What is the Digital Radiography Market Size?

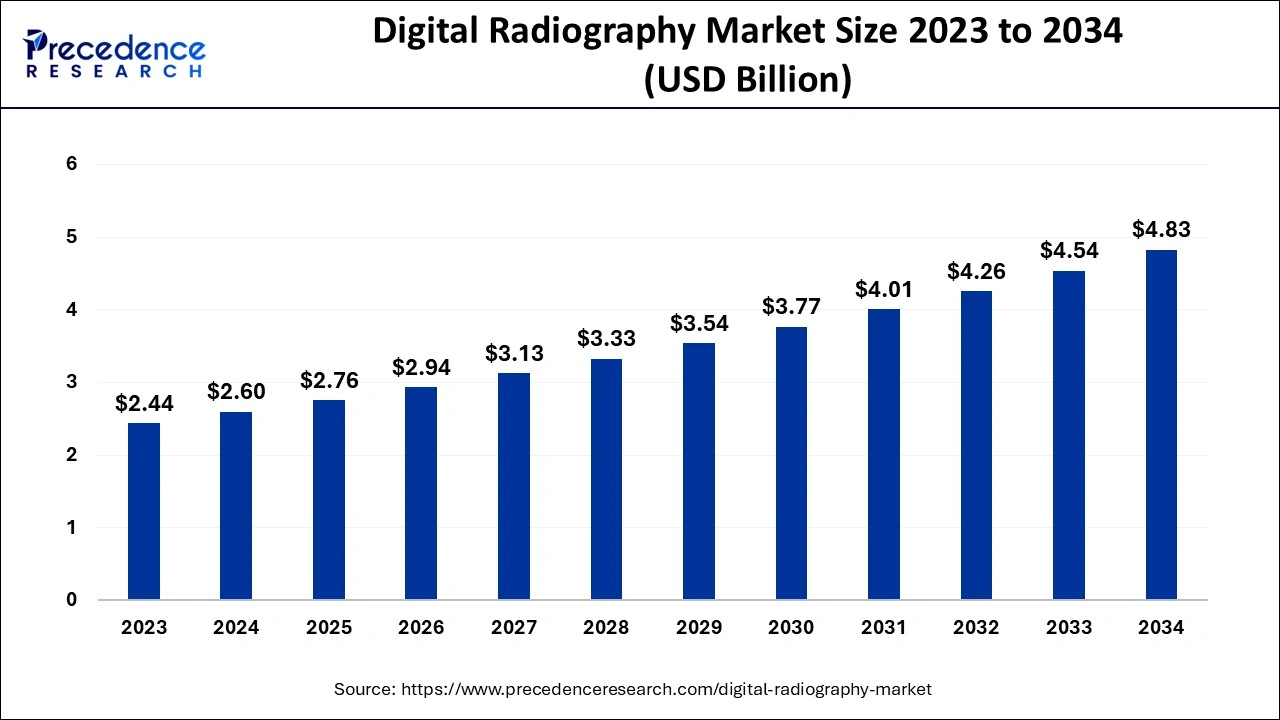

The global digital radiography market size is calculated at USD 2.76 billion in 2025 and is predicted to increase from USD 2.94 billion in 2026 to approximately USD 5.11 billion by 2035, expanding at a CAGR of 6.35% from 2026 to 2035.

Digital Radiography Market Key Takeaways

- By product, the portable system segment accounted for 72% of revenue share in 2025.

- By technology, the direct digital radiography segment hit largest revenue share in 2025.

- By end user, the diagnostics clinics segment contributed 51% revenue share in 2025.

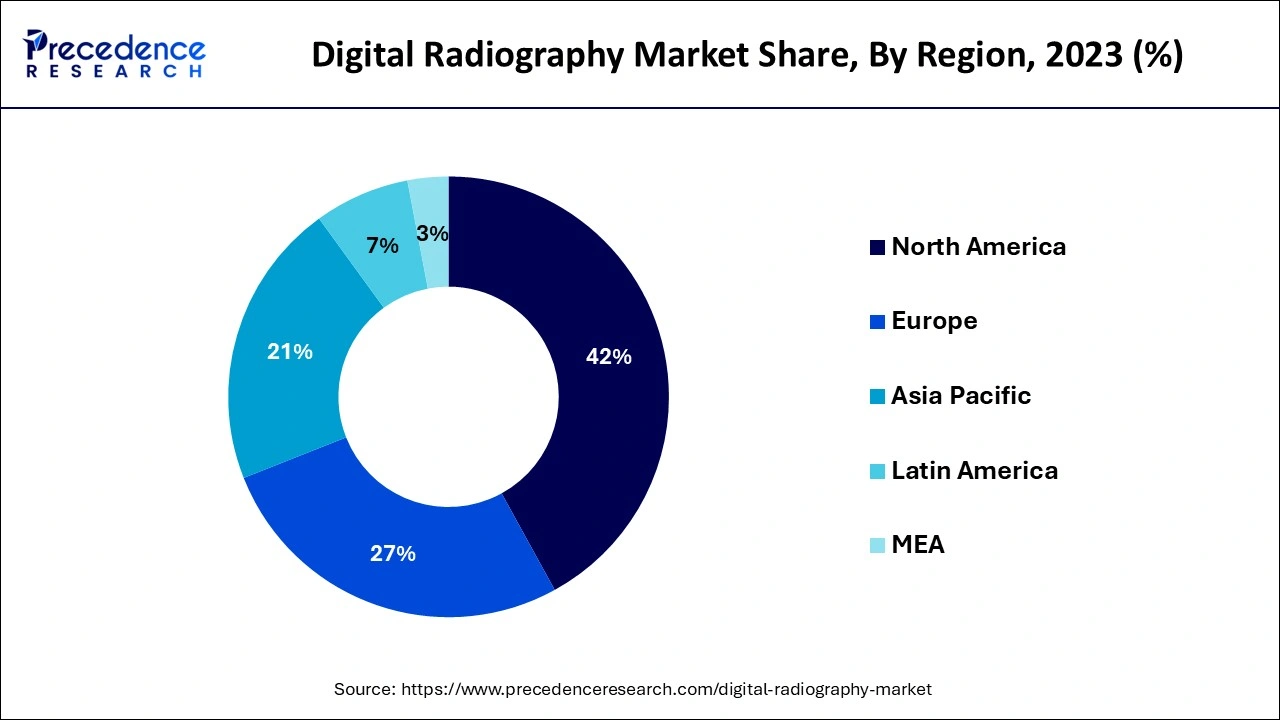

- By region, North America region has captured 42% revenue share in 2025.

Artificial Intelligence: The Next Growth Catalyst in Digital Radiography

AI is revolutionizing the digital radiography industry by dramatically improving diagnostic speed and accuracy, particularly in detecting subtle abnormalities like lung nodules or fractures. AI algorithms are being integrated directly into imaging workflows to automatically flag critical cases, such as pneumothorax or hemorrhages, enabling faster triage in emergencies.

Furthermore, AI enhances image quality by automatically optimizing patient positioning and reducing noise, which reduces the need for repeat scans and lowers radiation exposure for patients.

Digital Radiography Market Growth Factors

The growth of global digital radiography market is being driven by the growing number of cancer and dental disorder diseases. According to the American Heart Association's, cardiovascular disease is the leading cause of death in the U.S., accounting for 874,613 deaths in 2019. On average, someone died of a stroke every 3 minutes 30 seconds and someone died of a myocardial infarction every 40 seconds in 2019. In addition, technological developments and adoption of new and innovative technologies are driving the growth of global digital radiography market.

Digital X-ray systems, mammography systems, fluoroscopy systems, mobile C-arms, mobile X-ray systems, and robotic X-ray systems are all available from market participants. To improve and retain its market position, it relies on inorganic and organic growth tactics, such as new product launches, collaborations, and agreements. In the previous three years, they've released a number of items in the digital X-ray industry and are always working on new product development. The company has a large regional footprint and is continually pursuing strategic deals and alliances to help the industry flourish.

Market Outlook

- Market Growth Overview: The digital radiography market is expected to grow significantly between 2025 and 2034, driven by the increasing disease burdens, integration of AI for image analysis, better digital detectors for faster acquisition, and rising dental sector adoption.

- Sustainability Trends: Sustainability trends involve energy efficiency and management, designing a circular economy and upgrades, and the rising use of eco-friendly design and materials.

- Major Investors: Major investors in the market include GE Healthcare, Siemens Healthineers, Koninklijke Philips, Fujifilm, Canon, and Carestream Health.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.76 Billion |

| Market Size in 2026 | USD 2.94 Billion |

| Market Size by 2035 | USD 5.11 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.35% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, Technology, Method, End User, and Geography |

Segment Insights

Product Insights

The portable system segment dominated the digital radiography market in 2025. Factors like the growing quantity ofdiagnostic imaging due to the ageing population and the widespread deployment of portable radiology systems throughout diagnostic centers. In addition, an increase in ailments such as vascular, dental, and cancer, particularly breast disorders and others, is propelling the portable digital radiography segment forward. The government's support for numerous radiology research programs is also propelling the sector forward.

The stationary system segment is the fastest growing segment of the market in 2023. The rise in the prevalence of chronic diseases and cancer is driving the expansion of the stationary digital radiography system market. Many patients, particularly in developing nations, have imaging tests every year. Furthermore, future population expansion will increase demand for digital radiological detectors, boosting the segment's growth. One of the significant digital radiography market trends is that older persons acquire age-related diseases, necessitating the usage of a variety of radiographic tests.

Technology Insights

The direct digital radiography segment dominated the market in 2025. Direct digital radiography is a type of x-ray examination that produces a digital radiologic image on a supercomputer very quickly. This technique captures information during object examination using x-ray subtle plates, which are then transferred to a processor without the obligation of the middle cassette. A detector sensor alters the incident x-ray radiation to an equal electric control, which is then translated to a digital image.

The computed digital radiography segment is the fastest growing segment in 2025. When imaging plates are subjected to X-rays or gamma rays, the energy of the incoming radiation is recorded in a specific phosphor layer in computed digital radiography. The latent picture from the plate is then read out using a scanner, which stimulates it with a very precisely focused laser beam. The plate produces blue light with an intensity proportionate to the quantity of radiation acknowledged during the contact when triggered.

Application Insights

The dental radiology segment dominated the digital radiography market in 2025. Digital radiography is used in dental radiology on a large scale. Instead of film, digital imaging uses a hard sensor, such as a connected or wireless hard sensor, or phosphor plate sensors, known as a receptor. Pixels are grouped in a matrix of rows and columns in digital images.

The cardiovascular imaging segment is the fastest growing segment in 2025. One of the primary factors projected to boost the segment is rising demand for technologically advanced breast cancer screening systems. TheMedical Imaging Modernization Act of 2015, which was enacted to stimulate technical breakthroughs, led in a boom in demand for digital radiography systems.

Regional Insights

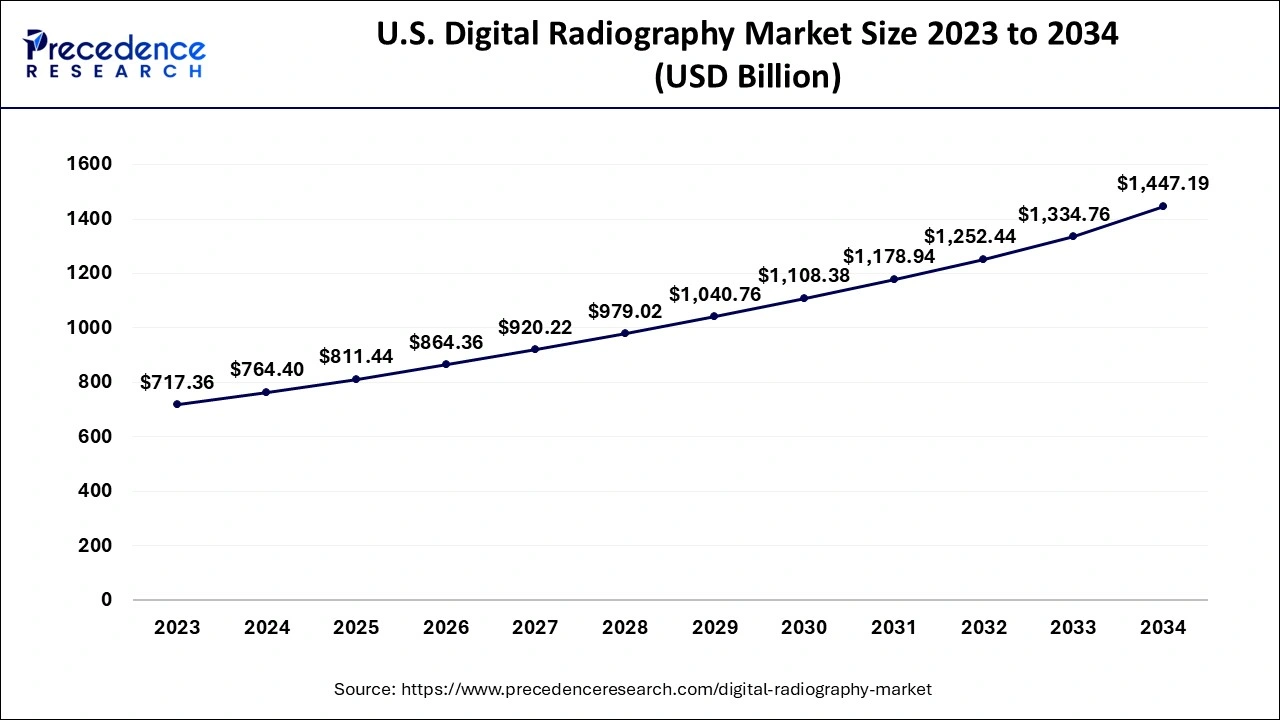

What is the U.S. Digital Radiography Market Size?

The U.S. digital radiography market size is evaluated at USD 811.44 million in 2025 and is predicted to be worth around USD 1,525.10 million by 2035, rising at a CAGR of 6.51% from 2026 to 2035.

Why has North America region dominated the digital radiography market?

North America dominated the digital radiography market in 2025. The U.S. dominated the digital radiography market in North America region. One of the key factors driving the growth of North America digital radiography market is the growing prevalence of chronic disorders. According to the GLOBOCON 2020 data, there were 2,281,658 new cancer cases identified in the U.S. in 2020, with 612,390 fatalities.

According to the Arthritis Foundation Fact Sheet for 2019, the number of people in the U.S. with doctor-detected arthritis is expected to reach 78.4 million by 2040, accounting for 25.9% of all adults in the country. In addition, according to Arthritis Foundation data updated in October 2021, 1.5 million people in the U.S. suffer from rheumatoid arthritis, which strikes women between the ages of 30 and 60.

In addition, the existence of major market players as well as growing adoption of key strategies by market players are also contributing towards the digital radiography market in North America region. Canon Medical System USA, Inc., for example, introduced the OMNERA 500A Digital Radiography System in December 2020, which includes cutting-edge intelligent auto-positioning capability to increase workflow.

What Made North America the Dominant Region in the Digital Radiography Market?

North America dominated the market while holding the largest share in 2025. This is mainly due to its advanced healthcare infrastructure, high adoption of cutting-edge imaging technologies, and widespread availability of digital radiography systems in hospitals and diagnostic centers. The region also benefits from strong government healthcare funding, favorable reimbursement policies, significant investments in R&D, and a high prevalence of chronic diseases that drive demand for accurate and efficient diagnostic imaging solutions.

U.S. Digital Radiography Market Analysis

The U.S. is a major contributor to the North American market. One of the main factors driving market growth in the U.S. is the increasing prevalence of chronic disorders. Additionally, the presence of major market players and their adoption of key strategies are also supporting market expansion. Canon Medical System USA, Inc., for example, recently introduced the OMNERA 500A Digital Radiography System, which features advanced intelligent auto-positioning capability to improve workflow

Why Asia-Pacific region is growing faster in the digital radiography market?

Asia-Pacific is expected to develop at the fastest rate during the forecast period. China, India, and Japan dominate the digital radiography market in Asia-Pacific region. The growing cases of target diseases, as well as favorable government measures, are driving the digital radiography market in Asia Pacific. These aspects contribute to the growth of the digital radiography systems market in this region, as well as attracting foreign investment and partnerships. Low hospital budgets, expensive equipment costs, and a lack of government investment in some countries, on the other hand, are constraining the market's growth in Asia Pacific.

India Digital Radiography Market Analysis

The market in India is being driven by increasing adoption of advanced imaging technologies in hospitals, diagnostic centers, and specialty clinics to improve accuracy, efficiency, and patient care. Government initiatives, such as the planned 20% capital subsidy for domestic manufacturing of medtech components announced in August 2024, are encouraging local production and reducing dependence on imports. Additionally, events such as the second Regional Open Digital Health Summit (RODHS) 2025, held in November 2025, highlight India's focus on digital public health infrastructure and the integration of technology into healthcare delivery.

What Makes Europe a Notably Growing Area in the Digital Radiography Market?

Europe is expected to grow at a notable rate in the market in the upcoming period. This growth is driven by the rising demand for early disease detection, growing healthcare awareness, and well-established healthcare infrastructure. There is high adoption of innovative imaging technologies and a strong focus on improving diagnostic efficiency and patient outcomes. Supportive government initiatives, favorable reimbursement policies, and increasing investment in healthcare digitization and AI‑enabled imaging solutions further drive market growth.

Germany Digital Radiography Market Trends

Germany's raid coverage of AI-driven diagnostics and high-mobility, low-dose imaging solutions that prioritize patient safety and clinical efficiency. As hospitals integrate these advanced systems into unified digital health networks, there is an increasing emphasis on telemedicine connectivity and sustainable manufacturing to meet national climate mandates. This technological shift is most evident in the surge of point-of-care mobile systems, which offer the flexibility required for modern diagnostic workflows.

What are the Major Factors Contributing to the Digital Radiography Market within Latin America?

The market in Latin America is propelled by major digital health and AI initiatives aimed at integrating medical imaging technologies like digital X-rays. The Pan American Health Organization (PAHO/WHO) digital health program promotes the adoption of connected, accessible, and interoperable health systems. The rising demand for accurate, high‑quality diagnostic imaging across hospitals and diagnostic centers also contributes to regional market growth.

What Opportunities Exist in the Middle East & Africa for the Digital Radiography Market?

The Middle East & Africa (MEA) offers significant opportunities for the market, driven by government-led programs to deploy AI-powered X-ray systems and advanced digital radiography. These efforts also aim to improve public health screening for diseases such as TB. Governments and healthcare providers are increasingly investing in modernizing healthcare infrastructure and expanding access to advanced diagnostic imaging systems, particularly in leading countries like Saudi Arabia, the UAE, Egypt, and South Africa, boosting the market growth.

Value Chain Analysis

- R&D:The R&D stages for digital radiography include research and concept development, design and creation, verification and validation, regulatory approval, and manufacturing and commercialization.

Key Players: GE HealthCare, Siemens Healthineers, Koninklijke Philips N.V., FUJIFILM Holdings Corporation, Carestream Health, Canon Medical Systems Corporation. - Distribution to Hospitals, Pharmacies: The various distribution channels focus on supply chain optimization and meeting the growing demand for early diagnosis.

Key Players: GE HealthCare, Siemens Healthineers, Philips Healthcare, Carestream Health, Fujifilm Holdings Corporation. - Patient Support and Services: Patient support and related services include improved communication and education, shorter waiting times, quicker diagnosis, minimized radiation exposure, and personalized diagnostic approaches.

Key Players: Canon Medical Systems, Carestream Health, Philips Healthcare, Siemens Healthineers, GE HealthCare, Hologic.

Digital Radiography Market Top Companies

- Agfa-Gevaert group: Agfa-Gevaert provides advanced digital radiography (DR) solutions, including high-performance detectors and its MUSICA image processing software, which are designed to enhance diagnostic quality and speed.

- Cannon Inc.: Canon is a major contributor through its development of high-resolution digital flat-panel detectors (FPDs) for both static and dynamic imaging in medical, dental, and veterinary applications.

- Detection Technology:Detection Technology specializes in supplying high-performance, cost-effective X-ray detectors (both CMOS and TFT) for various medical imaging applications.

- Fujifilm Holdings:Fujifilm is a pioneer in digital X-ray, offering a broad portfolio of DR systems, including the first glass-free detector series and lightweight portable solutions.

- Hitachi, Ltd.:Hitachi provides high-end imaging technology, including digital radiography systems that integrate with advanced diagnostic suites and hospital IT environments.

- General Electric (GE Healthcare):GE Healthcare provides a complete portfolio of digital radiography systems, such as the Definium and Optima XR series, known for high image quality and reliability.

Other Major Key Players

- Medtronics

- Koninklijke Phillips

- Samsung Electronics Co Ltd.

Key Market Developments

- CombiDiagnost R90, a high-quality digital radiography-based fluoroscopy structure, was given FDA 510(k) approval by Koninklijke Philips N.V. in March 2021.

- Mireye Imaging Inc. announced the release of an artificial intelligence-based Software for X-ray Patient Positioning in January 2022. This advanced and innovative imaging technology mechanizes the patient location process for X-ray inspections, eliminating the need for manual dimensions and body part alignment.

- In May 2018, ScreenPoint Medical and Siemens Healthineers teamed. Siemens was able to build artificial intelligence-powered breast imaging solutions as a result of this collaboration.

- In April 2019, Varex Imaging Corporation completed its acquisition of Direct Conversion, a leading manufacturer and marketer of linear array digital detectors based in Stockholm.

- Canon Medical USA announced the SOLTUS 500 Mobile Digital X-ray system in August 2020, which contains features that help speed up bedside exams while also improving efficiency and productivity.

- At the Radiological Society of North America's annual meeting in November 2018, Siemens Healthineers unveiled Multix Impact, a floor-mounted radiology system.

- In November 2025, Hologic expanded its digital pathology capabilities with CE marking for its Genius Digital Diagnostics System in the European Union, allowing for imaging and reviewing both cell and tissue specimens.

(Source: https://www.hologic.com) - In March 2025, Canon Medical Systems, USA announced the FDA approval and broader market availability of its automated hybrid solution called Adora DRFi for radiography and fluoroscopy.

(Source: https://us.medical.canon)

Segments Covered in the Report

By Product

- Stationary

- Portable

By Application

- Cardiovascular Imaging

- Chest Imaging

- Dental Imaging

- Digital Mammography

- Orthopedic Imaging

- Other

By Technology

- Direct

- Charged Couple Device (CCD)

- Flat Panel Detector

- Computed

By Method

- Computed Radiography (CR)

- Direct Radiography (DR)

By End User

- Diagnostic Clinics

- Other End Users

- Hospitals

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting