What is U.S. Supplemental Health Market Size?

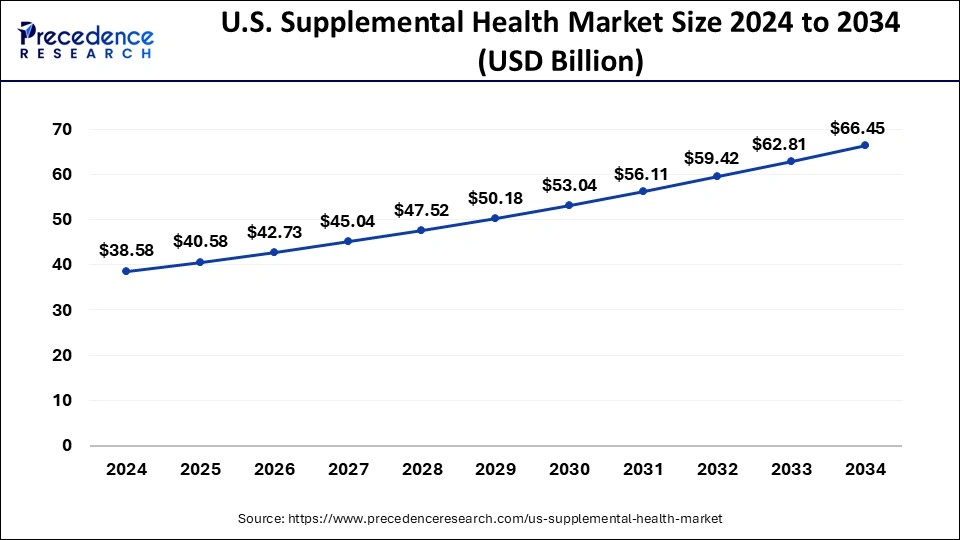

The U.S. supplemental health market size accounted for USD 40.58 billion in 2025 and is predicted to increase from USD 42.73 billion in 2026 to approximately USD 69.92 billion by 2035, expanding at a CAGR of 5.59% from 2026 to 2035

Market Highlights

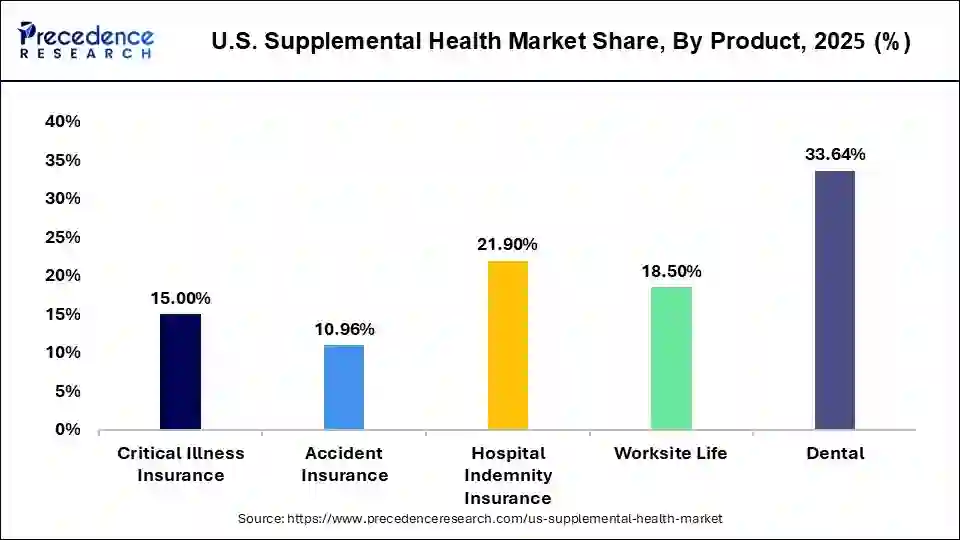

- By Product, the hospital indemnity insurance segment generated more than 21.90% of revenue share in 2025.

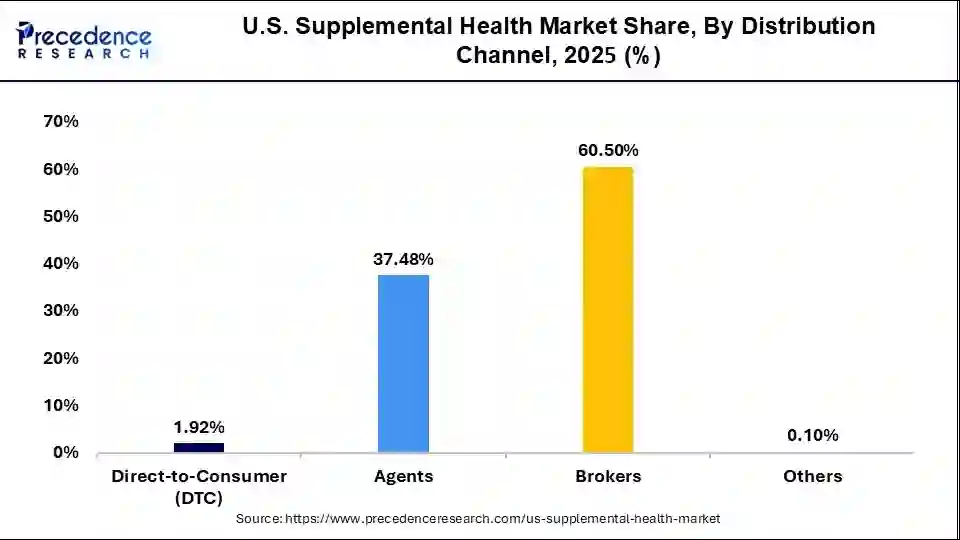

- By Distribution Channel, the brokers segment contributed more than 60.50% of revenue share in 2025.

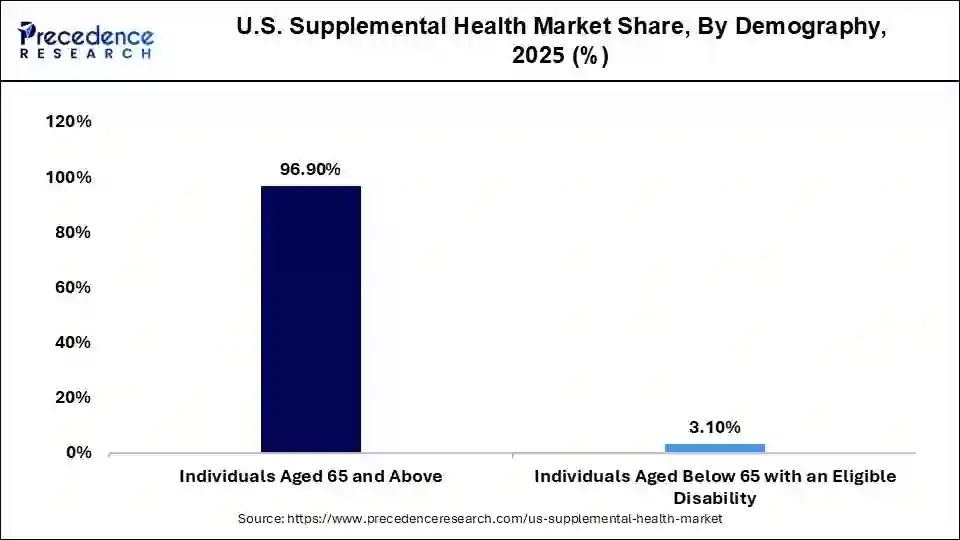

- By Demography, the individuals aged 65 and above segment dominated the market and accounted more than 96.90% of revenue share in 2025.

Market Overview

Supplemental health insurance is used to supplement the existing health insurance policies. It delivers additional coverage for specific plans like vision, dental care, and long-term care for healthcare expenses that were not covered by the healthcare plan. The supplemental plans do not cover medical therapies like medications or surgeries, which are included under the health plan. The U.S. is one of the developed countries owing to the existence of favorable economic policies, high GDP, and innovative medical technologies. Along with this, the awareness regarding health insurance policies is considerably high in the U.S.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 40.58 Billion |

| Market Size in 2025 | USD 42.73 Billion |

| Market Size by 2035 | USD 69.92 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.59% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Distribution Channel, and Demography |

Market Dynamics

Drivers

Growing awareness of the benefits of supplemental health insurance

The growing awareness regarding the benefits of supplemental health insurance is anticipated to propel the growth of the U.S. supplemental health market during the predicted period. As consumers become more educated about the risks and costs associated with healthcare, they are increasingly looking out for insurance products that provide additional economic protection. Due to the rising awareness regarding the limitations of the traditional insurance plan, the use of supplemental health is rising to provide additional coverage. Additional security is often required because standard insurance plans have deductibles, premiums, and other expenses that quickly add up to thousands of dollars in uncovered expenses.

Technological advancements

The supplemental health market is driven by technological advancement. Various companies are implementing techniques to enhance the customer experience as well as to ease access to the care that customer needs. For instance, some firms are using telemedicine and mobile applications to deliver virtual consultations.

As per a survey, the global insurance company invested approximately 571 million in software that uses ML and A.I. technologies. Along with this, chatbots are gaining demand as customers prefer to solve issues through chatbots than real people.

Restraints

Limited coverage

The factor impacting the supplemental health market is the limited coverage offered by these plans. Some plans exclude certain procedures and conditions which limit their demand. For instance, certain cancer policies deliver limited advantages when a person is diagnosed with a tumor. Most of the benefits are normally paid to the insured person directly. Along with this, some of the providers have service capacity as well as limited resources. This act as a hindrance in the U.S. supplemental health market.

Opportunities

Rising healthcare costs

More people are seeking supplemental health insurance to cover the gap in their traditional health insurance plans due to the rising cost of healthcare. This is anticipated to provide an opportunity for firms in the supplemental health market to expand their customer base. Furthermore, the development of novel, innovative healthcare techniques leads to better products and procedures.

Segment Insights

Product Insights

Critical illness insurance is growing at the fastest rate from 2026 to 2035. It is a type of health insurance policy that includes payment of a direct lump-sum amount. Such payment of a lump-sum amount is utilized for expenditure that is not covered by regular insurance. Any individual is able to buy such a critical illness insurance policy by themselves or through their respective employer. In certain cases, such a policy is also added to an individual's personal life insurance plan.

Accident Insurance is anticipated to expand at the highest CAGR from 2026 to 2035. Across the United States, 35,766 fatal car accidents occurred on roadways in 2020. These fatal car accidents resulted in 38,824 deaths. 35% of all fatal car accidents in the U.S. were found to occur due to impaired driving. Accident insurance assists in paying for medical as well as other out-of-pocket expenses that the individual incurs post-accidental injury. Accident insurance tends to cover numerous aspects such as hospital stays, emergency treatment, transportation, medical examinations, and other expenses such as lodging requirements.

U.S. Supplemental Health Market, By Product, 2022-2024 (USD Million)

| By Product | 2022 | 2023 | 2024 |

| Critical Illness Insurance | 5,218.04 | 5,484.44 | 5,786.27 |

| Accident Insurance | 3,843.02 | 4,023.15 | 4,227.84 |

| Hospital Indemnity Insurance | 7,756.55 | 8,079.43 | 8,447.96 |

| Worksite Life | 6,452.04 | 6,772.74 | 7,136.40 |

| Dental | 11,987.39 | 12,448.58 | 12,976.68 |

Distribution Channel Insights

Direct-to-Consumer (DTC) is growing at the highest rate during the forecasted period. As per the United States Census Bureau, around 9% of citizens buy their health insurance policy directly. Private health insurance is one of the predominant sources of health coverage in the U.S. The private health insurance market consists of the nongroup market (usually referred to as the individual market, where insurance plans are purchased directly from an insurer). In 2021, the nongroup market covered an estimated 45 million individuals.

The agent sector is anticipated to grow at the fastest rate from 2026 to 2035. Agents usually work for only one health insurance company and negotiate, convince, and sell health, life, or term insurance policy to as per the requirements and needs of their clients. As per a survey, in September 2022, there are more than 142,927 health insurance agents employed in the U.S. Growing count of agents is supporting the agent segment growth notably.

U.S. Supplemental Health Market, By Distribution Channel, 2022-2024 (USD Million)

| By Distribution Channel | 2022 | 2023 | 2024 |

| Direct-to-Consumer (DTC) | 669.88 | 702.67 | 739.87 |

| Agents | 13,186.13 | 13,781.78 | 14,459.51 |

| Brokers | 21,365.77 | 22,287.46 | 23,337.97 |

| Others | 35.26 | 36.44 | 37.80 |

Demography Insights

Individuals Aged 65 and above are anticipated to expand at the highest CAGR during the projected period. In the United States, a very less count of adults aged 65 and above was found without a health insurance policy in 2020. The cause for this is that nearly all people in this age group are eligible for medical care coverage through the Medicare program.

Individuals Aged Below 65 with an Eligible Disability are growing at a remarkable rate. As per the National Health Statistics Reports based on the data from the 2020 National Health Interview Survey, 31.2 million (11.5%) people under the age of 65 were uninsured.

In the category of people aged below 65 years, about 2 out of 5 children and 1 out of 5 adults were covered with public medical coverage, mainly from the Children's Health Insurance Program (CHIP) and Medicaid. This boosts the demand for supplemental health markets in the United States.

U.S. Supplemental Health Market, By Demography, 2022-2024 (USD Million)

| By Demography | 2022 | 2023 | 2024 |

| Individuals Aged 65 and Above | 34,199.33 | 35,685.70 | 37,379.32 |

| Individuals Aged Below 65 with an Eligible Disability | 1,057.71 | 1,122.65 | 1,195.83 |

Recent Developments

- In October 2022, Allianz announced the acquisition of Jubilee Holdings Limited in East Africa for a controlling interest in the general insurance business.

- In April 2023, AIG announced the agreement with Stone Point Capital LLC (Stone Point).

- In February 2022, Assurant and Tekion came into a partnership to enhance Digital F&I experiences in Automotive Retail.

- In January 2023, Humana acquired Doctors on Demand, a telemedicine provider.

U.S. Supplemental Health Market Companies

- Aetna Inc.

- Allianz S.E.

- American International Group, Inc.

- Anthem, Inc.

- Assurant, Inc.

- AXA Group

- Cigna Corporation

- Humana Inc.

- MetLife, Inc.

- Zurich Insurance Group AG

Segments Covered in the Report

By Product

- Critical Illness Insurance

- Accident Insurance

- Hospital Indemnity Insurance

- Worksite Life

- Dental

By Distribution Channel

- Direct-to-Consumer (DTC)

- Agents

- Brokers

- Others

By Demography

- Individuals Aged 65 and Above

- Individuals Aged Below 65 with an Eligible Disability

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting