Blood Platelets Market Size and Companies

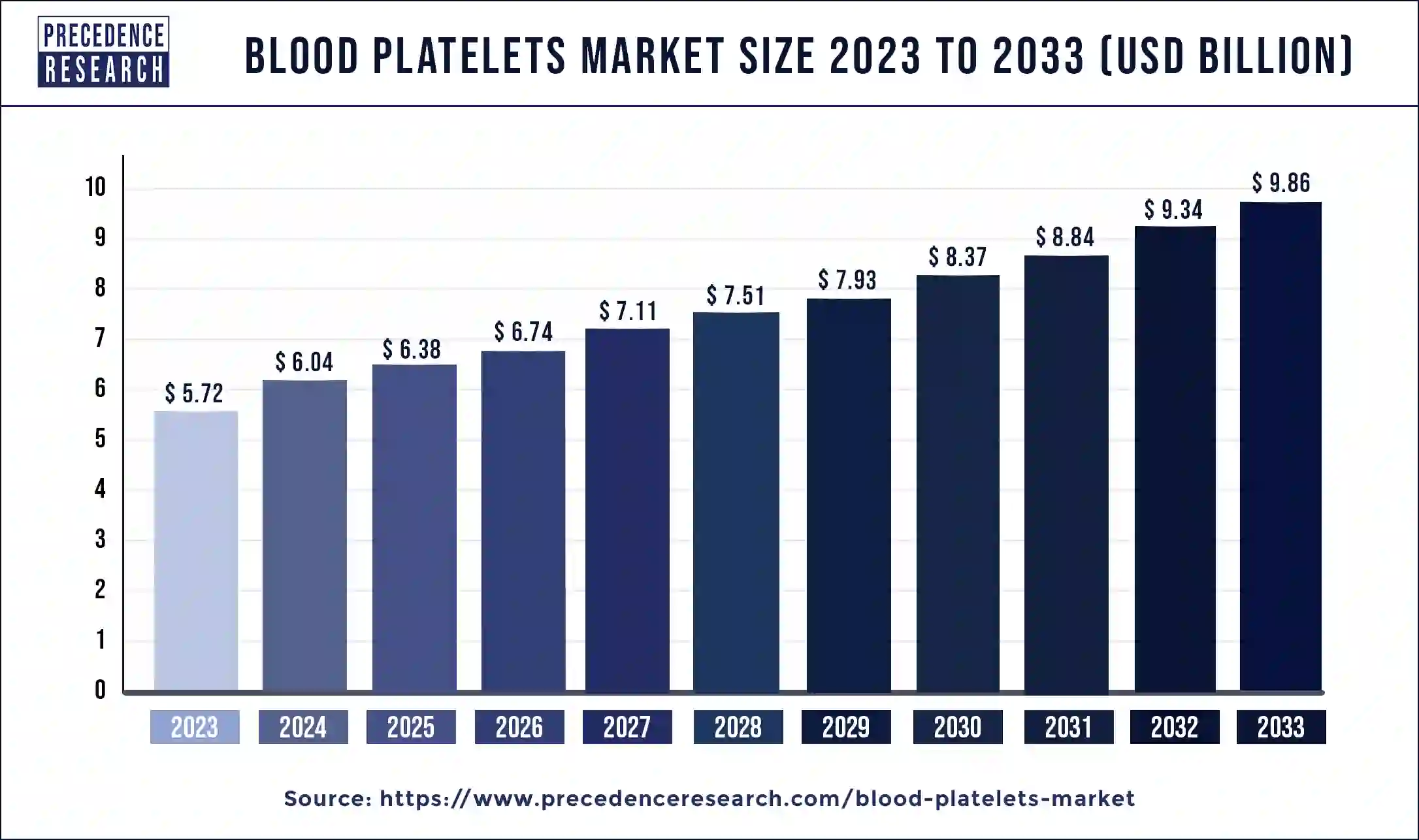

The global blood platelets market size was valued at USD 5.72 billion in 2023 and is projected to hit around USD 9.86 billion by 2033 with a CAGR of 5.59% from 2024 to 2033. Technological innovations and increasing healthcare expenditure also contribute to blood platelets market growth. Increasing incidence of chronic diseases requiring platelet transfusions, advancements in platelet storage techniques, rising demand for platelet-rich plasma therapies, and growing awareness about platelet donation.

Key Takeaways

- North America led the market with the biggest market share in 2023.

- Asia Pacific is projected to expand at the fastest rate during the forecast period of 2024-2033.

- By application type, the platelet function disorder segment had a significant share of the market in 2023.

- By application type, the hemophilia segment is observed to witness a notable rate of growth during the forecast period.

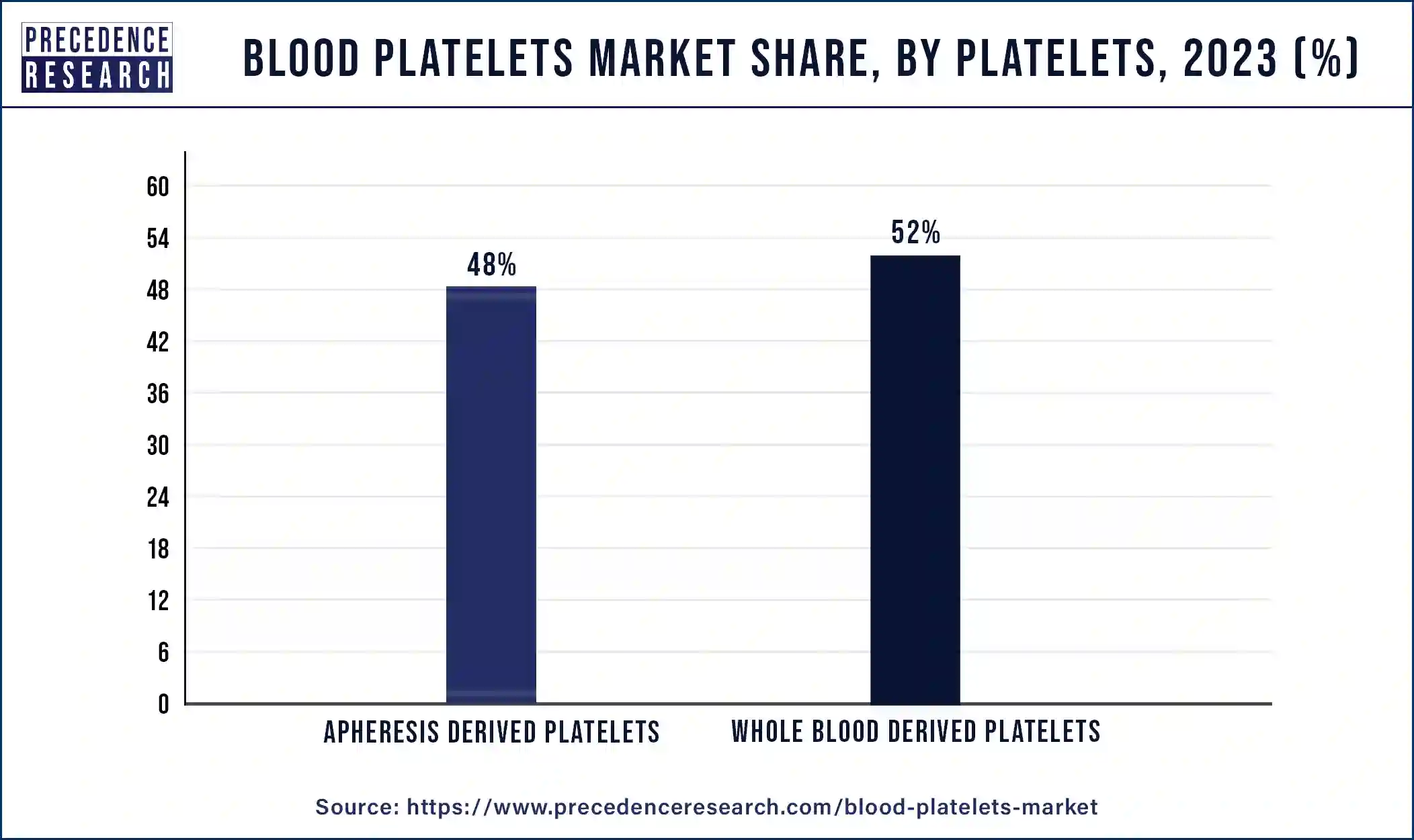

- By platelets, the whole blood derived platelets segment dominated the market in 2023.

- By end-user, the hospitals segment led the market with the largest share in 2023.

- By end-user, the ambulatory surgical centers segment is observed to witness a significant rate of growth during the forecast period.

Blood Platelets Market Overview

The blood platelets market revolves around meeting the demand for platelets in various medical settings, including hospitals, blood banks, and research laboratories. Platelet products are utilized in treating patients with hematological disorders, such as thrombocytopenia, leukemia, and aplastic anemia, as well as in surgical procedures, trauma care, and oncology treatments. The market is influenced by advancements in platelet storage technologies, improvements in platelet collection methods, and increasing awareness about the importance of platelet donation.

The rising incidence of chronic diseases requiring platelet transfusions, coupled with the growing demand for personalized medicine and regenerative therapies, further drives market growth. Technological innovations, strategic collaborations among healthcare providers, and government initiatives promoting blood donation also play significant roles in shaping the market. Overall, the blood platelets market serves a vital function in ensuring the availability of safe and effective platelet products to support various medical interventions and patient care needs globally.

- In May 2023, PlasmaGen Biosciences inaugurated a new manufacturing plant in Kolar, Bengaluru, focusing on blood plasma-derived protein therapeutics. The state-of-the-art facility spans 8 acres and employs advanced in-house process technology, enhancing production efficiency and yielding high-quality products like albumin, immunoglobulins, and coagulation factors.

Growth Factors

- Advancements in platelet collection and processing technologies have significantly improved the efficiency and safety of platelet products. Automated systems for plateletpheresis and pathogen reduction techniques have reduced the risk of contamination and increased the shelf life of platelet concentrates, driving the growth of the blood platelets market.

- The increasing prevalence of hematological disorders and chronic diseases requiring platelet transfusions is a major growth factor. Conditions such as thrombocytopenia, leukemia, and aplastic anemia necessitate regular platelet transfusions to manage symptoms and improve patient outcomes, thereby boosting demand for platelet products.

- The growing adoption of platelet-rich plasma (PRP) therapies in various medical and aesthetic applications contributes to market expansion. PRP is utilized in orthopedics, dermatology, and dentistry for its regenerative properties, driving demand for platelet-derived growth factors and cytokines.

- Rising awareness about the importance of platelet donation and initiatives to promote blood donation play a crucial role in sustaining market growth. Campaigns aimed at recruiting voluntary donors and improving donation infrastructure help ensure an adequate supply of platelet products to meet healthcare demands.

- Strategic collaborations between healthcare providers, research institutions, and pharmaceutical companies drive innovation and market expansion. Partnerships focused on developing novel platelet-based therapies, improving manufacturing processes, and expanding distribution networks contribute to the dynamic growth of the blood platelets market.

Blood Platelets Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.59% |

| Global Market Size in 2023 | USD 5.72 Billion |

| Global Market Size by 2033 | USD 9.86 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Application, By Platelets, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Blood Platelets Market Dynamics

Drivers

Advancements in technology

The continual evolution of technology in platelet collection and processing methods is a primary driver of growth in the blood platelets market. Innovations such as automated plateletpheresis systems and pathogen reduction technologies have vastly improved the efficiency, safety, and quality of platelet products. Automated systems enhance the speed and precision of platelet collection, reducing donor time and increasing the yield of viable platelets.

Pathogen reduction techniques, including UV light treatment and chemical agents, help mitigate the risk of transfusion-transmitted infections, ensuring the safety of platelet transfusions. These technological advancements not only enhance patient care by providing safer and more effective platelet products but also streamline manufacturing processes, reducing costs and increasing scalability, thus driving market growth.

Increasing demand for platelet-rich plasma (PRP) therapies

The rising popularity of platelet-rich plasma (PRP) therapies across various medical and aesthetic fields is another significant driver of the blood platelets market. PRP, derived from a patient's own blood, contains high concentrations of platelets, growth factors, and cytokines, which have regenerative and healing properties.

PRP is utilized in orthopedic treatments, sports medicine, dermatology, and cosmetic procedures for tissue regeneration, wound healing, and hair restoration. The growing acceptance and adoption of PRP therapies by healthcare professionals and patients drive demand for platelet concentrates and PRP kits. This increased demand for platelet-rich plasma products not only expands the market for platelet-derived growth factors but also stimulates innovation in PRP processing techniques, contributing to the overall growth of the blood platelets market.

- In July 2023, APC prepared to send its spray-dried plasma and red cells on a NASA rocket to advance research on treating traumatic injury in space. Meanwhile, New England Sci-Tech students engage in the Cubes in Space program, proposing an experiment to test the feasibility of launching spray-dried blood into space for rehydration in zero-gravity environments.

Restraints

Stringent regulatory landscape governing blood product manufacturing and distribution

Regulatory agencies impose rigorous standards to ensure the safety, efficacy, and quality of platelet products, resulting in compliance challenges for manufacturers and blood banks. These regulations encompass various aspects of platelet processing, storage, testing, and transportation, imposing financial burdens and logistical complexities on industry stakeholders.

Compliance with good manufacturing practices (GMP), good distribution practices (GDP), and regulatory requirements for blood donor screening and testing necessitate significant investments in infrastructure, training, and quality control measures. Evolving regulatory guidelines and updates to blood safety standards add further complexity and uncertainty to the market environment. Adherence to changing regulatory requirements often requires continuous adaptation and investment in technology and process improvements, which can strain resources and impact profitability.

Regulatory challenges pose a formidable barrier to entry and expansion in the blood platelets market, limiting the ability of manufacturers and blood banks to meet growing demand and innovate effectively. Mitigating regulatory risks and ensuring compliance remains a key priority for industry participants seeking to navigate the dynamic regulatory landscape and capitalize on market opportunities.

Opportunities

Personalized medicine and regenerative therapies

The emergence of personalized medicine and regenerative therapies presents significant opportunities for the blood platelets market. Platelet-rich plasma (PRP) therapy, a form of regenerative medicine, utilizes the patient's own platelets to promote tissue repair and regeneration. This approach has gained traction in various medical specialties, including orthopedics, dermatology, and dentistry, offering opportunities for market growth.

Additionally, advancements in cell-based therapies, such as platelet-derived growth factor (PDGF) and platelet-rich fibrin (PRF), hold promise for treating a range of conditions, including chronic wounds, musculoskeletal injuries, and aesthetic concerns. These therapies leverage the bioactive factors present in platelets to stimulate tissue healing and regeneration, creating new avenues for product development and clinical applications.

- In January 2023, FUJIFILM Cellular Dynamics introduced the Human iPSC-derived iCell Blood-Brain Barrier Isogenic Kit, a breakthrough tool for neuroscience research and drug discovery. This innovative kit, the first of its kind, accurately models the human blood-brain barrier, offering significant advancements in drug development for CNS disorders.

Technological innovations in platelet storage and processing

Continuous advancements in platelet storage and processing technologies offer opportunities to enhance product quality, safety, and shelf life. Innovations such as pathogen reduction systems and cryopreservation techniques address challenges related to bacterial contamination and platelet storage duration, thereby expanding the scope of platelet utilization. Moreover, the development of automated platelet collection devices and closed-system processing platforms streamlines.

The production process improves efficiency and reduces the risk of product contamination. These technological innovations not only enhance the availability and safety of platelet products but also open doors to new market segments, including point-of-care platelet processing systems for smaller healthcare facilities and remote settings.

Application Insights

The platelet function disorder segment carried a significant share of the blood platelets market in 2023. Platelet function disorders are relatively common hematologic conditions characterized by abnormalities in the function of platelets, which play a crucial role in blood clotting and hemostasis. These disorders can lead to excessive bleeding and other complications, making them a significant healthcare concern. Platelet function tests are used in a wide range of clinical settings, including the diagnosis and management of bleeding disorders, thrombotic disorders, and other hematologic conditions. They are also utilized in preoperative assessment, cardiovascular risk stratification, and monitoring of antiplatelet therapy efficacy.

Besides, the hemophilia segment is observed to witness a notable rate of growth during the forecast period. Individuals with hemophilia experience recurrent bleeding episodes, both spontaneously and as a result of minor injuries or trauma. These frequent bleeding episodes necessitate regular platelet transfusions to prevent or treat bleeding complications, leading to a consistent need for blood platelets among hemophilia patients.

Platelet Insights

The whole blood derived platelets segment dominated the blood platelets market share of 52% in 2023. Whole blood-derived platelets are relatively cost-effective compared to other sources of platelets, such as apheresis or platelet concentrates. This makes them an attractive option for healthcare facilities, particularly in resource-limited settings or regions with budget constraints.

Obtaining platelets from whole blood involves a straightforward processing method that does not require specialized equipment or extensive laboratory infrastructure. This simplicity in processing contributes to the widespread adoption of whole blood-derived platelets in healthcare settings.

End-user Insights

The hospitals segment led the blood platelets market in 2023. The segment is observed to continue dominance over the forecast period. Hospitals provide specialized medical care across a wide range of disciplines, including oncology, hematology, surgery, and critical care. Many patients in these specialties require blood platelet transfusions as part of their treatment protocols, such as those undergoing chemotherapy, organ transplants, or major surgeries. Hospitals serve as primary centers for emergency and trauma care, where timely access to blood products, including platelets, is critical for treating patients with traumatic injuries, hemorrhage, or severe bleeding. The availability of platelet transfusions can be life-saving in these acute care settings.

The ambulatory surgical centers segment is observed to grow significantly. Ambulatory surgical centers are witnessing a rise in the number of surgical procedures performed on an outpatient basis. These centers offer a convenient and cost-effective alternative to traditional hospital settings for a wide range of surgical interventions, including minor surgeries, orthopedic procedures, and ophthalmic surgeries.

Regional Insights

North America led the global blood platelets market with the highest market share in 2023. North America dominates the blood platelets market due to several factors. The region boasts advanced healthcare infrastructure, high healthcare expenditure, and a well-established regulatory framework, facilitating the widespread adoption of platelet products and therapies. In particular, the United States contributes significantly to the market's dominance in North America, driven by its large population base, high prevalence of chronic diseases, and strong emphasis on medical innovation and research. Additionally, increasing awareness about the importance of platelet donation and the presence of leading pharmaceutical companies and research institutions further propel market growth in the region.

Asia-Pacific is expected to witness growth at a significant rate in the blood platelets market during the forecast period of 2024-2033. The Asia Pacific region is emerging as a lucrative market for blood platelets due to several factors. Rapid urbanization, improving healthcare infrastructure, and rising healthcare expenditure contribute to the region's growing demand for platelet products and therapies. Countries such as China and India, with their large populations, present substantial opportunities for market expansion.

The increasing incidences of chronic diseases, a growing aging population, and expanding access to healthcare services drive the utilization of platelet products in the region. Furthermore, government initiatives to improve blood donation infrastructure and regulatory reforms aimed at enhancing the safety and quality of blood products stimulate market growth in emerging Asia Pacific countries. Overall, the region's evolving healthcare landscape and demographic trends position it as a key growth market for blood platelets.

Recent Developments

- In February 2024, GC Biopharma's ‘Alyglo', South Korea's first FDA-approved blood plasma, announced its launch in the U.S. to take place in July. ‘Alyglo' marks a significant milestone for GC Biopharma as it enters the U.S. market with its innovative blood plasma product.

- In December 2023, in a study titled ‘Space Anemia,' researchers explore the effects of a rocket launched on the human body. The intense gravitational forces experienced during the roughly eight-minute journey into orbit may lead to a phenomenon where blood cells burst, posing potential health risks for astronauts.

Blood Platelets Market Companies

- Arthrex, Inc.

- AdiStem Ltd.

- Arteriocyte Medical Systems, Inc.

- Biomet, Inc.

- Cesca Therapeutics, Inc

- DePuy Synthes, Inc.

- EmCyte Corporation

- Dr. PRP America LLC

- Exactech, Inc.

- Harvest Technologies Corp

Segments Covered in the Report

By Application

- Platelet Function Disorder

- Hemophilia

- Thrombocytopenia

- Perioperative Indication

By Platelets

- Whole Blood Derived Platelets

- Apheresis Derived Platelets

By End-user

- Hospitals

- Ambulatory Surgical Centers

- Blood Banks

- Research Laboratories

- Specialty Clinics

- Orthopedic Clinics

- Dermatology Clinics

- Dental Clinics

- Cancer Treatment Centers

- Trauma Centers

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting