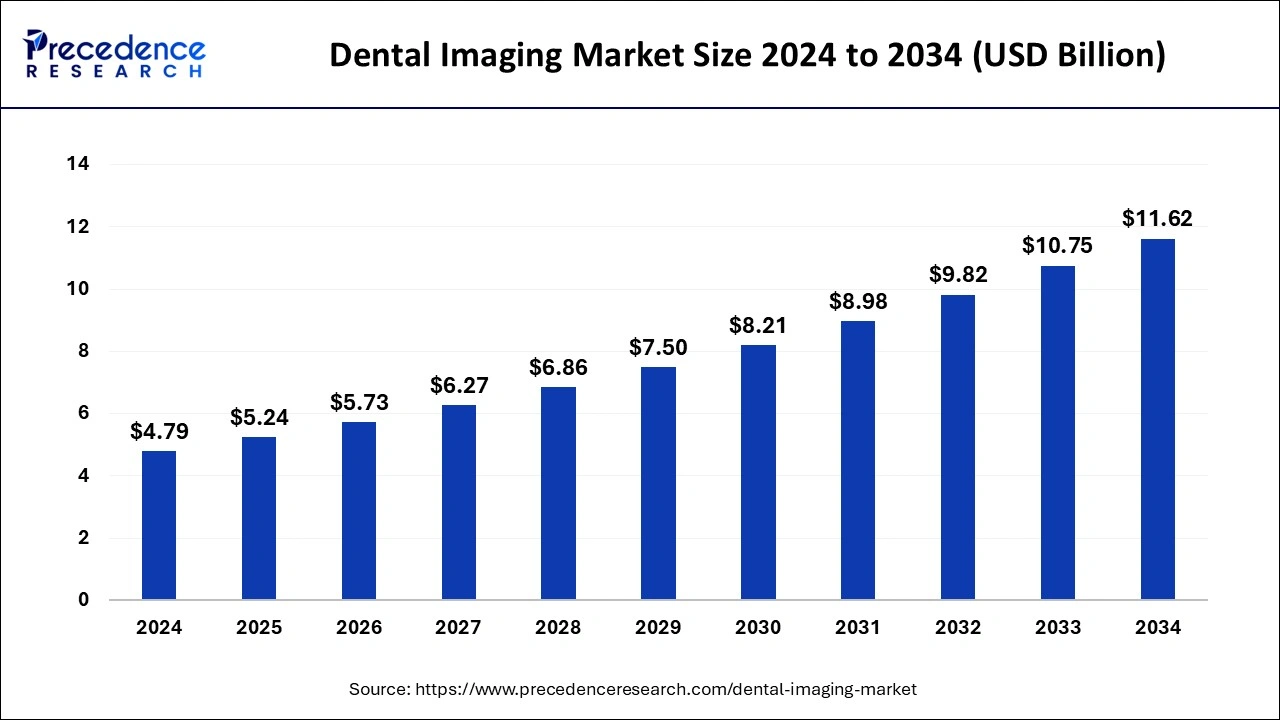

Dental Imaging Market Size and Growth 2025 to 2034

The global dental imaging market size was valued at USD 4.79 billion in 2024 and is expected to hit USD 11.62 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.27% from 2025 to 2034.

Dental Imaging Market Key Takeaways

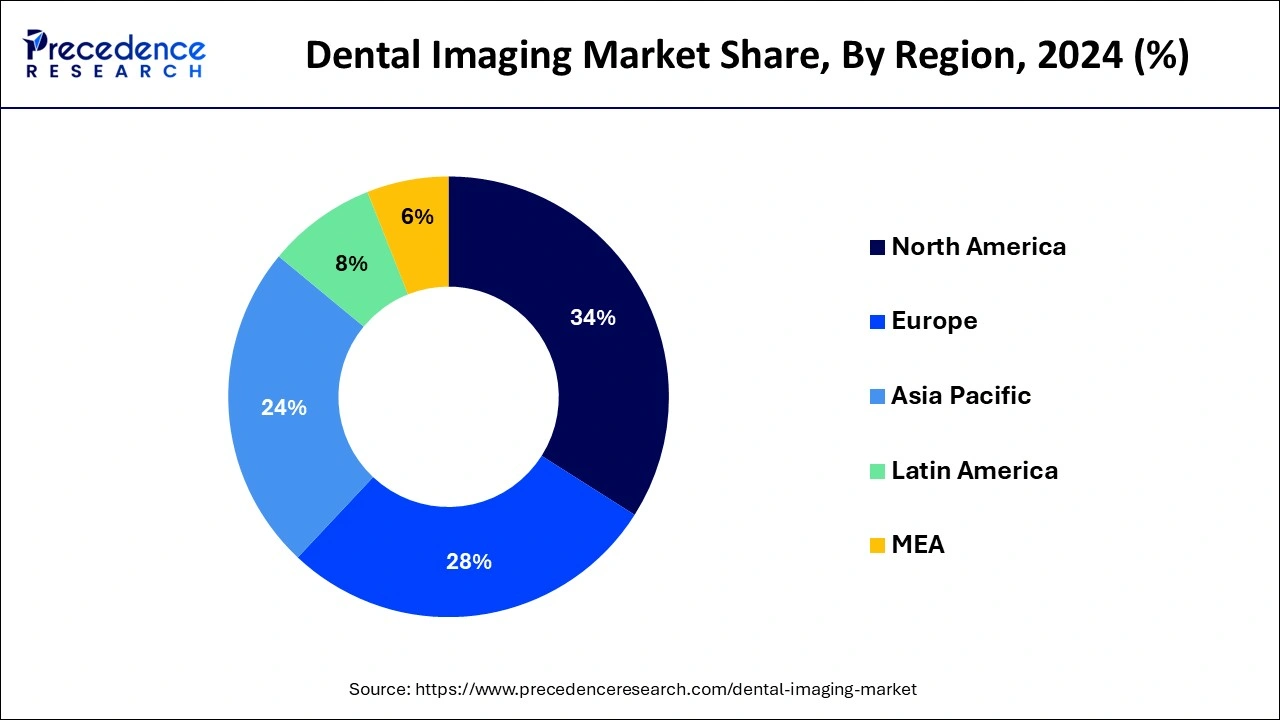

- North America led the global market with the highest market share of 34% in 2024.

- By type, the intraoral segment has held the largest market share in 2024.

- By product, the analog segment captured the biggest revenue share in 2024.

- By application, the cosmetic dentistry segment registered the maximum market share in 2024.

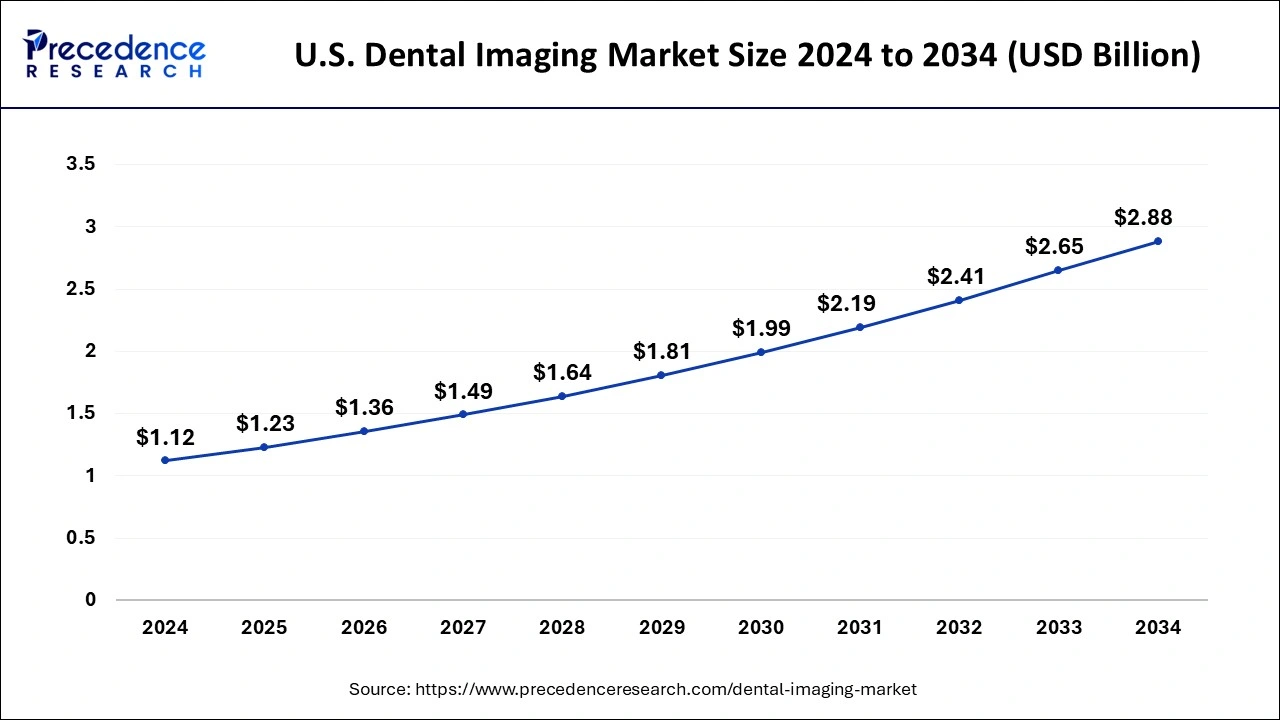

U.S. Dental Imaging Market Size and Growth 2025 to 2034

The U.S. dental imaging market size was estimated at USD 1.12 billion in 2024 and is predicted to be worth around USD 2.88 billion by 2034, at a CAGR of 9.91% from 2025 to 2034.

North America dominated the dental imaging market in 2024. The growth of dental imaging market in North America region is attributed to the growing prevalence of dental diseases. In addition, major market players are adopting new strategies for the research and development in dental imaging market. As per the American Dental Association 2020, more than 5 million elders aged 65 to 74 in the U.S. had full tooth loss with approximately 3 million being edentulous. In addition, tooth loss is predominantly an issue among the aged. This is because 91% of people aged 20 to 64 have dental cavities, with a tremendous 27% of them staying undiagnosed. Thus, due to this factor the dental imaging market is growing in the region.

Europe, on the other hand, is expected to develop at the fastest rate during the forecast period. The UK dominates the dental imaging market in Europe region.The factors such as existence of key market players, favorable reimbursement policies, and growing government activities are driving the growth of dental imaging market in Europe region. Furthermore, the growing number of geriatrics with tooth decay and tooth loss problems are supporting towards the growth of Europe dental imaging market.

Dental Imaging Market Growth Factors

One of the major factors driving the growth of global dental imaging market is growing burden of dental disorders. According to World Health Organization (WHO) report from March 2020, oral disorders impact approximately 3.5 billion people globally, and severe gum disorders which can lead to tooth loss is also highly frequent, affecting nearly 10% of the worldwide population. Hence, these figures show the surge in demand for dental imaging all around the globe.

The global dental imaging market is expanding due to adoption of innovative technologies. In addition, the growing research and development activities in dental radiology is also paving way for the growth and development of global dental imaging market. Moreover, computer aided manufacturing and computer aided design are widely used in dental imaging. All these factors are creating growth opportunities for the global dental imaging market.

On the other hand, the factors such as lack of awareness regarding dental imaging among people and lack of resources in developing and underdeveloped regions are restricting the expansion of global dental imaging market. In addition, the high cost of dental imaging devices and equipment also hampers the dental imaging market growth. Furthermore, the global dental imaging market is also hampered due to the low number of dentists and dental practitioners in low- and medium-income nations. As per the National Health Profile in 2018, the Dental Council of India has over 2.7 lakh qualified dentists, with the government employing only 7,239 of them. Thus, all these factors are hindering the growth of global dental imaging market.

The government is also taking constant efforts for the development of dental imaging market. The government is collaborating with market players for launch of new products in the dental imaging market. In addition, government is also providing tax benefits to the dental imaging market players all around the globe.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.38 Billion |

| Market Size by 2034 | USD 9.60 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.4% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Product, By Application, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Type Insights

The intraoral segment dominated the dental imaging market in 2024. 1.4 billion dental imaging were performed in the U.S. previous year, with operations involving intraoral and extraoral dental imaging, with intraoral dental imaging accounting for over 90% of the total. The intraoral dental imaging is cost effective in nature as compared to extraoral dental imaging. In addition, intraoral dental imaging requires low-cost operation and maintenance. All these factors are driving the growth of intraoral dental imaging segment.

The extraoral segment is expected to witness fastest growth over the forecast period. The extraoral dental imaging segment is growing at moderate rate as they provide greater control over radiation dose than intraoral modalities. They are most typically utilized to diagnose bigger problems like temporomandibular joint abnormalities or jammed teeth. Thus, this factor is driving demand for extraoral dental imaging in the global market.

Product Insights

The analog segment accounted largest revenue share in 2024. The analog devices are considered as traditional type of dental imaging devices. But now also many dental practitioners and doctors use analog devices over digital devices. This is due to the high cost of digital devices and not everyone can afford to buy. Therefore, analog devices are highly adopted in dental imaging market.

The digital segment is fastest growing segment of the dental imaging market in 2024. According to a poll done by the National Library of Medicine in 2015, 80% of patients of patients favored the digital method over the analog technique due to ease of operation, reduced breathing problems, and the concern of having to repeat the treatment. Thus, the market for digital devices is growing at a rapid pace.

Application Insights

The cosmetic dentistry segment dominated the dental imaging market in 2024. The cosmetics dentistry is gaining traction globally due to the growing trend of esthetics. The two types of dental imaging are used in cosmetics dentistry. They are intraoral and extraoral dental imaging. These are quite important during cosmetic surgeries. The dental imaging helps to get accurate images, which helps to detect and treat dental problems on a large scale.

The forensics segment is expected to grow faster during forecast period. The dental imaging is widely used in forensics. Due to their usage in prompt and fast crime investigation as well as age assessment through measuring the stage of tooth deterioration, digital dental imaging play an important part in forensics.

Dental Imaging Market Companies

- Envista Holdings Corporation

- PLANMECA OY

- ACTEON Group

- Carestream Dental LLC

- Owandy Radiology

- Midmark Corporation

- Asahi Roentgen Co. Ltd

- Ningbo Runyes Medical Instrument Co. Ltd

- Align Technology Inc.

- FONA Italy

Segments Covered in the Report

By Product

- Analog

- Digital

By Type

- Intraoral

- Intraoral Scanners

- Intraoral X-ray Systems

- Intraoral Sensors

- Intraoral PSP Systems

- Intraoral Cameras

- Extraoral

- Panoramic Systems

- Panoramic & Cephalometric Systems

- 3D CBCT Systems

By Application

- Medical

- Cosmetic Dentistry

- Forensic

- Implantology

- Endodontics

- Oral & Maxillofacial Surgery

- Orthodontics

- Others

By End User

- Dental Hospitals & Clinics

- Dental Diagnostic Centers

- Dental Academic & Research Institutes

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content