What is the Blood and Fluid Warmer Market Size?

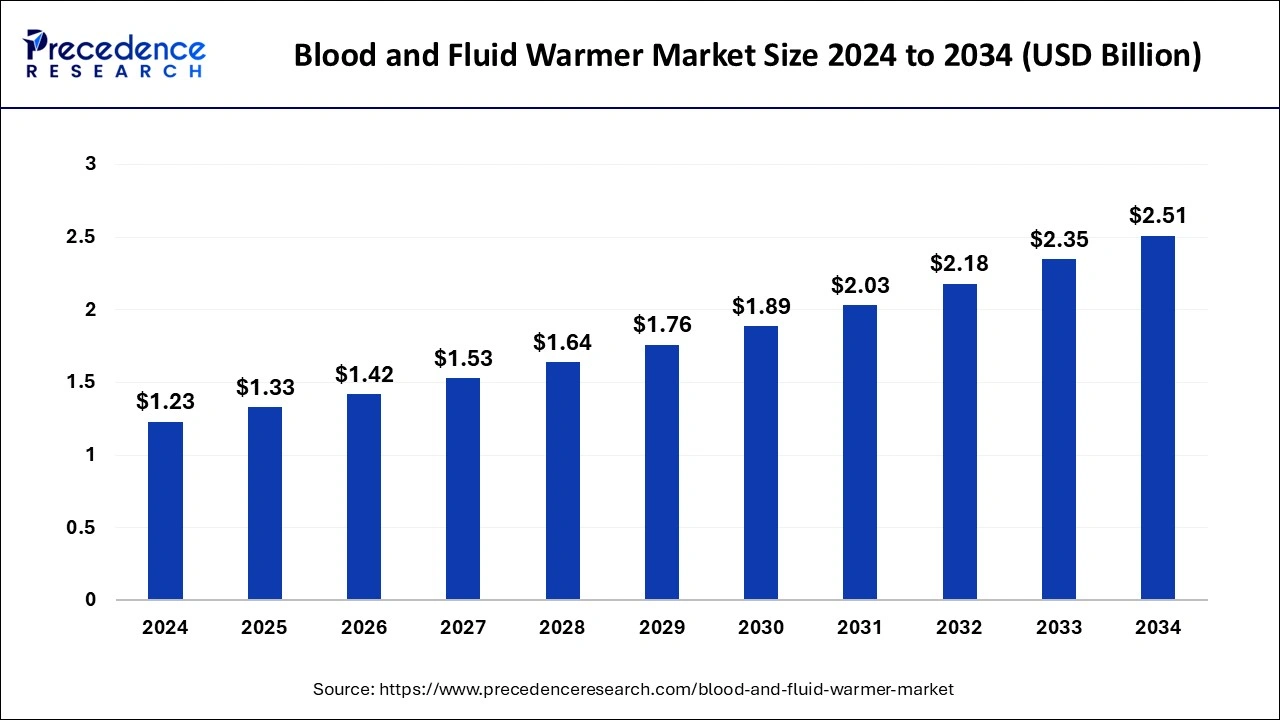

The global blood and fluid warmer market size is estimated at USD 1.33 billion in 2025 and is predicted to increase from USD 1.42 billion in 2026 to approximately USD 2.51 billion by 2034, expanding at a CAGR of 7.39% from 2025 to 2034. The aging population and childbirth are driving incessant growth, which will drive the growth of the blood and fluid warmer market over the forecast period.

Blood and Fluid Warmer Market Key Takeaways

- In terms of revenue, the global blood and fluid warmer market was valued at USD 1.33 billion in 2025.

- It is projected to reach USD 2.51 billion by 2034.

- The market is expected to grow at a CAGR of 7.39% from 2025 to 2034.

- North America dominated the blood and fluid warmer market in 2024.

- Asia Pacific is expected to host the fastest-growing market throughout the forecast period.

- By application, in 2024, the acute care segment dominated the market.

- By application, the homecare segment is expected to show the fastest growth in the market over the forecast period.

- By end-user, the hospitals segment dominated the market in 2024.

- By end-user, the specialty centers segment is projected to show the fastest growth during the forecast period.

Market Overview

A blood warmer is a device used to heat blood or fluids before transfusion, ensuring they reach a temperature safe for infusion. This device is particularly utilized in ICUs, hospitals, clinics, and operating rooms to prevent hypothermia. Hypothermia can result from medical complications such as diabetes, thyroid conditions, severe trauma, and drug or alcohol abuse. Blood warmers feature enhanced accessibility, portability, and patient comfort. Additionally, the increasing average life expectancy is a key factor driving the blood fluid warming system market. Even moderate environments can cause hypothermia, depending on factors like age, overall metabolism, body mass, and duration of exposure to cold climates.

Blood and Fluid Warmer Market Growth Factors

- Rising average life expectancy of people globally is one of the major factors driving the growth of the blood and fluid warmer market.

- Increasing incidence of hypothermic deaths can fuel the growth of the blood and fluid warmer market shortly.

- The growing awareness of maintaining the proper temperature for faster body healing after surgery can boost market growth.

- Technological advancements in the field of blood fluid warming systems can propel the blood and fluid warmer market growth further.

- Increasing preference for minimally invasive surgical techniques will likely help market expansion soon.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.33 Billion |

| Market Size in 2026 | USD 1.42 Billion |

| Market Size by 2034 | USD 2.51 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.39% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Product, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing the number of surgical interventions

The global blood and fluid warmer market is expected to grow due to the rising number of surgical interventions worldwide. The increasing prevalence of patients with various medical conditions, including life-threatening issues, along with greater access to medical care as global healthcare expenditure rises, are key factors driving higher consumption of blood and fluid warmers.

Additionally, a sedentary lifestyle, poor dietary choices, excessive consumption of unhealthy food, frequent smoking, and alcohol intake contribute to a higher risk of cardiovascular diseases (CVDs). Blood and fluid warmers are not limited to surgical centers; they are also extensively used in trauma units. The growing number of accidents, incidents, and injuries caused by various external factors has led to an increased use of warmers in trauma units.

- In April 2023, Baxter International Inc., a leader in solutions to advance surgical innovation, unveiled multiple new additions to its surgical portfolios. These innovations include the launch of the new Baxter Patient Warming system, the unveiling of the Helux Pro Connected Surgical Light, and the launch of the Floseal + Recothrom flowable hemostat.

Restraints

Complexity in healthcare regulatory frameworks

Financial constraints faced by healthcare institutions, particularly in developing regions, can create a significant challenge to the growth of the blood and fluid warmer market. Limited financial resources can hinder the wider implementation of blood fluid warming systems despite considerable interest in advanced medical technologies. Moreover, the complexity of healthcare regulatory frameworks also creates challenges for manufacturers and healthcare institutions attempting to integrate these systems into their standard operating procedures.

Opportunity

Increasing demand for portable blood/IV fluid warmers

The blood and fluid warmer market expansion for portable blood/IV fluid warmers is anticipated to be driven by increased usage by hospitals, EMS crews, and the military to prevent hypothermia during fluid transfer in hazardous field settings. Unlike non-portable versions, portable blood warmers do not need an external power source and typically weigh less than 1 kg, including batteries and additional accessories, which makes them ideal for field use by EMS providers. These factors are likely to stimulate growth in the portable warmer market soon.

Moreover, increasing R&D activities by scientists to enhance physicians' understanding of blood warmers positively impacts market growth. Research initiatives aimed at developing safe and effective methods to improve blood transfusions are expected to create opportunities for market growth over the forecast period.

- In June 2023, QinFlow Inc. and Life-Assist completed the integration of a distribution partnership for the Warrior line of high-performance yet portable blood and IV fluid warming devices. This new partnership will further support emergency care professionals' access to this critical equipment across the United States.

Application Insights

The acute care segment dominated the blood and fluid warmer market share in 2025. This pertains to medical procedures for urgent conditions, severe injuries, illnesses, or during the postoperative recovery phase. The rising number of accident cases and increasing patient admissions in trauma care centers have driven significant growth in this segment. Additionally, growing investments in constructing well-equipped EMS units are expected to support future growth.

- In April 2024, Forcura launched a Referral Summary for the post-acute care market. The new feature instantly summarizes a patient referral packet and presents essential referral criteria in a concise, shareable format. The summary also represents Forcura's first deployment of generative artificial intelligence in its cloud-based workflow platform.

The homecare segment is expected to show the fastest growth in the blood and fluid warmer market over the forecast period. These services aim to enhance the patient's health and well-being, foster independence and self-care, and reduce the necessity for hospitalizations or long-term care facility visits. By managing their health conditions at home, older adults can avoid unnecessary hospital visits. Home health care in the context of blood monitoring provides regular check-ups and education. Patients also have 24/7 access to a professional for guidance when experiencing troubling symptoms and uncertainty about their next steps.

End-use Insights

The hospitals segment dominated the blood and fluid warmer market in 2025. Hospital institutions dominate the blood/IV warmers market, serving most of the population at any time. Hospitals are the largest consumers of IV and blood infusion products and services. Due to their long-term agreements with suppliers of blood-IV warming machines, hospitals possess significant negotiating power, making them a key market for product after-sales services. Additionally, the increasing rate of hospitalizations driven by the rise in trauma cases and infectious diseases, the proliferation of advanced and well-equipped hospitals, the aging population, and the growing prevalence of chronic illnesses are expected to fuel segment growth.

The specialty centers segment is projected to show the fastest growth during the forecast period. The demand for specialized inpatient and outpatient care has been increasing. Specialty hospitals play a crucial role in treating patients requiring specific care by offering high-quality care and safety while enhancing access. These institutions contribute to improved functional independence, reduced medical complications, relevant education and resources, and increased productivity.

Regional Insights

North America dominated the blood and fluid warmer market in 2025. North America is poised to experience the highest growth in the global blood and fluid warmer market, driven by the widespread adoption of these devices in the region's healthcare sector. The presence of numerous players focusing on research and development to enhance device performance, combined with the availability of skilled medical professionals, is expected to stimulate regional growth.

The U.S. healthcare industry also operates under stringent quality guidelines, with established protocols shaping the country's medical care sector. The increasing rate of U.S. Food and Drug Administration (FDA) approvals and the entry of new market players have significantly propelled growth in North America.

- In June 2023, Bound Tree Medical, North America's foremost pre-hospital equipment and supplies provider, signed a distribution agreement with QinFlow Inc. to distribute the Warrior line of blood and fluid warmers (Quality in Flow).

- In May 2022, LifeWarmer introduced the Quantum Blood and Fluid Warming System, filling a substantial capability void in the market. This innovation can significantly impact the market by improving effectiveness and functionalities, setting a new standard for efficiency in the sector.

Asia Pacific is expected to host the fastest-growing blood and fluid warmer market throughout the forecast period. Asia Pacific is poised to witness significant growth in the global blood and fluid warmer market, driven by several factors. A large patient population and increasing demand for advanced yet cost-effective healthcare solutions are expected to create substantial growth opportunities in the region. Furthermore, global players are making high investments in research and development to tap into untapped markets in Asia Pacific, leveraging its low-cost services and conducive clinical trial environment. Moreover, the region is experiencing an uptick in hospitalizations and advancements in the clinical development framework of developing nations, which further supports market growth.

Blood and Fluid Warmer Market Companies

- The 37 Company (37°C)

- Smiths Medical

- Enthermics Medical Systems

- Becton

- Dickinson and Company (BD)

- The 41st Parameter

- 3M Healthcare

- Gambro

- Stihler Electronic GmbH

- di Barkey GmbH & Co. KG

- Meri an Medical Systems

- Stryker Corporation

- Inditherm Medical

- Belmont Medical Technologies

- Sintetica S.A.

- EMIT Corporation

Recent Developments

- In May 2022, Medtronic derived Food and Drug Administration consent for the Nellcor OxySoft neonatal-adult SpO2 sensor. The latter is the initial pulse oximetry sensor that uses a silicone adhesive to shield delicate skin by suppressing fewer skin cells while upgrading sensing element repositionability and signal acquisition.

- In January 2022, ICU Medical Inc. proclaimed acquiring Smiths Medical, Inc., adding products like syringes and ambulatory infusion apparatus, vascular access, and vital care equipment to the ICU Medical portfolio.

Segments Covered in the Report

By Application

- Homecare

- Acute Care

- Newborn Care

- Preoperative Care

- Others

By Product

- Patient Warming Accessories

- Intravenous Warming System

- Surface Warming System

By End-user

- Clinics

- Hospitals

- Specialty Centers

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting