Durable Medical Equipment Market Size and Forecast 2025 to 2034

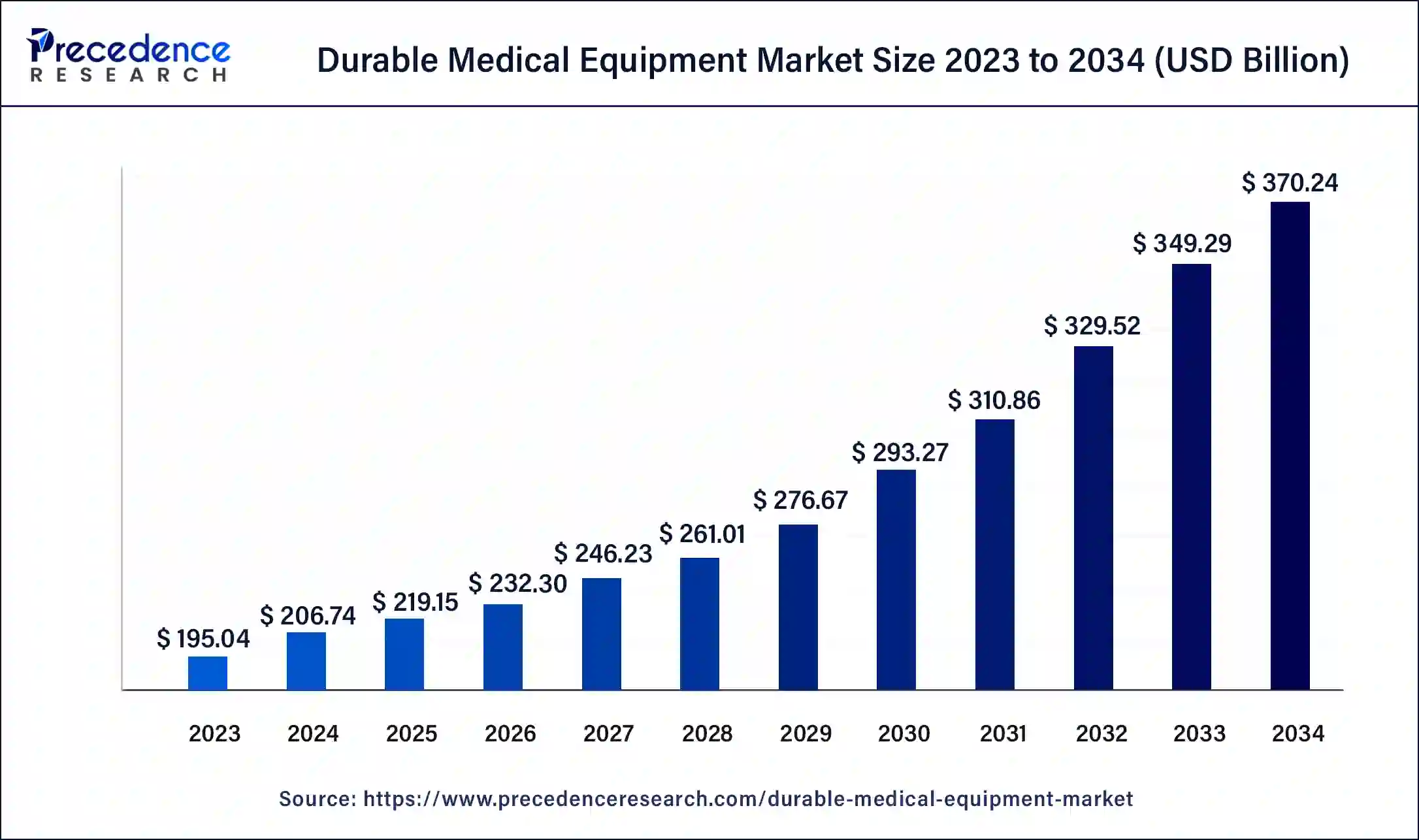

The global durable medical equipment market size was estimated at USD 206.74 billion in 2024 and is predicted to increase from USD 219.15 billion in 2025 to approximately USD 370.24 billion by 2034, expanding at a CAGR of 6% from 2025 to 2034.

Durable Medical Equipment Market Key Takeaways

- In terms of revenue, the durable medical equipment market is valued at $219.15 billion in 2025.

- It is projected to reach $370.24 billion by 2034.

- The durable medical equipment market is expected to grow at a CAGR of 6% from 2025 to 2034.

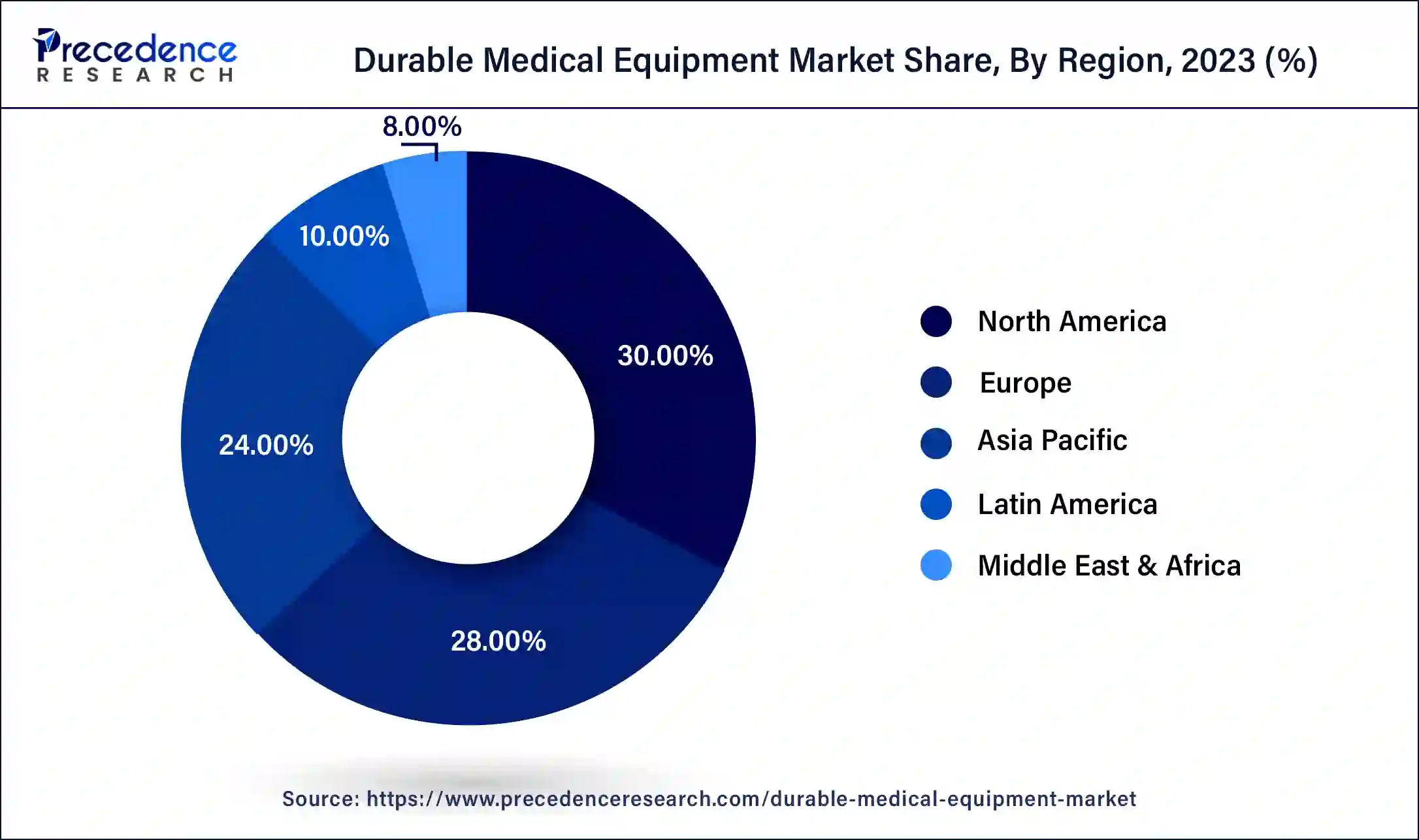

- North America dominated the market with the highest market share of 30% in 2023.

- Asia Pacific is observed to witness the fastest rate of growth during the forecast period.

- By Product, the monitoring and therapeutic devices segment dominated the market in 2023.

- By End-use, the hospital segment dominated the market in 2023.

U.S. Durable Medical Equipment Market Size and Growth 2024 to 2034

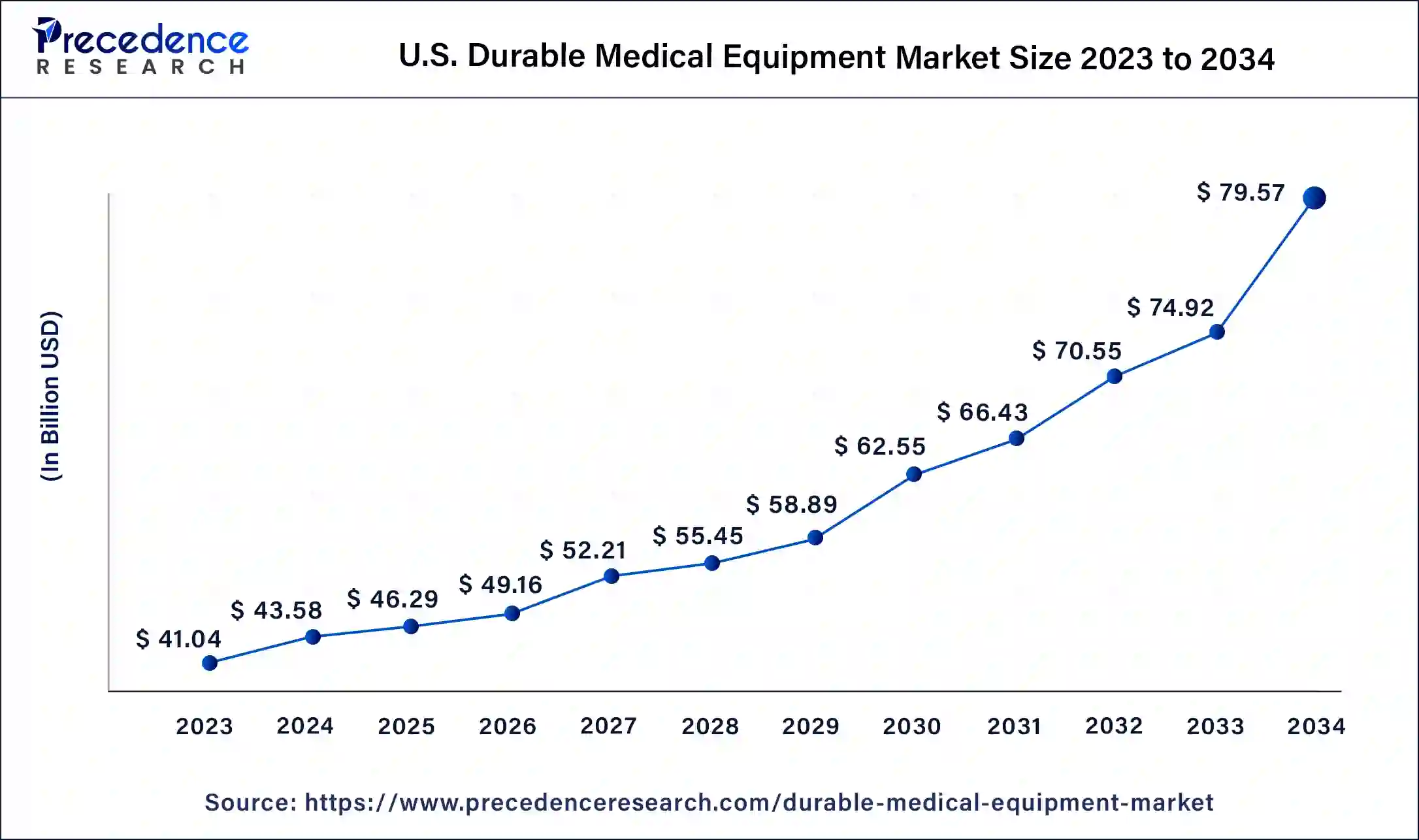

The U.S. durable medical equipment market size was exhibited at USD 43.58 billion in 2024 and is predicted to be worth around USD 79.57 billion by 2034, at a CAGR of 6.21% from 2025 to 2034.

North America leads the market in durable medical equipment. The U.S. is the largest contributor to the revenue of the North American market. The primary factors for the largest growth of the durable medical equipment market in the North American market is the rise in elderly population and the rapid growthof chronic disease among the people of North America. Furthermore, the major market players in North America are continuously innovating new products for the wellbeing of the patients. Also, the unexpected emergence of COVID-19 pandemic outbreak has generated huge demand for the durable medical equipment in the market.

United States Durable Medical Equipment Market Trends

The aging population and rising prevalence of chronic diseases like osteoporosis, cardiovascular diseases, arthritis, and respiratory issues increase demand for durable medical equipment. The growing preference for home healthcare increases demand for devices like monitoring devices, oxygen concentrators, and wheelchairs helps in the market growth.

The well-established healthcare system increases demand for durable medical equipment. The growing advancements in medical equipment like remote patient monitoring, monitoring devices, and assistive technology, drive the market growth.

The favorable government reimbursement policies, like Medicaid & Medicare, and growing spending on healthcare, increase the adoption of durable medical equipment. Additionally, the strong presence of major manufacturers and distributors drives the overall growth of the market.

Asia-Pacific region is also expected to contribute significantly towards the market share of durable medical equipment owing to the rapid increase in chronic diseases such as diabetics, hypertension, high blood pressures and many others especially in the developing countries such as in China, India and Japan. Also, the increase in the disposable income of the customers and the desire to avail medical facilities at home has fostered the growth of the durable medical equipment market.

China Durable Medical Equipment Market Trends

China is a major contributor to the durable medical equipment market. The aging population and growing demand for extensive healthcare resources increase the demand for durable medical equipment. The strong government support for the medical device industry helps in the market growth. The strong investment of MedTech companies in research & development and technological advancements in medical device technologies like digital health solutions, advanced imaging techniques, and robotic surgery drives the market growth.

- Additionally, growing healthcare costs and rising prevalence of chronic conditions fuel demand for durable medical equipment, contributing to the overall growth of the market.

Durable Medical Equipment Market Growth Factors

The surge in demand for the durable medical equipment's to be used residentially is the primary factor that is expected to drive the growth of the Durable Medical Equipment Market. Furthermore, the increasing cardiovascular disease across the globe where constant body monitoring is required by the patients is anticipated to fuel the growth of the Durable Medical Equipment Market.

During the COVID-19 outbreak, the demand for the Durable Medical Equipment's increased in the local hospitals and the healthcare facilities. To meet this demand the manufacturers of the Durable medical equipment's fastened the production process for these equipment's and this attribute is expected to boost the growth of the Durable Medical Equipment Market. Additionally, the surge in chronic diseases such as cancer, diabetics, cardiac disorders, neurological conditions and others across the world is yet another factor that is anticipated to fuel the growth of the Durable Medical Equipment Market.

With rapid technological developments, the Durable medical equipment manufacturing companies are innovating new equipment's that can accurately measure different body parameters. This factor is expected to drive the growth of the Durable Medical Equipment Market. Furthermore, increasing demand for therapeutic and monitoring devices across the globe is expected to boost the growth of the Durable Medical Equipment Market.

The surge in older population across the globe is a major factor that is fueling the growth of the Durable Medical Equipment Market. The older generation people usually suffer from chronic diseases that need constant monitoring of their health condition and this boost the demand for the Durable Medical Equipment's in the Market. Also, the development of technologically advanced durable medical equipment's such as wheelchairs, crutches, ventilators, nebulizers, oxygen monitors and many othersthat provides comfort to the patients is anticipated to drive the growth of the Durable Medical Equipment Market.

Market Scope

| Report Highlights | Details |

| Market Size in 2024 | USD 206.74 Billion |

| Market Size in 2025 | USD 219.15 Billion |

| Market Size by 2034 | USD 370.24 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End User, and Region |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

Market Dynamics

Drivers

The durable medical equipment market is expanding due to many driving factors, including a growing geriatric population across the globe, home healthcare shifts, advanced technologies integrated with the healthcare sector, and government reimbursement policies for patients. Chronic diseases like cardiovascular diseases, respiratory illnesses, neurological disorders, and orthopedic conditions require special attention and long-term continuous treatment, which is expanding the durable medical equipment market.

Moreover, many countries' governments are taking initiatives to treat ailments of aging people, providing reimbursement policies for medical treatment that is not affordable for ordinary people, insurance coverage, and offering easy accessibility to all the benefits of medical policies, further driving the market.

Restraints

The durable medical equipment market is facing restraints, including limitations in reimbursement policies, complicated and time-consuming insurance methods, high cost needed for durable medical equipment, lack of awareness and education about medical policies and benefits offered by the government, along with product safety and quality. These challenges can be overcome by ensuring cost-effective maintenance services, streamlining insurance procedures, and collaboration among regulatory reformers and stakeholders, further expanding the market growth.

Opportunity

The durable medical equipment market is witnessing significant opportunities such as customized solutions, increasing demand for home-health services for better accessibility and convenience, and telehealth integration. To proliferate the business, manufacturers of durable medical equipment provide a wider range of medical devices and services that sustain long-term solutions for patients' health conditions. Technological advancements and their integration into the healthcare domain, like telehealth, are paving the way to creating reliable and convenient options to take care of patients looking for remote connectivity to medical professionals and clinicians. Additionally, a growing rate of aging population who are more susceptible to the manifestation of chronic health illnesses that can lead to health complexities is a major drive to offer innovative medical products by durable medical equipment manufacturers.

Product Insights

Based on Product, the durable medical equipment Market is divided into personal mobility devices, monitoring and therapeutic devices, bathroom safety devices, medical furniture, incontinent pads, breast pumps, catheters, consumables and accessories and others. The monitoring and therapeutic devices sector will lead the durable medical equipment market with highest revenue share during the forecast period owing to the rapid increase of chronic disease among the people all over the world that requires long term treatments. Additionally, the preference of patients to be treated at home is estimated to drive the growth of the durable medical equipment market.

The personal mobility devices such as wheelchair, scooter, crutches, canes and others is also expected to experience significant growth in the upcoming years due to the rapid increase in geriatric population across the world. The increase in elderly population will generate more demand for the mobility products and therefore will contribute significantly towards the growth of the durable medical equipment market.

End-use Insights

On the basis on end-use, the market is categorized into hospitals, home healthcare, ambulatory surgical centers and others. The durable medical equipment used in the hospital and other healthcare center holds a significant share in the end use segment. The accuracy and precision with which these equipment's monitor the patient's health condition amplifies the demand for the need of durable medical equipment in the market. Also, the ambulance is equipped with durable medical equipment in order to monitor the patient health condition and to provide preliminary treatment based on the health condition of the patient.

During the COVID-19 pandemic outbreak many people preferred to monitor their health condition at home and this factor increased the demand of the durable medical equipment in the market.

Durable Medical Equipment Market Companies

- ArjoHuntleigh

- Becton Dickinson and Company

- General Electric Company

- GF Health Products Inc.

- Hill-Rom Services Inc.

- Invacare Corporation

- Koninklijke Philips NV

- Medical Device Depot Inc.

- Medline Industries Inc.

- Medtronic PLC

Recent Developments

- In June 2025, GenHealth.ai launched an AI-powered order automation solution for Home and Durable Medical Equipment providers. The solutions help healthcare applications by accelerating access to care, boosting accuracy, and reducing delays. The features of the solution are automated patient intake, real-time coverage, medical necessity, eligibility checks, prior auth submission, seamless billing integration, and deep insights into payment analytics. (Source: https://fox40.com)

- In June 2025, Cardinal Health launched a medical device, Kendall DL, for monitoring temperature, cardiac activity, and blood sugar level. It determines the best course of care, improves clinician workflows, and provides reliable monitoring. The device provides cleaner electrocardiogram tracings and lowers the chance of infection. The system is available in the United States.

- In May 2024, a leading healthcare company named Beurer India Pvt. limited offered a blood glucose reveal tool, with the price of INR 1,200. It can be easily accessible for patients suffering from diabetes or suspects of pre-diabetic conditions to get precise results of glucose levels in the blood.

- On 27th August, 2021 Siemens Healthineers inaugurated a manufacturing facility for molecular diagnostic kits in Vadodara, Gujarat with a production capacity of 25 million tests per annum.

- On 15th September, 2021 ArjoHuntleigha global medical technology company has been rewarded with an Innovative Technology Contract for the Provizio SEM Scanner with Vizient Inc. The Provizio SEM Scanner has unique qualities that help in the identification of pressure injury risk, which can help caregivers provide earlier interventions to reduce both patient suffering and healthcare costs.

Segments Covered in the Report

By Product

- Personal Mobility Devices

- Wheelchair and Scooter

- Crutches and Canes

- Walkers

- Others

- Monitoring and Therapeutic Devices

- Oxygen Equipment

- Blood Glucose Analyzers

- Vital Sign Monitors

- Infusion Pumps

- Continuous Positive Airway Pressure (CPAP) Devices

- Nebulizers

- Others

- Bathroom Safety Devices

- Medical Furniture

- Incontinent Pads

- Breast Pumps

- Catheters

- Consumables and Accessories

- Others

By End-use

- Hospitals

- Home Healthcare

- Ambulatory Surgical Centers

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting