Active Noise and Vibration Control (ANVC) System Market Size and Forecast 2025 to 2034

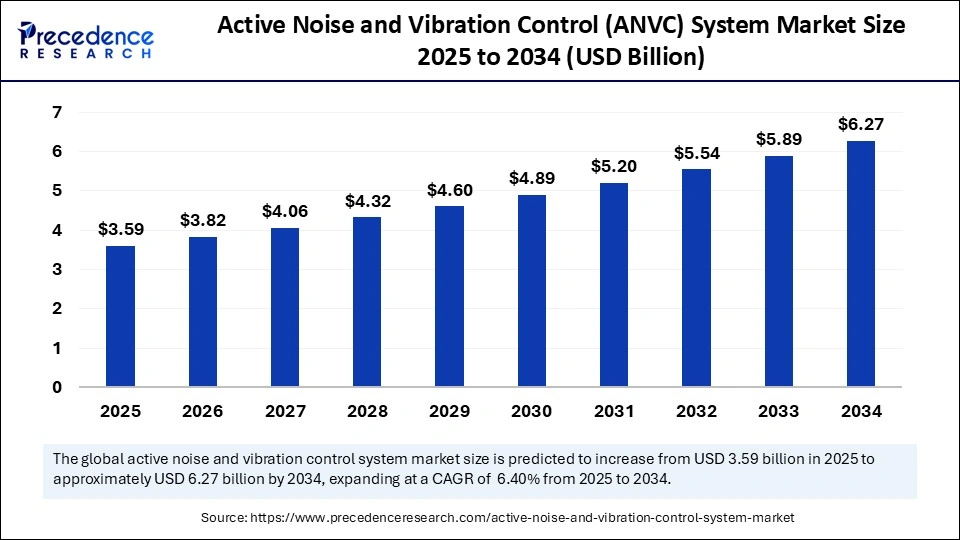

The global active noise and vibration control (ANVC) system market size accounted for USD 3.37 billion in 2024 and is predicted to increase from USD 3.59 billion in 2025 to approximately USD 6.27 billion by 2034, expanding at a CAGR of 6.40% from 2025 to 2034. The growth of the market is driven by the growing need to improve passenger comfort and aircraft efficiency.

Active Noise and Vibration Control (ANVC) System Market Key Takeaways

- In terms of revenue, the active noise and vibration control (ANVC) system market is valued at $3.59 billion in 2025.

- It is projected to reach $6.27 billion by 2034.

- The market is expected to grow at a CAGR of 6.40% from 2025 to 2034.

- North America dominated the active noise and vibration control (ANVC) system market in 2024.

- Asia Pacific is expected to witness rapid growth during the forecast period.

- By component, the hardware segment dominated the market in 2024.

- By component, the software segment is projected to expand at the fastest rate in the coming years.

- By application, the noise segment led the market in 2024.

- By application, the voice segment is anticipated to grow at the fastest rate between 2025 and 2034.

- By platform, the commercial segment held the largest share of the market in 2024.

- By platform, the military segment is likely to grow rapidly in the upcoming period.

Role of AI in Active Noise and Vibration Control (ANVC) Systems

Integrating artificial intelligence algorithms in ANVC systems significantly improves their efficiency and performance. Machine Learning (ML) algorithms analyze vibration and noise patterns in real time, leading to more effective vibration reduction and noise cancellation. AI and Machine Learning algorithms enable predictive maintenance and real-time adjustments, confirming optimum performance and decreasing system failures. This significantly reduces maintenance costs. Moreover, AI enhances the capabilities of ANVC systems, enabling them to adapt to changing vibration and noise levels.

Market Overview

The active noise and vibration control (ANVC) system market is experiencing rapid growth due to the rising demand for ANVC systems from the aerospace, automotive, and military sectors. These systems are preferred for their capabilities to reduce vibration and noise levels. The significance of ANVC systems is rising in various workplaces. The rising focus on improving passenger comfort is boosting the demand for ANVC systems in the aerospace sector. These systems reduce noise and vibration levels from the cabin, creating quieter environments for passengers. In addition, stringent regulations regarding noise pollution encourage various industries to adopt ANVC systems in their operations.

Active Noise and Vibration Control (ANVC) System Market Growth Factors

- Expansion in aerospace and military applications boosts the growth of the market. ANVC systems are crucial in aircraft and military vehicles. These systems significantly improve the performance and efficiency of aircraft and military vehicles by reducing vibration and noise levels.

- Technological advancements boost the growth of the market. Recently, major progressive Technologies such as IoT and AI are enabling the development of more efficient ANVC systems, expanding the area of applications.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 6.27 Billion |

| Market Size in 2025 | USD 3.59 Billion |

| Market Size in 2024 | USD 3.37 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.40% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Application, Platform, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Expanding Applications of ANVC

The expanding area of applications of ANVC systems beyond aerospace and military is a key factor driving the growth of the active noise and vibration control (ANVC) system market. These systems are receiving attention from the automotive and consumer electronics industries. There is a high need for quiet environments in various industries. The rising concerns about noise pollution are boosting the demand for ANVC systems. These systems provide a highly efficient solution for addressing the adverse health and environmental impacts of industrial and transport noise. They reduce or eliminate noise, especially low-frequency noise ranges up to 200 Hz, in various industrial applications. This not only helps industries comply with stringent noise control regulations but also improves workers' well-being.

Restraint

High Costs and Technical Challenges

ANVC systems are costlier, creating barriers for SMEs. This, in turn, limits their adoption and encourages businesses to find cost-effective alternatives such as soundproofing and vibration isolation. Moreover, the efficiency of ANVC depends on the precise modelling of the system. Faults in modelling can lead to inadequacies in the performance of the ANVC systems. In applications like aerospace, the power consumption and size of ANVC systems are critical to enhance aircraft performance. This limits the adoption of certain ANVC systems.

Opportunity

Demand for Integrated and Smart Systems

The rising demand for integrated and smart ANVC systems creates immense opportunities in the active noise and vibration control (ANVC) system market. Integrating ANVC systems with other technologies like Internet of Things enables the development of smart and more efficient solutions. The integration of IoT and smart technologies enables ANVC systems to adjust vibration and noise to various conditions, enhancing their performance. Modern sensor technologies offer accurate measurements of noise and vibration levels, allowing more accurate and efficient control. Integrated systems are gaining traction in the automotive industry for noise reduction in vehicles. By deploying advanced ANVC systems in vehicles, acoustic intrusion can be reduced, enhancing the driver and passenger comfort and safety.

Component Insights

The hardware segment held the largest share of the active noise and vibration control (ANVC) system market in 2024, as hardware is important for ensuring the efficiency of ANVC systems. Hardware contains controllers, sensors, actuators, and pilot & crew communication systems. High-quality hardware significantly improves the performance and reliability of these systems. Advancements in sensor technology and actuators optimize control mechanisms, leading to the development of high-performance ANVC systems.

The software segment is projected to expand at the fastest rate in the coming years. Software plays a crucial role in implementing advanced control algorithms, which improve the performance of ANVC systems. Software analyzes and processes data from sensors, enabling real-time adjustments to control noise and vibration. Software further improves the flexibility and efficiency of these systems in various applications.

Application Insights

The noise segment dominated the active noise and vibration control (ANVC) system market with a significant share in 2024. This is mainly due to the increased need for active noise control (ANC) in various applications. ANC systems counteract sound waves of equal amplitude. The outcome is that the unwanted sound is removed. ANC technology comprises signal conditioning, sensors, a control system, actuators, and power amplifiers. Governments around the world have imposed stringent noise regulations across industries, boosting the need for active noise control systems.

The voice segment is anticipated to grow at the fastest rate during the forecast period. The growth of the segment can be attributed to the increasing demand for vibration control systems (VCSs). Vibration control is essential in industrial applications. These systems are significant for ensuring the precision, comfort, and safety of aircraft, military vehicles, and industrial machines. VCS reduces vibration levels, significantly enhance the performance of military vehicles and aircraft.

Platform Insights

The commercial segment held the largest share of the active noise and vibration control (ANVC) system market in 2024. This is mainly due to the increased need for enhancing the performance of aircraft. ANVC systems reduce unwanted vibrations and noise in fixed-wing aircraft, which minimizes tremble in the helicopter and aircraft. This significantly extends the longevity of components, optimizes fuel efficiency, and enhances the overall performance of helicopters and aircraft by reducing maintenance. The increasing need to improve passenger comfort and safety is likely to sustain the segment's long-term growth.

The military segment held a significant share of the market in 2024 and is likely to grow at the fastest rate during the projection period. ANVC systems are essential in military vehicles. These systems reduce noise and vibration in military vehicles, significantly improving stealth. These systems ensure optimal functioning of vehicle parts, improving fuel efficiency. The rising government investments in military technologies and increasing production of military vehicles are likely to contribute to segmental growth.

Regional Insights

North America registered dominance in the active noise and vibration control (ANVC) system market by capturing the largest share in 2024. The region is expected to sustain its position in the market in the upcoming period. This region is a hub for technological innovations, boosting the development of sophisticated ANVC systems. The region is home to some of the leading aircraft manufacturing companies, such as Boeing and Lockheed Martin. These companies are continuously developing a range of aircraft, such as commercial jets and military vehicles. This, in turn, creates the need for ANVC systems.

The U.S. plays a major role in the North American active noise and vibration control (ANVC) system market. The U.S. government has imposed stringent regulations regarding noise control. This significantly increased the adoption of ANVC systems across various industries. There is a strong emphasis on enhancing drive and passenger comfort and safety, boosting the adoption of ANVC systems in the automotive and aerospace industries.

Asia Pacific is expected to witness the fastest growth in the coming years. Rapid industrialization and urbanization lead to increased noise pollution, boosting the need for ANVC systems. Governments around the region are making initiatives to control noise pollution, encouraging various industries to adopt ANVC systems. The rapid expansion of the automotive and aerospace industries, along with the rising production of vehicles, is driving the growth of the market.

China is projected to have a stronghold on the active noise and vibration control (ANVC) system market in Asia Pacific. The rising urbanization and infrastructure development are increasing noise pollution. Noise pollution has become a major environmental challenge in the country, impacting millions of lives. The country is at the forefront of vehicle production. All these factors are boosting the demand for ANVC systems. In addition, India plays a crucial role in the Asia Pacific market. The Indian government imposed various regulations on several industries to reduce noise pollution. Increasing the defense budget and rising modernization of existing aircraft and military vehicles significantly contribute to market growth.

Recent Developments in the Market

- In November 2023, Worldsensing launched the Vibration Meter. The device uses a tri-axial accelerometer to measure vibrations, with a longer battery life, wider communications range, and more competitive price points than comparable products.

- In January 2023, CECO Environmental Corp., a leading environmentally focused, diversified industrial company whose solutions protect people, the environment, and industrial equipment, announced that it has completed the acquisition of Wakefield Acoustics, Ltd. ("Wakefield"), a UK-based design and manufacturing firm specializing in advanced industrial, commercial and environmental noise control systems. This acquisition advances CECO's leadership within the industrial silencing and noise attenuation segment by adding a range of solutions.

- In April 2022, PointCentral, the leading provider of rental property automation for short-term property managers, and a subsidiary of Alarm.com, introduced its new Smart Noise Monitor to give short-term rental managers peace of mind by identifying noisy renters before they result in costly problems or unhappy neighbors. The Smart Noise Monitor is a privacy-safe, affordable noise sensor that measures sound levels and alerts property managers or owners when the noise levels are exceeded.

Active Noise and Vibration Control (ANVC) System Market Companies

- LORD Corporation

- Ultra Electronics Holdings plc.

- Moog Inc.

- Bosch General Aviation Technology GmbH

- Creo Dynamics AB

- Hutchinson SA

- Terma A/S

- Wolfe Aviation

Segments Covered in the Report

By Component

- Hardware

- Sensors

- Controllers

- Actuators

- Pilot & Crew Communication System

- Software

By Application

- Noise

- Vibration

By Platform

- Commercial

- Fixed

- Rotary Wing

- Military

By Geography

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting