What is X-Ray Detectors Market Size?

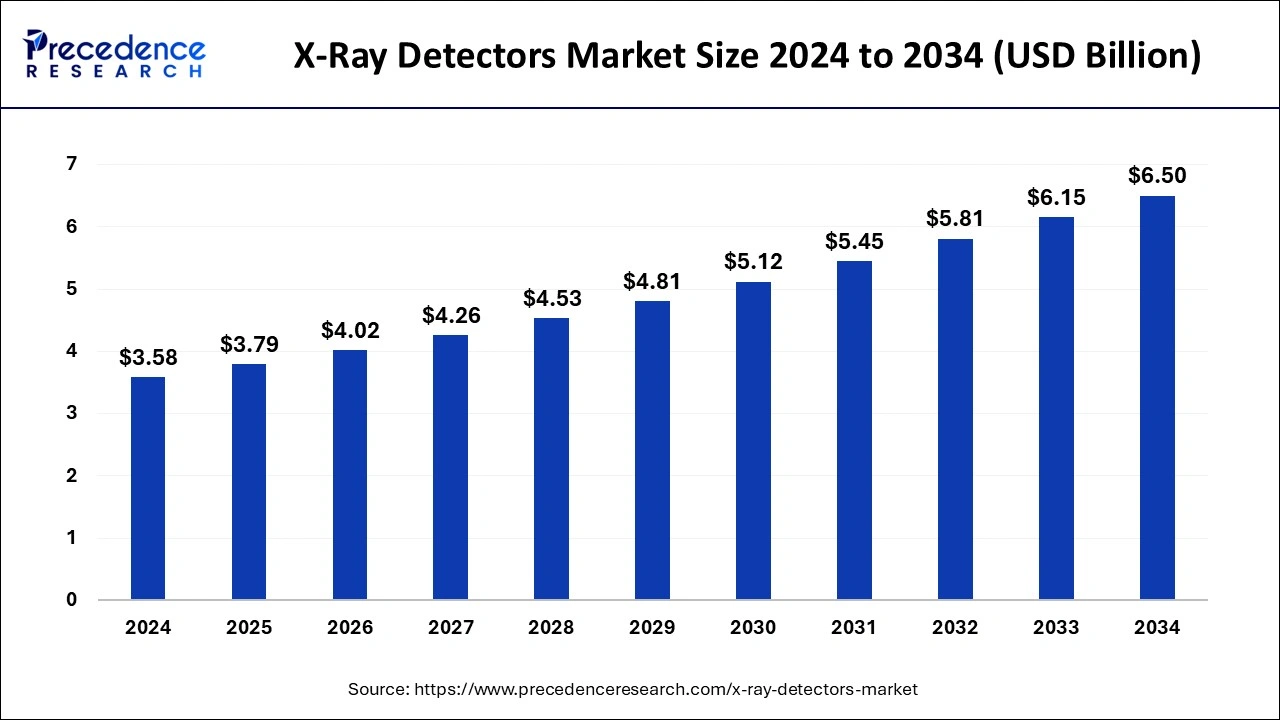

The global X-ray detectors market size is calculated at USD 3.79 billion in 2025 and is predicted to increase from USD 4.02 billion in 2026 to approximately USD 6.50 billion by 2034, expanding at a CAGR of 6.15% from 2025 to 2034.

Market Highlights

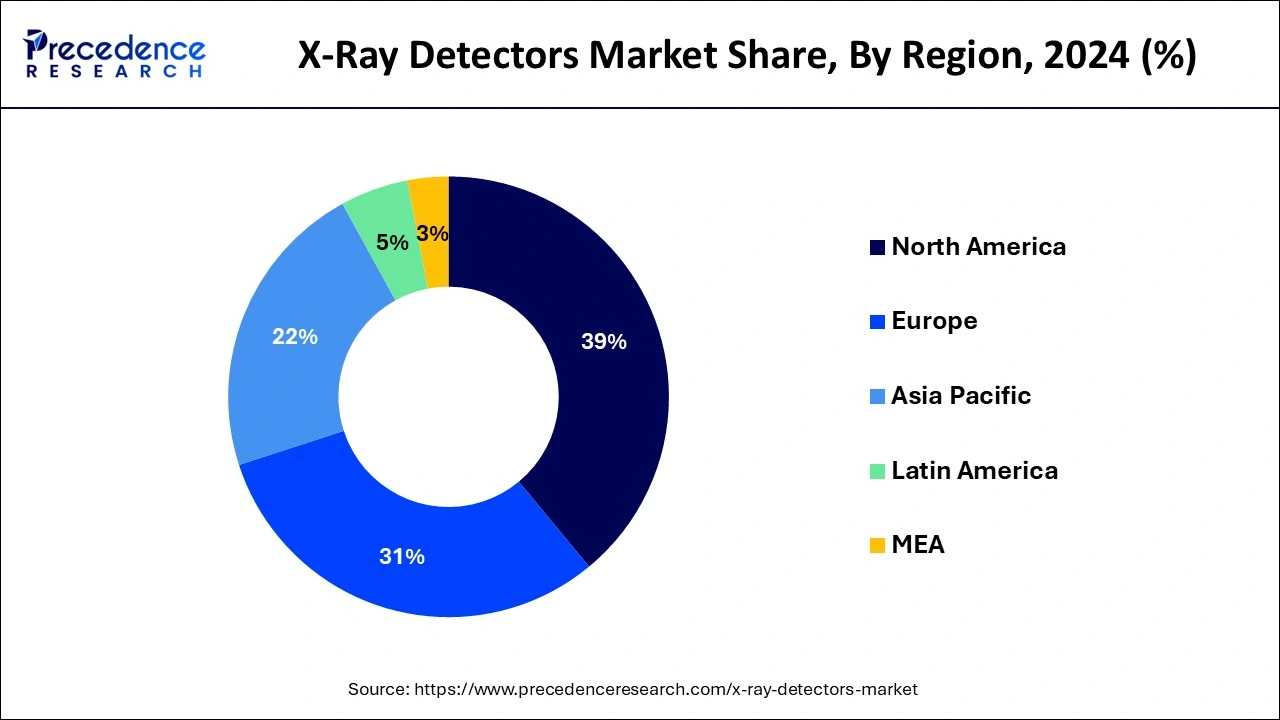

- North America contributed more than 39% of revenue share in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By type, the flat panel detector segment has held the largest market share of 44% in 2024.

- By type, the mobile detectors segment is anticipated to grow at a remarkable CAGR of 7.5% between 2025 and 2034.

- By panel size, the small area segment generated over 54% of revenue share in 2024..

- By panel size, the large area segment is expected to expand at the fastest CAGR over the projected period.

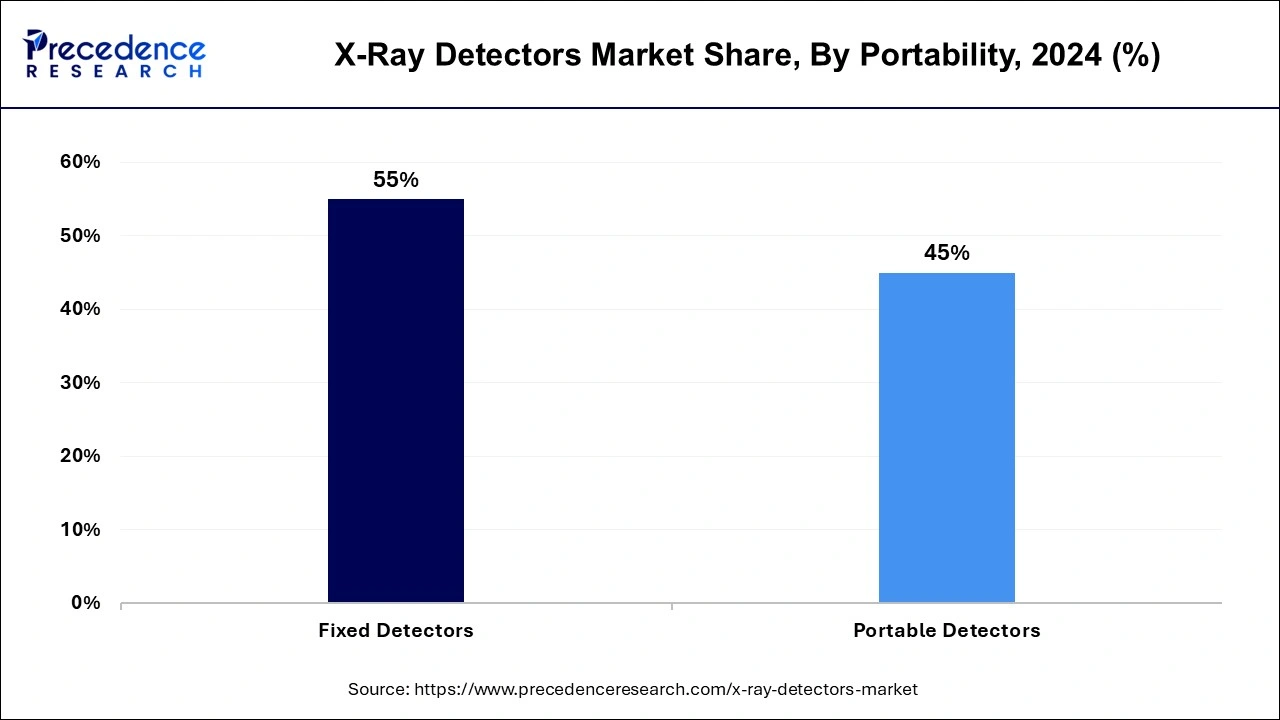

- By portability, the fixed detectors segment generated over 55% of revenue share in 2024.

- By portability, the portable detectors segment is expected to expand at the fastest CAGR over the projected period.

- By application, the medical imaging segment generated over 35% of revenue share in 2024.

- By application, the industrial application segment is expected to expand at the fastest CAGR over the projected period.

Strategic Overview of the Global X-Ray Detectors Industry:

X-ray detectors are essential tools in medical imaging and security screening. They play a key role in converting X-ray radiation into visible images or electronic signals. These detectors are crucial in medicine for visualizing internal body structures, aiding healthcare professionals in diagnosis. Two main types of X-ray detectors are commonly used in medical imaging: scintillation detectors, which use crystals emitting light when exposed to X-rays, and digital radiography detectors, directly converting X-ray photons into electrical signals to produce high-resolution digital images.

Beyond healthcare, X-ray detectors are vital in security systems, particularly in airports for baggage screening. They contribute to safety by identifying potential threats or prohibited items. Ongoing technological advancements in X-ray detectors focus on increasing sensitivity, efficiency, and overall performance, leading to improved image quality and faster imaging processes in both medical and security applications.

Artificial Intelligence: The Next Growth Catalyst in X-Ray Detectors

Artificial Intelligenceis significantly impacting the X-Ray Detectors market by transforming them into intelligent diagnostic tools that enhance efficiency, accuracy, and patient safety. Algorithms, particularly deep learning models, analyze vast amounts of imaging data to detect subtle anomalies, such as tumors or fractures, often with a speed and consistency that aids human radiologists and reduces diagnostic errors. This integration is also key to enabling low-dose imaging protocols, where AI reconstructs high-quality images from lower radiation exposures, improving patient safety without compromising diagnostic accuracy.

X-Ray Detectors Market Growth Factors

- Technological Advancements: Ongoing innovations in X-ray detector technology, such as the development of high-resolution sensors and advanced image processing algorithms, are driving market growth.

- Increased Diagnostic Imaging Demand: Rising healthcare needs and the growing prevalence of diseases necessitate expanded use of X-ray detectors for accurate and timely diagnostics.

- Aging Population: The global aging demographic contributes to increased medical imaging procedures, fostering a higher demand for X-ray detectors in diagnostic applications.

- Rising Incidence of Chronic Diseases: The surge in chronic conditions, like cardiovascular diseases and cancer, fuels the demand for X-ray detectors for early detection and monitoring.

- Growing Awareness of Radiation Hazards: Increasing awareness of the potential hazards of radiation exposure has led to the adoption of safer and more efficient X-ray detectors, boosting market growth.

- Government Initiatives: Supportive government policies and initiatives aimed at upgrading healthcare infrastructure contribute to the expansion of the X-ray detectors market.

- Emerging Markets: The rising adoption of X-ray detectors in emerging economies, driven by improving healthcare facilities, adds to the market's growth.

- Digitalization of Healthcare: The overall shift toward digital healthcare systems favors the adoption of digital X-ray detectors, enhancing efficiency and diagnostic capabilities.

- Miniaturization of Detectors: Advances in miniaturization technologies enable the development of portable and compact X-ray detectors, expanding their utility across various medical settings.

- Increasing Investments in Research and Development: Growing investments in R&D activities to enhance X-ray detector performance and capabilities contribute to market expansion.

- Integration of Artificial Intelligence: The integration of AI for image analysis and interpretation enhances the diagnostic accuracy of X-ray detectors, driving market growth.

- Rising Adoption of Cone Beam Computed Tomography (CBCT): The increasing use of Cone Beam Computed Tomography CBCT for three-dimensional imaging in various medical disciplines amplifies the demand for X-ray detectors.

- Expanding Applications in Non-Medical Sectors: X-ray detectors find applications beyond healthcare, such as in industrial and security sectors, diversifying their market scope.

- Globalization of Healthcare Services: The globalization of healthcare services increases the demand for advanced diagnostic tools, including X-ray detectors, worldwide.

- Advancements in Material Sciences: Ongoing developments in materials used in X-ray detectors, such as scintillator materials, contribute to improved sensitivity and efficiency.

- Demand for Point-of-Care Imaging: The increasing emphasis on point-of-care imaging solutions boosts the adoption of portable X-ray detectors for immediate diagnostics.

- Collaborations and Partnerships: Collaborative efforts between key industry players and healthcare providers drive the development and adoption of innovative X-ray detector technologies.

- Environmental Sustainability: The growing focus on environmentally sustainable practices encourages the development of eco-friendly X-ray detectors with reduced environmental impact.

- Telemedicine Trends: The rise of telemedicine increases the need for remote diagnostic capabilities, promoting the use of X-ray detectors in virtual healthcare settings.

- Cost-Effective Alternatives: The development of cost-effective X-ray detector solutions makes advanced imaging technology more accessible, fostering market growth in diverse healthcare settings.

- Toshiba Corporation annual revenue for 2022 was $28.2B. And annual revenue for 2021 was $28.3B.

Market Outlook

- Market Growth Overview: The X-Ray Detectors market is expected to grow significantly between 2025 and 2034, driven by the shift to advanced digital and portable systems, integrated AI for enhanced diagnostics, and growing demand across medical, industrial, and security applications.

- Sustainability Trends:Sustainability trends involve the energy efficiency, eco-friendly materials, and proper disposal and recycling of X-ray equipment and related electronic waste (e-waste) is crucial to prevent environmental contamination.

- Major Investors: Major investors in the market include Anguard Group, Inc., BlackRock, Inc., Gimv and Prime Ventures, and Advent International.

- Startup Economy: The startup economy in the market is a portable and handheld X-ray system, advanced sensor and detector technology, and targeting niche applications.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.79 Billion |

| Market Size in 2026 | USD 4.02 Billion |

| Market Size by 2034 | USD 6.50 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.15% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Panel Size, Portability, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing medical imaging demand and prevalence of chronic diseases

The growing need for medical imaging services, combined with an uptick in chronic illnesses, is fueling a heightened demand for X-ray detectors. As the global population expands and ages, there is a heightened requirement for diagnostic imaging to identify and monitor various health conditions. X-ray detectors, being crucial in this context, enable accurate and prompt diagnoses.

The prevalence of chronic diseases, such as heart conditions and cancer, further underscores the importance of advanced diagnostic tools like X-ray detectors, given their role in early detection and continuous monitoring. With their capability to provide detailed images of internal structures, X-ray detectors empower healthcare professionals to make well-informed decisions about treatment strategies, contributing to better patient outcomes.

As healthcare systems globally aim for improved diagnostic capacities, the demand for X-ray detectors is on the rise, addressing the increasing requirements for medical imaging in an aging and health-conscious population.

Restraint

Data security and privacy concerns

Data security and privacy concerns represent significant hurdles to the growth of the X-ray detectors market. As healthcare systems increasingly transition to digital platforms, the digitization of X-ray images raises apprehensions about the protection of sensitive patient information. The potential for unauthorized access or breaches poses a risk to patient privacy, making healthcare providers and institutions cautious about fully embracing digital X-ray detector systems. Adhering to stringent data protection regulations adds complexity to the implementation of secure storage, transmission, and access protocols for X-ray data.

This concern not only impacts the adoption rate among healthcare providers but also influences patient confidence in undergoing X-ray procedures. To foster market growth, industry stakeholders must prioritize robust data security measures, invest in encryption technologies, and advocate for stringent compliance standards to allay concerns surrounding the confidentiality and integrity of medical imaging data.

Opportunity

Diversification into non-medical sectors

Diversification into non-medical sectors is a strategic move that creates significant opportunities in the X-ray detectors market. Beyond traditional medical applications, X-ray detectors find use in industrial and security sectors, presenting avenues for market expansion. In industrial settings, X-ray detectors are vital for quality control in manufacturing processes, material analysis, and non-destructive testing. The demand for robust security systems has led to the incorporation of X-ray detectors in baggage and cargo screening, enhancing threat detection capabilities.

Manufacturers capitalizing on these non-medical applications can tap into a broader market base, reducing dependency on the healthcare sector alone. Moreover, the versatility of X-ray detectors in diverse industries fosters innovation, encouraging the development of specialized detectors tailored to the unique requirements of each sector. By exploring and investing in these non-medical applications, X-ray detector manufacturers can enhance revenue streams and ensure sustained growth in an evolving market landscape.

Segment Insights

Type Insights

In 2024, the flat panel detectors segment had the highest market share of 44% based on the type. Flat panel detectors (FPDs) in the X-ray detectors market refer to digital imaging devices that directly capture X-ray images. These detectors offer advantages over traditional methods by providing real-time imaging, improved image quality, and reduced radiation exposure.

A trend in the FPD segment involves the increasing adoption of amorphous silicon (a-Si) and amorphous selenium (a-Se) technologies, enhancing sensitivity and resolution. The demand for portable and lightweight FPDs is also on the rise, catering to the need for flexibility in various medical and non-medical applications.

The mobile detectors segment is anticipated to expand at a significant CAGR of 7.5% during the projected period. The mobile detectors segment in the X-ray detectors market refers to portable and mobile X-ray systems designed for on-the-go imaging applications. These detectors offer flexibility and convenience, particularly in emergency medical services, bedside diagnostics, and field environments.

A trend in this segment involves the development of lightweight, compact, and easy-to-maneuver mobile X-ray detectors. Advancements in battery technology, wireless connectivity, and image processing contribute to the growing popularity of mobile detectors, enabling healthcare professionals to conduct imaging procedures efficiently outside traditional healthcare settings.

Panel Size Insights

According to the panel size, the small area segment has held 54% revenue share in 2024. In the X-ray detectors market, the small panel size segment typically refers to detectors with dimensions suitable for imaging specific anatomical areas, such as extremities or dental applications. This niche segment is witnessing a growing trend as healthcare providers increasingly value specialized imaging solutions for focused diagnostics. Compact panel sizes allow for targeted and efficient imaging, contributing to reduced radiation exposure and enhanced patient comfort. The demand for small-area X-ray detectors is driven by the emphasis on precision diagnostics and the need for tailored solutions in specific medical and dental procedures.

The large area segment is anticipated to expand fastest over the projected period. The large area segment in the X-ray detectors market refers to detectors with expansive panels, typically used in applications requiring extensive coverage, such as full-body imaging and industrial inspections. This segment is witnessing a trend towards larger panel sizes, driven by the demand for higher-resolution imaging and improved efficiency. The adoption of larger panels enables enhanced diagnostic capabilities in medical imaging while catering to the growing needs of industrial sectors for comprehensive and detailed inspections, contributing to the overall growth and diversification of the X-ray detectors market.

Portability Insights

According to the portability, the fixed detectors segment has held a 55% revenue share in 2024. In the X-ray detectors market, fixed detectors refer to stationary imaging devices typically installed in dedicated locations within healthcare facilities. These detectors are integral to traditional radiography and fluoroscopy setups, providing stable and consistent imaging. A notable trend in this segment involves continuous advancements in technology, enhancing the resolution and efficiency of fixed X-ray detectors. Despite the rise of portable options, fixed detectors maintain significance in comprehensive medical imaging systems, ensuring reliable and high-quality diagnostic capabilities within established healthcare infrastructures.

The portable detectors segment is anticipated to expand fastest over the projected period. The portable detectors segment in the X-ray detectors market refers to compact, mobile devices that offer flexibility in medical imaging. These detectors enable point-of-care diagnostics, allowing healthcare professionals to perform X-ray examinations at the patient's bedside or in remote locations.

A notable trend in this segment is the increasing demand for lightweight and user-friendly portable X-ray detectors, driven by the growing emphasis on mobile healthcare solutions. Advancements in battery technology and the development of wireless connectivity further contribute to the rising popularity of portable X-ray detectors for their convenience and efficiency in various healthcare settings.

Application Insights

According to the application, the medical imaging segment has held a 35% revenue share in 2024. In the X-ray detectors market, the medical imaging segment involves the use of detectors for capturing detailed images of the human body, aiding in diagnostics. A key trend in this segment is the increasing demand for digital radiography detectors, offering higher image quality and faster processing. The transition from traditional film-based systems to digital solutions continues, driven by the advantages of improved workflow efficiency and the ability to store and transmit digital images. This trend reflects a broader industry shift towards advanced technology adoption for enhanced diagnostic accuracy in medical imaging.

The industrial application segment is anticipated to expand fastest over the projected period. In the X-ray detectors market, the industrial application segment involves the use of X-ray detectors for quality control, material analysis, and non-destructive testing in manufacturing settings. A key trend in this segment is the increasing adoption of digital X-ray detectors for improved imaging precision and efficiency in industrial processes. These detectors aid in identifying defects, ensuring product quality, and enhancing overall manufacturing reliability. As industries prioritize advanced technology for quality assurance, the industrial application segment is witnessing a surge in demand for cutting-edge X-ray detector solutions.

Regional Insights

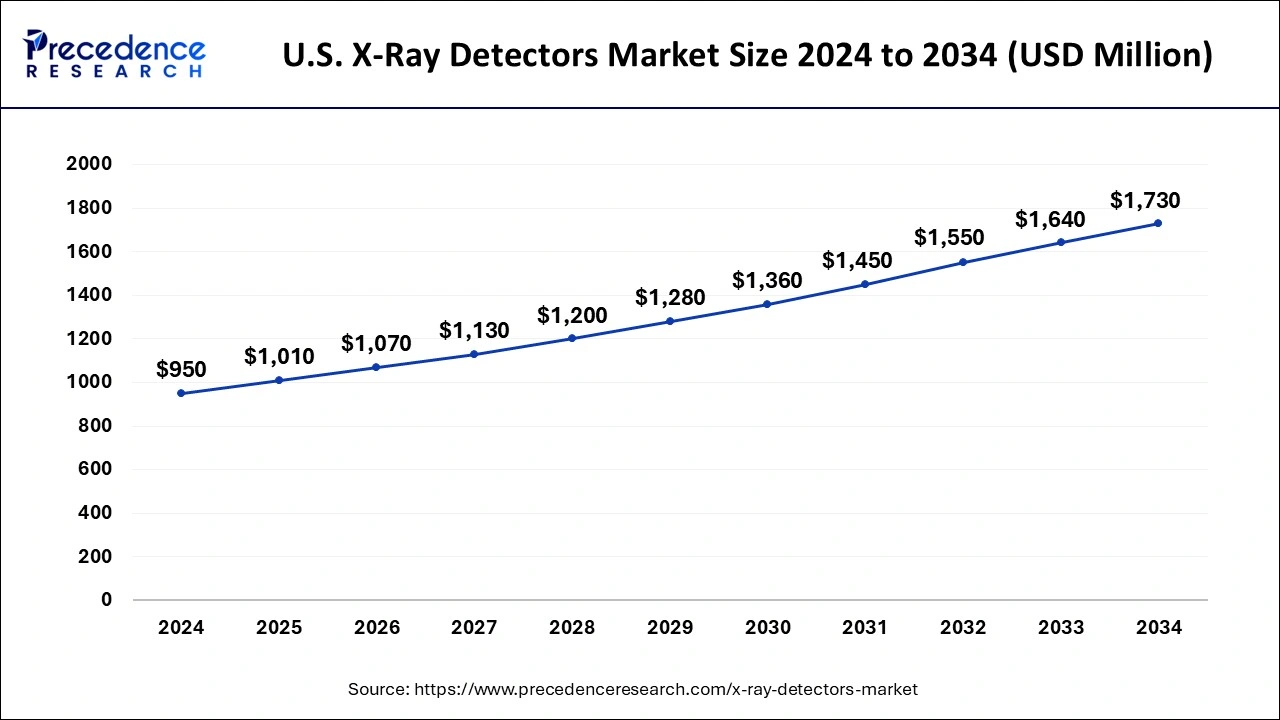

U.S. X-Ray Detectors Market Size and Growth 2025 to 2034

The U.S. X-ray detectors market size is exhibited at USD 1,010 million in 2025 and is projected to be worth around USD 1,730 million by 2034, growing at a CAGR of 6.18% from 2025 to 2034.

The U.S. is integrating AI and machine learning for automated image analysis, improved diagnostics, and lower radiation exposure. Demand is robust across medical imaging, industrial non-destructive testing, and security applications.

North America has held the largest revenue share 39% in 2024. North America holds a major share in the X-ray detectors market due to robust healthcare infrastructure, high healthcare expenditure, and early adoption of advanced medical technologies. The region benefits from a well-established regulatory framework and significant investments in research and development. Moreover, the presence of key market players contributes to technological advancements. The demand for diagnostic imaging in various medical disciplines, coupled with a proactive approach toward integrating innovative solutions, positions North America as a leader in the X-ray detectors market.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific dominates the X-ray detectors market due to factors such as rapid technological advancements, a burgeoning population, and increased healthcare infrastructure investments. The region's growing aging population contributes to heightened medical imaging needs, boosting the demand for X-ray detectors.

Additionally, expanding economies, rising awareness of advanced diagnostic technologies, and supportive government initiatives further propel the market. The increasing prevalence of chronic diseases in the region also drives the adoption of X-ray detectors for efficient diagnostics, solidifying Asia-Pacific's significant share in the global market.

Strong Healthcare Infrastructure: Trend in China's Market

China is the major player in the Asian X-ray detectors market, driven by countries' well-established healthcare infrastructure and shift toward digital imaging technologies. The government is investing heavily in digitalization. India, Japan, and South Korea are leading regional markets with significant rates, due to the countries' expanding healthcare expenditure, medical tourism, and rising demand for advanced medical technologies.

South Korea, China, and India are the top three suppliers of X-ray detectors. these three countries are global leaders in the export of X-ray machines. According to Volza's Global Export data, India holds the leading position in the world's X-ray machine exports with 11,363 shipments, followed by China with 8,968 shipments, and South Korea taking the third spot with 7,134 shipments.

Germany's X-ray detectors market is stringent EU safety regulations and the need for superior image quality. The market serves a wide range of applications, including medical diagnostics, industrial NDT, and security screening, all underpinned by high R&D investment and a growing demand for portable wireless systems in flexible clinical settings.

X-Ray Detectors Market Value Chain Analysis

- Component Manufacturing and Material Sourcing: This initial stage involves the production of essential detector components, including scintillators, thin-film transistors (TFTs), photodiodes, and advanced CMOS sensors.

Key Players: Hamamatsu Photonics, Teledyne DALSA, Canon and Siemens Healthineers. - Detector Assembly and Manufacturing: In this core manufacturing stage, the individual components are integrated into the final flat-panel detector (FPD) or other detector systems.

Key Players: Varex Imaging Corporation, Trixell S.A.S., and Konica Minolta. - System Integration and Software Development: This crucial stage involves integrating the detector with the X-ray source, gantry, and advanced imaging software for image acquisition, processing, and analysis.

Key Players: Siemens Healthineers, GE HealthCare, Philips Healthcare, Yxlon International. - Installation, Service, and Post-Sales Support:The final stage involves installing the complex equipment, providing technical support, maintenance, and software updates to ensure optimal performance and longevity.

Key Players: Siemens, GE, and Philips.

Recent Developments

- In March 2025, Align launched the Align™ X-ray Insights, a new software-based computer-aided detection solution that uses artificial intelligence to automatically analyze 2D radiographs in European Union countries and the United Kingdom.

- In February 2025, Detection Technology, a global leader in X-ray detector solutions, expanded its X-ray flat-panel detector portfolio by featuring over 60 products. The portfolio includes advanced amorphous silicon, indium gallium zinc oxide (IGZO), and complementary metal-oxide semiconductor technology-based detectors, optimised for a wide range of industrial, medical, and security X-ray imaging applications.

- In November 2024, Silveray's technology unveiled its Digital X-ray Film (DXF), a flexible, direct-conversion digital X-ray detector, designed by using a patented X-ray sensitive semiconductor ink to create a thin, flexible detector suitable for curved surface or pipe inspection.

The 100-day Tuberculosis (TB) Detection Campaign under the National Tuberculosis Eradication Programme was heled in Nagpur by The Nagpur Municipal Corporation (NMC), running from December 7, 2024, to March 24, 2025 (World Tuberculosis Day), with the goal of boosting TB detection, treatment, and awareness efforts. - In November 2022, Varex Imaging Corporation showcased its advancements in X-ray technology at the annual Radiological Society of North America conference in Chicago, USA. The focus was on photon-counting X-ray detectors, emphasizing the science behind them and the benefits they bring by making the invisible visible. Additionally, Varex demonstrated ways for radiology departments to reduce dependence on scarce helium, showcasing sustainable MR operations without compromising productivity. The company also presented its AZURE flat panel detector, designed for smoother motion and faster integration in real-time image applications.

- In November 2022, Konica Minolta Healthcare Americas, Inc. announced new digital radiography (DR) solutions aimed at transforming X-ray clinical value. This upgrade extended to the KDR Flex Overhead X-ray System, a smart radiography system with workflow innovations and DDR incorporation. Both Varex and Konica Minolta showcased their commitment to advancing X-ray technology and improving diagnostic capabilities in the healthcare sector.

Key Players in and Their Offerings

- Varex Imaging Corporation

Varex is a global leader and significant pure-play provider of X-ray imaging components, specializing in the design and manufacture of high-quality X-ray detectors for medical, industrial, and security applications. - Konica Minolta, Inc.

Konica Minolta contributes to the market with innovative digital radiography systems and detectors, focusing on high image quality and workflow efficiency, particularly in medical settings. - Agfa-Gevaert Group

Agfa provides a comprehensive portfolio of digital imaging solutions, including direct radiography (DR) and computed radiography (CR) detectors, to the healthcare market. - Canon Inc.

Canon is a key player in the medical imaging market, known for developing and manufacturing high-quality, flat-panel detectors with proprietary CMOS (Complementary Metal-Oxide-Semiconductor) technology. - Fujifilm Holdings Corporation

Fujifilm is a major contributor to the X-ray detectors market with its advanced digital radiography systems, including high-performance flat-panel detectors and mobile X-ray solutions. The company leverages its expertise in imaging technology to provide solutions that improve diagnostic accuracy and healthcare efficiency globally. - General Electric Company

General Electric (through its former GE HealthCare division) develops and integrates advanced X-ray detectors into its wide range of medical imaging systems, from general X-ray to CT scanners. - Hamamatsu Photonics K.K.

Hamamatsu Photonics is a leading manufacturer of optoelectronics components, including highly sensitive photodiodes and sensors that are essential for high-performance X-ray detectors. - PerkinElmer, Inc.

PerkinElmer provides specialized X-ray detectors for industrial and security applications, focusing on non-destructive testing (NDT) and threat detection. The company offers a range of high-resolution detectors that ensure quality control in manufacturing and enhance security screening capabilities at borders and airports. - Teledyne DALSA Inc.

Teledyne DALSA is a major supplier of high-performance digital imaging components, including advanced X-ray detectors and cameras used in industrial NDT and medical applications. The company contributes highly specialized sensor technology and expertise in custom solutions to meet demanding imaging requirements. - Analogic Corporation

Analogic provides advanced X-ray technology solutions for medical and security applications, including high-speed and high-resolution detectors. The company contributes significantly to the security screening market with its technology integrated into advanced aviation and checkpoint screening systems. - Thales Group

Thales is a global technology leader that provides X-ray imaging solutions, including high-performance flat-panel detectors, for a wide range of applications from medical to industrial controls. - Varian Medical Systems, Inc. (a Siemens Healthineers Company)

Varian specializes in cancer care solutions, providing X-ray imaging components that are essential for guiding radiation therapy treatments. - Rigaku Corporation

Rigaku is a leading provider of X-ray technologies for industrial and research applications, contributing specialized detectors for materials analysis and non-destructive testing. - Vieworks Co., Ltd.

Vieworks is a global provider of digital imaging solutions, including a comprehensive lineup of flat-panel detectors for medical and industrial applications. The company is known for its wireless and portable detectors that enhance efficiency and flexibility in healthcare settings. - Carestream Health, Inc.

Carestream Health provides medical imaging systems, including a wide range of digital radiography detectors, with a focus on delivering solutions for general radiology and point-of-care diagnostics.

Segments Covered in the Report

By Type

- Flat Panel Detector

- Computed Radiography Detectors

- Line Scan Detectors

- Charged Coupled Device (CCD) Detectors

- Mobile Detectors

By Panel Size

- Small Area

- Large Area

By Portability

- Fixed Detectors

- Portable Detectors

By Application

- Medical Imaging

- Dental Application

- Security Application

- Veterinary Application

- Industrial Application

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting