Healthcare ERP Market Size and Forecast 2025 to 2034

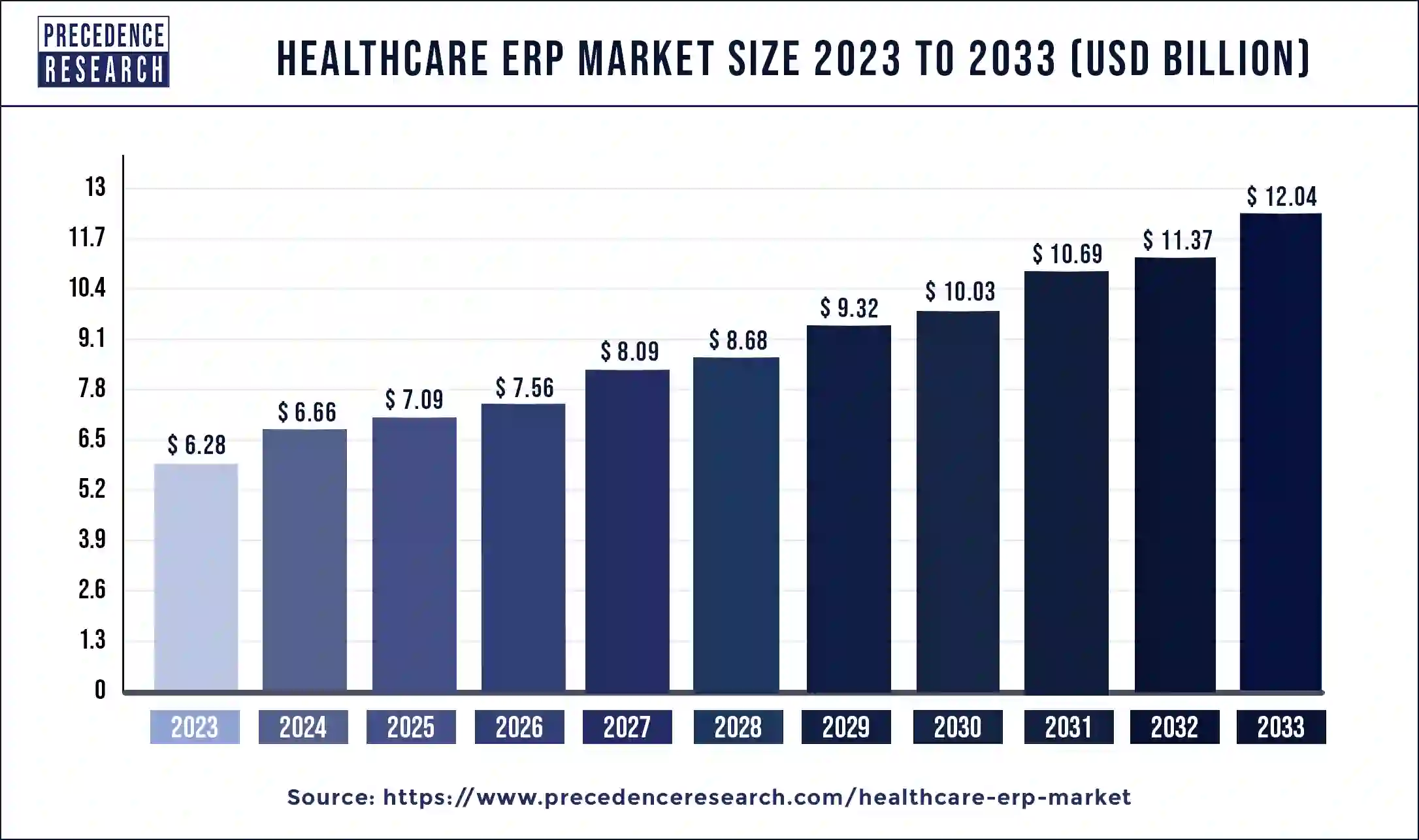

The global healthcare ERP market size was valued at USD 6.66 billion in 2024, and it is projected to hit around USD 12.71 billion by 2034, growing at a CAGR of 6.68% during the forecast period 2025 to 2034.

Healthcare ERP Market Key Takeaways

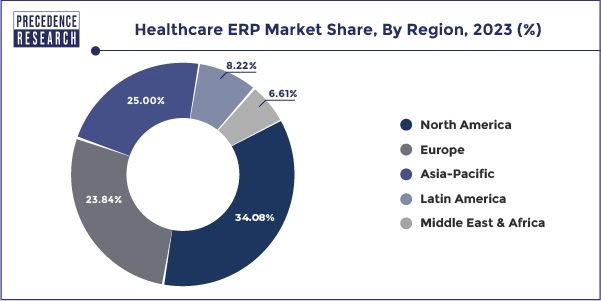

- North America healthcare ERP market size was valued at USD 2,143.4 million in 2024.

- By deployment, the on premises segment dominated the market in 2024.

- By deployment, the cloud segment is expected to grow at the fastest CAGR over the forecast period.

- By function, the finance, the finance and billing segment dominated the market in 2024.

- By function, the function the inventory and material management segment is expected to experience the highest growth rate during the forecast period.

- By region, North America dominated the healthcare ERP market in 2024.

- By region, Asia Pacific is expected to have the fastest growth during the forecast period.

- By End Use, the hospital segment dominated the healthcare ERP market in 2024.

- By end-use, the clinics segment is projected to witness significant growth during the forecast period.

How AI has been affected :

AI has significantly enhanced healthcare ERP market by enabling smarter, data driven decision making and automating complex processes. Through predictive analytics, AI allows healthcare providers to forecast patient volumes, optimize resource allocation, and anticipate inventory needs. Reducing waste and preventing shortages. Machine learning algorithms help identify inefficiencies in workflows. Streamline administrative tasks, and improve billing accuracy, ultimately boosting operational efficiency. Natural language processing facilities faster data entry and retrieval from unstructured medical records, while AI powered chatbots and virtual assistants support staff by handling routine queries. By integrating AI into ERP systems, healthcare organizations can move from reactive management to proactive strategies, improving both cost control and patient care outcomes.

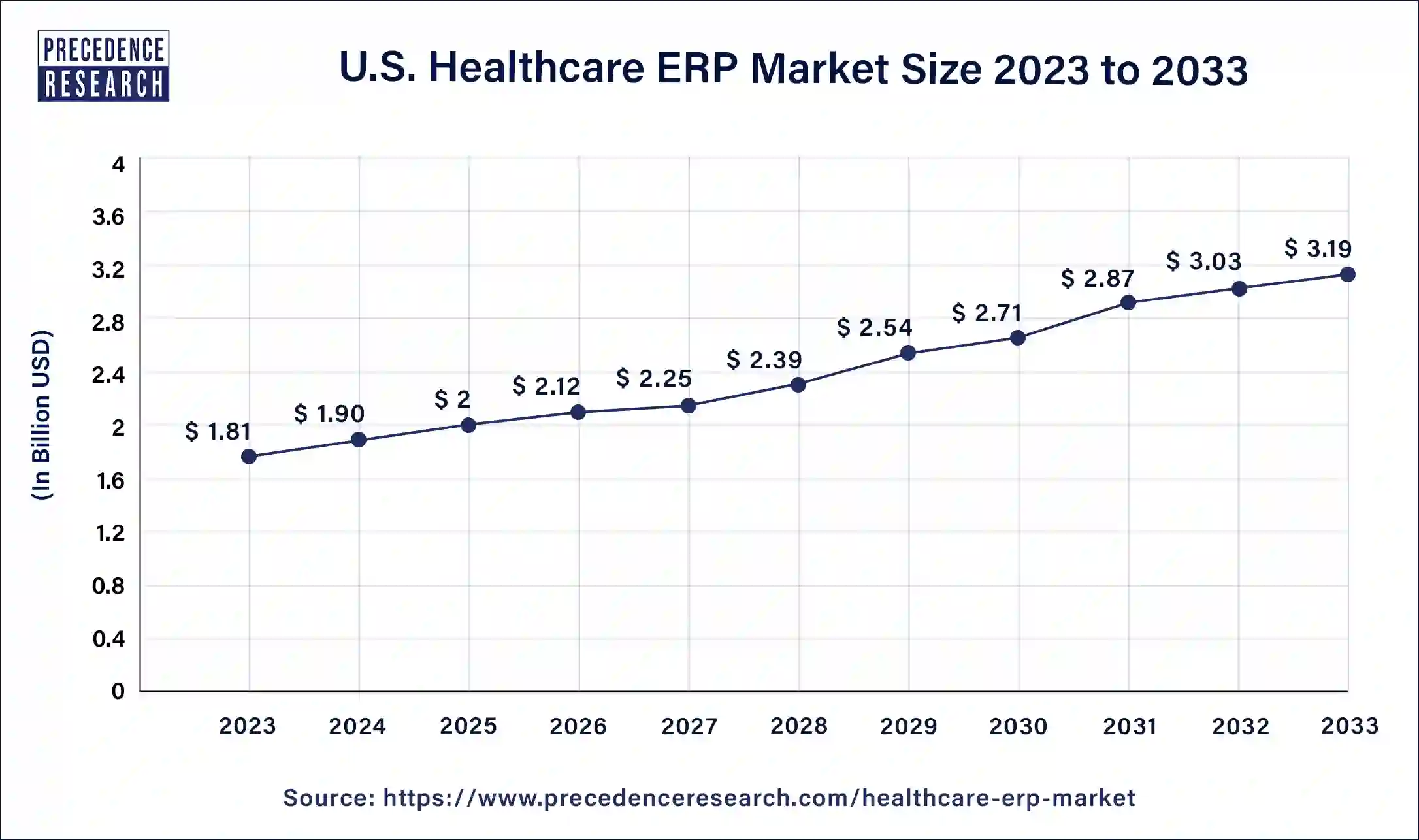

U.S. Healthcare ERP Market Size and Growth 2025 to 2034

The U.S. healthcare ERP market size accounted for USD 1.90 billion in 2024 and is estimated to reach around USD 3.35 billion by 2034, growing at a CAGR of 5.83% from 2025 to 2034.

North America dominated the market in 2024 with the largest revenue share 34%.This is attributable to the increased adoption of digital and automated technologies in the healthcare sector of North America. Moreover, the increased adoption of healthcare services owing to the increased prevalence of diseases and increased healthcare expenditure has compelled the healthcare service providers to adopt the ERP systems to offer enhanced and personalized services to patients in North America. Moreover, the government initiatives to boost the adoption of digital technologies to reduce the paperwork, maintain a database of the patients, and enhance the delivery of quick health services have played a crucial role in the growth of the North America healthcare ERP market.

North America maintains its dominance in the Healthcare ERP market, thanks to a confluence of advantageous factors. The region's sophisticated healthcare infrastructure is complemented by early technology adoption and strong government support for healthcare IT initiatives. These elements collectively reinforce the demand for ERP solutions that enhance operational efficiency, drive data-driven decision-making, and ensure compliance with regulatory standards.

Notably, the region's established healthcare system has paved the way for the rapid assimilation of technologies such as Electronic Health Records (EHRs), which are frequently integrated with ERP systems to offer comprehensive management capabilities.

On the other hand, Asia Pacific is estimated to be the most opportunistic market during the forecast period. The increasing government investments in the development of digitalized and technologically advanced healthcare infrastructure in the region are expected to drive the market growth. Moreover, the rising prevalence of various chronic diseases and rapidly growing geriatric population is boosting the number of patients at a rapid rate. Therefore, to offer quick and enhanced care services to the patients, the demand for the healthcare ERP is expected to grow rapidly in Asia Pacific region during the forecast period.

Asia-Pacific is witnessing remarkable growth in the Healthcare ERP sector, fueled by increased healthcare expenditures, a burgeoning private healthcare sector, and widespread adoption of digital healthcare technologies. Rising public and private healthcare spending, along with a growing workforce shortage, underscores the urgent need for sophisticated and seamless healthcare management systems.

The expanding private healthcare market in Asia-Pacific particularly drives demand for ERP solutions, as hospitals and clinics strive to enhance their operational efficiencies and elevate the quality of patient care.

Healthcare ERP Market Growth Factors

The global healthcare ERP market is significantly driven by the rising demand for the efficient digital management solutions in the healthcare sector, growing need for the automation of tasks, and streamlining the information across the departments in the healthcare unit has fostered the adoption of the ERP systems in the healthcare sector. The adoption of the healthcare ERP offers enhanced patient care services and optimum utilization of resources. The developers and the providers are taking efforts to integrate the advanced technologies like Artificial intelligence into the healthcare ERP systems to enhance the efficiency of the system. The AI-powered ERP systems will enhance the data processing and data analytics and would offer more enhanced decision-making.

The various functions offered by the healthcare ERP such as supply chain & logistics, finance & billing, inventory management, patient relationship management helps the healthcare units to focus on the core activities of patient care and treatment and hence foster the operational efficiency of the healthcare units like clinics and hospitals. Moreover, the ERP systems synchronize the patient related data to the clinicians and enhance the patient and healthcare professional interaction.

Furthermore, the growing number of hospital admissions is creating a pressure on the healthcare systems to deliver services quickly. The growing hospital admissions are a result of the rapidly growing prevalence of various chronic diseases among the global population. According to the International Agency for Research on Cancer, in 2020, around 19.3 million new cancer cases and 10 million cancer deaths were reported across the globe. It is estimated that around 28.4 million new cancer cases will be recorded in 2040, globally.

According to the World Health Organization, the cardiovascular diseases results in around 17.9 million or 32% of the global deaths and it is a leading cause of death across the globe. As per the International Diabetes Federation, the global diabetic population is estimated to reach at 783 million by 2045. Therefore, an alarming rise in the number of patients is boosting the number of hospital admissions, which is fostering the deployment of the healthcare ERP systems across the healthcare sector.

Report Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.68% |

| Market Size in 2034 | USD 12.71Billion |

| Market Size by 2025 | USD 7.09 Billion |

| Market Size by 2024 | USD 6.66 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | End User, Deployment, Function, Geography |

Drivers

Across healthcare systems worldwide, there's an increasing to streamline operations ranging from billing and supply chain to patient management through a unified digital platform. Healthcare ERP systems deliver this by integrating diverse administrative and clinical workflows into a single system, reducing manual redundancies, improving data management, and freeing staff to prioritize patient care over paperwork. This drive for better resource utilization and enhanced productivity is a core force behind ERP adoption.

The transition to cloud based ERP platforms has significantly lowered entry barriers for healthcare providers, offering scalability and remote accessibility without heavy upfront costs. Alongside this, integrating artificial intelligence and machine learning into ERP systems allows for predictive analytics such as forecasting patient demand and optimizing staffing and supplies. These technology innovations not only boost operational agility but also enhance service delivery and decision making.

Healthcare organizations are grappling with growing patient populations, aging demographics, and tightening regulatory requirements. These pressures drive the need for robust ERP systems that can support scalable operations, maintain compliance, and enable efficient delivery of care.

Opportunity

One of the biggest opportunities emerging in the healthcare ERP market is the integration of advanced analytics and AI-driven insights to transform operational decision making. While current ERP systems already centralize data, the next wave will leverage predictive analytics to forecast patient admission surges, anticipate supply shortages, end even optimize staffing schedules in real time. Hospitals and clinics that adopt these capabilities will be able to move from reactive to proactive management, reducing costs while improving patient outcomes. With the rise of value based care models, these is a growing incentive for healthcare providers to invest in ERP platforms that go beyond administration and actively contribute to care quality improvements.

Another major opportunity lies in the expansion of ERP adoption among small and mid-sized healthcare facilities, particularly, in merging economies. Historically, ERP systems were seen as costly and complex, favouring large hospitals. However, the increasing availability of cloud based, modular ERP solutions allows smaller providers to access core functionalities without heavy infrastructure investments. This democratization of ERP technology opens the door for rapid adoption in underserved regions, enabling these providers to enhance operational efficiency, comply with digital health mandates, and compete more effectively. Vendors that offer scalable, user-friendly, and regionally localized solutions stand to gain significant market share.

Restraints

One major restraint in the healthcare ERP market is the high initial implementation cost and complexity of integration with existing systems. Many healthcare organization, specially in developing regions, operate on tight budgets and rely on legacy software that may not be compatible with modern ERP solutions. Transitioning to new platform often involves significant expenses for software licensing, customization, data migration, and staff training. Additionally, the process can cause temporary workflow disruptions, making administrators hesitant to commit to such a large scale transformation. These financial and operational barriers slow adoption, particularly for smaller facilities.

Another significant restraint is the heightened concern around data security and compliance. Healthcare ERP systems handle vast amounts of sensitive patient and financial information, making them prime targets for cyberattacks. Assuring compliance with strict regulations, such as HIPPAA in the U.S. or GDPR in Europe, requires continuous monitoring, regular security updates, and robust encryption measures. Any breach not only carriers legal and financial consequences but also risks damaging patient trust. For many healthcare providers, the fear of exposing critical data during system integration or migration creates reluctance to adopt new ERP technologies, specially if they lack in house cybersecurity expertise.

Function Insights

The finance and billing segment dominated the market with the highest revenue share in 2024.The inventory management segment also hit the remarkable share of 19.43% in 2024. The rising number of patients along with the growing consumption of various healthcare products and healthcareconsumables across the nursing homes, hospitals, and clinics has significantly boosted the inventory management services of the healthcare ERP. The rising consumption of the healthcare consumables and keeping a track of it to ensure efficient supply of the stocks in the healthcare units has fostered the growth of the inventory management segment.

On the other hand, the patient relationship management is estimated to be the most opportunistic segment during the forecast period. The healthcare ERP helps the healthcare administrators to efficiently handle the backend operations at a low cost thereby enhancing the operational efficiency of the healthcare unit. The ERP systems provides quality patient care and helps to provide personalized healthcare services to the patients, which helps to improve the patient relationship. The enhanced marketing tools and establishment of trust between the doctors and the patients is the significant function of the ERP system that fuels the growth of the patient relationship management segment.

Healthcare ERP Market Value USD Mn Analysis, By Function, 2022 – 2024

| By Function | 2022 | 2023 | 2024 |

| Supply Chain & Logistics | 1,407.8 | 1,493.1 | 1,588.0 |

| Finance & Billing | 1,958.3 | 2,063.8 | 2,181.2 |

| Inventory Management | 1,137.3 | 1,221.9 | 1,316.4 |

| Patient Relationship Management | 799.8 | 838.6 | 881.9 |

| Others | 642.4 | 670.9 | 702.1 |

Deployment Insights

The premises segment dominated the healthcare ERP market in 2024. This dominance can be attributed to the preference of healthcare institutions for maintaining complete control over their ERP systems, assuring data security, and meeting strict compliance requirements. On premises solutions are often favoured by larger healthcare organizations with the resources to manage in house. IT infrastructure, offering them a high degree of customization and integration with existing systems. However, the cloud segment is projected to grow at the fastest pace during the forecast period. Cloud based ERP systems appeal to healthcare providers due to their scalability, cost effectiveness, and ability to support remote access an increasingly vital capability as telehealth and distributed care model expand. Furthermore, the cloud model reduces the need for heavy upfront investments and provides frequent updates, keeping systems agile and adaptable.

Healthcare ERP Market Value (US$ Mn) Analysis and Forecast, By Deployment, 2022 – 2024

| By Deployment | 2022 | 2023 | 2024 |

| On-premise | 3,655.2 | 3,831.2 | 4,027.0 |

| Cloud | 2,290.3 | 2,457.1 | 2,642.6 |

End Use Insights

The finance and billing segment maintained a leading position in the market in 2024. Financial and billing modules within ERP systems help healthcare providers manage complex billing cycles, insurance claims, and regulatory compliance while improving revenue cycle management. With rising operational costs and intricate reimbursement structures, healthcare organizations rely heavily on ERP tools streamline financial workflows and reduce revenue leakages. In contrast, the inventory and material management segment is expected to experience the fastest growth in the coming years. The increasing focus on cost optimization, supply chain efficiency, and real time tracking of medical supplies is driving the adoption of ERP modules that can automate procurement, monitor stock levels, and prevent shortages. This trend has been accelerated by the growing need for better resource management in response to unpredictable demand in healthcare services.

Healthcare ERP Market Value (USD Mn) Analysis and Forecast, By End Use, 2022 – 2024

| By End Use | 2022 | 2023 | 2024 |

| Hospitals | 917.4 | 973.5 | 1,035.9 |

| Clinics | 577.9 | 605.4 | 636.0 |

| Nursing Homes | 351.6 | 364.9 | 379.8 |

| Others | 194.5 | 199.6 | 205.2 |

Key Market Developments

The global healthcare ERP market is fragmented due to the presence of numerous market players. The market players are constantly engaged in various developmental strategies in order to exploit the prevailing market opportunities and gain competitive advantages. The various developmental strategies such as new launches, joint ventures, acquisitions, and partnerships adopted by the key market players significantly impacts the market growth.

Healthcare ERP Market Companies

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- McKesson Corporation

- Sage Group Plc.

- Infor, Inc.

- Odoo

- QAD, Inc.

- Aptean

- Epicor Software Corporation

Recent Developments

- In June 2025, NetSuite introduced a tailored Healthcare Solution specifically aimed at enhancing operational efficiency and significantly improving patient care outcomes within healthcare organizations.

- In January 2025, Samsung made headlines by partnering with Eka Care to launch an innovative Health Records feature, aimed at streamlining patient record management and enhancing accessibility for healthcare providers.

- In September 2024, Deloitte initiated the launch of outcome-focused, industry-specific Workday Accelerators, targeting sectors such as Banking, Healthcare, Higher Education, and Technology and Media to address unique organizational challenges through optimized ERP solutions.

Segments Covered in the Report

By Function

- Supply Chain & Logistics

- Finance & Billing

- Inventory Management

- Patient Relationship Management

- Others

By Deployment

- On Premise

- Cloud

By End User

- Hospitals

- Clinics

- Nursing Homes

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting