What is the Air Traffic Control (ATC) Equipment Market Size?

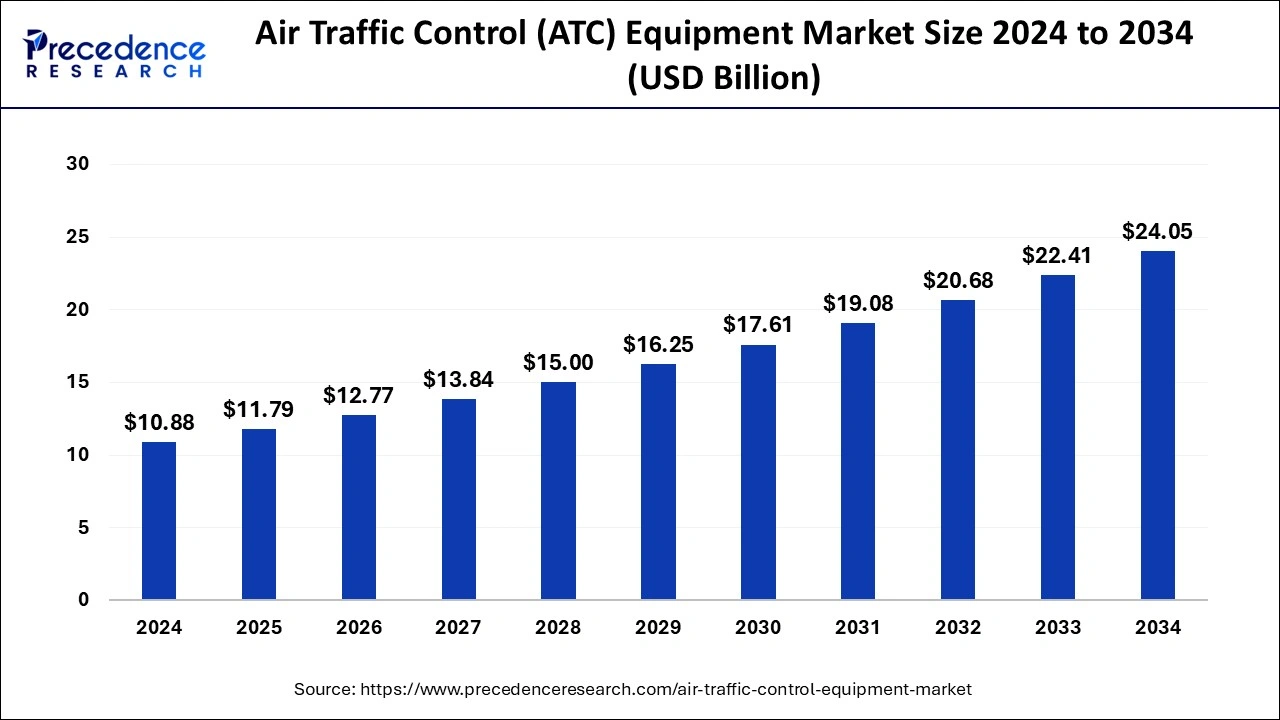

The global air traffic control (ATC) equipment market size was estimated at USD 11.79 billion in 2025 and is predicted to increase from USD 12.77 billion in 2026 to approximately USD 25.75 billion by 2035, expanding at a CAGR of 8.13% from 2026 to 2035.

Air Traffic Control (ATC) Equipment MarketKey Takeaways

- The global air traffic control (ATC) equipment market was valued at USD 11.79billion in 2025.

- It is projected to reach USD 25.75billion by 2035.

- The air traffic control (ATC) equipment market is expected to grow at a CAGR of 8.13% from 2026 to 2035.

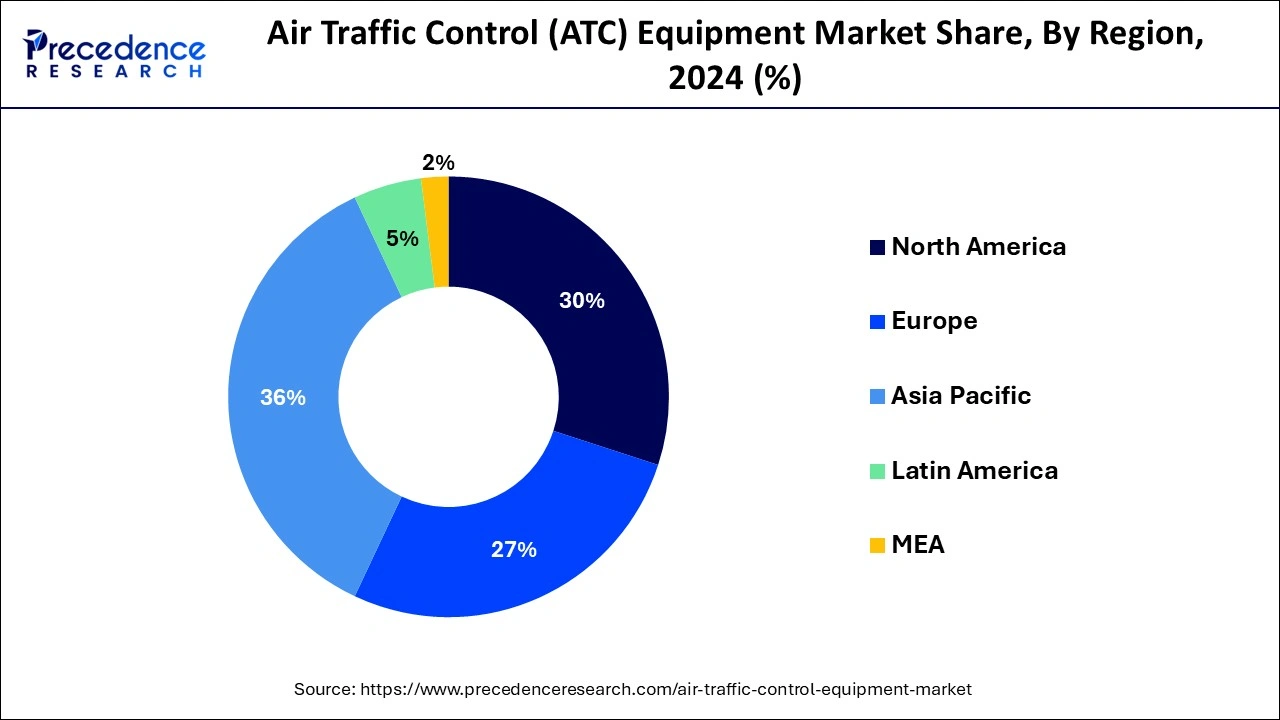

- Asia Pacific dominated the market with the largest market share of 36% in 2025.

- By product, the communications equipment segment has contributed over 40% of market share in 2025.

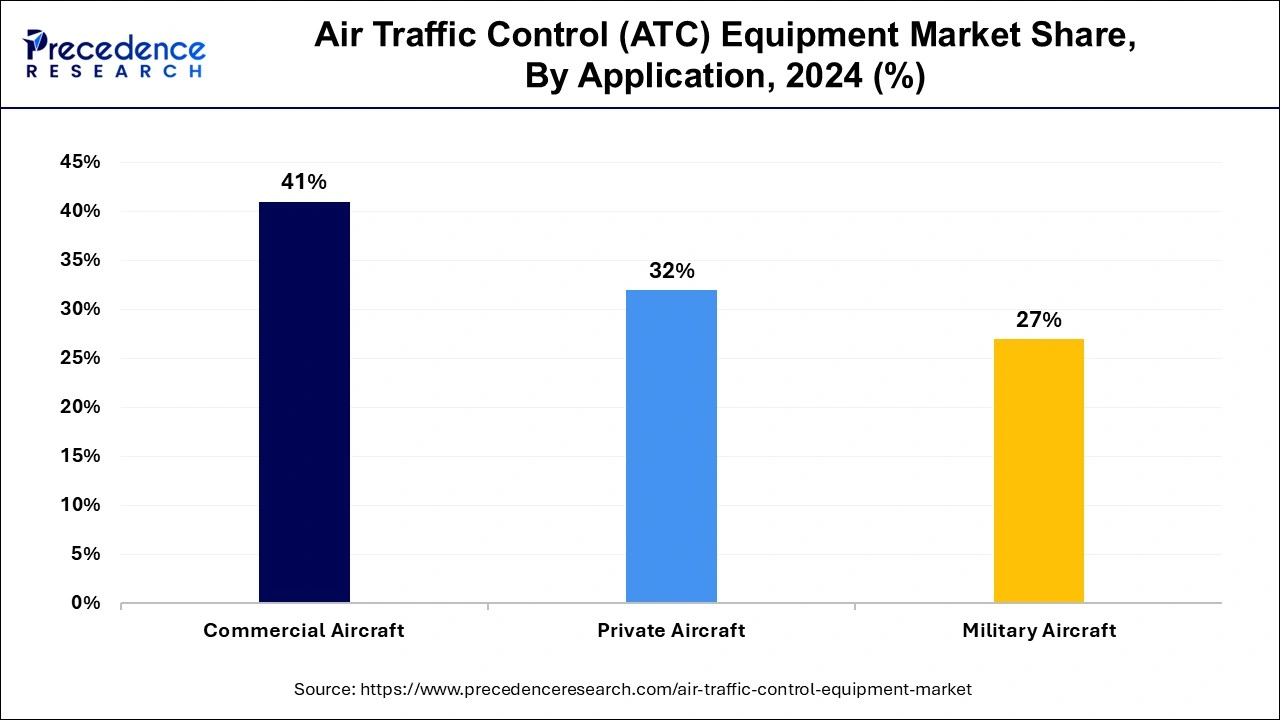

- By application, the commercial aircraft segment has held a major market share of 41% in 2025.

- By application, the military aircraft segment is projected to show the fastest growth during the forecast period.

Market Overview

The air traffic control (ATC)equipment market is a crucial segment within the aerospace and aviation sector, tasked with ensuring the safe and efficient movement of aircraft in increasingly congested skies. This market encompasses a wide array of technologies and systems aimed at preventing collisions, maintaining orderly traffic flow, and optimizing airspace utilization. Key components of this market include surface movement and surveillance radars, as well as advanced holographic radar systems, which enable air traffic controllers to monitor and manage traffic both in the air and on the ground.

As air transportation continues to experience significant growth projections over the next two decades, the importance of enhancing safety measures and minimizing operational costs becomes paramount. Stakeholders in the industry, including governmental entities and airspace users, are increasingly focused on investing in innovative air traffic management (ATM) solutions to address these challenges. This includes the adoption of cutting-edge air traffic control (ATC)systems, navigation tools, communication networks, and surveillance solutions to improve operational efficiency and mitigate risks.

The evolution of air traffic management is driven by advancements in technology and the need to optimize airspace utilization in the face of escalating flight volumes. Effective ATM not only minimizes the possibility of accidents and incidents but also reduces delays and enhances overall operational performance. Strategic partnerships with leading contractors and suppliers are essential for the development and deployment of state-of-the-art ATM solutions that cater to the evolving needs of the industry.

- In July 2023, the FAA and ATCA launched the Advancing Acquisitions Challenge, aiming to improve the acquisitions process of the FAA through soliciting suggestions.

- In May 2023, Indra solidified its global leadership in Air Traffic Management (ATM) with the establishment of its subsidiary in the USA, Indra Air Traffic Inc.

Air Traffic Control (ATC) Equipment MarketGrowth Factors

- The ATC system is bound by national security considerations, particularly during times of conflict, where it must cater to military needs without compromising operational integrity or aiding enemy targeting. This necessitates continuous advancements in ATC equipment and facilities, thereby driving growth in the Air Traffic Control (ATC)equipment market.

- The surge in demand for Air Traffic Control (ATC)services has surpassed the data-processing capability of existing infrastructure, particularly evidenced in ARTCCs operating at or nearing capacity. This surge propels the expansion of the Air Traffic Control (ATC)equipment market to accommodate burgeoning demand.

- From manual to automated systems, Air Traffic Control (ATC) has evolved significantly to meet the demands of growing air traffic. The limitations of manual communication and coordination became apparent as air traffic increased, prompting the development and adoption of sophisticated automated systems, thus stimulating growth in the Air Traffic Control (ATC ) equipment market.

- With escalating aviation traffic, the imperative to enhance efficiency and capacity in air traffic management becomes critical. Addressing issues such as congestion, delays, and airspace optimization necessitates the implementation of advanced technologies, spurring growth in Air Traffic Control (ATC) equipment to meet these evolving needs.

- Automation, particularly driven by artificial intelligence (AI), is increasingly prevalent in Air Traffic Control (ATC) systems, offering enhanced efficiency and error reduction. AI algorithms play a pivotal role in optimizing flight planning, trajectory adjustments, and decision-making processes, thus fueling growth in the Air Traffic Control (ATC)equipment market.

- The integration of AI and automation has revolutionized Air Traffic Control (ATC)operations. By leveraging AI applications across various domains, such as flight planning and weather prediction, the industry achieves optimized outcomes, including reduced fuel consumption, shorter flight durations, and increased operational efficiency. This transformation acts as a significant growth factor in the Air Traffic Control (ATC)equipment market.

- Ongoing technological advancements drive evolution in air traffic management, with notable developments in remote tower operations and unmanned aerial systems (drones). Remote tower operations, facilitated by advanced camera and sensor technologies, enable centralized monitoring and control of multiple airports, fostering growth in the Air Traffic Control (ATC)equipment market to support these emerging paradigms.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 8.13% |

| Market Size in 2025 | USD 11.79Billion |

| Market Size by 2035 | USD 25.75Billion |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Emergence of FAA forecasts

The Federal Aviation Administration (FAA) anticipates a significant increase in air traffic over the next 10 to 20 years, necessitating a corresponding rise in demand for air traffic control (ATC)(ATC) services. FAA's plans for modernizing and expanding the National Airspace System are built upon the expectation of accommodating continued rapid growth.

Despite past discrepancies between FAA forecasts and actual demand, where projections exceeded real growth by as much as fifty percent, the agency's assumption of unconstrained future growth remains a key driver for the expansion of the Air Traffic Control (ATC)equipment market. This discrepancy underscores the imperative for ongoing investments in advanced ATC facilities and equipment to meet the anticipated surge in air traffic effectively.

- In December 2022, INVOLI introduced the G-1090 product line of air traffic signal receivers, consisting of Swiss-made ground-based receivers of cooperative air traffic signals.

- In November 2022, Indra entered a binding agreement to acquire Selex ES Inc's Air Traffic Management line of business from Leonardo to penetrate the USA market and strengthen its global leadership.

Enhanced security and efficiency in airspace utilization

The evolving trend in air traffic management emphasizes the imperative for enhanced security and efficiency in airspace utilization, coupled with heightened control over air threats within it. This necessitates greater interoperability and integration between civilian and military air surveillance, control, and navigation systems.

Suppliers in the Defense and Security field, renowned for their proprietary technology-based solutions tailored for Armed and Security Forces globally, are playing a pivotal role. Their offerings in Surveillance and Air Defense systems are pivotal drivers in the expansion of the air traffic control (ATC) equipment market, facilitating the adoption of advanced solutions to meet the evolving demands of airspace management and security.

- In July 2023, Safran announced its acquisition of Collins Aerospace's actuation and flight control business.

- In January 2024, Airbus Helicopters expanded its unmanned aerial system portfolio through the acquisition of Aerovel.

Restraints

Cost pressures and certification requirements

The air traffic control (ATC) industry, characterized by high costs and concentration, faces significant political pressure to reduce operational expenses, particularly to maintain competitiveness among smaller airports. Despite the trend towards centralized remote towers for cost efficiency, the risks and associated costs of cyber and physical attacks are often underestimated, posing substantial challenges. Moreover, stringent FAA certification requirements add to the expense, limiting market growth by elevating barriers to entry and investment in air taffic control (ATC) equipment.

Opportunities

Digital tower technologies

The integration of automation and digital technologies in air traffic control (ATC) and management presents lucrative opportunities for the air traffic control (ATC) equipment market. High-definition (HD) cameras, automatic surveillance-broadcast technology, and remote sensing technologies are driving the development of unmanned or autonomous digital towers.

Technological advancements enable remote centralized air control centers to receive comprehensive views of airfields, enhancing controller awareness and improving operational efficiency, safety, and flexibility. Digital tower technologies also streamline operations, increase productivity through centralized control, and reduce maintenance requirements for systems and equipment. As such, the adoption of these innovative technologies creates a favorable landscape for growth and expansion within the market.

- In September 2023, UK researchers began utilizing AI for air traffic control.

Advanced computing technology

The introduction of advanced high-speed computers and new software heralds a significant opportunity for the air traffic control (ATC) equipment market. These technological advancements empower the ATC system to enhance overall traffic flow management and devise tactical measures ensuring conflict-free, expeditious, and fuel-efficient flight paths for individual aircraft.

The phased replacement of computers, starting from en route ATC centers to terminal areas and culminating in a centralized flow control facility for national air traffic management, promises not only safety and capacity benefits but also a remarkable level of automation in ATC operations. This automation holds the potential to substantially reduce the workforce required to handle future traffic loads, paving the way for increased efficiency and cost-effectiveness in air traffic control (ATC) operations and thus driving growth opportunities within the market.

- In January 2024, UNO Technology initiated its inaugural project in India, introducing a cutting-edge Air Traffic Control (ATC)Cabin at Noida International Airport.

Segment Insights

Product Insight

The communications equipment segment held the largest market share by product. Central to this segment is the communication backbone (CB), a sophisticated network comprising synchronous digital hierarchy rings and microwave links. This network seamlessly interconnects various vital systems, including communication, navigation, surveillance, and air traffic management, ensuring robust and efficient data transmission.

A pivotal component within the communications equipment segment is the voice communication switching system (VCSS), a state-of-the-art computerized voice communication system. VCSS facilitates direct and seamless communication between pilots and Air Traffic Control (ATC) officers, as well as among various Air Traffic Control (ATC) working positions in ATC Centers, ATC Towers, and Rescue Coordination Centers. VCSS ensures clear and reliable communication channels essential for safe air traffic management by leveraging preset aeronautical frequencies, direct communication lines, and telephone connections.

Effective communication is paramount in air traffic control (ATC) for ensuring the safe and efficient movement of air traffic. The communication process involves using standardized phrases, abbreviations, and procedures to enhance clarity and minimize the risk of miscommunication. Proper communication protocols ensure that all parties involved are well-informed of the current situation, enabling prompt and appropriate action to be taken when necessary.

Application Insights

The commercial aircraft segment held the largest share of the air traffic control (ATC) equipment market in 2024. This dominance was fueled by the pivotal role of modern aircraft in global networking and connectivity. These aircraft, characterized by high-speed operations, rely on advanced material selection to ensure safety, reliability, and efficiency. High-speed aircraft typically utilize low-drag, low-lift airfoils, while slower aircraft carrying heavy loads opt for thicker airfoils with high drag and lift.

The modernization of commercial aircraft has significantly contributed to shrinking the world by enabling seamless global connectivity. This transformation is made possible through the utilization of advanced materials in aircraft manufacturing, ensuring optimal performance across a wide range of temperature and force conditions. These materials are selected to withstand extremes of temperature, from high-altitude lows to ground-level ambient temperatures, while also delivering high strength-to-weight and stiffness-to-weight ratios.

- In February 2024, Malaysia Airlines partnered with Thales to enhance Flight Management and Surveillance Solutions.

Besides commercial aircraft, the military aircraft segment is projected to show the fastest growth during the forecast period. The recent expansion of the industry can be attributed to increased demand for military aircraft and revelatory equipment in response to tense international relationships. This expansion is further supported by government policies and technological advancements. Moreover, the market further benefits from the growing defense sector, especially the naval forces. Another key aspect of the dynamics of this segment is the favorable regulatory support granted to the military. Federal and state policies make it possible for market players to engage in profitable business opportunities, enhancing the growth of the segment and overall market.

- In March 2022, The French Ministry of Defence (MoD) appointed Indra's air traffic management and radar system for three airbases through the Direction Générale de l'Armement (DGA). Together with the company's air traffic automation system, it established one of the most effective systems for the control, monitoring, detection, and automation of military airbases.

Regional Insights

What is the Asia Pacific Air Traffic Control (ATC) Equipment Market Size?

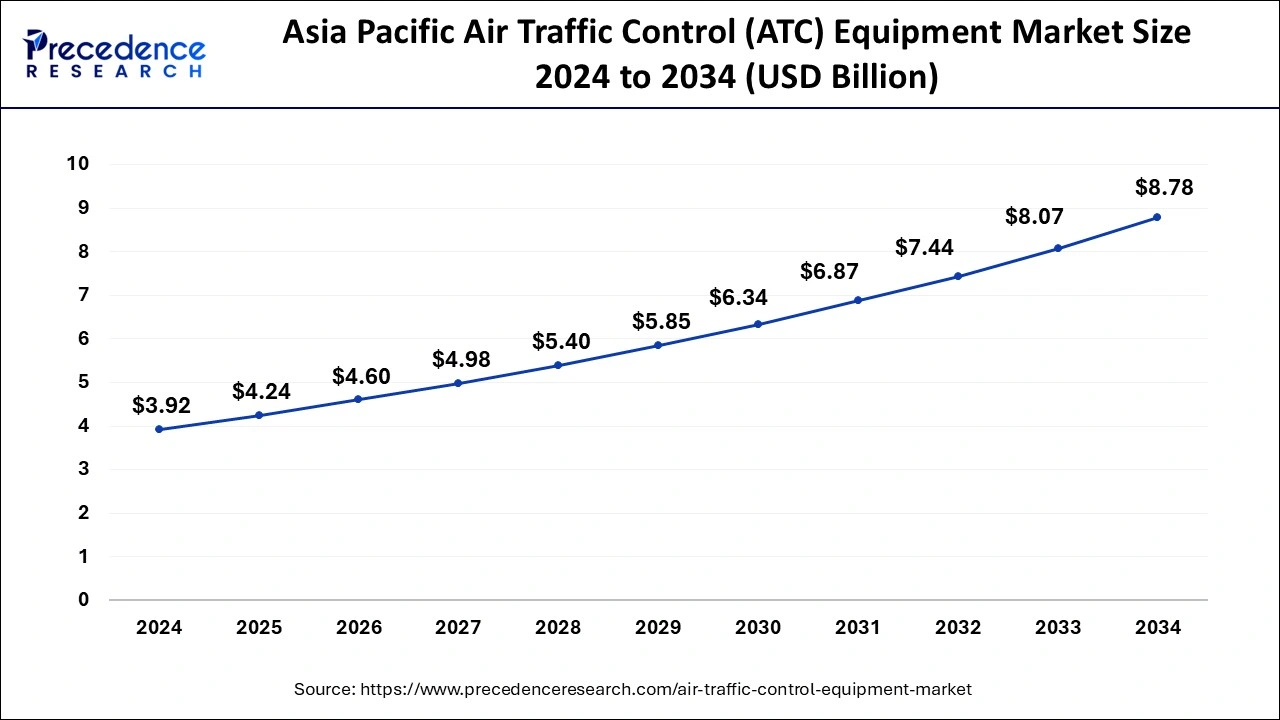

The Asia Pacific air traffic control (ATC) equipment market size was estimated at USD 4.24 billion in 2025 and is predicted to hit around USD 9.44 billion by 2035 at a CAGR of 8.33% from 2026 to 2035.

Asia Pacific emerged as a dominant force propelling the expansion of the Air Traffic Control (ATC) equipment market, driven by concerted efforts to modernize aviation infrastructure and meet growing demand. The introduction of the Common Regional Virtual Private Network (CRV) infrastructure, spearheaded by the International Civil Aviation Organization (ICAO), addresses communication limitations inherent in legacy civil aviation technologies. By transitioning to a centralized IP-based network infrastructure, the APAC region paves the way for future high-speed aviation applications, facilitating the exchange of crucial meteorological and surveillance data among Aviation Navigation Service Providers.

The Asia Pacific Regional Air Traffic Flow Management (ATFM) Concept of Operations (CONOPS), developed collaboratively by key stakeholders, including Civil Aviation Authorities and industry partners, underscores the region's commitment to innovation and operational efficiency. Singapore, a major air hub in the region, leads by example as an early adopter of Air Traffic Management (ATM) changes to accommodate rising capacity demands. Drawing lessons from Europe's Single European Sky ATM Research (SESAR) and the United States NextGEN programs, which paved the way for modernizing ATM systems, APAC invests in research and development to synchronize plans and federate resources.

With Asia Pacific hosting many of the world's largest and fastest-growing economies, it has experienced significant economic and aviation growth in recent years. Looking ahead, as the aviation sector rebounds from the global pandemic, the region is poised to exhibit the highest economic growth worldwide over the next two decades. This growth trajectory, propelled by the expanding middle class in several APAC countries, will drive continuous increases in airline passenger volumes, both domestically and internationally. As such, the Asia Pacific region presents lucrative opportunities for the Air Traffic Control (ATC)equipment market, fueled by a commitment to innovation, infrastructure modernization, and sustained economic growth.

- In February 2024, Embraer and Mahindra announced their collaboration on the C-390 Millennium Medium Transport Aircraft in India.

North America's Growth in the Air Traffic Control (ATC) Equipment Industry

North America is seeing rapid growth in the market. This growth is driven by the region's increasing air traffic, advancements in technology, and stringent regulatory requirements that are aimed at enhancing safety and efficiency. The Federal Aviation Administration (FAA) plays a crucial role here by setting standards and regulations that propel market demand. Countries like the USA and Canada are leading players.

USA Air Traffic Control (ATC) Equipment Market Trends

The country is seen investing significantly in modernizing its air traffic management systems, with a high focus on enhancing safety, efficiency, and environmental sustainability. The implementation of satellite-based navigation and communication systems is also expected to drive market innovation and growth.

How is Europe Growing in the Air Traffic Control (ATC) Equipment Industry?

Europe is expected to witness a significant amount of growth throughout the forecast period. This growth is fueled by the European Union's Single European Sky initiative, which aims to enhance air traffic management efficiency and safety. This regulatory framework also helps in encouraging investments in advanced technologies and infrastructure upgrades, thus driving demand for innovative solutions. Countries such as the UK, Germany, and France are leading players.

Germany Air Traffic Control (ATC) Equipment Market Trends

The country's market landscape is characterized by a high number of collaborations and partnerships, with aims to improve service delivery. The high focus on sustainability and reducing carbon emissions is also shaping the region's market dynamics.

Latin America's Growth in the Air Traffic Control (ATC) Equipment Industry

Latin America is expected to have substantial growth in the market. The increasing number of air passengers and the expansion of airport infrastructure are key market drivers. Countries like Brazil and Mexico are leading players as they are seen investing heavily in modernizing their air traffic management systems in order to manage rising air traffic volumes and improve safety standards.

Brazil Air Traffic Control (ATC) Equipment Market Trends

The country has a high focus on technological advancements and regulatory compliance, which is expected to further enhance market growth, making it a beneficial area for investments in air traffic control solutions.

MEA's Growth in the Air Traffic Control (ATC) Equipment Industry

The Middle East and Africa are expected to witness steady growth in the market. This growth is driven by factors like increasing air travel demand, rising investments in airport infrastructure, and government initiatives that are aimed at enhancing aviation safety and efficiency. Countries like the UAE and South Africa are leading players in the region. The competitive landscape is evolving at a steady pace, with both regional and international companies focusing on innovative solutions.

Saudi Arabia Air Traffic Control (ATC) Equipment Market Trends

The ongoing development of smart airports and air traffic modernization projects opens up several opportunities for growth in this region. The region's market landscape is further driven by high investments in airport infrastructure and the expansion of airline networks.

Air Traffic Control (ATC) Equipment Market Companies

- Cobham Limited

- Advanced Navigation and Positioning Corporation

- BAE Systems

- Endeavor Business Media, LLC.

- L3Harris Technologies, Inc.

- Intelcan Technosystems Inc

- Lockheed Martin Corporation

- Indra

- Northrop Grumman

- Verdict Media Limited.

- RTX

- Thales

- Searidge Technologies

Recent Developments

- In March 2024, Leidos established an Air Traffic Management Office in the Indo-Pacific region.

- In March 2023, Leonardo's ATC systems had been deployed to optimize the management of Somalia airspace.

- In December 2022, Thales and DSNA unveiled a new vision of air traffic management with 4-Flight.

- In February 2024, Airbus and TotalEnergies signed a strategic partnership for sustainable aviation fuels.

- In June 2022, Saab received an order for Integrated Air Traffic Control (ATC)in Dubai.

Segments Covered in the Report

By Product

- Communications Equipment

- Navigation Equipment

- Surveillance Equipment

By Application

- Commercial Aircraft

- Private Aircraft

- Military Aircraft

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting