What is the Healthcare Consumables Market Size?

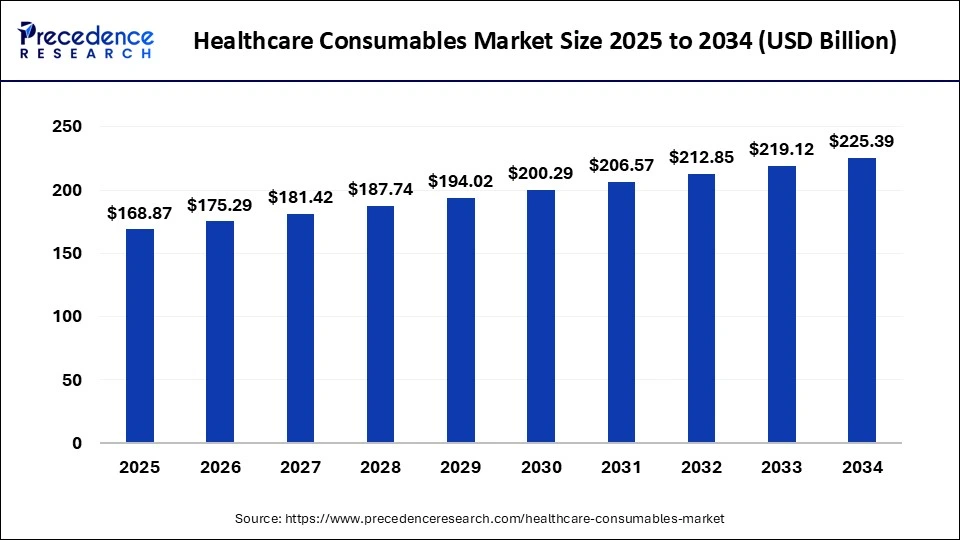

The global healthcare consumables market size is calculated at USD 168.87 billion in 2025 and is predicted to increase from USD 175.29 billion in 2026 to approximately USD 231.66 billion by 2035, growing at a CAGR of 3.21% from 2026 to 2035.

Market Highlights

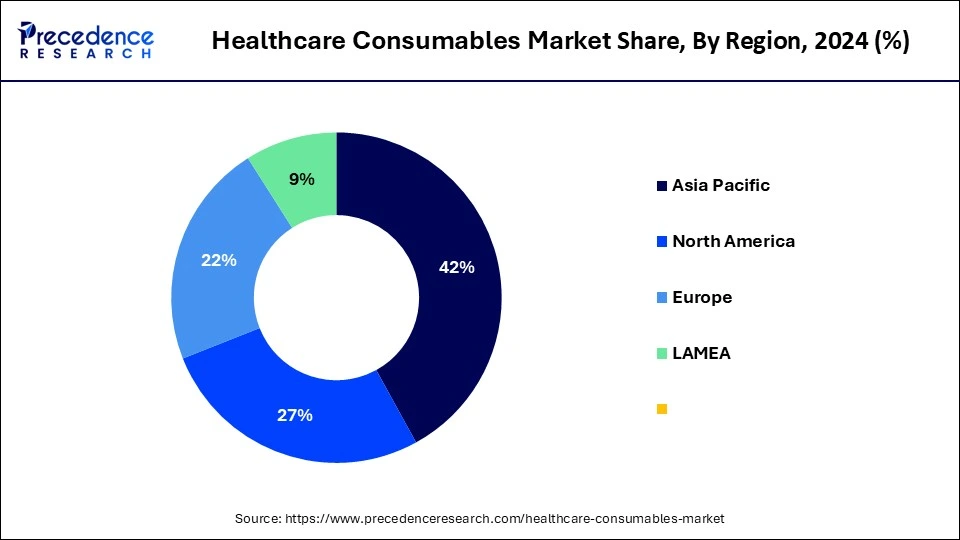

- North America led the global market with the highest market share of 42% in 2025

- By Product Type, the sterilization segment has held the largest market share in 2025

- By Raw Material, the plastic resin segment captured the biggest revenue share in 2025

- By End User, the hospitals segment is estimated to hold the highest of 67% market share in 2025.

From Precision to Intelligence: AI Meets Healthcare Consumables

The application of artificial intelligence can be of great benefit to the healthcare consumables market as it allows streamlining supply chain management. Through further manufacturing processes, AI can issue quality control to spot problems on manufacturing lines, predict when machines will need maintenance and reduce shutdown time, and improve efficiency. Also, it makes many real-time insights, which allows managing time and increasing the quality of outputs.

In post-production, AI can assist in inventory management by reviewing the data in warehouses, streamlining stock, and reducing wastage. Artificial Intelligence in transportation facilitates a real-time overview of shipments, effective route schedules, and forecast maintenance of delivery cars. AI helps in demand forecasting, enabling the aligned distribution according to the market requirements, decreasing overproduction, and minimizing transportation and storage costs.

Inside the Surge: The Hidden Drivers Powering Healthcare Consumables Growth

The global healthcare consumables market is primarily driven by the increased number of hospitals admissions owing to various reasons like the rising prevalence of chronic diseases, increasing the number of road traffic accidents, and increased adoption of surgical procedures for treatment among the population. Moreover, the rising number of hospital acquired diseases and growing awareness regarding this is boosting the consumption of healthcare consumables.

The rising prevalence of various chronic diseases like CVDs, COPD, and diabetes is a significant contributor to the healthcare consumables market growth. According to the International Diabetes Federation, the global diabetic population is estimated to reach at around 552 million by 2030. According to the WHO, diabetes is a major reason for kidney failure, blindness, stroke, and diabetic foot ulcer. This results in prolonged hospital stays.

The rising the geriatric population across the globe is expected to drive the growth of the market, as old age people as more prone to various diseases and they need utmost attention and continuous monitoring, which may fuel the demand for the healthcare consumables. According to the WHO, the global geriatric population is anticipated to reach 2 billion by 2050. Moreover, the rising demand for the various invasive and minimally-invasive surgeries for the treatment is positively impacting the growth of the global healthcare consumables market.

Market Outlook

- Industry Growth Overview: The healthcare consumables market worldwide is expected to grow steadily between 2025 and 2030. This growth is driven by an aging population, a higher prevalence of chronic diseases, and ongoing efforts to prevent infections. The supply chain of the industry has become the backbone, comprising cost-effective, sterile, and regulation-compliant supplies that ensure patient safety in healthcare systems.

- Sustainability and Circular Trends: One of the current trends in the international healthcare consumables industry is sustainability, with regulators and hospitals working to reduce medical waste. The U.S. NHS, Sweden, and France are also shifting toward reusable gowns and sustainable waste segregation methods in hospitals. These changes are transforming procurement models into environmentally friendly supply frameworks.

- Global Manufacturing/ Supply Chain Expansion: Companies are also strategically decentralizing production facilities to boost supply resilience and reduce dependence on manufacturing hubs in a single region. Becton Dickinson (BD) has invested over USD 200 million in developing syringes and IV catheters in Haryana, India, while Terumo Corporation and Nipro Medical are expanding operations in Vietnam and Thailand to meet ASEAN demand. Such expansions shorten lead times, strengthen local supply chains, and create a geographically balanced manufacturing support system for global healthcare consumables.

- Innovation Strategy: The healthcare consumables industry is expanding through cross-disciplinary research and development to improve performance, patient safety, and environmental impact. Startups such as Axio Biosolutions (India), GreenSurgical (U.S.), and Enbiosis Health (U.K.) are leading with biocompatible wound treatments and compostable surgical gloves. This wave of innovations marks the end of the traditional disposable items in medical material science and the start of intelligent, eco-friendly, traceable consumable ecosystems.

Global Lifelines Rewired: Trade, Tech, and Tactics in the Healthcare Consumables Revolution

- The European Commission approved up to €403 million in public funding to support medical device innovation, signaling targeted support for advanced consumables, smart devices, and regional manufacturing scale-ups.

- U.S. MedTech manufacturing generates about USD 250 billion in output and supports roughly 3 million jobs, with leading manufacturers boosting domestic capacity and investing in automation and advanced sterile-consumable lines to cut down on imports.

- Trade-level HS data show significant cross-border flows for essential consumables. U.S. imports of syringes reached approximately USD 1.17 billion in 2023, highlighting the motivations for importing countries to develop local syringe and single-use device manufacturing capacity.

- In 2024, China's exports of medical-grade gloves under HS 401519 totaled approximately USD 599.65 million, with around 126.97 million kilograms shipped worldwide.

- Thailand is strengthening its position as a manufacturing hub for medical consumables through increased investment flows: in 2024, it secured investment pledges of USD 21.78 billion (800 billion baht), with an industrial policy explicitly encouraging a shift from traditional manufacturing to sectors such as medical equipment and consumables.

- Multiple studies estimate that African countries import approximately 80–94% of medical supplies, 75% of testing kits, and between 70–95% of pharmaceuticals, highlighting their heavy reliance on foreign-made consumables.

- In 2024, the EU exported €531.6 billion worth of goods to the United States (imports from the U.S. totaling €333.4 billion), highlighting the significant U.S.–EU trade route that transports high-value medical consumables along with other manufactured products.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 168.87 Billion |

| Market Size in 2026 | USD 175.29 Billion |

| Market Size by 2035 | USD 231.66 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 3.21% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Raw Material, End User, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Geriatric Population

As people grow old, they are more susceptible to chronic and age-related diseases like diabetes, arthritis, cardiovascular diseases, dementia, and respiratory diseases. These medical conditions have forced such people to receive medical attention on a regular basis, such as visits to the hospital, surgeries, patient care at home, and constant evaluation of their health etc., which is severely dependent on consumable medical supplies. Also, older people are weaker and more affected by infections and complications due to the weakening of their immune system, which needs to be taken into consideration, and disposable medical supplies should be used regularly to maintain hygiene and the ability to respond to diseases properly.

The Silver Surge: How America's Aging Population Expanded from 2010 to 2020

| Age Group (Years) | Population in 2010 (Millions) | Population in 2020 (Millions) | Growth (Millions) |

| 65 to 74 | 21.7 | 33.1 | +11.4 |

| 75 to 84 | 13.1 | 16.3 | +3.2 |

| 85 to 94 | 13.1 | 5.7 | +0.6 |

| 95 and over | 0.4 | 0.6 | +0.2 |

Restraint

Pollution due to the Healthcare Consumables

There is a huge environmental challenge posed by the growing use of single-use healthcare consumables. This is mainly about products being made of plastic, versus syringes, gloves, masks, bandages, and other disposable materials that were to be used at least once to maintain hygiene and prevent cross-contamination. Sanitary disposal of this kind of waste is important, but it is also expensive, as it can be infectious. These types of materials need special processing procedures and laws to handle and dispose of them safely, greatly adding to the costs of operations by healthcare institutions. Besides, inappropriate management of medical waste may result in serious health hazards to the population, causing infections. The cost of training the staff and ensuring measures of waste management safety also contributes to the economic load.

Opportunity

Trend of Sustainability

This emerging problem is making the healthcare industry move towards industrial practices that are greener and more sustainable. Shifting to biodegradable or compostable materials is one of the key strategic directions. Such options cut long-term waste but also assist in reducing the carbon footprint of the industry. Recycling offers are becoming increasingly popular, and waste-to-energy facilities that deal with high quantities of medical waste to produce energy that can be used in productive ways. Also, environmentally friendly ways of using the gloves, gowns, and other indispensable consumable products, with the need to satisfy the hygiene criteria, are moving towards reusable alternatives to their equivalents.

Segment Insights

Product Type Insights

Based on the product type, the sterilization consumables segment captured the biggest revenue share in 2025. The sterilization consumables consists of cotton swabs, test tubes, sterilizer bags, and cotton balls, which are increasingly used for the skin preparation and sterilization of differentmedical equipment. The growing demand for the premixed cotton swabs and cotton balls is further fueling the growth of the sterilization consumables segment.

On the other hand, the hands sanitizer is estimated to be the most opportunistic segment during the forecast period. This can be attributed to the rising awareness regarding the various infections through hand. The increased burden of fungal and bacterial infections is boosting the growth of this segment. Moreover, the rising awareness regarding the hospital acquired infections is expected to boost the demand for the hands sanitizer during the forecast period.

Raw Material Insights

Based on the raw materials, the plastic resin segment has held the largest market share in 2025. This is simply attributed to the increased utilization of the plastic resins in the production of wide range of healthcare consumables such as syringes, tubes, packaging materials, and containers for medical purposes. Moreover, the low cost, durability, and availability of different plastics such as PP, PVC, and polystyrene has exponentially created the growth opportunities in the healthcare industry.

On the other hand, non-woven materials segment is expected to be the fastest-growing segment during the forecast period. This is attributable to the increased awareness regarding benefits of the non-woven materials in efficiently preventing the hospital acquired infections and surgical infections. The easy disposal, recyclability, and low cost are the several benefits associated with the non-woven materials that fosters the market growth.

End User Insights

The hospitals segment held the largest share of the market in 2025 and the segment is observed to sustain its dominance throughout the forecast period. Hospitals typically experience a continuous and high patient flow, leading to a consistent demand for healthcare consumables. These facilities handle a wide range of medical conditions and treatments, requiring a variety of consumables on a daily basis. Many hospitals incorporate specialized units such as laboratories, imaging centers, and rehabilitation facilities. Each of these units requires specific consumables related to their functions, contributing to the overall demand within the hospital setting. Hospitals cater to a diverse patient population with varying medical needs. This diversity necessitates a wide range of consumables to address different health conditions, ages, and medical requirements.

Regional Insights

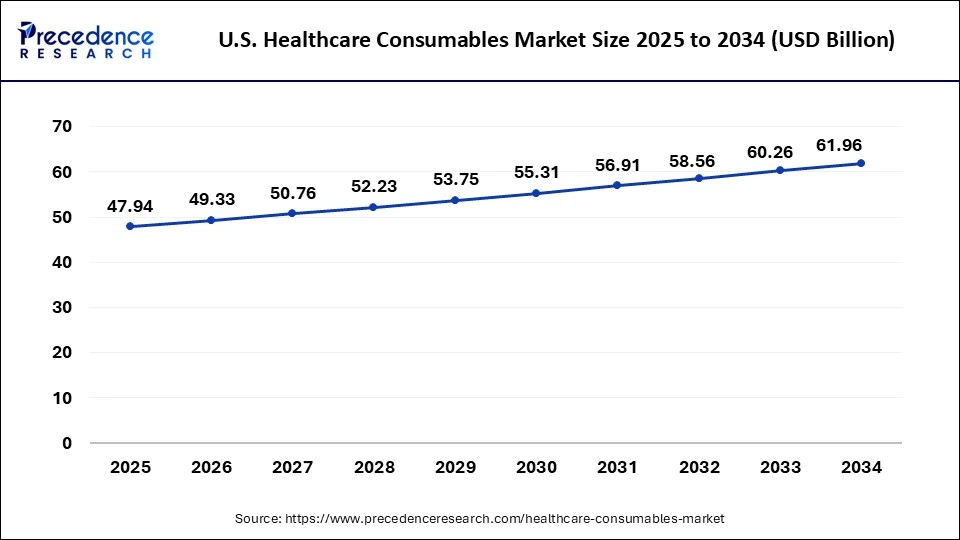

U.S. Healthcare Consumables Market from 2026 to 2035

The U.S. healthcare consumables market size is valued at USD 47.94 billion in 2025 and is expected to reach around USD 63.66 billion by 2035, growing at a CAGR of 2.88% from 2026 to 2035.

U.S. Healthcare Consumables Market Analysis

The healthcare consumables market in North America was predominantly dominated by the U.S. in 2025 due to extensive hospital supplies, high surgical volumes, and strong regulatory standards. The U.S. market is anticipated to be the benchmark for the technological use of biocompatible materials and AI-based integrated consumables in hospitals and diagnostic labs.

Based on region, North America accounted for over 42% of the market share in 2025. North America is characterized by the increased healthcare expenditure, rising awareness regarding minimally-invasive surgeries, presence of strong healthcare infrastructure, and increased penetration of healthcare units. Moreover, rising number of hospital admissions is boosting the market growth. As per the data revealed by the CDC, there were around 45 million outpatient surgeries, more than 900 million physician visits, and 155 million emergency department visits in US, in 2019.

On the other hand, Asia Pacific is estimated to be the most opportunistic market during the forecast period. Asia Pacific is projected to witness huge presence of the geriatric population in the upcoming future. According to WHO, 80% of the global geriatric population is expected to be living in the low and middle-income countries, by 2050. Moreover, the rising penetration of hospitals, ambulatory services, clinic, and diagnostic labs in the region is boosting the market growth.

China Healthcare Consumables Market Analysis

China leads the Asia-Pacific healthcare consumables market due to its large and aging population, rapidly expanding healthcare infrastructure, and strong government investment in healthcare modernization. Additionally, the country's robust manufacturing base and growing domestic demand for medical supplies drive both production and consumption growth.

What are the Key Trends Driving the Europe Healthcare consumables market?

The European healthcare consumables market is expected to account for a substantial market share in 2025, propelled by factors such as the presence of an upgraded healthcare infrastructure, a rising healthcare spend, and the rise in the burden of chronic conditions. Nations such as the UK, France, and Germany are taking pole position as they have an established medical system and direct attention towards the quality of care for patients. The growing importance of hygiene and infection control in recent years, and particularly after COVID-19, has boosted the consumption of disposable healthcare items in clinics, hospitals, and home settings.

The healthcare system of Germany facilitates the extensive usage of innovative consumable goods, such as complex wounds, infection control products, and diagnostic consumables. The dedication to medical care innovation and sustainability expressed by the German government is fostering the creation of eco-friendly, one-time use healthcare products. The market leadership in the country is also supported by the presence of major players in the industry, as well as the presence of strategic partnerships between manufacturers and healthcare institutions.

Germany Healthcare Consumables Market Analysis

The country is characterized by high consumption of healthcare consumables, making Germany the leader in the European market for this sector. Thanks to a well-developed healthcare system, a large elderly population, and a focus on infection prevention, it can be expected that the digitalization of hospital procurement systems under the Krankenhauszukunftsgesetz (KHZG) initiative will streamline supply chains. Additionally, these advancements provide better traceability, helping the healthcare consumables market in the country stay ahead in the European market.

Navigating the South American Healthcare Consumables Landscape

South America has shown consistent growth in the market, driven by rising hospital construction, increased government healthcare spending, and higher imports of sterile medical disposables. Adoption of single-use devices and surgical kits is also growing in emerging private hospital networks in Chile, Colombia, and Argentina, enhancing patient safety and aligning with international hygiene standards.

Brazil Healthcare Consumables Market Analysis

Brazil leads the South American healthcare consumables market, driven by national health expansion programs and hospital modernization. The 2024–2028 National Health Plan emphasizes digital monitoring, medical supplies, and sustainable procurement. Brazil is expected to remain the region's largest consumer over the next decade, fueled by rising chronic disease treatments and surgical procedures.

Unlocking Growth in the Middle East & Africa Healthcare Consumables Sector

The Middle East and Africa healthcare consumables market has gained strong momentum, driven by large-scale hospital developments in Saudi Arabia, the UAE, and Qatar. Initiatives like Saudi Vision 2030 and the UAE National Strategy of Wellbeing 2031 have boosted investment in medical infrastructure, increasing demand for surgical consumables, catheters, and diagnostic supplies. In Africa, rising funding from the WHO, African Development Bank, and international health initiatives, along with local partnerships, such as GE HealthCare's operations in Kenya and Ethiopia, are strengthening regional production, gradually reducing reliance on imports from Europe and Asia.

Saudi Arabia Healthcare Consumables Market Analysis

The Middle East and Africa healthcare consumables market was led by Saudi Arabia, thanks to substantial national health investments under Saudi Vision 2030. The shift toward a public-private sector and stronger international supplier relationships is expected to improve product availability, compliance, and cost-efficiency in the region.

South Africa Healthcare Consumables Market Analysis

South Africa held the largest share of the market in the region, supported by the strong growth of hospitals and improved public health programs. The medical manufacturing roadmap by the Africa CDC and the African Continental Free Trade Area (AfCFTA) is expected to boost regional production capacity. South Africa's position as a logistics hub in the southern part of Africa has further strengthened its role in the continent's healthcare consumable supply chain.

Lifelines of Care: Inside the End-to-End Value Chain of the Healthcare Consumables Industry

- Raw Material Sourcing

The foundation of healthcare consumables production lies in sourcing high-quality base materials, including medical-grade plastics (PVC, PP, PE, silicone), natural and synthetic rubbers, cotton, nonwovens, and biocompatible polymers. These materials form the backbone of products such as syringes, gloves, dressings, and tubing.

Key Players: ExxonMobil Chemical, SABIC, Dow Inc., BASF SE, DuPont, LyondellBasell Industries.

- Component Fabrication

At this stage, raw materials are transformed into key consumable components, films, tubing, molded parts, filters, and absorbent layers. Precision molding, extrusion, sterilization, and coating technologies are used to meet strict medical standards.

Key Players: Tekni-Plex, Nelipak Healthcare Packaging, GW Plastics, Saint-Gobain Performance Plastics, Röchling Medical.

- Product Manufacturing & Assembly

Fabricated parts are assembled into final consumable products, such as syringes, catheters, surgical gloves, wound dressings, drapes, and diagnostic kits. This stage requires cleanroom manufacturing, sterilization (ETO, gamma, steam), and ISO 13485-certified production environments to ensure biocompatibility and safety.

Key Players:Becton Dickinson (BD), 3M Health Care, B. Braun Melsungen AG, Smith & Nephew, Teleflex, Mölnlycke

- Health Care, Terumo Corporation.

Quality Control & Regulatory Compliance

Products go through rigorous quality checks for sterility, material integrity, and regulatory compliance. Manufacturers must adhere to global standards like FDA 21 CFR (U.S.), EU MDR 2017/745, ISO 10993 (biocompatibility), and ISO 13485 (QMS).

Key Players:SGS, TÜV SÜD, UL Solutions, Intertek, Bureau Veritas, Eurofins Scientific.

- Packaging & Sterilization Services

Proper packaging is essential for maintaining sterility and shelf life. Medical consumables are sealed in barrier films, sterile wraps, or blister packs, often using gamma or E-beam sterilization. Contract sterilization services are crucial for scalability and compliance.

Key Players: Steris Corporation, Sotera Health (Nelson Labs & Sterigenics), Amcor Healthcare Packaging, Berry Global, DuPont Tyvek.

- Distribution & Supply Chain Management

Finished products are distributed through intricate supply chains involving direct hospital deliveries, group purchasing organizations (GPOs), and distributors. Effective logistics guarantee timely arrival at healthcare facilities, especially during emergencies or periods of high demand.

Key Players:Cardinal Health, Owens & Minor, Medline Industries, McKesson Corporation, Henry Schein, DHL Supply Chain, FedEx Healthcare.

- End-User Delivery & Consumption

Hospitals, clinics, diagnostic centers, and home-care providers use these consumables for patient treatment, diagnostics, and infection prevention. Usage data from hospitals and procurement systems affect future demand forecasting and stockpiling strategies.

Key Players: National Health Service (NHS), Mayo Clinic, Apollo Hospitals, Cleveland Clinic, Kaiser Permanente, Fortis Healthcare.

- Waste Management & Recycling

Post-use consumables, especially single-use plastics and sharps, are subject to regulated disposal or recycling. Emphasis is increasingly placed on sustainable material recovery, sterilization, and circular economy initiatives to reduce the impact of medical waste.

Key Players: Stericycle, Veolia Environnement, Sharps Compliance Inc., Clean Harbors, EnviroServ Waste Management.

Top Companies in the Healthcare Consumables

- 3M Company (U.S.)

Corporate Information

- Headquarters: St.Paul, Minnesota, U.S.

- Year Founded: 1902 (as Minnesota Mining & Manufacturing Company)

Business Overview

3M is a diversified, global technology company operating across a broad range of product categories, including industrial, safety, consumer, electronics, and healthcare. In the healthcare consumables space specifically, 3M supplies medical tapes, dressings, wound care products, sterilization wraps, surgical consumables, dental/orthodontic consumables, and other hospital-use consumables. The company's innovation-driven culture underpins its ability to supply large volumes of healthcare consumables globally.

Business Segments / Divisions

- Industrial – abrasion, adhesives, tapes, films, etc.

- Safety & Graphics – personal protective equipment (PPE), safety products, signage.

- Electronics & Energy – electronics materials, interconnects, energy solutions.

- Health?Care – medical consumables (the focus for our interest), dental/orthodontic, health care IT, sterilization, wound care, etc.

- Consumer – products like Post it, Scotch, adhesives, etc (though less relevant for healthcare consumables).

It's noteworthy that the healthcare segment was spun off into an independent company called Solventum Corp. in April 2024.

Geographic Presence

3M operates globally, with:

- Presence in 200 countries and territories.

- Manufacturing and R&D sites across Americas, Europe, Asia Pacific, and other regions. For example, 3M Malaysia operations illustrate its Asia presence.

- Its consumable healthcare products are distributed worldwide, supported by regional manufacturing and supply chain networks to serve hospitals, clinics, and other healthcare providers globally.

Key Offerings

- Medical tape and adhesive products for surgical, wound care, and hospital use (e.g., surgical drape tapes, fixation tapes).

- Wound care dressings and surgical wraps for trauma, burns, and post-operative care.

- Sterilization wraps, packaging, and barrier materials for medical instruments and devices.

- Dental and orthodontic consumables (bonding materials, cements, etc) which feed into the broader hospital consumables market.

- Infection control consumables: barrier films, protective products for the healthcare environment.

- Consumables used in hospitals and clinics for everyday procedures, supporting the consumables frontier of healthcare.

SWOT Analysis

Strengths

- Strong global brand with over a century of innovation and hundreds of thousands of patents, providing a broad product portfolio and R&D advantage.

- Diversified offerings reduce dependence on any single market; in healthcare consumables, the scale and quality reputation are significant differentiators.

- Extensive global footprint and supply chain capability for consumables allows a reliable supply to healthcare providers worldwide.

Weaknesses

- The breadth and complexity of 3M's business segments may lead to slower decision-making and reduced agility compared with more specialized firms.

- Legal and regulatory liabilities (notably environmental issues such as PFAS and product liability suits) have weighed on financial performance and may distract from the core consumables focus.

Opportunities

- Growing global demand for healthcare consumables driven by aging populations, increased surgical and wound care procedures, and emerging market healthcare expansion.

- Innovation in materials (e.g., smarter adhesives, sensor-enabled consumables, infection control consumables) could allow 3M to capture higher margin growth in healthcare.

- Emerging markets represent an opportunity for expanded adoption of consumables and hospital infrastructure build-out, which aligns with 3M's global reach.

Threats

- Intense competition from specialized medical consumables companies and low-cost regional manufacturers could pressure margins.

- Regulatory and reimbursement pressures in healthcare systems could constrain hospital consumables spending or demand cheaper alternatives.

- Supply chain disruptions, raw material cost volatility, and global trade/tariff risks may impact the consumables manufacturing and distribution business.

Other Major Companies

- Becton, Dickinson and Company (BD) (USA): BD is one of the world's largest suppliers of medical consumables and devices, providing syringes, needles, catheters, infusion sets, and diagnostic collection systems.

- Cardinal Health, Inc. (USA): A key distributor and manufacturer of disposable medical products, Cardinal Health delivers surgical drapes, gloves, gowns, and fluid management systems to hospitals and clinics.

- Medtronic plc (Ireland): Beyond its well-known medical devices, Medtronic offers a wide range of consumable surgical instruments and patient monitoring disposables.

- Johnson & Johnson MedTech (USA): Through its Ethicon and DePuy Synthes divisions, J&J is a top manufacturer of surgical sutures, staplers, and wound closure consumables.

- B. Braun Melsungen AG (Germany): A pioneer in infusion therapy and surgical consumables, B. Braun provides IV sets, catheters, wound care products, and surgical instruments to healthcare facilities worldwide.

- Terumo Corporation (Japan): Terumo is a global manufacturer of blood management, vascular access, and injection-related consumables.

- Smith & Nephew plc (UK): Renowned for wound management and surgical consumables, Smith & Nephew's offerings include advanced dressings, negative pressure therapy systems, and surgical instruments.

Recent Developments

- In March 2024, Hindustan Syringes and Medical Devices (HMD) released the Dispojekt single-use syringes with safety needles, cementing India as one of the emerging global giants in the medical device business.(Source : https://economictimes.indiatimes.com)

- In January 2024, Reliance Fusion is a next-generation sterilization wrap that helps hospitals sterilize surgical equipment trays more effectively. Ahlstrom has gained FDA 510(k) approval from the U.S. Food and Drug Administration for this product. To promote and sell medical devices in the United States, one must obtain FDA 510(k) authorization. (Source : https://www.ahlstrom.com)

- In May 2023, the Bayer unit to develop technology and innovative precision health consumer goods was formed. With digital solutions to make better decisions via personal insights and enabling new business models of delivery, Bayer will be focusing on delivering products, enabling more people to take greater control over their health.(Source :https://www.bayer.com)

- In July 2024, HORIBA India inaugurated its medical equipment and consumables manufacturing facility in Butibori, Nagpur, in line with the Atmanirbhar Bharat and Make in India initiatives. With a phased investment of INR 200 crore (3.8 B JPY), the facility, one of India's largest, is set to serve over 30,000 labs and hospitals, mark HORIBA's third major investment in India, and create jobs in tier two cities. HORIBA's global revenue stands at $2.3 B.

Recent News

- In April 2024, 3M spun off its healthcare division, creating Solventum Corporation as a standalone company.

Segments Covered in the Report

By Product Type

- Wound care Consumables

- Diagnostic Consumables

- Respiratory Supplies

- Drug Delivery Products

- Dialysis Consumables

- Sterilization Consumables

- Incontinence Products

- Disposable Gloves

- Disposable Masks

- Hands Sanitizer

- Others

By Raw Materials

- Rubber

- Non-woven Materials

- Glass

- Metals

- Plastic Resin

- Paper

- Others

By End User

- Hospitals

- Clinics/physician office

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content