Space Radar Market Size and Forecast 2025 to 2034

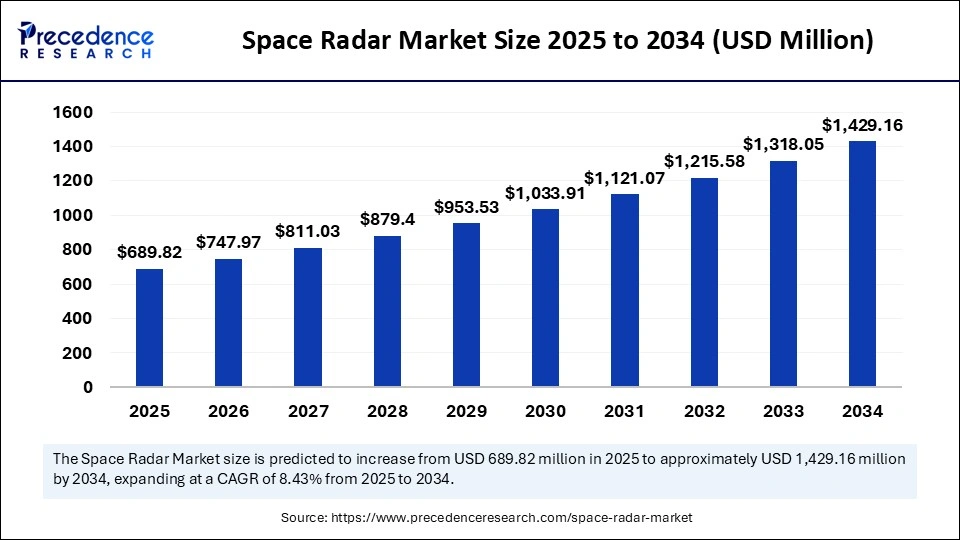

The global space radar market size accounted for USD 636.19 million in 2024 and is predicted to increase from USD 689.82 million in 2025 to approximately USD 1,429.16 million by 2034, expanding at a CAGR of 8.43% from 2025 to 2034. The market growth is attributed to the escalating integration of advanced radar technologies in satellite missions for enhanced all-weather, day-and-night Earth observation capabilities.

Space Radar MarketKey Takeaways

- In terms of revenue, the space radar market is valued at $689.82 million in 2025.

- It is projected to reach $1,429.16 million by 2034.

- The market is expected to grow at a CAGR of 8.43% from 2025 to 2034.

- North America dominated the global space radar market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR between 2025 and 2034.

- By type, the synthetic aperture radar segment held the major market share in 2024.

- By type, the doppler radar segment is projected to grow at the highest CAGR during the forecast period.

- By application, the earth observation segment contributed the biggest market share in 2024.

- By application, the weather forecasting segment is expected to expand to a significant CAGR in the coming years.

- By platform, the satellite-based segment captured the largest market share in 2024.

- By platform, the airborne platforms segment is expected to grow at a rapid pace over the projection period.

- By frequency band, the X-band segment generated the major market share in 2024.

- By frequency band, the L-band segment is expected to grow at a notable CAGR from 2025 to 2034.

- By end-user, the defense and security segment held the biggest 2024.

- By end-user, the government and commercial segment is expected to grow at the fastest CAGR in the upcoming period.

Market Overview

There is a high need for around-the-clock monitoring of the Earth and climate. This makes synthetic aperture radar (SAR) a top focus for national space agencies due to its strong ability to produce high-resolution images under different weather and lighting conditions. Space SAR uses radio waves to observe the ground closely, giving detailed and three-dimensional results, whether it is day or night, or if there are clouds nearby. NASA and the Indian Space Research Organisation (ISRO) is set to launch the NISAR (NASA-ISRO Synthetic Aperture Radar) satellite mission in 2025. The new NISAR project will scan nearly all of Earth's land and ice surfaces twice every 12 days. Furthermore, the increasing international disputes and the importance of watching any situation from space lead to increased investment in advanced spaceborne radar technology, supporting market growth.

(Source: https://science.nasa.gov)

Impact of Artificial Intelligence on the Space Radar Market

Artificial intelligence (AI) algorithms are now incorporated into orbiting radar systems by engineers and researchers to enhance the detection of changes across the Earth. Such intelligent systems look at radar readings better and let analysts assess the weather, military maneuvers, and any probable disasters. A high number of government and business space organizations are using AI to spot slight shifts in the landscape, ice sheets, or unusual movements of satellites. Moreover, a combination of AI and radar is boosting advances in Earth observing, space surveillance, and national security, so AI is a central element of future spaceborne radar projects.

Space Radar MarketGrowth Factors

- The rising frequency of natural disasters is fueling the demand for space-based radar imaging to support rapid emergency response.

- Surging investment in AI-powered onboard analytics is propelling real-time SAR data processing capabilities.

- Expanding maritime activities are boosting radar satellite applications in ocean surveillance.

- Growing space privatization is driving commercial partnerships in radar satellite development and operations.

- Accelerating the space race among emerging economies is spurring national radar satellite launch programs.

- Increasing focus on precision agriculture is enhancing the use of radar satellites for crop monitoring and land use mapping.

- Advancements in miniaturized radar payloads are enabling cost-effective deployment of SAR satellites in low Earth orbit.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,429.16 Million |

| Market Size in 2025 | USD 689.82 Million |

| Market Size in 2024 | USD 636.19 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.43% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Platform, Frequency Band,End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Need for Earth Observation and Environmental Monitoring

The increasing need for earth observation and environmental monitoring is expected to drive the growth of the space radar market. More need for studying Earth and its environment is expected to lead to the use of improved space radar technologies. Governments and scientific organizations often rely on spaceborne synthetic aperture radar for its high accuracy and ability to work well in any weather. Spaceborne synthetic aperture radar helps monitor deforestation, glaciers, the ocean's currents, and the state of the soil. Continuous surveillance has been achieved since these systems provide unstoppable data collection throughout the year. Both NASA and the European Space Agency (ESA) put a lot of effort into satellite radars, including NISAR and Sentinel-1, to play a role in climate research and disaster planning. According to ESA, in 2024, Sentinel-1 satellites delivered about two million square kilometers of radar data every week for fast action on dealing with floods and changes in land use. Furthermore, relying on radar data from space is helping in both civilian and defense sectors and encouraging more countries to switch to satellite monitoring, thus further boosting the market.

Restraint

High Development and Launch Costs

High development and launch costs are expected to limit the expansion of space radar infrastructure, hindering market growth. The cost of developing and launching space radar restricts infrastructure improvements and wider accessibility. Further operations costs are increased by launch vehicle integration, set-up of ground control systems, and buying insurance coverage. Building the NISAR mission has taken years because of the involvement of multiple agencies and the high costs of radar equipment. Financial constraints also make it difficult for small firms to enter the market, which slows down the deployment of more radars worldwide.

Opportunity

Growing Military and Defense Investments

Growing military and defense investments are anticipated to create immense opportunities for players competing in the space radar market. Intensified spending in the military and defense sectors is predicted to speed up the use of satellites with radar technology. Both state and international organizations are continuously building and upgrading satellites to track ballistic missiles and watch over competition in space-related regions. The military is using space radar more to ensure continued intelligence, surveillance, and reconnaissance services in weather conditions. The U.S. Space Force's Radar Constellation Program has been designed to spend a lot of money on future radar satellite services. The Department of Defense stated in 2024 that it is enhancing its orbital surveying by launching SBSS FO, a system that broadens space surveillance capacities and aims to detect orbiting threats with new and improved radar gadgets. Furthermore, as a result of these global efforts, the world's dependence on space-based radar systems for defense and keeping technological superiority over others has increased, further propelling the market.

Type Insights

The synthetic aperture radar segment dominated the space radar market with the largest revenue share in 2024 due to its ability to produce high-resolution images in all weather situations. To ensure continuous observation of the Earth, environmental monitoring, and disaster management, agencies and scientific bodies prioritized SAR deployment in 2024. Furthermore, the dual-use functionality and technical superiority of this technology further fuel the segment. The versatility of SAR further bolstered the segmental growth.

The doppler radar segment is projected to grow at the highest CAGR during the forecast period. This is mainly due to the increasing number of objects in space and the critical need for countries to monitor orbiting objects. Doppler radar systems help measure changes in objects' velocities and follow high-speed objects. Together with the ESA, EUSPA built and launched two small satellites for testing Doppler radar technology as part of the Horizon Europe 2024 program, meant to improve the ability to avoid collisions. Moreover, these improvements mean doppler radar is essential for better targeting, real-time measurement of speed, and effective control of satellites as the space environment gets more advanced.

Application Insights

The earth observation segment dominated the space radar market with the largest revenue share in 2024. This is mainly due to the increased importance of space radar in Earth observation. Countries and international groups increasingly rely on SAR satellites to watch changes in land structures, melting of glaciers, forest cover losses, and urban growth. Because clouds and darkness did not affect the capability of producing images, SAR systems allowed for lasting observations of the environment. Additionally, with extensive agency collaborations and diverse applications, this segment continues to lead the space industry.

The weather forecasting segment is expected to expand at a significant CAGR in the coming years due to unpredictable weather and the need for correct atmospheric data. Using radar, satellites are able to monitor the atmosphere all the time and support forecasting of cyclones, severe rainfall, and how snow accumulates. Other than that, global disaster management groups often put a strong focus on radar for early warning, especially in areas where floods or rainy seasons cause serious problems. The Indian Space Research Organization announced in 2024 that it has completed reviews for an upcoming radar satellite meant to observe storms and aid forecasts of the monsoon season.

(Source: https://www.isro.gov.in)

Platform Insights

The satellite-based segment dominated the space radar market by capturing a major revenue share in 2024. This is mainly due to the increased need for large-scale Earth observation, environmental monitoring, and active defense efforts. Satellite platforms, with their wide and unbroken territory coverage, are suitable for taking global images in every type of place and weather. It is possible to keep collecting data on glacial movement, deal with floods, and check on the health of crops through these platforms. Furthermore, the increased reliance of the military on satellites for strategic intelligence propelled the segment.

The airborne platforms segment is expected to grow at a rapid pace over the projection period due to its swift deployment, flexibility, and high usage in regional and tactical reconnaissance. Radar systems deployed on aircraft and unmanned drones provide quick, accurate, and detailed images over a targeted region since they are closer to the earth. This capability is useful for border surveillance, disaster response, and border security in conflict zones.

Frequency Band Insights

The X-band segment dominated the space radar market with the largest revenue share in 2024 as it is preferred for detailed imaging and sophisticated surveillance in the military sector. Shorter wavelengths in this frequency band make it possible to detect small things on Earth, including surface movements and building changes. Both ESA's TerraSAR-X and Italy's COSMO-SkyMed have made use of X-Band SAR systems for different defense, environmental, and emergency needs. Moreover, the increased focus on real-time, high-resolution Earth observation solidified the X-Band's position as the leading frequency band in the market.

The L-band segment is expected to grow at a notable CAGR during the assessment years. Since L-Band waves are longer than higher-frequency varieties, they are able to go through vegetation, forest roofs, and topsoil. That is why they are especially useful for finding biomass growth, measuring soil moisture, and checking the geology of the soil underground. The NISAR mission supports large-scale climate and ecosystem studies on Earth by using L-band in 2025. In 2024, ISRO announced that L-Band data from NISAR be combined into the development of India's agricultural policies. Because more attention is being given to ecosystems and land resources, the need for L-band frequency is expected to rise.

End-User Insights

The defense and security segment dominated the global market with the largest share in 2024 due to the growing tension between nations and the requirement for border security. Governments worldwide have been investing in SAR satellites for real-time intelligence, surveillance, and reconnaissance, mainly in areas that are disputed or hard to reach. Space forces in the U.S. and the NRO put together radar-equipped satellites to detect missiles, follow opponents' movements, and guard satellites in orbit.

The government and commercial segment is expected to grow at the fastest CAGR in the upcoming period, owing to the higher need for environmental monitoring, urban planning, and infrastructure analysis. Government agencies and commercial users are turning to space radar data for land use planning, disaster response, and climate change adaptation. In 2024, the European Space Agency showed that Sentinel-1 data used through Copernicus increased, providing valuable information to over 70,000 global users.

Regional Insights

What Made North America the Dominant Region in the Space Radar Market?

North America registered dominance in the market by capturing the largest revenue share in 2024 due to significant investments in space-based science and security programs. Synthetic aperture radar (SAR) was still given priority by the U.S., through NASA, the U.S. Space Force, and the National Reconnaissance Office (NRO), for military use, monitoring disasters, and environmental protection. In anticipation of the 2025 launch of the NISAR mission, a collaborative project between NASA and ISRO, the agencies worked together to create global radar maps every fortnight in order to study the earth's crust and its biomass.

The U.S. Department of Defense updated its Defense Space Strategy Implementation Plan, outlining a bigger radar satellite system designed to provide more comprehensive warning capabilities. The NGA reported an increased utilization of commercial SAR data for accurate targeting and providing assistance in humanitarian emergencies. The Space Force's development of the Silent Barker mission enhances the force's ability to monitor space from orbit. This combined effort, involving civil, defense, and commercial sectors, has strengthened North America's position in both technology and operational capabilities.

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period, driven by advancements in space activities and a heightened focus on regional security. In 2024, ISRO completed the testing of RISAT-1A, a satellite that enhanced India's radar capabilities for seasonal weather forecasting and military operations. China launched the L-SAR 01B satellite in 2024 to monitor geological hazards and land subsidence. The United Nations Office for Outer Space Affairs (UNOOSA) noted in its report that the Asia-Pacific is expanding its role in sustainable Earth observations through SAR operations.

The Asia-Pacific Space Cooperation Organization (APSCO) facilitated collaborative use of radar data among countries for environmental and agricultural applications. With several Asia-Pacific nations increasingly relying on their own technological resources and utilizing SAR tools across various sectors, market development in the region is expected to accelerate."

Europe is expected to grow at a notable rate in the upcoming years, supported by robust investment in Earth observation and defense activities. The European Space Agency (ESA) advanced SAR capabilities through its Copernicus program, funding the Sentinel-1 satellite series. In 2024, the European Union Agency for the Space Programme (EUSPA) allocated additional funding to enhance dual-use radar tools for border monitoring and crisis management within both the Galileo and Copernicus projects. European countries also collaborated, linking Germany's DLR with France's CNES to develop high-resolution radar payloads focused on environmental protection and safety.

The European Maritime Safety Agency (EMSA) utilized SAR imagery to monitor over 5,000 vessels monthly, adhering to heating and navigation regulations. These radar applications, leveraging space data, are integral to Europe's climate and maritime security strategies. Sustained financial support, collaborations between public and private entities, and close cooperation across Europe are expected to bolster space radar market's growth within Europe.

Space Radar Market Companies

- AIRBUS

- BAE Systems

- Boeing

- Capella Space

- Denel Dynamics

- ICEYE

- Leonardo S.p.A.

- Lockheed Martin Corporation

- NEC Corporation

- Northrop Grumman

- RTX

- Saab AB

- Thales

Latest Announcement by Industry Leader

- In May 2025, XDLINX Space Labs, a leading provider of end-to-end satellite solutions for global commercial and defense intelligence, surveillance, and reconnaissance (ISR) missions, has entered a strategic partnership with Sisir Radar, a pioneer in synthetic aperture radar (SAR) technology. Together, the companies will develop India's first privately built L-band SAR satellite, powered by Antaris software, with a launch planned by 2027. “This partnership marks a significant milestone in our journey to democratize access to advanced radar imaging,” said Dr. Tapan Misra, Founder and Chief Scientist of Sisir Radar. “By combining our expertise in SAR technology with XDLINX's agile satellite platforms, we're setting new benchmarks for what private industry can achieve in space.” Rupesh Gandupalli, Co-Founder and CEO of XDLINX Space Labs, added, “At XDLINX, our mission is to accelerate space innovation through modular and scalable satellite solutions. Collaborating with Sisir Radar enables us to embed next-generation SAR capabilities into our platforms, opening new frontiers for strategic applications and Earth observation. We are proud to contribute to advancing India's space ecosystem, driven by a shared vision of innovation.” This initiative represents a critical step forward in bolstering indigenous capabilities and elevating India's position in the global SAR imaging landscape.

(Source: https://xdlinx.space)

Recent Developments

- In May 2025, India continues to strengthen its Earth observation and radar satellite capabilities through high-profile international collaborations and climate-focused missions. ISRO Chairman Dr. V. Narayanan announced the scheduled launch of the much-anticipated NASA-ISRO Synthetic Aperture Radar (NISAR) mission. This satellite carries two advanced payloads—one developed by NASA and the other by ISRO—designed for detailed microwave remote sensing. NISAR is expected to monitor Earth's surface deformation and ecosystem disturbances with unprecedented accuracy, supporting disaster response, agricultural planning, and environmental research. (Source: https://www.newsonair.gov.in)

- In May 2025, Japan's commercial space radar segment gained momentum in 2025 through targeted satellite deployments and a strategic constellation roadmap. The launch placed the payload into a 575-kilometer circular orbit with a 42-degree inclination, enhancing the company's imaging capabilities. QPS-SAR-10 is the tenth satellite launched by iQPS, marking its continued progress despite earlier setbacks, including launch vehicle failures in 2022. iQPS aims to expand its constellation to 24 satellites by 2027 and ultimately to 36, offering frequent revisit times and high-resolution radar imaging for urban infrastructure analysis, disaster monitoring, and maritime awareness. (Source: https://www.newsonair.gov.in)

- In November 2024, China is rapidly scaling its state-directed radar satellite operations to support national mapping, surveillance, and environmental objectives. The China Aerospace Science and Technology Corporation (CASC), through its subsidiary Shanghai Academy of Spaceflight Technology (SAST), launched two radar-equipped satellites—SuperView Neo-2 03 and 04—onboard a Long March 2C rocket from Jiuquan Satellite Launch Center. The strategic expansion of China Siwei's SAR infrastructure showcases the nation's continued investment in dual-use technologies that support both economic planning and national security initiatives, further intensifying regional competition in orbital radar systems. (Source:https://spacenews.com)

Segments covered in the report

By Type

- Synthetic Aperture Radar

- Doppler Radar

By Application

- Earth Observation

- Weather Forecasting

- Disaster Management

- Others

By Platform

- Satellite-Based

- Airborne Platforms

By Frequency Band

- X-Band (8-12 GHz)

- C-Band (4-8 GHz)

- L-Band (1-2 GHz)

- Ku, Ka, and V Bands

By End User

- Defense and Security

- Government and Commercial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting