What is Used Car Market Size?

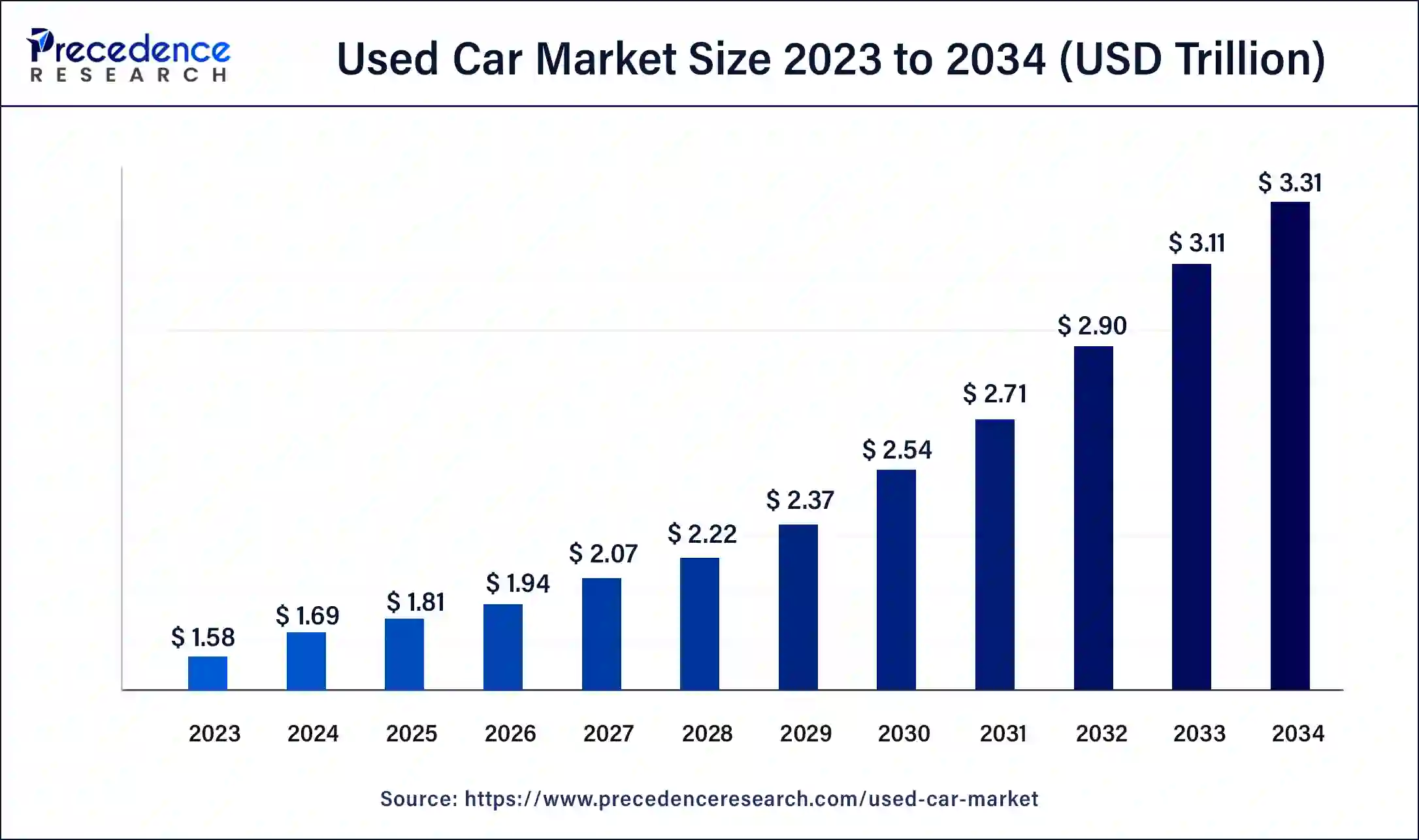

The global used car market size is estimated at USD 1.81 trillion in 2025 and is predicted to increase from USD 136.06 trillion in 2026 to approximately USD 1712.5 trillion by 2035, expanding at a CAGR of 32.62% from 2026 to 2035

Market Highlights

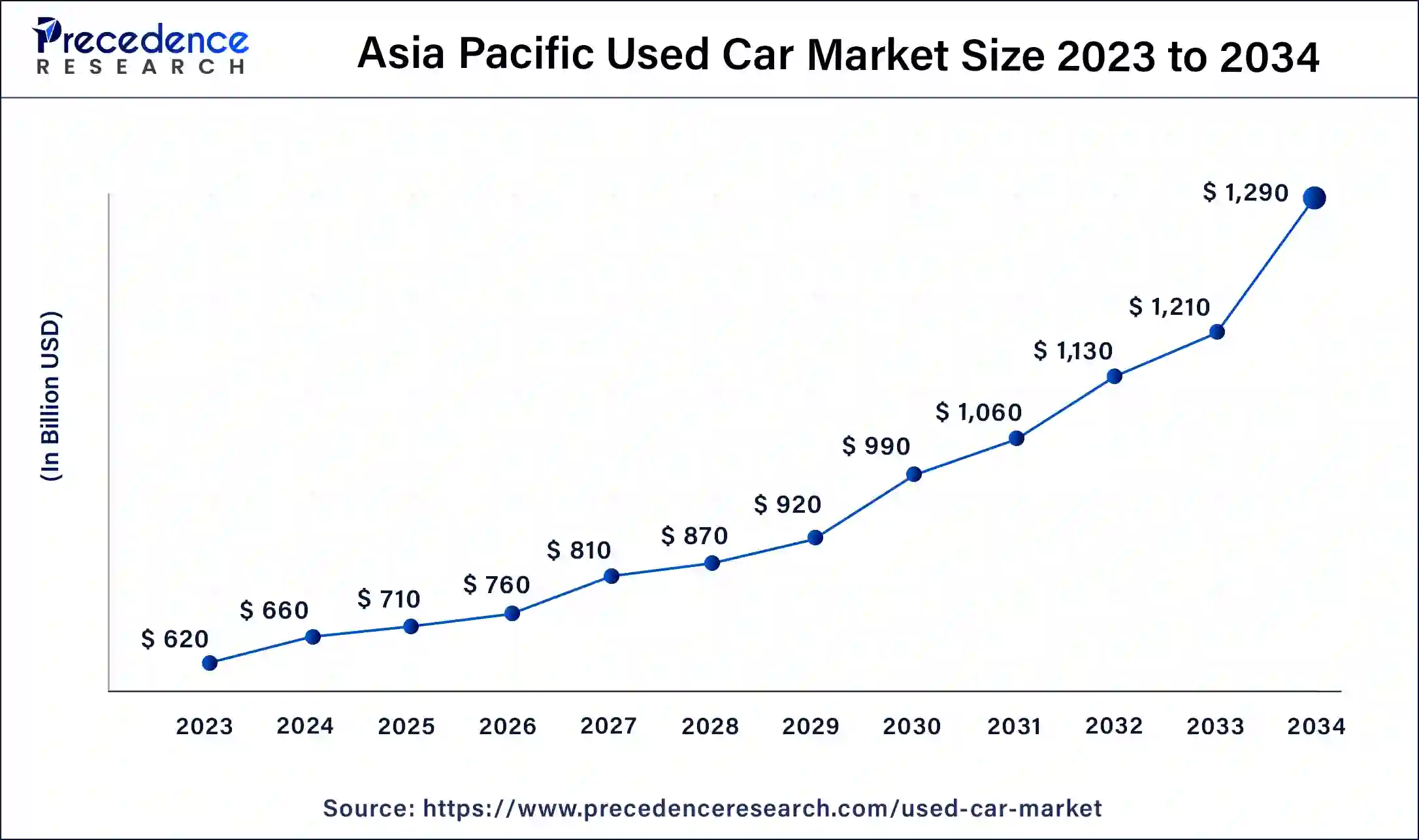

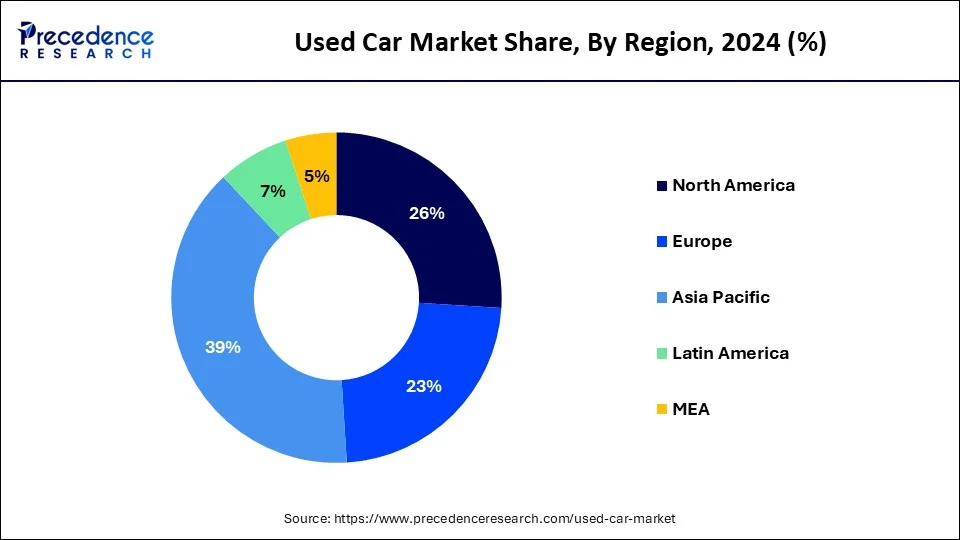

- Asia Pacific contributed the highest revenue share of 39% in 2025.

- North America is estimated to expand the fastest CAGR between 2026 and 2035.

- By Vehicle Type, the conventional segment has held the largest market share of 47% in 2025 and is anticipated to grow at a remarkable CAGR between 2026 and 2035

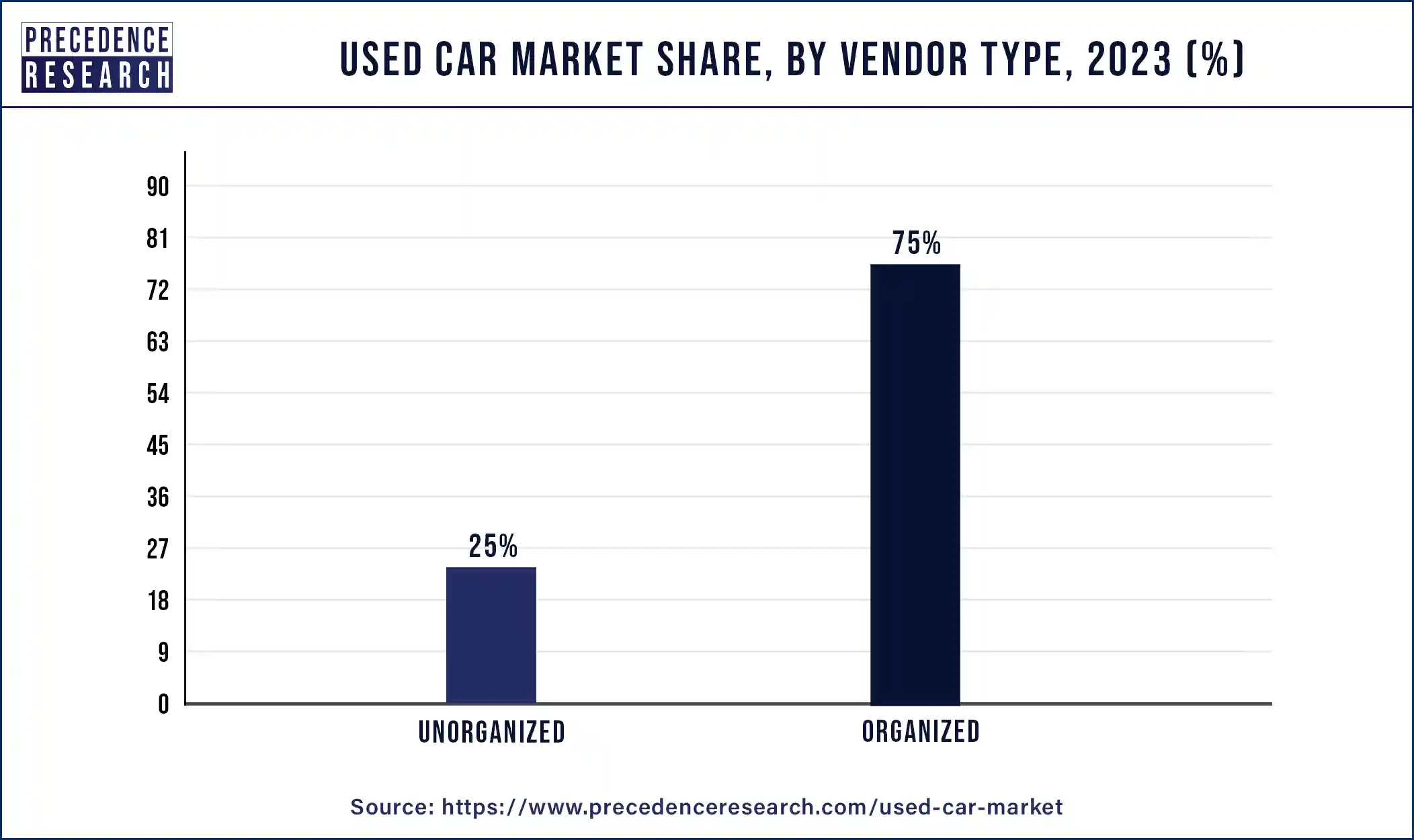

- By Vendor Type, the organized segment generated the highest revenue share of 75% in 2025.

- By Fuel Type, the petrol segment generated the highest revenue share of 42% in 2025.

- By Size, the compact segment registered a maximum market share of 45% in 2025.

- By Sales Channel, the offline segment captured the biggest revenue share of 80% in 2025.

Used Car Market Trends

- Electric Vehicles (EV) Shift: The shift to EV is increasing due to government incentives and the fast development of the charging infrastructure, enabling purchasers of used cars to consider used EVs as a more environmentally friendly and affordable option.

- Online Sales Platforms Growth: The strategy of digital transformation is transforming consumer used car purchases. The online platforms are more transparent, have wider access to vehicles, and are convenient, as buyers can compare prices, features, and reviews.

- Green Policies and Regulatory Support: The trends in the used cars are also considerably being affected by the government policies that are promoting cleaner transportation. With the increase in regulatory pressure, the environmentally friendly options will become more favourable in the market and will transform the inventory and buyer purchasing behaviour.

- Increasing Fuel Costs and Efficiency Demand: Customers want cost-effective transportation that lowers the overall operating expenses in the long run. This will likely continue to be reinforced in the future, particularly in areas where fuel taxes are high, to determine the kind of cars that will prevail in the used car market.

Used Car Market Growth Factors

The shipment of used cars was recorded mpre than 106 million units in the year 2022. The market growth for used cars witnessed significant growth during the past few years because of price competitiveness among new market players along with inability of significant share of customers to buy a new car. In addition, the market players in the used car market are strengthening their dealership network through he investment in different regions to grab major share of customers in that region and to establish their hold in the market. These dealership network help industry participants to establish their brand recognition as well as to make used car options viable mostly for the lower middle-class population.

In addition, online sales are one of the most critical factors that drive the market growth for used car during the forthcoming years. Online sites play a major role in bringing access of used cars to huge number of customers in just single touch. Hence, the aforementioned factors significantly propel the market growth for used car in the upcoming period.

Earlier, automotive manufacturers were mainly focused towards the new car production and sales, whereas now view used cars as a byproduct for their sales growth. However, increasing competition in the used car market has significantly surged the dealership networks. Moreover, an added advantage for high reliability and quality of the used vehicles has upended the customer perspective towards used passenger cars and thus propels the market growth for used cars during the forthcoming years.

Market Scope

| Report Scope | Details |

| Market Size in 2025 | USD 101.54 Trillion |

| Market Size in 2026 | USD 136.06 Trillion |

| Market Size by 2035 | USD 1712.5 Trillion |

| Growth Rate from 2026 to 2035 | CAGR of 32.62% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Vehicle Type, Vendor Type, Fuel Type, Size, Sales Channel, and Region |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

Used Car Market Segmental Insights

Vehicle Type Insights

The conventional vehicle type segment dominated the global used car market accounting for a revenue share of more than 47% in the year 2025 and estimated to exhibit significant growth over the forthcoming years. The prominent share of the segment is mainly attributed to its large inventory that offers large number of choices for the customer at an affordable price. In addition, the conventional vehicles cover maximum share in all sizes of vehicles that include mid-size, compact, and SUVs. The electric vehicle witnessed the fastest growth rate due to shifting customer preference from conventional vehicles to electric-powered vehicles.

Vendor Type Insights

The organized vendor type segment registered the fastest growth and accounted to hold more than two-thirdsof the total market revenue over the analysis period owing to new retail model as well as significant amount of entry of new players favor the market growth of organized vendor segment.

Fuel Type Insights

The petrol fuel type accounted to register the largest revenue share of nearly 42% in the year 2025 and expected to witness a stagnant growth over the forecast period. This is primarily because of declining usage of diesel-based vehicles. In addition, the government of various regions has issued stringent regulations for the diesel-powered vehicles, this triggers the market growth for alternate fuel sources.

Size Insights

Based on size, the global used car market is classified into mid-size, compact, and SUVs. The compact size held the majority of revenue share accounting for approximately 45% in the year 2025 because of increasing preference of customers towards compact and economical vehicles. On the other hand, SUVs have shown downfall in their sale owing to changing landscape in the automobile industry. Nonetheless, with the advancements in SUVs, the segment likely to witness an upsurge during the forthcoming years.

Sales Channel Analysis

Offline sales channel accounted to hold majority of revenue share of nearly 80% in the year 2025 and anticipated to continue its dominance during the forecast time frame. This is mainly attributed to the high consumer preference for conventional mode of purchasing. In addition, the offline sales also offer higher consumer satisfaction. However, shifting trend for online purchasing has also triggered the online sales of used cars. Further, the rising penetration of internet in developing and under-developed nations anticipated to favor the growth of online sales channel.

Used Car Market Regional Insights

The Asia Pacific used car market size is valued at USD 710 billion in 2025 and is expected to be worth around USD 548.01 billion by 2035, at a CAGR of 32.65% from 2026 to 2035

Asia Pacific dominated the global used car market with the largest share in 2025. The region's market growth is driven by the increased urbanization activities, surge in number of middle class population, availability of budget-friendly used cars and rising disposable incomes in countries like India and China. A significant rise in businesses selling used cars and growing use of online platforms offering trading services for used cars to cater the increased demand is boosting the market growth. Additionally, consumer access to financing options for streamlining purchase of used cars, launch of certified pre-owned (CPO) programs by manufacturers offering extended warranties and quality assurance as well as supportive government initiatives for promoting sustainable transportation and mitigating the environmental impact of the automotive industry by fostering the adoption of used cars is strengthening the presence of Asia Pacific in the used cars market.

North America used car market is expected to grow at the fastest rate over the forecast period. The rising prices of new cars, inflation in market, increased influence of automotive manufacturers in the used car business providing certified pre-owned (CPO) vehicles and growing consumer preference for buying or renting used cars is fuelling the market growth. Integration of digital technologies and AI algorithms by major market companies like eBay Motors for retailing and streamlining buying process by enhancing accessibility for customers to wide range of vehicles is expanding the market. Furthermore, franchise dealers and dealership networks are focused on expanding their market presence by offering trustworthy and organized service options for used car buyers.

- For instance, AutoNation, a leading automotive retailer in U.S., is focused on gaining a larger share of the used vehicle market by expanding its network of AutoNation USA stores.

The European used car market is on the verge of significant growth in the forecast period due to the changing consumer behavior, environmental concerns, and technological changes in the sale of vehicles. The emergence of the need for fuel-efficient cars and low-emission cars with the rising cost of fuel prices and the awareness of the changing climatic conditions.

Government push and incentives in countries like Germany, France, and the Netherlands, which are promoting the usage of more environmentally friendly vehicles and subsidizing the purchase of an EV, also contribute to the trend. The strong demand for SUVs and the ever-increasing popularity of car subscription businesses and shared mobility are also indicating market growth.

- In August 2024, MOTORS partnered with Parkers, a U.K. used car buyer platform, to increase the coverage of its multisite advertising service. The partnership will provide dealers with increased exposure and consumers with a wider choice of used vehicles on a platform one of the most respected automotive sites within the U.K.

Key Companies & Market Share Insights

The global market for used car is highly competitive as the leading industry platers are highly focused towards expanding their consumer base to gain significant competitive edge in the market. Hence, vendors adopt various inorganic growth strategies such as merger & acquisitions, collaborations, strategic alliances, and many others. For instance, in the year 2020, Volkswagen announced to invest in the market through collaborating with its own used car chain i.e. Das WeltAuto to expand its reach in the market and gain higher degree of competitive advantage on the global scale.

Used Car Market Companies

- CarMax Business Service LLC,

- Alibaba.com,

- Asbury Automotive Group,

- Hendrick Automotive Group,

- Scout24 AG,

- TrueCar Inc.,

- Lithia Motor Inc., Group

- 1 Automotive Inc.,

- AutoNation Inc.,

- eBay Inc.

Recent Developments

- In April 2025, Renault UK collaborated with Phyron, a Swedish AI-powered content creation platform for car dealers. The partnership aims at automating the creation of video content for vehicle listings of Renault UK's approved used car programme, Renew, by enhancing Renew's online retail experience leading to accelerated vehicle sales with improved customer engagement.

- In April 2025, Cars24, a well-known new and used vehicles e-commerce platform, acquired Team-BHP, India's largest automotive forum.

Used Car MarketSegments Covered in the Report

By Vehicle Type

- Conventional

- Hybrid

- Electric

By Vendor Type

- Unorganized

- Organized

By Fuel Type

- Diesel

- Petrol

- Others

By Size

- Mid-Size

- Compact

- SUVs

By Sales Channel

- Offline

- Online

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting