What is the Digital Health Monitoring Devices Market Size?

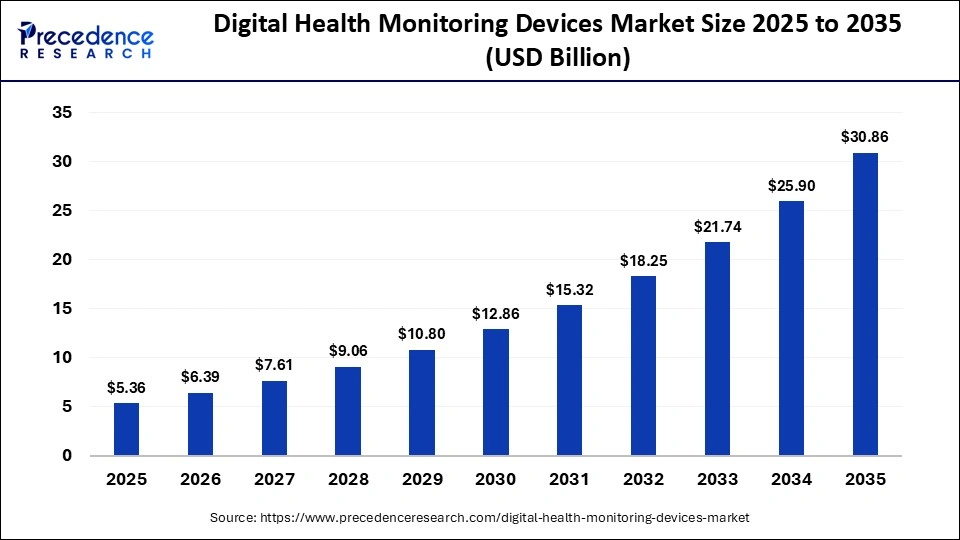

The global digital health monitoring devices market size is calculated at USD 5.36 billion in 2025 and is predicted to increase from USD 6.39 billion in 2026 to approximately USD 30.86 billion by 2035, expanding at a CAGR of 19.13% from 2026 to 2035. This market is growing due to rising adoption of remote patient monitoring technologies, driven by the increasing prevalence of chronic illnesses and the demand for real-time, data-driven healthcare.

Market Highlights

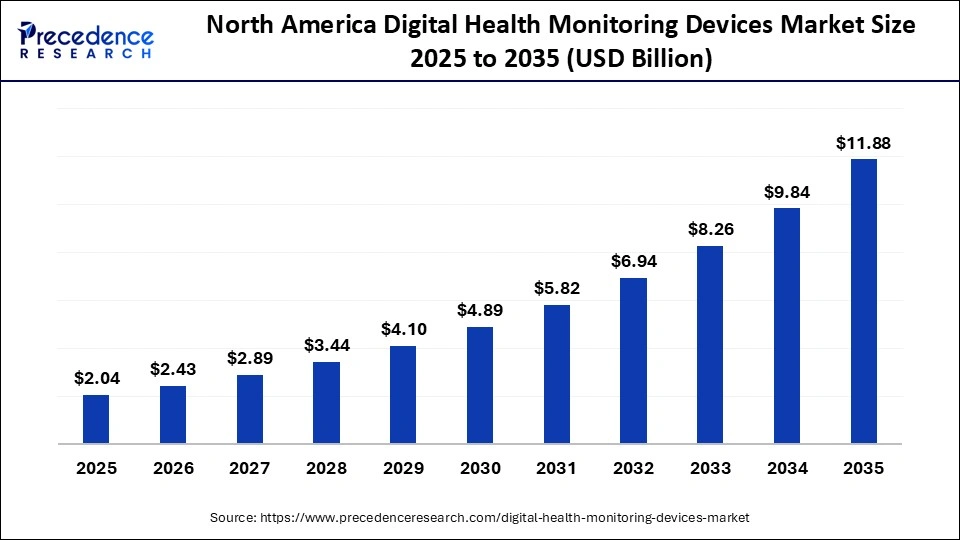

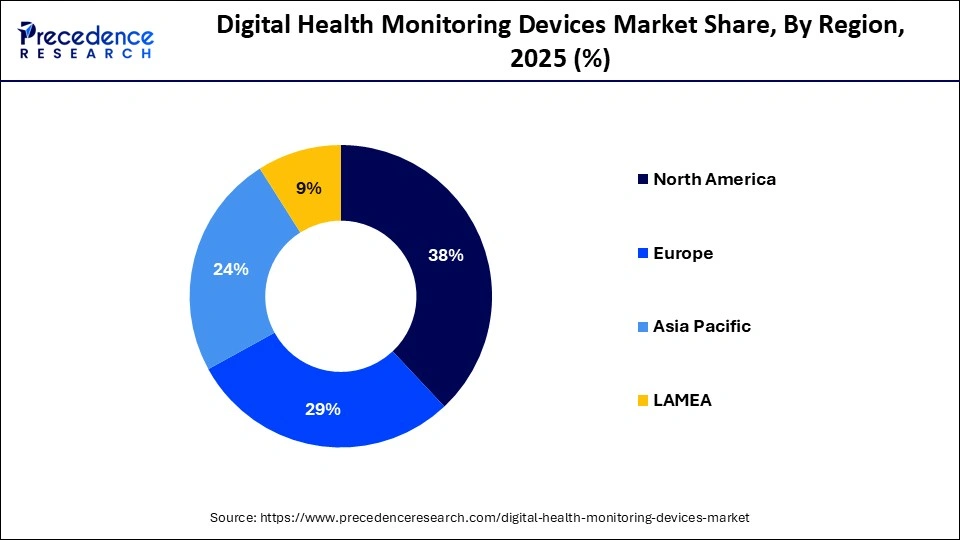

- North America dominated the market, having the biggest market share of 38% in 2025.

- The Asia Pacific is expected to grow at a strong CAGR between 2026 and 2035.

- By device type, the smartwatches with health sensors segment contributed the biggest market share in 2025.

- By device type, the smart patches/skin sensors segment will grow rapidly between 2026 and 2035.

- By connectivity technology, the Bluetooth-enabled devices segment held the major market share in 2025.

- By connectivity technology, the cellular/5G connected devices segment is expanding at a notable CAGR between 2026 and 2035.

- By end user, the home healthcare users/consumers segment captured the biggest market share in 2025.

- By end user, the monitoring providers segment is growing at a solid between 2026 and 2035.

- By distribution channel, the online/e-commerce segment accounted for the largest market share in 2025.

- By distribution channel, the direct-to-consumer channels segment is poised to grow at a healthy CAGR between 2026 and 2035.

Market Overview

How is remote patient monitoring influencing the adoption of digital health devices?

The digital health monitoring devices market is growing as healthcare providers and consumers move toward data-driven networked wellness solutions. Patient tracking of vital signs and management of chronic conditions is changing due to an increasing reliance on wearable sensors, smart medical devices, and mobile health applications. Furthermore, growing investments in telehealth ecosystems are bolstering the market's general growth momentum.

Market Trends

- Shift toward remote patient monitoring: Hospitals and doctors increasingly rely on devices that track vitals from home.

- Rise of medical-grade wearables: Smartwatches now include ECG, oxygen tracking, and heart rhythm monitoring.

- Focus on preventive healthcare: Consumers prefer devices that help manage fitness, stress, sleep, and lifestyle.

- Expansion of telehealth ecosystems: Teleconsultation platforms integrate monitoring devices for real-time data.

- Miniaturization of devices: Devices are becoming smaller, lighter, and more comfortable for continuous use.

- Increasing home-care adoption: Families use digital monitors to avoid frequent hospital visits.

Key Technological Shifts

- AI-driven insights for early detection and personalized health monitoring.

- Advanced wearable sensors enabling real-time, continuous vital tracking.

- IoT and cloud connectivity for seamless remote monitoring and data sharing.

- Mobile health integration is turning smartphones into central health hubs.

- Miniaturized, energy-efficient chips are improving battery life and comfort.

- Interoperable platforms connecting devices with hospital and EMR systems.

- Non-invasive monitoring is replacing traditional invasive methods.

What will Drive Future Demand in the Digital Health Monitoring Devices Market?

| Trend |

Future Demand (2025-2030) |

| More chronic diseases | Future demand will be very high due to rising cases of diabetes, heart issues, and hypertension increase the need for continuous monitoring. |

| Growth in telehealth | Future demand will be very high, as remote consultations will require devices capable of sending real-time health data. |

| Rise of smart wearables | Future demand will be high because smartwatches with ECG, SpOâ‚‚, and heart monitoring drive consumer adoption |

| Shift to home-based care | Demand will be high because patients prefer to track their health from home rather than make hospital visits. |

| AI-enabled devices | Demand is high because AI improves early detection and personalized insights. |

| Fitness and wellness trend |

The demand will be medium because people want to track sleep, stress, steps, and overall wellness. |

Digital Health Monitoring Devices Market Outlook

- Industry Growth Overview: The industry is growing fast due to rising demand for remote monitoring and advanced wearables. More healthcare providers are integrating digital tools to improve patient outcomes.

- Sustainability Trends: Brands are adopting recyclable materials and energy-efficient designs to reduce e-waste. Manufacturers are also extending product life cycles to minimize environmental impact.

- Global Expansion: Adoption is increasing worldwide, with rapid growth in the U.S., Europe, India, and Southeast Asia. Government support for digital healthcare is accelerating global rollout.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.36 Billion |

| Market Size in 2026 | USD 6.39 Billion |

| Market Size by 2035 | USD 30.86 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 19.13% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Device Type, Connectivity Technology, End-User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental insights

Device Type Insights

What Made the Smartwatch Segment With Health Sensors Dominate the Market?

Smartwatches with health sensors dominated the digital health monitoring devices market in 2025, thanks to their features, including ECG tracking, heart rate monitoring, sleep analysis, and mobile application integration. Their long battery life, attractive designs, and compatibility with a variety of smartphones all contribute to their popularity. These devices are becoming increasingly popular among consumers for fitness management, daily health tracking, and preventive healthcare.

Smart patches/skin sensors are growing rapidly because they provide real-time health data for applications in early detection and chronic disease management, as well as for continuous, non-invasive monitoring of vital signs and biomarkers. They are very comfortable to use for extended periods because of their lightweight, flexible design. Demand has been further increased by developments in biosensing technology and by the integration of biosensors with mobile apps.

Connectivity Technology Insights

Why Did the Bluetooth-Enabled Devices Segment Dominate the Market?

The Bluetooth-enabled devices segment dominated the digital health monitoring devices market in 2025, driven by seamless connectivity with smartphones and tablets, low power consumption, and ease of use. They are perfect for managing one's own health because they are widely compatible with cloud platforms and current mobile health apps. Additionally, these devices are more affordable than alternatives with cellular capabilities, which encourages consumer adoption. Additionally, they are widely used in smart scales, wearable fitness trackers, and home-monitoring devices, thereby increasing their market share.

Cellular/5G-connected devices are growing in popularity because they enable real-time remote monitoring and instant data transmission to healthcare providers. The expansion of 5G networks supports faster, more reliable communication for remote patient monitoring. Hospitals and telehealth platforms are increasingly relying on these devices to collect critical patient data. With rising demand for connected care solutions and chronic disease management, cellular and 5G-enabled devices are expected to continue rapid adoption.

End User Insights

Why Did the Home Healthcare Users/Consumers Segment Dominate the Market?

The home healthcare users/consumers segment dominated the digital health monitoring devices market in 2025 because self-management of chronic illnesses and home-based monitoring solutions are becoming increasingly popular. Consumer adoption of smart monitoring devices has increased due to growing awareness of fitness and preventive healthcare. Additionally, remote monitoring reduces hospital visits, thereby enhancing quality of life. Customers can also monitor their health trends and share information with healthcare providers through mobile apps and cloud-based dashboards.

The monitoring providers segment is growing rapidly due to remote patient monitoring (RPM) devices are being used more and more by clinics, hospitals, and telehealth platforms to improve patient care and operational effectiveness. Making better decisions is made possible by integration with AI analytics and electronic health records (EHR). Rising investments in digital health infrastructure further accelerate adoption. Monitoring providers are anticipated to increase their use of cutting-edge devices as healthcare systems prioritize cost reduction and preventive care.

Distribution Channel Insights

Why Did Online/E-commerce Segment Dominate the Market in 2025?

The online/e-commerce segment dominated the digital health monitoring devices market in 2025, driven by ease of ordering, greater product availability, and affordable prices. Online shopping is appealing because many brands provide easy returns, doorstep delivery, and customer service. The pandemic-driven increase in digital commerce further accelerated adoption. Additionally, online platforms offer product comparisons, ratings, and reviews to help customers make well-informed purchases.

Direct-to-consumer channels are growing as companies interact directly with customers by providing individualized healthcare solutions, device bundles, and subscription-based services. These channels enable the delivery of customized health solutions and improve brand-consumer relationships. Marketing initiatives and loyalty plans further fuel adoption. Direct-to-consumer sales are expected to increase significantly as preventive healthcare and personalized monitoring gain greater emphasis.

Regional Insights

How Big is the North America Digital Health Monitoring Devices Market Size?

The North America digital health monitoring devices market size is estimated at USD 2.04 billion in 2025 and is projected to reach approximately USD 11.88 billion by 2035, with a 19.27% CAGR from 2026 to 2035.

What Made North America Dominate the Market?

The North America region dominated the digital health monitoring devices market in 2025 because telehealth services are widely used healthcare infrastructure is sophisticated, and consumer awareness is high. The U.S. propels this expansion through favorable laws, substantial healthcare expenditures, and a tech-savvy populace seeking home-monitoring options. Demand is further increased by the increasing prevalence of chronic illnesses and the integration of devices with hospital networks.

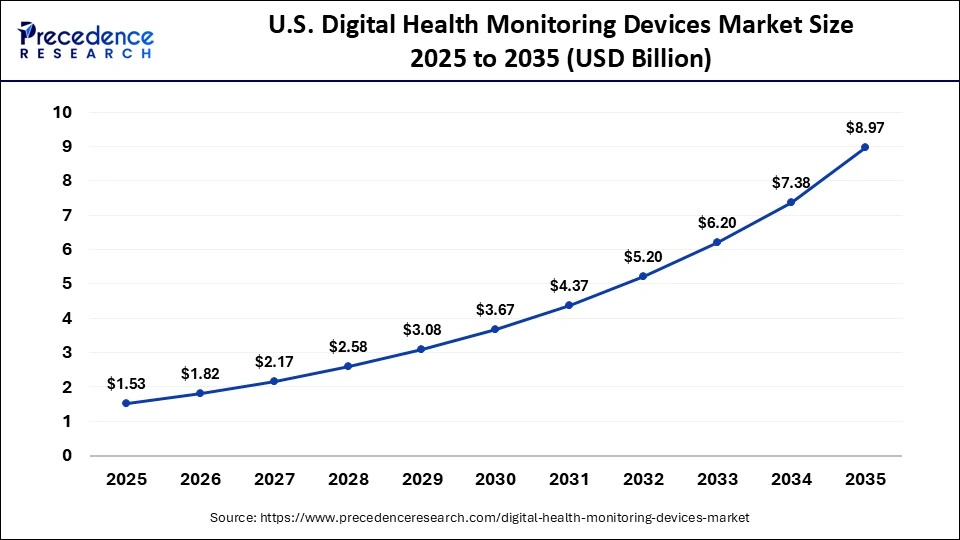

What is the Size of the U.S. Digital Health Monitoring Devices Market?

The U.S. digital health monitoring devicesmarket size is calculated at USD 1.53 billion in 2025 and is expected to reach nearly USD 8.97 billion in 2035, accelerating at a strong CAGR of 19.35% between 2026 and 2035.

U.S. Digital Health Monitoring Devices Market Analysis

The U.S. remains the largest market in North America, driven by growing consumer preference for preventive healthcare, widespread use of smart wearables, and legal support for remote patient monitoring. Expanding telehealth and paying for remote monitoring services make the U. S. for U.S. a major source of income for the area. The widespread use of smartphones, the presence of major device manufacturers, and ongoing technological advancements all contribute to the rapid adoption of cutting-edge health-monitoring technology.

What drove the Asia-Pacific region's rapid growth in the Digital Health Monitoring Devices Market?

The Asia Pacific region is growing rapidly because more people are using smartphones, having more money to spend, and being more conscious of their health. Adoption is accelerated by government initiatives supporting digital healthcare and rapid urbanization. Digital monitoring device adoption is rapidly increasing in China and India, among both consumers and clinicians. The region's market is expanding due to the growth of e-commerce platforms and rising demand for wearable technology in the fitness and wellness sectors.

India's digital health monitoring market is expanding quickly as home healthcare and telemedicine become more common. Government initiatives for digital health, growing rates of chronic illness, and reasonably priced wearable technology are all important factors. Demand isfurther fueled by growing awareness among urban and semi-urban populations. In the coming years, it is anticipated that expanding internet connectivity, rising digital literacy, and growing consumer preference for smart health devices will drive steady market growth.

How Did Europe Perform in the Digital Health Monitoring Devices Market?

Europe holds a significant share of the market, led by high adoption of wearable health devices and strong healthcare infrastructure. Government policies promoting telemedicine and chronic disease management support market growth. Consumers increasingly prefer connected health solutions for home care and wellness monitoring. The presence of major healthcare technology companies, advanced R&D facilities, and rising collaborations between hospitals and device makers further strengthen Europe's position in the market.

Germany Digital Health Monitoring Devices Market Trends

Germany dominates Europe because of the widespread use of medical wearables, sophisticated healthcare services, and hospital integration of remote patient monitoring. Strict regulations regarding device quality and reimbursement policies facilitate widespread adoption among healthcare providers and consumers. Germany continues to lead the market in the region thanks to its strong emphasis on digital health innovation, smart hospital initiatives, and high consumer trust in certified devices.

How Did Latin America Do in the Market for Digital Health Monitoring Devices?

Latin America is witnessing steady growth driven by rising awareness of preventive healthcare, urbanization, and the expansion of telehealth services. Rising smartphone use and growing interest in wearable devices are driving adoption in countries such as Brazil and Mexico. Government initiatives to improve digital healthcare infrastructure, coupled with growing investments from international device manufacturers, are supporting further market penetration across the region.

Brazil Digital Health Monitoring Devices Market Trends

Brazil is the largest market in Latin America, driven by telemedicine programs, rising chronic illness prevalence, and increased use of home health monitoring systems. Device penetration in the nation is further encouraged by private healthcare investment and government incentives. Digital health monitoring devices are expected to grow steadily in Brazil due to the country's expanding middle class, rising consumer interest in fitness and wellness, and expanding online sales channels.

Why Is MEA Showing Significant Growth in the Market?

MEA digital health monitoring devices market is growing steadily because of growing telemedicine services, rising chronic disease prevalence, and growing awareness of preventive healthcare. Key growth drivers include wearable device adoption in urban populations, government initiatives to promote digital health, and investments in healthcare infrastructure. The region's market adoption is also being accelerated by rising smartphone penetration and growing interest in home-based health monitoring.

UAE Digital Health Monitoring Devices Market Trends

UAE is the leading market in the MEA region, driven by strong government support for digital health initiatives, sophisticated healthcare infrastructure, and high disposable income. In both home care and clinical settings, the nation is seeing an increase in the use of smartwatches, wearable monitors, and connected devices. Tech-savvy individuals and strategic alliances between healthcare providers and device manufacturers further drive the demand for digital health monitoring solutions.

Digital Health Monitoring Devices Market Companies

- Medtronic

- Philips Healthcare

- GE Healthcare

- Abbott Laboratories

- Siemens Healthineers

- OMRON Healthcare

- Dexcom

- Fitbit (Google)

- ResMed

- Withings

- AliveCor

- Apple Inc.

- Samsung Electronics

- Garmin Ltd.

- Boston Scientific

- Johnson & Johnson MedTech

- Stryker

- Masimo Corporation

- Honeywell International Inc.

- iRhythm Technologies

- Oura

- Biotronik

- Mindray Medical

Recent Developments

- In January 2025,Wearable Devices Ltd launched its Mudra Link neural wristband at CES 2025, introducing touchless gesture-control technology compatible with Android, macOS, and Windows for next-generation health and mobility tracking.

- In June 2025, Wearable Devices Ltd announced the expansion of its AI-powered LMM biosignal platform into predictive health monitoring, enabling deeper cognitive and physiological insights for advanced wearable applications.

- In September 2025, Wearable Devices Ltd reported its first-half 2025 results, noting initial commercial sales of the Mudra Link device and reduced net losses, indicating rising market acceptance of neural-interface health wearables.

Segments Covered in the Report

By Device Type

- Wearable Health Trackers (fitness bands,wristbands)

- Smartwatches with Health Sensors

- Clinical-Grade Remote Monitoring Devices

- IoT-Enabled Medical Devices

- Smart Patches/Skin Sensors

- Portable Diagnostic Devices

By Connectivity Technology

- Bluetooth-Enabled Devices

- Wi-Fi Enabled Devices

- Cellular/5G Connected Devices

- Near-Field Communication (NFC) Devices

By End-User

- Home Healthcare Users/Consumers

- Hospitals & Clinics

- Ambulatory Care Centers

- Remote Patient Monitoring Providers

- Fitness & Wellness Centers

By Distribution Channel

- Online/E-Commerce Platforms

- Retail Pharmacies

- Hospital/Clinic Procurement

- Direct-to-Consumer (D2C) Manufacturer Channels

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content