What is the Aircraft Health Monitoring System Market Size?

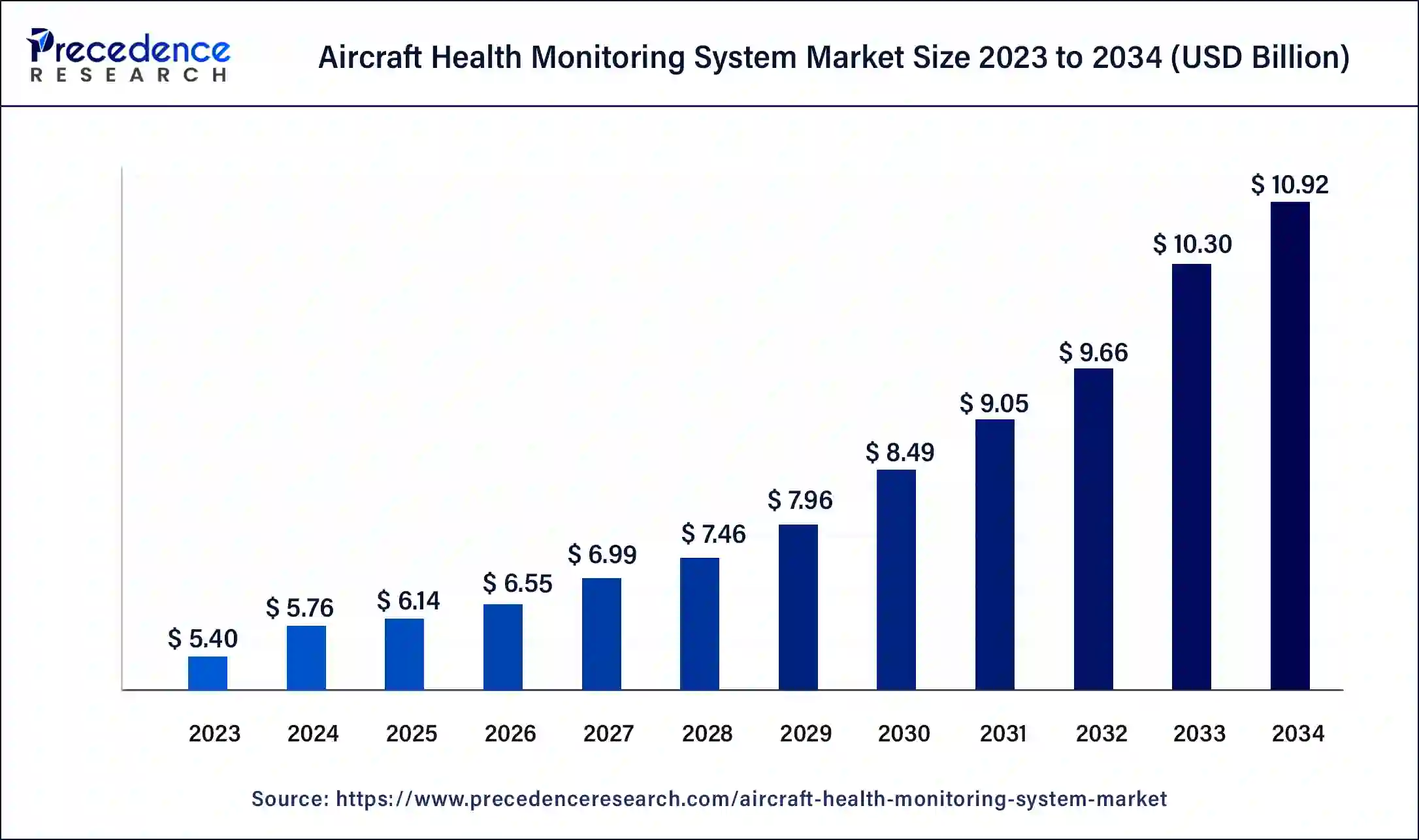

The global aircraft health monitoring system market size was calculated at USD 6.14 billion in 2025and is predicted to increase from USD 6.55 billion in 2026 to approximately USD 11.55 billion by 2035, expanding at a CAGR of 6.52% from 2026 to 2035. The rise in demand for real-time problem management, custom alerting & analysis solutions, and the rise in demand for performance monitoring drive the growth of theaircraft health monitoring system market.

Aircraft Health Monitoring System Market Key Takeaways

- In terms of revenue, the aircraft health monitoring system market is valued at USD 6.14 billion in 2025.

- It is projected to reach USD 11.55 billion by 2035.

- The aircraft health monitoring system market is expected to grow at a CAGR of 6.52% from 2026 to 2035.

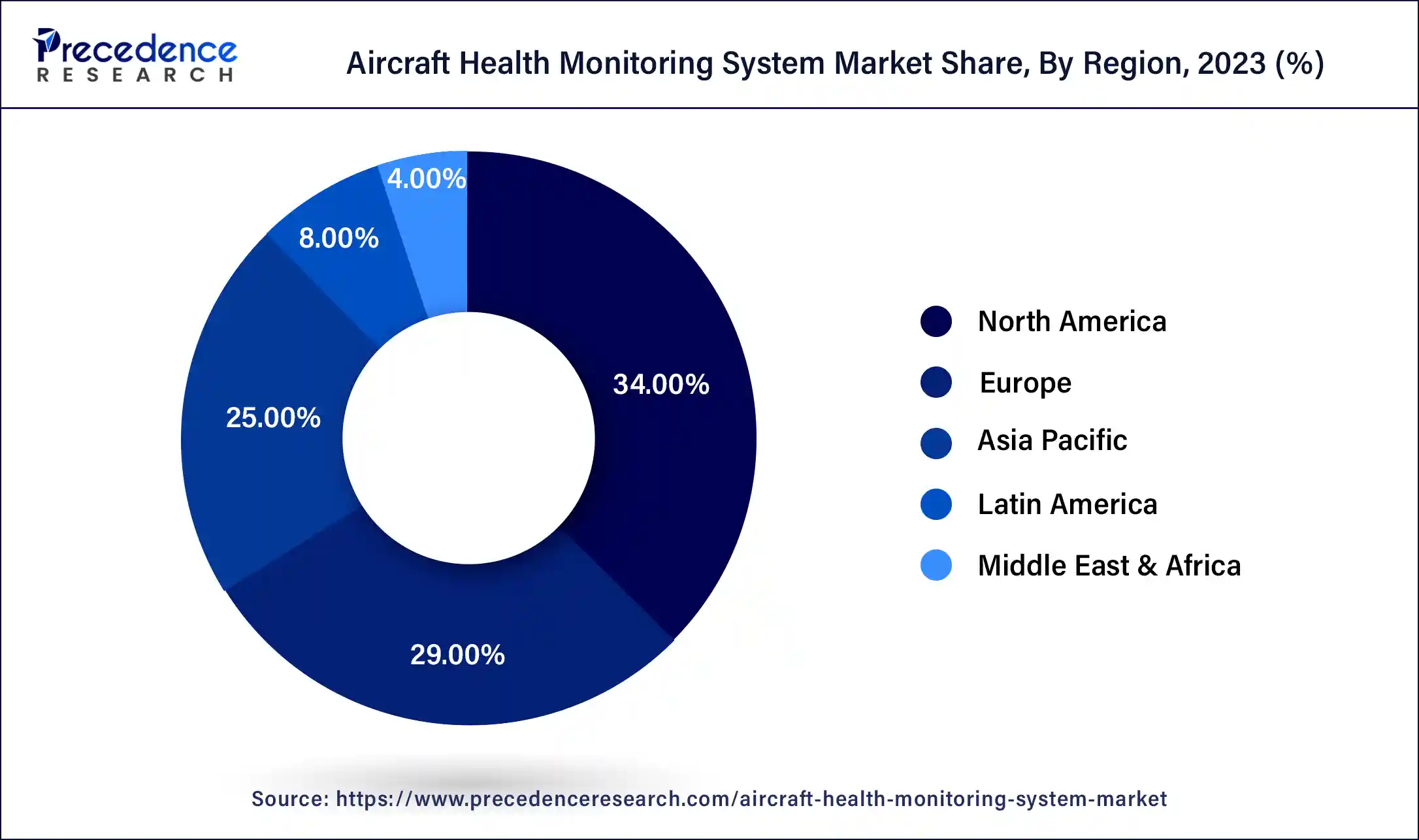

- North America is expected to lead the global aircraft health monitoring system market in 2025 with a revenue share of 34%.

- Asia Pacific is witnessing notable growth during the forecast period 2026 to 2035.

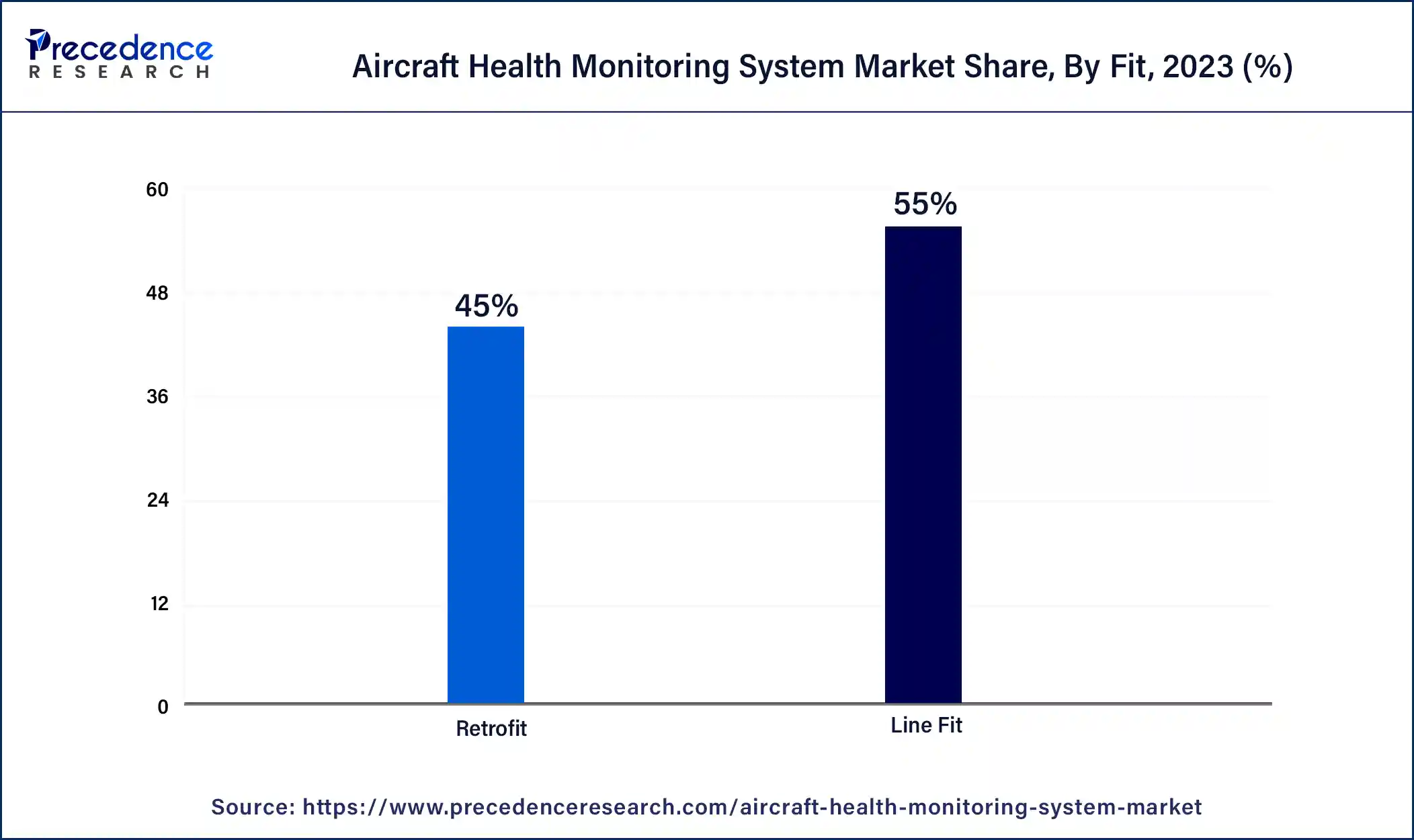

- By Fit, the line fit segment has captured the highest revenue share of around 85% in 2025.

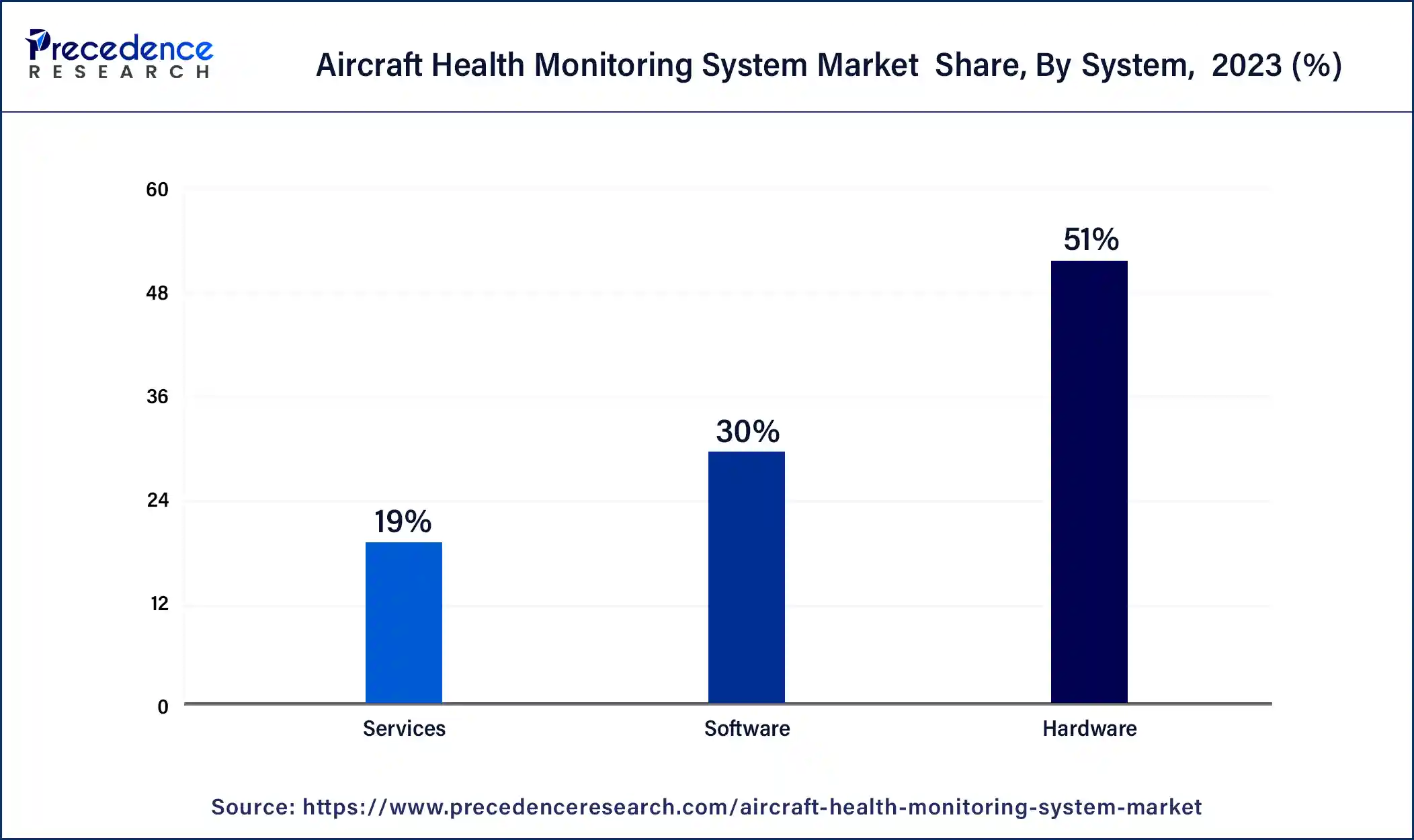

- By system, the software segment has dominated the market in 2024 with a revenue share of 51% in 2025.

- By platform, the narrow-body aircraft segment has dominated the market in 2024 with a revenue share of 33.8%.

Strategic Overview of the Global Aircraft Health Monitoring System Industry

An aircraft health monitoring system (AHMS) is a software and hardware setup that includes sensors and networked processing units. It remotely monitors airplane data to evaluate its current or future serviceability and performance. These systems are also referred to as aircraft condition monitoring systems (ACMS). AHMS directly impacts the maintenance, repair, and overhaul (MRO) segment of the airline industry. Their use reduces maintenance and operational costs while enhancing aircraft safety.

The main objectives of AHMS are safety, operational efficiency, cost savings in maintenance, and improved aircraft performance. AHMS can support predictive maintenance strategies, provide early warnings of potential failures, and help airlines and operators make informed decisions regarding maintenance actions, component replacements, and operational adjustments by continuously monitoring and analyzing data.

Artificial Intelligence: The Next Growth Catalyst in Aircraft Health Monitoring Systems

AI is fundamentally transforming the aircraft health monitoring system (AHMS) industry by empowering a shift from traditional, reactive maintenance to proactive, predictive maintenance. By leveraging machine learning algorithms to analyze vast amounts of real-time data from on-board sensors, AI systems can identify subtle patterns and anomalies indicative of potential failures long before they occur.

This predictive capability significantly enhances flight safety and reliability, while also optimizing maintenance schedules to reduce unplanned downtime and operational costs for airlines.

Aircraft Health Monitoring System Market Growth Factors

- An increase in aerospace IT investment in developing countries is driving the growth of the aircraft health monitoring system market.

- Technical advancements for workflow optimization further create the demand for advanced analytical systems, which can lead to market growth.

- The growing use of advanced materials like composites used in aircraft construction, which needs simple monitoring to assess structural integrity, is fueling the aircraft health monitoring system market growth.

- The rise in the use of the Internet of Things (IoT), which enables data collection and transmission and makes it easier to integrate AHMS with different systems for a deep overview of aircraft health, is boosting the market growth.

- Increasing competition among airlines to provide cutting-edge technology services can also contribute to the expansion of the aircraft health monitoring system market.

Market Outlook

- Market Growth Overview: The aircraft health monitoring system market is expected to grow significantly between 2025 and 2034, driven by the growing technological advancements, growing predictive and condition-based maintenance, and increased operational efficiency.

- Sustainability Trends: Sustainability trends involve predictive maintenance and efficiency, integration for holistic sustainability, and rising environmental, social, and governance focus.

- Major Investors: Major investors in the market include Boeing, Airbus, Honeywell, GE Aviation, Rolls-Royce, RTX Corporation (Raytheon), Lufthansa Technik, Safran, Curtiss-Wright, and FLYHT Aerospace.

- Startup Economy: The startup economy is focused on niche areas, addressing industry challenges, and navigating regulatory hurdles.

Market Scope

| Report Coverage | Details |

| Global Market Size By 2035 | USD 11.55 Billion |

| Global Market Size in 2025 | USD 6.14 Billion |

| Global Market Size in 2026 | USD 6.55 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.52% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Platform, Fit, System, Operation, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

The increasing focus on enhancing aviation safety

The increasing emphasis on enhancing aviation safety stands as a pivotal driver propelling the aircraft health monitoring system market forward. Safety remains a paramount concern for aviation authorities, aircraft manufacturers, and airline operators worldwide, given the rising number of air travelers. Regulatory bodies are enforcing stricter safety standards and guidelines, necessitating the adoption of advanced health monitoring systems.

In the aircraft health monitoring system market, regulations mandate frequent and comprehensive checks to ensure aircraft safety, underscoring the significance of real-time and precise monitoring systems like AHMS. Furthermore, incidents related to aircraft safety can have profound consequences, including loss of life, damage to reputation, and financial liabilities for airlines and manufacturers. AHMS, equipped with various types and components, offers capabilities for real-time diagnosis and predictive maintenance, playing a crucial role in averting catastrophic failures.

- In January 2024, Cirrus Aircraft, the company that brought you the aircraft with the parachute and the Vision Jet that lands itself with the touch of a button, announced the newest generation of the world's best-selling, high-performance, single-engine piston aircraft – the SR Series G7. The SR Series G7 aircraft features touchscreen interfaces, large high-resolution displays, and advanced safety systems.

Restraint

Operational challenges

The growth of the aircraft health monitoring systems market is closely tied to concerns surrounding aircraft maintenance. With a narrow net profit margin of less than 4%, aircraft operators are keen on reducing operational expenses while maintaining high safety standards and service quality, as mandated by air regulatory authorities and expected by passengers. Concerns about aircraft maintenance and expenditure are expected to impede the aircraft health monitoring system market growth during the forecast period.

In the aircraft health monitoring system market, the operational fleet of aircraft presents challenges for operators and MRO service providers due to the need for enhanced damage detection, frequent inspections, and increased maintenance. While schedule-based maintenance is effective over the desired service life, it also leads to longer inspection times, higher operational and maintenance costs, and reduced aircraft availability due to maintenance downtime.

Opportunities

The recent advancements in sensor technology and data analytics

The rapid progress in sensor technology and data analytics is a significant factor fueling the growth of the aircraft health monitoring system market. Sensors have become more accurate, durable, and cost-effective, enabling comprehensive monitoring of various aircraft systems such as engines, wings, landing gear, and cabin environments. These advancements allow for the collection of a wider range of data, from vibration frequencies to thermal patterns, which enhances the analysis process.

Modern sensors are better equipped to withstand harsh conditions like extreme temperatures and pressures, making them more suitable in the aircraft health monitoring system market. Alongside sensor technology, improvements in data analytics are also contributing to market expansion. The development of data analytics tools enables AHMS to quickly process large volumes of real-time data, detect anomalies, predict potential malfunctions, and recommend proactive maintenance actions.

How Will Future Opportunities Shape the Demand for Aircraft Health Monitoring Systems?

Aircraft Health Monitoring Systems (AHMS) are set for rapid expansion, fueled by demands for better safety, predictive maintenance, and effective operations. The advances in IoT, AI, and big data analytics have enabled real-time diagnostics to reduce unscheduled downtime and maintenance costs. The trend towards connected aircraft (or smart aircraft) will continue to drive demand, along with regulators emphasizing proactive maintenance for aircraft. The increase in commercial and military aircraft fleets around the world will also provide significant opportunities for AHMS providers to offer integrated solutions to improve aircraft reliability and lifecycle management.

Government regulations

The aircraft health monitoring systems market is propelled by several pivotal factors, all converging to enhance aviation safety and efficiency. These factors include the imperative to reduce aviation accidents, driven by the proliferation of commercial aircraft and the escalating volume of air traffic worldwide. AHMS solutions are highly sought-after for their capabilities in real-time fault management, predictive maintenance, performance monitoring, and tailored alerting and analysis solutions, catering to a global demand.

The emergence of connected aircraft solutions is poised to boost market growth, promising even greater levels of connectivity and data utilization. Additionally, government regulations aimed at bolstering safety standards, coupled with heightened demand from the defense sector, contribute significantly to AHMS adoption. Technological advancements, coupled with the ongoing modernization of aircraft fleets and the increasing integration of IoT technologies, further bolster the expansion of the aircraft health monitoring system market.

Segment Insights

System Insights

The aircraft health monitoring system market is segmented into software, hardware, and services. In 2024, the software segment dominated the market and is expected to maintain its position throughout the forecast period. The rising importance of data analytics in the aviation industry is fueling the demand for convenient AHMS software. These software solutions also use AL and ML algorithms to process vast amounts of data gathered from aircraft sensors. Moreover, they can identify anomalies, patterns, and potential issues regarding predictive maintenance and early fault detection.

- In October 2023, FLYHT Aerospace Solutions Ltd. revealed a strategic collaboration with Air North, Yukon's Airline, as the airline embarks on fleet renewal initiatives. Under this agreement, Air North will acquire FLYHT's innovative hardware and software services aimed at elevating aircraft communications and optimizing operational efficiency and safety across its fleet.

Platform Insights

The narrow body aircraft segment dominated the market in 2024 and is expected to grow at a significant CAGR in the upcoming years. These aircraft are extensively used by various airlines for short to medium routes, making them an important division of the aviation industry. Narrow-body aircraft are also preferred for their cost-effectiveness. Airlines operating narrow-body aircraft must stick to strict safety and maintenance regulations imposed by aviation authorities globally.

The wide-body aircraft segment is expected to show considerable growth during the projected period. This is attributed to the acceptance of IoT smart sensors, data analytics for advanced effectiveness, and international trade between different countries. Moreover, the rise in demand for MRO outsourcing is further expected to drive the growth of the aircraft health monitoring system market in the future.

Fit Insights

The retrofit segment is observed to grow at a notable rate during the forecast period. Many airlines and aircraft operators are looking to upgrade their existing fleets with modern technologies to enhance safety, efficiency, and maintenance practices. Retrofitting AHMS onto older aircraft allows operators to monitor the health of critical systems and components, improving overall reliability and reducing maintenance costs.

The line fit segment held a notable share of the aircraft health monitoring system market in 2023. Line fit installations refer to aircraft health monitoring systems that are integrated into new aircraft during their manufacturing process, before they are delivered to the customers. This segment is significant because many airlines prefer to have health monitoring systems installed directly during the production of new aircraft rather than retrofitting them later.

Operation Insights

The real time segment held a significant share of the aircraft health monitoring system market in 2023. By continuously monitoring critical systems and components in real-time, aircraft health monitoring systems can contribute to enhanced safety by providing early warnings of potential safety hazards or malfunctions. This allows pilots and maintenance crews to respond proactively to mitigate risks. Real-time monitoring systems are often required to comply with regulatory requirements and safety standards imposed by aviation authorities. These regulations may mandate the use of real-time aircraft health monitoring systems for specific aircraft systems or operations, driving market demand.

Regional Insights

What is the U.S Aircraft Health Monitoring System Market Size?

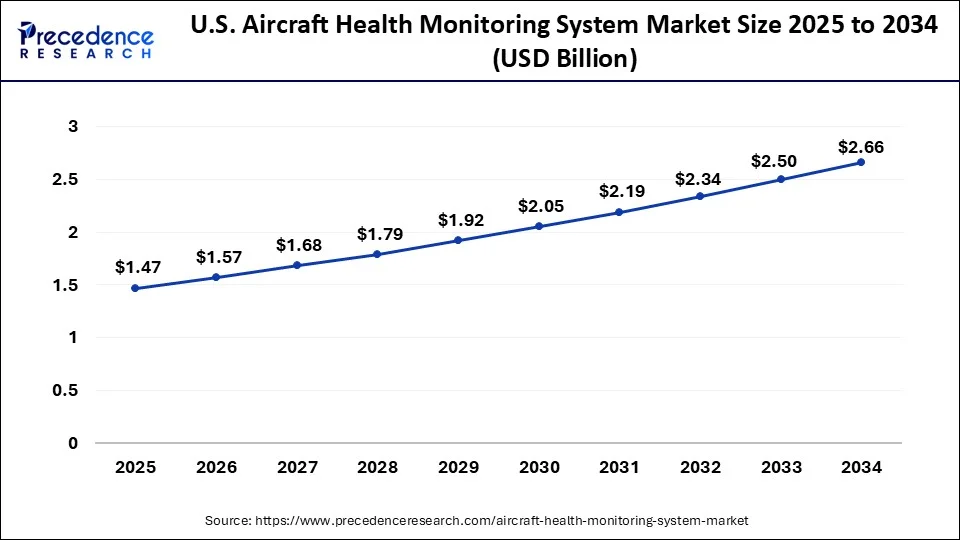

The U.S. aircraft health monitoring system market size was estimated at USD 1.47 billion in 2025 and is projected to surpass around USD 2.82 billion by 2035 at a CAGR of 6.73% from 2026 to 2035.

North America is expected to lead the global aircraft health monitoring system market in 2024. This region is a hub for key players in the aerospace and aviation industries, including major aircraft manufacturers, technology developers, and service providers. The United States is home to renowned companies such as Boeing and Lockheed Martin, which play a significant role in advancing and adopting advanced aviation technologies, including AHMS.

Established in 1998 and based in Calgary, Canada, FLYHT Aerospace Solutions Ltd. is a global leader in providing innovative data solutions for the airline industry. With offices in the US, Germany, China, Southeast Asia, and Europe, FLYHT offers a comprehensive suite of hardware, software, weather sensors, and services. Specializing in Actionable Intelligence, FLYHT enables partners to improve operational efficiency, sustainability, and profitability. Known for its AFIRS 228 Satcom solutions and pioneering AFIRS Edge WQAR for 5G connectivity, FLYHT's software solutions address current challenges and prepare clients for the future in areas such as AHMS, fuel and APU usage, and fleet and turn management.

U.S. Aircraft Health Monitoring System Market Trends

U.S.'s shift toward autonomous, real-time diagnostic ecosystems driven by AI and edge computing. These technologies enable predictive failure analysis and faster onboard data processing, significantly reducing aircraft downtime and operational costs. The increased use of sophisticated sensor networks ensures superior situational awareness, while robust cybersecurity measures protect the integrity of sensitive flight data.

Asia Pacific is witnessing notable growth during the forecast period. This growth is propelled by factors such as urbanization, economic expansion, and a burgeoning middle class with increased disposable income. This region boasts some of the busiest airports worldwide, demanding top-notch efficiency and safety measures. With the substantial air traffic volume, the demand for sophisticated monitoring systems from the aircraft health monitoring system market has become paramount to ensure safety and operational excellence.

China Aircraft Health Monitoring System Market Trends

China's expanding domestic airlines and rising passenger AHMS necessitate advanced monitoring for safety and efficiency. The civil aviation administration for compliance and operational reliability, and minimizing cost and improving profitability through predictive insights.

Governments in the region are making substantial investments in modernizing existing infrastructure and procuring new aircraft, many of which are equipped with advanced health monitoring systems. Furthermore, there's extensive collaboration among governments, research institutions, and private enterprises to pioneer and integrate AHMS technologies into aviation practices. This plays an important role in the dynamics of the regional aircraft health monitoring system market.

How did Europe experience notable growth in the Aircraft Health Monitoring System Industry?

Europe's strong push for cost reduction through predictive maintenance. The integration of IoT, AI, and digital twins enables sophisticated real-time monitoring and proactive diagnostics that minimize unscheduled downtime. With increasing air traffic and a focus on sustainability, AHMS has become essential for optimizing fleet performance and reducing fuel consumption.

Germany Aircraft Health Monitoring System Market Trends

Germany's shift toward predictive maintenance powered by AI-driven autonomous diagnostics and miniaturized sensors. This transition is solidified by EASA regulatory alignment, which mandates integrated monitoring to ensure fleet-wide airworthiness and proactive fault detection.

Value Chain Analysis of Aircraft Health Monitoring System Market

- Research & Development (R&D) and Design

This foundational stage involves the conceptualization and design of AHMS solutions, including hardware (sensors, data acquisition units) and software (data analytics, AI/ML algorithms).

Key Players: General Electric (GE) Aviation, Honeywell Aerospace, Safran S.A., and Raytheon Technologies Corporation. - Raw Material Sourcing and Component Manufacturing

This stage involves the procurement of specialized raw materials, such as advanced metals, composites, and electronic components, followed by the manufacturing of individual AHMS components.

Key Players: Meggitt PLC, Curtiss-Wright Corporation, and Teledyne Controls LLC. - Assembly and Integration

Once components are manufactured, they are assembled into a complete AHMS and integrated into the aircraft's complex systems, either during initial production (line-fit) or as an upgrade to existing fleets (retrofit).

Key Players: Airbus SE, The Boeing Company, Lockheed Martin, and Embraer.

Aircraft Health Monitoring System Market Companies

- Airbus SE: As a leading aircraft manufacturer, Airbus contributes by integrating advanced, proprietary Health and Usage Monitoring Systems (HUMS) directly into its aircraft designs, using the collected data for predictive maintenance and operational efficiency across its fleet.

- Curtiss-Wright Corporation: This company provides critical data acquisition and recording solutions, including flight data recorders and sensor condition monitoring units, which are essential components for capturing and analyzing aircraft health information.

- FLYHT Aerospace Solutions Ltd.: FLYHT specializes in real-time data transmission and analysis solutions (AFIRS), allowing for the immediate streaming of aircraft health information to ground crews via satellite communication.

- GE Engine Services LLC (General Electric Company): GE's contribution focuses heavily on engine health monitoring through its powerful data analytics platform, leveraging the vast amount of sensor data generated by its engines to predict component failures and optimize maintenance cycles.

- Honeywell Aerospace: Honeywell provides a comprehensive suite of integrated Aircraft Health Monitoring (AHM) solutions that monitor various aircraft systems beyond the engine, including the Auxiliary Power Unit (APU) and avionics.

Other Major Key Players

- Meggitt Plc

- Rolls-Royce Plc

- Safran

- SITA N.V.

- The Boeing Company

Recent Developments

- In March 2025, the European Defence Agency (EDA) launched a new research project to monitor and predict the health of batteries in aircraft, known as Prognostic Health Management (PHM). The project aims to develop aircraft power systems, with a focus on hybrid aircraft and unmanned aerial vehicles (UAVs) for defense, to help support longer lifespans and high performance. The systems will help predict how long the batteries and the materials can be safely used, reducing the risk of failure. (Source: chargedevs.com )

- In April 2025, the Indian Air Force (IAF) called for industrial collaboration to develop a cutting-edge remote real-time in-flight health monitoring system. These developments reflect IFA's commitment to adopting advance technologies to safeguard its personnel, particularly in high-stress environments. (Source: idrw.org )

- In March 2025, iSurface unveiled live and intelligent composite materials for structural health monitoring of critical aircraft structures. Dr Peyman Adl, Chief Operating Officer, Z Prime, stated, “Integrated self-diagnosing Structural Health Analysis powered by AI technologies has the potential to revolutionise the design, manufacture, and deployment of critical and damage-prone components in the aerospace, turbine, and high-tech automotive sectors.”

- In March 2023, GE Aerospace and PHI Aviation launched a pilot program featuring GE's new digital engine health monitoring technology for CT7-8 engines through its industry-leading fleet support team. The objective of the program is to refine and expand the tool, eventually making it available to operators of CT7-8 and other CT7 variants. (Source: geaerospace.com )

- In June 2023, GE Engine Services LLC (General Electric Company) was selected by Korea Aerospace Industries (KAI) to supply health and usage monitoring systems (HUMS).

- In July 2022, Curtiss-Wright Corporation was awarded a contract by Airbus to provide custom actuation technology. This technology offers improved reliability over legacy systems and incorporates health monitoring functions.

- In April 2022, Lufthansa Technik announced that it had recently enhanced its AVIATAR digital platform with various new digital fleet management applications for the Boeing 737 NG (Next Generation), which are now available to 737 operators around the world.

- In March 2022, Indigo announced that it had become the 55th airline to adopt Skywise Health Monitoring (SHM) as its future fleet performance tool.

Segments Covered in the Report

By Platform

- Narrow-body Aircraft

- Wide-body Aircraft

- Regional Aircraft

- Business Jet

- Helicopter

- Fighter Jet

By Fit

- Line Fit

- Retrofit

By System

- Hardware

- Software

- Services

By Operation

- Real-time

- Non-real-time

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting