Yacht Charter Market Size and Forecast 2025 to 2034

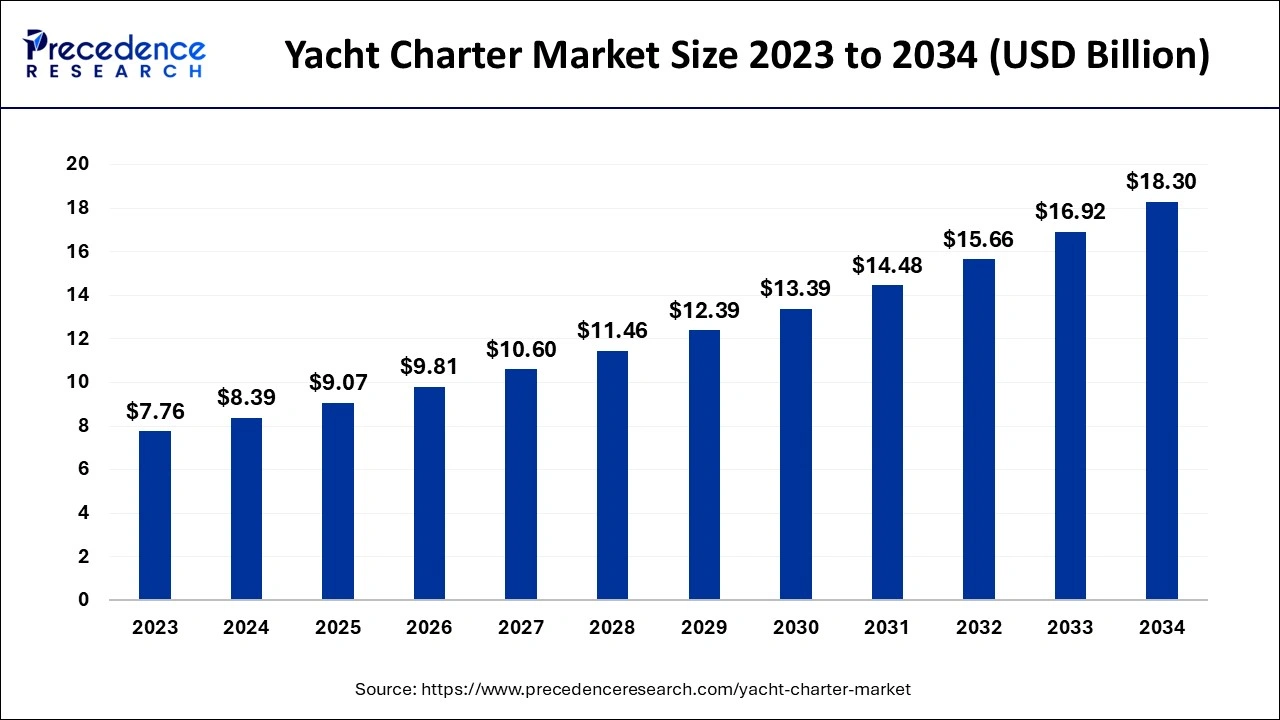

The global yacht charter market size was estimated at USD 8.39 billion in 2024 and is predicted to increase from USD 9.07 billion in 2025 to approximately USD 18.3 billion by 2034, expanding at a CAGR of 8.11% from 2025 to 2034. Technological improvements, like the incorporation of sustainable practices for easy booking and management, can have a positive impact on the overall yacht charter market

Yacht Charter Market Key Takeaways

- In terms of revenue, the global yacht charter market was valued at USD 8.39 billion in 2024.

- It is projected to reach USD 18.3 billion by 2034.

- The market is expected to grow at a CAGR of 8.11% from 2025 to

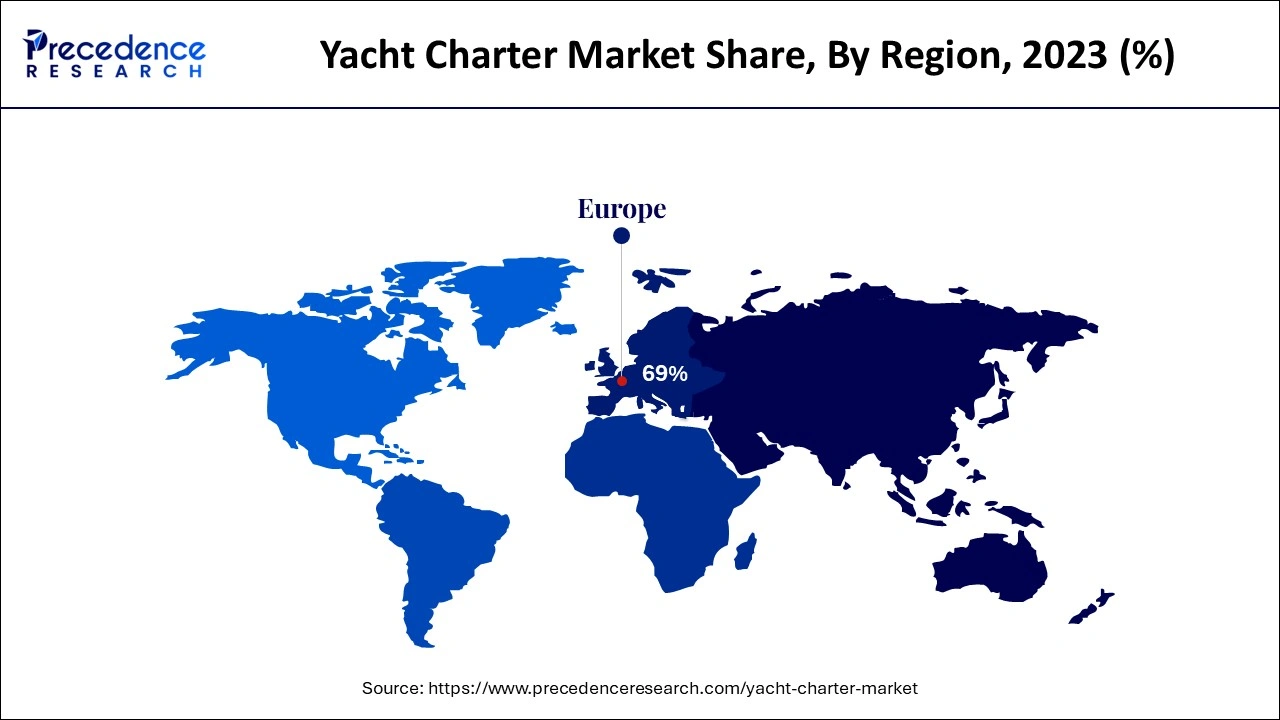

- Europe dominated the global yacht charter market and contributed the biggest market share of 69% in 2024.

- Asia Pacific is anticipated to grow at the fastest rate in the market over the studied period.

- By yacht length, the 20 to 50 ft segment led the market in 2023 and is anticipated to grow at the fastest rate during the forecast period.

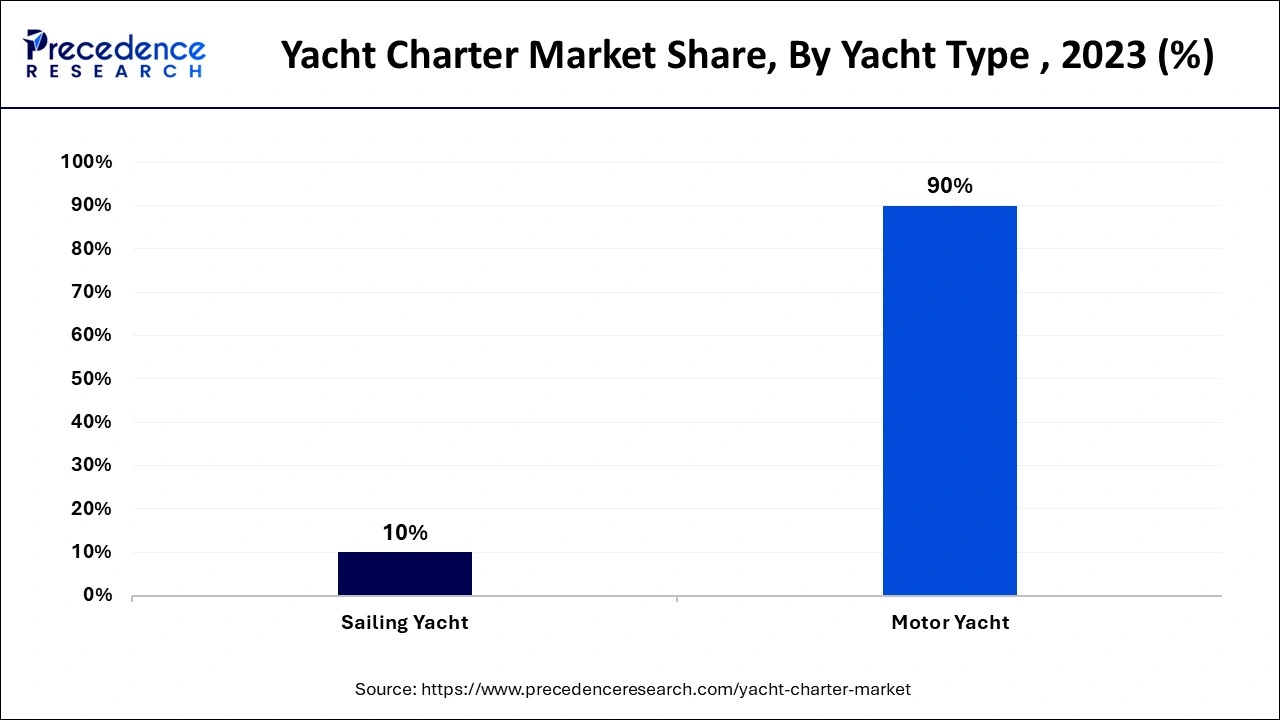

- By yacht type, the motor yacht segment accounted for the biggest market share of 90% in 2024.

- By contract type, in 2023, the crewed charter contract type segment dominated the market.

- By contract type, the bareboat charter segment will show significant growth in the market during the projected period.

How Will AI Transform the Yacht Charter Market?

Artificial intelligence (AI) can revolutionize the yacht charter market by increasing energy efficiency to pioneering sustainable design and streamlining logistics. AI is rapidly becoming a fueling force that is helping to create a greener boating future. Furthermore, AI-powered navigation tools can decrease fuel emissions and energy consumption, which helps the industry align with sustainability goals.

- In June 2024, Rossinavi launched a 42.8-metre hybrid-electric catamaran named Seawolf X, previously known as Sea Cat, which features cutting-edge innovations, such as solar panels and AI, a testament to Rossinavi's commitment to the environment through its BluE initiative.

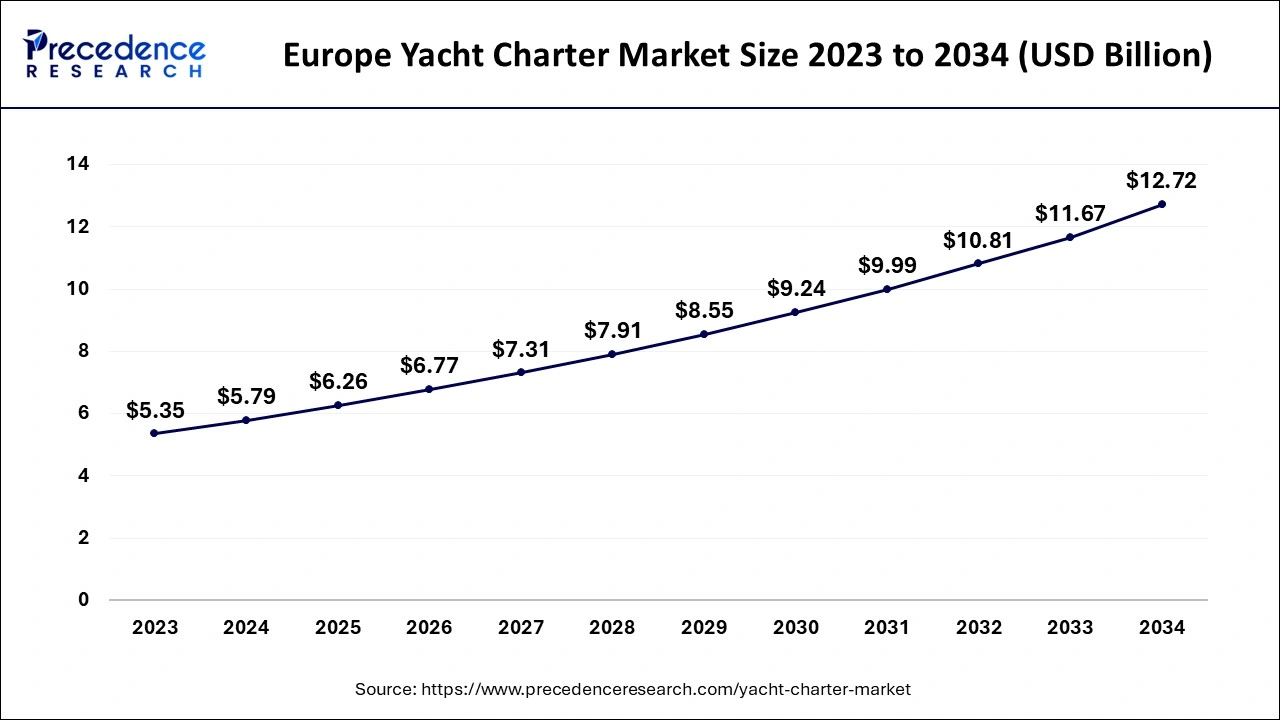

Europe Yacht Charter Market Size and Growth 2025 to 2034

The Europe yacht charter market size was evaluated at USD 5.79 billion in 2024 and is predicted to hit around USD 12.72 billion by 2034, growing at a CAGR of 8.19% from 2025 to 2034.

Europe dominated the global yacht charter market in 2024. The dominance of the region can be attributed to the rising popularity of water adventures along with fishing activities and the growing number of high-net-worth individuals. Furthermore, countries such as Greece and Croatia are among the most popular destinations for tourism, and they hold the majority of revenue share. Europe's well-established infrastructure and high service standards help to strengthen its position as the preferred choice for a luxury yacht charter in the region.

- In July 2024, Uber Boat will launch across Europe this summer. Designed to help tourists go anywhere by boat to some of the most popular destinations across the continent. Uber Yacht leads a boatload of new travel products launching across Europe just in time for the summer holidays.

Asia Pacific is anticipated to grow at the fastest rate in the yacht charter market over the studied period. This is because an enhanced standard of living due to a rise in disposable income is the key factor responsible for the change in consumer preference. Moreover, government initiatives in developing tourism sectors in nations like India and China are expected to drive market growth in the region. Government initiatives, such as the Swadesh Darshan Scheme and Incredible India, will likely contribute to market expansion.

Market Overview

A yacht charter is the hiring of a yacht for recreational reasons, which allows people or groups to explore coastal seas in luxury and comfort. A yacht charter can be utilized for different recreational activities such as celebrations, corporate events, vacations, and even filming sites. Providing a private and customizable experience specific to the charterer's tastes is an essential part of the yacht charter market.

World tourism rankings by country in terms of total arrivals 2023

| Rank | Country | Arrivals (million) |

| 1 | France | 100.00 |

| 2 | Spain | 85.17 |

| 3 | United States | 66.48 |

| 4 | Italy | 57.25 |

| 5 | Turkey | 55.16 |

| 6 | Mexico | 42.15 |

| 7 | United Kingdom | 37.22 |

| 8 | Germany | 34.80 |

| 9 | Greece | 32.74 |

| 10 | Austria | 30.91 |

Yacht Charter Marke Growth Factors

- Rising worldwide affluence for distinctive and exclusive vacation experiences is expected to fuel market growth during the forecast period.

- The development of marine tourism infrastructure can propel market growth soon.

- The increasing popularity of corporate events and celebrations in a remote location will likely contribute to the yacht charter market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 18.30 Billion |

| Market Size in 2025 | USD 9.07 Billion |

| Market Size in 2024 | USD 8.39 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.11% |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Yacht Type, Yacht Length, Contract Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Rising trend towards personalization and customization

The growing demand for the yacht charter market that caters to particular interests and preferences is the key trend toward personalized travel experiences. Additionally, charter operators offer onboard facilities, tailored itineraries, and concierge services to fulfill the customized needs and preferences of their customers. The charter experience can be improved with different customization choices, such as themed parties, gourmet events, and adventure excursions.

- In May 2024, Falmouth Boat Hire, based at Custom House Quay, acquired four new 100% recyclable motorboats from manufacturers in the Netherlands. The boats are smaller and lighter than the ones they replace and easier for people to handle. They also have smaller, much more fuel-efficient engines of six horsepower fitted by Robin Curnow, Outboard Motor Specialist in Commercial Road, Penryn.

Restraint

Seasonal demand and weather dependence

The yacht charter market faces issues due to weather patterns and seasonal demand swings. Popular charter destinations continuously have peak seasons, which results in raised competition for available vessels and higher pricing. Moreover, severe weather, like storms or hurricanes, can disturb charter itineraries by affecting operational logistics and client satisfaction.

Opportunity

The increase in recreational tourism

Tourism is an important economic activity across the globe that contributes significantly to economic growth, social advancement in many countries, and job creation. It also has a great impact on the market, especially through commercial operators and brokers, and luxury prices in the yacht charter market. Furthermore, countries like Greece, Spain, and Italy are popular tourist destinations. These nations also attract business events and meetings.

- In September 2024, the Saudi Red Sea Authority (SRSA) introduced Saudi Arabia's first regulatory framework for the operation of yachts within the Red Sea. This groundbreaking set of regulations governs yacht activities, licensing, and environmental sustainability, marking a significant step toward developing a sustainable coastal tourism sector in the country.

Yacht Length Insights

The 20 to 50 ft segment led the yacht charter market in 2024 and is anticipated to grow at the fastest rate during the forecast period. This is attributed to the availability of vessel variants with wind sailing capabilities, which save fuel and allow for travel in a specific wind direction. Additionally, their shallow draft for water anchorages and low maintenance make these yachts the top choice for end-users. The emerging trend in developed economies of using renewable energy sources, such as solar and wind energy, in marine vessels is likely to have a positive impact on segment growth.

- In May 2024, a Bulgarian family-owned business, Elica Group, announced the launch of its luxury power catamaran brand Omaya Yachts, with its first model, the OMAYA 50, hitting the water this summer. Situated on the banks of the Danube and where Omaya's yachts are created, the yard is aiming to lead the manufacture of luxury power catamarans for the private and charter markets.

Yacht Type Insights

The motor yacht segment dominated the yacht charter market in 2024 and is expected to maintain its dominance over the forecast period. The dominance and growth of the segment can be attributed to the advantages of this type like power and speed and the capability to cover large distances in less time. Additionally, offers customers a chance to navigate almost any coastline or archipelago. Regardless of whether the water passage is shallow or not.

- In July 2024, the RMK120 Seven Seas motor yacht was launched, which features exterior design and naval architecture by Vripack, while her interior was penned by Turkish-based studio Epikworks. Seven Seas marks the sixth collaboration between Dutch design studio Vripack and Turkish shipyard RMK Marine.

Contract Type Insights

The crewed charter contract type segment dominated the yacht charter market. The dominance of the segment can be credited to shifting consumer preference towards marine tourism and voyages coupled with the increasing requirement of the crew for technical maintenance including system inspections and engine oiling for smooth functioning of the system. Furthermore, the growing popularity of yacht booking for anniversary parties and corporate meetings is anticipated to boost the demand for charter crew soon.

The bareboat charter segment will show significant growth in the yacht charter market during the projected period. The growth of the segment is driven by the rising popularity of water activities, the increasing number of high-net-worth individuals, and technological developments. Also, the boat is fully equipped with sails and needed items. The charter of a bareboat can also appoint the crew and ship's master. Rising inclination towards outdoor recreational activities is also a crucial factor influencing segment growth.

Yacht Charter Market Companies

- Beneteau S.A

- Sunseeker International Ltd.

- The Moorings Limited

- Camper & Nicholsons International Ltd.

- Sunsail Worldwide Sailing Ltd.

- Argo Nautical Limited

- Kiriacoulis Mediterranean Cruises Shipping S.A.

- Boat International Media Ltd.

- Yachtico Inc.

- Fraser Yachts Florida Inc.

Recent Developments

- In May 2024, the 19th edition of the World Superyacht Awards concluded with a bang, recognizing some of the most innovative luxury yacht rentals on the market, as well as the excellent workmanship that goes into every superyacht.

- In February 2024, Bilgin Yachts launched its first motor yacht hitting the water in Istanbul in the form of the striking 50m charter yacht ETERNAL SPARK. Designed with the discerning charter client in mind, the latest Bilgin 163 charter yacht promises an experience like no other.

- In January 2024, Getmyboat, the world's leading booking platform for yacht charters and boat rentals, and Your Boat Club, the world's largest privately-owned boat club, joined forces to expand offerings to meet customer demand in key locations.

- In February 2022, Northrop & Johnson cooperated with NetJets. This collaboration will provide clients with luxury, pleasant, and memorable travel experiences. This relationship creates the potential for unique and unforgettable vacations, providing clients with exceptional ease, comfort, and sophistication.

Segments Covered in the Report

By Yacht Type

- Sailing Yacht

- Motor Yacht

By Yacht Length

- Up To 20 Ft

- 20 To 50 Ft

- Above 50 Ft

By Contract Type

- Bareboat Charter

- Crewed Charter

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting