What is the Space Sensors and Actuators Market Size?

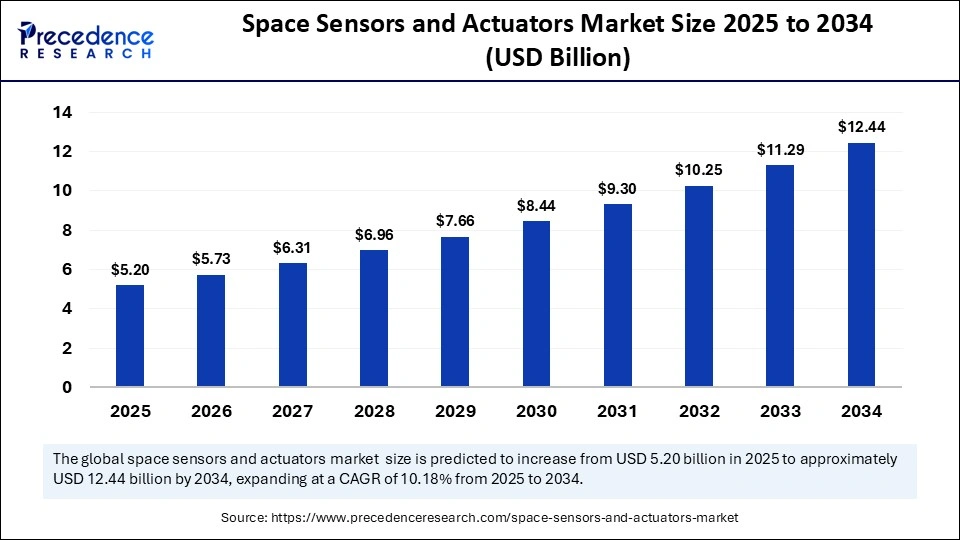

The global space sensors and actuators market size accounted for USD 5.20 billion in 2025 and is predicted to increase from USD 5.73 billion in 2026 to approximately USD 12.44 billion by 2034, expanding at a CAGR of 10.18% from 2025 to 2034. The market for space sensors and actuators is witnessing unprecedented growth, driven by rapid advancements in space technologies that are increasing demand for reliable sensor and actuator components.

Market Highlights

- North America dominated the market, holding the largest market share in 2024.

- The Asia-Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By product type, the sensors segment contributed the highest market share in 2024.

- By product type, the actuators segment is growing at a remarkable CAGR between 2025 and 2034.

- By platform, the satellites segment recorded the biggest market share on 2024.

- By platform, the rovers/spacecraft landers segment is expected to grow at a significant CAGR between 2025 and 2034.

- By end user, the government and defense segment held the major market share in 2024.

- By end user, the commercial segment is expected to expand at a remarkable CAGR between 2025 and 2034.

The Space Industry: Accelerating Growth in the New Space Age

Space sensors and actuators are essential components widely used to monitor and control actions. Sensors gather data on various parameters, including position and orientation, system health, and environmental factors such as temperature, pressure, radiation, and micrometeoroid sensors. Actuators receive commands and perform physical actions, such as attitude adjustment, deployment, and thermal control. The combined function of the space sensor and actuator is fundamental to an intelligent system.

Sensors perceive data and collect information from the environment, while actuators perform actions based on the processed data. This enables autonomous operations, where real-time human control is impossible, such as deep-space exploration.

How AI Is Accelerating Innovation in Advanced Sensing and Control Systems

In the rapidly evolving technological landscape, the integration of Artificial Intelligence (AI) holds great potential to accelerate the growth of the space sensors and actuators market. Artificial Intelligence (AI) with space sensors and actuators is significantly transforming spacecraft operations by enabling increased efficiency, autonomy, and reliability, especially for deep-space missions.

Machine learning and computer vision enable systems such as the Mars rovers to effectively analyze images from onboard cameras, create 3D maps, detect potential hazards, and autonomously plan optimal paths. An AI-powered system drives smart actuators to execute complex, adaptive physical actions with high precision. AI-based controllers can accurately adjust a satellites orientation in real time to respond to environmental disturbances.

Space Sensors And Actuators Market Outlook

Between 2025 and 2030, the industry is expected to grow rapidly. The market is driven by rising demand for autonomous spacecraft, advances in miniaturized and radiation-hardened components, increased government investments in space exploration, and growing demand from the commercial space sector. This growth is supported by the increasing use of autonomous navigation and onboard decision-making in missions such as NASAs Mars Sample Return campaign and ESAs Hera planetary defense mission, both of which rely on advanced sensing units and fault-tolerant actuators.

Several leading players in the space sensors and actuators market, including Teledyne Technologies, Honeywell International Inc., Airbus, Safran, and Moog Inc., are expanding their global presence through a variety of strategies, including introducing new technologies and products, pursuing partnerships and collaborations, and expanding facilities. For instance, in June 2025, Moog Inc. reached a significant milestone in its comprehensive building expansion project. The company has completed its new electromechanical actuation facility to enhance its manufacturing capabilities for space and defense customers that need precision steering in the most demanding domains. This customer-focused expansion at Moog headquarters in East Aurora addresses the growing need for innovative precision actuation and avionics systems to control and steer launchers.

Governments and defense agencies are increasingly investing in advanced satellite technology for intelligence, surveillance, reconnaissance (ISR), and missile-tracking systems, thereby accelerating market growth over the forecast period. For instance, in September 2025, Spanish startup Kreios Space, whose breakthrough technology allows satellites to operate in Very Low Earth Orbit (VLEO), announced €8M seed financing to bring satellites closer to Earth and Europe closer to strategic autonomy. It is led by the NATO Innovation Fund and JOIN Capital. This financing marks the largest-ever European round in Very Low Earth Orbit technology.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.20 Billion |

| Market Size in 2026 | USD 5.73 Billion |

| Market Size by 2034 | USD 12.44 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.18% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Platform, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Space Sensors And Actuators Market Segmental Insights

Product Type Insights

The sensors segment held the largest market share in 2024. The segment includes pressure sensors, humidity/temperature sensors, GPS sensors, attitude measurement, vacuum-ultraviolet photodetectors, proximity sensors, and gravity sensors. Sensors are designed to detect and measure various physical conditions in space, such as pressure, temperature, position, velocity, magnetic fields, and radiation. Sensors gather information in real time, enabling the interconnection between the physical world and digital networks.

On the other hand, the actuators segment is expected to grow at a remarkable CAGR between 2025 and 2034. The segment includes linear actuators and rotary actuators. Actuators convert electrical signals into mechanical force. The segments growth is driven by the increase in satellite launches, particularly large LEO constellations, which in turn drive demand for compact and reliable actuators. The need for precise attitude control, solar array deployment, antenna positioning, and propulsion system adjustments in modern spacecraft increases the use of both linear and rotary designs. Larger satellite batches from programs such as mass-produced communication constellations require standardized actuator units with higher durability and lower power consumption. Government space agencies and commercial operators also prefer actuators with enhanced radiation tolerance and longer operational lifetimes, which pushes manufacturers to improve materials, motor efficiency, and thermal stability.

Platform Insights

Satellites: The satellites segment dominates the space sensors and actuators market, accounting for the majority of the market share. The segments growth is driven by the surge in satellite constellations (LEO and GEO) for applications such as earth observation, communication, and scientific research. Moreover, ongoing modernization efforts in the defense sector, including the use of satellites for surveillance and reconnaissance, are expected to boost demand for advanced space sensors.

Rovers/Spacecraft Landers: The rovers/spacecraft landers segment is the fastest-growing in the space sensors and actuators market. The segments growth is driven by the global resurgence in lunar and Martian exploration, the growing demand for advanced autonomy in deep-space missions, rapid technological advancements in autonomy and power systems, and rising government and private investment.

Interplanetary Spacecraft & Probes: The interplanetary spacecraft & probes segment is anticipated to expand at a considerable rate and is poised for significant growth, owing to increasing mission activity from national space agencies and new commercial players support this trend, especially as programs focus on Mars, the Moon, asteroids, and the outer planets. Scientific instruments carried by these missions require high precision, which increases the importance of advanced sensing systems, thermal control units, and radiation-resistant components that can operate for long periods without human intervention.

End Users Insights

The government and defense segment is dominating the space sensors and actuators market, owing to rising investments in space missions. Government agencies like NASA (the US National Aeronautics and Space Administration) and the ESA (European Space Agency) are leading ambitious lunar and deep-space missions that require efficient, reliable sensors and actuators. Several defense agencies around the world are increasingly deploying large, distributed constellations of small satellites to enhance resilience against potential attacks.

The commercial segment is set to see the fastest growth in the space sensors and actuators market during the forecasted period, owing to rising private investment in satellite constellations, launch services, and new space ventures such as space tourism and in-orbit services. Several commercial companies are increasingly focusing on using high-performance, efficient, and scalable components to lower the overall cost of space missions. The commercial sector is seeing a rise in satellite constellations, which increases the need to develop advanced sensors and actuators to support them and ensure smooth satellite communication.

Space Sensors And Actuators Market Regional Insights

North America dominates the space sensors and actuators market, accounting for the majority of revenue. The regions growth is attributed to the rising investment in space exploration, an increase in satellite constellations, a surge in defense space programs, and rapid technological advancements in satellite technology. Moreover, the increasing demand for lightweight, compact, reliable, and radiation-hardened components is expected to drive regional growth during the forecast period. Strong participation from government agencies, established aerospace manufacturers, and commercial launch providers further reinforces this position.

Expanding low-earth-orbit and medium-earth-orbit deployments, along with next-generation Earth observation, weather monitoring, and communication satellites, creates a consistent demand for advanced sensors that support navigation, attitude control, and environmental monitoring. Defense organizations in the region continue to prioritize space-based intelligence and surveillance capabilities, which boosts the need for high-precision actuators and resilient sensing systems. Continuous innovation in materials engineering, microelectronics, and propulsion system design also supports the development of components that offer higher efficiency and longer operational lifetimes.

The United States space sensors and actuators market is the major contributor to the growth of the North American region, fuelled by a robust aerospace ecosystem, increasing investment in deep space missions led by NASA, a surge in satellite deployments, rising advancement in miniaturization, increasing government focus on defense modernization, and a rapidly expanding commercial space sector. The country heavily invests in research and development, particularly in areas such as miniaturization, AI integration, and radiation-hardened components, which are vital to advanced space missions.

The ARCSTONE hyperspectral instrument was successfully launched from Vandenberg Space Force Base aboard the SpaceX Transporter 14 mission in June 2025. First contact with the satellite was made approximately 2.5 hours later. This research mission aims to improve the accuracy of data recorded by many satellites, including data already collected, while also reducing costs for future satellite-based instruments.

Asia Pacific is the fastest-growing region in the space sensors and actuators market, driven by ambitious national space programs, rising government funding for space missions, expanding satellite launches and constellations, and a rapidly growing commercial space sector. Countries like India, China, and Japan are at the forefront of accelerating the expansion of the space sensors and actuators industry in the region. These countries are increasing investments in launch vehicle development, interplanetary missions, and advanced Earth observation programs, which strengthens demand for high-performance sensors and actuators.

The rise of private launch service providers and small satellite manufacturers across the region further contributes to the need for components that offer high accuracy, low mass, and long-term durability. Growing interest in navigation systems, climate monitoring, and national security applications encourages continuous upgrades in sensing technologies and spacecraft mechanisms. Regional supply chains are also expanding as local manufacturers develop capabilities in microelectronics, precision engineering, and radiation-resistant materials.

How Is India Transforming the Space Sensors and Actuators Market?

The Indian market for space sensors and actuators is experiencing significant growth, supported by the established presence of the military & defense sector, rising government space budgets, the increasing frequency of space exploration missions, and the growing demand for miniaturized, AI-enabled, and highly precise sensors and actuators. The country has allocated substantial funds for satellite development, deep space exploration, and defense-related space applications, which propel the growth of the space sensors and actuators sector during the forecast period.

Indias national space programs continue to expand, with a strong pipeline of missions in Earth observation, navigation, lunar exploration, and planetary science, thereby increasing the need for high-accuracy sensing technologies. The rising production of small satellites and the development of reusable launch vehicles encourage the adoption of lightweight components that support efficient power use and long-duration operation. Defense agencies are also strengthening their focus on space-based surveillance, communication, and situational awareness, underscoring the need for rugged sensors and actuators designed to operate in challenging orbital environments.

Europe holds a notable market share in the space sensors and actuators market due to significant investment in the European Space Agency (ESA) and national agencies, which drive demand through scientific research, Earth observation, and exploration missions. Recent ESA programs illustrate this demand. The Juice mission, launched in 2023 and designed to study the icy moons of Jupiter, relies on high-precision star trackers, reaction wheels, thermal control actuators, and multispectral sensors to support long-distance navigation and deep-space operations.

Earth observation missions under the Copernicus program, including Sentinel 1, Sentinel 2, Sentinel 5P, and the upcoming Sentinel Expansion missions, require advanced imaging sensors, magnetic torquers, gyroscopes, and mechanical actuators for instrument pointing and data acquisition. Euclid, launched in 2023, uses fine guidance sensors and high-stability mechanisms to map dark matter and dark energy, increasing demand for ultra-stable attitude control components across Europe.

German Space Sensors and Actuators Market Trends

The German space sensors and actuators market is experiencing significant growth. The market is driven by increasing satellite deployments and deep space exploration programs, strong government investment, and a growing domestic commercial space sector. Germanys expertise is leading to advances in miniaturized, high-performance, radiation-hardened components. Such factors are propelling the growth of the space sensors and actuators market during the forecast period.

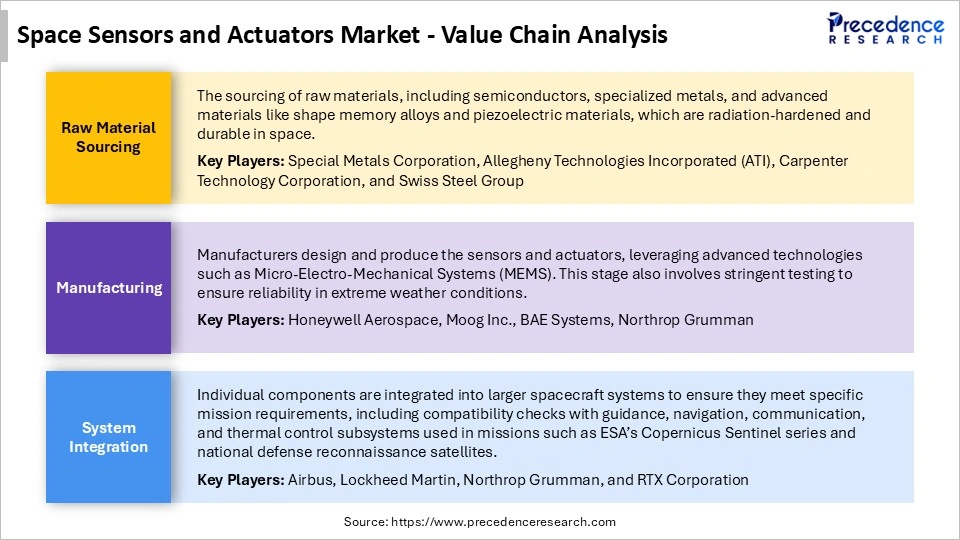

Space Sensors and Actuators Market Value Chain

Space Sensors and Actuators Market Companies

A major aerospace and defense technology provider known for avionics, sensors, propulsion controls, and spacecraft components. The company delivers mission-critical systems for satellite platforms, launch vehicles, and deep-space programs.

A global leader in high-reliability connectors, sensors, and electronic components used extensively in spacecraft, satellites, and launch systems. The company supports harsh-environment applications requiring vibration resistance and radiation tolerance.

A leading aerospace manufacturer with a dedicated space division producing satellites, payload equipment, and spacecraft subsystems. The company is active in telecommunications, earth observation, and next-generation space infrastructure.

A Spanish technology company specializing in advanced actuators, motion systems, and radiation-tolerant components for space missions. It provides flight-proven mechanisms for satellites, launchers, and scientific missions.

A provider of high-precision actuators, piezoelectric mechanisms, and motion control systems for space and defense. The company technologies are widely used in optics positioning, satellite payloads, and active vibration control.

A French space engineering company offering mechanisms, deployable structures, and fluidic systems for satellites and launch vehicles. It supplies custom equipment for propulsion, payload, and ground-support operations.

A specialist in attitude-control systems (ADCS) for CubeSats and small satellites. The company provides integrated modules, sensors, and flight-proven controllers for academic, commercial, and defense missions.

A leading provider of aerospace energetic systems including initiation devices, separation mechanisms, and mission-critical pyrotechnics. Its products support satellite deployment, launch vehicles, and defense applications.

A major developer of high-performance earth-observation satellites, robotics, and spacecraft platforms. The company is known for precision imaging systems and satellite buses used in civil, defense, and commercial missions.

A manufacturer of advanced electronic instruments, sensors, and power systems used in aerospace and defense. Its technologies support environmental monitoring, avionics, and spacecraft payload systems.

A major semiconductor company producing radiation-tolerant processors, analog ICs, and power-management devices for space electronics. TI components are widely used in satellite subsystems and mission-critical control units.

Recent Development

- In June 2025, BAE Systems and South Koreas Hanwha Systems signed a memorandum of understanding (MoU) to jointly develop an advanced multi-sensor satellite system. The collaboration will look to integrate BAE Systems ultra-wideband radio frequency (RF) sensor technology with Hanwha Systems cutting-edge small synthetic aperture radar (SAR) satellite capabilities.(Source: https://euro-sd.com)

- In June 2025, Blue Canyon Technologies, RTXs small satellite manufacturer and mission services provider, announced the successful launch of a CubeSat in support of Arcstone, a NASA mission to measure lunar spectral reflectance, or the way sunlight is reflected from the Moons surface at different wavelengths of light. The Arcstone mission will use the data it collects to help calibrate space-based imagers for Earth observation.(Source: https://www.bluecanyontech.com)

Space Sensors and Actuators MarketSegments Covered in the Report

By Product Type

- Sensors

- Actuators

By Platform

- Satellites

- Capsules/Cargo Modules

- Interplanetary Spacecraft & Probes

- Rovers/Spacecraft Landers

- Launch Vehicles

By End User

- Commercial

- Government and Defense

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting