U.S. Water and Wastewater Treatment Market Size and Forecast 2025 to 2034

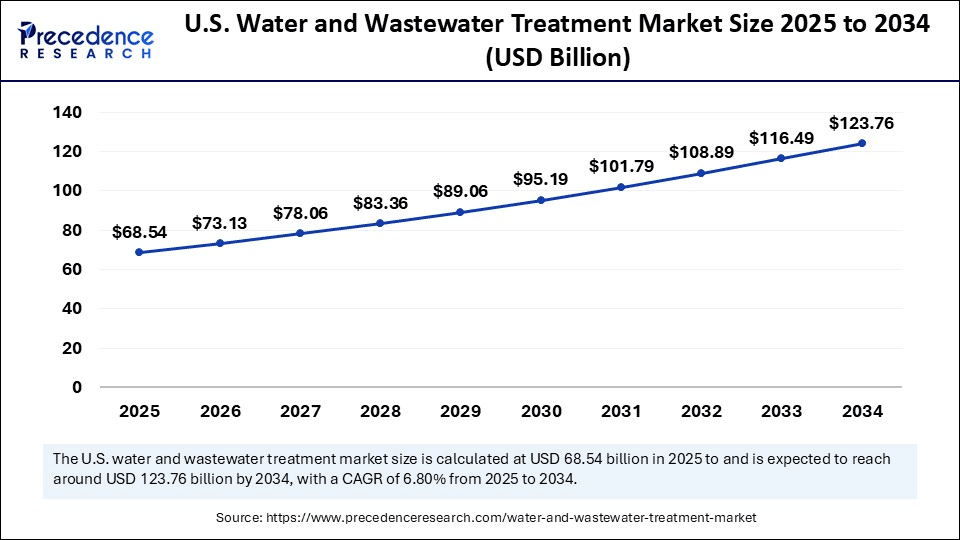

The U.S. water and wastewater treatment market size accounted for USD 64.27 billion in 2024 and is predicted to increase from USD 68.54 billion in 2025 to approximately USD 123.76 billion by 2034, expanding at a CAGR of 6.80% from 2025 to 2034. The growth of the U.S. water and wastewater treatment market is propelled by rising industrialization, urbanization, technological advancements, and stricter environmental regulations.

U.S. Water and Wastewater Treatment Market Key Takeaways

- By equipment, the membrane separation segment held the largest market share of 34.77% in 2024.

- By equipment, the biological segment is anticipated to grow at the fastest CAGR 7.3% over the forecast period.

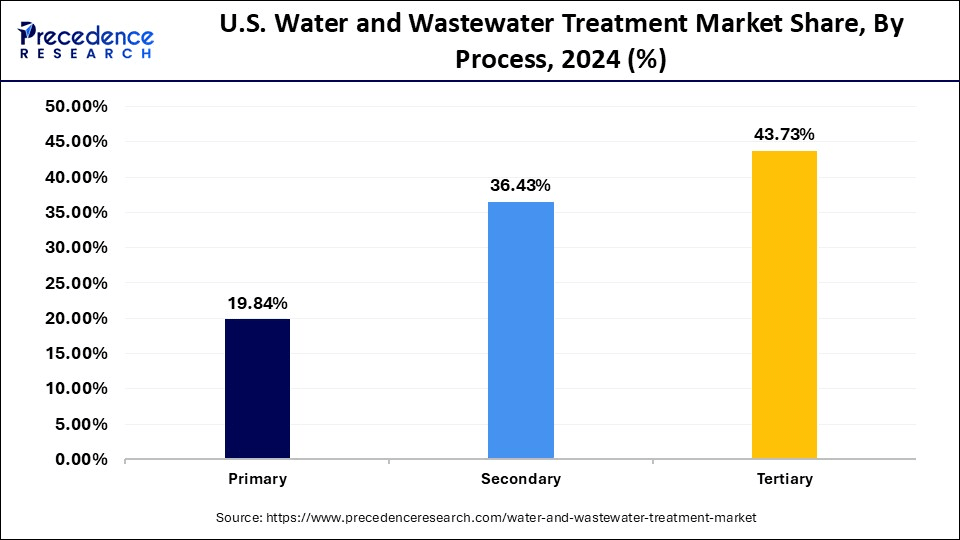

- By process, the tertiary segment contributed the biggest market share of 43.73% in 2024.

- By process, the secondary segment is anticipated to show considerable growth at CAGR of 7.2% over the forecast period.

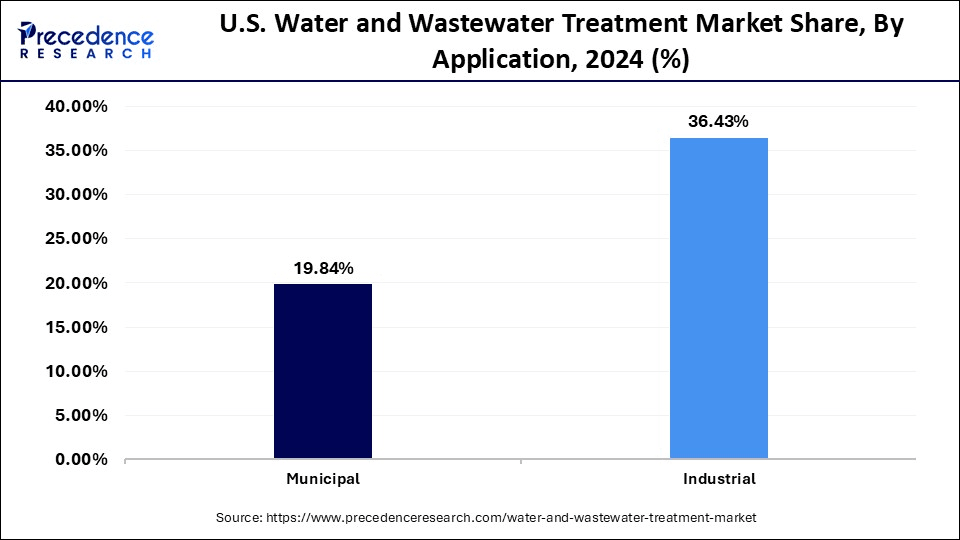

- By application, the industrial segment captured the highest market share of 66.03% 2024.

- By application, the municipal segment is expected to grow at a solid CAGR of 7% during the forecast period.

How is AI Integration Transforming the U.S. Water and Wastewater Treatment Market?

The integration of artificial intelligence in is transforming water and wastewater treatment processes. AI facilitates sustainable water management by streamlining recycling and reuse, enhancing resource recovery efficiency. Predictive maintenance, powered by AI, can detect and prevent equipment breakdowns, prolonging asset life and decreasing downtime. Incorporating AI and smart monitoring technologies makes operations more efficient, uses fewer chemicals, and reduces energy costs. Moreover, AI automates several processes in wastewater treatment, optimizing efficiency and sustainability.

Market Overview

Wastewater treatment is the process by which impurities of sewerage are cleaned before being released to either water bodies like rivers, lakes, oceans, or aquifers. Treatment of wastewater is the key to responding to water pollution and ensuring water quality. Both municipalities and industries are investing heavily in sustainable and innovative solutions to meet regulatory requirements, reduce environmental impact, and ensure long-term water resources management.

Due to the increased urbanization in the U.S., the demand for supply of clean water is rising, and there is a huge rise in wastewater production, which requires improvement in the structures and treatment plants. Moreover, a rise in industrialization, particularly the expansion of energy, chemicals, and manufacturing industries, has created demand for sophisticated industrial wastewater management solutions. These trends, along with strict environmental standards and government investments, are pushing for the implementation of the most effective water treatment technologies.

What are the Major Factors Boosting the Growth of the U.S. Water and Wastewater Treatment Market?

- Population Growth and Urbanization: The increasing residential, commercial, and industrial populations in the U.S. are driving up the demand for clean water and increasing wastewater production. This population growth puts a strain on existing infrastructure, leading to investments in modern, more efficient treatment plants.

- Increased Industrialization: Industrialization, including the expansion of manufacturing, pharmaceuticals, and energy generation, consumes a significant amount of water. This growth also highlights the need for effective water management and treatment.

- Environmental Regulations and Compliance: Federal and state laws, such as those enforced by the Environmental Protection Agency (EPA), mandate strict water quality practices. Regulatory compliance significantly drives innovation and sustainable practices in U.S. wastewater management, pushing industries to adopt more effective strategies.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 123.76 Billion |

| Market Size in 2025 | USD 68.54 Billion |

| Market Size in 2024 | USD 64.27 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.80% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Equipment, Process, Application, and Region |

Market Dynamics

Drivers

Increased Industrial Activities

The increasing industrial activities, especially in the pharmaceutical, food and beverages, chemicals, textile industry, and energy industries, is boosting the demand for clean process-grade water. These are some of the industries that use water extensively in their manufacturing, cooling, and cleaning systems, and they produce high volumes of industrial waste in the forms of water, which need to be treated first before being discharged or reused. Complex pollutants often found in industrial wastewater, such as heavy metals, organic chemicals, and suspended solids, require advanced, customized treatment solutions to meet environmental standards, as conventional methods are insufficient.

Energy Industry's High Demand for Wastewater Treatment Technologies

Power generation, particularly the thermal power stations, is one of the most water-intensive sectors that depend on the availability of water to carry out the processes of cooling, steam making, and equipment cleaning. With the growth and modernization of power generation to keep up with the increasing energy demands, especially through renewable and hybrid systems, integrating water management solutions becomes more important. Moreover, the shift toward sustainable energy drives market growth. Utilizing wastewater treatment processes to generate biogas and other forms of energy provides an additional revenue stream and promotes sustainability.

Restraint

High Capital Costs

High cost associated with establishing and running infrastructure restraints the growth of the U.S. water and wastewater treatment market. Implementing advanced water and wastewater treatment technologies can be expensive. High energy costs are a major component affecting energy-intensive processes like membrane filtration, UV disinfection, and sludge treatment. Furthermore, the ongoing need for chemicals, such as coagulants and disinfectants, adds to operational costs. Regular maintenance and system upgrades also require continuous financial investment, further straining resources. Operating and maintaining treatment plants require skilled labor. All these factors create challenges for municipalities and industries, limiting the prospects of the market.

Opportunity

Increasing Research & Development Activities

Government and private funds are being channelled to develop new, efficient, advanced, and sustainable treatment technologies to overcome the increasing complexity of the contaminants and the strict environmental requirements. The federal and state governments are actively supporting research and development efforts through grant money, pilot programs, and the establishment of funds designed to support water innovation hubs.

Within these programs, the development of new solutions, such as membrane bioreactors, advanced oxidation processes, and intelligent monitoring systems based on AI and IoT, is being actively encouraged. This surge in R&D drives the invention of next-generation treatment methods, offering profitable opportunities for manufacturers and service providers, and ultimately promoting long-term growth and sustainability in the U.S. water and wastewater treatment market.

Equipment Insights

U.S Water and Wastewater Treatment Market Revenue, By Equipment 2022-2024 (USD Billion)

| By Equipment | 2022 | 2023 | 2024 |

| Membrane Separation | 19.6 | 20.9 | 22.3 |

| Biological | 16.4 | 17.5 | 18.8 |

| Disinfection | 6.9 | 7.3 | 7.8 |

| Sludge Treatment | 10.6 | 11.3 | 12.0 |

| Others | 3.1 | 3.2 | 3.4 |

How Does the Membrane Separation Segment Dominate the U.S. Water and Wastewater Treatment Market?

The membrane separation segment dominated the market with the largest revenue share in 2024. This is mainly due to the increased usage of membrane technologies in different industries because of its high level of filtration and small area of operation. Reverse osmosis ultrafiltration and nanofiltration have become more common because they remove a broad selection of contaminants. Industries like pharmaceutical, food and beverage, and power generation are highly dependent on such systems so that they can achieve the required quality of water.

The demand for high-performance water purification solutions is growing due to increased industrial activity and investments in advanced machinery. Continuous technological advancements are extending membrane lifespan, reducing fouling, and lowering operating costs, making membrane separation technologies more user-friendly. Because of rising environmental awareness and the need for sustainable solutions, membrane separation systems continue holding the top spot in the market.

The biological segment is expected to grow at the highest CAGR over the forecast period. Biological treatment are ideal to treat the wastewater by converting the organic pollutants to other organic compounds with the help of microorganisms, normally used after the primary treatment. In the U.S., regulations governing the minimization of water pollution, i.e., the Clean Water Act, are influencing the system to adopt the use of friendly and highly efficient biological treatment systems.

Biological systems play an essential role in treating biodegradable wastes in industries likr food processing, pulp and paper, and chemical manufacturing. In addition, better designs of bioreactors, such as sequencing batch reactors (SBRs) and membrane bioreactors (MBRs), are further increasing performance, space reduction, and process control.

Process Insights

U.S Water and Wastewater Treatment Market Revenue, By Process 2022-2024 (USD Billion)

| By Process | 2022 | 2023 | 2024 |

| Primary | 11.3 | 12.0 | 12.8 |

| Secondary | 20.5 | 21.9 | 23.4 |

| Tertiary | 24.8 | 26.4 | 28.1 |

Why Did the Tertiary Segment Dominate the Market in 2024?

The tertiary segment dominated the U.S. water and wastewater treatment market with the most revenue share in 2024. This is mainly due to the increased need to treat wastewater for reuse. Tertiary treatment employs advanced techniques like membrane filtration, chemical processes, advanced oxidation, nutrient removal, and disinfection (e.g., UV irradiation) to eliminate persistent contaminants such as pathogens, heavy metals, and nutrients (nitrogen and phosphorus). The stricter environmental regulations, water quality monitoring, and the growing trend of water reuse in industrial and municipal sectors are increasing the demand for tertiary water treatment. The ongoing advancements in tertiary treatment technologies, along with the implementation of smart monitoring systems, are boosting their effectiveness and cost-efficiency.

The secondary segment is expected to grow at a significant rate in the upcoming period as secondary treatment is important in reducing the amount of wastewater discharge into the environment, especially in the case of municipal and industrial usage. Although it ends up biologically degrading organic matter, the process serves as a biological safeguard against oxygen stress in the aquatic ecosystems, as well as minimizes the amount of pollutants being carried into the natural water bodies.

Urbanization and industrialization in the U.S. are increasing wastewater production, necessitating the expansion and improvement of secondary treatment facilities. Membrane bioreactors and sequencing batch reactors are emerging technologies in biological treatment, enhancing treatment efficiency and reducing the footprint, thereby making this treatment more attractive.

Application Insights

U.S Water and Wastewater Treatment Market Revenue, By Application 2022-2024 (USD Billion)

| By Application | 2022 | 2023 | 2024 |

| Municipal | 19.1 | 20.4 | 21.8 |

| Industrial | 37.4 | 39.8 | 42.4 |

What Made Industrial the Dominant Segment in the U.S. Water and Wastewater Treatment Market?

The industrial segment dominated the U.S water and wastewater market, accounting for the largest revenue share in 2024. This is mainly due to the increased industrialization and industrial wastewater. Industries such as pharmaceuticals, food and beverages, chemicals, and textiles generate substantial wastewater volumes that require specialized treatment to meet stringent environmental standards. Industrial wastewater often contains chemicals, heavy metals, and organic pollutants, necessitating specialized technologies for their removal.

Advanced treatment technologies like reverse osmosis, ion exchange, chemical precipitation, and membrane filtration are widely used in the industial sector to treat water for discharge and reuse. These technologies help industries comply with environmental regulations, support sustainability by enabling water recycling, and minimize freshwater usage.

The municipal segment is expected to grow at a significant CAGR over the forecast period. Municipal wastewater consists of domestic wastewater and residential, commercial, and certain industrial liquid wastes, all of which need to be treated. Investment in municipal water and wastewater treatment is increasing due to government initiatives to ensure more people have access to clean water. To deal with the issues of water scarcity, pollution management, and resource recovery, long-term storage and treatment, sustainable water management practices are gaining wide acceptance among the municipalities. This positions the municipal segment as crucial for public health, environmental protection, and sustainable water management in the U.S., driving market growth.

Country Level Analysis

The U.S. water and wastewater treatment technologies market is poised for rapid growth. The water and wastewater treatment activities is rising in the country. With the increased industrialization, the volume of wastewater had increased, significantly creating the need for thorough wastewater treatment for reuse. Most of the sewage pipes, water lines, and treatment facilities are decades old and are now falling into poor condition. This drives investment of federal, state, and municipal governments in improving systems to conform to the current environmental standards and safety requirements.

Population growth and urbanization are driving the need for effective water treatment infrastructure. The expansion of industrial operations, particularly in sectors like oil & gas, food & beverage, and pharmaceuticals, is increasing the demand for high-efficiency treatment technologies. These factors, along with environmental and public health concerns, are propelling the growth of the U.S. water and wastewater treatment market.

- In October 2023, Stanley County, North Carolina, allocated $32 million to upgrade the West Stanley Wastewater Plant. The initiative is set to improve wastewater service for Red, Locust, Oakboro, and Stanfield communities through extra aeration tanks, new pump stations, a chemical feed system, and a fresh equipment building.

(Source: https://smartwatermagazine.com)

Recent Developments

- In October 2024, the Hubgrade center for digital management and control of wastewater treatment was introduced in New Orleans, U.S., by Veolia North America, Mayor LaToya Cantrell, and the Sewerage and Water Board of New Orleans. Hubgrade integrates the Veolia water activities with the Veolia energy activities to achieve improvements in the environmental quality of New Orleans and reduce costs, emissions, and long-term sustainability.

- In October 2024, the United States Section of the International Boundary and Water Commission (USIBWC) marked the opening of the rehabilitation and increase in capacity of the South Bay International Wastewater Treatment Plant (SBIWTP), which will increase the capacity of the plant twice. The project with the San Diego, Calif., plant is being jointly funded by both the USIBWC and the U.S. Environmental Protection Agency with a view to severely cutting down transboundary sewage flows out of Baja California, Mexico.

- In March 2023, on World Water Day, the Biden-Harris Administration announced more than $49 billion in domestic and global action to ensure that equitable access and climate-resilient water and sanitation infrastructure remain a priority at home and around the world. These announcements are the next step in President Biden's once-in-a-generation investments in water conservation and resilience planning, water storage and conveyance, watershed health and management, and drought resilience as the Administration operates to ensure environmental justice is achieved.

(Source: https://www.veolianorthamerica.com)

(source: https://www.ibwc.gov/wp-content)

(Source: https://usun.usmission.gov)

U.S Water and Wastewater Treatment Market Companies

- Xylem, Inc. (U.S.)

- DuPont de Nemours, Inc. (U.S.)

- 3M Company, Inc. (U.S.)

- The Dow Chemical Company (U.S.)

- Bio-Microbics, Inc. (U.S.)

- Calgon Carbon Corporation (U.S.)

- Burns & McDonnell (U.S.)

- SPEC Limited (India), Ecolab, Inc. (U.S.)

- GFL Environmental Inc. (U.S.)

Segments Covered in the Report

By Equipment

- Membrane separation

- Biological

- Disinfection

- Sludge treatment

- Others

By Process

- Primary

- Secondary

- Tertiary

By Application

- Municipal

- Industrial

Get a Sample

Get a Sample

Table Of Content

Table Of Content