What is the U.S. Oral Care Market Size?

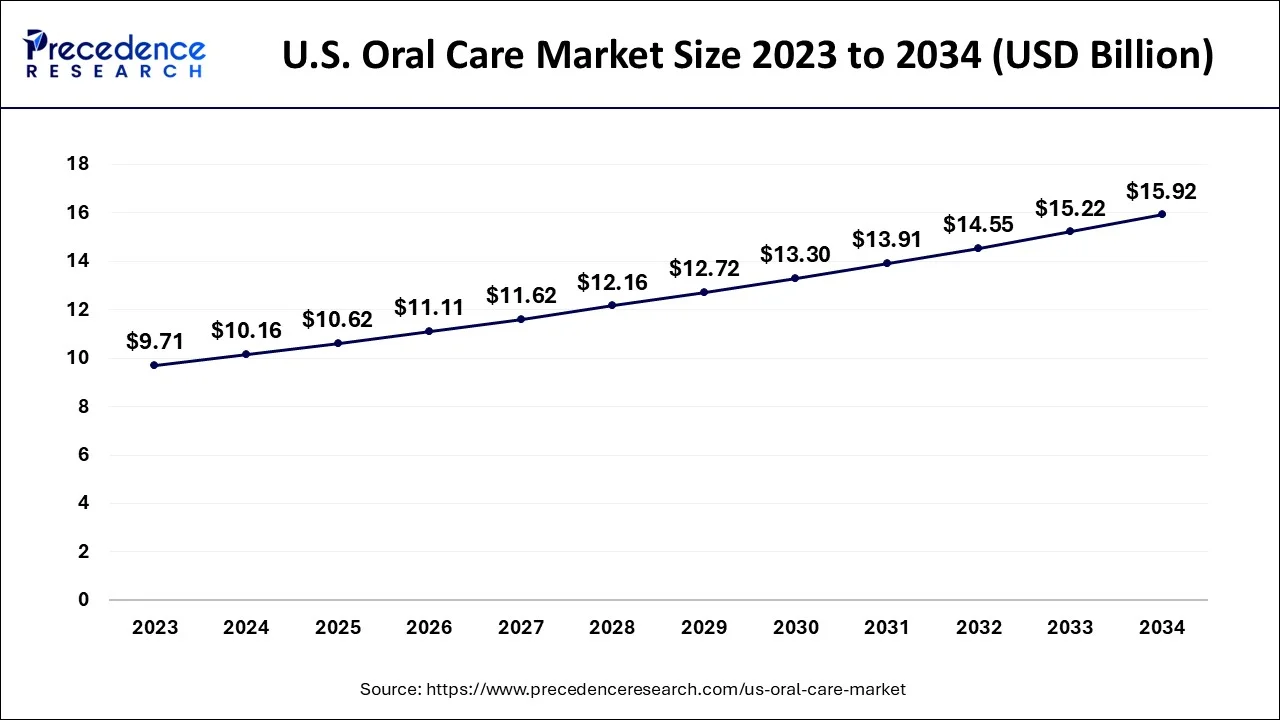

The global U.S. oral care market size is calculated at USD 10.62 billion in 2025 and is predicted to increase from USD 11.11 billion in 2026 to approximately USD 16.60 billion by 2035, expanding at a CAGR of 4.57% from 2026 to 2035.

U.S. Oral Care Market Key Takeaways

- By product type, the toothbrushes and replacements segment had the highest revenue share, around 27% in 2025.

- By product type, the toothpaste segment accounted for the highest revenue share of more than 26% in 2025.

- By distribution channels, the supermarkets/hypermarkets segment will lead the oral care market from 2026 to 2035.

Market Overview

The practice of brushing and flossing teeth and gums is Oral hygiene, often known as dental hygiene. Oral hygiene is essential for keeping teeth, gums, and breath healthy. According to the American Dental Association, the most frequent oral problems among Americans are dry mouth, sensitivity, foul breath, and oral infections. The rising frequency of dental diseases, the growing number of dental professionals on a worldwide scale, and technological advancements in oral care products all over the world play a part in the oral healthcare market's growth. For instance, according to the World Health Organization (WHO), about 530 million children suffer from primary tooth decay. According to the American Dental Hygienists' Association (ADHA), there are over 150,000 licensed dental hygienists who promote excellent oral hygiene by offering correct dental hygiene practices and strategies, in the US.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 10.62 Billion |

| Market Size in 2026 | USD 11.11 Billion |

| Market Size by 2035 | USD 16.60 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.57% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered |

Product Type,Distribution Channel |

Market Dynamics

Drivers

High product demand due to increased incidence of dental and gum-related diseases.

Tooth decay (dental caries) and periodontal diseases (gum diseases) are the most common chronic illnesses in the world, posing a significant global public health issue. According to a study done by the Centers for Disease Control and Prevention (CDC) in 2018, the overall rate of untreated dental caries was 13.2% (for ages 5 to 14) and 25.9% (for ages 15 and up). Dental caries treatment is costly, accounting for 5-10% of overall healthcare spending in developed countries. As people become more aware of the importance of dental and oral health, sales of oral hygiene goods such as toothbrushes, mouthwashes, toothpaste, and many more will grow. Manufacturers have been able to boost the exposure of their products and brands. Furthermore, it will add to the market over the forecast period.

Restraints

Adverse effects due to certain ingredients

In 2022, the toothpaste sector had the highest revenue share of more than 26%. It is the most widely used oral care product and is seen as a need by individuals of all socioeconomic backgrounds. For the improvement of the taste and color of the toothpaste and mouthwash, certain additives are added such as abrasive agents and humectants. These items may lead to various allergic reactions to the gums and teeth such as contact dermatitis, urticaria, rhinitis, angioedema, etc. This has a large impact on the demand for such products. Although teeth whitening is a growing trend in the dental care sector, it also has the potential to create certain negative side effects in customers. Using whitening treatments, such as teeth whitening pens, regularly might cause irreversible harm to the tooth enamel. As a result of the continuous loss of the protective enamel layer, this might lead to tooth sensitivity. Furthermore, the teeth whitening chemical is likely to come into touch with the gum line during usage, causing regional discomfort and pain. Whitening chemicals can also produce uneven tooth whitening, particularly if a few or a majority of the dentition's teeth are artificial.

Opportunities

Rising online purchasing and e-commerce trend

The increasing number of Internet users (4.8 billion) supports the growing trend of online purchases. For instance, according to Miniwatts Marketing Group, oral care items accounted for 13% of personal care goods bought through online portals in June 2019. The COVID-19 scenario has greatly increased the online distribution of oral care products. Consumers have increasingly switched to e-commerce and online channels to acquire oral care goods as a result of the lockdown and quarantine measures implemented during the pandemic scenario, resulting in the rise of the online mode of distribution over the past year.

Segment Insights

Product Type Insights

The U.S. oral care market is segmented into breath fresheners, dental floss, denture care, mouthwashes and rinses, toothbrushes and replacements, and toothpaste. In 2025, the toothbrush had the highest revenue share (26%). According to National Health and Nutrition Examination, periodontal disease affects 17.20% of American seniors aged 65 and above and 8.52% of individuals aged 20 to 64.

The growing frequency of cavities, sensitivity, and gingivitis in both developing and developed countries has increased toothpaste usage significantly. The toothbrush category grew significantly as a result of the launch of revolutionary teeth cleaning brush products by well-known brands, which attracted customer interest in purchasing these products. Additionally, the availability of toothpaste in a wide variety such as gel, liquid, spray, capsule, paste, etc. is largely driving the segment growth.

Distribution Channel Insights

The US Oral Care Market is segmented into supermarkets/hypermarkets, convenience stores, pharmacies and drug stores, online retail stores, and other distribution channels. During the projection period, Supermarkets/Hypermarkets will lead the oral care market. Supermarkets/Hypermarkets sell a diverse variety of products such as toothbrushes, toothpaste, mouthwashes, breath freshener, dental floss, etc. This might create confusion in the consumer regarding which brand's product to purchase. To overcome this, the employees provide reliable product information to the customers in Supermarkets/Hypermarkets. Customers may also buy all types of dental care goods from Supermarkets/Hypermarkets under one roof. On the other hand, online retail stores are predicted to expand rapidly throughout the projection period. Rising internet penetration in emerging and underdeveloped areas is driving market expansion in the online retail store segment. Additionally, discounts on oral care products are offered by online retail stores which boosts the segment growth.

COVID-19 Impact

The COVID-19 pandemic had a favorable effect on the development of the U.S. Oral Care Market. As a result of the pandemic, in-office dental procedures were halted but the need for at-home oral care increased. In 2020, online purchases of items such as air freshener sprays, cosmetic whitening treatments, mouthwashes, and electronic toothbrushes surged. In 2022, oral care firms reported increased demand for luxury items such as teeth-whitening gels, creams, mouthwash, and whitening pens. Traditional distributors, merchants, and pharmacies are progressively declining due to online sellers. Buying oral care items through e-commerce portals has various advantages, including the availability of multi-brand oral care products at reduced costs, the convenience of purchase, and free shipping. The successful selling of oral care goods via e-commerce has spurred key industry participants to increase their investment in these channels.

Country-Level Analysis

The U.S. oral care market is driven by high consumer awareness of dental hygiene, increasing prevalence of oral diseases, and a strong preference for advanced oral care products such as electric toothbrushes, whitening solutions, and mouthwashes. Rising disposable incomes and widespread access to retail and e-commerce channels further support market growth. Key players, including Colgate-Palmolive, Procter & Gamble, and Johnson & Johnson, are investing in innovative product development and marketing to capture a larger share of the market.

Government initiatives also bolster the market, such as the Centers for Disease Control and Prevention (CDC) oral health programs and the Healthy People 2030 campaign, which promote preventive dental care and awareness. Public health programs in schools and community clinics enhance access to oral care services for children and underserved populations. These efforts, combined with increasing consumer focus on preventive care, are expected to sustain robust growth in the U.S. oral care market over the coming years.

Top Companies in the Market & Their Offerings

- 3M Company: 3M provides dental materials, preventive oral care products, adhesives, restoratives, and infection prevention solutions widely used in dental clinics and professional oral hygiene settings.

- Unilever PLC: Unilever offers oral care brands such as Closeup and Signal, providing toothpaste, mouthwash, whitening products, and daily hygiene solutions to meet global consumer oral health needs.

- Procter & Gamble (P&G): P&G delivers leading oral care products under the Oral-B and Crest brands, including toothpaste, toothbrushes, mouth rinses, whitening systems, and electric brushing devices.

- Supersmile: Supersmile specializes in premium whitening toothpaste, oral care systems, sensitivity solutions, and enamel-safe cleaning products designed for cosmetic and professional-grade dental hygiene.

Other Major Companies

- Koninklijke Philips N.V.

- Colgate-Palmolive Company

- GlaxoSmithKline plc

- Johnson & Johnson

- Ultradent Products, Inc.

- Hain Celestial Group (Jason Natural products, Inc.)

- Church & Dwight Co, Inc

- CloSYS

Recent Developments

- In October 2024, Royal Philips partnered with Aspen Dental to offer Philips Sonicare products across its 1,100+ U.S. locations. Clinicians can now provide in-office solutions like Sonicare ExpertClean with smart brushing sensors, as well as the Cordless Power Flosser and Teeth Whitening Kits, expanding access to comprehensive at-home oral care. (Source: usa.philips.com)

- In August 2022,Oral-B launched New Products and Innovations for Better Oral Care Health, Access, and Education. They have released the Oral-B iO10 smart toothbrush with iOSenseTM, which is the ultimate oral health advisor.

- In March 2021, Colgate-Palmolive will offer an ayurvedic toothpaste for diabetics in India. The toothpaste contains ayurvedic components such as Madhunashini, Neem, Jamun Seed Extract, and Amla and is clinically verified.

- In January 2020, Colgate-Palmolive Company launch Colgate Plaqless Pro. This smart electric toothbrush employs updated optic sensor technology to detect biofilm formation in the mouth and simply remove it with a brush.

Segments Covered in the Report

By Product Type

- Breath Fresheners

- Dental Floss

- Denture Care

- Mouthwashes and Rinses

- Toothbrushes and Replacements

- Toothpaste

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Pharmacies and Drug Stores

- Online Retail Stores

- Other Distribution Channels

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting