Active Phased Array Radar Market Size and Forecast 2025 to 2034

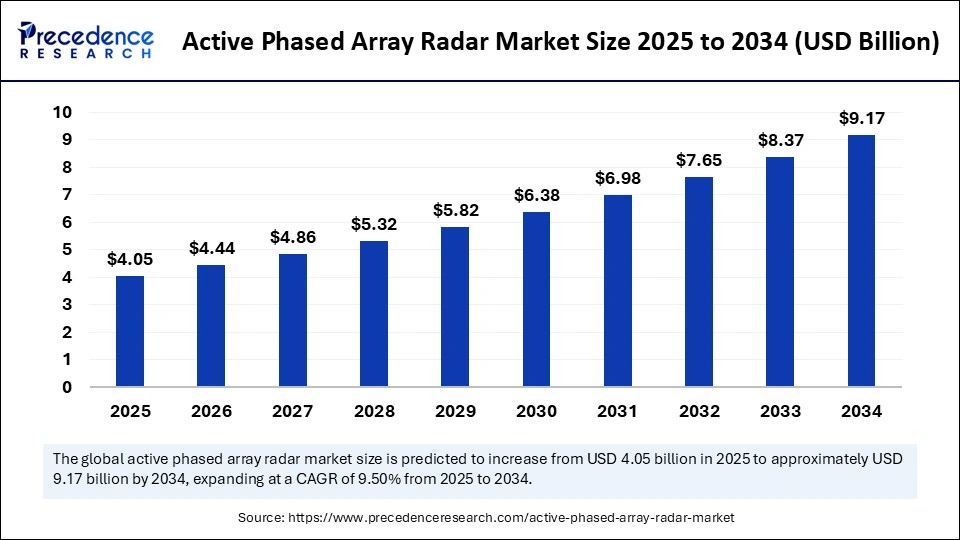

The global active phased array radar market size accounted for USD 3.70 billion in 2024 and is predicted to increase from USD 4.05 billion in 2025 to approximately USD 9.17 billion by 2034, expanding at a CAGR of 9.50% from 2025 to 2034. The market growth is attributed to increasing defense investments and technological advancements. Rising geopolitical tensions further drive the demand for advanced radar systems, including active phased array radars.

Active Phased Array Radar Market Key Takeaways

- In terms of revenue, the active phased array radar market is valued at $4.05 billion in 2025.

- It is projected to reach $9.17 billion by 2034.

- The market is expected to grow at a CAGR of 9.5% from 2025 to 2034.

- The U.S. active phased array radar market was valued at $1 billion in 2024.

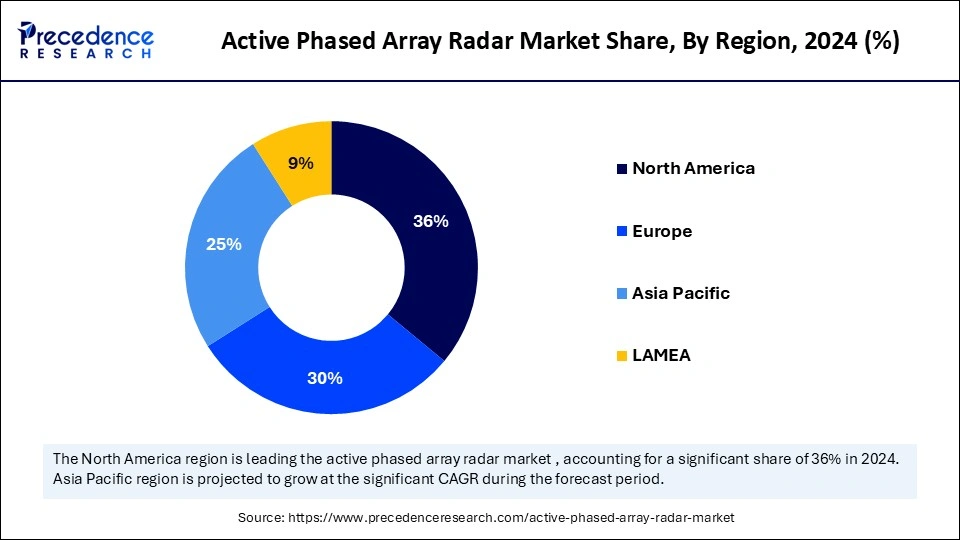

- North America dominated the active phased array radar market in 2024.

- By region, Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period.

- By platform, the land-based segment held the dominant share of the market in 2024.

- By platform, the naval segment is expected to grow at the fastest rate between 2025 and 2034.

- By frequency band, the S-band segment accounted for a considerable share of the market in 2024.

- By frequency band, the W-band segment is anticipated to grow at a notable CAGR during the assessment years.

- By function, the anti-ship warfare segment led the global market in 2024.

- By function, the early warning segment is projected to expand rapidly in the market in the coming years.

- By power output, the low power segment dominated the market in 2024.

- By power output, the high power segment is projected to grow at a significant rate in the upcoming period.

- By antenna type, the planar segment led the market with the largest share in 2024.

- By antenna type, the conformal antenna segment is expected to witness significant growth between 2025 and 2034.

Impact of Artificial Intelligence on the Active Phased Array Radar Market

Integrating AI algorithms in radar systems boosts detection and tracking capabilities, identifying multiple targets with enhanced speed. This improved accuracy provides defense and commercial sectors with advanced situational awareness. Real-time decision systems achieve better performance through machine learning models, which specifically work well in dynamic challenging operations. Through AI's predictive analytics, radar systems obtain the capability to forecast signal interference, leading to improved operational dependability.

U.S. Active Phased Array Radar Market Size and Growth 2025 to 2034

The U.S. active phased array radar market size was exhibited at USD 1.00 billion in 2024 and is projected to be worth around USD 2.53 billion by 2034, growing at a CAGR of 9.72% from 2025 to 2034.

North America led the active phased array radar market by capturing the largest share in 2024. This is mainly due increased adoption of advanced technologies, including advanced radar systems. The increased defense budgets, particularly from the U.S. further bolstered the growth of the market in the region. There is a heightened need for radar systems that center on better air and missile defense operations.

The U.S. is a major contributor to the market in North America. In 2024, the U.S. military dedicated substantial funds to modernizing its radar systems while investing heavily in advanced radar technologies designed to combat hypersonic missiles and unmanned aerial systems. A significant increase in installing active phased array radars on fighter jets, naval ships, and land-based defense systems contributes to market growth.

Asia Pacific is anticipated to witness the fastest growth during the forecast period. The growth of the market in Asia Pacific is attributed to the rising defense budget and rising geopolitical tensions among China, India, and Japan. China intensifies its radar technology investments under its military modernization program through its surveillance and missile defense system developments. India is witnessing a dramatic rise in defense expenditures, focusing on improving its naval force along with air force capabilities, boosting the need for advanced radar systems to operate effectively. Future growth of the market in Asia Pacific relies heavily on the development of domestic radar technology and APAR system integration with air defense systems.

Europe is considered to be a significantly growing area. The growth of the active phased array radar market in Europe can be attributed to the rising need for air defense. Many European countries have increased their defense budgets in the last few years for military modernization and security threat adaptation. The European Defense Fund (EDF) within the European Union aims to promote advanced radar technology cooperation for regional defense capability enhancement in 2024. The expanding UAV operations and hypersonic missile deployment further support regional market growth

Market Overview

Defense modernization programs from across the globe have become the major factor of active phased array radar market expansion. Active phased array radar (APAR) systems function with multiple antennas that transduce radio waves for target detection with electronic beam steering, which enables fast and accurate tracking abilities. The U.S. Department of Defense particularly highlighted APAR technology for law enforcement purposes, as it enhances situational tracking of new missile threats. The rising spending on radar development further supports market growth. Furthermore, the rising defense budget across the globe due to the growing concerns about national security fuels the growth of the market.

Active Phased Array Radar Market Growth Factors

- Increasing Military Modernization Initiatives: Ongoing investments in defense technology upgrades, particularly in emerging economies, are expected to drive demand for advanced radar systems, including APAR.

- Expanding Geopolitical Tensions: Heightened security concerns and the increasing need for advanced surveillance capabilities are likely to spur growth in the APAR market.

- Advancements in Radar Technology: Continuous innovations in radar systems, offering improved target detection and tracking, are projected to accelerate APAR adoption across military and civilian sectors.

- Demand for Border Security: A rising focus on border security and surveillance infrastructure is anticipated to further drive the integration of APAR systems into defense strategies.

- Advancements in Electronic Warfare: The increasing prevalence of electronic warfare tactics necessitates advanced radar solutions, driving growth in the APAR market.

- Government Defense Spending: Higher defense budgets globally, particularly in defense-heavy countries, are expected to fuel investments in radar technologies like APAR.

- Integration with Unmanned Systems: The growing use of unmanned aerial vehicles (UAVs) and autonomous defense platforms is likely to boost the demand for APAR systems with enhanced tracking capabilities.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 9.17 Billion |

| Market Size in 2025 | USD 4.05 Billion |

| Market Size in 2024 | USD 3.70 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.50% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Platform, Frequency Band, Function, Power Output, Antenna Type and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Defense Modernization Efforts

Increasing defense modernization programs are expected to drive the growth of the active phased array radar market. The demand for APAR systems grows, as defense modernization projects continue to increase. Active phased array radars have become defense priorities for global militaries, as these networks strengthen surveillance, tracking, and threat detection capabilities against changing security threats. The U.S., China, and India strongly prioritize the deployment of advanced radar systems for their next-generation military platforms. Active phased array radars deliver fast mechanical beam steering functions, enhance target multi-tracker ability, and provide superior jamming protection. During their 2024 Defense Ministers' Meeting, NATO members declared the necessity of deploying agile radar systems that maintain electronic resilience against growing aerial threats.

Restraint

Environmental Interference and Jamming Vulnerabilities

Environmental interference and vulnerability to jamming are likely to hinder the growth of the active phased array radar market. APAR systems experience performance reduction when operating in highly electromagnetic crowded environments, as they become exposed to outside interferences. Radar reliability faces risks from environmental elements, which include adverse weather, signal blocking, and intense electronic warfare (EW) conditions. Furthermore, the APAR systems may encounter limitations in hosting sustained reliability during high-threat environments because they remain exposed to interference and jamming attacks.

Opportunity

Rising Defense Budgets in Emerging Economies

Rising defense budgets in emerging economies create immense opportunities in the active phased array radar systems market. Indian, South Korean, and Brazilian militaries are continuously increasing their budget for purchasing modern military equipment and improved defensive abilities. Market opportunities exist for APAR technology, as defense infrastructure growth provides nations with a chance to acquire advanced radar systems for air defense and missile protection, military surveillance, and border protection needs. The Indian government planned to enlarge its defense financing in 2024 while directing funds toward air defense and surveillance systems, which established a favorable environment for APAR technology adoption.

Platform Insights

The land-based segment dominated the active phased array radar market in 2024. Land-based radar systems serve as essential components for missile defense, border surveillance, and airspace monitoring functions. National defense organizations heavily prefer ground-based radar systems for air defense and border surveillance. Furthermore, increased air defense system development significantly increased the need for land-based systems for worldwide air force protection.

The naval segment is expected to grow at the fastest rate in the coming years. Naval radar systems enhance threat detection capabilities, navigation systems, and defense strategies. The adoption of APAR systems in vessels has increased in the last few years due to the rising geopolitical tensions that exist in both the South China Sea and Indo-Pacific regions. Moreover, the U.S. Navy fleet modernization initiatives involve APAR system installation on its new destroyers and submarines, which position the naval as a rapidly growing market segment.

Frequency Band Insights

The S-band segment held the largest share of the active phased array radar market in 2024. S-Band radar systems excel in medium-range situations, as they provide both satisfactory range capabilities and sufficient resolution quality. In 2024, the Federal Aviation Administration of the U.S. declared that S-Band radar systems are necessary for air traffic control duties and weather observation operations at major American airports. Furthermore, the adoption of S-Band has increased in the last few years because of its weather forecasting capabilities, which enable operations in rain and fog conditions.

The W-band segment is anticipated to grow at a notable CAGR during the assessment years, owing to its ability to deliver precise radar imaging, which is beneficial for advanced military systems and commercial applications. W-Band functions with superior frequency patterns in comparison to S-Band, making it suitable for demanding applications. The rising demand for precision in performance tracking in short-range radar systems further creates demand for modernized W-band radar instruments within UAVs, automotive solutions, and missile protection systems, contributing to segmental growth.

Function Insights

The anti-ship warfare segment dominated the active phased array radar market in 2024. This segment employs active phased array radars, which maintain real-time target detection alongside precision targeting abilities. Such radars serve numerous destroyers, frigates, and coastal defense systems to track down and eliminate possible maritime assaults. Furthermore, there is a significant increase in defense spending worldwide, as nations are placing emphasis on protecting their exclusive economic zones with fundamental maritime infrastructure, bolstering the growth of the segment.

The early warning segment is projected to expand rapidly in the market in the coming years. The growth of the segment can be attributed to the rising government spending to improve defense infrastructure and the increasing need for quick threat identification. Early warning radar systems operate as critical elements that identify missile threats and airspace violations. They detect airborne threats throughout extended ranges. The rising deployment of defense systems that depend on early warning technology for missile defense and border surveillance is expected to drive the segment's growth.

Power Output Insights

The low power segment held the largest share of the active phased array radar market in 2024. Low-power radar systems serve various applications requiring both lengthy detection ranges and minimal energy usage. Radar systems using low power are heavily preferred in commercial environments such as air traffic monitoring and military operations. Radar systems achieve efficient performance through reduced power requirements and heat production design factors. Moreover, low-power systems' cost-effectiveness and compact design contribute to their increased utilization.

The high power segment is projected to grow at a significant rate in the upcoming period. Radar systems with high power capacity find their primary applications in missile defense and ballistic missile tracking. The high energy output enables detection ranges for distant or low-altitude targets. Furthermore, multiple defense agencies, including NATO and the U.S. Department of Defense, have started implementing higher-powered radar systems in 2024 to boost their missile defense capabilities and expand their surveillance zones.

Antenna Type Insights

The planar segment led the active phased array radar market in 2024. Planar antennas have adaptable design and exceptional performance capabilities. Flat antennas, also known as planars, represent major radar system applications for their cost-effective design and compact operational requirements. The Federal Aviation Administration (FAA) maintains planar antennas as crucial systems in air traffic management due to their dependable operational efficiency throughout 2024. Furthermore, the real-time data processing systems and smart transportation needs in air traffic control have boosted the adoption of planar antennas.

The conformal antenna segment is expected to witness significant growth during the projection period. Conformal antennas deliver drag reduction while maintaining aerodynamics. This makes them appropriate for low-observable or stealth applications. These antennas fit seamlessly into the host platform structure. These antennas are suitable for applications where low visibility and stealth are essential. Furthermore, the rising need for stealth and multi-functional systems propels the adoption of conformal antennas.

Active Phased Array Radar Market Companies

- Thales Group

- Selex ES

- Saab

- Raytheon Technologies

- Lockheed Martin

- Leonardo S.p.A.

- L3Harris Technologies

- Kongsberg Gruppen

- Indra Sistemas

- China Electronics Technology Group Corporation

- CEIEC

- BAE Systems

- Aselsan

- Airbus Group

Recent Developments

- In March 2025, India's Ministry of Defence (MoD) signed a ₹2,906 crore contract with Bharat Electronics Limited (BEL) for the procurement of the Low-Level Transportable Radar (LLTR), Ashwini. This active electronically scanned phased array radar is based on advanced solid-state technology and is capable of detecting and tracking high-speed aircraft, UAVs, and helicopters. Designed by DRDO's Electronics and Radar Development Establishment, Ashwini is expected to enhance the Indian Air Force's operational readiness. The contract was formalized in the presence of Defence Secretary Rajesh Kumar Singh.

- In February 2025, Saab announced the launch of its Coast Control Radar at the International Defence Exhibition and Conference (IDEX) in the UAE. This next-generation, software-defined, non-rotating phased-array radar is designed to safeguard territorial waters and maritime traffic. Its compact and modular build enables accurate tracking of small vessels under demanding coastal conditions, addressing maritime security and sovereignty priorities.

- In October 2024, Numerica Corporation introduced its Spark Radar, an advanced, wideband hemispheric radar platform designed for multi-mission roles. Spark supports Active Protection Systems (APS), Short-Range Air Defense (SHORAD), and counter-uncrewed aircraft systems (C-UAS). It enhances vehicle defense capabilities against threats such as RPGs, anti-tank guided missiles (ATGMs), one-way attack drones, FPV aircraft, and top-attack UAS, offering a unified solution to evolving battlefield threats.

- In May 2024, General Radar Corporation, a U.S.-based developer of high-resolution and long-range multi-mission AESA (Active Electronically Scanned Array) radars, introduced a transformative and cost-effective radar solution. This launch aims to enhance detection and tracking of airborne targets, including aircraft, drones, cruise missiles, balloons, and other emerging threats, serving both commercial and government sectors.

Segments Covered in the Report

By Platform

- Airborne

- Land-Based

- Naval

- Spaceborne

By Frequency Band

- X-Band

- W-Band

- S-Band

- Ka-Band

- C-Band

By Function

- Early Warning

- Ballistic Missile Defense

- Anti-Ship Warfare

- Air Traffic Control

By Power Output

- Medium Power

- Low Power

- High Power

By Antenna Type

- Planar

- Phased Array

- Conformal

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting