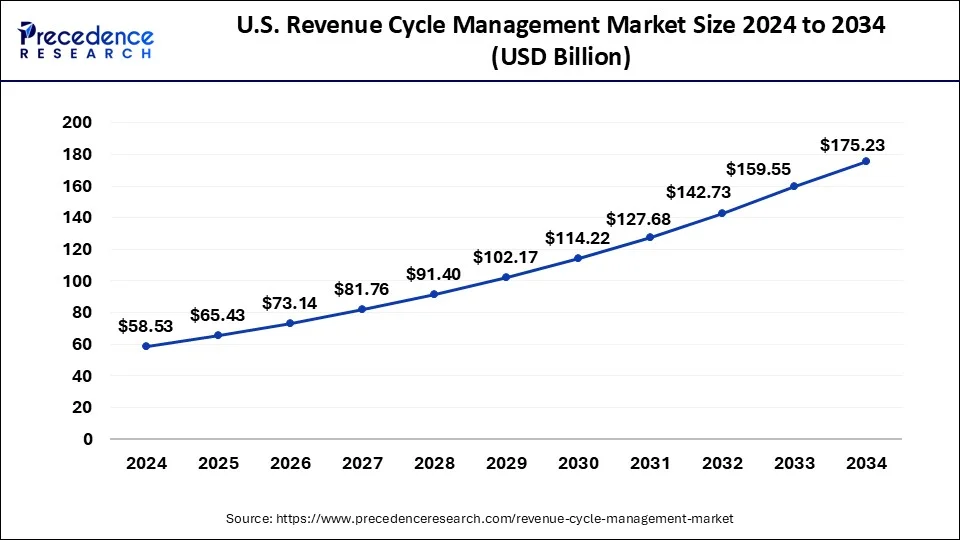

The U.S. revenue cycle management market size is estimated at USD 58.53 billion in 2024 and is predicted to surpass around USD 175.23 billion by 2034, growing at a CAGR of 11.50% from 20245 to 2034.

U.S. Revenue Cycle Management Market Key Takeaways

- By component, the services segment has generated a revenue share of 66% in 2024.

- By product type, the integrated system segment contributed the highest market share of 72%in 2024

- By delivery mode, the web-based delivery mode segment captured the biggest market share of 55.4% in 2024.

- By end-user, the hospitals segment generated a major market share of 56% in 2024.

- By physician specialty, the others egment has held the largest market share of 71% in 2024.

- By sourcing, the in-house segment accounted for a market share of 70.5% in 2024.

Market Overview

Revenue Cycle Management (RCM) is a financial process that uses medical billing software. Healthcare facilities use to track episodes of patient care, from registration and appointment scheduling to final balance payment connects the business and clinical aspects of healthcare by associating administrative data such as patient names, insurance companies, and other personal information with the treatments they receive and their health records. Communication with health insurance companies is an important part of RCM. Typically, when a patient makes an appointment, the doctor's office or hospital staff will review the patient's reported insurance coverage prior to the visit. After an insured person receives treatment for a particular condition and makes a co-payment, the healthcare provider or coder classifies the type of treatment according to the ICD-10 code. The hospital or nursing home then sends a treatment summary, including the ICD and current procedural technology code, to the patient's insurance company to confirm the portion of the treatment covered by the policy and bill the patient for the remainder.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 58.53 Billion |

| Market Size in 2025 | USD 65.43 Billion |

| Market Size by 2034 | USD 175.23 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 11.59% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Function, Product, Type, Delivery Mode, and End User |

Market Dynamics

Driver

Increasing patient volume and subsequent growth in health insurance drive the market growth

The growing elderly population in the United States is creating a highly favorable environment for electronic health records and RCM Revenue Cycle management. For instance, the WHO report also found that the global population aged 60 and over will double from 12% to 22% between 2015 and 2022. In addition, the increasing number of cases of chronic diseases across the world is expected to significantly increase the demand for care services in the coming years. For instance, the American Heart Association (AHA) estimates that 48% of the U.S. population has some type of heart disease. Furthermore, favorable insurance and reimbursement policies from several healthcare providers are expected to drive demand for aged care services.

Restraints

IT infrastructural constraints in underdeveloped and developing countries

RCM solutions are typically integrated with an EHR or practice management suite, where the EHR manages patient clinical data and the RCM system handles billing. However, the success of RCM is highly dependent on the IT infrastructure and support within your organization. The software solutions that RCM companies provide to vendors require IT expertise and infrastructure to function properly. This is required to receive patient information from various departments and healthcare providers. Data collected from all these departments is used for correct claims and clear coding claims rejection management, and establishing effective health data security. Budget constraints in most developing markets lack the interoperable infrastructure required to implement an RCM solution. These gaps in infrastructure are proving to be the major obstacles to the growth of the RCM solutions market in developing regions.

Opportunities

Reduced administrative overhead and improved efficiencies are expected to provide future opportunities

Vendor models have the potential to increase the efficiency of the RCM process. Efficiency opportunities include reducing the administrative burden and time associated with vendor management and creating and implementing best practices. Outpatient care, improved collections, optimized delivery times, and improved patient satisfaction all lead to fewer patients. Moreover, vendor systems recognize the efficiencies of outsourcing RCM functions to a single integration vendor. Additionally, the trend toward RCM integration and the increasing number of RCM vendors striving to provide a robust "end-to-end" solution helps in drive the market in the future.

Healthcare Facility Type Insights

The hospitals segment peaked with the largest share of 44.50% in the U.S. revenue cycle management market. The hospitals are like the manager of the revenue cycle. The hospital optimizes the end-to-end processes targeting efficient claims processing, timely payment collection, and appropriate patient intake. This stabilizes the financial ground and enhances patient experience. The academic medical centers face a few RCM challenges, to which ACMs are discovering new solutions, like collaborating with specialized RCM firms and adopting unified electronic health records (EHRs). The community hospitals in the US manage financial aspects of patient care. The integrated delivery networks (IDNs) are networks of healthcare providers who provide an inclusive number of services using RCM to manage their financial operations.

The ambulatory surgery centers (ASCs) segment is expected to accelerate at a CAGR of 8.60% during the forecast period. The ASCs an independent facilities enabling surgical care on the same day and need excellent RCM to address critical operational and financial challenges. The US RCM industry is evolving with the rapidly growing acceptance of technologies and the driven development in the ASCs, bolstering the market globally.

Component Insights

The RCM services segment held the largest share of 53.60% in the 2024 U.S. revenue cycle management market. The RCM services are complex for the US healthcare providers to administer the financial processes of billing, collecting, and monitoring the payments from the payers and the patients. The end-to-end RCM outsourcing involves functioning services through BPOs or international healthcare services companies working on financial billing for healthcare providers. The services (functions) involve one source platform for AR, coding, and billing.

The RCM software segment is expected to grow at a CAGR of 8.70% during the forecast period. The RCM software streamlines the financial processes related to patient care. The integrated RCM platforms within the US healthcare software are an inclusive solo system streamlining and automating the entire patient-to-payment financial process by linking with numerous RCM functions. The standalone RCM modules are a single component engaging in specific functions within the vast RCM process, like claim management, patient registration, and more.

Function Insights

The back-end functions (collections, denials Mgmt, A/R) segment held the largest share of 41.80% in the 2024 U.S. revenue cycle management market. The backend functions in the RCM cycle involve various functions and processes. The claim management cycle includes claim scrubbing, submission, and denial management. With the understanding of the medical code, the RCM cycle is run. The batches created for forming claim management further become a part of payment posting & reconciliation. The payment posting team and the AR accounts receivable team are strongly associated to provide an accurate detail of the patient's type of treatment and services taken by a healthcare provider. The patient's billing is referred during payment posting further AR team initiates follow-up on the same and further collects the delayed or remaining amount from the client (payer or patient). The bad debt management is handled by the AR (collection team) to clear out all dues.

The analytics and intelligence segment is expected to grow at a CAGR of 9.40% during the forecast period. The analytics and intelligence are transitioning the RCM in the US by accelerating business intelligence (BI) and artificial intelligence (AI) to initiate automation and address trends in data. The option of integrating revenue into the technology has made RCM KPIs seamless through an analytical tool. The analytical tool uses KPIs for monitoring the patient in the payment process.

The price transparency is trusted, with no changes to the pricing, ensuring the payment is received without any dispute. The audit and compliance reporting address regulatory and financial risk by monitoring metrics such as payer contract adherence and claim denial rates. The major reports focus on claim submission, denial management, patient registration, and coding accuracy. The financial forecasting makes the RCM cycle smooth to process and settle international claims seamlessly in the US.

Type Insights

Based on type, the market is segmented into integrated and standalone. An integrated system is an end-to-end system that enhances an organization's data sharing and interoperability capabilities. Integrated solutions enable healthcare professionals to increase productivity, minimize costs and increase net operating margins. Finally, the growing need to reduce human error and speed up administrative functions is driving the growth of integrated RCM solutions. The integrated solutions segment is expected to witness the fastest growth rate in the coming years. The integrated solution uses standardized data collection and analysis processes to provide a synchronized, streamlined platform for financial activities.

Delivery Mode Insights

The cloud-based/SaaS segment held the largest share of 47.90% in the 2024 U.S. revenue cycle management market. The cloud-based/SaaS delivery mode is a technologically proven source to share or update the healthcare financial data. It helps healthcare providers pay return subscription fees to access RCM software led by the vendor. This delivery mode moves IT expenses from capital to operational costs. The SaaS RCM is fueled by its cost savings on hardware/software maintenance and cost effectiveness, allowing providers to concentrate on major operations.

The hybrid segment is expected to grow at a CAGR of 9.20% during the forecast period. The hybrid RCM merges in-house management with outsourced expertise that helps healthcare providers maintain control over confidential and sensitive tasks. While accelerating the third-party specialist for critical functions such as claims processing, denial management, and medical coding. This segment enables flexibility and reach to specialized skills and technology.

End User Insights

The market is segmented into physician offices, hospitals, laboratories, and others. The increasing presence of well-known and established hospitals in the United States and increasing regulatory reforms and patient care policies introduced by regulators are driving the hospital sector. Hospitals are focused on implementing innovative revenue cycle management solutions by working with vendors to transform reimbursement scenarios. This is expected to drive growth in the segment. Additionally, the growing demand to streamline hospital workflows to improve efficiency and productivity is driving the adoption of integrated RCM systems in hospitals.

The Physician Office segment is expected to witness the fastest growth rate during the forecast period as the number of physicians increases in the United States. Additionally, the Covid-19 pandemic is expected to increase the demand for remote monitoring and doctor visits, which is expected to contribute to the growth of the segment. Private medical practices and clinical services readily outsource RCM systems and services to meet unmet financial needs.

Lab RCM solutions advocate a policy that labs maintain critical communication with referring physicians and keep the pulse of the relationship to ensure they receive the information essential to paying for their services. In order to make these efforts effective, lab professionals will support these efforts, use the information received to generate revenue more quickly, and manage the lab's claim filings more effectively.

Buyer Type Insights

The health systems/IDNs segment held the largest share of 37.20% in the 2024 U.S. revenue cycle management market. In the US RCM, the IDNs play a major role in the management of a unified system of healthcare end-to-end services. The development is based on the smart integration of providers to trim the financial and care process effectively. The IDNs accelerate the entire market, comprehensively, and data potency to utilize the RCM process. This segment of the US RCM industry ensures patients receive affordable and accessible care.

The private equity/ MSO-backed groups segment is expected to grow at a CAGR of 9.00% during the forecast period. Private equity (PE)/ management services organizations (MSOs) are mostly engaged in the US RCM industry by occupying physician practices and enabling services via MSOs to perform non-clinical functions such as collections and billing. The trend is strengthened by private equity firms anticipating high returns, prompting healthcare providers to reduce costs and navigate critical regulations.

End-user Department Insights

The finance and billing segment held the largest share of 39.70% in the 2024 U.S. revenue cycle management market. The US financing and billing sector within RCM is critical for accurate payment and detailing of services rendered for health providers to receive precise information and payment. A certain initial task is important for the provider's financial stability, with the accuracy in the insurance verification, medical coding, and more. The development of this segment includes the acceptance of new technologies such as automation software and AI-driven tools to diminish errors, improve cash flow, and efficiency.

The IT/RCM operations segment is expected to accelerate at a CAGR of 8.90% during the forecast period. In the US RCM, the IT operations include deploying and developing technology for automating tasks, enhancing data accuracy, and streamlining workflow in the healthcare providers' financial processes, covering RCM functions (processes) essential for the RCM operations.

U.S. Revenue Cycle Management Market Companies

- Allscripts Healthcare Solutions

- Change Healthcare Inc.

- Cognizant Technology Solutions Corp.

- Computer Programs and Systems Inc.

- Experian Plc

- Medical Information Technology Inc.

- MEDIREVV

- OSP Labs

- Quest Diagnostics Inc.

- R1 RCM Inc.

Recent Developments

- In May 2022, N. Harris computer corporation (Constellation Software inc) announced the acquisition with Allscripts healthcare solutions

- In July 2021, R1 RCM Inc., a provider of technology-driven solutions that improve the patient experience and the financial performance of healthcare providers, announced that it has completed the acquisition of Visit Pay, a provider of digital payment solutions. Acquisition brings together Visit Pay's customer payment infrastructure and R1's leading patient access technology, enabling providers to offer patients a seamless financial journey

Segments Covered in the Report

By Function / Process Step

- Front-End Functions

- Patient Scheduling & Pre-Registration

- Insurance Eligibility Verification

- Benefit Verification

- Prior Authorization Management

- Patient Estimates / Cost Transparency Tools

- Patient Communication (Pre-service)

- Mid-Cycle Functions

- Clinical Documentation Improvement (CDI)

- Medical Coding (ICD-10, CPT, HCPCS)

- Charge Capture & Charge Entry

- Utilization Review & Management

- Case Management

- Back-End Functions

- Claims Management

- Claims Scrubbing

- Claims Submission

- Denial Management

- Payment Posting & Reconciliation

- Accounts Receivable (A/R) Follow-up

- Patient Billing & Statements

- Collections & Bad Debt Management

- Claims Management

- Analytics & Intelligence

- Revenue Integrity

- RCM KPIs & Benchmarking

- Audit & Compliance Reporting

- Financial Forecasting & Contract Management

- Price Transparency Compliance

By Component

- RCM Software

- Integrated RCM Platforms

- Standalone RCM Modules

- RCM Services

- End-to-End RCM Outsourcing

- Function-specific BPO (e.g., Coding, AR, Billing)

- Consulting & Compliance Services

- Hybrid Offerings

- Tech-enabled Services

- BPaaS (Business Process as a Service)

By Delivery Mode.

- On-Premise

- Cloud-based / SaaS

- Hybrid

By Healthcare Facility Type

- Hospitals

- Academic Medical Centers

- Community Hospitals

- Integrated Delivery Networks (IDNs)

- Physician Practices

- Solo Practices

- Group Practices

- Specialty Clinics

- Ambulatory Surgery Centers (ASCs)

- Diagnostic Labs & Imaging Centers

- Urgent Care Centers

- Behavioral Health Facilities

- Post-Acute Care Providers

- Long-Term Care Facilities

- Skilled Nursing Facilities

- Home Health Agencies

- Dental & Allied Health Clinics

By Buyer Type

- Independent Practices / Providers

- Health Systems / IDNs

- Medical Billing Companies / RCM BPOs

- Private Equity / MSO-backed Groups

- Payers & Insurance Companies (limited overlap in delegated RCM)

By End User Department

- Finance & Billing

- Health Information Management (HIM)

- Compliance & Audit

- Patient Access / Front Desk

- IT/RCM Operations

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting