Bio-detectors and Accessories Market Size and Forecast 2025 to 2034

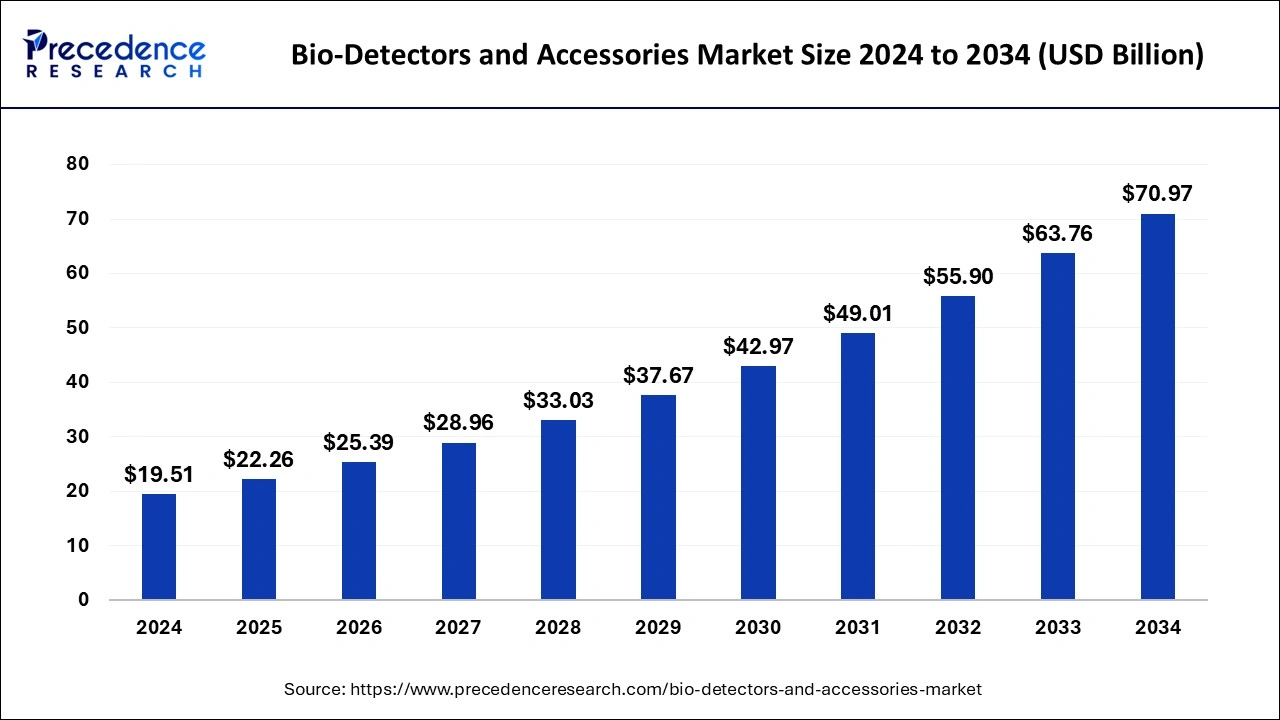

The global bio-detectors and accessories market size accounted for USD 19.51 billion in 2024 and is predicted to increase from USD 22.26 billion in 2025 to approximately USD 70.97 billion by 2034, expanding at a CAGR of 13.78% from 2025 to 2034. The emergence of portable devices in bio-detectors and accessories may be the growth factor of the bio-detectors and accessories market.

Bio-detectors and Accessories Market Key Takeaways

- The global bio-detectors and accessories market was valued at USD 19.51 billion in 2024.

- It is projected to reach USD 70.97 billion by 2034.

- The bio-detectors and accessories market is expected to grow at a CAGR of 13.78% from 2025 to 2034.

- North America dominated the bio-detectors and accessories market by region in 2024.

- Asia Pacific is expected to grow at the highest CAGR by region during the forecast period.

- The instruments segment dominated the market by product in 2024.

- The reagents & media segment is expected to grow rapidly in the market by product during the forecast period.

- The clinical segment dominated the market by application in 2024.

- The food & environmental segment is expected to gain a significant share of the market by application during the forecast period.

- The point-of-care testing segment dominated the market by end-use in 2024.

- The diagnostics segment is expected to grow at the highest CAGR in the market by end-use during the forecast period.

Market Overview

The bio-detectors and accessories market refers to a bio detector as a device used to detect the presence of biological materials, such as bacteria, viruses, or proteins, in various samples that cause diseases. It can be used in medical diagnostics, environmental monitoring, food safety, and biosecurity. The accessories for a bio-detector may include sample collection kits, disposable test cartridges, calibration, standards, and software for data analysis. The bio detector and accessories market includes devices and tools used for detecting biological substances or markers, like pathogens or bio-molecules, often in clinical, research, or environmental settings. The accessories could include reagents, software, or consumables needed for these detectors.

The bio-detectors and accessories market is fragmented with multiple small-scale and large-scale players, such as BioDetection Systems, BioDetection Instruments, Inc., Smith Detection, Bertin Technologies, MSA the Safety Company, Research International, Physical Sciences, Inc., NetBio, Inc., Shimadzu Corporation, Agilent Technologies, Response BioMedical, Bio-Rad Laboratories, PositiveID Corporation, BBI Detection, Thermo Fisher Scientific, MBio Diagnostics, Inc.

Bio-Detectors and Accessories Market Growth Factors

- The emergence of portable devices in bio-detectors and accessories may be the growth factor of the bio-detectors and accessories market.

- The advancement in bio-sensor technology can be an opportunity for bio-detectors and accessories in the market.

- Bio-Detectors and Accessories Market Dynamics

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 13.78% |

| Market Size in 2025 | USD 22.26 Billion |

| Market Size in 2024 | USD 19.51 Billion |

| Market Size by 2034 | USD 70.97 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Application, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Emergence of portable devices

The emergence of portable devices in bio-detectors and accessories may be the growth factor of the bio-detectors and accessories market. Portable devices are small forms of computing devices. With the use of portable bio detectors, testing outside of lab settings is simple and easy, and biological agents like diseases or poisons can be quickly found in variety.

The researchers can perform field research and collect real-time data on biological samples using portable instruments. Examples of this application include monitoring disease outbreaks in the field or checking the quality of the water in remote places. Portable bio detectors give first responders the resources they need to swiftly assess the situation and put the appropriate precautions in place to protect the public's health in emergency scenarios like disease outbreaks or natural catastrophes.

Restraint

High cost of investment for research

The high cost of investment for research in bio-detectors and accessories may slow down the bio-detectors and accessories market. The cost of development as a whole is increased by the demand for expensive personnel, supplies, and equipment for research in biotechnology and related sectors. Additionally, the strict regulatory requirements apply to bio-detectors and accessories, requiring expensive compliance measures and testing procedures. The higher labor costs and the requirement for specialized training and education result from the highly specialized skills needed to develop and certify bio-detectors and accessories.

Opportunity

Technological advancements in bio-sensors

The advancement in bio-sensor technology can be an opportunity for bio-detectors and accessories in the market. The recent development in biological techniques and instruments, including fluorescence to nanomaterials, increases the sensitive limit of bio-sensors. The major technical advancement in bio-sensors is the discovery of genetically encoded or synthetic fluorescent bio-sensors to analyze the molecular mechanism of biological processes.

- In April 2024, Biolinq Incorporated, a healthcare technology company pioneering precision multi-analyte biosensors to improve metabolic health, announced the completion of $58 million in financing led by Alpha Wave Ventures.

Product Insights

The instruments segment dominated the bio-detectors and accessories market by product in 2024. The devices and instruments used to detect biological materials or markers, such as pathogens or bio-molecules, frequently in clinical, research, or environmental situations, are included in the market for bio detectors and accessories. Regents, software, or consumables required for these detectors could be considered accessories. It's a wide market with a range of technologies, including bio-sensors, PCR immune assays, and more, that serve a variety of purposes in environmental monitoring, food safety, healthcare, and agriculture.

The primary tools or apparatus used for identifying biological materials or markers are referred to as instruments in the detector and accessories sector. PCR machines, mass spectrometers, flow cytometers, bio-sensors, and other devices can be among these tools. In labs, clinics, and research institutions, these are the main instruments used to analyze biological samples and find certain targets like infection, bio-molecules, or genetic material.

The reagents & media segment is expected to grow rapidly in the bio-detectors and accessories market by product during the forecast period. Regents are materials or compounds used in biochemical reactions to identify particular molecules or diseases, according to the detector and accessories market.

The enzymes, substrates, antibodies, and other substances required for identifying and quantifying biological targets can be among them. Conversely, the term media usually refers to culture media that are used in laboratory settings to support and grow microorganisms or cells. Agar plates, liquid broth, and other formulations intended to promote the growth of particular organisms for testing and analysis can be examples of this. The need for diagnostic testing is increasing due to the rise in chronic illnesses, infectious diseases, and new pathogens. The growth of this market is fueled by the necessity of reagents and mediums for these tests.

Application Insights

The clinical segment dominated the bio-detectors and accessories market by application in 2024. The dominance of the clinical segment is because of the increasing need for precise and dependable diagnostic instruments in healthcare settings. These detectors are essential for identifying a wide range of viruses, illnesses, and biomarkers, which makes them invaluable for doctors to diagnose and track the health of patients. Clinical bio-detectors and accessories dominate the market in part due to technical advancement and rising investment in healthcare infrastructure.

The food & environmental segment is expected to gain a significant share of the bio-detectors and accessories market by application during the forecast period. The growing worries about food safety and environmental pollution are fueling the growth of the detector and accessories markets in the food and environmental segment. The need for instruments to identify pollutants, diseases, and toxins in food and the environment is growing as awareness and legislation become more stringent. This fuels the market expansion by creating a need for increasingly sophisticated and effective biodetectors and accessories.

End-use Insights

The point-of-care testing segment dominated the bio-detectors and accessories market by end-use in 2024. Point of care testing eliminates the need to send samples to a central laboratory and wait for findings by enabling testing to be done at or close to the patient. This convenience is especially important in locations like emergency rooms or distant areas where prompt finding is required. The point-of-care testing devices usually yield results quickly, often in a matter of minutes, allowing medical professionals to decide how best to treat patients right away. Because point-of-care testing devices require less manpower and transportation than standard laboratory testing, the total cost of testing may be lower, even though the initial investment in these devices may be more. Point-of-care testing enables prompt diagnosis and treatment, which can improve patient outcomes by lowering rates of morbidity and death.

The diagnostics segment is expected to grow at the highest CAGR in the bio-detectors and accessories market by end-use during the forecast period. Because there is a growing need for quick and precise identification of a wide range of illnesses, infections, and pollutants. The diagnostic segment of the bio detector and accessories market is anticipated to expand. The need for advanced diagnostic instruments and accessories is being driven by the rising emphasis on early detection and diagnosis as a result of technological advancement. The necessity for point-of-care testing, government measures for disease control, and growing healthcare awareness are further reasons driving this segment's rise.

Regional Insights

North America dominated the bio-detectors and accessories market by region in 2024. North America is a center for innovation and technological advancement, especially the U.S. The area frequently takes the lead in the creation of innovative bio-detecting accessories and technology. North America's large concentration of research facilities, academic institutions, and pharmaceutical firms creates an environment that is favorable for biotech research and development, which results in the development of novel bio-detection solutions. The bio-detection and accessory market in North America is quite large because of things like high healthcare costs, strict regulation, and bio-security concerns. Innovation and investment in the industry are fueled by this need.

Asia Pacific is expected to grow to the highest CAGR in the bio-detectors and accessories market by region during the forecast period. The market for bio detectors and accessories is anticipated to expand in the Asia Pacific for a number of reasons. The need for bio detector is being driven by growing knowledge and concerns about environmental pollution, food safety and disease outbreaks. Furthermore, as notation like China and India rapidly industrialize and urbanize, more money is being invested in healthcare infrastructure.

Recent Developments

- In April 2024, Bio-Rad Laboratories, Inc., a global leader in life science research and clinical diagnostic products, announced the launch of its first ultrasensitive multiplexed digital PCR assay, the ddPLEX ESR1 Mutation Detection Kit. The assay expands the company's Droplet Digital PCR (ddPCR™) offering for the oncology market, where highly sensitive and multiplexed mutation detection assays aid translational research, therapy selection, and disease monitoring.

- In December 2023, HiGenoMB in joint collaboration with NG Biotech are making this rapid kit available to Indian market. The kit is a rapid test for the qualitative detection and differentiation of five common carbapenemase enzymes (KPC (K), OXA-48-like (O), IMP (I), VIM (V), NDM (N)) in bacterial colonies.

- In October 2023, VedaBio, the biotechnology company leading a paradigm shift in molecular detection, announced the launch with initial funding of over $40 million backed by lead investor OMX Ventures along with a select group of family offices, including Kleinmuntz Associates. VedaBio has unlocked the true power of CRISPR for molecular detection by developing the CRISPR Cascade, a revolutionary platform born from the intersection of engineering and biology.

Bio-detectors and Accessories Market Companies

- BioDetection Instruments, Inc.

- PositiveID Corporation

- BioDetection Systems

- Bertin Technologies

- BBI Detection

- Smith Detection

- MSA, the Safety Company

- Research International

- Shimadzu Corporation

- Agilent Technologies

- Bio-Rad Laboratories

- Thermo Fisher Scientific

- Response BioMedical, Corp.

- Physical Sciences, Inc.

- NetBio, Inc.

- MBio Diagnostics, Inc.

Segment Covered in the Report

By Product

- Instruments

- Reagents & Media

- Accessories & Consumables

By Application

- Clinical

- Food & Environmental

- Defense

By End-use

- Point Of Care Testing

- Diagnostics

- Research Laboratories

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting