What is the Aerospace Electronics Market Size?

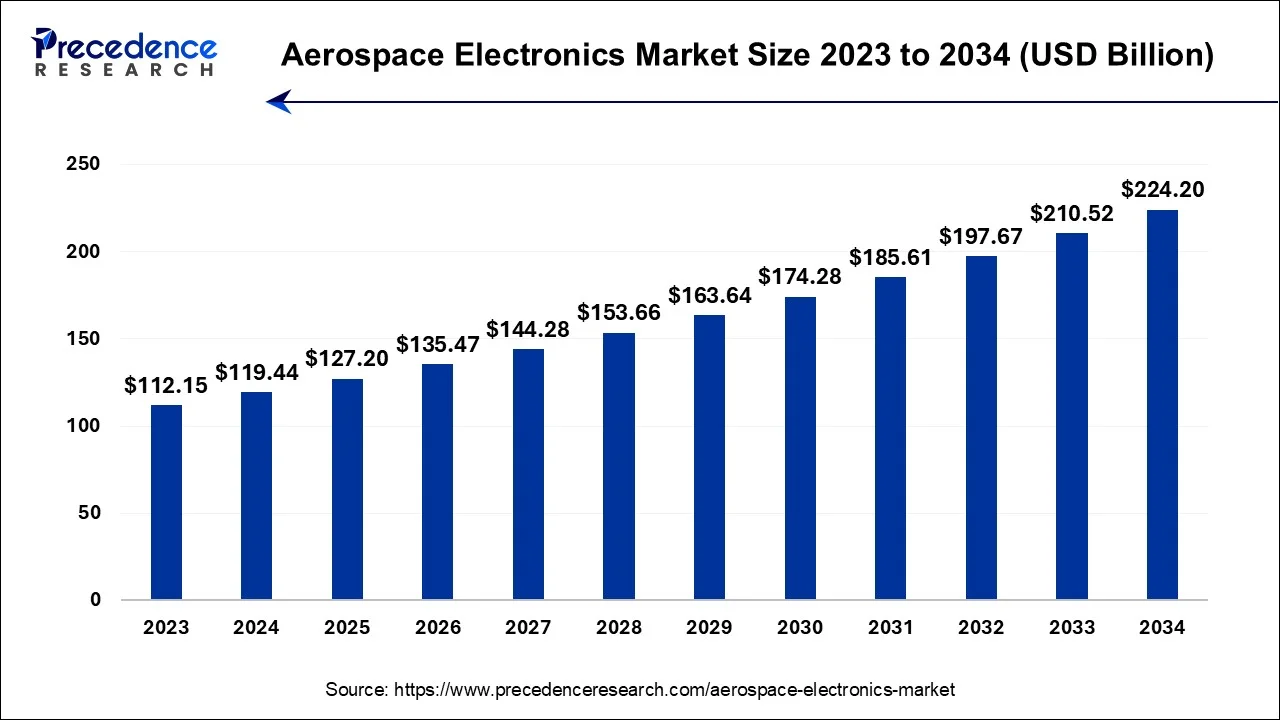

The global aerospace electronics market size accounted for USD 127.20 billion in 2025 and is predicted to increase from USD 135.47 billion in 2026 to approximately USD 237.33 billion by 2035, expanding at a CAGR of 6.44% between 2026 to 2035.

Aerospace Electronics MarketKey Takeaways

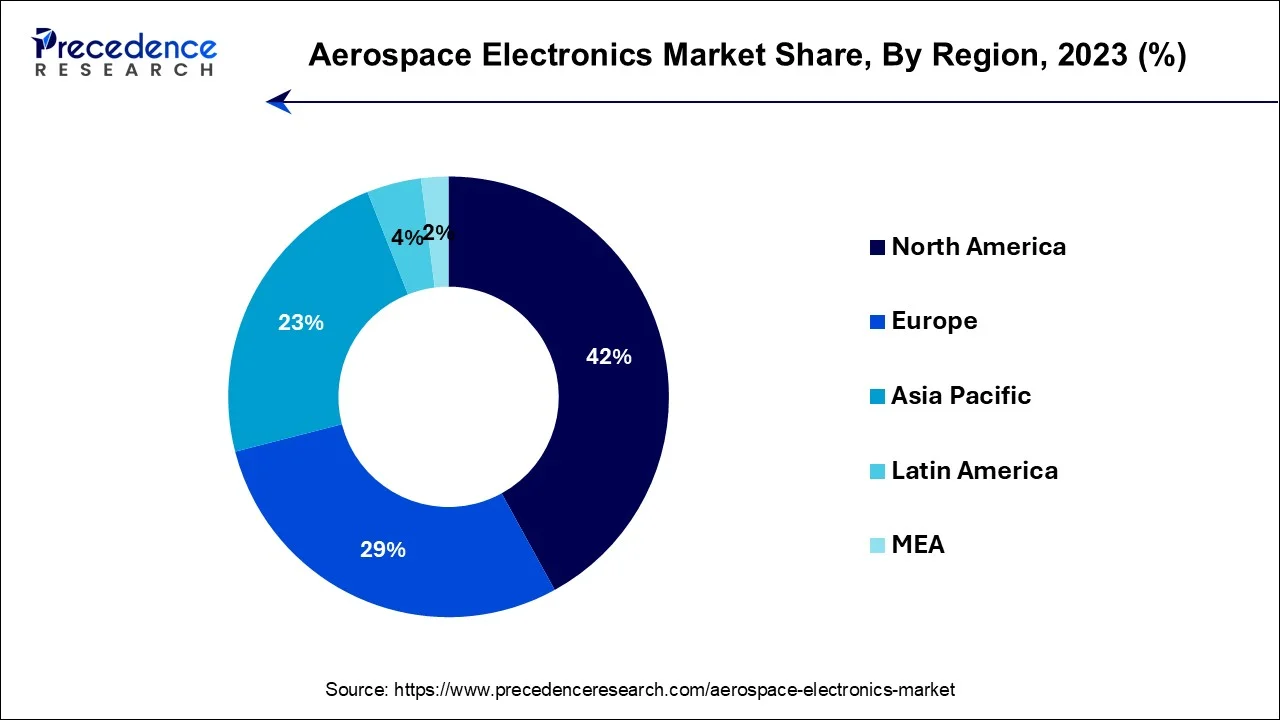

- North America contributed more than 42% of revenue share in the aerospace electronics market in 2025.

- Asia-Pacific is estimated to expand the fastest CAGR between 2026 to 2035.

- By type, the avionics segment has held the largest market share of 35% in 2025. Meanwhile, the radar systems segment is anticipated to grow at a remarkable CAGR of 7.5% between 2026 to 2035.

- By application, the commercial aerospace segment had the largest market share of 55% in 2025. Whereas the military aerospace segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

The aerospace electronics industry pertains to the manufacturing and trade ofelectronic componentsand systems utilized in aviation and space exploration. This encompasses electronic hardware for flight control, navigation, communication, radar technology, and avionics. Market dynamics are shaped by the pursuit of enhanced safety and efficiency in aircraft and spacecraft, in addition to ongoing efforts to upgrade existing aerospace platforms.

The sector's growth is significantly influenced by the rising volume of global air travel, increased space exploration endeavours, and ongoing military technology enhancements. With continual advancements in automation, connectivity, and miniaturization, the aerospace electronics sector remains dynamic, offering scope for innovation and expansion.

Growth Factors

- The soaring demand for air travel on a global scale remains a pivotal catalyst behind the flourishing aerospace electronics sector. The burgeoning middle-class populace, augmented affordability of air journeys, and the emergence of novel air routes have ignited the call for more advanced and proficient aircraft.

- The evolution and integration of state-of-the-art aerospace electronics is vital to augment safety, bolster navigation, invigorate communication, and heighten the passenger experience. With the surge in passenger numbers, airlines are perpetually on the lookout for cutting-edge avionics and in-flight entertainment systems, to uphold their competitive standing and ensure passenger contentment.

- The forward thrust of aerospace electronics finds its roots in the perpetual headway of celestial exploration. Government space agencies and private enterprises are progressively venturing into the cosmos, instigating an augmented necessity for intricate electronics, facilitating satellite communication, interplanetary expeditions, and the smooth functioning of space stations. Furthermore, the burgeoning industry of commercial space travel mandates top-notch avionics and communication systems to warrant the security and accomplishment of these missions.

- Governments worldwide are channelling substantial resources into the revamping of their military aircraft and equipment. This includes the modernization of aging fleets with cutting-edge electronic systems, securing a tactical edge in defence capabilities. Aerospace electronics play a pivotal role in the development of advanced radar, communication, and surveillance systems. As geopolitical tensions endure, nations persist in earmarking substantial budgets for aerospace electronics, ensconcing military preparedness and national security.

- The rapid headway in electronic technology, including the downsizing of components, the augmentation of computational prowess, and the refinement of materials, has paved the way for the production of more compact, effective, and potent aerospace electronics. This empowers the creation of lightweight, high-performance systems, accentuating the capabilities of aircraft and spacecraft while mitigating fuel consumption and operational expenses. As these technologies continue to advance, aerospace electronics corporations need to be innovative to remain at the forefront of the market.

- The aerospace sector faces mounting pressure to mitigate its environmental footprint. Aerospace electronics emerge as instrumental in achieving this objective by fine-tuning fuel efficiency, diminishing emissions, and enhancing the overall sustainability of aviation and space exploration. Electronic systems that are geared toward more efficient flight control, engine administration, and power allocation can be instrumental in fostering a greener aerospace domain.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 6.44% |

| Market Size in 2025 | USD 127.20Billion |

| Market Size in 2026 | USD 135.47 Billion |

| Market Size by 2035 | USD 237.33Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Rapid technological advancements

The relentless technological progress stands as the paramount impetus behind the burgeoning aerospace electronics market. These headway strides manifest across multifarious dimensions, encompassing electronics, materials, and software, and exert profound influence on the augmentation of aircraft and spacecraft's functionality, safety, and adaptability. In avionics, the relentless evolution of compact yet efficient microprocessors, sensors, and communication systems yields notable enhancements in flight control, navigation precision, and communication reliability. These developments not only optimize the operational efficiency of aircraft but also fortify passenger well-being and in-flight comfort.

Materials science breakthroughs usher in the era of lighter yet sturdier materials, affording the construction of aerospace components that shed excess weight, culminating in heightened fuel efficiency. Composite materials and cutting-edge alloys contribute to the crafting of structures that are both robust and aerodynamically optimized. Furthermore, the software landscape witnesses a proliferation of increasingly intricate flight management systems, data analytics solutions, and predictive maintenance tools. These software innovations amplify situational awareness, streamline maintenance protocols, and furnish a substantial boost to overall operational efficacy.

Beyond these, strides in autonomous technologies and the maturation of artificial intelligence bestow enhanced capabilities upon unmanned aerial vehicles and drones, expanding their utility in domains spanning surveillance, cargo logistics, and remote sensing. In summation, the ceaseless momentum of technological progression serves as a driver within the aerospace electronics market, persistently elevating the benchmarks for performance, efficiency, and safety in aviation and space exploration. This catalytic force simultaneously kindles innovation and sustains market expansion.

Restraint

Complexity and integration

Complexity and integration present a significant restraint to the growth of the aerospace electronics market. As technology advances, the integration of new, sophisticated electronic systems into existing aircraft and spacecraft becomes more intricate and time-consuming. This complexity often necessitates extensive redesign and testing of systems to ensure compatibility, safety, and performance. It can also lead to budget overruns and project delays. Moreover, the aerospace industry relies on a multitude of legacy systems, which were not originally designed to accommodate the level of connectivity and automation now demanded. Adapting these older platforms to incorporate modern electronics can be a resource-intensive process.

In addition, integration challenges can compromise system reliability and safety. Errors in integration can have critical consequences in aerospace applications, making thorough testing and validation paramount. The effort required for seamless integration poses a significant hurdle for aerospace electronics manufacturers, especially when they must balance performance improvements with certification and regulatory compliance. These constraints hinder the industry's ability to swiftly adopt the latest technologies, slowing overall growth.

Opportunity

Emergence of unmanned aerial vehicles (UAVs) and drones

The ubiquity of unmanned aerial Vehicles (UAVs) and drones has forged compelling pathways within the aerospace electronics market. UAVs find themselves increasingly deployed across a spectrum of applications, spanning surveillance, agricultural practices, logistics, and ecological monitoring. Central to the success of these unmanned systems lies the critical role of aerospace electronics, encompassing elements like guidance and control systems, sensory apparatus, advanced communication technologies, and data analytics prowess.

In the backdrop of soaring demand for UAVs and drones, aerospace electronics manufacturers are confronted with opportunities to engineer avant-garde, compact, and super-efficient electronic components and systems. These not only amplify the performance and capabilities of these unmanned contraptions but also align with the ever-evolving regulatory frameworks. This burgeoning market stratum not only sparks a cauldron of innovation but also furnishes aerospace electronics firms with the prospect of broadening their product array, diversifying their clientele, and reaping the rewards of the escalating requisition for unmanned systems in commerce and defence.

Impact of COVID-19

The COVID-19 pandemic led to extensive disruptions in global supply chains, severely affecting the aerospace electronics market. Restrictions on international trade, factory closures, and reduced production capacity created shortages of critical electronic components. This resulted in delays in the manufacturing and delivery of aerospace electronics systems, causing setbacks in various projects. Many aerospace electronics manufacturers had to reevaluate their supply chain strategies to ensure resilience against future disruptions.

The sharp decline in air travel due to lockdowns and travel restrictions during the pandemic significantly impacted the aerospace industry. Airlines and aircraft manufacturers faced financial difficulties, leading to reduced orders for new aircraft and avionics systems. The reduced demand for new aircraft translated into lower demand for aerospace electronics. This, in turn, forced companies to recalibrate their production and growth expectations.

Aerospace electronics manufacturers faced financial challenges as airlines and other customers deferred or cancelled orders, resulting in reduced revenue. Many companies were compelled to implement cost-cutting measures, including layoffs and postponing research and development projects. The pandemic amplified the need for financial prudence and flexibility in the industry.

COVID-19 prompted a heightened focus on safety and hygiene in air travel. This led to an increased interest in touchless and contactless technologies, which, in turn, influenced the development of aerospace electronics for cabin systems. Airlines and aircraft manufacturers started looking for solutions to enhance cabin air quality and touchless controls, such as sensors and interfaces, creating new opportunities for aerospace electronics companies.

Segment Insights

Type Insights

The avionics segment held a 35% market share in 2023. The avionics segment commands a substantial share in the aerospace electronics market due to its critical role in ensuring the safety, navigation, and communication systems of aircraft. Avionics encompass a wide range of electronic systems, including flight management, radar, autopilot, and in-flight.

entertainment, vital for efficient aircraft operation. With an increasing emphasis on safety, automation, and connectivity in modern aviation, the demand for advanced avionics solutions has surged. Additionally, stringent regulatory standards mandate the use of state-of-the-art avionics systems, driving continuous innovation and making it a dominant sector within the aerospace electronics market.

Radar systems hold a major growth in the aerospace electronics market due to their critical role in aviation and defence. These systems are indispensable for aircraft navigation, collision avoidance, weather monitoring, and military applications. With increasing global air traffic, the demand for advanced radar technology to enhance safety and air traffic management is substantial.

Moreover, radar systems are continuously evolving with the integration of modern technologies like phased-array radar and synthetic aperture radar, ensuring their relevance and prominence in the aerospace electronics sector. Their versatility, efficiency, and multifaceted applications cement their growth as a significant market segment.

Application Insights

The commercial aerospace segment held the largest market share of 55% in 2023. The commercial aerospace segment holds a significant share in the aerospace electronics market due to the surging demand for air travel, the expansion of commercial aviation, and the continuous modernization of aircraft. Airlines and aircraft manufacturers prioritize advanced electronics systems to enhance safety, efficiency, and passenger experience. Moreover, the commercial aerospace sector benefits from frequent technological advancements, inflight connectivity, and passenger entertainment systems. The competitive landscape also drives innovation as aerospace electronics companies strive to meet the growing needs of the commercial aviation industry, making it a dominant and lucrative segment in the market.

On the other hand, the military aerospace segment is projected to grow at the fastest rate over the projected period. The military aerospace sector commands a substantial growth in the aerospace electronics market, primarily due to its distinct and demanding requirements. Defence applications necessitate cutting-edge electronics for vital functions such as communication, radar systems, surveillance, and precise navigation. Advanced avionics and electronics are paramount in military endeavours, providing the crucial tactical edge requisite for contemporary warfare scenarios.

The sector's unwavering commitment to pioneering research, development, and stringent security standards fosters a culture of continuous innovation, securing lucrative high-value contracts. Furthermore, the military's steadfast dedication to enhancing situational awareness, data processing, and the deployment of unmanned systems consistently fuels substantial investments in aerospace electronics, reinforcing its dominant influence within the market.

Regional Insights

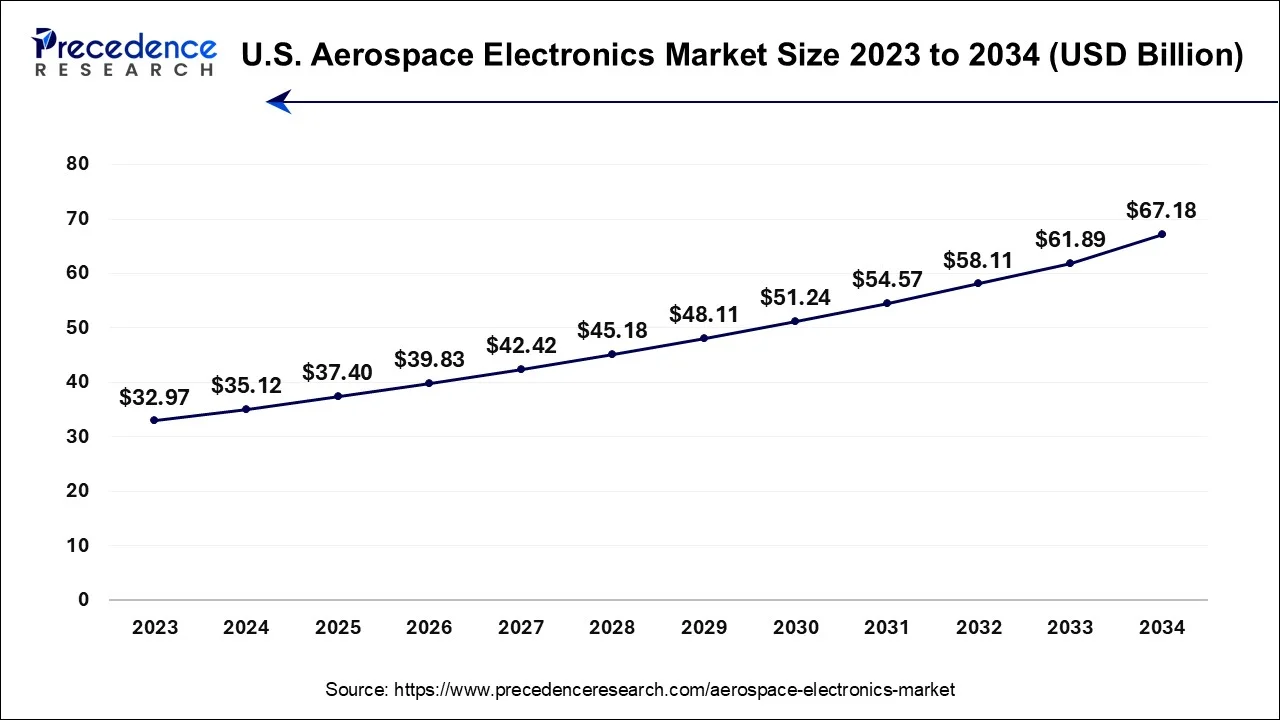

What is the U.S. Aerospace Electronics Market Size?

The U.S. aerospace electronics market size accounted for USD 37.40 billion in 2025 and is expected to be worth around USD 71.46 billion by 2035, at a CAGR of 6.69% from 2026 to 2035.

What is the Remarkable Position of North America in the Aerospace Electronics Market in 2025?

North America held the largest revenue share 42% in 2023. North America dominates the aerospace electronics market due to several key factors. First, the region is home to numerous major aerospace and defence companies, fostering a strong industrial base for electronics production. Second, North America's robust military and civil aviation sectors drive substantial demand for advanced electronics systems. Third, significant investments in research and development and government contracts further bolster the industry's presence. Moreover, the region's commitment to innovation and technological advancements maintains its competitive edge. These factors collectively contribute to North America's significant share in the aerospace electronics market, setting it apart as a global leader in this sector.

U.S. Aerospace Electronics Market Analysis

The U.S. industry is expanding due to technological innovations, AI integration, and sustainability initiatives. In April 2024, the Biden-Harris Administration reported that the U.S. Department of Commerce and Samsung Electronics (Samsung) planned to provide $6.4 billion in funding to strengthen aerospace, automotive, defense, and semiconductor industries in the U.S.

How is the Massive Growth of the Asia Pacific in the Aerospace Electronics Market?

Asia-Pacific is estimated to observe the fastest expansion during the predicted timeframe. The ascendancy of Asia-Pacific in the aerospace electronics market can be attributed to a confluence of distinct factors. Primarily, this dynamic region is witnessing an upsurge in economic prosperity, leading to an escalating appetite for air travel and a flourishing aerospace industry. Moreover, Asia-Pacific nations are strategically channelling substantial resources into defence modernization efforts, thereby propelling the demand for cutting-edge aerospace electronics.

India Aerospace Electronics Market Analysis

India is witnessing rapid growth due to increased defense spending, the expansion of civil aviation, and cutting-edge electronics. In October 2025, the Government of India approved seven projects with an investment of ₹5,500 Crore under the electronics manufacturing scheme.

The region's competitive edge is further fortified by its adept workforce and a proliferating array of aerospace manufacturers and suppliers, prominently exemplified in countries like China, India, and Japan. These factors collectively position the region as a commanding force in the aerospace electronics market, fostering innovation and advancement while providing cost-effective solutions.

How does Europe Grow Notably in the Aerospace Electronics Market?

Europe is expected to grow at a notable rate in the market in 2025, owing to digitalization, AI integration, commercial fleet modernization, and rapid technological advancements in autonomous systems. In March 2025, GE Aerospace planned to invest € 78 million in European manufacturing in 2025.

How is the Considerable Growth of the Aerospace Electronics Market within South America?

South America is expected to experience significant growth during the forecast period, driven by the rising investments in satellite and space technology and expanding aircraft production. The Space Generation Advisory Council (SGAC) present in South America aims to promote aerospace technology and encourage participation in the space community.

How is the Middle East and Africa Gaining Momentum in the Aerospace Electronics Market?

MEA is expected to grow at a lucrative rate in the market in the coming years, driven by large-scale infrastructure investments, fleet modernization, and the adoption of next-generation technologies.

- In August 2024, the UAE planned to launch advanced defense and aerospace technologies at the Egypt International Airshow 2024.

Value Chain Analysis

- Raw Material Sourcing

This stage is accelerated by electronic components, titanium and semiconductor supplies, and sustainable and localized sourcing.

Key Players: Toray Industries, Hexcel Corporation, Solvay SA, Materion Corporation, ATI Inc., Constellium SE. - Supply to Governments and Airlines

This stage is driven by an electronic upgrade, avionics modernization, and major electronic technologies.

Key Players: Honeywell Aerospace, Thales Group, RTX Corporation, BAE Systems, Bharat Electronics Limited, Hindustan Aeronautics Limited, Safran Electronics & Defense. - Aftermarket Services and Upgrades

This stage is growing due to predictive maintenance, digital twin technology, additive manufacturing, connectivity solutions, and avionics modernization.

Key Players: Honeywell Aerospace, Thales Group, RTX Corporation, L3Harris Technologies, Garmin Ltd., Safran Electronics & Defense.

Aerospace Electronics Market Companies

- Honeywell International Inc.

- Thales Group

- BAE Systems

- Raytheon Technologies Corporation

- Northrop Grumman Corporation

- Safran Electronics & Defense

- L3Harris Technologies, Inc.

- Collins Aerospace (a Raytheon Technologies business)

- General Electric Company

- Cobham plc

- Moog Inc.

- Teledyne Technologies Inc.

- Garmin Ltd.

- Curtiss-Wright Corporation

- Esterline Technologies Corporation

Recent Developments

- In June 2025, BAE Systems and Hanwha Systems signed an MoU to boost the development of an advanced multi-sensor satellite system.

(Source: https://www.baesystems.com/ ) - In September 2025, Thales Group and Autonomous Devices collaborated to develop a drone-based electronic warfare solution for naval and land forces(Source: https://www.thalesgroup.com/ )

- In March 2022, BAE Systems unveiled an innovative Electronic Warfare (EW) suite, introducing a comprehensive set of both offensive and defensive EW capabilities that can be integrated into a diverse range of platforms. This groundbreaking technology, termed the Storm Electronic Warfare Module system, offers adaptable integration options, spanning fixed-wing aircraft, helicopters, unmanned aerial vehicles, and missiles.

Segments Covered in the Report

By Type

- Avionics

- Communication, Navigation, And Surveillance (CNS) Systems

- Electronic Warfare (EW) Systems

- Radar Systems

- Space Electronics

By Application

- Commercial Aerospace

- Military Aerospace

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting